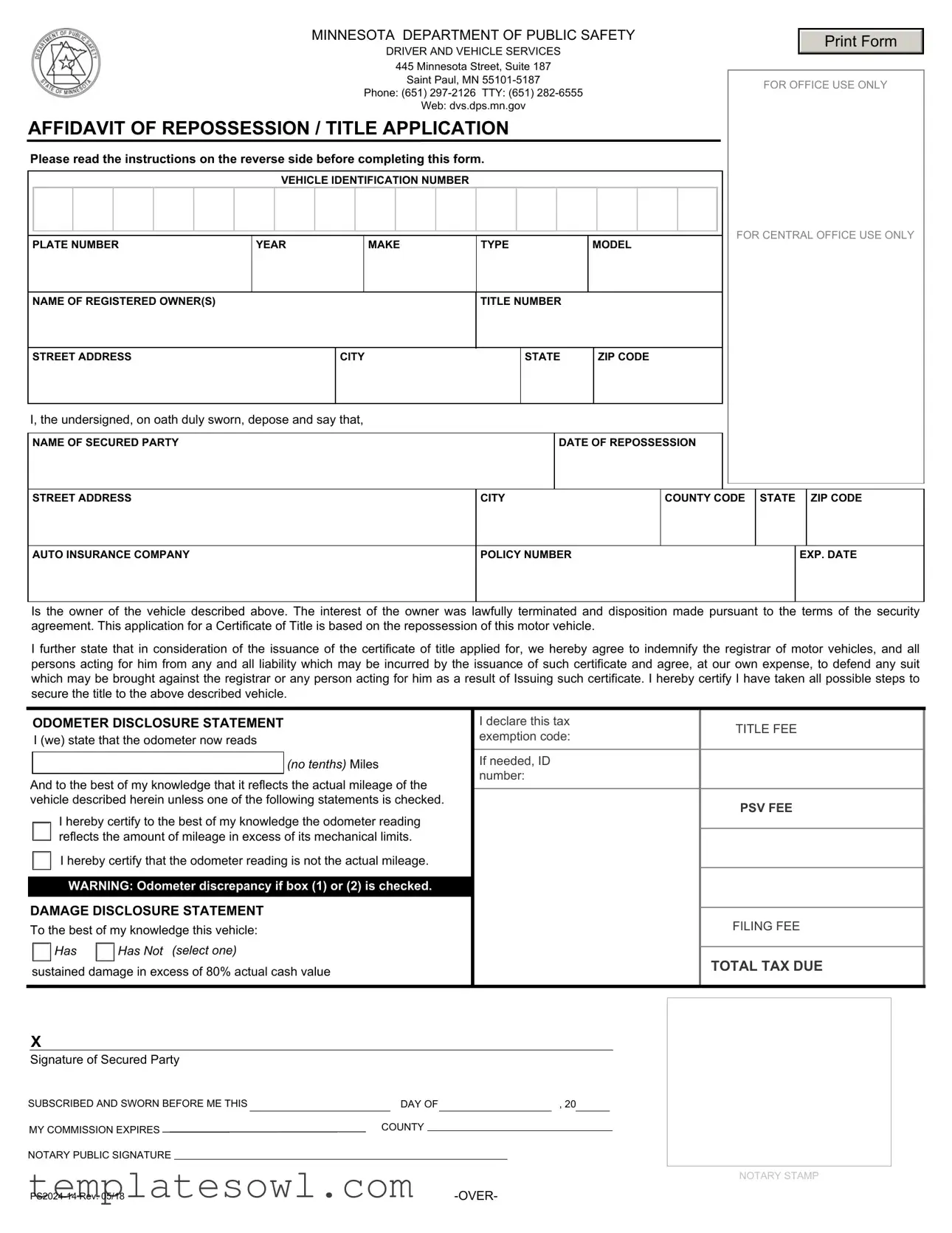

Fill Out Your Affidavit Of Repossession Minnesota Form

When it comes to the repossession of a vehicle in Minnesota, the Affidavit of Repossession plays a crucial role in facilitating the legal transfer of ownership. This form, managed by the Minnesota Department of Public Safety, is designed to document the repossession process and is also used as an application for a new title in the repossessing party's name. Within this form, you will find essential information, including the vehicle's identification number, the details of the registered owner, and the secured party who is reclaiming the vehicle. It's vital to accurately list the vehicle’s make, model, year, and the odometer reading, as discrepancies in these details can lead to complications later. The form also requires a disclosure statement regarding any damage the vehicle may have sustained, ensuring transparency in the transaction. Furthermore, the applicant agrees to indemnify the registrar of motor vehicles against any liabilities that may arise from the issuance of a new certificate of title. Given the stakes involved, it is important to carefully read the instructions provided and ensure that all necessary fees are submitted with the application to avoid delays in processing. Understanding the implications and requirements of this document is critical for anyone involved in the repossession process.

Affidavit Of Repossession Minnesota Example

MINNESOTA DEPARTMENT OF PUBLIC SAFETY |

|

|

Print Form |

||

DRIVER AND VEHICLE SERVICES |

||

|

445 Minnesota Street, Suite 187

Saint Paul, MN

Web: dvs.dps.mn.gov

AFFIDAVIT OF REPOSSESSION / TITLE APPLICATION

Please read the instructions on the reverse side before completing this form.

|

|

|

|

|

|

|

|

VEHICLE IDENTIFICATION NUMBER |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR CENTRAL OFFICE USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLATE NUMBER |

YEAR |

|

|

MAKE |

TYPE |

MODEL |

|||||||||||||||||||

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF REGISTERED OWNER(S) |

|

|

|

|

|

|

|

|

TITLE NUMBER |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STREET ADDRESS |

|

|

|

CITY |

|

|

STATE |

|

|

ZIP CODE |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I, the undersigned, on oath duly sworn, depose and say that, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

NAME OF SECURED PARTY |

|

DATE OF REPOSSESSION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

STREET ADDRESS |

CITY |

COUNTY CODE |

STATE |

ZIP CODE |

||||

|

|

|

|

|

|

|

|

|

AUTO INSURANCE COMPANY |

POLICY NUMBER |

|

|

|

|

EXP. DATE |

||

|

|

|

|

|

|

|

|

|

Is the owner of the vehicle described above. The interest of the owner was lawfully terminated and disposition made pursuant to the terms of the security agreement. This application for a Certificate of Title is based on the repossession of this motor vehicle.

I further state that in consideration of the issuance of the certificate of title applied for, we hereby agree to indemnify the registrar of motor vehicles, and all persons acting for him from any and all liability which may be incurred by the issuance of such certificate and agree, at our own expense, to defend any suit which may be brought against the registrar or any person acting for him as a result of Issuing such certificate. I hereby certify I have taken all possible steps to secure the title to the above described vehicle.

ODOMETER DISCLOSURE STATEMENT

I (we) state that the odometer now reads

(no tenths) Miles

And to the best of my knowledge that it reflects the actual mileage of the vehicle described herein unless one of the following statements is checked.

I hereby certify to the best of my knowledge the odometer reading reflects the amount of mileage in excess of its mechanical limits.

I hereby certify that the odometer reading is not the actual mileage.

WARNING: Odometer discrepancy if box (1) or (2) is checked.

DAMAGE DISCLOSURE STATEMENT

To the best of my knowledge this vehicle:

Has

Has  Has Not (select one)

Has Not (select one)

sustained damage in excess of 80% actual cash value

I declare this tax |

TITLE FEE |

|

exemption code: |

||

|

||

|

|

|

If needed, ID |

|

|

number: |

|

|

|

|

|

|

PSV FEE |

FILING FEE

TOTAL TAX DUE

|

X |

|

|

|

|

|

|

|

|

|

|

|

Signature of Secured Party |

|

|

|

|

|

|

|

|

|

|

||

SUBSCRIBED AND SWORN BEFORE ME THIS |

|

DAY OF |

|

, 20 |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

MY COMMISSION EXPIRES |

COUNTY |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

NOTARY PUBLIC SIGNATURE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTARY STAMP |

|

|

|

||||||||||

Affidavit of Repossession/Title Application

INSTRUCTIONS

Repossession/Title Application

1.When the repossessing party chooses to title the vehicle in their name, this form also serves as their application for title.

If the repossessing party has the Minnesota title in their possession, they do not need to apply for a title in their name. If the repossessing party is a private individual, please include their driver’s license number and date of birth.

2.The following fees are due when the repossessing party titles the vehicle in their name: Title, Public Safety Vehicle (PSV), and Filing. If a private party is repossessing this vehicle, MN sales tax is due if the private party was not the previous owner. To determine the amount due, visit dvs.dps.mn.gov and select Fees from the top menu or call (651)

3.A secured party that has the certificate of title but elects not to title the vehicle in their name must complete and submit a dealer purchase receipt (PS2009).

4.All forms and fees may be submitted to your local deputy registrar office or by mail to:

MINNESOTA DEPARTMENT OF PUBLIC SAFETY DRIVER AND VEHICLE SERVICES

445 MINNESOTA STREET, SUITE 187

ST. PAUL, MINNESOTA

For a list of office locations, visit dvs.dps.mn.gov or call (651)

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Affidavit of Repossession in Minnesota is governed by Minnesota Statutes, Chapter 168A. |

| Purpose | This form serves as a legal declaration for repossessing a vehicle and applying for a new title. |

| Eligibility | The secured party is eligible to file this form once they have completed vehicle repossession legally. |

| Fees | Fees include Title, Public Safety Vehicle (PSV), and Filing fees when titling the vehicle in the repossessing party's name. |

| Odometer Disclosure | An odometer disclosure is required, indicating the current mileage and any discrepancies. |

| Damage Disclosure | The form includes a section to declare if the vehicle has sustained damage exceeding 80% of its actual cash value. |

| Notarization Requirement | The signature of the secured party must be notarized to validate the affidavit. |

| Submission Process | Completed forms may be submitted to your local deputy registrar office or mailed to the Minnesota Department of Public Safety. |

Guidelines on Utilizing Affidavit Of Repossession Minnesota

Once all necessary information is gathered and the form is completed, it should be submitted to the appropriate authorities for processing. This will initiate the next steps needed to reestablish ownership of the vehicle.

- Begin by locating the Vehicle Identification Number (VIN) and entering it in the designated area at the top of the form.

- Fill in the plate number, year, make, type, and model of the vehicle.

- Provide the name(s) of the registered owner(s).

- Enter the title number associated with the vehicle.

- Complete the street address, city, state, and zip code of the registered owner(s).

- In the section for the secured party, enter their name and the date of repossession.

- Fill in the secured party's address including city, county, state, and zip code.

- List the auto insurance company and provide the policy number and its expiration date.

- In the odometer section, indicate the current reading (without tenths) and check any applicable statements regarding mileage.

- In the damage disclosure statement, select whether the vehicle has or has not sustained damage in excess of 80% of its actual cash value.

- State any applicable tax or fee exemptions and provide an ID number if necessary.

- Sign the document as the secured party.

- Have the affidavit notarized. The notary public will sign and affix their stamp in the designated location.

Ensure that all information is accurate and complete. After filling out the form, submit it along with required fees to the Minnesota Department of Public Safety or to your local deputy registrar office.

What You Should Know About This Form

What is the Affidavit of Repossession in Minnesota?

The Affidavit of Repossession is a form used in Minnesota when a secured party, such as a lender or finance company, takes back possession of a vehicle due to default on loan payments. This form serves multiple purposes, including documenting the repossession and serving as an application for a new title for the vehicle. By completing this affidavit, the secured party assures that they have followed legal procedures in repossessing the vehicle and provides necessary information for the issuance of a new certificate of title.

Who needs to complete this form?

This form is typically completed by secured parties, which may be financial institutions or individuals who have a valid security interest in the vehicle. If the secured party wishes to take possession of the title following a repossession, they need to fill out this affidavit. In cases where the title is already in their possession, they may not need to submit a new application. Private individuals who are repossessing a vehicle must also include their driver’s license number and date of birth on the form.

What information is required on the Affidavit of Repossession?

Several key pieces of information must be provided when completing this document. You will need to

Common mistakes

When completing the Affidavit of Repossession in Minnesota, several common mistakes can derail the process. One of the most frequent errors is failing to provide accurate vehicle identification numbers (VIN). The VIN must match the information on the existing title. Parents or guardians acting on behalf of minors should double-check this detail, as inaccuracies can lead to delays or denial.

Another mistake involves incomplete information regarding the owner(s) of the vehicle. It's essential to list all registered owners precisely as they appear on the title. Omitting a co-owner's name or making typographical errors in the names can cause complications in the title transfer process.

Many individuals also overlook the need to indicate the correct odometer reading. Reporting inaccurate mileage can open up significant issues, including potential legal ramifications. It’s vital to ensure that the odometer disclosure statement reflects the true mileage. If there’s a discrepancy, checking the appropriate box and providing a clear explanation is crucial.

Understanding the fees associated with filing this affidavit is another area where errors commonly occur. Failing to include the necessary fees, such as title and filing fees, can result in processing delays. It’s important to verify the total fee amount on the Minnesota Department of Public Safety's website or by calling their office prior to submission.

Finally, neglecting to obtain the required notarization can halt the process entirely. The affidavit must be signed in front of a notary public to validate the signature. Make sure to coordinate this step before sending the form to avoid any unnecessary setbacks.

Documents used along the form

The Affidavit of Repossession in Minnesota is often accompanied by several additional forms and documents that assist in the repossession and titling process. Understanding these documents is crucial for ensuring compliance with regulations and proper vehicle title processing.

- Dealer Purchase Receipt (PS2009): This document is required when a secured party has the certificate of title but chooses not to title the vehicle in their name. It serves as proof of purchase and helps to facilitate the transfer of ownership when applicable.

- Odometer Disclosure Statement: This statement provides important information about the vehicle's mileage at the time of repossession. It includes certifications regarding whether the mileage is actual, exceeded mechanical limits, or is not actual, helping to prevent potential fraud related to odometer reading discrepancies.

- Damage Disclosure Statement: This form indicates whether the vehicle has sustained damage exceeding a certain percentage of its cash value. It is important for transparency regarding the vehicle's condition and valuation.

- Certificate of Title Application: If the repossessing party wishes to obtain the title in their name, this application must be submitted along with the Affidavit of Repossession. It is a formal request to change ownership records and establish legal ownership of the vehicle.

Each of these documents plays a significant role in the repossession process. Proper completion and submission of all necessary forms is essential for a smooth transaction and compliance with Minnesota laws.

Similar forms

The Affidavit of Repossession in Minnesota is a specific document used in the process of repossessing a vehicle. Several other documents serve similar purposes in the context of property claims or securing ownership. Below are four such documents and their similarities:

- Security Agreement: This document outlines the terms under which a borrower agrees to provide collateral for a loan. Like the Affidavit of Repossession, it includes details about the secured party and the property involved, ensuring that the lender has a legal claim to the collateral if the borrower defaults.

- Repossession Notice: This form notifies the vehicle owner of the lender's intention to repossess due to default. Similar to the Affidavit, it confirms that the owner's rights have been terminated and that the lender has the authority to reclaim the vehicle.

- Title Application: A Title Application is filed to transfer ownership of a vehicle. This is similar to the Affidavit of Repossession as it can be submitted when a lender or secured party seeks to establish legal ownership following repossession.

- Odometer Disclosure Statement: This document is often required when a vehicle is sold or transferred. Like the Affidavit, it aims to protect the interests of both parties by verifying the condition and mileage of the vehicle at the time of transfer.

Dos and Don'ts

When filling out the Affidavit of Repossession in Minnesota, there are important actions to consider. Here’s a list of dos and don’ts to guide you through the process.

- Do read the instructions on the reverse side of the form carefully before starting.

- Do provide accurate and complete information, including the vehicle identification number and the name of the secured party.

- Do indicate any odometer discrepancies if applicable to avoid future complications.

- Do ensure all required fees are calculated and included with the submission to avoid delays.

- Do verify that your signature is notarized to validate the affidavit.

- Don't omit any required information, as this may lead to rejection of your application.

- Don't falsify any details regarding the vehicle's condition or ownership.

- Don't ignore the need for a notary public; an unsigned affidavit will not be accepted.

- Don't forget to submit the form to the correct local deputy registrar office or mail it to the appropriate address.

- Don't neglect to keep copies of all documents submitted for your own records.

Misconceptions

When it comes to the Affidavit of Repossession in Minnesota, misunderstandings can lead to confusion for both secured parties and vehicle owners. Here are nine common misconceptions addressed clearly.

- Only banks can file an Affidavit of Repossession. Many believe that only financial institutions are eligible to file this affidavit. In truth, any secured party with a legal interest in the vehicle, including private individuals, can complete this process.

- The affidavit guarantees title transfer automatically. While filling out the affidavit is a crucial step, it does not automatically ensure that title is transferred. Additional fees and requirements must still be fulfilled to complete the title transfer process.

- The form is only for vehicles that were stolen. Some people think this form is relevant only in theft scenarios. In reality, it applies to any situation where a vehicle is repossessed due to default on a loan or lease agreement.

- It's unnecessary to have the vehicle's title to file. While having the title is ideal, a secured party can still initiate the affidavit process even if they do not possess the original title, provided they have a lawful claim.

- There are no fees associated with filing the affidavit. This is a common fallacy. There are specific fees related to titling the vehicle, which include the title, public safety vehicle (PSV), and filing fees that must be paid to finalize the process.

- Odometer disclosure is not mandatory. It is important to understand that odometer disclosure is required by law to prevent fraud. The affidavit must include accurate odometer readings to ensure compliance.

- The affidavit process is quick and simple. While the form might seem straightforward, the entire process can be time-consuming. Depending on various factors, including documentation and fees, it may take longer than anticipated.

- All previous owners must consent to the repossession. This is a significant misconception. If you have a lawful right under a security agreement, prior consent from previous owners is typically not required for repossession.

- The affidavit can be filed online. Many assume that the process can be completed online. However, it usually requires physical submission of forms and fees, either through your local registrar's office or by mail.

Understanding these misconceptions can save you time and hassle when dealing with the Affidavit of Repossession in Minnesota. Knowledge is empowering, and being informed is crucial when navigating legal obligations.

Key takeaways

When filling out and using the Affidavit of Repossession Minnesota form, it is crucial to adhere to the following key takeaways:

- Understand the Purpose: This form serves as both an affidavit of repossession and an application for a title. Ensure you understand when to use it based on your situation.

- Complete All Required Information: Provide accurate details, including vehicle identification number, the name of the registered owner, and the secured party's information. Incorrect entries can delay processing.

- Be Aware of Fees: There are fees associated with titling the vehicle, including title, PSV, and filing fees. If you are a private party repossessing, be prepared to pay sales tax unless you were the previous owner.

- Submit Correctly: After completing the form, it can be submitted to your local deputy registrar office or mailed to the Department of Public Safety. Confirm your submission method aligns with your needs.

Browse Other Templates

How to Ask for Letter of Recommendation - This student balances academic responsibilities with extracurricular activities effectively.

Form 126 - Retain a copy of the submitted OF-126 for your records after submission.