Fill Out Your Aflac Direct Deposit Form

The Aflac Direct Deposit form is a vital document for shareholders wishing to manage their investments effectively, particularly when liquidating shares from the AFL Stock Plan. This form allows you to authorize Aflac Incorporated to deposit the proceeds directly into your bank account, offering a seamless way to receive your funds. It requires basic personal information, including your name, address, and Social Security or Tax ID number. Additionally, you'll need to provide your account number and the name of your financial institution, ensuring that you attach a voided check or deposit slip to facilitate the banking transactions. The form consists of options for partial or full withdrawals, enabling you to choose whether to issue stock certificates or sell your shares. A significant feature is your acknowledgment that errors in the transfer process can be corrected by the company, while also waiving any claims against Aflac or the financial institution involved. Lastly, the form mandates notarized signatures from all shareholders if the bank account name differs from the stock account name, emphasizing the importance of accuracy in the information provided. All these aspects work together to ensure you receive your funds promptly, typically within three business days after the trading date, making adherence to the form’s requirements crucial for a successful transaction.

Aflac Direct Deposit Example

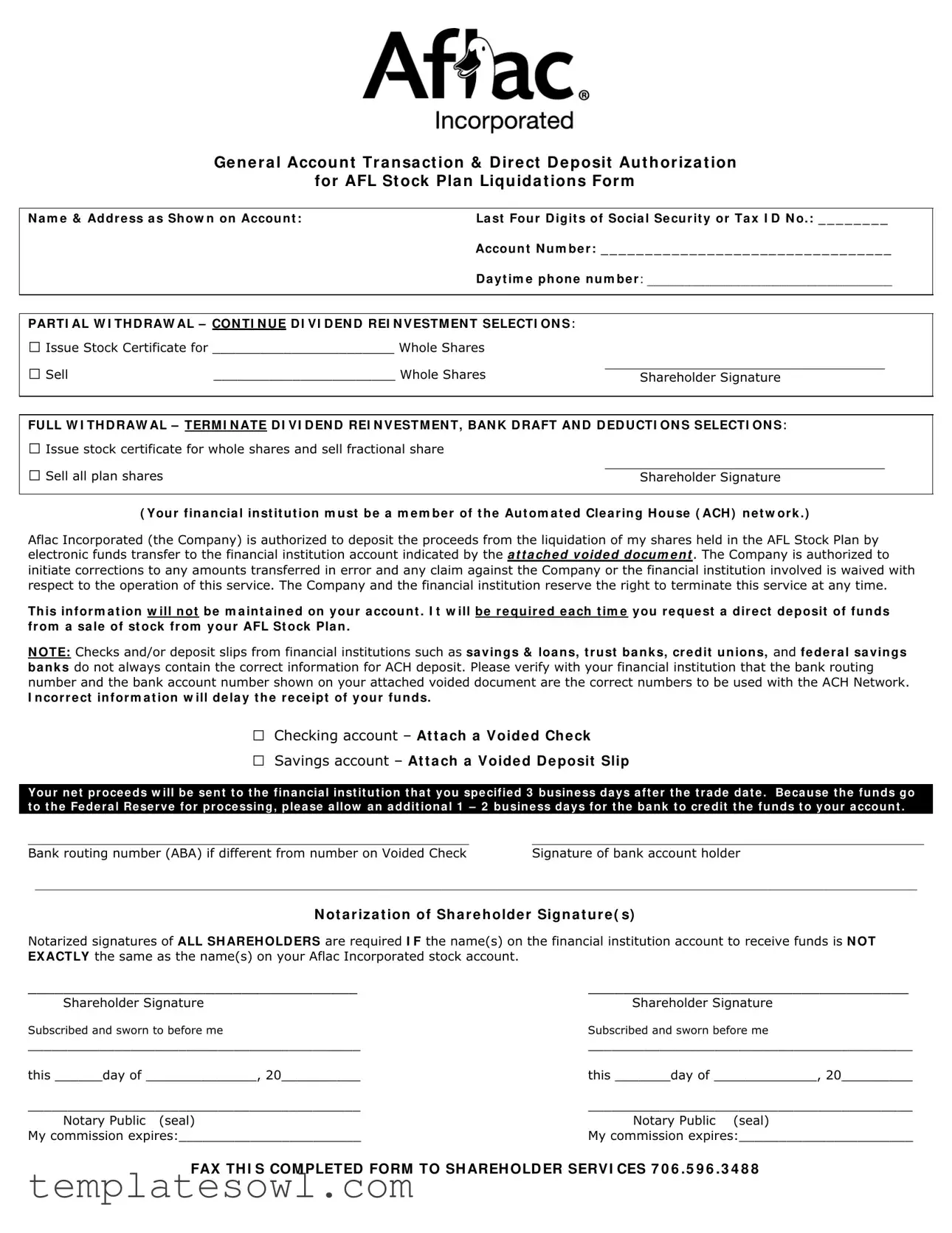

Ge n e r a l Accou n t Tr a n sa ct ion & D ir e ct D e posit Au t h or iza t ion

for AFL St ock Pla n Liqu ida t ion s For m

N a m e & Ad dr e ss a s Sh ow n on Accou n t : |

La st Fou r D igit s of Socia l Se cu r it y or Ta x I D N o. : _ _ _ _ _ _ _ _ |

|

Accou n t N u m be r : _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ |

|

D a y t im e ph on e n u m be r : ___________________________________ |

|

|

PARTI AL W I TH D RAW AL – CON TI N UE D I V I D EN D REI N V ESTM EN T SELECTI ON S:

□Issue Stock Certificate for _______________________ Whole Shares

□ Sell |

_______________________ Whole Shares |

____________________________________ |

Shareholder Signature |

FULL W I TH D RAW AL – TERM I N ATE D I V I D EN D REI N V ESTM EN T, BAN K D RAFT AN D D ED UCTI ON S SELECTI ON S:

□Issue stock certificate for whole shares and sell fractional share

□ Sell all plan shares |

____________________________________ |

Shareholder Signature |

( You r f in a n cia l in st it u t ion m u st b e a m e m be r of t h e Au t om a t e d Cle a r in g H ou se ( ACH ) n e t w or k . )

Aflac Incorporated (the Company) is authorized to deposit the proceeds from the liquidation of my shares held in the AFL Stock Plan by electronic funds transfer to the financial institution account indicated by the A T T A CH E D V OID E D D O CU M E N T . The Company is authorized to initiate corrections to any amounts transferred in error and any claim against the Company or the financial institution involved is waived with respect to the operation of this service. The Company and the financial institution reserve the right to terminate this service at any time.

Th is in f or m a t ion w ill n ot be m a in t a in e d on y ou r a ccou n t . I t w ill be r e qu ir e d e a ch t im e y ou r e qu e st a dir e ct de p osit of fu n ds fr om a sa le of st ock fr om y ou r AFL St ock Pla n .

N OTE: Checks and/or deposit slips from financial institutions such as sa vin g s & loa n s, t r u st ba n k s, cr e d it u n ion s, and fe de r a l sa vin g s ba n k s do not always contain the correct information for ACH deposit. Please verify with your financial institution that the bank routing number and the bank account number shown on your attached voided document are the correct numbers to be used with the ACH Network.

In cor r e ct in for m a t ion w ill de la y t h e r e ce ipt of y ou r fu n ds.

□Checking account – At t a ch a V oide d Ch e ck

□Savings account – At t a ch a V oide d D e posit Slip

You r n e t pr oce e ds w ill be se n t t o t h e fin a n cia l in st it u t ion t h a t you spe cifie d 3 bu sin e ss da ys a ft e r t h e t r a de da t e . Be ca u se t h e fu n ds go t o t h e Fe de r a l Re se r ve for pr oce ssin g, ple a se a llow a n a ddit ion a l 1 – 2 bu sin e ss da ys for t h e ba n k t o cr e dit t h e fu n ds t o you r a ccou n t .

_______________________________________________________________ |

________________________________________________________ |

Bank routing number (ABA) if different from number on Voided Check |

Signature of bank account holder |

______________________________________________________________________________________________________________________________

N ot a r iz a t ion of Sh a r e h olde r Sign a t u r e ( s)

Notarized signatures of ALL SH AREH OLD ERS are required I F the name(s) on the financial institution account to receive funds is N OT EX ACTLY the same as the name(s) on your Aflac Incorporated stock account.

_____________________________________ |

____________________________________ |

Shareholder Signature |

Shareholder Signature |

Subscribed and sworn to before me |

Subscribed and sworn before me |

__________________________________________ |

_________________________________________ |

this ______day of ______________, 20__________ |

this _______day of _____________, 20_________ |

__________________________________________ |

_________________________________________ |

Notary Public (seal) |

Notary Public (seal) |

My commission expires:_______________________ |

My commission expires:______________________ |

FAX TH I S COM PLETED FORM TO SH AREH OLD ER SERV I CES 7 0 6 . 5 9 6 . 3 4 8 8

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form authorizes Aflac to deposit funds electronically into a specified bank account. |

| Personal Information | It requires your name, address, and the last four digits of your Social Security or Tax ID Number. |

| Account Information | You must provide the account number and the bank routing number for the ACH transfer. |

| Withdrawal Options | Participants can choose between a partial or full withdrawal of their stock account. |

| Signature Requirement | Shareholder signatures are mandatory for processing the transactions indicated on the form. |

| Bank Verification | It's essential to verify the routing number and account number with your bank to avoid errors. |

| Processing Time | Your net proceeds will typically be sent to your financial institution three business days after the trade date. |

| Notarization Requirement | If the names on the account differ from the stock account, notarized signatures for all shareholders are necessary. |

| Fax Submission | The completed form needs to be faxed to Shareholder Services at 706-596-3488 for processing. |

| Governing Laws | State-specific forms must comply with local regulations and laws concerning electronic fund transfers. |

Guidelines on Utilizing Aflac Direct Deposit

Completing the Aflac Direct Deposit form entails providing specific account information to ensure your funds are directed appropriately. This process typically involves verifying account details and obtaining necessary signatures. Following the completion of the form, submitting it to Aflac enables the processing of direct deposits into your specified bank account.

- Begin by filling in your name and address as shown on your account.

- Input the last four digits of your Social Security number or Tax ID number in the designated field.

- Write your account number in the corresponding section.

- Provide your daytime phone number for any necessary follow-up.

- Choose whether you want a partial or full withdrawal of shares by checking the appropriate box.

- If you select a partial withdrawal, indicate the number of whole shares for which you would like to issue a stock certificate or sell.

- For a full withdrawal, specify whether to issue a stock certificate for whole shares or to sell all plan shares.

- Attach a voided check or deposit slip to verify your bank account details. This should confirm that your financial institution is a member of the ACH network.

- Fill in the bank routing number (if different from the one on your attached document).

- The bank account holder must sign in the designated area.

- If the names on your bank account differ from those on your Aflac stock account, all shareholders must sign and notarize the document.

- Provide a date and location for notarization, along with the notary’s signature and seal.

- Finally, fax the completed form to Shareholder Services at 706-596-3488.

What You Should Know About This Form

What is the purpose of the Aflac Direct Deposit form?

The Aflac Direct Deposit form is designed to facilitate the electronic transfer of funds from the liquidation of shares held in the AFL Stock Plan directly into a designated bank account. By completing this form, a shareholder authorizes Aflac to deposit their earnings seamlessly and efficiently, rather than receiving checks through the mail. This method not only speeds up the transfer process but also minimizes the risk of lost or delayed payments.

What information do I need to provide on the form?

When filling out the Aflac Direct Deposit form, you will need to provide essential personal information. This includes your name and address as shown on your account, the last four digits of your Social Security or Tax ID number, and your account number. Additionally, you must include your daytime phone number for contact purposes. Ensure that you specify your preferred method for receiving funds, either through a checking or savings account, by attaching the appropriate voided document. A notary signature may also be required for verification.

How long will it take for the funds to be deposited?

Upon completion and submission of the Aflac Direct Deposit form, your net proceeds will typically be deposited into your specified financial institution within three business days after the trade date. It’s important to keep in mind that due to the Federal Reserve processing system, there may be an additional delay of 1–2 business days before the funds are credited to your account. Therefore, allow some time before expecting the funds to be fully accessible.

What happens if there is an error with my direct deposit?

If an error occurs during the direct deposit process, Aflac is authorized to initiate corrections. This means that any incorrect amounts transferred in error can be adjusted accordingly. However, it’s important to note that by using this service, the account holder waives any claim against Aflac or the financial institution involved with respect to the operation of the direct deposit. To prevent delays, double-check that the bank routing number and account numbers on your attached documents are accurate before submission.

Common mistakes

Filling out the Aflac Direct Deposit form can be straightforward, but many people make common mistakes that can lead to delays or complications. One frequent error is not providing the correct account number. Make sure you carefully write down your account number as it appears on your bank documents. Even a single digit mistake can result in funds being deposited into the wrong account.

Another common mistake is skipping the bank routing number. This number is essential for directing funds to your bank. Double-check the routing number on the attached voided document to ensure it matches your financial institution’s records. Incorrect routing information can lead to significant delays in accessing your funds.

A lot of individuals forget to include the required voided check or deposit slip, which is a critical part of the process. Without this attachment, your application might not be processed at all. Ensure you attach the correct document that clearly shows your account information.

Many people also overlook the need for notarization. If the name on your bank account differs from the name on your Aflac account, you must have notarized signatures from all shareholders. Failing to do this can halt the processing of your request.

Poor handwriting can lead to another major issue. If your writing is unclear, bank officials might misinterpret your account details. Take your time and ensure that each number and letter is legible.

Another mistake is not providing a current daytime phone number. This information is important for any follow-up questions or confirmations. If there's an issue with your form, having a way for the processing team to reach you can help resolve it quickly.

Some people forget to review their entire form before submission. Make it a habit to double-check all entries before sending. Look for typos and ensure that all necessary sections are filled out completely.

Lastly, not keeping a copy of the completed form is a frequent oversight. It’s wise to have a copy for your records. This will help you if you need to reference it in the future or if there’s a discrepancy that needs addressing. Each of these steps can help facilitate a smooth direct deposit process with Aflac.

Documents used along the form

When completing the Aflac Direct Deposit form, there are several other documents that you may need to consider. These documents often complement the direct deposit process and provide important information or verification to ensure accuracy. Here is a list of key forms that could be required or beneficial in conjunction with the Aflac Direct Deposit form.

- Voided Check: This document provides the correct bank account information required for direct deposit. It shows the bank routing number and account number necessary for the transfer.

- Voided Deposit Slip: Similar to a voided check, a deposit slip verifies your bank account details. It is vital for ensuring that funds are deposited correctly into your savings or checking account.

- Stock Sale Request Form: If you're liquidating your shares for direct deposit, this form specifies how many shares you wish to sell and any preferred selling options.

- Notarized Signature Form: If there are discrepancies between the name on your bank account and your Aflac stock account, notarized signatures may be necessary. This form verifies the identities of all shareholders.

- Tax Identification Form: You may need to submit your taxpayer information, especially if the reason for the direct deposit involves tax implications or reporting requirements.

- Account Verification Letter: Some financial institutions may require a letter verifying your account details to process funds accurately.

- Proceeds Statement: This statement outlines detailed information about the expected proceeds from your stock sale, providing clarity on what will be deposited.

- Withdrawal Authorization Form: This document grants permission for the sale of shares and is crucial if the transaction is not a straightforward sale.

- Beneficiary Designation Form: If you need to designate beneficiaries for your shares, this form provides the necessary information for Aflac to update their records.

Understanding and preparing these documents can streamline your interactions with Aflac. They help facilitate accurate and timely processing of your requests, ensuring that your funds reach you without unnecessary delays. Always remember to double-check your submissions to avoid complications with your direct deposit setup.

Similar forms

- Direct Deposit Authorization Form: Like the Aflac form, this document permits an employer or organization to deposit payments directly into an individual's bank account. It includes personal and banking information necessary for processing deposits efficiently.

- Paycheck Stub: This document provides a detailed summary of earnings and deductions associated with direct deposits. Both documents focus on transaction clarity and may reference specific bank account details for direct deposit purposes.

- IRS Form W-4: This form allows employees to indicate their tax withholding preferences. Similar to Aflac's form, it contains personal information and specifies how financial institutions manage funds related to tax withholdings.

- Loan Payment Authorization Form: When individuals authorize a lender to withdraw payments from their bank accounts, this document shares similarities with the Aflac Direct Deposit form, as both require banking information for automatic transactions.

- Social Security Direct Deposit Form: This form is used to arrange direct deposits for Social Security benefits, mirroring Aflac's focus on direct bank deposits and the necessity of accurate banking details.

- ACH Debit Authorization: This document enables companies to withdraw funds automatically from one’s bank account, paralleling the Aflac form's purpose by requiring both personal and banking information for electronic transactions.

- Retirement Plan Distribution Form: When individuals request disbursements from a retirement plan, they may use this form, which also mandates personal and bank details for processing in alignment with Aflac's direct deposit methodology.

- Insurance Premium Payment Authorization: This allows policyholders to authorize automatic premiums from their accounts, similar to how Aflac manages fund transfers while ensuring financial and personal information is verified.

- Vendor Payment Authorization Form: Companies often require this document from vendors to ensure payments are made directly to specified accounts, resembling how Aflac ensures secure deposit transactions through detailed banking protocols.

- Refund Request Form: When clients seek refunds that involve direct transfers to their accounts, this form necessitates banking information akin to the Aflac Direct Deposit form, emphasizing financial accuracy and clarity in transactions.

Dos and Don'ts

When filling out the Aflac Direct Deposit form, consider the following dos and don’ts:

- Do read the entire form carefully before starting.

- Do ensure your name and address match exactly what is on your account.

- Do double-check the last four digits of your Social Security or Tax ID number.

- Do provide accurate account numbers for the direct deposit.

- Do attach a voided check or deposit slip for your specified account.

- Don’t leave any sections blank unless instructed.

- Don’t use outdated or incorrect information regarding your financial institution.

- Don’t forget to notarize your signature if the names don’t match on both accounts.

- Don’t fax the form without ensuring all details are complete and correct.

Misconceptions

The Aflac Direct Deposit form is a necessary document for shareholders wishing to deposit proceeds directly into their bank accounts following stock liquidations. However, several misconceptions may lead to confusion or errors when completing this process. Here are ten common misconceptions:

- Direct deposit is automatic for all shareholders. Some people believe that directing funds to their accounts is automatic. In reality, shareholders must complete this form each time they wish to set up a direct deposit for proceeds.

- Any bank can accept the direct deposit. Many assume any financial institution can process Aflac Direct Deposits. However, only those that participate in the Automated Clearing House (ACH) network are eligible.

- A voided check is not necessary. Some individuals think they can skip the requirement for a voided check or deposit slip. The form explicitly states that attaching these documents is crucial for accurate processing.

- Incorrect bank information will not delay funds. A common belief is that inaccuracies in bank details won't affect the transaction. In fact, incorrect information will lead to delays in receiving funds.

- Signatures from all shareholders are optional. Some might believe that only one signature is needed for a joint account. In truth, notarized signatures from all shareholders are required if names on the account differ from those on the Aflac stock account.

- Funds are transferred immediately after submission. Quite a few expect instant transfers after submitting the form. However, funds are typically sent three business days following the trade date, with additional processing time by the bank.

- The form does not expire. Individuals may presume that the form remains valid indefinitely. The reality is that it needs to be completed each time a direct deposit is requested, regardless of previous submissions.

- Corrections to transferred amounts are handled manually. There’s a misconception that any errors require a lengthy manual process. In fact, Aflac is authorized to initiate corrections automatically for any amounts transferred in error.

- Notarization is only a formality. People often think notarization can be overlooked. However, notarization is crucial if there is a discrepancy between the names on the account and those listed on the stock account.

- All types of accounts are treated the same. Some believe checking and savings accounts are interchangeable. While both are acceptable, Aflac specifies that different forms (voided check versus deposit slip) must be included depending on the account type.

Understanding these misconceptions can help ensure a smoother process when using the Aflac Direct Deposit form. Proper completion reduces delays and increases the likelihood of timely fund availability.

Key takeaways

Filling out the Aflac Direct Deposit form correctly is crucial for seamless processing. Here are some key takeaways to keep in mind:

- The form must include your name and address exactly as they appear on your account.

- You will need to provide the last four digits of your Social Security number or Tax ID number.

- Accurate account information, including your account number, is essential. This could cause delays if incorrect.

- A daytime phone number should be included in case Aflac needs to reach you for any verification.

- For direct deposit, your financial institution must be a member of the Automated Clearing House (ACH) network.

- Ensure you attach a voided check for checking accounts or a voided deposit slip for savings accounts.

- Your net proceeds will be sent to your specified financial institution within three business days after the trade date.

- Allow additional processing time of 1 to 2 business days for the bank to credit the funds to your account.

- Notarized signatures from all shareholders may be required if the name(s) on your bank account do not match your Aflac stock account exactly.

Remember: Double-check all information before submitting the form. This can save you time and ensure that you receive your funds promptly.

Browse Other Templates

1099 K Meaning - Backup withholding, as reported on the 1099-K, acts as a safeguard for the IRS against underreporting tax obligations.

Ca Dept of Consumer Affairs - Stations operating in Change of Ownership areas must meet distinct requirements for Gold Shield certification.

Houston Burglar Alarm Permits - Read and understand the fee structure before submitting payment.