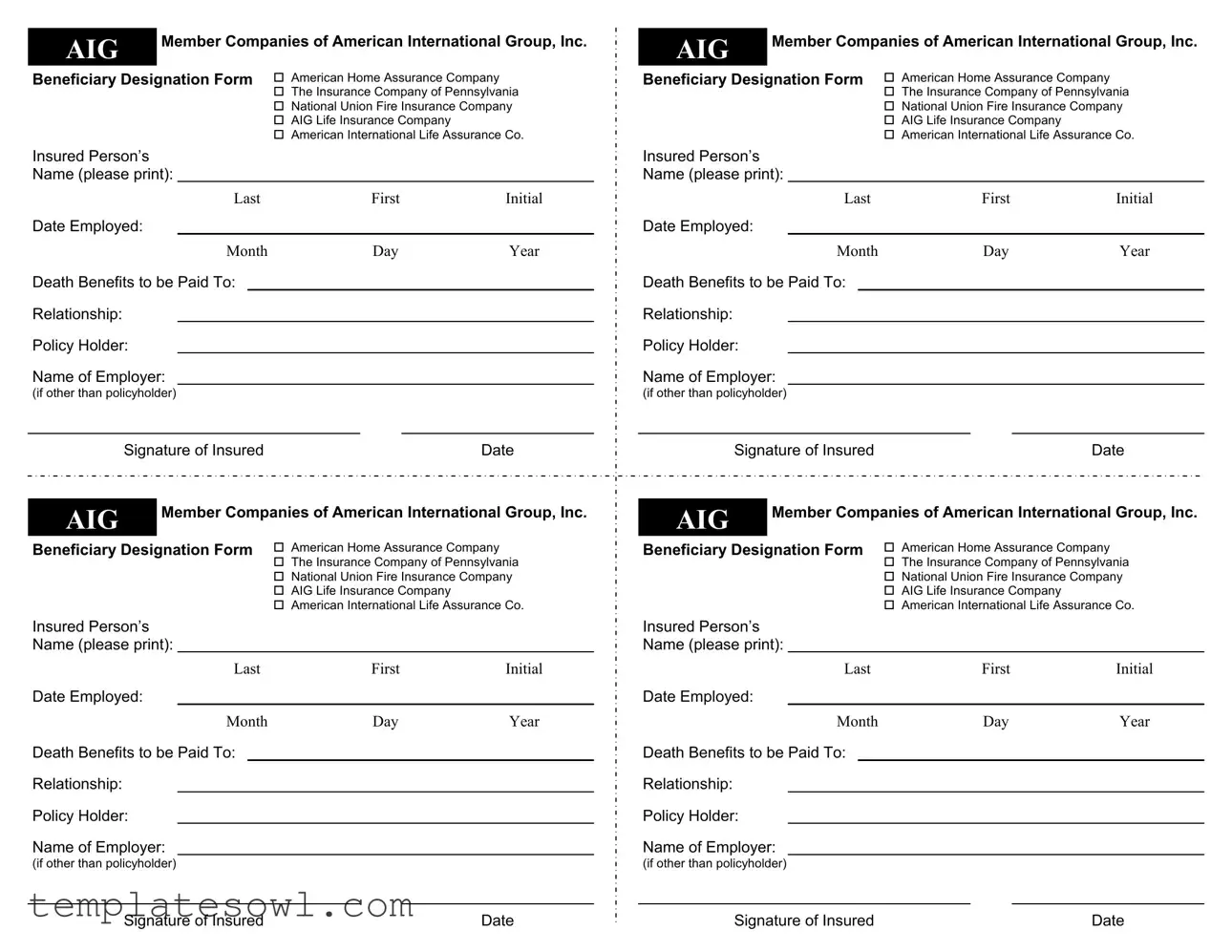

Fill Out Your Aig Beneficiary Designation Form

When it comes to planning for the unexpected, ensuring that your financial wishes are clearly communicated can provide peace of mind. The AIG Beneficiary Designation Form plays a vital role in this process, as it allows individuals to specify who will receive death benefits from their insurance policies. This form is associated with several AIG Member Companies, such as American Home Assurance Company and AIG Life Insurance Company, establishing clarity about the distribution of benefits upon the policyholder's passing. In completing the form, the insured person must provide essential information, including their name, employment date, and the name of the policyholder if different from themselves. Additionally, designating a beneficiary requires indicating the relationship of the individual receiving the benefits, thus ensuring that the intended recipient is properly documented. The signatures of the insured person affirm the accuracy of the information provided. By taking the time to complete this form, individuals not only express their wishes but also help their loved ones navigate a challenging time with greater ease and fewer uncertainties.

Aig Beneficiary Designation Example

AIG |

Member Companies of American International Group, Inc. |

|

AIG |

Member Companies of American International Group, Inc. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Beneficiary Designation Form |

American Home Assurance Company |

|

|

Beneficiary Designation Form |

American Home Assurance Company |

|

||||||||||

|

|

|

|

The Insurance Company of Pennsylvania |

|

|

|

|

|

The Insurance Company of Pennsylvania |

||||||

|

|

|

|

National Union Fire Insurance Company |

|

|

|

|

|

National Union Fire Insurance Company |

||||||

|

|

|

|

AIG Life Insurance Company |

|

|

|

|

|

|

AIG Life Insurance Company |

|

||||

|

|

|

|

American International Life Assurance Co. |

|

|

|

|

|

American International Life Assurance Co. |

||||||

Insured Person’s |

|

|

|

|

|

|

|

|

Insured Person’s |

|

|

|

|

|

|

|

Name (please print): |

|

|

|

|

|

Name (please print): |

|

|

|

|

||||||

|

|

Last |

|

First |

Initial |

|

|

|

Last |

|

First |

Initial |

||||

Date Employed: |

|

|

|

|

|

|

|

|

Date Employed: |

|

|

|

|

|

|

|

|

|

Month |

|

Day |

Year |

|

|

|

Month |

|

Day |

Year |

||||

Death Benefits to be Paid To: |

|

|

|

|

|

Death Benefits to be Paid To: |

|

|

|

|

||||||

Relationship: |

|

|

|

|

|

|

|

|

Relationship: |

|

|

|

|

|

|

|

Policy Holder: |

|

|

|

|

|

|

|

|

Policy Holder: |

|

|

|

|

|

|

|

Name of Employer: |

|

|

|

|

|

Name of Employer: |

|

|

|

|

||||||

(if other than policyholder) |

|

|

|

|

|

|

(if other than policyholder) |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||||

Signature of Insured |

|

|

Date |

|

Signature of Insured |

|

|

Date |

||||||||

|

|

|

|

|

|

|

|

|

||||||||

AIG |

Member Companies of American International Group, Inc. |

|

AIG |

Member Companies of American International Group, Inc. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Beneficiary Designation Form |

American Home Assurance Company |

|

|

Beneficiary Designation Form |

American Home Assurance Company |

|

||||||||||

|

|

|

|

The Insurance Company of Pennsylvania |

|

|

|

|

|

The Insurance Company of Pennsylvania |

||||||

|

|

|

|

National Union Fire Insurance Company |

|

|

|

|

|

National Union Fire Insurance Company |

||||||

|

|

|

|

AIG Life Insurance Company |

|

|

|

|

|

|

AIG Life Insurance Company |

|

||||

|

|

|

|

American International Life Assurance Co. |

|

|

|

|

|

American International Life Assurance Co. |

||||||

Insured Person’s |

|

|

|

|

|

|

|

|

Insured Person’s |

|

|

|

|

|

|

|

Name (please print): |

|

|

|

|

|

Name (please print): |

|

|

|

|

||||||

|

|

Last |

|

First |

Initial |

|

|

|

Last |

|

First |

Initial |

||||

Date Employed: |

|

|

|

|

|

|

|

|

Date Employed: |

|

|

|

|

|

|

|

|

|

Month |

|

Day |

Year |

|

|

|

Month |

|

Day |

Year |

||||

Death Benefits to be Paid To: |

|

|

|

|

|

Death Benefits to be Paid To: |

|

|

|

|

||||||

Relationship: |

|

|

|

|

|

|

|

|

Relationship: |

|

|

|

|

|

|

|

Policy Holder: |

|

|

|

|

|

|

|

|

Policy Holder: |

|

|

|

|

|

|

|

Name of Employer: |

|

|

|

|

|

Name of Employer: |

|

|

|

|

||||||

(if other than policyholder) |

|

|

|

|

|

|

(if other than policyholder) |

|

|

|

|

|

||||

Signature of Insured |

Date |

Signature of Insured |

Date |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The AIG Beneficiary Designation form is used to specify who will receive death benefits from an insurance policy. |

| Insured Person's Information | The form requires the insured person's full name and date of employment. |

| Death Benefits | It allows individuals to designate the recipient(s) of the death benefits, along with their relationship to the insured. |

| Policyholder Information | Details about the policyholder, including their name and employer, are necessary if they differ from the insured person. |

| Signature Requirement | The form must be signed and dated by the insured person to validate the beneficiary designation. |

| State-Specific Forms | Certain states may have specific versions of the form, governed by state insurance laws, which can differ significantly. |

| Multiple Beneficiaries | Individuals can often name multiple beneficiaries, specifying how benefits should be divided among them. |

| Updating Information | It is crucial to update the form as life circumstances change, such as marriage, divorce, or the birth of a child. |

Guidelines on Utilizing Aig Beneficiary Designation

Completing the AIG Beneficiary Designation Form is essential for ensuring that your benefits are distributed according to your wishes. After filling out this form, it must be submitted to AIG for processing. Below are the steps to guide you through filling out the form.

- Print the form: Obtain a copy of the AIG Beneficiary Designation Form.

- Fill in your information: Write your last name, first name, and middle initial in the designated fields. Ensure accuracy in spelling.

- Date of employment: Enter your date of employment using the format Month, Day, Year.

- Specify the death benefits recipient: Choose the individual or entity to receive the death benefits. Write their name clearly.

- Indicate your relationship: Specify your relationship with the beneficiary (e.g., spouse, child, friend).

- Policyholder information: If you are not the policyholder, provide the name of the policyholder here.

- Employer's name: If the policyholder is not your employer, enter the name of your employer.

- Signature: Sign the form to confirm the provided information is correct. Include the current date next to your signature.

What You Should Know About This Form

What is the AIG Beneficiary Designation Form?

The AIG Beneficiary Designation Form is a document used by policyholders to specify who will receive death benefits from an insurance policy issued by the AIG Member Companies. These may include entities such as American Home Assurance Company, The Insurance Company of Pennsylvania, and AIG Life Insurance Company.

Why do I need to fill out the Beneficiary Designation Form?

Filling out the Beneficiary Designation Form ensures that the death benefits are distributed according to your wishes. Without a completed form, benefits may be subject to state laws or may go through probate, which can delay payments and reduce their value.

Who can I designate as a beneficiary?

You may designate any individual or entity, such as a family member, friend, charity, or trust. It's important to consider the relationship and any potential tax implications when making your selection.

What information do I need to provide on the form?

The form requires the insured person's name, the date of employment, the name of the insurance policyholder, the name of the beneficiary, their relationship to you, and the name of the employer (if different from the policyholder).

How do I submit the completed form?

Once the form is completed and signed, it should be submitted to AIG either through mail or electronically, depending on the instructions provided on the form. Confirming receipt is advisable to ensure that your designation is processed.

Can I change my beneficiary after I submit the form?

Yes, beneficiaries can be changed at any time by filling out a new Beneficiary Designation Form. It is crucial to keep your beneficiary information updated, especially after major life events such as marriage, divorce, or the birth of a child.

What happens if I do not designate a beneficiary?

If no beneficiary is designated, the death benefits may be paid to your estate. This can lead to a longer payout process and may incur additional legal fees. Ultimately, it may not align with your intended wishes for your beneficiaries.

Common mistakes

Filling out the AIG Beneficiary Designation form can seem straightforward, but several common mistakes can result in complications down the line. One of the most frequent errors is failing to provide complete and accurate personal information. It's important to ensure that the insured person's name is clearly printed, including the last name, first name, and middle initial. Any missing information may lead to delays or issues in processing the form.

Another mistake involves not specifying the beneficiary clearly. Individuals often write vague terms like “family” or “my children” instead of providing full names and relationships. If the beneficiary cannot be clearly identified, it could create disputes or confusion during the claims process. Therefore, each beneficiary should be named along with their relationship to the insured.

Additionally, omitting the date of employment is another common oversight. This date helps to establish the context surrounding the beneficiary designation. When filling out the date, ensure that the format is correct—month, day, and year—to avoid misunderstandings.

Many people also forget to include the signature of the insured. Without this signature, the form is incomplete. It is crucial to sign the document in the designated area and to ensure that the signature matches the name provided earlier in the form. Any discrepancies might raise questions about the validity of the designation.

Some individuals neglect to consider the current situation of the beneficiaries. Life changes such as marriage, divorce, or the birth of a child can impact who should be designated. Regularly reviewing and updating the beneficiary designation form helps ensure that it reflects life changes accurately and avoids unintended consequences.

Another mistake is failing to keep a copy of the completed form. After submission, having a personal copy allows you to confirm that the changes have been made as intended. This practice can save time and trouble in the future if disputes arise regarding the intended beneficiaries.

It is also not uncommon for people to fill out the form with incorrect or outdated information about the policyholder or employer. It is imperative to ensure that all details about the policyholder’s name and the employer’s name (if different) are current and accurate. This information can be crucial in processing claims efficiently.

Lastly, neglecting to consult a professional can lead to misunderstandings of the form's implications. While filling out the form may seem simple, it carries significant legal weight. Seeking advice ensures that you fully understand the consequences of your choices and helps prevent any mistakes that could complicate the beneficiary designation.

Documents used along the form

When completing the AIG Beneficiary Designation form, there are several other important forms and documents that you may need to consider. Each of these documents plays a crucial role in ensuring that your benefits are distributed according to your wishes and in compliance with internal and regulatory requirements. Below is a list of related documents.

- Life Insurance Policy Document: This document outlines the terms and conditions of your life insurance coverage. It provides details about the coverage amount, policy duration, and specific clauses relevant to the payout in case of death.

- Will: A will is a legal document that dictates how your assets and dependents will be managed after your passing. Including your life insurance policies in your will ensures that your beneficiary designations are honored according to your wishes.

- Power of Attorney: This document grants authority to an individual to make financial or medical decisions on your behalf if you are unable to do so. It's essential for managing your affairs, especially in situations where you may need assistance due to incapacity.

- Trust Agreement: A trust is a legal arrangement that holds assets for the benefit of a person or entity. A trust agreement can help manage the distribution of funds from your life insurance policy, ensuring that your beneficiaries receive their benefits under specified conditions.

Understanding these forms and documents aids in proper administration of your financial affairs. Taking the time to gather and complete these documents can provide peace of mind, knowing your wishes will be fulfilled as intended.

Similar forms

-

Life Insurance Beneficiary Form: Similar to the AIG Beneficiary Designation form, this document allows the insured person to name individuals or entities that will receive the benefits from a life insurance policy upon the insured's death. It captures essential information, such as the insured’s name and relationship to the beneficiaries.

-

Retirement Account Beneficiary Designation: This form serves to designate beneficiaries for retirement accounts, such as 401(k)s or IRAs. This document ensures that the assets in the account are transferred according to the insured’s wishes, just like the AIG Beneficiary Designation form.

-

Health Insurance Beneficiary Designation: While primarily for life insurance, a health insurance beneficiary designation form also specifies who receives any remaining benefits upon the insured’s death. This promotes clarity and security for the insured's loved ones.

-

Trust Beneficiary Designation: This document names beneficiaries who will receive assets held in a trust upon the grantor’s passing. Similar to the AIG form, it requires identification of the beneficiaries and the relationship to improve the accuracy of asset distribution.

-

Property Transfer on Death Deed: This deed allows individuals to designate beneficiaries for real estate, transferring ownership automatically upon death. Like the AIG form, it provides a straightforward process for ensuring property goes to designated individuals without going through probate.

-

Transfer on Death Account Designation: This form is used for bank and investment accounts, allowing assets to pass directly to named beneficiaries upon the account holder’s death. It mirrors the intent of the AIG Beneficiary Designation form in ensuring that assets are managed according to the holder’s wishes.

-

Funeral and Burial Insurance Beneficiary Form: This document allows individuals to name beneficiaries for policies intended to cover funeral or burial expenses. It is similar to the AIG form in that it addresses the allocation of death benefits and identifies the responsible parties.

-

Payable on Death (POD) Designation: This form is used to designate beneficiaries for bank accounts so that funds are distributed directly to them after the account holder’s death. It streamlines the process much like the AIG Beneficiary Designation form, emphasizing the importance of direct transfers.

Dos and Don'ts

When filling out the AIG Beneficiary Designation form, careful attention is essential. Here are some key points to keep in mind:

- Do double-check the spelling of names.

- Do provide complete and accurate information about relationships.

- Do ensure you sign and date the form in the required sections.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank; every section is important.

- Don't use nicknames when filling out names; use full legal names only.

- Don't forget to inform your beneficiaries about their designation.

- Don't rush the process; take your time to ensure everything is correct.

Misconceptions

- Misconception: The form is only needed for life insurance policies. Many individuals believe that the AIG Beneficiary Designation form is relevant only for life insurance. In reality, this form can apply to various types of insurance policies, including health, accident, and other benefit plans.

- Misconception: A beneficiary designation is permanent. Some people think once a beneficiary designation is made, it cannot be changed. This is incorrect. Beneficiaries can be updated at any time if circumstances change, such as marriage, divorce, or the birth of children.

- Misconception: Only immediate family can be designated as beneficiaries. It is a common misconception that only relatives can be named beneficiaries. In fact, policyholders can designate anyone they choose, including friends or charities.

- Misconception: A handwritten note can substitute for a formal designation. While individuals may think that a casual note or verbal statement suffices, insurers typically require a formal designation on their provided form. This ensures clarity and legal validity.

- Misconception: No consequence for not designating a beneficiary. Failing to fill out the beneficiary designation form may lead to complications. If no beneficiary is designated, benefits may be paid to the estate, which can delay distributions and create additional tax complications.

- Misconception: There is no need to review the beneficiary designation regularly. Some individuals assume that one designation suffices for life. However, reviewing and updating the form regularly is essential to reflect any significant life changes.

- Misconception: A joint account holder is automatically a beneficiary. Just because two individuals share an account does not mean they will both receive benefits upon the death of the policyholder. A formal designation still needs to be made in the beneficiary form.

- Misconception: The beneficiary designation has no impact on taxes. Many believe that naming a beneficiary does not affect taxes. In truth, options chosen can influence tax liability, and understanding these implications is vital for effective estate planning.

Key takeaways

When filling out the AIG Beneficiary Designation form, there are several important points to keep in mind:

- Accuracy is crucial. Ensure that all the information, including names and dates, is complete and correct to avoid disputes later.

- List all beneficiaries clearly. Specify the names and relationships of all individuals or entities designated to receive benefits.

- Understand the different types of beneficiaries. You can designate primary and contingent beneficiaries; make sure to account for both.

- Keep a copy for your records. After submitting the form, retain a copy for personal records, as it will be useful for future reference.

- Review and update regularly. Life changes such as marriage, divorce, or the birth of a child may necessitate an update to the beneficiaries you’ve chosen.

- Seek assistance if needed. If you have questions, consult with a financial advisor or an insurance professional to clarify any uncertainties.

Filling out this form thoughtfully ensures your intentions are honored should the need arise.

Browse Other Templates

Vs-35 - If applicable, any claims of overcharges for services rendered should be included in the report.

Mcs-90 Lookup - This form is necessary for compliance with the Motor Carrier Act of 1980.