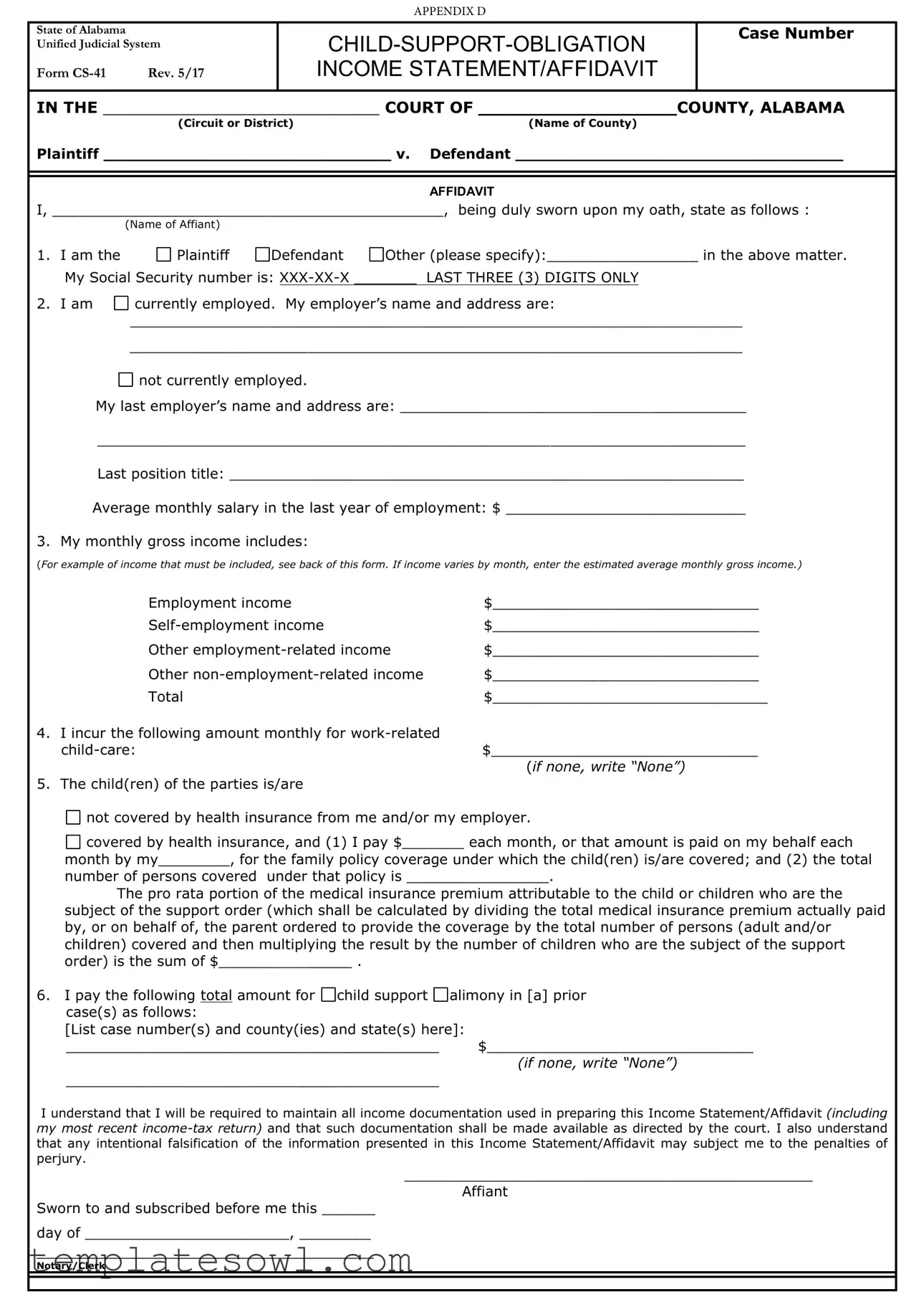

Fill Out Your Alabama Child Support Income Form

The Alabama Child Support Income form, known as Form CS-41, plays a critical role in determining the financial responsibilities of parents in child support cases. It requires detailed information about the financial situation of the parent filling it out. Individuals must provide their current employment status, including the name and address of their employer, or details of their last employer if they are unemployed. The form also outlines various income sources that must be reported, such as employment income, self-employment earnings, and other income types. Monthly gross income needs special attention, as it includes a calculation of work-related child-care expenses and health insurance coverage for the children. Additionally, the form addresses obligations like alimony from previous cases, ensuring that all financial responsibilities are accounted for. Completing this form accurately is essential, as discrepancies or intentional misinformation can lead to legal penalties, including charges of perjury. This document not only serves to provide transparency in financial matters but also assists the court in making informed decisions regarding child support obligations.

Alabama Child Support Income Example

|

|

|

|

|

APPENDIX D |

|

|

State of Alabama |

|

|

|

Case Number |

|||

Unified Judicial System |

|

|

|

||||

Form |

Rev. 5/17 |

|

|

INCOME STATEMENT/AFFIDAVIT |

|

||

|

|

|

|||||

IN THE ____________________________ COURT OF __________________COUNTY, ALABAMA |

|||||||

|

(Circuit or District) |

|

|

(Name of County) |

|

||

Plaintiff _____________________________ v. |

Defendant _________________________________ |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AFFIDAVIT |

|

I, ____________________________________________, being duly sworn upon my oath, state as follows : |

|||||||

(Name of Affiant) |

|

|

|

|

|

|

|

1. I am the |

Plaintiff |

Defendant |

Other (please specify):_________________ in the above matter. |

||||

My Social Security number is: |

LAST THREE (3) DIGITS ONLY |

|

|||||

2. I am |

currently employed. My employer’s name and address are: |

|

|||||

|

_____________________________________________________________________ |

||||||

_____________________________________________________________________

not currently employed.

not currently employed.

My last employer’s name and address are: _______________________________________

_________________________________________________________________________

Last position title: __________________________________________________________

Average monthly salary in the last year of employment: $ ___________________________

3. My monthly gross income includes:

(For example of income that must be included, see back of this form. If income varies by month, enter the estimated average monthly gross income.)

|

Employment income |

$______________________________ |

|

$______________________________ |

|

|

Other |

$______________________________ |

|

Other |

$______________________________ |

|

Total |

$_______________________________ |

4. |

I incur the following amount monthly for |

|

|

$______________________________ |

|

|

|

(if none, write “None”) |

5. |

The child(ren) of the parties is/are |

|

not covered by health insurance from me and/or my employer.

not covered by health insurance from me and/or my employer.

covered by health insurance, and (1) I pay $_______ each month, or that amount is paid on my behalf each

covered by health insurance, and (1) I pay $_______ each month, or that amount is paid on my behalf each

month by my________, for the family policy coverage under which the child(ren) is/are covered; and (2) the total

number of persons covered under that policy is ________________.

The pro rata portion of the medical insurance premium attributable to the child or children who are the subject of the support order (which shall be calculated by dividing the total medical insurance premium actually paid by, or on behalf of, the parent ordered to provide the coverage by the total number of persons (adult and/or children) covered and then multiplying the result by the number of children who are the subject of the support order) is the sum of $_______________ .

6.I pay the following total amount for

child support

child support

alimony in [a] prior case(s) as follows:

alimony in [a] prior case(s) as follows:

[List case number(s) and county(ies) and state(s) here]:

__________________________________________ $______________________________

(if none, write “None”)

__________________________________________

I understand that I will be required to maintain all income documentation used in preparing this Income Statement/Affidavit (including my most recent

______________________________________________

Affiant

Sworn to and subscribed before me this ______

day of _______________________, ________

______________________________________

Notary/Clerk

Form

EXAMPLES OF INCOME THAT MUST BE INCLUDED IN YOUR GROSS MONTHLY INCOME

1.Employment Income – shall include, but not be limited to, salary, wages, bonuses, commissions, severance pay, worker’s compensation, pension income, unemployment insurance, disability insurance, and Social Security benefits.

2.

3.Other

4.Other

RULE 32, ALABAMA RULES OF JUDICIAL ADMINISTRATION, PROVIDES THE FOLLOWING DEFINITIONS:

Income. For purposes of the guidelines specified in this Rule, “income” means the actual gross income of a parent, if the parent is employed to full capacity, or if the parent is unemployed or underemployed, then it means the actual gross income the parent has the ability to earn.

Gross Income.

“Gross income” includes income from any source, and includes, but is not limited to, income from salaries,

wages, commissions, bonuses, dividends, severance pay, pensions, interest, trust income, annuities, capital gains, Social Security benefits, workers’ compensation benefits,

insurance benefits, gifts, prizes, and preexisting periodic alimony.

“Gross income” does not include child support received for other children or benefits received from means- tested

For income from

expenses required to produce such income, as allowed by the Internal Revenue Service, with the exceptions noted in Rule 32 (B)(3)(b).

Under those exceptions, “ordinary and necessary expenses” does not include amounts allowable by the Internal Revenue Service for the accelerated component of depreciation expenses, investment tax credits, or any other business expenses determined by the court to be inappropriate for determining gross income for purposes of calculating child support.

Other Income. Expense reimbursements or

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of the Form | The Alabama Child Support Income Form is used to provide a detailed account of a parent's income and expenses for determining child support obligations in court. |

| Governing Law | This form is governed by Rule 32 of the Alabama Rules of Judicial Administration, which sets forth the definitions and guidelines for calculating child support. |

| Documentation Required | Affiants must maintain all income documentation, including the most recent income tax return, and provide them upon the court's request. |

| Consequences of Falsification | Any intentional falsification in the Income Statement/Affidavit may result in penalties, including the potential for perjury charges. |

Guidelines on Utilizing Alabama Child Support Income

Once you have the Alabama Child Support Income form in front of you, it’s important to gather all necessary information about your income and expenses. This includes your employment status, insurance coverage for the children, and any ongoing child support obligations. Carefully complete each section to ensure accurate reporting, which will assist in the determination of the child support amount.

- Begin by filling out your case number and the appropriate court information at the top of the form.

- Identify yourself as either the Plaintiff or Defendant in the case. Write your name in the designated space.

- Enter your Social Security number by providing only the last three digits.

- Indicate your employment status: state if you are currently employed, self-employed, or unemployed, and provide your employer’s name and address if applicable.

- If you are not currently employed, note the name and address of your last employer, along with your last job title and average monthly salary from that position.

- Report your monthly gross income by detailing different sources:

- Employment income

- Self-employment income

- Other employment-related income

- Other non-employment-related income

- Fill in the amount you incur monthly for work-related child care. If none, write “None.”

- State whether the child(ren) are covered by health insurance and provide details, including costs paid and the total number of persons covered under the policy.

- List any prior child support or alimony obligations, including case numbers and counties, as required.

- Review your completed form for accuracy, ensuring all sections are filled out completely and truthfully.

- Sign the affidavit section and have it witnessed by a notary or clerk, noting the date.

After completing the form, keep copies of all submitted paperwork for your records. The information provided will be reviewed in your case, so maintaining this documentation is crucial. Be prepared to present any additional information if requested by the court.

What You Should Know About This Form

What is the Alabama Child Support Income form?

The Alabama Child Support Income form, specifically Form CS-41, is a document used in child support proceedings. This form requires both parties to disclose their income to determine the appropriate amount of child support that should be paid. It gathers information about employment income, self-employment income, work-related child care costs, and health insurance coverage for the children.

Who needs to fill out the Child Support Income form?

Both parents involved in a child support case must fill out this form. Whether you're a plaintiff or defendant, it’s essential to provide accurate details about your finances. The information helps the court calculate child support obligations fairly.

What types of income should be included on this form?

You should include all sources of income, such as employment earnings, self-employment profits, and other income types like dividends and interest. Additionally, any bonuses, commissions, or pension benefits must be reported. Be thorough to ensure a precise calculation of your child support obligations.

How does the form address child care costs?

The form allows you to detail any monthly work-related child care expenses. If you don’t incur any, simply write “None.” Including this information can impact the overall child support calculations, so it's important to provide accurate figures.

What if I do not have a job?

If you are currently unemployed, you can still fill out the form. You will need to report your last employer and the average monthly salary earned during your last employment. Additionally, you should describe any efforts to seek employment or any sources of income you may have.

Are there penalties for providing false information?

Yes, the form includes a notice regarding the penalties for perjury. Intentionally falsifying information can lead to serious legal consequences. It is crucial to provide accurate and honest details to avoid potential penalties.

What should I do with the completed form?

Once you have completed the Child Support Income form, you must file it with the court as directed. Be sure to keep copies for your records, and hold onto any documentation you've used to fill out the form, such as pay stubs or tax returns, in case the court requests them in the future.

Common mistakes

Filling out the Alabama Child Support Income form can be a complex task, and many individuals make common mistakes that can affect the outcome of their case. One major error occurs when people underestimate their income. Be sure to include all sources of income, even if they seem minor or irregular. Not reporting income from bonuses, commissions, or even side jobs can lead to severe underrepresentation of your financial situation. This might not only affect child support calculations but could also raise red flags with the court.

Another frequent misstep involves inaccurate reporting of employment and self-employment income. When transitioning between jobs or working multiple gigs, individuals sometimes fail to provide a complete employment history. This can create inconsistencies that the court may notice. Instead of just listing your current job's income, include previous employment details and ensure you account for any self-employment income correctly. Don’t forget, the total gross income is important, and any discrepancies can complicate your case.

Moreover, many people neglect to include all necessary documentation. The form requires proof of income, so it’s crucial to maintain and submit documents such as pay stubs, tax returns, and proof of any other sources of income. Skipping this step can lead to complications down the line. The court expects full transparency regarding your financial situation, and having the required documentation readily available can streamline the process.

Lastly, miscalculating the pro rata portion of health insurance premiums is a mistake that can have lasting repercussions. It’s important to understand how to divide your total medical insurance premium properly when calculating the amount attributable to your child(ren). Carefully read the instructions provided on the form, and if you are uncertain, consider seeking assistance. Accurate calculations are key to ensuring that the information you provide is clear and justifiable.

Documents used along the form

The Alabama Child Support Income form serves as a critical tool in determining an individual's income for child support calculations. Along with this form, there are several other important documents that may be required to ensure accurate reporting of income and expenses related to child support obligations. Below is a list of these documents and a brief description of each.

- Employment Verification Letter: This letter, typically issued by an employer, confirms details about an employee's position, salary, and length of employment. It provides an official snapshot of the individual's current financial situation.

- Recent Pay Stubs: Pay stubs give a clear view of an individual's earnings over a specified period. They document gross wages, deductions, and net pay, making them essential for verifying monthly income.

- Tax Returns: Previous years' tax returns are essential for understanding an individual's overall income. They reflect all sources of income and provide a comprehensive financial picture, which can be crucial in child support calculations.

- Bank Statements: These statements offer insight into an individual's financial habits. They can reveal other sources of income, expenses, and patterns in saving and spending which may affect the support amount.

- Child Care Expense Statement: This document outlines any incurred expenses related to child care, which can affect child support obligations. It helps to detail the costs already being managed by the parent who is seeking support.

These documents work together with the Alabama Child Support Income form to provide a complete financial overview necessary for determining child support obligations. When all relevant paperwork is gathered, the process becomes much clearer and more efficient for everyone involved.

Similar forms

- Income Verification Form: Similar to the Alabama Child Support Income form, this document collects detailed information about an individual's income sources, including their employment and self-employment details. It requires sworn statements regarding financial stability, ensuring accuracy for financial assessments related to obligations.

- Affidavit of Support: This document is often required in immigration processes. It serves to assure that a person has the financial means to support another individual. Like the income form, it necessitates the declaration of income and financial resources, typically under the penalty of perjury.

- Financial Disclosure Statement: Used in divorce and custody cases, this statement outlines a party’s financial situation. It parallels the child support income form in its detailed breakdown of income, expenses, and assets, aiming to provide a clear picture of financial responsibilities.

- Tax Returns: Tax returns provide comprehensive documentation of an individual's income, similar to the information required in the Alabama Child Support Income form. Both documents outline sources of income and can serve as proof of earnings used for calculating support obligations.

- Child Support Guidelines Worksheet: This worksheet is used in many jurisdictions to help determine child support amounts. It is similar because it requires a detailed account of income and other financial obligations directly related to child support calculations.

Dos and Don'ts

When completing the Alabama Child Support Income form, there are important guidelines to follow. Here are seven things you should and shouldn't do:

- Do include all sources of income. Make sure to report your employment income, self-employment income, and any other relevant earnings.

- Don't omit past employment information. If you are currently unemployed, provide details about your last job, including the employer and your last position.

- Do provide accurate estimates of your monthly income. If your income varies from month to month, calculate the average monthly income as accurately as possible.

- Don't forget to report child care expenses. Specify the amount you pay monthly for work-related child care, or write “None” if applicable.

- Do disclose any child support or alimony already being paid. Include details such as case numbers and amounts for prior obligations.

- Don't leave out health insurance details. Indicate whether the children are covered by health insurance, and provide the monthly payment amount if relevant.

- Do keep documentation handy. Maintain records of all income sources and supporting documents in case you need to provide them later.

Following these guidelines can help ensure that your Income Statement/Affidavit is completed correctly. Understanding and fulfilling your responsibilities in this process is crucial for both legal compliance and child support calculations.

Misconceptions

Here are four common misconceptions about the Alabama Child Support Income form:

- Misconception 1: The form only applies to employed parents.

- Misconception 2: All income types are automatically counted.

- Misconception 3: You don’t need to keep records of income.

- Misconception 4: The Child Support Income form is a one-time requirement.

Many believe the form is only for parents who are currently employed. In reality, it also applies to those who are unemployed or underemployed. It requires them to report potential income and previous employment information as well.

Some think that all income sources are considered when calculating child support. This is not true. Certain types of income, like benefits from public assistance programs, do not count towards the gross income calculation for child support.

It is a common belief that once the form is submitted, no further documentation is necessary. However, it is crucial to keep all income documentation. The court may request to see these records at any time to ensure accuracy and compliance.

Many parents assume they need to fill out the form just once. In fact, this form may need to be updated regularly. Changes in employment status or income can affect child support obligations, and these must be reported to the court.

Key takeaways

Filling out the Alabama Child Support Income form requires personal information, including your Social Security number and employment details. Be prepared to disclose accurate and comprehensive information about your income.

Income must be reported in various categories. This includes employment income, self-employment income, and other sources like dividends or alimony. It is crucial to provide a complete picture of your financial situation.

If your income fluctuates, provide an estimated average monthly gross income. This ensures the court has a fair assessment of your financial capability.

Record any work-related child-care costs on the form. Ensure you either state the monthly amount or indicate “None” if you do not incur such expenses.

Indicate the child’s health insurance coverage, if applicable. You will need to report the monthly premium you pay and the number of individuals covered by that policy.

Document any child support or alimony obligations from prior cases. This information is relevant to understanding your overall financial responsibilities.

Maintain all supporting documentation used in completing the form, including tax returns. This documentation should be available for court review if requested.

Browse Other Templates

Gbreb Rental Application - Detail your source of income and its nature.

Indian Overseas Bank Account Opening Form Pdf - Changes in account services can be adopted at the bank's discretion as stated in the form.