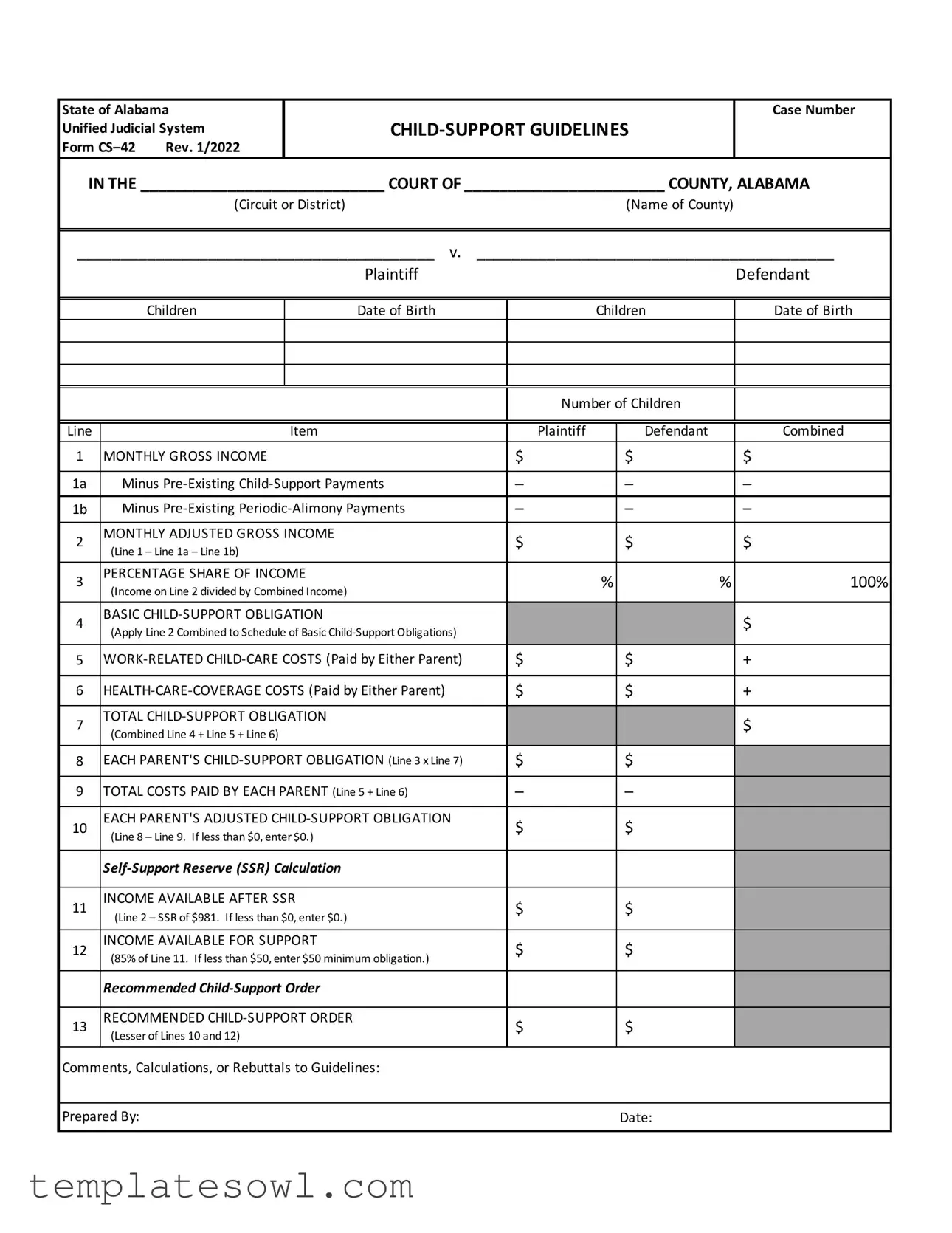

Fill Out Your Alabama Child Support Sheet Form

The Alabama Child Support Sheet serves as a crucial tool for determining the financial responsibilities of parents in child support cases. Designed for use in both circuit and district courts, this form encompasses essential components that facilitate calculations pertaining to child support obligations. The initial section captures both parents' monthly gross incomes, accounting for any existing child support or alimony payments that may exist. This information allows for a clear picture of each parent's financial situation while considering their obligations. Once the monthly adjusted gross income is established, the form calculates each parent's percentage share, leading to an understanding of the basic child support obligation. Furthermore, by incorporating work-related child-care costs and health-care coverage expenses, the form ensures that all relevant financial obligations are taken into account. This holistic approach culminates in determining the total child support obligation and the final recommended child support order, providing a clear outcome that reflects the needs of the children involved. By promoting transparency and fairness, the Alabama Child Support Sheet plays a vital role in the delicate balancing act of fostering parental responsibility while prioritizing the welfare of the children. The design of the form emphasizes clarity, ensuring that all participants understand their roles and responsibilities in the child support process.

Alabama Child Support Sheet Example

State of Alabama |

|

Case Number |

||||||

Unified Judicial System |

|

|

||||||

Form |

Rev. 1/2022 |

|

|

|

|

|

|

|

IN THE ____________________________ COURT OF _______________________ COUNTY, ALABAMA |

||||||||

|

|

(Circuit or District) |

|

|

|

(Name of County) |

|

|

|

|

|||||||

|

|

|||||||

_________________________________________ v. |

_________________________________________ |

|||||||

|

|

|

|

Plaintiff |

|

|

|

Defendant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Children |

|

Date of Birth |

|

Children |

Date of Birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Children |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Line |

|

|

Item |

|

|

Plaintiff |

Defendant |

Combined |

1 |

MONTHLY GROSS INCOME |

|

|

$ |

$ |

$ |

||

|

|

|

|

|

|

|||

1a |

Minus |

|

– |

– |

– |

|||

1b |

Minus |

|

– |

– |

– |

|||

2 |

MONTHLY ADJUSTED GROSS INCOME |

|

|

$ |

$ |

$ |

||

(Line 1 – Line 1a – Line 1b) |

|

|

||||||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

3 |

PERCENTAGE SHARE OF INCOME |

|

|

% |

% |

100% |

||

(Income on Line 2 divided by Combined Income) |

|

|

||||||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

4 |

BASIC |

|

|

|

|

$ |

||

(Apply Line 2 Combined to Schedule of Basic |

|

|

|

|||||

|

|

|

|

|

||||

5 |

|

$ |

$ |

+ |

||||

|

|

|

|

|

|

|||

6 |

|

$ |

$ |

+ |

||||

|

|

|

|

|

|

|

|

|

7 |

TOTAL |

|

|

|

|

$ |

||

(Combined Line 4 + Line 5 + Line 6) |

|

|

|

|

||||

|

|

|

|

|

|

|||

8 |

EACH PARENT'S |

|

$ |

$ |

|

|||

9 |

TOTAL COSTS PAID BY EACH PARENT (Line 5 + Line 6) |

|

– |

– |

|

|||

10 |

EACH PARENT'S ADJUSTED |

|

$ |

$ |

|

|||

(Line 8 – Line 9. If less than $0, enter $0.) |

|

|

|

|||||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

11 |

INCOME AVAILABLE AFTER SSR |

|

|

$ |

$ |

|

||

(Line 2 – SSR of $981. If less than $0, enter $0.) |

|

|

|

|||||

|

|

|

|

|

|

|||

12 |

INCOME AVAILABLE FOR SUPPORT |

|

|

$ |

$ |

|

||

(85% of Line 11. If less than $50, enter $50 minimum obligation.) |

|

|

||||||

|

|

|

|

|

||||

|

Recommended |

|

|

|

|

|

||

|

|

|

|

|

|

|

||

13 |

RECOMMENDED |

|

|

$ |

$ |

|

||

(Lesser of Lines 10 and 12) |

|

|

|

|||||

|

|

|

|

|

|

|||

Comments, Calculations, or Rebuttals to Guidelines: |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

Prepared By: |

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact | Description |

|---|---|

| Form Title | The form is officially titled "Alabama Child Support Sheet." It is designated as Unified Judicial System Form CS-42. |

| Revision Date | This current version of the form was revised in January 2022. |

| Purpose | The form is designed to calculate child support obligations based on the monthly gross incomes of both parents. |

| Governing Law | It operates under the Alabama Child Support Guidelines outlined in Alabama Code Title 30, Chapter 3. |

| Monthly Gross Income | Line 1 accounts for the monthly gross income. It includes adjustments for existing child support and alimony payments. |

| Total Obligation | Line 7 summarizes the total child support obligation, combining basic support and additional costs like child care and health care coverage. |

| Recommended Order | Line 13 provides the recommended child support order, which is the lesser amount between the adjusted obligation and the income available for support. |

| Self-Support Reserve | There is a self-support reserve calculation: Line 11 ensures that income available after a determined reserve is accounted for. |

| Minimum Obligation | To ensure a minimal support output, the form states that if income available for support is less than $50, a minimum obligation of $50 will apply. |

Guidelines on Utilizing Alabama Child Support Sheet

Completing the Alabama Child Support Sheet form involves gathering the necessary financial information for each parent and their children. Accurately filling out this form is essential for calculating appropriate child support obligations. Follow these steps to ensure the form is completed correctly.

- Begin by entering the Case Number at the top of the form.

- In the space marked Court, specify whether this is a Circuit or District Court. Fill in the Name of County.

- List the names of the Plaintiff and Defendant under the appropriate headings.

- For each child involved, write the Name and Date of Birth in the designated sections.

- In Line 1, fill in the Monthly Gross Income for both the Plaintiff and Defendant. Include the amounts in their respective columns.

- If applicable, enter any Pre-Existing Child-Support Payments on Line 1a. This amount should be subtracted from Line 1.

- For Line 1b, include any Pre-Existing Periodic-Alimony Payments to subtract from the income.

- On Line 2, calculate the Monthly Adjusted Gross Income for both parents. This requires taking Line 1 and subtracting Line 1a and Line 1b.

- Determine each parent's Percentage Share of Income on Line 3. This is the income from Line 2 divided by the Combined Income.

- For Line 4, apply the Combined Income to the Schedule of Basic Child-Support Obligations to find the Basic Child-Support Obligation.

- On Line 5, enter any Work-Related Child-Care Costs paid by either parent.

- Record the Health-Care-Coverage Costs on Line 6, also paid by either parent.

- Calculate the Total Child-Support Obligation in Line 7 by adding Line 4, Line 5, and Line 6.

- On Line 8, determine each parent's Child-Support Obligation by multiplying their respective percentages from Line 3 by the total from Line 7.

- In Line 9, record the Total Costs Paid by Each Parent by summing Line 5 and Line 6.

- Calculate the Adjusted Child-Support Obligation for each parent on Line 10 by subtracting Line 9 from Line 8. If the result is less than $0, enter $0.

- For Line 11, find the Income Available After Self-Support Reserve by subtracting $981 from Line 2. Again, if this is less than $0, enter $0.

- Calculate Income Available for Support on Line 12 by taking 85% of Line 11. If this is less than $50, enter a minimum obligation of $50.

- Finally, determine the Recommended Child-Support Order for Line 13. This will be the lesser amount between Line 10 and Line 12.

- Use the space provided at the bottom for any Comments, Calculations, or Rebuttals to Guidelines. Include the name of the person who prepared the document and the date.

What You Should Know About This Form

What is the purpose of the Alabama Child Support Sheet form?

The Alabama Child Support Sheet form is used to calculate child support obligations in the state of Alabama. This form helps determine how much financial support each parent is responsible for contributing towards their children's care. It outlines the parents’ monthly gross income, adjusted income after certain deductions, and the total child support obligation based on these figures. The goal is to ensure that children receive adequate financial support from both parents.

Who needs to fill out the Child Support Sheet form?

The form needs to be completed by both parents during child support proceedings. It can be utilized in cases where child support is being established, modified, or enforced. Each parent must provide their financial information to ensure an accurate calculation of child support obligations. This fosters fairness and helps courts make informed decisions regarding support payments.

How do I calculate my child support obligation using this form?

To calculate the child support obligation, start by entering your monthly gross income on the form. Next, deduct any pre-existing child support and alimony payments you already make. This will give you your adjusted gross income. Then, find your percentage share of combined income, which reflects your contribution towards the total family income. Use this information to determine the basic child-support obligation and factor in any additional costs for childcare and health coverage to arrive at your total child-support obligation. Each parent's specific amount is then calculated from this total.

What if my calculated obligation is less than $0?

If your calculated child support obligation comes out to less than $0, you should enter $0. This means that, based on the provided income and expenses, the calculation does not require you to make any child support payments. However, it is important to note that other financial responsibilities related to the child's care may still exist, so it may be helpful to seek additional guidance or clarification on this matter.

Common mistakes

Filling out the Alabama Child Support Sheet can be a challenging task, and mistakes often occur. One common error is not providing accurate monthly gross income figures. Individuals sometimes underestimate or overestimate their earnings, leading to improper calculations in later sections of the form. It’s crucial to account for all sources of income to ensure the calculations reflect the true financial situation.

Another frequent mistake is neglecting to deduct pre-existing child support or alimony payments. Line 1a and Line 1b require these deductions, but many forget to include them. This oversight can inflate the monthly adjusted gross income, resulting in an unjust child support obligation. Deductions must be precise to avoid complications down the line.

The calculation of the percentage share of income often introduces confusion. Individuals may not realize that the percentage share is based on the combined income of both parents. Failure to accurately divide the income from Line 2 by the total combined income means that the resulting percentage will be incorrect, affecting all subsequent calculations for child support obligations.

People also commonly misinterpret how to determine the basic child support obligation on Line 4. This obligation relies on a Schedule of Basic Child-Support Obligations that is linked to the combined income. Individuals sometimes disregard or fail to reference this schedule accurately, leading to miscalculations that can impact the final support amount.

An additional issue arises with the total child support obligation. On Line 7, the total combines Line 4 with any work-related child-care costs and health-care coverage costs. People frequently miss including one of these expenses, which results in an incorrect final obligation. It's essential to combine these figures correctly to achieve an accurate total.

Finally, errors can occur in the calculation of the self-support reserve (SSR) on Line 11. The SSR establishes a minimum income that parents need to meet basic living expenses. If individuals do not properly account for the SSR or confuse it with their total income, they may end up with invalid figures for income available for support, which can adversely affect the recommended child support order.

Documents used along the form

The Alabama Child Support Sheet is a crucial document in determining child support obligations. However, it often goes hand-in-hand with other forms that provide additional information and support in child support cases. Here’s a quick overview of related documents that you might need.

- Affidavit of Income: This document provides detailed information about each parent's income, including pay stubs, tax returns, and other sources of revenue. It helps ensure that the court has an accurate picture of the financial circumstances of both parents.

- Child Support Guidelines Worksheet: This form outlines the specific calculations used to determine the child support amount. It includes factors like the number of children and each parent's income to arrive at a reasonable support figure that meets the needs of the children.

- Income Withholding Order: Once child support is established, this document directs the employer to deduct the support payments directly from the non-custodial parent's paycheck. This ensures timely and consistent payments to the custodial parent.

- Parenting Plan: This outlines the custody arrangement and visitation schedule for the children. It may include terms related to shared responsibilities and can affect the amount of child support required.

Understanding these documents can make the child support process smoother. Each form plays an important role in ensuring that the needs of the children are met while considering the financial situations of both parents.

Similar forms

- Child Support Calculation Worksheet - Similar in structure, this document provides a framework for calculating child support obligations. It focuses on the income of both parents and includes deductions for any existing obligations.

- Child Support Guidelines from Other States - While varying by state, these guidelines typically follow a similar format. They outline income calculations, need assessments, and support obligations.

- Alabama Income Deduction Order - This document lays out how income can be deducted for child support directly from paychecks, paralleling the income details found in the Alabama Child Support Sheet.

- Alabama Family Court Financial Affidavit - This form details the financial circumstances of both parents. It complements the Child Support Sheet by providing a comprehensive view of income and expenses.

- Child Support Enforcement Agency (CSEA) Worksheet - Similar to the Child Support Sheet, this worksheet assists in determining obligations and includes income and expense entries for both parents.

- Income and Expense Statement for Family Law Cases - Provides a clear breakdown of financial obligations. Like the Child Support Sheet, it focuses on income to assess support capacity.

- Child Care Expense Declaration Form - This document outlines child care costs, resembling sections of the Child Support Sheet that account for specific expenses related to child care.

- Health Care Coverage Assessment Form - It evaluates health coverage expenses for children. This form correlates with the Child Support Sheet's section on health care costs.

- Alabama Divorce Settlement Agreement - This legal document often includes child support obligations and income calculations, similar in purpose to the Child Support Sheet as it aims to finalize support terms.

Dos and Don'ts

When filling out the Alabama Child Support Sheet form, certain actions can lead to a smoother process, while others can create complications. Here are some clear guidelines:

- Ensure all names and dates are accurate. Mistakes can delay proceedings.

- Provide complete and honest income information. Transparency is crucial.

- Include all relevant costs associated with child care and healthcare. This affects the total obligation.

- Double-check the calculations on each line. Accuracy prevents issues later.

Conversely, some actions should be avoided:

- Do not omit pre-existing child support or alimony payments. These directly impact the calculations.

- Avoid rounding numbers inaccurately. Precision is necessary for fairness.

- Do not leave sections blank if applicable. Each item needs a response.

- Refrain from using estimates for income. Use verified figures for reliability.

Misconceptions

Understanding the Alabama Child Support Sheet form is crucial for both parents involved in child support cases. Despite its importance, several misconceptions surround this form. Here are seven common misconceptions and explanations to clarify each.

- The form is only for low-income individuals. Many believe that the Alabama Child Support Sheet is only applicable to those with low financial means. In reality, the form is designed to calculate child support obligations for parents at various income levels, ensuring fairness regardless of income.

- It's mandatory to use the form in every child support case. Some think that this form must be used in all child support cases. However, while many courts prefer its use for standard calculations, there are instances where other methods may be applied, especially in unique circumstances.

- The calculations are always accurate and fair. Many assume that the calculations produced by the form are infallible. Although it provides a systematic way to compute obligations, factors such as unique financial situations or parenting arrangements can greatly influence the outcome.

- All expenses related to children are included automatically. There is a belief that the form covers all child-related expenses without any added calculations. Notably, only specific costs, like health care and child care, are included. Parents must discuss other expenses separately.

- The form dictates the final child support amount. This misconception leads some to think that the number from the form automatically becomes the final support amount. In fact, the form offers a recommendation, but the court ultimately decides based on the case’s context.

- Using the form requires an attorney. Some parents feel they cannot use the Child Support Sheet without a legal representative. While having an attorney can be beneficial, it's not a strict requirement. Many parents navigate the process independently.

- Once filled out, the form cannot be changed. Lastly, there is a belief that once the form is completed, it is set in stone. This is not true. Parents can modify the information as situations evolve, such as changes in income or custody arrangements.

Being informed about these misconceptions can empower parents to approach their child support obligations with confidence and clarity. Understanding the nuances of the Alabama Child Support Sheet form plays a crucial role in ensuring fair arrangements for all parties involved.

Key takeaways

Filling out the Alabama Child Support Sheet form is a critical step in determining child support obligations. Understanding its layout and requirements can simplify the process. Here are some important points to keep in mind:

- Accurate Information: Ensure that all information regarding income and expenses is complete and accurate. Mistakes can delay proceedings.

- Combined Income: Calculate the total income of both parents. This figure is essential for determining the overall child support obligation.

- Adjustments: Be meticulous when accounting for pre-existing child support or periodic alimony payments. These adjustments will affect the adjusted gross income calculation.

- Percentage Share: Identify the percentage share of each parent’s income. This is calculated based on each parent’s adjusted gross income relative to the total combined income.

- Healthcare and Childcare Costs: Include any work-related childcare and healthcare coverage costs paid by either parent. These costs contribute to the total child support obligation.

- Self-Support Reserve: Consider the self-support reserve, which allows parents to maintain a minimum standard of living after child support obligations are calculated.

- Recommended Order: The final child support amount will be the lesser of two calculations. This ensures a fair distribution based on each parent’s financial capability.

By carefully reviewing these key elements and accurately completing each section, both parents can facilitate a more efficient process when establishing child support obligations in Alabama.

Browse Other Templates

What Is Estoppel Certificate - The Estoppel Certificate should be stored in a safe place for future reference following its completion.

Printable Blank Football Depth Chart Pdf - D.J. Polite-Bray is a sophomore wide receiver from Lithonia, Georgia.