Fill Out Your Alabama Mvt 5 63 Form

Navigating the nuances of vehicle ownership and lien release can often feel overwhelming, particularly in specific jurisdictions like Alabama. One essential document in this process is the Alabama Mvt 5 63 form, which serves as an application for lien release. When an individual pays off a loan or resolves a financial obligation tied to a vehicle, this form must be filled out by the lienholder to officially document the release of that lien. Importantly, the vehicle in question must currently be titled in Alabama for this form to be applicable. The Mvt 5 63 requires various details, including lienholder information, dates, and the Vehicle Identification Number (VIN), which consists of 17 characters for vehicles produced since 1981. This form mandates accurate representation, as providing false information can lead to serious legal consequences. Alongside the completed form, a certificate of title must be submitted to the Alabama Department of Revenue's Motor Vehicle Division, ensuring all transactions are properly recorded. By understanding the requirements and implications of the Mvt 5 63, vehicle owners and lienholders can navigate the title transfer process more smoothly, reflecting a commitment to compliance and accountability.

Alabama Mvt 5 63 Example

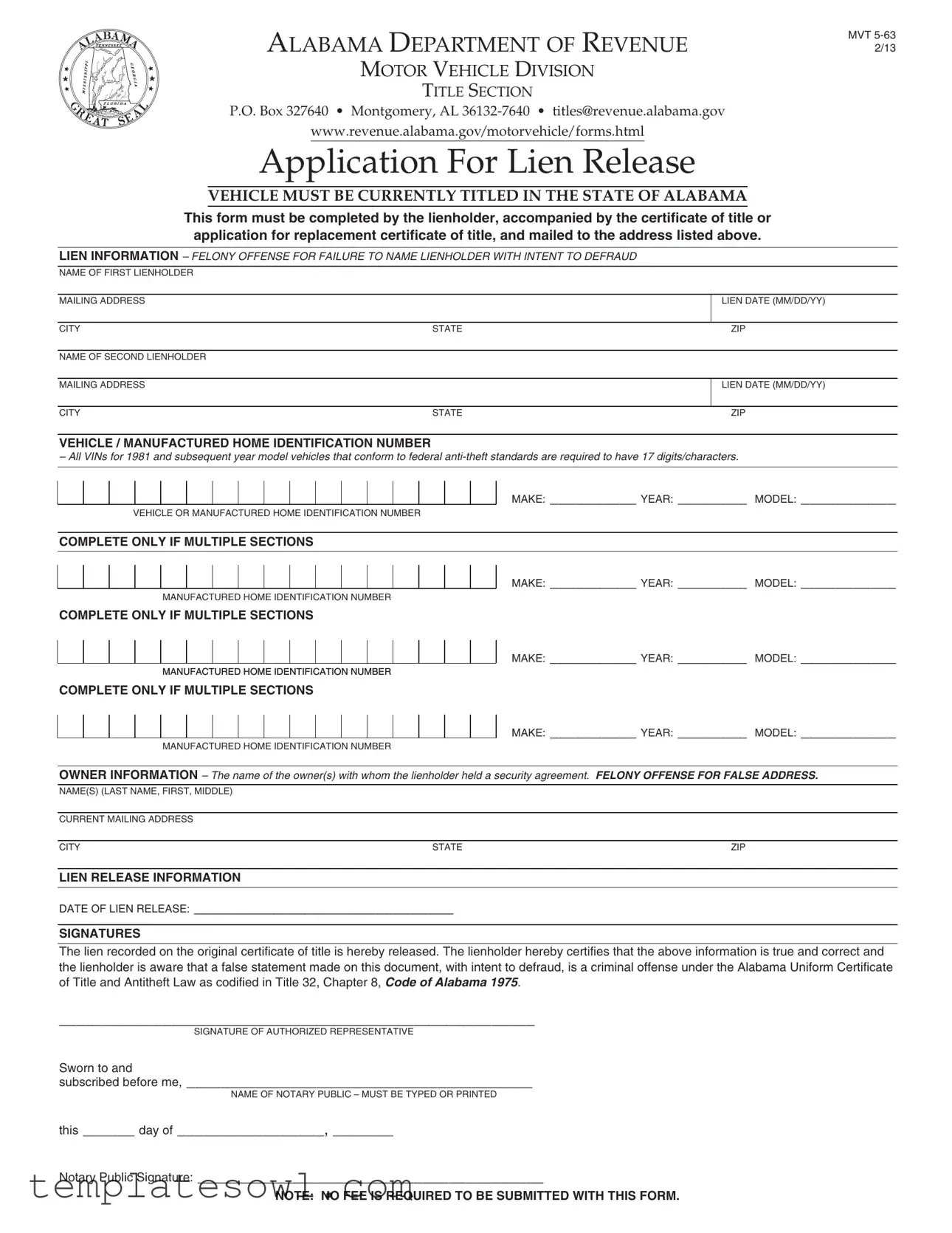

ALABAMA DEPARTMENT OF REVENUE

MOTOR VEHICLE DIVISION

MVT

TITLE SECTION

P.O. Box 327640 • Montgomery, AL

www.revenue.alabama.gov/motorvehicle/forms.html

Application For Lien Release

VEHICLE MUST BE CURRENTLY TITLED IN THE STATE OF ALABAMA

This form must be completed by the lienholder, accompanied by the certificate of title or

application for replacement certificate of title, and mailed to the address listed above.

LIEN INFORMATION – FELONY OFFENSE FOR FAILURE TO NAME LIENHOLDER WITH INTENT TO DEFRAUD

NAME OF FIRST LIENHOLDER

MAILING ADDRESS

LIEN DATE (MM/DD/YY)

CITY |

STATE |

ZIP |

NAME OF SECOND LIENHOLDER

MAILING ADDRESS

LIEN DATE (MM/DD/YY)

CITY |

STATE |

ZIP |

VEHICLE / MANUFACTURED HOME IDENTIFICATION NUMBER

– All VINs for 1981 and subsequent year model vehicles that conform to federal

MAKE: __________ YEAR: ________ MODEL: ___________

VEHICLE OR MANUFACTURED HOME IDENTIFICATION NUMBER

COMPLETE ONLY IF MULTIPLE SECTIONS

MAKE: __________ YEAR: ________ MODEL: ___________

MANUFACTURED HOME IDENTIFICATION NUMBER

COMPLETE ONLY IF MULTIPLE SECTIONS

MAKE: __________ YEAR: ________ MODEL: ___________

MANUFACTURED HOME IDENTIFICATION NUMBER

COMPLETE ONLY IF MULTIPLE SECTIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAKE: __________ YEAR: ________ MODEL: ___________ |

|

|

|

|

MANUFACTURED HOME IDENTIFICATION NUMBER |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OWNER INFORMATION – The name of the owner(s) with whom the lienholder held a security agreement. FELONY OFFENSE FOR FALSE ADDRESS. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME(S) (LAST NAME, FIRST, MIDDLE) |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT MAILING ADDRESS |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

STATE |

ZIP |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN RELEASE INFORMATION |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE OF LIEN RELEASE: ______________________________

SIGNATURES

The lien recorded on the original certificate of title is hereby released. The lienholder hereby certifies that the above information is true and correct and the lienholder is aware that a false statement made on this document, with intent to defraud, is a criminal offense under the Alabama Uniform Certificate of Title and Antitheft Law as codified in Title 32, Chapter 8, CODE OF ALABAMA 1975.

_______________________________________________________

SIGNATURE OF AUTHORIZED REPRESENTATIVE

Sworn to and

subscribed before me, ________________________________________

NAME OF NOTARY PUBLIC – MUST BE TYPED OR PRINTED

this ______ day of _________________, _______

Notary Public Signature: ________________________________________

NOTE: NO FEE IS REQUIRED TO BE SUBMITTED WITH THIS FORM.

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Alabama MVT 5-63 form is governed by the Alabama Uniform Certificate of Title and Antitheft Law, Title 32, Chapter 8, CODE OF ALABAMA 1975. |

| Purpose | This form is utilized for the release of a lien on a vehicle or manufactured home that is currently titled in Alabama. |

| Completion Requirement | The form must be completed by the lienholder and accompanied by either the original certificate of title or an application for a replacement certificate of title. |

| Felony Offense Warning | Failure to name a lienholder with the intent to defraud is a felony offense, as stated on the form. |

Guidelines on Utilizing Alabama Mvt 5 63

Filling out the Alabama MVT 5 63 form is a straightforward process, but accuracy is crucial. Make sure to have all necessary documents, such as the certificate of title or application for a replacement. Follow the steps below to ensure you complete the form correctly.

- Obtain the form: Download the MVT 5 63 form from the Alabama Department of Revenue website or get a physical copy.

- Fill in Lien Information: Input the name, mailing address, and lien date for the first lienholder. If there’s a second lienholder, fill out their details as well.

- Provide Vehicle Information: Enter the make, year, model, and Vehicle Identification Number (VIN) for the vehicle or manufactured home. If you have multiple vehicles, repeat this step for each.

- Owner Information: List the full names of the owner(s) as they appear on the title, along with the current mailing address, city, state, and zip code.

- Include Lien Release Information: Write the date of the lien release in the designated section.

- Sign the Form: The authorized representative of the lienholder must sign the form, affirming that all information is correct.

- Notary Public: Have a notary public witness the signature. The notary must print their name and sign the form as well.

- Mail the Form: Send the completed form, along with the necessary supporting documents, to the provided address.

What You Should Know About This Form

What is the Alabama Mvt 5 63 form used for?

The Alabama Mvt 5 63 form is an application for lien release. It is used when a lienholder needs to officially release their claim on a vehicle or manufactured home that is titled in Alabama. This form ensures that the owner of the vehicle can obtain clear title free of any liens that may have been placed on it.

Who needs to fill out the Mvt 5 63 form?

The lienholder is responsible for completing the Mvt 5 63 form. This includes financial institutions, dealerships, or any other entity that holds a lien on the vehicle. They must also provide the certificate of title or a replacement title application along with the completed form.

Where do I send the completed Mvt 5 63 form?

Once the form is completed, it should be mailed to the Alabama Department of Revenue, Motor Vehicle Division, using the address provided on the form: P.O. Box 327640, Montgomery, AL 36132-7640. Ensure that all required documents are included to avoid delays.

Is there a fee associated with submitting the Mvt 5 63 form?

No fee is required when submitting the Mvt 5 63 form. This means you can complete the lien release process without incurring any additional costs, making it easier for both lienholders and vehicle owners.

What information do I need to provide on the form?

The form requires specific details, including the name and address of the lienholder, lien dates, vehicle information (make, year, model, and VIN), and owner information (name and address). Completing all sections accurately is crucial to ensuring that the lien release is processed smoothly.

What happens if I provide false information on the Mvt 5 63 form?

Providing false information can lead to serious consequences. Under Alabama law, knowingly submitting false information with the intent to defraud is considered a felony. It's crucial to ensure that all information on the form is accurate and truthful to avoid legal repercussions.

What is required in terms of signatures on the Mvt 5 63 form?

The form must be signed by an authorized representative of the lienholder, certifying the truth of the information provided. Additionally, it must be notarized to confirm the identity of the signer and the validity of the document.

Can I track the status of my lien release after submitting the form?

Tracking the status of a lien release can be complex. While there is no formal tracking system provided by the Alabama Department of Revenue, you can contact their office directly for updates. Typically, a response will take some time, so patience is required during the process.

Common mistakes

Filling out the Alabama MVT 5 63 form accurately is critical for ensuring that lien releases are processed correctly. One common mistake individuals make is neglecting to provide the complete name and address of the lienholder. It's essential that all information is precise, as an incomplete submission can lead to delays or rejection.

Another frequent error is overlooking the requirement that the vehicle must be currently titled in Alabama. Applicants sometimes assume that previous titles or registrations are sufficient. This oversight could result in complications, as the form is designed solely for vehicles with a valid Alabama title.

Many individuals fail to include all necessary lienholder information. If there are multiple lienholders, each must be listed clearly. Omitting a lienholder, or providing inaccurate details can create legal complications and may require additional documentation later on.

Some people mistakenly provide the incorrect dates for the lien. The lien date should reflect when the security agreement was established. Providing inaccurate dates can hinder the processing of the lien release and lead to further issues requiring time-consuming resolutions.

The vehicle identification number (VIN) is another area where errors frequently occur. The form necessitates the submission of a 17-character VIN for vehicles from 1981 and onwards. Omitting digits or misplacing characters can result in problems that may prevent the effective release of the lien.

Individuals often forget to sign the document. It is crucial that the authorized representative of the lienholder signs the form, as a missing signature can render the entire application invalid. A simple oversight here could severely delay the release of the lien.

Additionally, the date of the lien release must be clearly stated. Leaving this section blank leads to confusion and may hinder the processing of the form. It is best practice to ensure that all fields are duly completed before submission.

Lastly, failing to include the notarization of the signature can jeopardize the validity of the document. Notarization serves as an important verification step, and neglecting it might lead the application to be returned or rejected, thereby prolonging the release process.

Documents used along the form

The Alabama Mvt 5 63 form acts as a crucial document for lien release on a vehicle in Alabama. When dealing with transactions related to vehicle ownership or liens, understanding other supporting documents is essential. Here’s a list of documents often used alongside the Mvt 5 63 form.

- Certificate of Title - This is the primary document proving ownership of the vehicle. It contains important details such as the vehicle’s identification number (VIN) and outlines any existing liens.

- Application for Replacement Title - If the original title is lost or damaged, this application is needed to obtain a new title. It serves as a safeguard for owners who need to maintain proof of ownership.

- Notice of Lien - This document notifies the state and other parties that a lien has been placed on the vehicle. It details who holds the lien and ensures that the lienholder's interest is officially recorded.

- Affidavit of Lien Satisfaction - Filed by the lienholder, this affidavit serves as proof that the lien has been satisfied and can be used to remove the lien from the title record.

- Bill of Sale - This document transfers ownership from one party to another. It includes information on the sale price, the buyer, and the seller and is vital when ownership changes hands.

- Power of Attorney - This legal document allows the lienholder to act on behalf of the vehicle owner in handling title-related issues. This is especially useful if the owner cannot be present for the transaction.

- VIN Verification - In some cases, a VIN verification document is required to confirm the vehicle's identity, especially if the vehicle has been moved from another state or if the title is not readily available.

Each of these documents plays an important role in the vehicle title process in Alabama. By ensuring that you have all necessary forms and understand their purposes, you increase the chances of a smooth transaction and compliance with state regulations.

Similar forms

The Alabama Mvt 5 63 form is specifically used for lien release applications in the state of Alabama. However, there are several other documents that serve similar purposes in various circumstances. Here’s a list of four documents that share similarities with the Mvt 5 63 form:

- MV-1 Title Application: This form is used when applying for a new title for a vehicle. Like the Mvt 5 63, it requires detailed vehicle information and must be submitted to the state’s motor vehicle division.

- Title Transfer Form: When a vehicle ownership is changing hands, this form outlines the transfer process. Similar to the Mvt 5 63, it requires the lienholder’s information and the previous owner’s details to ensure that the title is legally transferred.

- Application for Rebuilt Title: If a vehicle has been salvaged and repaired, this application is necessary to obtain a rebuilt title. It shares components with the Mvt 5 63, including the need for specific vehicle identification information and acknowledgment of prior liens.

- Notice of Lien: When a lender places a lien on a vehicle, this document acts as a formal notification. The Notice of Lien must include similar vital information about the lienholder and the vehicle, mirroring the Mvt 5 63 in purpose.

Each of these documents is essential in their own right and ensures that vehicle ownership and lien status are clearly communicated to the appropriate state departments.

Dos and Don'ts

When it comes to filling out the Alabama MVT 5 63 form, attention to detail is crucial. This application is for a lien release and must be completed accurately to avoid any complications. Here’s a list of do's and don’ts to consider.

- Do ensure that the vehicle is currently titled in Alabama.

- Do fill out each section completely and clearly, including vehicle details and lienholder information.

- Do include all necessary documentation, such as the certificate of title or an application for a replacement certificate.

- Do check for any spelling errors in names and addresses before submission.

- Do sign the form as required and ensure that all signatures are from authorized representatives.

- Don't leave any sections blank; incomplete forms may delay processing.

- Don't attempt to fill out the form with incorrect or false information.

- Don't forget to have the form notarized if required.

- Don't submit payment, as no fee is required for this application.

- Don't use abbreviations for addresses; write them out completely to prevent confusion.

By following this guide, you can ensure the process goes smoothly and reduces the chances of delays. Always double-check your information and reach out to the Alabama Department of Revenue if you have any concerns. Good luck!

Misconceptions

Misconceptions about the Alabama Mvt 5 63 form can lead to confusion regarding the lien release process. Understanding these misconceptions is important for ensuring compliance and clarity. Here are ten common misconceptions clarified:

- The form can be submitted by anyone. Only the lienholder can complete and submit the Alabama Mvt 5 63 form.

- A fee is required to file the form. No fee is required when submitting this form to the Alabama Department of Revenue.

- The vehicle does not need to be titled in Alabama. The vehicle must currently be titled in the State of Alabama to utilize this form.

- An incomplete form can still be accepted. All sections of the form must be completed accurately for it to be processed.

- Digital submission of the form is allowed. The form must be mailed; electronic submissions are not accepted.

- Copies of the title are sufficient. The original title or a replacement certificate must accompany the submission.

- Any notary can certify the signatures. The notarization must be performed by a licensed notary public.

- Changes to lienholder information can be made after submission. Once submitted, the information cannot be altered; a new form must be submitted.

- A lien release is automatic upon payment. A formal lien release using this form must be filed to officially release the lien.

- This form is only for vehicles. It can also be used for manufactured homes; both types of identification information must be provided.

Key takeaways

Here are five key takeaways regarding the Alabama MVT 5 63 form:

- Purpose of the Form: The MVT 5 63 form is used for requesting a lien release on a vehicle or manufactured home currently titled in Alabama.

- Required Information: The form must include detailed lien information, including names of lienholders, their addresses, and lien dates.

- Owner Information: Accurate owner information is essential on the form, including the owner's full name and current mailing address.

- Signature Requirements: The form must be signed by an authorized representative of the lienholder and notarized to validate the release.

- No Fee Required: There's no fee necessary for submitting the MVT 5 63 form.

Browse Other Templates

Fort Lauderdale Construction Permit,City Permit Application Form,Building Permit Request,Fort Lauderdale Master Permit Form,Residential Construction Application,Contractor Work Permit,Permit Application for Construction,Fort Lauderdale Zoning Permit, - This form is necessary for obtaining various construction permits in the city.

Bennett Mechanical Comprehension Test Answer Key - John’s score implies he may prefer roles with more guidance on complex tasks.

Express Scripts Refill - Ensure accurate documentation of the patient's demographic details.