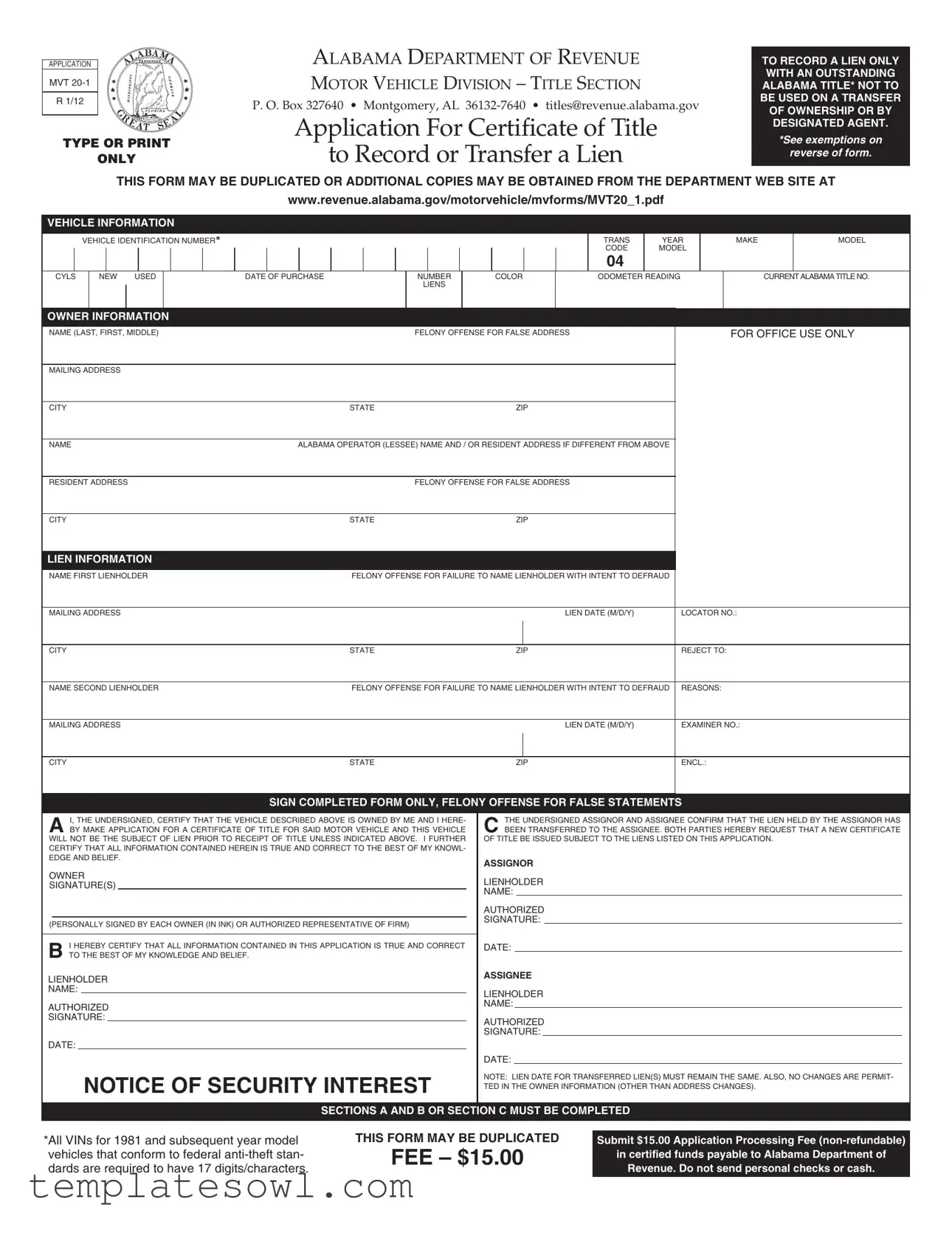

Fill Out Your Alabama Mvt 20 1 Form

The Alabama MVT 20-1 form serves a specific and important function within the realm of vehicle ownership and lien management. It is primarily used by lienholders to apply for a certificate of title solely to record or transfer a lien on a vehicle that already has an Alabama title. This form does not pertain to any transfer of ownership, nor can it be completed by designated agents—these situations require a different form. Applicants need to provide detailed vehicle information, including the Vehicle Identification Number (VIN), make, model, and current title number, alongside the owner's information such as name and address. It is critical that all entered data mirrors the information on the original Alabama title to avoid complications. With a processing fee of $15, this form is essential for ensuring that liens are officially recognized, thereby protecting the rights of secured parties. Additionally, applicants should note important exemptions, which outline the conditions under which certain vehicles, such as those older than specified years, may not require titling. Understanding the intricacies of the MVT 20-1 form is vital for lienholders to operate within the law and safeguard their financial interests in vehicles.

Alabama Mvt 20 1 Example

|

ALABAMA DEPARTMENT OF REVENUE |

||

APPLICATION |

|

||

MVT |

|

MOTOR VEHICLE DIVISION – TITLE SECTION |

|

|

|

|

|

R 1/12 |

|

P. O. Box 327640 • Montgomery, AL |

|

|

|

||

TYPE OR PRINT |

Application For Certificate of Title |

||

to Record or Transfer a Lien |

|||

|

ONLY |

||

TO RECORD A LIEN ONLY WITH AN OUTSTANDING ALABAMA TITLE* NOT TO BE USED ON A TRANSFER OF OWNERSHIP OR BY DESIGNATED AGENT.

*See exemptions on reverse of form.

THIS FORM MAY BE DUPLICATED OR ADDITIONAL COPIES MAY BE OBTAINED FROM THE DEPARTMENT WEB SITE AT

www.revenue.alabama.gov/motorvehicle/mvforms/MVT20_1.pdf

VEHICLE INFORMATION

|

|

|

|

|

VEHICLE IDENTIFICATION NUMBER* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TRANS |

YEAR |

|

|

MAKE |

|

MODEL |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CODE |

MODEL |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

04 |

|

|

|

|

|

|

|

|

|

|

|

CYLS |

|

NEW USED |

|

|

|

DATE OF PURCHASE |

|

|

|

NUMBER |

|

|

|

COLOR |

|

|

ODOMETER READING |

|

|

|

|

CURRENT ALABAMA TITLE NO. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIENS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OWNER INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME (LAST, FIRST, MIDDLE) |

|

|

|

|

|

|

FELONY OFFENSE FOR FALSE ADDRESS |

|

|

|

|

|

FOR OFFICE USE ONLY |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

NAME |

|

|

|

|

|

|

|

|

|

|

ALABAMA OPERATOR (LESSEE) NAME AND / OR RESIDENT ADDRESS IF DIFFERENT FROM ABOVE |

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

RESIDENT ADDRESS |

|

|

|

|

|

|

FELONY OFFENSE FOR FALSE ADDRESS |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

NAME FIRST LIENHOLDER |

|

|

|

FELONY OFFENSE FOR FAILURE TO NAME LIENHOLDER WITH INTENT TO DEFRAUD |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN DATE (M/D/Y) |

|

|

LOCATOR NO.: |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

REJECT TO: |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

NAME SECOND LIENHOLDER |

|

|

|

FELONY OFFENSE FOR FAILURE TO NAME LIENHOLDER WITH INTENT TO DEFRAUD |

|

REASONS: |

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN DATE (M/D/Y) |

|

|

EXAMINER NO.: |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

ENCL.: |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGN COMPLETED FORM ONLY, FELONY OFFENSE FOR FALSE STATEMENTS |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I, THE UNDERSIGNED, CERTIFY THAT THE VEHICLE DESCRIBED ABOVE IS OWNED BY ME AND I HERE- |

|

|

THE UNDERSIGNED ASSIGNOR AND ASSIGNEE CONFIRM THAT THE LIEN HELD BY THE ASSIGNOR HAS |

||||||||||||||||||||||||||||||||||||

|

A BY MAKE APPLICATION FOR A CERTIFICATE OF TITLE FOR SAID MOTOR VEHICLE AND THIS VEHICLE |

|

C BEEN TRANSFERRED TO THE ASSIGNEE. BOTH PARTIES HEREBY REQUEST THAT A NEW CERTIFICATE |

||||||||||||||||||||||||||||||||||||||

|

WILL NOT BE THE SUBJECT OF LIEN PRIOR TO RECEIPT OF TITLE UNLESS INDICATED ABOVE. I FURTHER |

|

OF TITLE BE ISSUED SUBJECT TO THE LIENS LISTED ON THIS APPLICATION. |

||||||||||||||||||||||||||||||||||||||

|

CERTIFY THAT ALL INFORMATION CONTAINED HEREIN IS TRUE AND CORRECT TO THE BEST OF MY KNOWL- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

EDGE AND BELIEF. |

|

|

|

|

|

|

|

|

|

|

ASSIGNOR |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

OWNER |

|

|

|

|

|

|

|

|

|

|

LIENHOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

SIGNATURE(S) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUTHORIZED |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

(PERSONALLY SIGNED BY EACH OWNER (IN INK) OR AUTHORIZED REPRESENTATIVE OF FIRM) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

I HEREBY CERTIFY THAT ALL INFORMATION CONTAINED IN THIS APPLICATION IS TRUE AND CORRECT |

|

DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

B TO THE BEST OF MY KNOWLEDGE AND BELIEF. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

ASSIGNEE |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

LIENHOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIENHOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

AUTHORIZED |

|

|

|

|

|

|

|

|

|

|

NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

SIGNATURE: |

|

|

|

|

|

|

|

|

|

|

AUTHORIZED |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

NOTICE OF SECURITY INTEREST |

|

NOTE: LIEN DATE FOR TRANSFERRED LIEN(S) MUST REMAIN THE SAME. ALSO, NO CHANGES ARE PERMIT- |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

TED IN THE OWNER INFORMATION (OTHER THAN ADDRESS CHANGES). |

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*All VINs for 1981 and subsequent year model vehicles that conform to federal

SECTIONS A AND B OR SECTION C MUST BE COMPLETED

THIS FORM MAY BE DUPLICATED |

Submit $15.00 Application Processing Fee |

FEE – $15.00 |

in certified funds payable to Alabama Department of |

|

|

|

Revenue. Do not send personal checks or cash. |

|

|

Instructions

This form shall be typed or printed legibly.

Illegible forms will be returned.

This form is designed for use by a lienholder in order for an owner of a vehicle to comply with section

This form may not be used on a transfer of ownership or by designated agents. Designated agents shall use form MVT

NOTE: Vehicle information and owner information shall be identical to information appearing on surrendered alabama title except for current mailing address and current alabama resident address.

SUPPORTING DOCUMENTS – This application shall be accompanied by the current Alabama title to this vehicle and the title fee (certified funds only) payable to the Alabama Department of Revenue.

Exemptions

(1)Effective January 1, 2012, no certificate of title shall be issued for any manufactured homes, trail- er,

Example: As of January 1, 2012, all 1991 and prior year model manufactured homes, trailers,

(2)Effective January 1, 2012, no certificate of title shall be issued for any motor vehicle more than

Example: As of January 1, 2012, all 1976 and prior year model motor vehicles are exempt from the titling provisions of Chapter 8, Title 32, Code of Alabama 1975.

(3)Effective January 1, 2012, no certificate of title shall be issued for a low speed vehicle. A low speed vehicle is defined as a

NOTE: The exemption from titling does not invalidate any Alabama certificate of title that is currently in effect. However, no subsequent title, including a certificate of title to record or transfer a lien, can be issued if the vehicle is exempt from titling.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used to record a lien on a vehicle that has an outstanding Alabama title. |

| Eligibility | The application must be completed for vehicles with an existing Alabama title. It cannot be used to transfer ownership. |

| Required Fee | A non-refundable application processing fee of $15.00 must accompany the form, payable in certified funds. |

| Governing Law | This application complies with Section 32-8-61 of the Code of Alabama 1975. |

| Supporting Documents | Applicants must submit the current Alabama title along with the application. |

| Lienholder Requirements | Each lienholder must sign the application to confirm the lien has been established. |

| Information Accuracy | All information provided must be accurate, and significant discrepancies may lead to rejection of the form. |

| Duplicability | This form may be duplicated for further use or additional copies can be obtained online. |

| Exemptions | Vehicles more than 35 years old may be exempt from needing a title, along with certain trailers and manufactured homes. |

| Submission Guidelines | The form must be typed or printed clearly; illegible forms will be returned to the applicant. |

Guidelines on Utilizing Alabama Mvt 20 1

Completing the Alabama MVT 20 1 form is a straightforward process that requires careful attention to detail. It is essential to ensure that all the information is accurate and clearly presented. Once the form is filled out, it will need to be submitted along with the appropriate application fee and the current Alabama title for the vehicle. Following are the steps to fill out this form correctly.

- Obtain the form: Download or print the Alabama MVT 20 1 form from the Alabama Department of Revenue's website.

- Fill in vehicle information: Provide the vehicle identification number (VIN), year, make, model, color, odometer reading, and current Alabama title number.

- Owner information: Enter the name and mailing address of the vehicle owner, ensuring to include the city, state, and zip code. If the owner's address differs from the mailing address, include that as well.

- Liens details: If applicable, fill in the name and mailing address of the first lienholder and the second lienholder, including the lien dates.

- Signatures: Both the assignor and assignee must sign the form, certifying that the information provided is accurate to the best of their knowledge.

- Review: Double-check all entries for accuracy and legibility. Illegible forms will be returned.

- Prepare payment: Include a $15.00 application processing fee. Payment must be in certified funds, made out to the Alabama Department of Revenue. Personal checks and cash are not accepted.

- Submit the application: Send the completed form, payment, and the current Alabama title to the address listed on the form.

What You Should Know About This Form

What is the purpose of the Alabama Mvt 20 1 form?

The Alabama Mvt 20 1 form is used to apply for a certificate of title to record or transfer a lien on a vehicle that already has an outstanding Alabama title. This form should not be used for ownership transfers or by designated agents.

Who can use the Alabama Mvt 20 1 form?

This form is intended for lienholders that want to secure a lien on a vehicle owned by someone else. The vehicle must have a current Alabama title. It's important to remember that designated agents must use a different form (MVT 5-1E).

What information is required on the form?

You will need to provide detailed information about the vehicle, including the Vehicle Identification Number (VIN), make, model, year, color, and odometer reading. Owner information, including addresses and names, is also required. Additionally, you must provide details about the lienholder and lien dates.

Is there a fee to submit the Alabama Mvt 20 1 form?

Yes, a non-refundable application processing fee of $15.00 is required. This payment needs to be made in certified funds, payable to the Alabama Department of Revenue. Personal checks and cash are not accepted.

What supporting documents do I need?

You must submit the current Alabama title along with the Mvt 20 1 application and the processing fee. The application will be returned if the form is illegible or incomplete.

What happens if I don’t fill out the form correctly?

If the form is not filled out clearly or completely, it will be returned to you. It is essential to ensure that all sections are completed accurately, and the information matches the details on the surrendered Alabama title.

Can I make changes to the owner information on the form?

You cannot change the owner information other than updating the address. All other details must match those on the existing title. This includes the name and other identifying information concerning the vehicle owner.

Are there any vehicles exempt from titling?

Yes, some vehicles are exempt from titling, such as those over 20 years old including manufactured homes, trailers, and certain motor vehicles. Additionally, low-speed vehicles that meet specific criteria are not subject to titling. Ensure you check the latest exemptions before applying.

What should I do if I need additional forms?

You can duplicate the Mvt 20 1 form as needed. Alternatively, you can also download additional copies from the Alabama Department of Revenue website.

What does “certify” mean in the context of this form?

When you certify the form, you are confirming that the information provided is true and correct to the best of your knowledge. False statements can lead to serious legal consequences, so make sure all details are accurate before signing.

Common mistakes

Filling out the Alabama MVT 20 1 form can be straightforward, but there are common mistakes that applicants often make. One major error is **illegible writing**. Since the form must be typed or printed clearly, any unclear information may lead to the return of the application. Ensuring that every section is legible can save time and prevent delays.

Another frequent mistake is not including the **correct Vehicle Identification Number (VIN)**. The VIN must appear exactly as it does on the current Alabama title. A missing or incorrect VIN can cause confusion and result in processing issues. Applicants should double-check the VIN against the title before submitting the form.

Many people overlook the necessity to **include the current Alabama title** with their application. The form requires that this title accompanies the application to process the lien. Without the title, the form will be deemed incomplete, leading to further delays and frustration.

Additionally, applicants often fail to provide the **appropriate lienholder information**. The names and addresses of both the first and second lienholders must be accurate and complete. Incomplete lienholder details can create problems when trying to establish ownership and claim rights over the vehicle.

Another common oversight is misunderstanding the **fee requirements**. The application processing fee of $15.00 must be in certified funds, payable to the Alabama Department of Revenue. Applicants may mistakenly send personal checks or cash, which could lead to rejection of the entire submission due to payment issues.

Lastly, it's important to ensure that the **owner information is consistent** with the current Alabama title. If there are any discrepancies—except for address changes—the application may be rejected. Make it a priority to compare the form’s details with those on the title to avoid unnecessary complications.

Documents used along the form

When dealing with the Alabama MVT 20 1 form for recording or transferring a lien, it is common to encounter several other relevant documents. Each document serves a specific purpose in facilitating vehicle title transactions and ensuring compliance with Alabama regulations.

- MVT 5-1E: This form is used by designated agents to record liens on vehicles. Unlike the MVT 20 1, it is specifically designed for agents acting on behalf of the lienholder or owner.

- Certificate of Title: The current Alabama title for the vehicle must accompany the MVT 20 1 form. This document verifies ownership and is crucial for any lien recording process.

- Title Application (MVT 1): This form is required when applying for a new title for a vehicle that does not already have an Alabama title. It is distinct from the MVT 20 1 as it deals with ownership transfer rather than lien recording.

- Application for Duplicate Title (MVT 2): In cases where the original title has been lost or damaged, this form is used to request a replacement title. This ensures that ownership remains clear and documented.

- Bill of Sale: A bill of sale serves as proof of purchase and outlines the details of the transaction between the buyer and seller. It is often required when applying for a new title or recording a lien.

- Notice of Lien: This document may be necessary to notify involved parties about the existence of a lien on the vehicle, particularly in cases of default or repossession. It helps protect the lienholder’s interests.

- Affidavit of Death (if applicable): If the owner or lienholder passes away, this affidavit may be needed to settle title and lien matters as part of estate management. It clarifies the transfer of ownership or lien rights.

Understanding these associated documents can help streamline the process of securing or transferring a lien on a vehicle in Alabama. Ensuring all required paperwork is accurately completed and submitted can prevent delays and ensure compliance with state regulations.

Similar forms

- Form MVT 5-1E: This form is utilized by designated agents to record liens. Unlike the MVT 20 1 form, which is specifically for lien recording only, the MVT 5-1E can be used in situations involving transfers of ownership.

- Form MVT 2: The MVT 2 is an application for a duplicate title. While both forms may require information on lienholders, the MVT 2 focuses on replacing a lost or damaged title rather than recording new liens.

- Form MVT 20-2: This form is used to apply for a title for a vehicle purchased from a dealer. In contrast, the MVT 20 1 form is focused solely on lien recording and does not involve ownership transfers.

- Form MVT 5-1: Similar to the MVT 20 1, this form is used for lien recordation but does not specify lien details tied to an outstanding title, making it applicable for different situations.

- Form 65: The 65 form is for reporting a change of ownership for a vehicle. While both it and the MVT 20 1 may involve lien information, the 65 form primarily addresses ownership transition.

- Form MVT 17: This is a form for the application of a new title when a vehicle is purchased out of state. The MVT 20 1 form differs as it deals with recording existing liens rather than the initial titling process.

Dos and Don'ts

Filling out the Alabama MVT 20 1 form correctly is essential for a smooth application process. Here are some helpful tips on what to do and what to avoid:

- Do: Type or print all information clearly. Illegible forms will be returned, causing unnecessary delays.

- Do: Ensure that the vehicle and owner information matches exactly with what appears on the surrendered Alabama title.

- Do: Include all required supporting documents, such as the current Alabama title and the application fee in certified funds.

- Do: Sign the form where indicated, and ensure that signatures are original and in ink.

- Do: Double-check for any exemptions that may apply to your specific situation before submitting your application.

- Don't: Use this form for transferring ownership or by designated agents, as it is specifically for recording a lien.

- Don't: Submit personal checks or cash. Only certified funds should accompany the application fee.

- Don't: Alter any information on the form, especially regarding owner details, unless necessary address changes are being made.

- Don't: Leave any required sections blank; ensure that all relevant fields are filled out completely.

- Don't: Forget to pay attention to the specific formatting for the vehicle identification number (VIN), which should conform to federal anti-theft standards.

Misconceptions

Misunderstandings about the Alabama Mvt 20 1 form can lead to confusion during the title process. Here are five common misconceptions:

- It can be used for transferring ownership. The Mvt 20 1 form is strictly for recording or transferring a lien. It cannot be used to transfer ownership of a vehicle.

- Any type of vehicle is eligible. This form only applies to vehicles with an outstanding Alabama title. Certain types of vehicles, such as trailers older than 20 years or motor vehicles older than 35 years, may be exempt from titling.

- It’s fine to use personal checks for the fee. The processing fee must be submitted in certified funds. Personal checks or cash are not accepted.

- Changes can be made after submission. Once the form is submitted, no changes are allowed in the owner information except for address updates. Make sure to double-check all details before submission.

- Designated agents can use this form. The Mvt 20 1 form is not intended for use by designated agents. They need to use form MVT 5-1E instead.

Understanding these misconceptions can streamline the process of recording or transferring a lien on a vehicle in Alabama.

Key takeaways

Understanding how to fill out and use the Alabama MVT 20 1 form is essential for vehicle owners and lienholders. Here are key takeaways:

- Purpose of the Form: The MVT 20 1 form is specifically for recording or transferring a lien on a vehicle that has an outstanding Alabama title. It is not for transferring ownership.

- Eligibility Requirements: Only lienholders can use this form. It cannot be used by designated agents, who must use a different form for lien creation.

- Information Accuracy: Vehicle and owner information must match exactly with the surrendered Alabama title, except for address updates.

- Submission Guidelines: The form must be typed or printed legibly. Illegible forms will be returned, causing delays in processing.

- Supporting Documents: Along with the completed form, submit the current Alabama title and a $15 application processing fee in certified funds.

- Exemptions: Certain vehicles may be exempt from titling, including those over 20 or 35 years old, and low-speed vehicles. Check the latest exemptions to confirm eligibility.

Completing and using the MVT 20 1 form accurately ensures proper documentation of liens and compliance with Alabama regulations.

Browse Other Templates

Virginia Vehicle Title - Correctly documenting lien transfers protects all parties involved in vehicle financing.

Form Fl-155 - FL-155's format allows for easier comprehension by judges and opposing parties.