Fill Out Your Allied Authorization Form

The Allied Authorization form is designed to simplify the payment process for insurance premiums through automatic withdrawals, enhancing convenience for policyholders. Customers can take advantage of Flex Chek Allied® to eliminate the hassle of writing checks or mailing payments each month. By signing this form, individuals authorize Nationwide Mutual, AMCO, and Allied Property and Casualty to withdraw the necessary funds directly from their bank accounts. This ensures that insurance coverage remains active without interruptions caused by lost or delayed payments. Instead of dealing with monthly billing statements, customers will see these payments reflected on their bank statements, creating a more streamlined experience. If there is a change in the payment amount, the company commits to notifying account holders roughly 20 days in advance. To initiate this hassle-free payment option, policyholders need to complete the Authorization form, include the required minimum payment, and submit it along with a voided check for bank verification. Gathering this information allows for a smooth transition into automatic payments, making life just a bit easier for customers who value their time and peace of mind.

Allied Authorization Example

Please fill out this form and fax back to:

3820 109th St, Dept 5672

Des Moines, IA 50391- 5672

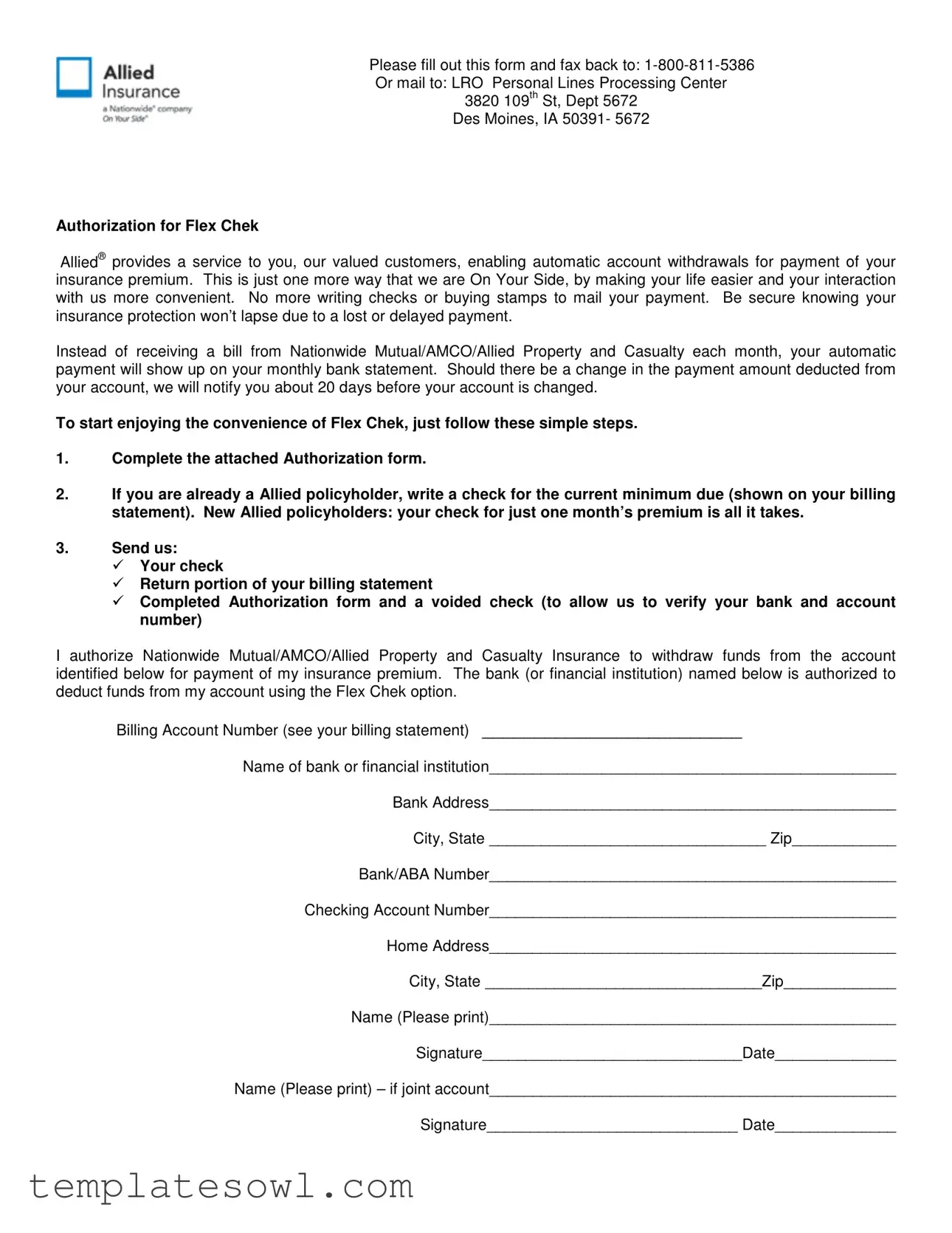

Authorization for Flex Chek

Allied® provides a service to you, our valued customers, enabling automatic account withdrawals for payment of your insurance premium. This is just one more way that we are On Your Side, by making your life easier and your interaction with us more convenient. No more writing checks or buying stamps to mail your payment. Be secure knowing your insurance protection won’t lapse due to a lost or delayed payment.

Instead of receiving a bill from Nationwide Mutual/AMCO/Allied Property and Casualty each month, your automatic payment will show up on your monthly bank statement. Should there be a change in the payment amount deducted from your account, we will notify you about 20 days before your account is changed.

To start enjoying the convenience of Flex Chek, just follow these simple steps.

1.Complete the attached Authorization form.

2.If you are already a Allied policyholder, write a check for the current minimum due (shown on your billing statement). New Allied policyholders: your check for just one month’s premium is all it takes.

3.Send us:

Your check

Return portion of your billing statement

Completed Authorization form and a voided check (to allow us to verify your bank and account number)

I authorize Nationwide Mutual/AMCO/Allied Property and Casualty Insurance to withdraw funds from the account identified below for payment of my insurance premium. The bank (or financial institution) named below is authorized to deduct funds from my account using the Flex Chek option.

Billing Account Number (see your billing statement) _________________________

Name of bank or financial institution_______________________________________________

Bank Address_______________________________________________

City, State ________________________________ Zip____________

Bank/ABA Number_______________________________________________

Checking Account Number_______________________________________________

Home Address_______________________________________________

City, State ________________________________Zip_____________

Name (Please print)_______________________________________________

Signature______________________________Date______________

Name (Please print) – if joint account_______________________________________________

Signature_____________________________ Date______________

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Allied Authorization form allows automatic withdrawals for insurance premium payments. |

| Contact Information | Fax: 1-800-811-5386, Mail: LRO Personal Lines Processing Center, 3820 109th St, Dept 5672, Des Moines, IA 50391-5672. |

| Service Provider | This service is provided by Allied, a part of Nationwide Mutual/AMCO/Allied Property and Casualty. |

| Notification of Changes | Customers will be notified about any changes to their withdrawal amount approximately 20 days in advance. |

| Required Steps | To enroll, complete the form, provide a check for the minimum due, and include a voided check. |

| Account Details | The form requires the billing account number and bank details for verification of the account. |

| Convenience | Using Flex Chek eliminates the need for writing checks and mailing payments, making life easier. |

| Legal Compliance | The form's operation is governed by applicable state laws concerning automatic payments and insurance policies. |

Guidelines on Utilizing Allied Authorization

Filling out the Allied Authorization form is straightforward. After you complete the form, you'll be able to set up automatic withdrawals for your insurance premium payments. This means no more worrying about missed payments or late fees. Here's how to do it:

- Download and print the Allied Authorization form from your provider's website or the specified source.

- Fill in your Billing Account Number that you find on your billing statement.

- Provide the Name of your bank or financial institution and its Address.

- Complete the City, State, and Zip for your bank's address.

- Insert your Bank/ABA Number for additional identification.

- Fill in your Checking Account Number.

- Provide your Home Address, along with the City, State, and Zip.

- Print and sign your name, making sure it is clear and legible.

- If this is a joint account, print and provide the name and signature of the other account holder.

- Write a check for the minimum current payment due if you are already an Allied policyholder or for one month’s premium if you are a new policyholder.

- Prepare to send the completed Authorization form, voided check, and billing statement return portion.

- Send everything via fax to 1-800-811-5386 or mail it to:

- LRO Personal Lines Processing Center

- 3820 109th St, Dept 5672

- Des Moines, IA 50391-5672

Once you've submitted your documents, you can expect to start enjoying the benefits of automatic withdrawals. Stay tuned for any notifications about changes to your payment amounts that may arise in the future.

What You Should Know About This Form

What is the Allied Authorization form used for?

The Allied Authorization form enables customers to set up automatic withdrawals for their insurance premium payments. This service, known as Flex Chek, streamlines the payment process by eliminating the need to write checks or send mail. Instead of receiving a monthly bill, customers will see the premium payment deducted directly from their bank account, providing peace of mind that their coverage will remain uninterrupted.

How do I fill out the Allied Authorization form?

To fill out the form, start by providing your billing account number as listed on your billing statement. Next, indicate the name and address of your bank or financial institution, including the bank's ABA number. You will also need to enter your checking account number, home address, and your printed name. Ensure that you sign and date the form. If the account is joint, the other account holder must also provide their printed name, signature, and date.

What payment information do I need to provide with the authorization form?

You need to include a check for the minimum amount due, as stated on your billing statement, if you are already a policyholder. If you are a new policyholder, you only need to send a check for one month's premium. Additionally, a voided check is required to verify your bank account details. This step is crucial for ensuring accurate withdrawals.

How will I know if my payment amount changes?

If there are any changes to the amount deducted from your account, Allied will notify you approximately 20 days before the change takes effect. This notification allows you to be prepared for any adjustments and ensures that you remain aware of your premium payments.

Where do I send the completed Allied Authorization form?

You can return the completed form and your check by faxing it to 1-800-811-5386. Alternatively, you may mail the documents to the LRO Personal Lines Processing Center at 3820 109th St, Dept 5672, Des Moines, IA 50391-5672. Make sure to send your submission to the correct location to avoid delays in processing your automatic payment request.

What are the benefits of using the Flex Chek option?

The Flex Chek option offers several advantages, including convenience, security, and peace of mind. Automatic withdrawals simplify the payment process, ensuring that customers do not miss a payment due to lost mail or forgetfulness. With Flex Chek, you can establish a reliable system for maintaining your insurance coverage without the burden of monthly billing reminders.

Common mistakes

Filling out the Allied Authorization form can seem straightforward, but there are common mistakes that can hinder the process. One frequent error occurs when individuals forget to include their billing account number. This number is essential for identifying the account from which payments will be deducted. Without it, the request may be delayed or rejected.

Another mistake people often make is neglecting to sign the form. Both the primary account holder and, if applicable, the joint account holder must provide their signatures. Missing signatures can lead to complications or the need to resend the form, which can delay the automatic payment setup.

Providing incorrect or incomplete bank information is also a common issue. Individuals may miswrite their checking account number or the bank's ABA number. These numbers are critical for the financial institution to process the payments correctly. Double-checking the accuracy of these numbers is vital.

Some people may overlook sending all necessary documentation. The completed authorization form, a voided check, and the return portion of the billing statement are all required. If any of these components are missing, the processing of the request can stall.

Another mistake is not informing the bank of the authorization. While many may assume that the form is sufficient, it’s also important to ensure the bank recognizes the authorization to deduct funds. This step can sometimes be overlooked, leading to confusion or failed transactions.

Lastly, failing to provide timely submissions can be problematic. It's important to send the completed form and all required documents promptly to the designated address or fax number. Delays in submission can result in missed payments, which could affect coverage. Taking the time to carefully review each section of the form can help avoid these common pitfalls.

Documents used along the form

When completing the Allied Authorization form, several other documents can also come into play to ensure a seamless transition to your automatic payment setup. These documents help maintain clarity and support the process, making your experience as smooth as possible. Here is a brief overview of each document commonly associated with the Allied Authorization:

- Billing Statement: This document shows the amount you owe and serves as a reference for your current premium payment. It typically includes important information like payment due dates and your billing account number, which you will need while completing the authorization form.

- Voided Check: A voided check helps verify your financial institution details. By submitting a voided check, you provide the necessary bank routing information and confirm your account number for automatic withdrawals.

- Initial Payment Check: If you are a new policyholder or renewing your policy with Allied, an initial payment is often required. This check covers the first month’s premium and ensures your account is active and ready for the automatic payment setup.

- Correspondence Letter: This document may accompany the Allied Authorization form, explaining the details of the automatic payment process. It reassures you about the benefits of the Flex Chek option and provides additional instructions if needed.

Having these documents handy will simplify the process and help ensure everything is in order for your automatic payments. By preparing ahead, you can enjoy the convenience of automatic withdrawals without any hiccups.

Similar forms

- Direct Debit Authorization Form: This document allows a consumer to authorize a service provider to withdraw funds directly from their bank account. Like the Allied Authorization form, it simplifies regular payments and increases payment security.

- Payment Authorization Form: Similar in purpose, this document is used for approving charges to a consumer's account for various services or goods, thus enhancing the convenience of payment processes.

- Automatic Bill Payment Agreement: This agreement facilitates automated payments for recurring bills. Just as with the Allied Authorization, it ensures timely payments to prevent service interruptions.

- Electronic Funds Transfer (EFT) Agreement: This document authorizes bank transfers for payments. It also provides for the secure transfer of funds, mirroring the function of the Allied Authorization in facilitating reliable payments to insurance providers.

- Credit Card Payment Authorization: A consumer uses this form to provide their credit card details for automatic payments. It shares a common goal with the Allied Authorization form—simplifying the process of ongoing payments.

- Recurring Payment Agreement: This agreement outlines the terms for ongoing payments at set intervals, offering customers a streamlined way to manage expenses consistently, just like the service offered through Flex Chek.

- Subscription Service Agreement: Similar documents used for memberships or subscriptions, they secure ongoing payments for services rendered. They enable consumers to enjoy uninterrupted service, replicating the assurance provided by the Allied Authorization form.

Dos and Don'ts

When completing the Allied Authorization form, it is essential to follow certain guidelines to ensure the process runs smoothly. Below is a list of recommendations:

- Do read the entire form carefully before filling it out.

- Do provide accurate and complete information.

- Do include a voided check with your submission.

- Do ensure your signatures are legible and consistent with your name.

- Don't leave any required fields blank.

- Don't rush through the process; take your time to verify all entries.

- Don't forget to send your check along with the form.

- Don't submit the form without double-checking the bank details.

Following these steps will help ensure that there are no delays in your authorization for automatic payments.

Misconceptions

There are several misconceptions surrounding the Allied Authorization form that can lead to confusion among customers. Understanding the truth behind these misconceptions can help streamline your experience. Below are some common misunderstandings:

- Misconception 1: Filling out the form is complicated.

- Misconception 2: I will lose control over my payments.

- Misconception 3: I need to send several forms of identification.

- Misconception 4: Automatic payments mean I can’t cancel anytime.

- Misconception 5: This service is only for current customers.

- Misconception 6: There are hidden fees associated with the Flex Chek option.

Many people feel the form is too complex. In reality, the steps are straightforward: complete the form, provide a check for the amount due, and return it with a voided check. Simplifying the payment process is the goal.

Some worry that automatic withdrawals mean they’ll lose track of their payments. However, cardholders receive a monthly bank statement that clearly shows deductions. Also, you will be notified 20 days in advance of any changes to the payment amount.

It’s a common belief that numerous documents are necessary. Actually, only a voided check is required to verify your bank account. This reduces the paperwork burden on policyholders.

Some individuals think that choosing Flex Chek ties them down without an escape. Cancelling automatic payments is not complicated, and customers have the freedom to stop the service whenever they wish with proper notice.

New customers might believe they cannot access the Flex Chek service. In truth, even if you are new to Allied, you can set up automatic payments by sending in your first month’s premium alongside the completed authorization form.

Many fear that signing up for automatic withdrawals comes with unexpected charges. In fact, this service is designed to make transactions easier and does not carry hidden fees. It’s a convenient way to manage your insurance payments seamlessly.

Key takeaways

When it comes to utilizing the Allied Authorization form for automatic payments, several key points can enhance your experience. These takeaways are designed to guide you through the process efficiently and effectively.

- Convenience: With Flex Chek, customers can eliminate the hassle of writing checks and mailing payments. It streamlines the billing process and saves time.

- Security: Automatic payments help ensure that your insurance coverage remains active, preventing lapses due to lost or delayed payments.

- Advance Notice: Should the payment amount change, you will receive a notification about 20 days in advance. This way, you can plan accordingly.

- Simple Start-Up: Starting Flex Chek requires just a few basic steps, making the transition to automatic payments straightforward.

- Documentation Required: To complete the authorization, you must submit your completed form, a voided check, and either your check for the minimum due or one month’s premium for new policyholders.

- Accurate Information: Make sure to accurately provide your bank details, including the bank account number and ABA number, to avoid any issues with withdrawals.

- Personal Touch: Remember to sign and date the form accurately. If it’s a joint account, both account holders need to provide their information and signatures.

Understanding these key points will help you navigate the Allied Authorization form with ease and confidence, ensuring that your payments are handled smoothly.

Browse Other Templates

Judicial Intervention Request Form,Commercial Division Case Form,UCS Commercial Addendum,Request for Case Assignment in Commercial Division,Litigation Initiation Form,Commercial Litigation Information Sheet,UCS Business Case Form,Judicial Request for - Acts in commercial dealings can be documented and claimed through the UCS 840C form.

What Is an Odometer Disclosure - Potential buyers should request this form to verify vehicle mileage history.

Coconut Bowl Hiring - Confirm your ability to provide legal work verification.