Fill Out Your Allstate Critical Illness Walmart Form

The Allstate Critical Illness Walmart form is an essential document for those enrolled in the Wal-Mart Group Critical Illness Policy. This form is designed to simplify the process of filing claims for critical illnesses covered under this policy. It outlines the necessary steps to ensure a smooth submission, including the requirement to complete all applicable sections and provide crucial information such as your certificate number. To expedite your claim, you are encouraged to include detailed medical documentation, which may include diagnostic studies, treatment records, and physician statements that establish the severity of the illness. Additionally, the form provides contact information for the Walmart Claim Department, where you can seek assistance or clarification on benefits or appeal decisions. Keep in mind, submitting this form does not imply that Allstate has accepted liability for the claim; it simply serves as a step in the claims process. Having this document at hand can significantly ease the burden during a challenging time, ensuring that you receive the benefits you are entitled to. Remember to either fax, electronically submit, or mail the claim to the designated address to ensure its proper handling and timely resolution.

Allstate Critical Illness Walmart Example

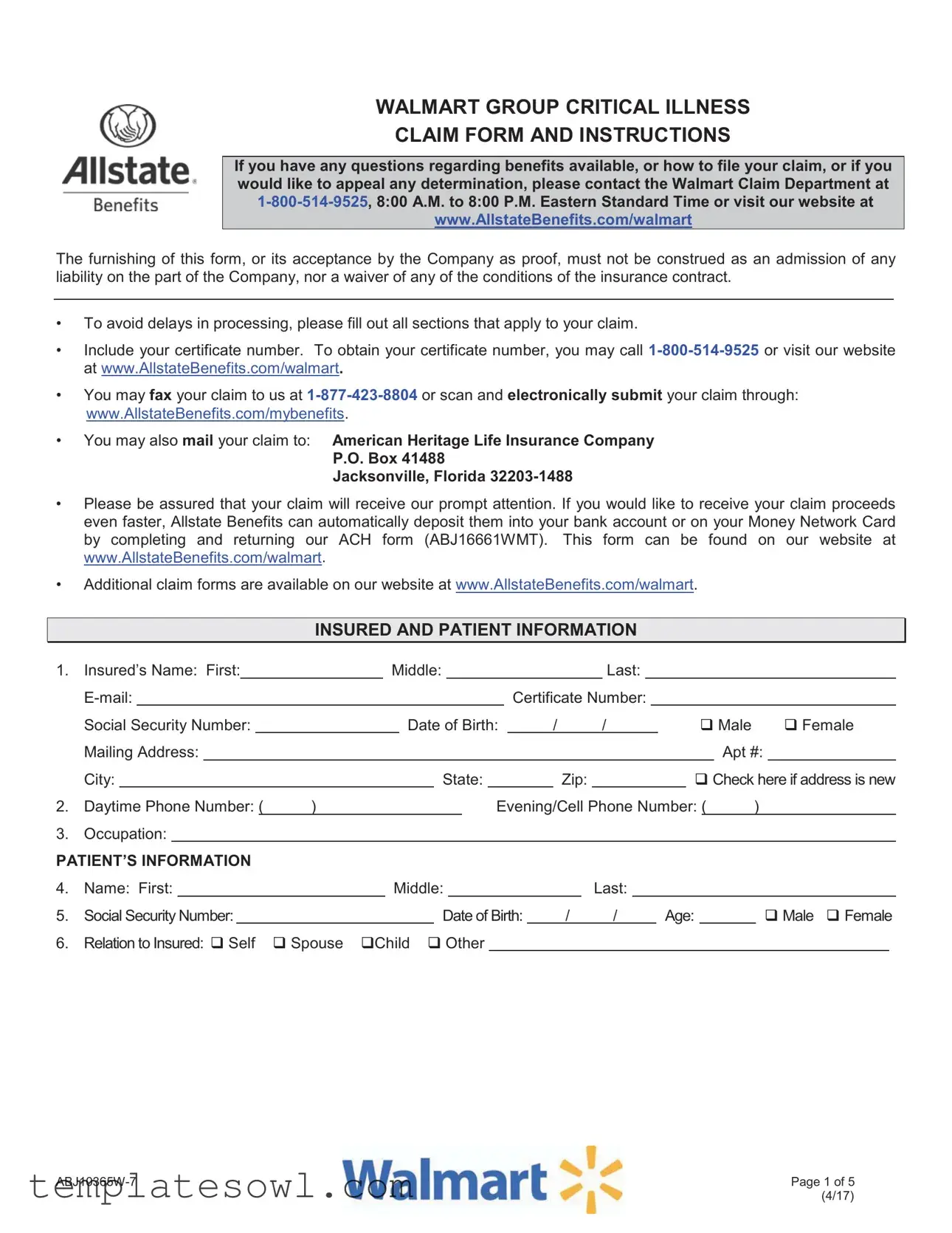

WALMART GROUP CRITICAL ILLNESS

CLAIM FORM AND INSTRUCTIONS

If you have any questions regarding benefits available, or how to file your claim, or if you would like to appeal any determination, please contact the Walmart Claim Department at

The furnishing of this form, or its acceptance by the Company as proof, must not be construed as an admission of any liability on the part of the Company, nor a waiver of any of the conditions of the insurance contract.

•To avoid delays in processing, please fill out all sections that apply to your claim.

•Include your certificate number. To obtain your certificate number, you may call

•You may fax your claim to us at

•You may also mail your claim to: American Heritage Life Insurance Company

P.O. Box 41488

Jacksonville, Florida

•Please be assured that your claim will receive our prompt attention. If you would like to receive your claim proceeds even faster, Allstate Benefits can automatically deposit them into your bank account or on your Money Network Card by completing and returning our ACH form (ABJ16661WMT). This form can be found on our website at www.AllstateBenefits.com/walmart.

•Additional claim forms are available on our website at www.AllstateBenefits.com/walmart.

INSURED AND PATIENT INFORMATION

1. |

Insured’s Name: First: |

|

Middle: |

|

|

|

|

|

Last: |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificate Number: |

|

|

|

|

|

|

|

||||||||||

|

Social Security Number: |

|

|

|

Date of Birth: |

|

/ |

/ |

|

|

|

Male |

|

Female |

||||||||||||||

|

Mailing Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt #: |

|

||||||

|

City: |

|

|

|

|

State: |

|

|

|

|

Zip: |

|

|

|

Check here if address is new |

|||||||||||||

2. |

Daytime Phone Number: ( |

) |

|

|

|

|

|

Evening/Cell Phone Number: ( |

) |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.Occupation:

PATIENT’S INFORMATION

4. |

Name: First: |

|

|

Middle: |

|

|

Last: |

|

|

|

|

|

|||

5. |

Social Security Number: |

|

|

|

Date of Birth: |

/ |

/ |

|

Age: |

|

Male Female |

||||

6. |

Relation to Insured: Self |

Spouse Child Other |

|

|

|

|

|

|

|

|

|||||

Page 1 of 5 |

|

|

(4/17) |

INSTRUCTIONS FOR FILING YOUR CRITICAL ILLNESS CLAIM

Following are the benefits available under your

The results of a tissue specimen, culture(s) and/or titer(s) or other diagnostic studies, which initially diagnosed the specified disease, must accompany your claim.

A copy of your itemized hospital billing and completed Attending Physician’s Statement.

*Additional information may be required as shown below.

Critical Illness Benefit |

|

|

Please attach the medical record documentation of your condition |

||||

Alzheimer’s Disease |

|

|

Medical record documentation by psychiatrist or neurologist to include proof of inability to perform 3 or |

||||

|

|

|

more activities of daily living |

|

|||

Benign Brain Tumor |

|

|

Pathology report |

|

|||

Carcinoma in situ |

|

|

Pathology report |

|

|||

Coma |

|

|

Medical documentation showing state of unconsciousness for 7 or more consecutive days |

||||

Complete Loss of Hearing |

|

|

Medical documentation showing diagnosis of total hearing loss in both ears for at least 6 months |

||||

Complete Loss of Sight |

|

|

Medical documentation by ophthalmologist showing permanent loss of sight to 20 degrees or less in |

||||

|

|

|

both eyes |

|

|

|

|

Coronary Artery |

|

|

Medical record or billing proof of procedure |

|

|||

Dismemberment |

|

|

Medical documentation showing permanent loss of one or more limbs |

||||

End Stage Renal Failure |

|

|

Medical record documentation showing proof of failure to both kidneys and proof of dialysis |

||||

|

|

|

or transplant |

|

|

|

|

Heart Attack |

|

|

Electrocardiograph proof and lab reports showing elevated |

|

|||

|

|

|

cardiac enzymes or biochemical markers |

|

|||

Invasive Cancer |

|

|

Pathology report |

|

|||

Paralysis |

|

|

Medical documentation showing diagnosis of the loss of the use of a limb without severance |

||||

|

|

|

|

|

|

||

Parkinson’s Disease |

|

|

Medical documentation by a neurologist showing inability to perform 3 or more daily living |

||||

|

|

|

activities |

|

|

|

|

Ruptured or Dissecting Aneurysm |

|

|

Medical records documentation of Ruptured or Dissecting Aneurysm |

||||

Skin Cancer |

|

|

Pathology report |

|

|||

Stroke |

|

|

Medical record documentation of permanent neurological deficit |

|

|||

Transient Ischemic Attack (TIA) |

|

|

Medical record documentation of a TIA |

|

|||

SPECIFIED DISEASES: (Please check the illness for which you are requesting benefits) |

|

||||||

Addison’s Disease |

|

|

|

|

|

|

|

Amyotrophic Lateral Sclerosis (Lou Gehrig’s Disease) |

|

|

|

|

|||

Cerebrospinal Meningitis (bacterial) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cerebral Palsy |

|

|

|

|

|

|

|

Cystic Fibrosis |

|

|

|

|

|

|

|

Diphtheria |

|

|

|

|

|

|

|

Encephalitis |

|

|

|

|

|

|

|

Huntington’s Chorea |

|

|

|

|

|

|

|

Legionnaire’s Disease |

|

|

|

|

|

*Confirmation by culture or sputum |

|

Malaria |

|

|

|

|

|

|

|

Multiple Sclerosis |

|

|

|

|

|

|

|

Muscular Dystrophy |

|

|

|

|

|

|

|

Myasthenia Gravis |

|

|

|

|

|

|

|

Necrotizing fasciitis |

|

|

|

|

|

|

|

Osteomyelitis |

|

|

|

|

|

|

|

Poliomyelitis |

|

|

|

|

|

|

|

Rabies |

|

|

|

|

|

*Also eligible for Recurrence Benefit |

|

Sickle Cell |

|

|

|

|

|

|

|

Systemic Lupus |

|

|

|

|

|

|

|

Systemic Sclerosis |

|

|

|

|

|

|

|

Tetanus |

|

|

|

|

|

|

|

Tuberculosis |

|

|

|

|

|

|

|

RECURRENCE BENEFIT |

MAJOR ORGAN TRANSPLANT OPTIONAL BENEFIT RIDER |

LODGING BENEFIT |

|||||

NATIONAL CANCER INSTITUTE (NCI) EVALUATION |

POST TRAUMATIC STRESS DISORDER |

AMBULANCE BENEFIT |

|||||

SIGN THIS PART ONLY IF YOU WISH TO ASSIGN YOUR BENEFITS TO A PROVIDER OR A FACILITY

I request that American Heritage Life Insurance Company send benefits to someone other than me. Please send benefits available to the name and address shown below:

|

Name |

|

|

Relationship |

|

|

|

|

|

|

|

|

|

|

|

|

Provider or Facility Tax Identification Number |

Address |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip |

|

|

|

|

|

|

|

|

|

|

|

Signature of Insured |

|

|

|

Date |

|

|

|

|

|

|

|

Page 2 of 5 |

|

|

ATTENDING PHYSICIAN’S STATEMENT

Patient’s Name: |

|

Age: |

1.Diagnosis:

2. |

If condition is due to pregnancy, what is expected delivery date? |

Date |

/ |

/ |

|

|||

|

|

|

|

|

|

MO/DAY/YR |

|

|

3. |

When did symptoms first appear or accident happen? Date |

/ |

|

/ |

|

|

||

|

|

|

|

MO/DAY/YR |

|

|

|

|

4. |

When did patient first consult you for this condition? Date |

/ |

|

/ |

|

|

||

|

|

|

|

MO/DAY/YR |

|

|

|

|

5. |

Has patient ever had same or similar condition? (If “yes,” state when and describe.) |

Yes No |

||||||

6.Describe any other diseases or infirmity affecting present condition.

7.Nature of surgical or obstetrical procedure, if any (describe fully).

8. |

Is patient unable to perform job duties? Yes |

No If yes, from |

|

|

|

through |

||||||||||

9a. |

What specific job duties is patient unable to perform? |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

9b. |

Specific RESTRICTIONS (What the patient should not do and why). Please quantify in hours, weight, etc. |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

9c. |

Specific LIMITATIONS (What the patient cannot do and why). |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

10. |

If retired or unemployed which activities of daily living (ADLs) is patient unable to perform? |

|

|

|

|

|

|

|

||||||||

11. |

Date patient last examined by you: |

|

|

|

Frequency of visits: weekly monthly other |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

12. |

Is patient: ambulatory bed confined house confined other |

|

|

|

|

|

|

|||||||||

13. |

If patient is hospitalized, give name and address of hospital. |

|

|

|

|

|

|

|

||||||||

|

Hospital: |

|

|

City: |

|

|

State: |

|

||||||||

14a. Date admitted: |

/ |

/ |

|

Date discharged: |

|

|

/ |

/ |

|

|

|

|

|

MO/DAY/YR |

|

|

|

|

MO/DAY/YR |

|

|

||||

14b. When do you expect patient to resume partial duties? |

/ |

|

/ |

|

|

Full duties? |

/ |

/ |

||||

|

|

|

|

MO/DAY/YR |

|

|

|

|

|

MO/DAY/YR |

|

|

14c. If patient is unemployed or retired, on what date would you expect a person of like age, gender and good health to resume his/her normal and

necessary activities? |

/ |

/ |

|

|

|

MO/DAY/YR |

|

|

|

15. Have you completed paperwork for any other insurance company? Yes No |

Social Security Disability? Yes No |

|||

Remember, it is a crime to fill out this form with facts you know are false or to leave out facts you know are relevant and important. Check to be sure that all information is correct before signing. Please refer to page 4 for notice specific to your state.

PHYSICIAN VERIFICATION

Signed: |

, MD |

Date: |

/ |

/ |

|

Phone: ( |

) |

|||||

|

|

|

|

|

|

|

MO/DAY/YR |

|

|

|

|

|

Street Address: |

|

|

|

|

|

|

|

|

|

|||

City/Town: |

|

|

|

|

|

|

|

|

|

|||

State/Province: |

|

|

|

|

|

Zip Code: |

|

|||||

CERTIFICATION

I acknowledge receipt of the Fraud Warnings By State provided with this claim packet. I have read the notices and I am aware that it is a crime to fill out this form with facts I know are false or to leave out facts I know are relevant and important. I certify that the answers given on this claim form are true, complete, and correctly recorded.

Signature: |

|

Date: |

Print Name:

Page 3 of 5 |

ILLINOIS INTEREST STATEMENT: For contracts issued in and residents of Illinois, unless payment is made within

FRAUD WARNINGS BY STATE

NOTICE IN ALABAMA: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject to restitution fines or confinement in prison, or any combination thereof.

NOTICE IN ALASKA, KENTUCKY, LOUISIANA, MAINE, NEW JERSEY AND NEW MEXICO: Any person who knowingly and with intent to injure, defraud or deceive an insurance company files a claim containing false, incomplete or misleading information may be prosecuted under state law.

NOTICE IN ARIZONA: For your protection Arizona law requires the following statement to appear on this form. Any person who knowingly presents a false or fraudulent claim for payment of a loss is subject to criminal and civil penalties.

NOTICE IN ARKANSAS: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

NOTICE IN CALIFORNIA: For your protection, California law requires the following to appear on this form. Any person who knowingly presents a false or fraudulent claim for payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

NOTICE IN COLORADO: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance, and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado division of insurance within the department of regulatory agencies.

NOTICE IN DELAWARE, IDAHO, INDIANA, MINNESOTA, AND OKLAHOMA: Any person who knowingly and with intent to injure, defraud or deceive an insurance company files a claim containing false, incomplete or misleading information is guilty of a felony.

NOTICE IN DISTRICT OF COLUMBIA: FRAUD NOTICE: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits, if false information materially related to a claim was provided by the applicant.

NOTICE IN FLORIDA: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

NOTICE IN MARYLAND: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

NOTICE IN NEW HAMPSHIRE: Any person who, with a purpose to injure, defraud or deceive any insurance company, files a statement of claim containing any false, incomplete, or misleading information is subject to prosecution and punishment for insurance fraud, as provided in RSA 638.20.

NOTICE IN NEW YORK: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

NOTICE IN OHIO: Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement is guilty of insurance fraud.

NOTICE IN OREGON: Any person who makes intentional misstatement that is material to the risk may be found guilty of insurance fraud by a court of law.

Page 4 of 5 |

NOTICE IN PENNSYLVANIA: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

NOTICE IN PUERTO RICO: Any person who knowingly and with the intention to defraud includes false information in an application for insurance or file, assist or abet in the filing of a fraudulent claim to obtain payment of a loss or other benefit, or files more than one claim for the same loss or damage, commits a felony and if found guilty shall be punished for each violation with a fine of no less than five thousands dollars ($5,000), not to exceed ten thousands dollars ($10,000); or imprisoned for a fixed term of three (3) years, or both. If aggravating circumstances exist, the fixed jail term may be increased to a maximum of five (5) years; and if mitigating circumstances are present, the jail term may be reduced to a minimum of two (2) years.

NOTICE IN TENNESSEE AND WASHINGTON: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

NOTICE IN TEXAS: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

NOTICE IN WEST VIRGINIA AND RHODE ISLAND: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Page 5 of 5 |

AMERICAN HERITAGE LIFE INSURANCE COMPANY

HOME OFFICE:

1776 AMERICAN HERITAGE LIFE DRIVE JACKSONVILLE, FLORIDA

AUTHORIZATION TO RELEASE INFORMATION TO AHL

I hereby authorize any physician, health care professional, hospital, clinic, laboratory, pharmacy, medical facility, health care provider, Pharmacy Benefit Manager, insurance company, the Medical Information Bureau (MIB) or other organization, institution or person that has any health related records or knowledge of me or minor dependents to disclose the entire medical record (excluding psychotherapy notes and in MAINE and VERMONT HIV related test results) to American Heritage Life Insurance Company (AHL), its duly authorized representatives, its subsidiaries or its reinsurers. This authorization extends to any minor dependent on whom insurance is requested or claim for benefits is being made.

The information to be obtained shall include insurance claim history from any Prescription Drug Database, pharmacy benefit manager, ambulance, insurance company, medical transport service, or the MIB. Also, I authorize any entity, person, or organization that has these records about me, including but not limited to my employer, employer representative and compensation sources, insurance company, financial institution or governmental entities, including departments of public safety and motor vehicle departments, to give any information or record it has about me, my employment, employment history or income to AHL.

I understand that this information will be used to evaluate and administer my claim for benefits or to evaluate my eligibility for insurance. I understand that there is a possibility of redisclosure of any information disclosed pursuant to this authorization and that information, once disclosed, may no longer be protected by certain federal regulations governing privacy and confidentiality, though it may still be protected by state privacy laws or other applicable privacy laws. I also authorize AHL or its reinsurers to make a brief report of my health information to MIB.

This authorization shall remain in force for 24 months following the date of my signature below or termination of my coverage, whichever occurs first. A copy of this authorization is as valid as the original. I or my legal representative may request a copy of this authorization. I understand that I may revoke this authorization at any time by sending a written notification to: Attn: Privacy Officer, American Heritage Life Insurance Company, 1776 American Heritage Life Drive, Jacksonville, FL 32224.

I understand that a revocation of this authorization is not effective if AHL has relied on the protected health information or has a legal right to contest a claim under an insurance policy or to contest the policy itself. The revocation will not apply to any information AHL requests or discloses prior to AHL receiving my revocation request. If I choose not to sign this authorization or if I later revoke it, I understand that AHL may not be able to process my application for coverage, or if coverage has been issued, AHL may not be able to administer my claim for benefits and this may result in a denial of my claim for benefits or request for services.

_________________________________ |

___________________________ |

Claimant/Applicant’s Signature |

Date Signed (mm/dd/yyyy) |

_________________________________ |

___________________________ |

Claimant/Applicant’s Printed Name |

Social Security Number |

If signed by the legal representative, please describe the authority under which the representative is authorized to act and enclose any related documentation granting authority.

__________________________________ |

__________________________ |

Signature of Legal Representative |

Relationship |

__________________________________ |

___________________________ |

Print Name of Legal Representative |

Date Signed (mm/dd/yyyy) |

ABJ21476

Form Characteristics

| Fact Name | Details |

|---|---|

| Claim Submission | Claim forms can be submitted via fax, mail, or electronically through their website. |

| Contact Information | For questions or assistance, contact the Walmart Claim Department at 1-800-514-9525. |

| Certificate Number | To file a claim, the insured must provide a certificate number which can be obtained through the claims department or website. |

| Benefits Information | The form includes a checklist for benefits available under the Walmart Group Critical Illness Policy. |

| Medical Documentation | Submit relevant medical records, including diagnostic studies and hospital billing, along with the claim. |

| Direct Deposit | Claim proceeds can be directly deposited into a bank account or on a Money Network Card with the completed ACH form. |

| Fraud Warning | Various state-specific fraud warnings apply, detailing penalties for filing false claims. |

Guidelines on Utilizing Allstate Critical Illness Walmart

Completing the Allstate Critical Illness Walmart form requires careful attention to detail to ensure a smooth claims process. Following the steps outlined below will guide you through the information needed for your claim submission.

- Start with the Insured and Patient Information section:

- Fill in the Insured’s Name, Email, Certificate Number, and Social Security Number.

- Provide the Date of Birth and mark the gender.

- Complete the Mailing Address, including Apt Number, City, State, and Zip code. Check the box if the address is new.

- List your Daytime and Evening/Cell Phone Numbers.

- State the Occupation.

- Next, provide the Patient’s Information:

- Enter the Patient's Name, Social Security Number, Date of Birth, and Age. Mark the gender.

- Indicate the Relation to Insured (e.g., Self, Spouse, Child, Other).

- Check the applicable Critical Illness Benefits based on your condition:

- Attach necessary medical documentation for the illnesses listed.

- Ensure all diagnostic reports and documentation specified in the form are included.

- Fill in the Attending Physician’s Statement with complete details:

- Provide the patient’s diagnosis and any relevant dates related to the condition.

- Answer all questions about the patient’s capabilities and restrictions.

- Ensure the physician signs and dates the statement.

- Review your completed form for any errors or missing information.

- Submit your claim:

- Fax to 1-877-423-8804 or scan and submit online at www.AllstateBenefits.com/mybenefits.

- Alternatively, you can mail your claim to American Heritage Life Insurance Company, P.O. Box 41488, Jacksonville, Florida 32203-1488.

What You Should Know About This Form

What is the purpose of the Allstate Critical Illness Walmart form?

This form is used to initiate a claim for benefits under the Allstate Critical Illness insurance policy provided through Walmart. It allows insured individuals to report a critical illness and submit necessary documentation required for the claim process.

How do I obtain my certificate number needed for filing a claim?

You can obtain your certificate number by contacting the Walmart Claim Department at 1-800-514-9525. Alternatively, you can visit the website at www.AllstateBenefits.com/walmart for more information.

What documentation is required to file a claim?

When submitting a claim, you need to include your certificate number, a signed Authorization to Release Information, and relevant medical documentation. This may include the results of any diagnostic tests or exams that identified the condition, an itemized hospital bill, and the Attending Physician's Statement. Supporting documents can vary depending on the specific critical illness being claimed.

Can I submit my claim electronically?

Yes, you can submit your claim electronically. You can either fax your claim to 1-877-423-8804 or scan and upload it through the website www.AllstateBenefits.com/mybenefits. This option helps streamline the submission process and may expedite the claim handling time.

How can I receive claim proceeds faster?

To receive your claim proceeds more quickly, you have the option to set up automatic deposits into your bank account or onto your Money Network Card. This requires completing and returning the ACH form, which you can find on the Allstate Benefits website.

What should I do if my claim is denied?

If your claim is denied, you have the right to appeal the determination. It is advisable to contact the Walmart Claim Department at 1-800-514-9525 for guidance on the appeal process and to understand the reasons for the denial. They can provide you with the necessary steps to take in order to contest the decision.

Common mistakes

Filling out the Allstate Critical Illness Walmart form can seem straightforward, but many people make mistakes that can delay their claims. One common mistake is not providing complete information in all applicable sections. It's essential to fill out every part that relates to your claim. If any section is left blank, it can cause delays in processing your claim.

Another frequent issue is failing to include the certificate number. This number is crucial for your claim to be tracked and processed efficiently. If you forget to include it, you may have to contact Walmart's Claim Department to retrieve it, which can hold up your claim. Ensure you have this number readily available when you fill out the form.

Some individuals neglect to sign the Authorization to Release Information form. This signature is required, especially when medical records and other sensitive information are involved. Without it, your claim could be rejected, leading to further delays. Always remember to include this important authorization to keep things moving smoothly.

Lastly, many submit their claims without including the necessary medical documentation. You'll need to provide detailed medical records that verify your condition. These documents are essential for proving your claim and can significantly affect its outcome. Ensure everything required is included before sending off your claim.

Documents used along the form

When dealing with the Allstate Critical Illness Walmart form, it is important to be aware of additional documents that may be required to ensure your claim is processed efficiently. Each of these forms plays a significant role in the claims process.

- Authorization to Release Information (Form ABJ21476): This form permits the release of medical records and other necessary information related to the claim. It must be signed by the patient.

- Attending Physician's Statement (APS): A detailed report completed by the patient's physician, providing diagnostics, treatment details, and the patient’s ability to perform daily activities.

- Medical Record Documentation: Documentation from healthcare providers detailing the medical condition for which benefits are being claimed. This can include test results and imaging studies.

- Hospital Billing Statement: An itemized bill from the hospital that outlines services rendered, which is crucial for verifying the costs associated with the medical care received.

- Proof of Diagnosis: This may include pathology reports, lab results, or imaging studies that support the diagnosis for which benefits are being sought.

- Certificate Number Verification: This document verifies the insured party’s identity and coverage details and is critical for processing claims efficiently.

- ACH Form (ABJ16661WMT): If the claimant prefers to receive their benefits electronically, this form authorizes the direct deposit of benefits into their bank account or onto a Money Network Card.

Understanding these documents and having them prepared can significantly expedite the claims process. Ensure all forms are completed accurately to minimize delays and ensure you receive the benefits you deserve.

Similar forms

- Health Insurance Claim Form: Similar to the Allstate Critical Illness form, this document is used to file claims for various health-related expenses. Both require personal information, details about the insured individual, and supporting medical documentation to validate the claim.

- Life Insurance Claim Form: This form serves a similar purpose during the claims process. It collects information about the deceased, the policyholder, and necessary documentation to prove the claim, ensuring that benefits are disbursed correctly.

- Short-Term Disability Claim Form: Like the Allstate form, this document is used to claim benefits due to illness or injury that restricts work capability. Both require medical corroboration and detailed patient information.

- Long-Term Care Insurance Claim Form: This form is used to initiate claims for long-term care services. It shares similarities in gathering details about the patient's conditions and the required medical approvals, focusing on ongoing health issues.

- Supplemental Health Insurance Claim Form: Much like the Allstate Critical Illness form, this document is meant for claims related to additional health coverage. It similarly necessitates detailed information about the insured and supporting medical records to process the claim effectively.

- Critical Illness Insurance Claim Form: Specific to policies that cover different critical illnesses, this document parallels the Allstate form in structure and requirements. Both request a comprehensive list of medical documentation to support the illness being claimed.

- Accidental Death and Dismemberment Claim Form: This document enables beneficiaries to claim benefits for death or dismemberment resulting from an accident. It seeks similar information about the insured person and requires medical validation, akin to the Allstate Critical Illness form.

Dos and Don'ts

When filling out the Allstate Critical Illness Walmart form, attention to detail is crucial. To help ensure a smooth process, here are five important things you should and should not do:

- Do fill out all sections that apply to your claim to avoid processing delays.

- Do include your certificate number. If you don't have this information, call the Walmart Claim Department at 1-800-514-9525.

- Do submit your claim electronically via fax or through the website to expedite processing.

- Do attach all necessary medical documentation to support your claim, such as hospital bills and physician statements.

- Do sign the Authorization to Release Information form; it's essential for processing your claim.

- Don't leave any required sections blank, as this could cause significant delays.

- Don't forget to double-check your personal information and ensure everything is accurate.

- Don't send your claim form via regular mail if you're looking for a faster response; consider electronic submission instead.

- Don't submit incomplete medical records or documentation, as this will likely delay your claim.

- Don't provide false information on the form. Doing so can lead to severe penalties for insurance fraud.

By following these guidelines, you can help ensure that your experience with the claims process is as smooth and efficient as possible.

Misconceptions

Misconceptions about the Allstate Critical Illness Walmart form can lead to confusion among policyholders. Here are four common misunderstandings:

- All claims will be automatically approved. Many believe that submitting the form guarantees a payout. In reality, the form must be completed correctly and all required documentation must be provided. Claims are subject to review based on the policy's terms.

- Only the insured individual needs to provide information. A common mistake is thinking only the insured must submit details. In fact, the form requires information for both the insured and the patient, especially if they are different individuals.

- Filing online is not an option. Some individuals assume they must mail their claims. However, the form allows for electronic submission. Claims can be faxed or submitted online, making the process potentially faster and more convenient.

- Medical documentation is optional. Another misconception is that supporting medical records aren't necessary. On the contrary, submitting the required medical documents is essential for the approval of a claim. Failure to provide these can result in delays or denials.

Key takeaways

Understanding how to fill out and use the Allstate Critical Illness Walmart form is essential for timely claims processing. Here are some key takeaways to make the process smoother:

- Complete All Sections: It's crucial to fill out every applicable section of the form to prevent delays. Missing information can stall your claim.

- Certificate Number: Always include your certificate number when submitting your claim. You can easily obtain this number by calling 1-800-514-9525 or visiting the Allstate Benefits website.

- Multiple Submission Options: You have several options for submitting your claim: fax, online, or traditional mail. Choose the method that works best for you, but ensure it’s sent to the correct address or fax number.

- Fast Claim Proceeds: If you want to receive your claim proceeds quicker, consider enrolling in automatic deposit. This option can expedite the delivery of funds to your bank account or Money Network Card.

- Documentation is Key: Be prepared to provide all required medical documentation, such as diagnostic studies or physician statements. Incomplete submissions can lead to additional delays.

Browse Other Templates

Texas Vehicle Information Request,Motor Vehicle Records Access Form,TxDMV Record Inquiry Form,Vehicle Title and Registration Request,Personal Vehicle Information Application,Motor Vehicle Data Request Form,Texas Driver Privacy Record Request,Vehicle - The form addresses the importance of lawful reasons for accessing personal vehicle data.

Salon Fundamentals Cosmetology Textbook Pdf - Fixed formats in PDFs enhance readability and usability of the manuals.