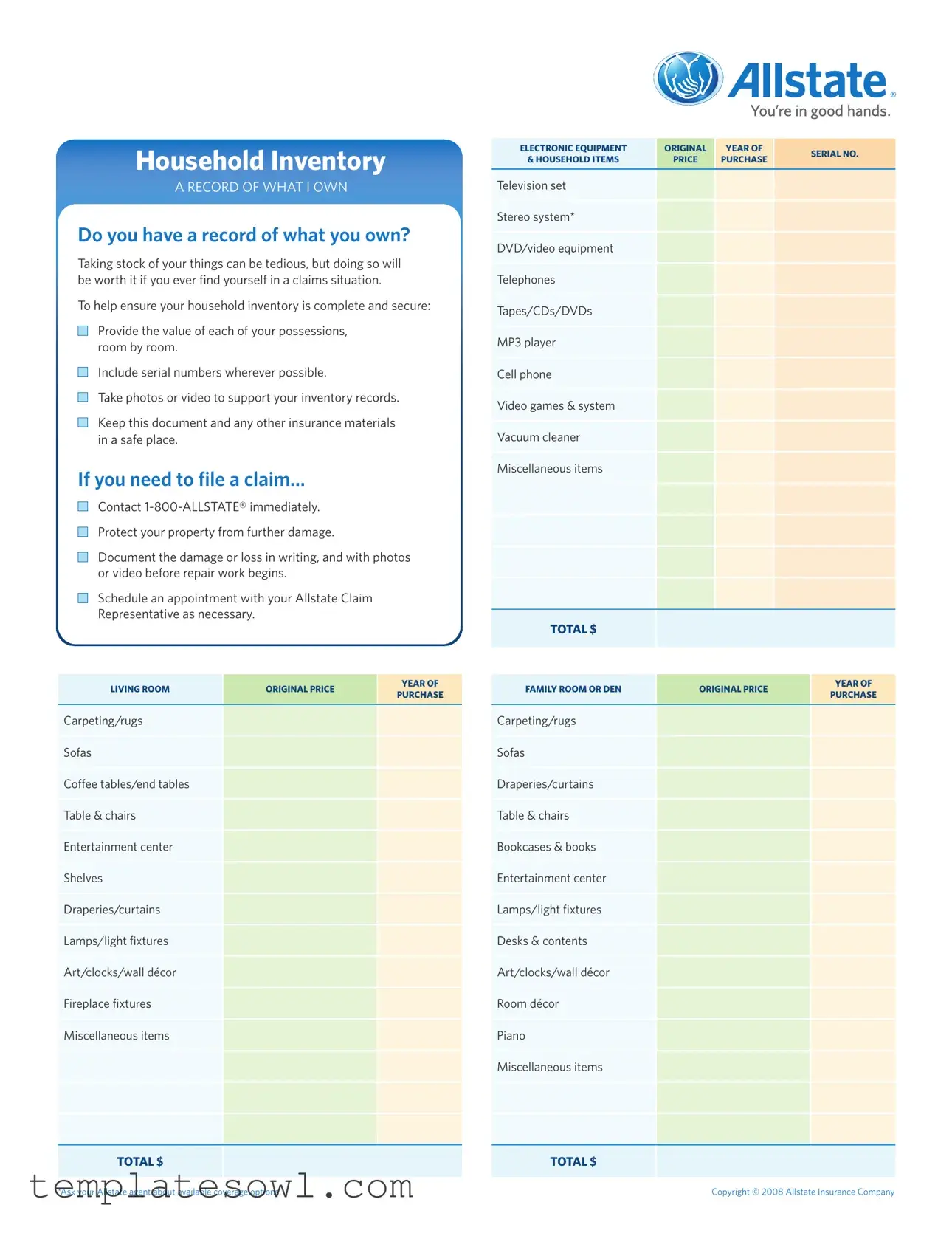

Fill Out Your Allstate Inventory Form

The Allstate Inventory form serves as a crucial tool for homeowners and renters alike, helping them keep a detailed account of their possessions. By methodically cataloging items room by room, individuals can ensure they have an accurate representation of their belongings, which is invaluable in the event of loss or damage. This form encourages users to not only provide the original purchase price and date for each item but also to include serial numbers whenever possible. The addition of photographs or videos further strengthens the inventory, providing visual proof of ownership. Key areas of focus include the living room, dining room, bedrooms, kitchen, bathrooms, and even outdoor spaces like the garage and attic. Each section prompts users to consider everything from electronics to clothing, ensuring a comprehensive collection of items. Moreover, the form outlines essential steps to take when filing an insurance claim, advocating for prompt action and thorough documentation. By maintaining this inventory in a safe place, policyholders can better protect their assets and facilitate smoother claims processing should they need it.

Allstate Inventory Example

Household Inventory

A RECORD OF WHAT I OWN

Do you have a record of what you own?

Taking stock of your things can be tedious, but doing so will be worth it if you ever find yourself in a claims situation.

To help ensure your household inventory is complete and secure:

Provide the value of each of your possessions, room by room.

Include serial numbers wherever possible.

Take photos or video to support your inventory records.

Keep this document and any other insurance materials in a safe place.

If you need to file a claim…

Contact

Protect your property from further damage.

Document the damage or loss in writing, and with photos or video before repair work begins.

Schedule an appointment with your Allstate Claim

Representative as necessary.

Living room |

Original price |

year of |

|

purchase |

|||

|

|

||

|

|

|

Carpeting/rugs

Sofas

Coffee tables/end tables

Table & chairs

Entertainment center

Shelves

Draperies/curtains

Lamps/light fixtures

Art/clocks/wall décor

Fireplace fixtures

Miscellaneous items

TOTAL $

Electronic equipment |

Original |

year of |

Serial No. |

|

& household items |

price |

purchase |

||

|

||||

|

|

|

|

Television set

Stereo system*

DVD/video equipment

Telephones

Tapes/CDs/DVDs

MP3 player

Cell phone

Video games & system

Vacuum cleaner

Miscellaneous items

TOTAL $

Family room or den |

Original price |

year of |

|

purchase |

|||

|

|

||

|

|

|

Carpeting/rugs

Sofas

Draperies/curtains

Table & chairs

Bookcases & books

Entertainment center

Lamps/light fixtures

Desks & contents

Art/clocks/wall décor

Room décor

Piano

Miscellaneous items

TOTAL $

*Ask your Allstate agent about available coverage options. |

Copyright © 2008 Allstate Insurance Company |

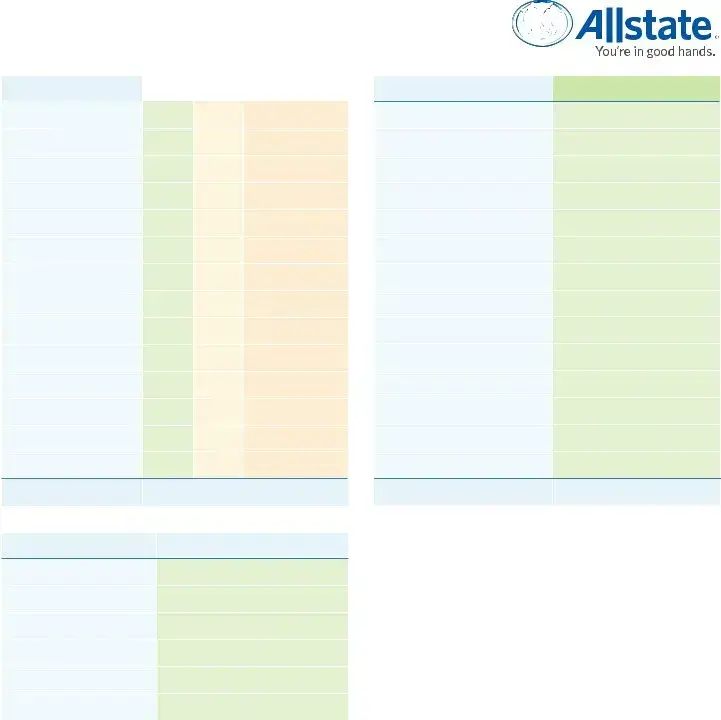

Household Inventory

a record of what i own

Dining room |

Original price |

year of |

|

purchase |

|||

|

|

||

|

|

|

Carpeting/rugs

Table & chairs

China cabinet/buffet

Draperies/curtains

Silverware

China

Glassware

Tablecloths & napkins

Art/clocks/wall décor

Lamps/light fixtures

Miscellaneous items

TOTAL $

Bedrooms |

Bedroom |

Bedroom |

Bedroom |

Bedroom |

# 1, 2, 3 & 4 |

# 1 price |

# 2 price |

# 3 price |

# 4 price |

|

|

|

|

|

Bed frame & mattress

Linens

Nightstand

Dresser

Bureau/chest

Bookcase & books

Desk

Mirror

Lamps/light fixtures

Closet accessories

Miscellaneous items

TOTAL $

*Ask your Allstate agent about available coverage options.

Kitchen |

Original |

year of |

Serial No. |

|

price |

purchase |

|||

|

|

|||

|

|

|

|

Table & chairs

Cabinets

China/silver/glassware*

Pots/pans

Food/freezer contents

Art/clocks/wall décor

Refrigerator

Stove

Microwave oven

Dishwasher

Electrical appliances

Utensils/cutlery

Miscellaneous items

TOTAL $

Bathrooms # 1 & 2 |

bathroom |

bathroom |

year of |

|

#1 price |

#2 price |

purchase |

||

|

||||

|

|

|

|

Cabinets/chests

Shower/bath mats/rugs

Mirrors/room décor

Toilet/bath accessories

Bathroom linens

Clothes hampers

Medicine cabinet contents

Hair dryers/curlers

Electric shavers

Personal care items

Miscellaneous items

TOTAL $

Copyright © 2008 Allstate Insurance Company

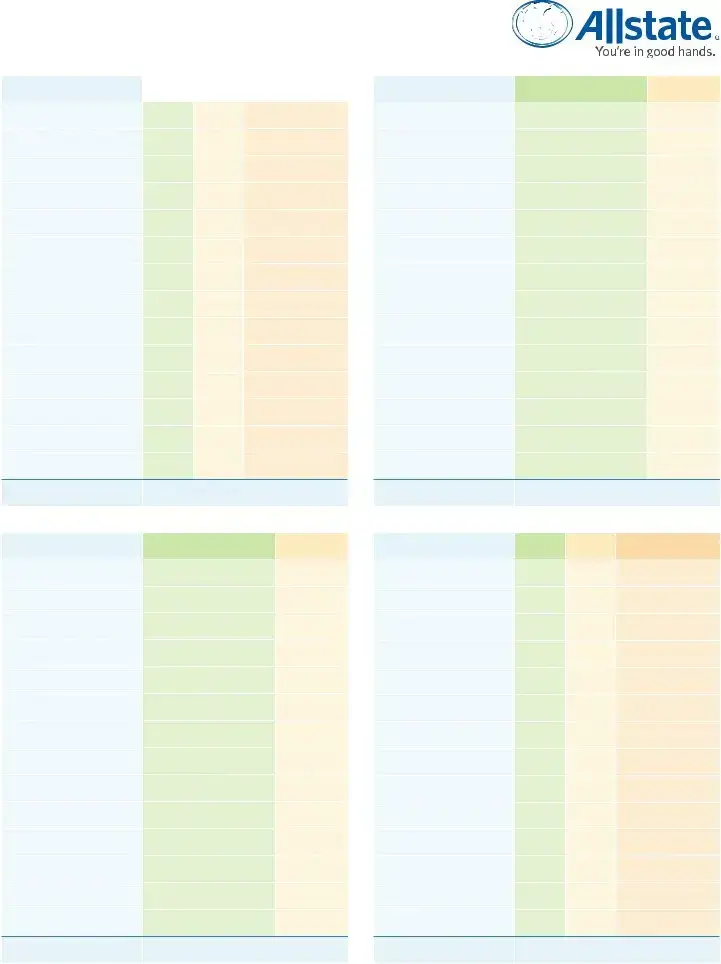

Household Inventory

a record of what i own

Sporting goods & hobby |

Original |

year of |

Serial No. |

|

price |

purchase |

|||

|

|

|||

|

|

|

|

Musical instruments*

Photographic equipment*

Camping equipment

Fishing/hunting equipment

Ski equipment

Golf clubs/accessories

Tennis equipment

Hobby materials

Boats/motors

Exercise equipment

Artwork

Collections

Miscellaneous items

TOTAL $

Clothing & personal |

Original price |

year of |

|

effects - women & girls |

purchase |

||

|

|||

|

|

|

Coats/jackets/furs*

Jewelry/watches*

Purses

Suits

Skirts/dresses

Sweaters/blouses

Slacks/jeans

Shoes/slippers

Lingerie

Cosmetics/perfume

Accessories

Miscellaneous items

TOTAL $

*Ask your Allstate agent about available coverage options.

Clothing & personal |

Original price |

year of |

|

effects - men & boys |

purchase |

||

|

|||

|

|

|

Coats

Suits

Slacks/jeans

Shirts

Neckties

Underwear/socks

Shoes

Sports clothes

Jewelry/watches

Work/sports bags

Miscellaneous items

TOTAL $

Garage, basement TOTAL |

Original |

year of |

Serial No. |

|

ORIGINAL PRICE & attic |

price |

purchase |

||

|

||||

|

|

|

|

Furniture

Washing machine/dryer

Iron/ironing board

Trunks/luggage

Work bench

Power & hand tools*

Garden tools

Lawn mower*

Ladders

Patio furniture

Lawn ornaments

Grill/barbecue equipment

Miscellaneous items

TOTAL $

Copyright © 2008 Allstate Insurance Company

Household Inventory

a record of what i own

Home office equipment* |

Original |

year of |

Serial No. |

|

price |

purchase |

|||

|

|

|||

|

|

|

|

Computer hardware

Computer software

Bookcases & books

Desk & chair

Fax machine

Phones

Miscellaneous items

TOTAL $

Summary

Total of all rooms

Amount of insurance

Difference

Value of dwelling (if you own)

Amount of insurance

Difference

Date inventory was completed: |

/ |

/ |

Agent info:

Personal inventory totals |

total Original price |

Electronic equipment

Living room

Family room or den

Dining room

Kitchen

Bedrooms

Bathrooms

Sporting goods/hobby

Men’s clothing & personal effects

Women’s clothing & personal effects

Garage, basement & attic

Home office equipment

Miscellaneous items

TOTAL $

DISCLAIMER

This brochure provides an example of precautions you can consider to help protect your personal property. Please recognize that a particular precaution may not be appropriate or effective in every circumstance. This list is not all inclusive.

*Ask your Allstate agent about available coverage options. |

Copyright © 2008 Allstate Insurance Company |

Form Characteristics

| Fact Title | Description |

|---|---|

| Purpose | The Allstate Inventory form helps individuals keep an organized record of their household possessions. |

| Importance | Having a detailed inventory can simplify the claims process in case of damage or loss. |

| Documentation | Users are encouraged to include serial numbers and take photos or videos of their items. |

| Safe Storage | The completed form should be kept in a secure location along with other insurance documents. |

| Claims Procedure | In the event of loss, contacting Allstate at 1-800-ALLSTATE® is essential for timely claims processing. |

Guidelines on Utilizing Allstate Inventory

Completing the Allstate Inventory form is an essential task that requires attention to detail. Once the form is filled out, it is advisable to keep the document in a secure location and possibly share it with your insurance provider. This will ensure you have accurate records should any claims need to be made in the future.

- Gather your household items room by room.

- For each item, record the original price and year of purchase.

- Include the serial number for each electronic item where applicable.

- Take clear photos or videos of each room and its contents.

- Complete the designated sections for each room:

- Living room

- Family room or den

- Dining room

- Bedrooms

- Kitchen

- Bathrooms

- Sporting goods & hobby

- Clothing & personal effects for men, women, and children

- Garage, basement & attic

- Home office equipment

- Calculate the TOTAL value for each room.

- Summarize the total of all rooms in the summary section.

- Record the date the inventory was completed.

- Provide your agent information if necessary.

What You Should Know About This Form

What is the purpose of the Allstate Inventory form?

The Allstate Inventory form serves as a detailed record of your personal belongings. Creating a comprehensive inventory is crucial for insurance purposes, especially when filing a claim. By documenting the value, condition, and any serial numbers of your possessions, you can streamline the claims process and ensure that you receive the compensation you deserve in case of theft, damage, or loss. This form encourages organization, helping you keep track of your items room by room, which can make life easier in times of distress.

How do I use the Allstate Inventory form effectively?

To use the Allstate Inventory form effectively, start by listing your possessions in each room. Note details such as the original price, year of purchase, and serial numbers when applicable. Take photographs or videos of your items to provide visual evidence that complements your written records. Be thorough—don't overlook small items, as they can add up. Once completed, keep this document in a safe place, along with your insurance policies, so it can be accessed easily when needed.

What should I do if I need to file a claim?

If you find yourself in a situation where you need to file a claim, act quickly. Contact Allstate immediately at 1-800-ALLSTATE® to initiate the process. Protect your property from any further damage and document the loss in writing and through photos or video before beginning repairs. After reporting the loss, you can schedule an appointment with your Allstate Claim Representative who will assist you through the claims process, ensuring that you understand every step along the way.

Why is it important to keep an updated inventory?

Keeping an updated inventory is essential for several reasons. First, as you acquire new items or dispose of old ones, your inventory reflects your current possessions, ensuring that your insurance coverage remains adequate. Regular updates can also help you remember the value of your belongings, which is beneficial not just for insurance but also for personal financial assessments. Moreover, in the event of a disaster or theft, having an up-to-date inventory allows for a smoother and quicker claims process, minimizing stress during an already difficult time.

Common mistakes

When completing the Allstate Inventory form, many people inadvertently make mistakes that could hinder their ability to claim losses effectively. One common error is failing to provide accurate valuations for each item. A rough estimate may seem sufficient at first, but undervaluing possessions can lead to inadequate compensation. It's crucial to take the time to assess each item's worth thoroughly, reflecting its current market value.

Another frequent oversight involves not including serial numbers. Serial numbers are often essential for identifying specific items, especially when it comes to electronics and large appliances. Missing this detail can complicate the claims process and potentially result in claims being denied. By ensuring that each item on the list has its serial number, you bolster the reliability of your inventory.

Visual documentation is sometimes overlooked as well. While listing items is important, taking photos or videos serves as additional proof of ownership and condition. Without this visual evidence, claims may become protracted or disputed. Including clear, high-quality images of your belongings can significantly enhance the accuracy and speed of the claims process.

Lastly, it’s vital to keep the completed inventory in a secure location. Too often, people store this important document in places that are easily damaged or lost, such as in attics or basements. Instead, consider a fireproof safe or a digital backup stored in a secure cloud service. Protecting your inventory helps ensure that you have ready access to it when you need it most.

Documents used along the form

When managing your household inventory and ensuring adequate coverage with Allstate, there are several additional forms and documents that can assist in the process. Each document serves a different purpose, helping to clarify your insurance needs and streamline the claims process if necessary.

- Proof of Ownership Documentation: This may include receipts, warranty documents, or bank statements demonstrating your purchase of valuable items. Keeping these documents on file helps verify ownership in case of a claim.

- Photos and Videos of Belongings: Visual documentation can be incredibly valuable. Taking clear photographs or videos of your possessions provides tangible evidence of their condition and existence, reinforcing your inventory list.

- Insurance Policy Documents: Understanding the details of your insurance policy can aid in identifying coverage limits and exclusions. These documents will outline what is covered and can guide you in protecting your valuables appropriately.

- Claim Forms: In the event you need to file a claim, having the necessary forms ready can expedite the process. These forms need to be filled out accurately to ensure a smooth claims experience, minimizing any delays in receiving compensation.

Being prepared with these additional documents along with the Allstate Inventory form contributes to a more secure and organized approach to your household insurance. Taking these steps can not only ease your mind but also assist in ensuring a more efficient claims process should the need arise.

Similar forms

The Allstate Inventory form serves as a crucial tool for households to document their possessions and facilitate insurance claims when necessary. Several other documents share similarities with this inventory form, each addressing different aspects of asset documentation and protection. Here are nine such documents:

- Home Inventory Checklist: This checklist provides a comprehensive list of common household items, similar to the Allstate Inventory form, prompting users to record important details such as purchase price and condition for each item.

- Personal Property Inventory: Designed to help individuals track their personal items, this document encourages users to include serial numbers and photographs, echoing the Allstate form's emphasis on thoroughness.

- Contents Schedule: Often used in insurance policies, this schedule details the contents of your home and their respective values. Much like the Allstate Inventory, it aims to provide a complete picture for insurance purposes.

- Property Insurance Policy: This policy outlines covered items and any specific limits. The Allstate Inventory aligns with this by documenting values to ensure coverage meets the documented worth of assets.

- Claim Documentation Form: When filing a claim, this form may be required to outline losses in detail. Similar to the inventory form, it stresses the importance of accuracy and evidence for items claimed.

- Moving Inventory List: This document is commonly used when relocating. It serves to catalog items being moved, paralleling the Allstate Inventory's function of item listing and valuation.

- Estate Inventory Form: For individuals organizing their estate, this form assists in recording all assets, similar to the Allstate Inventory’s role in cataloging personal belongings for protection and assessment.

- Insurance Policy Endorsements: These documents modify existing policies to include specific items or adjustments in coverage. They often reference inventory details, consistent with the thorough documentation found in the Allstate Inventory.

- Digital Asset Inventory: In the digital age, this form accounts for online and digital belongings. Like the Allstate Inventory, it highlights the need for comprehensive asset documentation, even in non-physical forms.

Having a detailed inventory of possessions not only aids in claim situations but also underscores the importance of being prepared for unforeseen events.

Dos and Don'ts

When filling out the Allstate Inventory form, consider these essential dos and don'ts to ensure accuracy and completeness.

- Do provide the value of each item accurately, reflecting its current worth.

- Do include serial numbers for all major items when possible for better documentation.

- Do take photos or videos of your possessions to support your written inventory.

- Do keep the completed form in a secure location along with other insurance documents.

- Don’t omit less expensive items; every item contributes to your total inventory value.

- Don’t forget to update your inventory after purchasing new items or disposing of old ones.

- Don’t delay contacting your Allstate representative if you need to file a claim.

Misconceptions

Many people have misconceptions about the Allstate Inventory form. Understanding these can help clarify its purpose and use. Here are seven common misconceptions:

- The form is only for high-value items. Many believe the inventory is necessary only for expensive possessions. In reality, documenting all items provides a comprehensive view of household belongings, which is crucial when filing an insurance claim.

- You only need to fill it out once. Some think that completing the inventory is a one-time task. However, it’s important to update the inventory regularly, especially after acquiring new items or making significant changes in the household.

- Photography isn’t necessary. A common belief is that simply listing possessions is sufficient. Taking photos or videos supports the written inventory and serves as a more effective way to prove ownership and condition during a claim.

- The form guarantees reimbursement. Some assume that filling out the inventory form guarantees full reimbursement from their insurance company. While it can help facilitate the claims process, actual reimbursement depends on the specifics of the policy and the situation.

- The inventory is only for property insurance claims. Many think this form is relevant only for those with property insurance. It is useful for anyone, regardless of the type of insurance they have, as it helps provide a clear understanding of what needs to be covered.

- Keeping the form in any place is acceptable. Some believe that the inventory can be stored in any location. Proper storage is essential; it should be kept in a safe and accessible place, preferably outside the home, in case of total loss due to fire or theft.

- Filing a claim is simple once the inventory is complete. There is an assumption that the process becomes straightforward after completing the inventory. While the form aids in filing a claim, it is still important to follow all claim procedures and cooperate with the insurance adjuster.

Understanding these misconceptions can lead to better preparation and a smoother claims process. A thorough household inventory not only protects your belongings but also provides peace of mind.

Key takeaways

Filling out the Allstate Inventory form is an essential step in protecting your belongings. Here are some key takeaways to keep in mind:

- Document Everything: Go room by room to record the value of each item, ensuring that nothing is overlooked.

- Include Serial Numbers: Whenever possible, write down the serial numbers of electronics or high-value items. This will make claims easier.

- Use Visual Evidence: Take photos or videos of your belongings. Visual support can significantly strengthen your claims if the need arises.

- Store Securely: Keep the completed inventory and related insurance documents in a safe location, easily accessible when you need them.

- Be Prepared to Act: If a loss occurs, contact Allstate immediately at 1-800-ALLSTATE®. Quick reporting can help expedite the claims process.

- Protect Your Property: Take steps to prevent further damage after a loss, such as covering broken windows or shutting off utilities if needed.

- Follow Up: Document the damage in writing and take additional photos before any repairs are made to ensure you have a clear record.

- Consult with Your Agent: For any questions regarding coverage options for specific items, don’t hesitate to reach out to your Allstate agent.

Completing this form is a proactive measure that can save you time and stress in the event of a claim. Take it seriously, and you’ll be well-prepared.

Browse Other Templates

Note Card Template Word - Reviewing formatting before printing will save time and prevent errors.

Brokerage Agreement Template - Broker fees are explained in detail to ensure the applicant understands their obligations.