Fill Out Your Ally Bank Ira Transfer Form

When transferring an Individual Retirement Account (IRA) to Ally Bank, it's important to have the correct documentation in hand, particularly the IRA Transfer Form. This form is designed to facilitate the movement of your existing IRA assets to Ally Bank, ensuring a smooth and compliant transition. It includes sections that collect vital personal information, such as the account holder’s name, address, and Social Security number, to verify identity and account ownership. Additionally, it requires details about the current financial institution holding the IRA and the specific account numbers involved in the transfer. There are also sections dedicated to outlining the reasons for the transfer, confirming that the account holder understands the implications, including potential tax consequences and any restrictions associated with their IRA before the transfer occurs. Furthermore, the form typically includes an authorization section where the account holder gives permission for the transfer to take place, signaling their understanding and agreement to the transfer process. Completing this form accurately is essential, as it not only initiates the transfer but also helps in ensuring compliance with regulations governing retirement accounts.

Ally Bank Ira Transfer Example

|

|

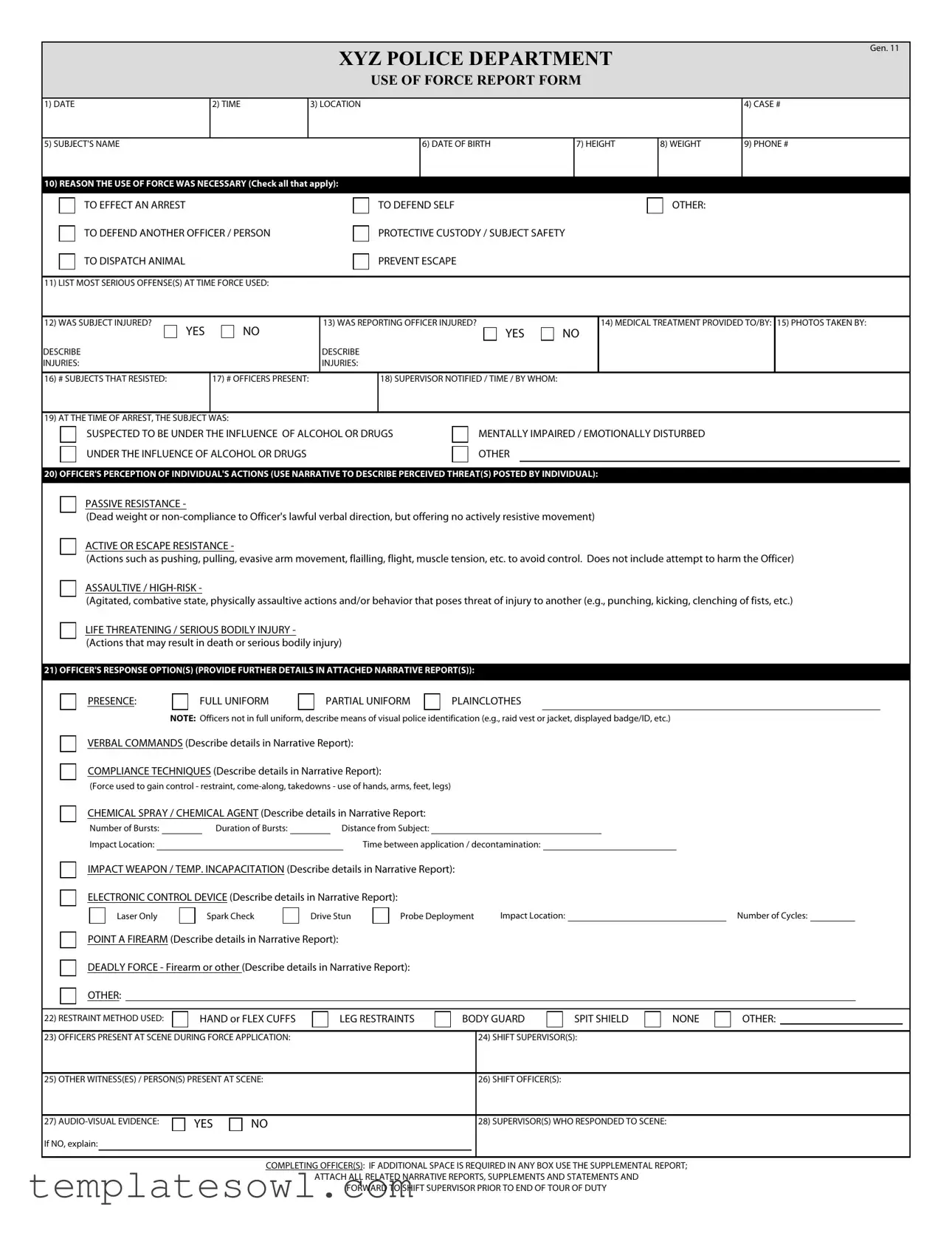

XYZ POLICE DEPARTMENT |

|

Gen. 11 |

||

|

|

|

|

|||

|

|

USE OF FORCE REPORT FORM |

|

|

||

|

|

|

|

|

|

|

1) DATE |

2) TIME |

3) LOCATION |

|

|

4) CASE # |

|

|

|

|

|

|

|

|

5) SUBJECT'S NAME |

|

|

6) DATE OF BIRTH |

7) HEIGHT |

8) WEIGHT |

9) PHONE # |

|

|

|

|

|

|

|

10) REASON THE USE OF FORCE WAS NECESSARY (Check all that apply):

TO EFFECT AN ARREST

TO DEFEND ANOTHER OFFICER / PERSON

TO DISPATCH ANIMAL

TO DEFEND SELF

PROTECTIVE CUSTODY / SUBJECT SAFETY

PREVENT ESCAPE

OTHER:

11) LIST MOST SERIOUS OFFENSE(S) AT TIME FORCE USED:

12) WAS SUBJECT INJURED? |

YES |

NO |

13) WAS REPORTING OFFICER INJURED? |

|

14) MEDICAL TREATMENT PROVIDED TO/BY: |

15) PHOTOS TAKEN BY: |

|

|

|

YES |

NO |

|

|

||

DESCRIBE |

|

|

DESCRIBE |

|

|

|

|

INJURIES: |

|

|

INJURIES: |

|

|

|

|

|

|

|

|

|

|

|

|

16) # SUBJECTS THAT RESISTED: |

|

17) # OFFICERS PRESENT: |

|

18) SUPERVISOR NOTIFIED / TIME / BY WHOM: |

|

|

|

|

|

|

|

|

|

|

|

19) AT THE TIME OF ARREST, THE SUBJECT WAS:

SUSPECTED TO BE UNDER THE INFLUENCE OF ALCOHOL OR DRUGS

UNDER THE INFLUENCE OF ALCOHOL OR DRUGS

MENTALLY IMPAIRED / EMOTIONALLY DISTURBED

OTHER

20) OFFICER'S PERCEPTION OF INDIVIDUAL'S ACTIONS (USE NARRATIVE TO DESCRIBE PERCEIVED THREAT(S) POSTED BY INDIVIDUAL):

PASSIVE RESISTANCE -

(Dead weight or

ACTIVE OR ESCAPE RESISTANCE -

(Actions such as pushing, pulling, evasive arm movement, flailling, flight, muscle tension, etc. to avoid control. Does not include attempt to harm the Officer)

ASSAULTIVE /

(Agitated, combative state, physically assaultive actions and/or behavior that poses threat of injury to another (e.g., punching, kicking, clenching of fists, etc.)

LIFE THREATENING / SERIOUS BODILY INJURY -

(Actions that may result in death or serious bodily injury)

21) OFFICER'S RESPONSE OPTION(S) (PROVIDE FURTHER DETAILS IN ATTACHED NARRATIVE REPORT(S)):

PRESENCE:

FULL UNIFORM

PARTIAL UNIFORM

PLAINCLOTHES

NOTE: Officers not in full uniform, describe means of visual police identification (e.g., raid vest or jacket, displayed badge/ID, etc.)

VERBAL COMMANDS (Describe details in Narrative Report):

COMPLIANCE TECHNIQUES (Describe details in Narrative Report):

(Force used to gain control - restraint,

CHEMICAL SPRAY / CHEMICAL AGENT (Describe details in Narrative Report:

Number of Bursts: |

|

Duration of Bursts: |

|

Distance from Subject: |

|

|

|||

Impact Location: |

|

|

|

|

|

Time between application / decontamination: |

|

|

|

IMPACT WEAPON / TEMP. INCAPACITATION (Describe details in Narrative Report):

ELECTRONIC CONTROL DEVICE (Describe details in Narrative Report):

Laser Only

Spark Check

Drive Stun

Probe Deployment |

Impact Location: |

|

Number of Cycles: |

POINT A FIREARM (Describe details in Narrative Report):

DEADLY FORCE - Firearm or other (Describe details in Narrative Report):

OTHER:

22) RESTRAINT METHOD USED: |

|

HAND or FLEX CUFFS |

|

LEG RESTRAINTS |

|

BODY GUARD |

|

SPIT SHIELD |

|

|

NONE |

|

OTHER: |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

23) OFFICERS PRESENT AT SCENE DURING FORCE APPLICATION: |

|

|

|

|

|

24) SHIFT SUPERVISOR(S): |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

25) OTHER WITNESS(ES) / PERSON(S) PRESENT AT SCENE: |

|

|

|

|

|

26) SHIFT OFFICER(S): |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

27) |

|

YES |

NO |

|

|

|

|

|

28) SUPERVISOR(S) WHO RESPONDED TO SCENE: |

|

|

|

|

|

|||||

If NO, explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

COMPLETING OFFICER(S): IF ADDITIONAL SPACE IS REQUIRED IN ANY BOX USE THE SUPPLEMENTAL REPORT; |

|

|

|

|

|||||||||||

|

|

|

|

|

ATTACH ALL RELATED NARRATIVE REPORTS, SUPPLEMENTS AND STATEMENTS AND |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

FORWARD TO SHIFT SUPERVISOR PRIOR TO END OF TOUR OF DUTY |

|

|

|

|

|

||||||||

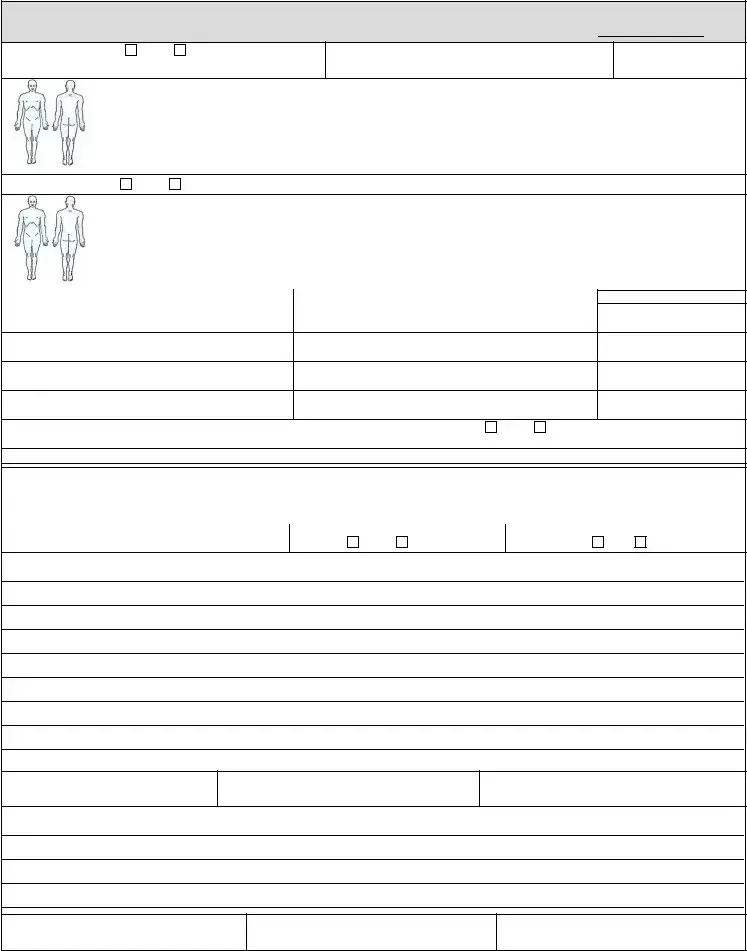

XYZ POLICE DEPARTMENT

OFFICER NARRATIVE |

Case #: |

29)WAS SUBJECT(S) INJURED? * *(Complete Diagram Below)

YES

NO

30) OFFICER(S) TAKING PHOTOS

31) TOTAL # OF PHOTOS

32) DESCRIBE THE EXTENT OF SUBJECT'S INJURIES AND PLACE ON THE DIAGRAM: |

SUBJECT #1 |

Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WAS OFFICER(S) INJURED? *

YES

NO |

*(Complete Diagram Below) |

33) DESCRIBE THE EXTENT OF OFFICER'S INJURIES AND PLACE ON THE DIAGRAM: |

OFFICER #1 |

Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34) WITNESS(ES) OR PERSON(S) WITH KNOWLEDGE: |

ADDRESS: |

PHONE #: |

|

|

|

1)

2) |

|

|

3) |

|

|

4) |

|

|

35) Officer's Narrative: Did officer prepare a detailed incident report describing the facts and circumstances leading to the use of force? |

YES |

NO If no, explain: |

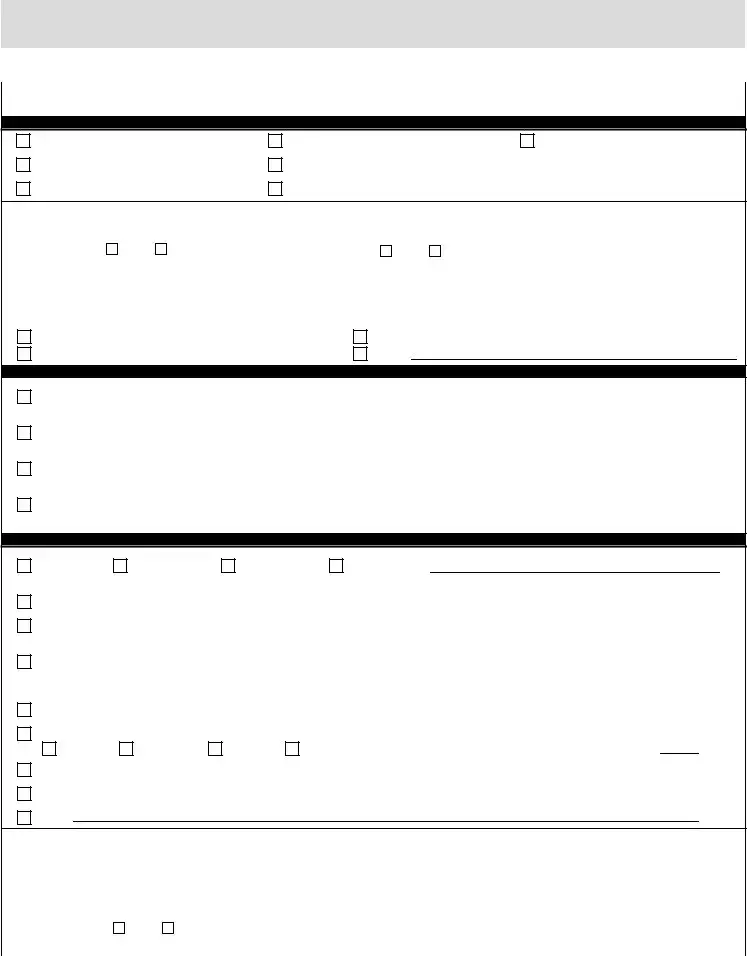

SUPERVISORY / COMMAND REVIEW

36) REPORTING SUPERVISOR (Name and Badge #) |

37) DATE AND TIME OF SUPERVISOR RESPONSE |

|

38) LOCATION |

|

|

|

|

|

|

39) OFFICER WHO USED FORCE (Name and Badge #) |

40) WAS SUBJECT(S) INJURED? |

|

41) WAS OFFICER(S) INJURED? |

|

|

YES |

NO |

YES |

NO |

42) Supervisor's Narrative: (Document steps taken to review and evaluate Officer's use of force)

43) A/V EVIDENCE AVAILABLE / REVIEWED BY SUPERVISOR: |

44) A/V EVIDENCE AVAILABLE / REVIEWED BY OFFICER: |

45) A/V EVIDENCE AVAILABLE / REVIEWED BY LIEUTENANT: |

|||||||||||||

|

|

YES |

|

NO Date: |

|

|

YES |

|

NO Date: |

|

|

YES |

|

NO |

Date: |

|

|

|

|

|

|

|

|

||||||||

46) Lieutenant Review Narrative: (Confirm proper and complete investigation was conducted)

OFFICER REVIEW (Print / Sign / Date): |

SUPERVISORY REVIEW (Print / Sign / Date): |

LIEUTENANT REVIEW (Print / Sign / Date): |

SUPERVISORY/COMMAND: REVIEW & CRITIQUE USE OF FORCE WITH INVOLVED OFFICER(S).

NOTE FINDINGS ABOVE AND FORWARD COMPLETED PACKET TO CHIEF OF POLICE

Use of force requires and

ECD Probe deployment or Drive Stun; any incident resulting in injury or complaint of injury; or any other time deemed appropriate by a supervisor

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose of the Form | This form is used by the XYZ Police Department to document instances of use of force during police operations. |

| Date and Time | The form requires details on the date and time when the use of force occurred, ensuring accurate record-keeping. |

| Location Details | The exact location of the incident must be recorded to aid in any investigations or reviews conducted afterwards. |

| Involved Parties | Information about the subject involved, including name, date of birth, height, and weight, is essential for identification. |

| Injury Reporting | The form includes sections to evaluate whether the subject or the reporting officer sustained injuries during the incident. |

| Supervisor Notification | It is mandatory to notify a supervisor about the incident, documenting who informed them and the time of notification. |

| Types of Resistance | Officers must describe the level of resistance encountered, categorized as passive, active, or aggressive. |

| Evidence Documentation | Officers are instructed to document any audio-visual evidence and detail its availability for review by supervisors. |

Guidelines on Utilizing Ally Bank Ira Transfer

Once the Ally Bank IRA Transfer form is completed, it can be submitted to facilitate the transfer of your IRA funds from one financial institution to another. Ensure that all sections are filled out accurately to avoid delays in processing.

- Start by entering the date in the designated field.

- Next, fill in the time of the transfer request.

- Provide the location where the account currently exists.

- Input the case number associated with the transfer.

- Enter the subject’s name as it appears on the current account.

- Fill in the date of birth of the account holder.

- Record the height of the account holder.

- Provide the weight of the account holder.

- Enter the phone number of the account holder.

- Check all reasons for the transfer that apply.

- List any offenses that are relevant at the time of transfer.

- Indicate if the subject was injured, selecting yes or no.

- Note if the reporting officer was injured.

- Fill in details about any medical treatment provided and by whom.

- State whether photos were taken during the transfer.

- Proceed to list the number of subjects that resisted.

- Document the number of officers present during the transfer.

- Note the supervisor's name, time of notification, and how they were notified.

- Describe the condition of the subject at the time of transfer.

- Provide an officer's perception of the individual's actions.

- List any response options that were employed.

- Detail restraint methods used during the process.

- Document the officers present at the scene during the transfer.

- Include the names of any shift supervisors overseeing the units.

- List other witnesses or persons present at the scene.

- Note which shift officers were involved in the transfer.

- Indicate whether audio-visual evidence was collected.

- If evidence was not collected, write a brief explanation.

- Complete the sections regarding injuries to subjects and officers.

- Provide the officer's narrative regarding the incident.

- Document the reporting supervisor's details.

- Specify if the subject or officer was injured based on previous responses.

- Finish with the officer's review and supervisor's feedback.

What You Should Know About This Form

1. What is the Ally Bank IRA Transfer form?

The Ally Bank IRA Transfer form is a document that allows individuals to transfer their existing Individual Retirement Account (IRA) from one financial institution to Ally Bank. This form streamlines the process by providing the necessary information to facilitate the transfer securely and efficiently.

2. Who should use the IRA Transfer form?

Any individual looking to move their IRA assets to Ally Bank should use the IRA Transfer form. This includes those transferring traditional IRAs, Roth IRAs, or any other eligible retirement accounts. It is essential to ensure that you are eligible for a transfer according to IRS regulations.

3. How do I fill out the IRA Transfer form?

To complete the form, you will need to provide personal information such as your name, address, and Social Security number. Additionally, details about your current financial institution and account numbers will be required. Be sure to review all information for accuracy before submission to avoid delays.

4. Is there a fee for transferring my IRA to Ally Bank?

Ally Bank does not charge a fee for IRA transfers. However, it is advisable to check with your current financial institution, as they may impose early withdrawal fees or transfer fees for closing your account.

5. How long does it take to complete the transfer process?

The transfer process can take between seven to ten business days once Ally Bank receives the completed form and all necessary documents. Factors such as the policies of your previous financial institution may also affect the timeline.

6. Can I transfer funds from multiple IRAs to Ally Bank?

Yes, you can transfer funds from multiple IRA accounts into one account at Ally Bank. Each account will require a separate IRA Transfer form, so ensure that all forms are filled out correctly to facilitate the transfers.

7. Will my IRA maintain its tax advantages during the transfer?

Yes, as long as the transfer is processed as a direct transfer, your IRA will retain its tax advantages. It is crucial not to withdraw funds and then deposit them yourself, as that could lead to tax liabilities and penalties.

8. What should I do if I make a mistake on the form?

If an error is found after submission, contact Ally Bank as soon as possible. They may be able to correct mistakes or guide you through the process of submitting a new form if necessary. Always double-check your entries before sending the form to minimize errors.

9. Where can I find the IRA Transfer form?

The IRA Transfer form can be found on the Ally Bank website under the IRA section or through customer service. If you need assistance locating the form, their representatives will be happy to help you.

Common mistakes

Completing the Ally Bank IRA Transfer form is important for ensuring a smooth transfer of funds. However, many individuals make common mistakes when filling out this form, which can lead to delays or complications. Understanding these pitfalls can help mitigate issues that might arise during the transfer process.

One frequent mistake is providing incorrect personal information. It's essential to accurately enter your full name, address, and Social Security number. Even minor typos can cause significant headaches. For instance, a misspelled name might lead to verification issues, preventing the transfer from being processed smoothly. Always double-check that the details match your identification documents precisely.

Another error often encountered is failing to provide all necessary documentation. Alongside the transfer form, supporting documents usually must accompany the request. These can include recent account statements or forms from your current financial institution. Missing any required paperwork can prolong the transfer process, requiring additional time to gather and submit the needed items.

Many people also overlook the importance of choosing the right transfer option. The Ally Bank IRA Transfer form may offer multiple options, such as direct and indirect transfers. Selecting the incorrect option can result in misunderstandings and potential tax implications. It's wise to review these options carefully to ensure the right choice aligns with your goals and preferences.

Another common issue is not obtaining the necessary signatures. The form typically requires authorization from your current financial institution and your signature. Failing to secure these signatures can halt the transfer in its tracks. To avoid this, make sure to read all instructions carefully and verify that your signatures are included before submitting the form.

In addition, individuals sometimes submit the transfer form without allowing sufficient time for processing. IRA transfers are not instantaneous. Several factors can influence the timeline, including the bank’s processing speed and any potential intermediary financial institutions involved. Planning ahead and being aware of these timelines can prevent last-minute issues.

Moreover, neglecting to follow up on the transfer request is another common oversight. After submitting the form, it’s advisable to check in with Ally Bank to confirm that everything is moving along as expected. Keeping lines of communication open can help address any concerns that might arise during the transfer period efficiently.

Lastly, misunderstanding the tax implications of an IRA transfer can lead to severe consequences down the line. It’s crucial to be aware of how a transfer may affect your tax obligations. In particular, indirect transfers could result in tax penalties if not done correctly. Consulting with a financial advisor or tax professional to clarify these potential issues can be beneficial.

By being mindful of these common mistakes, individuals can ensure a smoother and more efficient IRA transfer process with Ally Bank. Proper attention to detail, thoroughness in documentation, and clear communication will go a long way toward achieving a successful transfer.

Documents used along the form

When considering an IRA transfer with Ally Bank, several additional forms and documents play essential roles in ensuring a smooth transition. These documents, while distinct, work in harmony with the Ally Bank IRA Transfer Form to complete the process effectively.

- Account Application Form: This form gathers necessary personal information to establish a new IRA account. It often requires details such as name, address, social security number, and employment information.

- Transfer Request Form: This document specifically authorizes the transfer of funds from one retirement account to another. It needs signatures from both the account holder and the current financial institution.

- Beneficiary Designation Form: It outlines who will inherit the IRA upon the account holder’s death. Properly designating beneficiaries is crucial for ensuring that assets are distributed according to the holder's wishes.

- Tax Withholding Form: Sometimes, you may choose to have federal or state taxes withheld during the transfer process. This form outlines your preferences regarding tax withholding on distributions that might be taxable.

- Rollover Certification Form: If you’re rolling over funds from a qualified retirement plan, this form certifies that you intend to complete the rollover and understand the tax implications of such actions.

- Transfer Authorization Letter: Often required by the custodian of the existing account, this letter grants permission to release the funds as per the terms of the transfer.

- Proof of Identity Documents: Banks may require identification documents, such as a government-issued ID or utility bill, to verify your identity and address as part of their compliance procedures.

Each of these forms contributes to a comprehensive, compliant, and effective IRA transfer process. By gathering and completing them diligently, you can help ensure that your transfer goes smoothly, allowing you to focus on your financial future.

Similar forms

- IRA Contribution Form: Similar to the Ally Bank IRA Transfer form, this document serves as a means to designate the amount of money being contributed to an IRA account. Both require essential personal details and fund specifics.

- 403(b) Plan Transfer Form: Like the IRA Transfer form, this form is used to transfer funds, in this case from a qualified 403(b) retirement plan. Accurate details about the account holder and the amounts are critical in both documents.

- Rollover Request Form: This form facilitates the transfer of funds from a retirement account into another qualified retirement account, resembling the IRA Transfer form in purpose and the information required.

- Beneficiary Designation Form: Similar to the IRA Transfer form, this document allows account holders to declare beneficiaries for their accounts, necessitating personal information and details about the account.

- Retirement Account Transfer Request: This request form functions much like the IRA Transfer form, as it guides the transfer of assets between retirement accounts with specific requirements for information about the account holder and the accounts involved.

- Estate Planning Document: While serving a different end goal, this document also requires detailed personal information. It ensures clarity in asset distribution upon death, just as the IRA Transfer form is paramount for fund transfers.

- Trustee Change Request Form: This document shares a purpose with the IRA Transfer form in that it allows for the transfer of control over accounts, requiring similar personal details and documentation to facilitate the change.

- Financial Account Closure Form: When closing an account, this form requires information to finalize the process, similar to how the IRA Transfer form collects data to facilitate the transfer of funds to another institution.

Dos and Don'ts

When filling out the Ally Bank IRA Transfer form, here are some important things to remember:

- Read the instructions carefully. Ensure you fully understand the form requirements before starting.

- Double-check all information. Verify that names, dates, and account numbers are accurate to avoid processing delays.

- Provide complete and truthful information. Do not omit or alter any details, as accuracy is essential for a successful transfer.

- Use clear handwriting or type the form. Legibility is crucial. If the form is difficult to read, it may lead to errors.

- Do not rush the process. Take your time to fill out the form thoroughly to ensure all relevant information is included.

- Avoid leaving sections blank. If a question does not apply, mark it clearly rather than skipping it.

By following these guidelines, you can help ensure a smooth transfer process for your IRA with Ally Bank.

Misconceptions

When dealing with the Ally Bank IRA Transfer form, several misconceptions may arise that can lead to confusion. Here are five common misunderstandings:

- It is difficult to complete the transfer form accurately. Many people believe that the form is complicated. In reality, it is straightforward, designed for easy understanding, and includes clear instructions.

- The form can only be filled out online. Some individuals think that they must complete the form online. However, it is also available in a paper format, allowing flexibility in how it can be submitted.

- Submitting the form guarantees a swift transfer. There is a misconception that filling out the form ensures rapid processing. In truth, while submitting the form is essential, the actual transfer time can vary based on factors such as the financial institutions involved.

- The transfer form requires extensive documentation. Many assume that numerous documents are necessary to accompany the transfer form. In fact, only specific documents are needed, making the process less burdensome than expected.

- Ally Bank charges high fees for IRA transfers. Some people worry about potential hidden costs. However, Ally Bank is known for having competitive and transparent fee structures, often providing free transfer options.

Understanding these points can greatly assist individuals in navigating the IRA transfer process more smoothly.

Key takeaways

When completing the Ally Bank IRA Transfer form, there are several important points to keep in mind to ensure a smooth process.

- Accurate Information: Double-check that all personal information is correct. Mistakes in details like account numbers or names can lead to delays.

- Documentation is Essential: Attach any required documents. These might include financial statements or identification forms, which are crucial for the transfer process.

- Be Aware of Transfer Limits: Understand that there may be limits on the amount you can transfer. Familiarize yourself with any associated fees and restrictions before proceeding.

- Timing Matters: Processing times can vary. Transferring funds can take several days or even weeks, so plan accordingly when you need access to your funds.

Browse Other Templates

Dallascad - Trip details include departure and return times.

How to Cancel Car Registration in Ga - Ensure all information is true to avoid penalties under Georgia law.

Clark Atl - Counselors are encouraged to consider both academic and personal traits in their assessments.