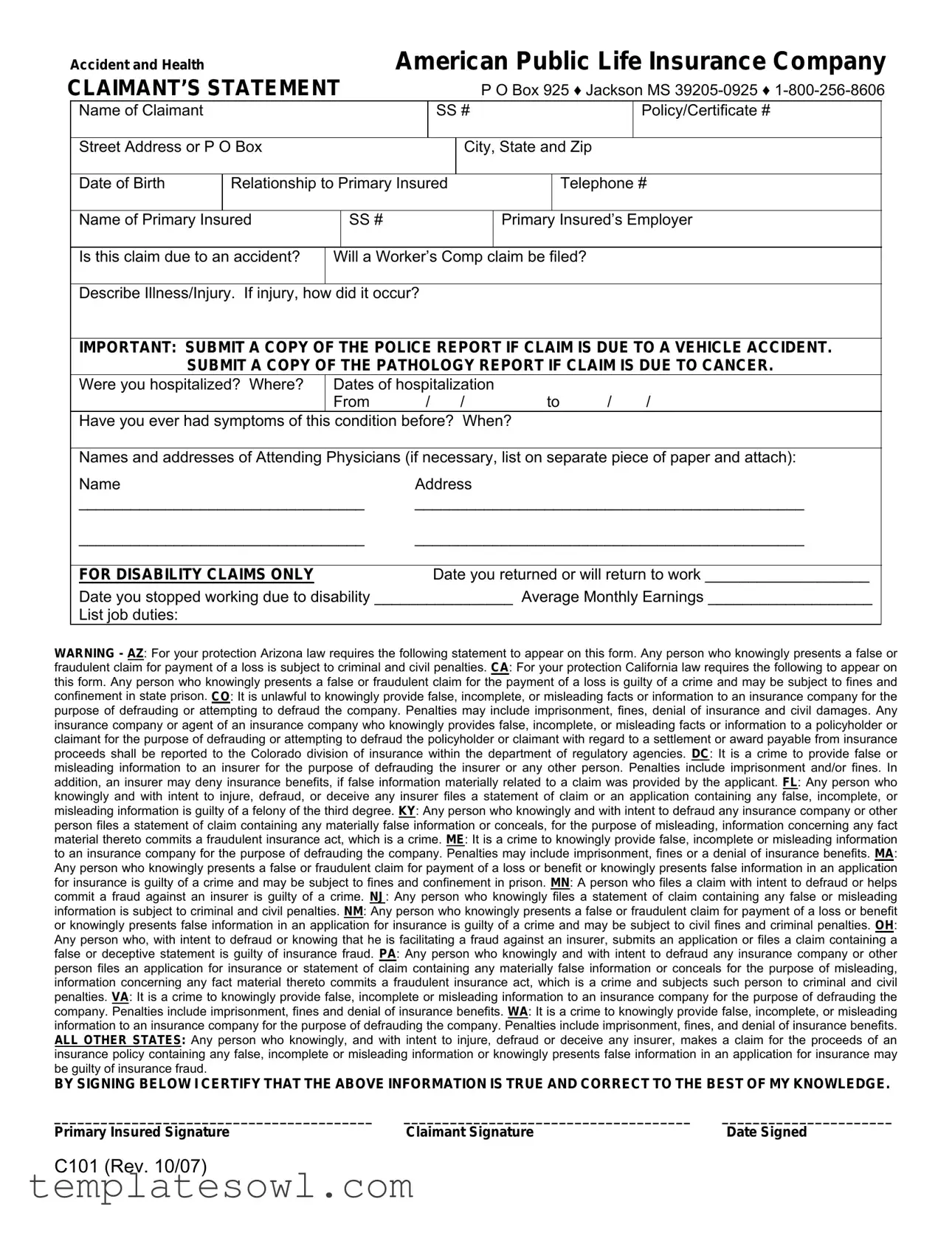

Fill Out Your American Public Life Form

The American Public Life Claimant’s Statement is a vital document that facilitates the claims process for insured individuals seeking benefits for accidents and illnesses. This form captures essential personal information about the claimant, such as their name, Social Security number, policy details, and contact information. It requires details about the primary insured, including their employment information, to establish relationships required for the claim. This form also includes specific inquiries regarding the nature of the claim. Claimants must indicate whether their situation stems from an accident or if a Worker’s Compensation claim will be pursued. It emphasizes the necessity of submitting supporting documentation, such as police reports for vehicle accidents or pathology reports for cancer-related claims. Important medical information is also requested, including hospitalization details and the names of attending physicians. For disability claims, additional specifics relate to dates of work cessation and anticipated return. At the same time, the document warns claimants about the legal repercussions of submitting false information, which is severe and includes potential criminal charges. Overall, the claim process is structured yet requires thorough attention to detail to ensure that all necessary information is reported accurately, thereby safeguarding both claimant interests and insurer obligations.

American Public Life Example

Accident and Health |

|

|

|

American Public Life Insurance Company |

|||||||||

CLAIMANT’S STATEMENT |

|

|

|

P O Box 925 ♦ Jackson MS |

|||||||||

|

Name of Claimant |

|

|

|

|

SS # |

|

|

|

|

Policy/Certificate # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address or P O Box |

|

|

|

|

City, State and Zip |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

|

Date of Birth |

Relationship to Primary Insured |

|

|

|

Telephone # |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Name of Primary Insured |

|

SS # |

|

|

|

|

Primary Insured’s Employer |

|

||||

|

|

|

|

|

|

|

|

||||||

|

Is this claim due to an accident? |

Will a Worker’s Comp claim be filed? |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||

|

Describe Illness/Injury. If injury, how |

did it occur? |

|

|

|

|

|

|

|||||

|

|

|

|||||||||||

|

IMPORTANT: SUBMIT A COPY OF THE POLICE REPORT IF CLAIM IS DUE TO A VEHICLE ACCIDENT. |

||||||||||||

|

SUBMIT A COPY OF THE PATHOLOGY REPORT IF CLAIM IS DUE TO CANCER. |

|

|||||||||||

|

Were you hospitalized? Where? |

Dates of hospitalization |

|

|

|

||||||||

|

|

|

From |

/ / |

|

to |

/ |

/ |

|

||||

|

Have you ever had symptoms of this |

condition before? When? |

|

|

|

||||||||

|

|

|

|||||||||||

|

Names and addresses of Attending Physicians (if necessary, list on separate piece of paper and attach): |

||||||||||||

|

Name |

|

|

|

Address |

|

|

|

|

|

|

||

|

_________________________________ |

_____________________________________________ |

|

||||||||||

|

_________________________________ |

_____________________________________________ |

|

||||||||||

|

|

|

|

|

|

|

|||||||

|

FOR DISABILITY CLAIMS ONLY |

|

|

|

Date you returned or will return to work ___________________ |

||||||||

|

Date you stopped working due to disability ________________ Average Monthly Earnings ___________________ |

|

|||||||||||

|

List job duties: |

|

|

|

|

|

|

|

|

|

|

|

|

WARNING - AZ: For your protection Arizona law requires the following statement to appear on this form. Any person who knowingly presents a false or

fraudulent claim for payment of a loss is subject to criminal and civil penalties. CA: For your protection California law requires the following to appear on this form. Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison. CO: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado division of insurance within the department of regulatory agencies. DC: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits, if false information materially related to a claim was provided by the applicant. FL: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree. KY: Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime. ME: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits. MA: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison. MN: A person who files a claim with intent to defraud or helps commit a fraud against an insurer is guilty of a crime. NJ: Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties. NM: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to civil fines and criminal penalties. OH: Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement is guilty of insurance fraud. PA: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties. VA: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits. WA: It is a crime to knowingly provide false, incomplete, or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines, and denial of insurance benefits. ALL OTHER STATES: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes a claim for the proceeds of an insurance policy containing any false, incomplete or misleading information or knowingly presents false information in an application for insurance may be guilty of insurance fraud.

BY SIGNING BELOW I CERTIFY THAT THE ABOVE INFORMATION IS TRUE AND CORRECT TO THE BEST OF MY KNOWLEDGE.

_________________________________________ |

_____________________________________ |

______________________ |

Primary Insured Signature |

Claimant Signature |

Date Signed |

C101 (Rev. 10/07)

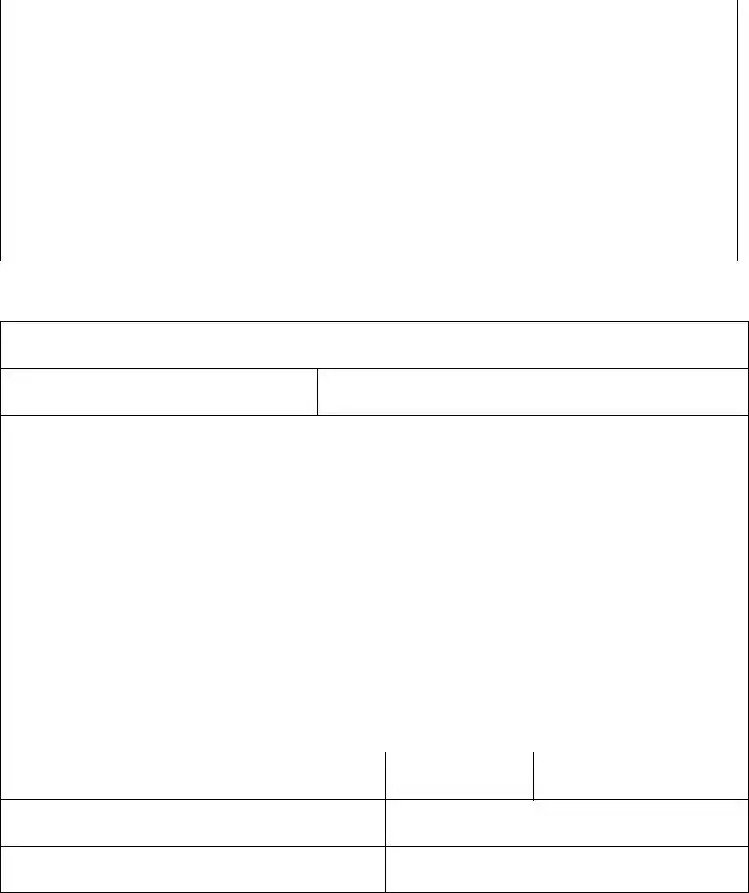

EMPLOYER’S STATEMENT: FOR DISABILITY OR WAIVER OF PREMIUM CLAIMS ONLY

1. |

Date of first absence due to disability |

2. |

Date employee returned to work |

|

|

|

|

3. |

Date hired |

4. |

Date of termination if terminated |

|

|

|

|

5. |

Date of retirement if retired |

6. |

Did employee take disability retirement? |

|

|

|

|

7. REQUIRED: If the employee pays the premium for this plan through payroll deduction, is the premium sheltered under

a Section 125 (cafeteria) plan? __________ |

Is the premium paid by the employer as an employee benefit? ___________ |

||||

8. |

Has claim or will claim be made for Worker’s Compensation Benefits? _________If yes, what is the status of the claim? |

||||

|

|

|

|

|

|

9. |

Will you provide “light duty” if employee is released with restrictions? |

|

|||

|

|

|

|

|

|

10. Employer Name |

|

11. Employer Telephone # |

|

||

|

|

|

|

|

|

Authorized Signature |

|

|

Title or Position |

Date |

|

|

|

|

|

|

|

ATTENDING PHYSICIAN’S STATEMENT: For routine

1. Diagnosis and concurrent conditions.

2. Is condition due to injury or sickness arising out

of patient’s employment? |

Yes |

No |

3. If condition is due to an accident, give details of the accident:

4. |

Is condition due to pregnancy? |

Yes |

No If yes, expected delivery date: ___________ Date of LMP __________ |

||||||||

5. |

Report of Services (or attach itemized bill): |

|

|

|

|

|

|

|

|

||

Date of Service |

CPT Code |

Description of Medical Service Rendered |

|

Charge |

|

||||||

____________ |

_________ |

________________________________________________ |

$ ________ |

|

|||||||

____________ |

_________ |

________________________________________________ |

$ ________ |

|

|||||||

____________ |

_________ |

________________________________________________ |

$ ________ |

|

|||||||

____________ |

_________ |

________________________________________________ |

$ ________ |

|

|||||||

6. |

Date symptoms first appeared or accident happened |

|

7. Date patient first consulted you for this condition |

|

|||||||

|

|

|

|

|

|

||||||

8. |

Has patient ever had same or similar condition? |

Yes |

No |

9. Patient still under your care for this condition? |

|

||||||

|

If “yes”, when and describe: |

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

Date last seen: ___________________________ |

|

|||

10. Patient was continuously and totally disabled (unable to |

|

11. Patient was partially disabled (able to perform |

|

||||||||

|

perform substantially all of his/her occupational duties) |

|

some but not all of his/her occupational duties) |

|

|||||||

From___________________Through ____________________ |

From___________________Through_______________ |

||||||||||

12. If still disabled, date patient should be able to |

13. Patient |

was hospital confined |

|

|

|

||||||

return to work? |

|

|

|

From___________________Through ____________________ |

|

||||||

14. Does patient have other health coverage? |

If |

15. Was patient referred to you by another physician”? |

Yes |

No |

|||||||

|

“Yes”, please identify: |

|

|

If “Yes”, please provide name of referring physician: |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Physician’s Name (Please Print)

Degree

IRS Identification Number

Address

Phone Number

Physician’s Signature

Date

C101 (Rev. 10/07)

2305 Lakeland Drive, Jackson, Mississippi 39232

(601)

AUTHORIZATION TO USE OR DISCLOSE

PROTECTED HEALTH INFORMATION

I hereby authorize any physician or practitioner of the healing arts, hospital, clinic or medically related facility, pharmacy, insurance company, health maintenance organization, medical information bureau, Worker’s Compensation carrier, Social Security office, Veterans Administration, retirement system, government entity (federal, state or local) or other organization, institution or person to release any information regarding the medical or mental health history, treatment, disability or benefits payable for medical care or disability to the American Public Life Insurance Company or its representative. A photocopy of this authorization shall be as valid as the original. This authorization shall be considered valid for the duration of the claim, but not to exceed one year from the date signed, except release of

Public Life has taken action in reliance of this authorization or to the extent that law allows American Public Life to contest claims or coverage. Written notice must refer to the authorization by indicating the date it was signed and should be mailed to APL Claims Department, P O Box 925, Jackson MS

American Public Life may use this information to determine what, if any, benefit can be provided for any American Public Life coverage for which I may be eligible.

By State Law, you must be advised that:

THE INFORMATION YOU AUTHORIZE FOR RELEASE MAY INCLUDE INFORMATION WHICH MAY INDICATE THE PRESENCE OF A COMMUNICABLE OR VENEREAL DISEASE WHICH MAY INCLUDE, BUT IS NOT LIMITED TO DISEASES SUCH AS HEPATITIS, SYPHILIS, GONORRHEA OR THE HUMAN IMMUNODEFICIENCY VIRUS, ALSO KNOWN AS ACQUIRED IMMUNE DEFICIENCY SYNDROME (“AIDS”).

The information you authorize for release may include your history of treatment for physical and/or emotional illness to include psychological testing (but not psychotherapy notes) and treatment records of alcohol and drug abuse.

You do have the right to refuse to sign this authorization; however, failure to sign the authorization may result in a denial of benefits.

American Public Life Insurance Company and its reinsurers agree to maintain the confidentiality of all the Insured’s nonpublic financial or medical information given to us by any authorized entities listed above; however, federal law (HIPPA) requires you be advised that information used or disclosed pursuant to this authorization may be subject to

Signature: |

|

Date: |

|||

|

|

|

|

|

|

Print Your Name: |

|

Name of Claimant: |

|

||

If a personal representative signs this authorization, a description of the authority to act on behalf of the Insured must be included.

RETAIN A COPY OF THIS AUTHORIZATION FOR YOUR PERSONAL RECORD.

Form Characteristics

| Fact Name | Description |

|---|---|

| Common Information Required | Claimants need to provide their name, Social Security number, policy number, and contact information. This ensures that all claims are accurately processed and tied to the correct policy. |

| State-Specific Laws | Various states have specific regulations around fraudulent claims. For instance, California states that any person who knowingly files a false claim may face criminal penalties including fines and possible imprisonment. |

| Documentation for Claims | For vehicle accidents, it is crucial to submit a police report, while cancer claims require a pathology report. These documents increase the likelihood of a successful claim. |

| Employee's Statement Requirement | If a claim involves disability benefits, an employer's statement that includes dates of absence and return to work is necessary. This helps verify the disability and supports the claim process. |

Guidelines on Utilizing American Public Life

Filling out the American Public Life form is an important step in processing your claim. Ensure that all required information is provided accurately to avoid any delays. Below are the steps to guide you through completing the form.

- Begin by filling in the Name of Claimant, SS #, and Policy/Certificate # fields at the top of the form.

- Provide your Street Address or P.O. Box, followed by City, State, and Zip Code.

- Enter your Date of Birth and your Relationship to Primary Insured.

- Fill in your Telephone #, the Name of Primary Insured, and the SS # of the primary insured individual.

- Indicate the Primary Insured’s Employer.

- Answer the questions regarding whether this claim is due to an accident, and if a Worker’s Comp claim will be filed.

- Describe the Illness/Injury and, if applicable, explain how the injury occurred.

- If the claim is due to a vehicle accident, ensure to submit a copy of the police report. If the claim is related to cancer, submit a pathology report.

- State whether you were hospitalized, the dates of hospitalization, and include the name of the facility.

- Report any prior symptoms of this condition and specify when they occurred.

- List the names and addresses of any Attending Physicians. If necessary, provide this information on a separate piece of paper and attach it.

- For disability claims, fill in the Date you returned or will return to work, the Date you stopped working due to disability, and your Average Monthly Earnings.

- List the duties associated with your job under List job duties.

- Read and consider the legal warnings printed on the form relevant to your state.

- Finally, sign the form where indicated and date it. Both the primary insured and the claimant must provide their signatures.

Once completed, it’s advisable to keep a copy of the form for your records before submission. Make sure to send the form to the address provided at the top: American Public Life, P.O. Box 925, Jackson, MS 39205-0925. Following these steps carefully will help facilitate the claims process.

What You Should Know About This Form

What is the purpose of the American Public Life Claimant’s Statement?

The Claimant’s Statement is a form used to report a claim for benefits from American Public Life Insurance Company. This statement helps capture essential information regarding the claimant, the primary insured, and the nature of the claim, whether it’s for accident, health issues, or disability. It serves as a formal request for insurance benefits based on the coverage provided in the policy.

What information do I need to provide about the claimant?

You must provide the claimant’s name, Social Security number, policy or certificate number, address, date of birth, relationship to the primary insured, and telephone number. This information verifies the identity of the claimant and connects them to the correct policy for processing the claim.

Do I need to submit any additional documentation with the Claimant’s Statement?

Yes, depending on the nature of the claim, additional documents may be required. If the claim is related to a vehicle accident, a copy of the police report is necessary. For claims due to cancer, a pathology report must be submitted. This documentation supports your claim and assists the insurance company in evaluating it accurately.

How should I describe the illness or injury on the form?

When describing the illness or injury, provide a detailed explanation of what occurred, how the injury happened if applicable, and any symptoms experienced. Including specifics will help the claims adjuster understand the situation and determine eligibility for benefits or compensation.

What if I was hospitalized?

If you were hospitalized, you need to indicate where you were treated and the dates of your hospitalization. Be specific about the duration of your hospital stay. This information can be crucial in establishing the extent of your medical needs and the related costs that will be covered under your policy.

What are the potential penalties for providing false information on the claim?

Providing false or misleading information can lead to serious consequences, including criminal charges and fines. Each state has specific regulations regarding insurance fraud. If the insurance company determines that false information was provided, they may deny your claim and report the incident to the proper authorities.

What happens if my claim is related to a disability?

If the claim is disability-related, additional details will be required, such as the date you stopped working and when you anticipate returning. It’s essential to provide this information accurately, as it will directly impact your benefits and any potential compensation for lost wages or medical expenses.

How does the authorization for disclosure of protected health information work?

This authorization allows healthcare providers and facilities to release your medical information relevant to your claim to American Public Life Insurance Company. This permission helps the company determine your eligibility for benefits. Remember, you can revoke this authorization at any time in writing, but it may affect ongoing claims if already acted upon.

Common mistakes

Completing the American Public Life form accurately is essential, but there are common mistakes that people may make. These errors can delay the processing of claims or even lead to denials. Understanding these mistakes can help ensure that the submission goes smoothly.

One frequent mistake is failing to fill out all required fields. The form requests specific information, such as the claimant's Social Security number and policy details. Omitting this information can result in a significant delay. It’s crucial to double-check that all sections, particularly the essential ones like the date of birth and relationship to the primary insured, are completed.

Another common oversight involves the lack of supporting documentation. For claims related to a vehicle accident or cancer, submitting copies of the police report and pathology report, respectively, is essential. Without these documents, the claim may be questioned or rejected. Always look closely at the instructions regarding necessary attachments and make sure to include them.

People sometimes misinterpret questions on the form. For instance, the inquiry about prior symptoms of the condition might not be clearly understood. Those completing the form should pay attention to how these questions are phrased. Providing unclear or vague responses can lead to further inquiries and potential misunderstandings.

It’s also not uncommon to see errors in the dates provided. For example, indicating an incorrect date of hospitalization or the date of accident can create complications in determining the validity of a claim. Accurate record-keeping at the time of the incident can help avoid these mix-ups later.

When filling in the attending physician’s information, some people skip the details or write illegibly. This inconsistency can lead to difficulties in verifying medical details. Taking the time to ensure this information is clear and precise is vital for the claims process.

Neglecting to sign and date the form is another frequent error. Both the primary insured and the claimant must sign to verify that the information provided is accurate. A missing signature can delay the processing significantly, so it’s always best to verify that all necessary signatures are present before submission.

Individuals sometimes misjudge the need for clarity when describing the illness or injury. Vague descriptions can lead to assumptions about the nature of the claim. Clear, concise descriptions help in swiftly processing the claim and provide a complete understanding of the situation.

A common pitfall is overlooking to enter information about additional insurance coverage. If a claimant has other health coverage, noting this on the form is important. This information can be vital in determining how liability is shared among insurers.

Finally, failing to retain a copy of the completed form can be a significant mistake. Having a record provides a reference point if any issues arise while the claim is being processed. It is always a good idea to keep a personal copy for your records, ensuring all information aligns with what was submitted.

By being mindful of these common mistakes, individuals can improve the accuracy of their submissions and help facilitate the claims process effectively.

Documents used along the form

The American Public Life form is essential for processing claims related to accident, health, and disability insurance. However, several other documents are often used in conjunction with this form to facilitate a comprehensive review of the claim. Each of these documents serves a specific purpose in gathering the necessary information for a thorough assessment. Below is a list of commonly used forms and their brief descriptions.

- Claimant’s Statement: This document is filled out by the claimant to provide personal and medical details about the claim, including employment information and the circumstances surrounding the illness or injury.

- Employer’s Statement: This form is completed by the employer and contains information about the employee's absence, job duties, and any related disability retirement, assisting in confirming the claimant’s work status.

- Attending Physician’s Statement: This statement is provided by the attending physician and includes medical diagnoses, treatment details, and any recovery timeline. It is vital for establishing the medical basis of the claim.

- Authorization to Use or Disclose Protected Health Information: This form allows healthcare providers and insurers to share necessary medical information relevant to the claim, ensuring compliance with privacy regulations.

- Health Insurance Claim Form: Often required by insurers, this form is used to submit details about healthcare services provided, including diagnosis codes and treatment descriptions, aiding the claims process.

- Disability Benefits Application: This application is specifically for those seeking disability benefits under their insurance policy, detailing the nature of the disability and its impact on work capacity.

- Independent Medical Examination (IME) Report: If requested, an IME provides an unbiased medical evaluation of the claimant’s condition, often used to verify the findings of the claimant's physician.

- Police Report (if applicable): In cases where the claim stems from an accident, a police report may be required to document the details and circumstances of the incident for verification.

Utilizing these documents alongside the American Public Life form maximizes the chances of a smooth claims process. Each form contributes vital information that aids the insurance company in making informed decisions about coverage and benefits.

Similar forms

- Health Insurance Claim Form: This document is similar as it also requires detailed information about the claimant's medical condition, treatment, and providers. Both forms serve to facilitate the processing of health-related claims.

- Disability Insurance Claim Form: Like the American Public Life form, this document gathers data related to the claimant’s disability status, time periods of absence from work, and medical professional consultations to assess eligibility for benefits.

- Auto Accident Claim Form: Both forms need specifics surrounding an incident, particularly if the claim is tied to an accident. Both require documentation such as police reports for verification purposes.

- Workers' Compensation Claim Form: This form, like the American Public Life form, addresses claims resulting from injuries sustained at work. Both require employers’ input on the claim and potential links to job-related incidents.

- Life Insurance Claim Form: These forms are similar in that they also demand vital information about the insured person, the relationship to the claimant, and details surrounding the claim for benefits to be processed.

- Long-Term Care Insurance Claim Form: This document parallels the American Public Life form through its requirement for a description of medical conditions and services received. Both are aimed at ensuring accurate assistance through health-related coverage.

- Medicare Claim Form: Similar to the American Public Life form, this document collects detailed personal and health information to help process claims for those eligible for Medicare benefits.

- Supplemental Health Insurance Claim Form: This form also gathers information about medical treatments and claims linked to supplemental policies, aiding in the smooth processing of benefits.

- Travel Insurance Claim Form: Both forms require evidence of an incident (e.g., illness or injury while traveling) and supporting documentation to validate the claim before any benefits are disbursed.

Dos and Don'ts

Do's and Don'ts for Filling Out the American Public Life Form

- Do provide accurate information: Make sure all details are correct and reflect your current situation.

- Do attach required documents: Include necessary reports, such as police reports for vehicle accidents.

- Do keep a copy for your records: Retain a copy of the completed form and any attachments for reference.

- Do answer all questions: Ensure that you fill out every section of the form to the best of your knowledge.

- Don't submit false information: Providing inaccurate details can lead to serious consequences, including criminal charges.

- Don't forget to sign: Ensure both the claimant and primary insured sign the form before submitting it.

Misconceptions

There are several misconceptions around the American Public Life form that can lead to confusion when filing claims. Here are four of the most common misunderstandings:

- Misconception 1: All claims require the same documentation.

- Misconception 2: You can't file a claim if you have other insurance.

- Misconception 3: Claims must always be filed in person.

- Misconception 4: The information on the form isn’t important.

Not every claim is the same. While some may need detailed medical reports, others—like routine first-aid claims—might not. It's essential to read the instructions for each specific claim type to avoid delays.

Having other health coverage does not prevent you from filing a claim with American Public Life. In fact, it's important to disclose any other insurance plans, as they may coordinate benefits with each other.

Surprisingly, many people think claims can only be filed face-to-face. However, you can submit your documents by mail or even electronically, depending on the specific instructions provided for your claim.

Many people underestimate the significance of providing accurate information. Falsifying any details can not only result in the denial of your claim but also potential legal consequences. It's crucial to be truthful and thorough.

Key takeaways

When filling out and using the American Public Life Claimant’s Statement, consider the following key takeaways:

- Complete All Required Fields: Ensure that every section of the form is filled out accurately. Missing information can lead to delays in processing your claim.

- Submit Supporting Documents: Include necessary documentation, such as police reports for vehicle accidents or pathology reports for cancer claims. This information helps to substantiate your claim.

- Understand Condition Details: Describe the nature of your illness or injury clearly. If applicable, elaborate on how the injury occurred, as this can impact your claim.

- Review State-Specific Requirements: Be aware that different states have varying laws regarding fraudulent claims. It's essential to provide truthful information to avoid legal repercussions.

- Keep Records: Maintain copies of all submitted forms and documents for your personal records. This can be beneficial for future reference or in case of any disputes.

- Consult Professionals if Needed: If you have questions about the process or specific sections of the form, consider consulting with an insurance representative or legal professional for assistance.

Browse Other Templates

Ssa-3105 - In case you disagree with the overpayment amount, the reconsideration request is essential.

Uba Account Opening Online - The form emphasizes that compliance with banking regulations is mandatory for all account holders.

Job Search Activity Log,Work Search Contact Record,Employment Search Tracking Form,Job Hunt Documentation Sheet,Work Seeking Record,Employment Inquiry Log,Job Application Contact Sheet,Work Search Reporting Form,Job Search Progress Tracker,Employment - Volunteered at a community organization to gain experience.