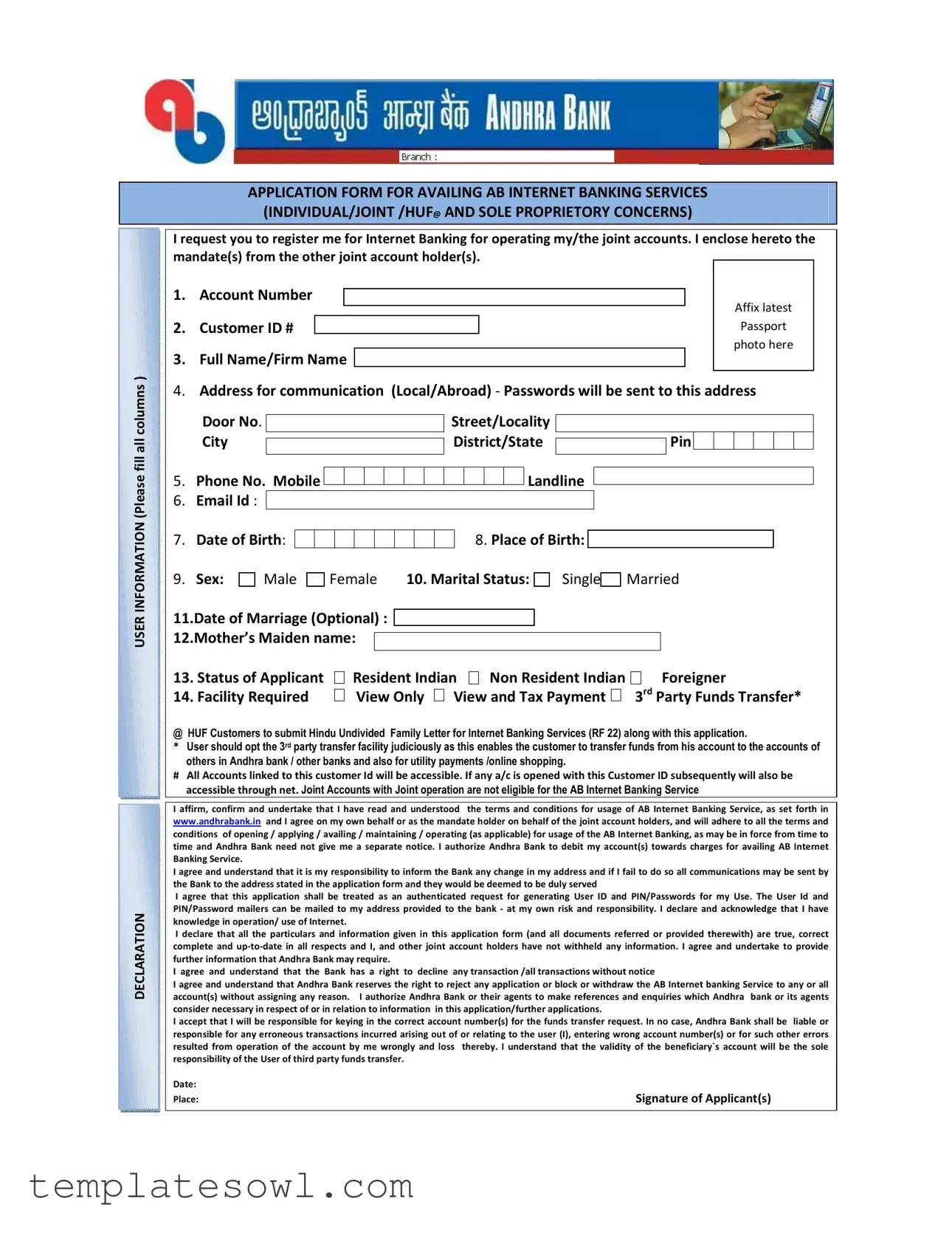

Fill Out Your Andhra Bank Customer Id Form

The Andhra Bank Customer ID form serves as an essential gateway for account holders wishing to access and utilize the bank's Internet Banking services. This comprehensive application form is designed for a variety of applicants, including individuals, joint account holders, Hindu Undivided Families (HUF), and sole proprietorships. Upon submitting the form, customers provide crucial information such as their account number, full name, communication address, and contact details. Importantly, applicants must also specify their requirements—from viewing account balances to making third-party funds transfers. The form ensures that users agree to essential terms and conditions, highlighting the bank's rights regarding transaction rejections and the responsibilities of the applicants towards maintaining the accuracy of their provided information. A fascinating aspect of the form is its emphasis on customer awareness; applicants are encouraged to verify their knowledge of Internet usage and to recognize the significance of safeguarding their online banking credentials. As the digital landscape evolves, this form not only facilitates seamless online transactions but also reinforces the commitment of Andhra Bank to secure and effective banking practices.

Andhra Bank Customer Id Example

(Please fill all columns )

APPLICATION FORM FOR AVAILING AB INTERNET BANKING SERVICES (INDIVIDUAL/JOINT /HUF@ AND SOLE PROPRIETORY CONCERNS)

I request you to register me for Internet Banking for operating my/the joint accounts. I enclose hereto the mandate(s) from the other joint account holder(s).

1. |

Account Number |

|

|

Affix latest |

|

|

|

|

|

|

|

2. |

Customer ID # |

|

|

|

Passport |

photo here

3.Full Name/Firm Name

4.Address for communication (Local/Abroad) - Passwords will be sent to this address

Door No. |

|

Street/Locality |

|

|

|

|

|

|

|

|

City |

|

District/State |

|

Pin |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

5.Phone No. Mobile

Landline

Landline

6. Email Id :

USER INFORMATION

7. Date of Birth:

9. Sex:

Male

Male

Female

Female

11.Date of Marriage (Optional) : 12.Mother’s Maiden name:

8. Place of Birth:

10. Marital Status:

Single

Single

Married

DECLARATION

13. Status of Applicant |

Resident Indian |

Non Resident Indian |

Foreigner |

|

14. Facility Required |

View Only |

View and Tax Payment |

3rd Party Funds Transfer* |

|

!"##$$%

*#$#&$'####

#(#)#$)#$$.

# All Accounts linked to this customer Id will be accessible. If any a/c is opened with this Customer ID subsequently will also be accessible through net. *("#*$#(

I affirm, confirm and undertake that I have read and understood the terms and conditions for usage of AB Internet Banking Service, as set forth in www.andhrabank.in and I agree on my own behalf or as the mandate holder on behalf of the joint account holders, and will adhere to all the terms and conditions of opening / applying / availing / maintaining / operating (as applicable) for usage of the AB Internet Banking, as may be in force from time to time and Andhra Bank need not give me a separate notice. I authorize Andhra Bank to debit my account(s) towards charges for availing AB Internet Banking Service.

I agree and understand that it is my responsibility to inform the Bank any change in my address and if I fail to do so all communications may be sent by the Bank to the address stated in the application form and they would be deemed to be duly served

I agree that this application shall be treated as an authenticated request for generating User ID and PIN/Passwords for my Use. The User Id and PIN/Password mailers can be mailed to my address provided to the bank - at my own risk and responsibility. I declare and acknowledge that I have knowledge in operation/ use of Internet.

I declare that all the particulars and information given in this application form (and all documents referred or provided therewith) are true, correct complete and

I agree and understand that the Bank has a right to decline any transaction /all transactions without notice

I agree and understand that Andhra Bank reserves the right to reject any application or block or withdraw the AB Internet banking Service to any or all account(s) without assigning any reason. I authorize Andhra Bank or their agents to make references and enquiries which Andhra bank or its agents consider necessary in respect of or in relation to information in this application/further applications.

I accept that I will be responsible for keying in the correct account number(s) for the funds transfer request. In no case, Andhra Bank shall be liable or responsible for any erroneous transactions incurred arising out of or relating to the user (I), entering wrong account number(s) or for such other errors

resulted from operation of the account by me wrongly and loss |

thereby. I understand that the validity of the beneficiary`s account will be the sole |

responsibility of the User of third party funds transfer. |

|

Date: |

|

Place: |

Signature of Applicant(s) |

|

|

NRI

JOINT HOLDER

FOR OFFICE USE ONLY

I/we hereby declare that I/we am/are a

Date:

Place: |

Signature of Applicants(s) |

I/we undersigned declare that the said First Joint holder has submitted an application for availing AB Internet Banking Service from your bank in respect of the account(s) applied in the application. I/we hereby authorize the said First Joint holder to view/access and conduct operations in the said accounts(s) for and on my/our behalf.

I/ we confirm/affirm and undertake that I/We have read and understood the terms and conditions for usage of the AB Internet Banking Services, as displayed on the website www.andhrabank.in and that I/we agree to abide by them.

Names of Joint Account Holder(s)Signatures of Joint Account holder(s) 1.

2._______________________________________________________________________________________

Note:For every addition of new Jt account, a separate

I have verified the application and the records and confirm that the applicant is

An Individual and sole holder of the account

An Individual and a First Joint holder of the joint account – operated not jointly but as:

Either or Survivor |

Former or Survivor |

Anyone Singly or Survivor |

Applicant is the Sole Proprietor and holder of the account

Karta of HUF Account

I have also verified and I hereby confirm that KYC Norms are fulfilled completely for the account(s) linked to this customer Id mentioned in the application form. I have also verified the signature of the applicant with his specimen signature available on

records and found in order. |

|

Date: |

Signature of Verifying Officer |

____________________________________________________________________________________________________________

Permitted to Register the Application Form for availing the AB

Date:Signature of Branch Head

Receipt of Acknowledgement from the applicant

Date: _______________ |

Signature of the applicant |

ACKNOWLEDGEMENT(Cut along and Handover to customer)

Andhra Bank

_____________________ Branch.

Acknowledgement cum User Id Intimation slip

(Individual Internet accounts)

Welcome to our

You can browse the homepage of our website www.andhrabank.in from where a link is provided for availing Internet Banking Services.

You require User Id and Login Password to access the applied accounts through online.

Your User ID is  (Please fill 8 digit customer Id of the account applied by the customer for net facility)

(Please fill 8 digit customer Id of the account applied by the customer for net facility)

You will receive login password through courier to your communication address.

Please collect your Transaction Password (if you have opted for Transaction facility) personally from our branch after you receive your Login password.

You can avail the Internet Banking services once you receive your Login password.

You can get acquainted with the usage of AB Internet Banking Service through the DEMO link available in our site.

Please feel free to contact us at 1800 425 1515 (Toll free) for any clarifications / information. I

It is our pleasure to receive your valuable suggestions for improving the AB Internet Banking Service further.

Date: |

Signature of the Officer/Manager |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | This form is used to apply for Internet Banking services for individual, joint, HUF, and sole proprietary accounts. |

| Required Information | Applicants must provide personal details, including name, address, phone number, email, and account number. |

| Customer ID | Each applicant is assigned a unique Customer ID for accessing their account via Internet Banking. |

| Declaration by User | Applicants must affirm that all information provided is correct and up-to-date, and they understand the service terms. |

| Data Protection | Account holders need to inform the bank about address changes to ensure communication is sent to the correct address. |

| Governing Law | This application is subject to the regulations of the Reserve Bank of India and relevant foreign exchange laws. |

| Verification Process | The application needs verification by a branch officer to confirm that KYC norms are fulfilled. |

Guidelines on Utilizing Andhra Bank Customer Id

Completing the Andhra Bank Customer ID form is crucial for obtaining Internet banking services. Following the instructions carefully ensures that the form is filled out correctly, allowing for a smooth registration process. Here’s how to fill out the form:

- Start with the top of the form: Fill in your account number in the first column.

- Add your Customer ID: Affix a recent passport-sized photograph in the designated area below your Customer ID.

- Provide your name: Write your full name or the name of your firm.

- Fill in your address: Include your complete address for communication (whether local or abroad). Remember, passwords will be sent to this address. Make sure to include the door number, street/locality, city, district/state, and pin code.

- Enter your phone numbers: Provide both mobile and landline numbers if applicable.

- Add your email ID: Write your email address clearly.

- Submit user information: Fill out the date of birth, sex, place of birth, marital status, and (optionally) the date of marriage and mother's maiden name.

- Specify your residency status: Select whether you are a Resident Indian, Non Resident Indian, or Foreigner.

- Select your required facility: Indicate whether you want View Only, View and Tax Payment, or 3rd Party Funds Transfer options.

- Read and agree to the declaration: Acknowledge that you understand and agree with the terms and conditions for Internet banking.

- Sign the application: Sign and date the form where indicated.

- Joint account holders: If applicable, ensure that joint holder details and signatures are included.

Once the form is fully completed, submit it to the bank. After processing, the bank will provide you with your User ID and related information via email or postal service, allowing you to utilize Internet banking services with your account.

What You Should Know About This Form

What is the Andhra Bank Customer ID form?

The Andhra Bank Customer ID form is an application that allows individuals or joint account holders to register for Internet Banking services. By filling out this form, you request access to manage your accounts online securely. It includes providing personal details and account information necessary for the registration process.

What information do I need to provide on the form?

You need to fill in several details, including your account number, customer ID, full name, address, phone numbers, email ID, date of birth, marital status, and other relevant personal information. It’s important to provide accurate and up-to-date information to avoid any issues during the registration process.

How is my privacy protected when I submit this form?

Your personal information is handled with confidentiality. The bank adheres to strict privacy regulations to protect customers' data. Ensure that you keep your login credentials secure and report any suspicious activity to the bank immediately.

What should I do if I make a mistake on the form?

If you notice a mistake after submitting the form, contact the bank’s customer service as soon as possible. You may need to fill out a new application or provide clarification regarding the error. Prompt action can help in rectifying the issue without delay.

How will I receive my User ID and password after submitting the form?

Your User ID will be generated based on your customer ID and can be accessed through the bank's online portal. The login password will be sent to your registered communication address via courier. If you opted for transaction capabilities, you will need to collect your transaction password in person at your branch.

Can I apply for Internet Banking for joint accounts?

Yes, the form accommodates applications for both individual and joint accounts. All joint account holders must provide their consent by signing the application. Ensure that any joint account holders are aware of and agree to the terms of Internet Banking services.

What should I do if my Internet Banking access is blocked?

If your Internet Banking access has been blocked, contact customer service immediately for assistance. They can help identify the reason for the block and guide you through the process to restore access. It’s essential to resolve any issues promptly to maintain control over your accounts.

Common mistakes

Completing the Andhra Bank Customer Id form can be straightforward if you pay attention to detail. However, several common mistakes can lead to delays or complications in the process. Here are eight mistakes to avoid when filling out this important document.

One significant error is leaving required fields blank. Each section of the form must be completed. Omitting any necessary information can result in the application being rejected. Ensure that you review each entry before submission, as incomplete forms can cause unnecessary delays.

Another common mistake is providing incorrect or outdated contact information. The address listed for communication is vital, as this is where important information regarding your Internet banking credentials will be sent. Verify all details, including your phone numbers and email address, to ensure they are current.

Failing to affix a recent passport-sized photograph in the designated area is also a frequent oversight. This photograph is a crucial part of your identification process. Make sure the photo meets any specified requirements and is securely attached to the form.

Some people forget to provide their Date of Birth or fail to select their correct marital status. These details are critical for identity verification and security purposes. Double-check that you have provided accurate information and that every dropdown or selection reflects your personal details correctly.

In the "User Information" section, it is essential not to mix up the details of the primary account holder with those of joint account holders. Each individual must have their information accurately recorded to avoid confusion and ensure that all account operations proceed smoothly.

A further mistake involves not understanding the facility required. Requesting the wrong Internet banking services could limit your access to important functions. Be clear about the services you need, such as "View Only" or "View and Tax Payment," and ensure these choices align with your banking needs.

Lastly, individuals sometimes overlook the declaration section of the form. It's important to read the terms and conditions you are agreeing to. This is not just a formality; it confirms your understanding and acceptance of the policies that govern Internet banking with Andhra Bank.

Avoid these mistakes to streamline your application process for the Andhra Bank Customer Id form. Thoroughly review your information, ensure all required fields are filled out, and understand the choices you are making within the application. Paying close attention to these details can facilitate a successful registration for Internet Banking services.

Documents used along the form

When applying for Internet banking services with Andhra Bank, you will encounter several other important forms and documents. Each plays a crucial role in the application process, ensuring that customer details are accurate and contracts are upheld. Here’s a brief overview of these essential documents.

- KYC (Know Your Customer) Form: This document is needed to verify your identity and ensures that the bank understands your financial activities. It includes details like your name, address, and identification proofs.

- Account Opening Form: If you are opening a new account, this form is necessary. It gathers information such as personal details and the type of account you wish to open.

- Nomination Form: This form allows you to designate a beneficiary for your accounts. It ensures that the stated person receives your assets in the event of your death.

- Signature Verification Form: Required for security purposes, this document ensures that the signatures on file match the ones you provide when making transactions.

- Password Reset Request Form: If you forget your internet banking password, this form helps you request a reset and regain access to your account.

- Mobile Banking Registration Form: This document registers you for mobile banking services, allowing transactions and account access via smartphones.

- Consent for Electronic Communication: By signing this, you give the bank consent to send electronic communications, including account statements and updates regarding your banking services.

- Joint Account Holder Declaration: In the case of joint accounts, this form authorizes one or more holders to operate the account on behalf of all account holders.

These documents collectively enhance the security and usability of your banking experience. They ensure that all parties are aware of their rights and responsibilities. Being equipped with the right forms can streamline your banking setup, making the process smoother and more efficient.

Similar forms

Bank Account Application Form: Similar to the Andhra Bank Customer ID form, this document collects personal details and account preferences of the applicant to open a new bank account.

Loan Application Form: This form requires the same personal and financial information as the Customer ID form for individuals seeking loan approval, including income details and purpose of the loan.

Credit Card Application Form: Like the Customer ID form, this document gathers personal information, employment status, and consent to process the application.

Internet Banking Registration Form: This form focuses on enabling online banking. It asks for personal identification similar to the Customer ID form while detailing the specific services requested.

KYC (Know Your Customer) Form: This document serves to verify the identity of the customer, akin to the information required in the Customer ID form, including identification proofs.

Beneficiary Addition Form: This form allows a customer to add a beneficiary for fund transfers, requiring account information similar to that gathered in the Customer ID form.

Joint Account Holder Application: This document registers joint account holders and collects personal data, much like the Customer ID form requests for joint account scenarios.

Change of Address Form: This form allows customers to update their address with the bank, similar to the Customer ID form, which also captures address details.

ATM Card Application Form: This document requests personal information for issuing an ATM card, sharing many similarities with the Customer ID form regarding identification and contact details.

Dos and Don'ts

When filling out the Andhra Bank Customer ID form, it is important to follow certain guidelines to ensure a smooth process. Here is a list of things to do and things to avoid:

- Do fill in all required fields completely to avoid delays.

- Do affix a recent passport-sized photograph in the designated area.

- Do provide a current address where you can receive communications.

- Do double-check the accuracy of your email and phone numbers.

- Do ensure that you include both your mobile and landline numbers if applicable.

- Do write your full name as it appears in your identification documents.

- Do declare your marital status accurately for proper account management.

- Do review the terms and conditions of Internet Banking before submitting your application.

- Do sign the form where indicated to ensure it is officially recognized.

- Do keep a copy of the filled form for your records.

- Don't leave any fields blank; this can lead to processing issues.

- Don't use outdated photographs; they should be recent.

- Don't provide an incorrect email address; this may prevent you from receiving confirmation details.

- Don't forget to include the names and signatures of any joint account holders, if applicable.

- Don't alter or scratch out any information on the form.

- Don't submit the form without checking for typos or errors.

- Don't expect immediate confirmation; processing may take time.

- Don't ignore the safety tips provided for Internet Banking usage.

- Don't request changes to your details without proper documentation.

- Don't forget to follow up if you do not receive a response after submitting your application.

Misconceptions

- Misconception 1: The customer ID is optional when filling out the form.

- Misconception 2: Only individual account holders need to fill out the form.

- Misconception 3: Providing a mobile number is not necessary.

- Misconception 4: The email address can be filled in as any random email.

- Misconception 5: The date of birth is not needed if you are not applying for a joint account.

- Misconception 6: The application will be automatically approved once submitted.

- Misconception 7: The bank is responsible for any erroneous transactions made by the user.

- Misconception 8: Once registered, users will receive both the login password and transaction password simultaneously.

In fact, the customer ID is a required field. It must be clearly stated on the form to register for internet banking services.

This application is intended for both individual and joint accounts, as well as sole proprietorship concerns. All relevant parties must complete the required information.

The form clearly asks for both mobile and landline numbers. This information is essential for communication and verification purposes.

Applicants must use a valid email address. Important account information, such as passwords, will be sent to this address. Accuracy is crucial.

The date of birth is required for all applicants, whether applying individually or jointly. This helps in identity verification.

Approval is not guaranteed. Andhra Bank reserves the right to reject any application without providing a reason, as outlined in the declaration section.

The form makes it clear that users are responsible for entering the correct account numbers. The bank will not accept liability for mistakes made by the user.

Users will only receive the login password through courier. The transaction password, if applicable, must be collected in person after receiving the login password.

Key takeaways

Filling out the Andhra Bank Customer ID form is crucial for accessing Internet Banking services. Here are key takeaways to guide you through the process:

- Complete All Sections: Ensure that every column of the application form is filled out. Incomplete forms may lead to delays in processing or even rejection.

- Accurate Information: Provide true and updated details, such as your full name, address, and contact numbers. Remember, any discrepancies might create issues later.

- Understand the Responsibilities: You will be responsible for ensuring that the correct account number is entered for fund transfers. Familiarize yourself with the terms and conditions as they are binding.

- Receipt and User ID: After submitting your application, keep an eye out for your User ID and password. You will receive these via courier, and you can only access Internet Banking once you have them.

Filling out this form carefully will pave the way for a smooth experience with Andhra Bank's Internet Banking services.

Browse Other Templates

Dept of Housing and Community Development - The insignia or HUD label number must be included if known, for tracking purposes.

Basic Work Incident Report Sample - The form supports transparency in the healthcare system by formally documenting incidents.

Ky Divorce Papers - All required fields on the VS-300 must be completed to generate the PDF.