Fill Out Your Annual Credit Report Form

Understanding the Annual Credit Report Request Form is essential for individuals wishing to access their credit reports. Each person has the legal right to receive a free copy of their credit report once a year from the three major credit reporting agencies: Equifax, Experian, and TransUnion. Instead of navigating complex websites, this form offers a straightforward method for those who prefer the traditional mail route. Accessing your credit report helps you monitor your financial health and ensures that your personal information is accurate and secure. To obtain your report, you will need to provide specific personal information, including your Social Security number, date of birth, and current mailing address. Incomplete submissions may lead to delays, so it is crucial to fill out each section diligently. Once completed, mail the form in a standard envelope, ensuring that it is properly folded and that you affix the correct amount of postage. Remember to use black or blue ink and write in capital letters to enhance readability. After the credit reporting agency receives your request, they will process it within 15 days and send you your report by mail, provided they have all the necessary information. For those in need of immediate access, visiting the official website at www.annualcreditreport.com is a convenient alternative that allows for quicker retrieval of your credit report.

Annual Credit Report Example

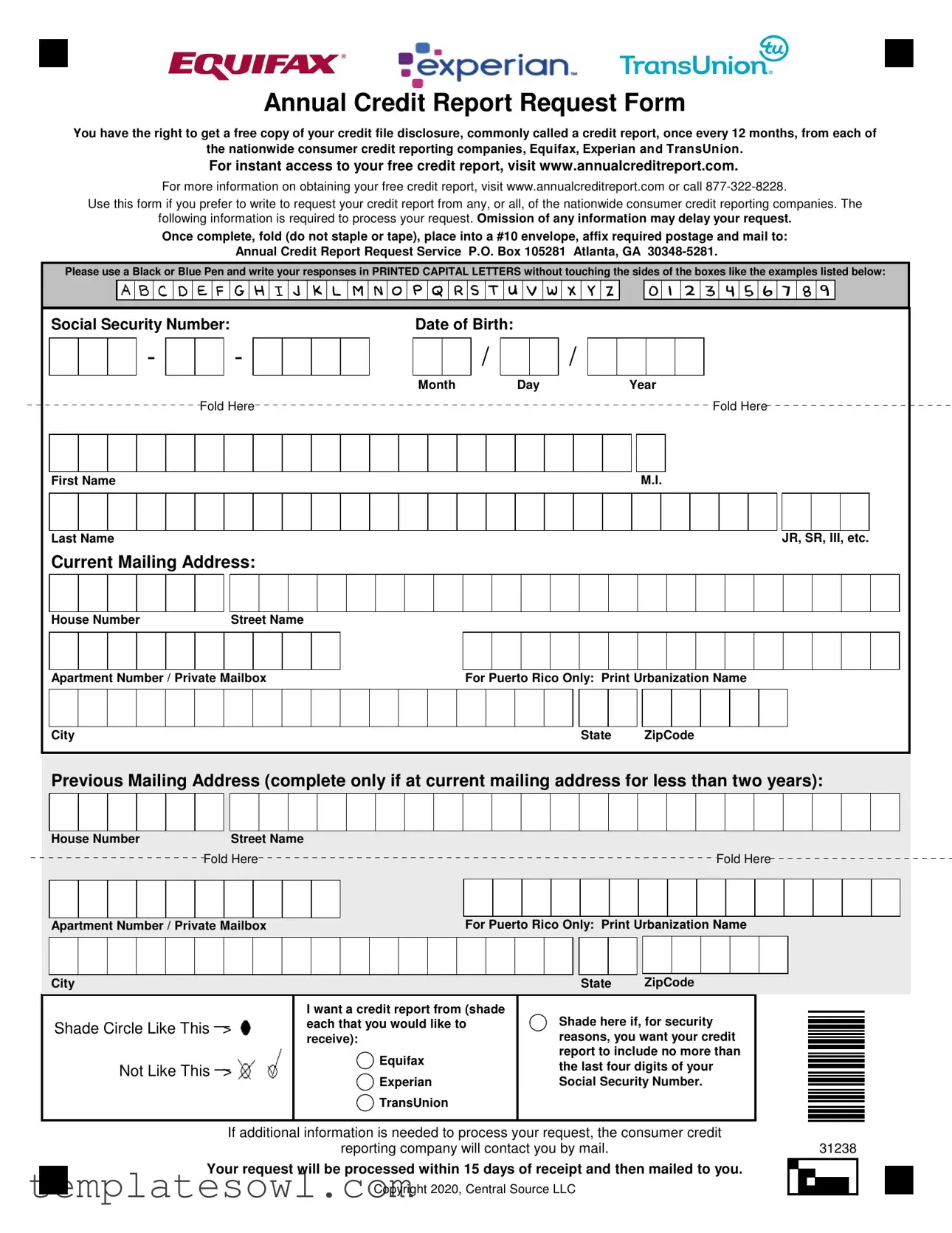

Annual Credit Report Request Form

You have the right to get a free copy of your credit file disclosure, commonly called a credit report, once every 12 months, from each of

the nationwide consumer credit reporting companies, Equifax, Experian and TransUnion.

For instant access to your free credit report, visit www.annualcreditreport.com.

For more information on obtaining your free credit report, visit www.annualcreditreport.com or call

Use this form if you prefer to write to request your credit report from any, or all, of the nationwide consumer credit reporting companies. The

following information is required to process your request. Omission of any information may delay your request.

Once complete, fold (do not staple or tape), place into a #10 envelope, affix required postage and mail to:

Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA

Please use a Black or Blue Pen and write your responses in PRINTED CAPITAL LETTERS without touching the sides of the boxes like the examples listed below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number: |

|

|

|

|

|

|

|

|

Date of Birth: |

|||||||||||||||||||

-

-

Fold Here

/

MonthDay

/

Year

Fold Here

First Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M.I. |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JR, SR, III, etc. |

|

||||||

Current Mailing Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

House Number |

|

|

|

Street Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apartment Number / Private Mailbox |

|

|

|

|

|

|

|

|

|

|

|

For Puerto Rico Only: Print Urbanization Name |

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

ZipCode |

|

||||||||||||||||||||||

Previous Mailing Address (complete only if at current mailing address for less than two years):

|

House Number |

|

|

Street Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

Fold Here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fold Here |

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apartment Number / Private Mailbox |

|

|

|

|

|

|

|

For Puerto Rico Only: Print Urbanization Name |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZipCode |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I want a credit report from (shade |

|

|

|

Shade here if, for security |

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

Shade Circle Like This |

> |

|

|

|

|

|

|

|

each that you would like to |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

reasons, you want your credit |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

receive): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equifax |

|

|

|

|

|

|

|

report to include no more than |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the last four digits of your |

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

Not Like This |

> |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Experian |

|

|

|

|

|

|

|

Social Security Number. |

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TransUnion |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If additional information is needed to process your request, the consumer credit |

|

|

|

|

|

|

reporting company will contact you by mail. |

31238 |

||||

|

Your request will be processed within 15 days of receipt and then mailed to you. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Copyright 2020, Central Source LLC |

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Right to Free Credit Report | Consumers are entitled to receive one free copy of their credit report annually from each of the three nationwide credit reporting companies: Equifax, Experian, and TransUnion. |

| Request Process | To request a credit report, individuals can visit www.annualcreditreport.com or call 877-322-8228. This can also be done via mail using the provided form. |

| Submission Requirements | Complete and accurate information must be provided on the form. Omission can lead to delays in processing the request. |

| Processing Time | Requests are processed within 15 days of receipt. Credit reports will then be mailed to the consumer. |

| Mailing Instructions | After completing the form, it must be folded (not stapled or taped) and sent to the Annual Credit Report Request Service at P.O. Box 105281, Atlanta, GA 30348-5281. |

Guidelines on Utilizing Annual Credit Report

Completing the Annual Credit Report form allows you to request your credit report from the major credit reporting agencies. After you fill out the form, you will need to mail it to the specified address. Here is a straightforward guide to help ensure you fill out the form correctly.

- Obtain a pen with black or blue ink.

- Start by writing your Social Security Number in the designated box. Be sure to exclude any dashes or spaces.

- Next, enter your Date of Birth, using the format: month/day/year.

- In the First Name, M.I., and Last Name sections, write your complete name, including any suffix like JR, SR, or III if applicable.

- Provide your Current Mailing Address. Include the House Number, Street Name, and Apartment Number if relevant. If you are in Puerto Rico, include the Urbanization Name as well.

- If you have lived at your current address for less than two years, complete the Previous Mailing Address section with the same details as your current address.

- Indicate which credit reporting agencies you would like to receive your report from by shading in the appropriate circles for Equifax, Experian, and TransUnion.

- Ensure that all information is written in printed capital letters without touching the sides of the boxes, keeping the writing neat and legible.

- Once everything is filled out, fold the form as directed (do not staple or tape it).

- Place the folded form into a #10 envelope.

- Affix the required postage on the envelope.

- Mail the envelope to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

What You Should Know About This Form

What is the Annual Credit Report form?

The Annual Credit Report form is a document that allows individuals to request their free credit reports from the three major consumer credit reporting companies: Equifax, Experian, and TransUnion. You can get a free copy of your credit report once every 12 months from each of these companies.

How do I obtain my free credit report using this form?

To obtain your free credit report using the form, fill it out with the required personal information, including your Social Security number and date of birth. Once completed, fold the form, place it in a #10 envelope, affix the necessary postage, and mail it to the designated address: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

What information is required to fill out the form?

The form requires several critical pieces of information to process your request. This includes your full name, Social Security number, date of birth, current mailing address, and, if applicable, your previous address. Omitting any of this information may delay your request.

What should I do if I prefer to request my credit report online?

If you prefer to request your credit report online, you can do so at www.annualcreditreport.com. This website allows for instant access to your free credit report without the need to mail in a form.

How long will it take to receive my credit report after mailing the form?

Your request will be processed within 15 days of the credit reporting company receiving your completed form. Once processed, your credit report will be mailed to you at the address you provided.

What if I need additional assistance with the form or my request?

If you require assistance or have questions about the form or the process, you can contact customer service by calling 877-322-8228. They can provide guidance on filling out the form or answer any questions related to your credit report request.

Can I request my credit report by phone?

Yes, you can request your credit report by phone. However, to get your free report, it is recommended to visit www.annualcreditreport.com. This is the preferred method for obtaining your credit report without any cost.

Common mistakes

Filling out the Annual Credit Report form may seem straightforward, but there are several common mistakes that can cause unnecessary delays and complications. Being aware of these pitfalls can pave the way for a smoother experience.

One major mistake is omitting crucial information. The form requires specific details like your Social Security Number and Date of Birth. If any of these fields is left blank, your request could be delayed significantly. Double-check your entries to ensure everything is included before sending it off.

Another frequent error is using incorrect writing instruments. It is important to use a black or blue pen as instructed. Using a different color may lead to issues with legibility, causing confusion for the processing personnel. Always adhere to the guidelines for your best chance of a smooth process.

Many individuals forget to print their responses in capital letters. This detail is easy to overlook, yet it is critical for ensuring clarity. Writing in all caps helps avoid misunderstandings and ensures that your information is easily readable.

Some people also neglect to fold the form properly. The instructions are clear: do not staple or tape the form. Instead, fold it neatly and place it into a #10 envelope. Poor folding can lead to damaged forms which might affect the processing of your request.

Listing both your current and previous mailing addresses accurately is another area where mistakes commonly occur. If you have lived at your current address for less than two years, ensure you fill out the relevant section for your previous address. Any inaccuracies can delay the verification process.

Choosing the credit reporting companies can also be a point of confusion. Make sure to clearly shade in the circles for Equifax, Experian, and TransUnion for the companies you wish to receive reports from. Not shading or doing it incorrectly may result in not receiving the credit report at all.

Some people don’t realize that they must affix the required postage correctly. Insufficient postage can cause your request to be returned or delayed. Always check the current postal rates to ensure your envelope is adequately stamped.

Failing to include additional requested information can also be a setback. If the credit reporting company requires more information to process your request, they will reach out via mail. Responding quickly to their inquiries can expedite the process.

Finally, providing an outdated or incorrect mailing address for your request can lead to significant delays. Ensure that your current mailing address is accurate, as any errors could result in your report being sent to the wrong location.

By paying attention to these details, you can avoid common pitfalls when requesting your Annual Credit Report. Taking the time to fill out the form correctly gives you access to your credit report without unnecessary delays.

Documents used along the form

The process of managing and understanding your credit is crucial in today's financial landscape. Along with the Annual Credit Report form, there are several other documents and forms you may find helpful in monitoring and improving your credit standing. Below is a list of related forms that can assist you in achieving your financial goals.

- Dispute Letter: Use this letter to formally challenge any inaccuracies on your credit report. Clearly state the errors you’ve found and provide supporting evidence.

- Credit Freeze Request Form: This form allows you to freeze your credit, preventing new creditors from accessing your credit report. It protects you from identity theft.

- Fraud Alert Request: Requesting a fraud alert notifies creditors to take extra steps to verify your identity before opening new accounts in your name.

- Debt Validation Letter: Send this letter to a creditor or collector to request proof that you owe the debt. It is your right to verify the legitimacy of any debt they claim you owe.

- Identity Theft Report: If you believe you’re a victim of identity theft, this report can help you document the crime and may assist in resolving any related financial issues.

- Credit Monitoring Service Signup: Enroll in services that monitor your credit report for changes, helping you stay alert to potential issues or fraudulent activity.

- Hardship Letter: If you're experiencing financial difficulties, this letter explains your situation to a lender, requesting assistance, loan modifications, or other relief options.

- Credit Counseling Request Form: Use this form to request help from a credit counseling agency. They can assist you in developing a plan to manage your debts effectively.

- Authorization for Release of Information: This form allows you to authorize a third party to access your credit information or to communicate on your behalf.

Each of these documents plays a vital role in managing and safeguarding your credit profile. Understanding how and when to use them can empower you towards making informed financial decisions.

Similar forms

- Credit Report Authorization Form: Similar to the Annual Credit Report Request Form, a Credit Report Authorization Form allows consumers to request a copy of their credit report. Both forms gather personal information to authenticate the identity of the requester, ensuring secure access to sensitive data.

- Credit Monitoring Consent Form: This document is often required to enroll in credit monitoring services. Like the Annual Credit Report Request Form, it requests personal identifying information. The primary difference lies in the purpose; one provides a static report, while the other enables ongoing account monitoring.

- Dispute Form for Credit Reports: If there are inaccuracies in your credit report, this form allows you to formally dispute those errors. Both documents require specific personal details to identify the consumer. However, the Dispute Form focuses on rectifying issues rather than merely requesting a credit report.

- Identity Theft Report: In the unfortunate event of identity theft, this report can be filed with the Federal Trade Commission. While it aligns with the Annual Credit Report Request Form in terms of collecting personal details, its aim is to initiate recovery procedures for victims, rather than obtaining credit report information.

Dos and Don'ts

When filling out the Annual Credit Report form, it is important to follow specific guidelines to ensure your request is processed efficiently. Here’s a list of dos and don’ts:

- Do provide all required information accurately.

- Do use a black or blue pen.

- Do write in printed capital letters.

- Do ensure your Social Security Number is visible but do not write more than the last four digits if so desired.

- Do double-check your mailing address for freshness and accuracy.

- Don’t omit any information; this can delay your request.

- Don’t staple or tape the form; simply fold it.

- Don’t use pencil or any ink color other than black or blue.

- Don’t leave out previous mailing addresses if you've moved within the last two years.

- Don’t forget to affix the correct postage before mailing.

Following these guidelines will help avoid unnecessary delays and ensure you receive your credit report promptly.

Misconceptions

Understanding the Annual Credit Report can be crucial for managing your financial health. However, there are several misconceptions surrounding the process. Here are ten common misunderstandings:

- All credit reports are the same. Many people believe that their credit report will be identical from all reporting agencies. In reality, each agency may have different information based on the creditors that report to them.

- You can only request your credit report once a year. While you can get one free report per agency each year, you can actually check your report more frequently by staggering requests from each agency.

- Your credit score will be included with the report. The Annual Credit Report does not provide your credit score. You must obtain it separately, often for a fee.

- Your credit report is completely free, no strings attached. While accessing your report through the government-sanctioned website is free, some services may try to upsell credit monitoring or identity theft protection.

- Ordering your credit report will hurt your credit score. This is a myth; checking your credit through annualcreditreport.com is considered a "soft inquiry" and does not affect your score.

- You don't need to verify your identity to receive a report. You must provide personal information to confirm your identity when requesting your credit report. Failure to do so might delay fulfillment.

- Errors on your credit report cannot be corrected. In fact, you have the right to dispute inaccuracies and request a correction from the credit reporting agency.

- Your credit report is permanent. Negative information typically stays on your report for seven years, while bankruptcies may last longer. However, you can improve your report over time.

- It’s unnecessary to check your credit report. Regularly reviewing your credit report is important, as it allows you to catch errors and monitor for signs of identity theft.

- Credit reporting companies are the only source of credit reports. Aside from the three major agencies, there are other services that provide credit reports, but they may charge a fee or not include all the data.

Being informed helps you take control of your financial situation. Clearing up these misconceptions can lead to better credit management and financial planning.

Key takeaways

Key Takeaways for Filling Out the Annual Credit Report Form:

- Each individual is entitled to receive a free credit report annually from all three major credit reporting companies: Equifax, Experian, and TransUnion.

- To obtain the credit report instantly, visit www.annualcreditreport.com or call 877-322-8228 for assistance.

- Complete the form carefully, ensuring that all required information is provided. Missing information can lead to delays in processing your request.

- Use a blue or black pen, and write in printed capital letters to enhance clarity. Avoid touching the sides of the boxes when entering your information.

- When mailing your request, fold the completed form (do not staple or tape), place it in a #10 envelope, and affix the necessary postage.

- Expect to receive your credit report within 15 days of the request being processed. If more information is needed, you will be contacted by mail.

Browse Other Templates

Letter to Tenant to Move Out - The notice establishes a legal basis for moving forward with eviction if needed.

Wells Fargo Beneficiary Form - The form includes fields for the specifics surrounding the security types involved in the request.

Medical Reimbursement Request,OWCP Medical Expense Claim,Claim for Medical Expenses,OWCP Medical Reimbursement Form,Out-of-Pocket Expense Reimbursement,Claim for Medical Payment,Form for Medical Reimbursement,Healthcare Expense Reimbursement Form,OWC - A detailed breakdown of expenses aids in the proper evaluation of the reimbursement request.