Fill Out Your Annual Report Form

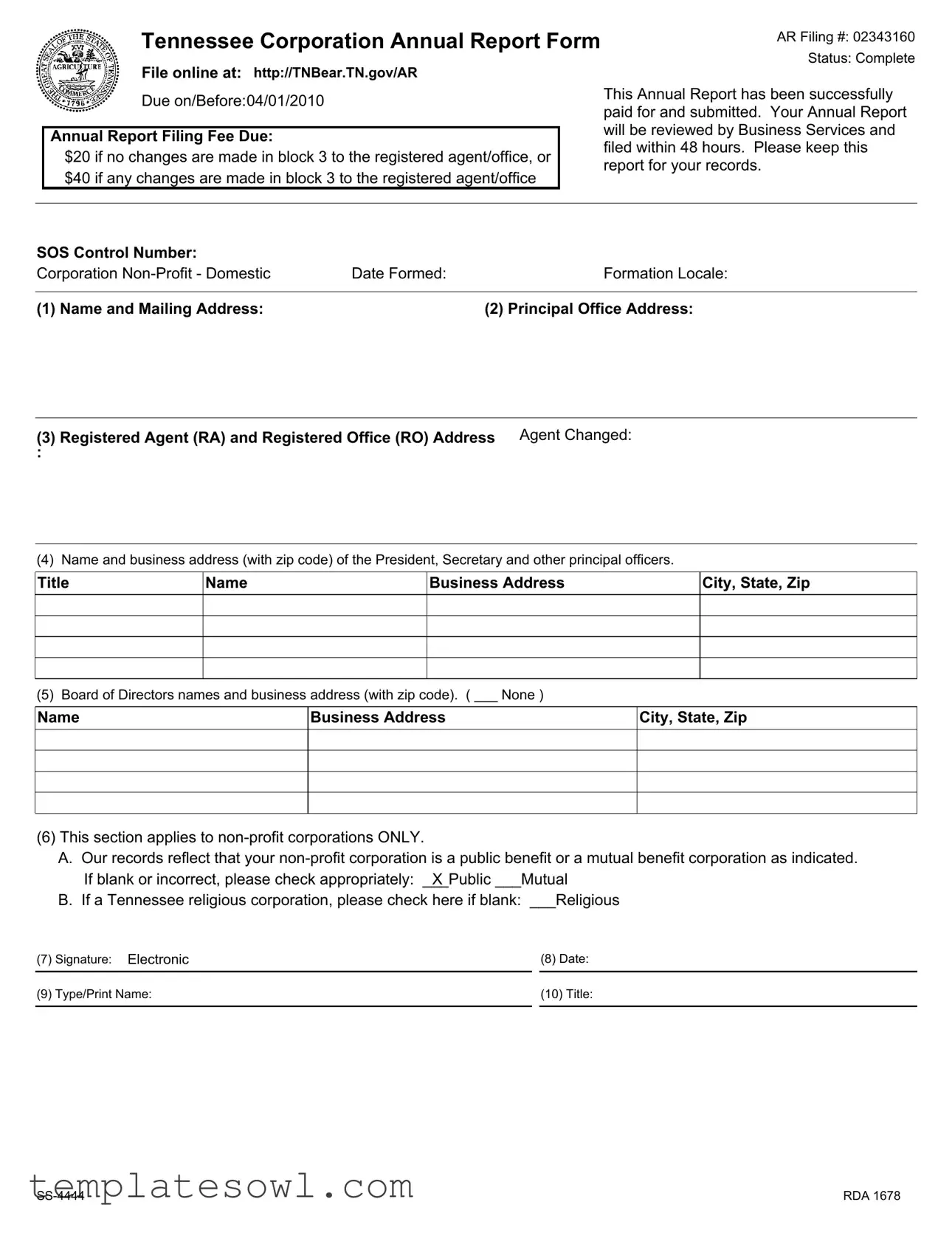

The Annual Report form is an essential document for corporations in Tennessee, specifically for ensuring compliance with state regulations. This report contains crucial information about the corporation, including its filing status, formation details, and key personnel. The filing must be submitted online by the deadline of April 1, 2010. A filing fee is applicable, set at $20 for submissions that do not involve any changes to the registered agent or office, while a fee of $40 is required if such changes have been made. After submission, the report will undergo review by the Business Services department and will be officially filed within 48 hours. It is recommended to retain a copy of the submitted report for personal records. Notably, the form requires details about the corporation's principal officers, board of directors, and registered agent. Non-profit corporations also have specific sections to indicate their classification, whether they are a public benefit or mutual benefit corporation. Compliance with these requirements helps maintain good standing and transparency in the business sector.

Annual Report Example

Tennessee Corporation Annual Report Form |

AR Filing #: 02343160 |

|

Status: Complete |

||

|

||

File online at: http://TNBear.TN.gov/AR |

|

Due on/Before:04/01/2010

Annual Report Filing Fee Due:

$20 if no changes are made in block 3 to the registered agent/office, or $40 if any changes are made in block 3 to the registered agent/office

This Annual Report has been successfully paid for and submitted. Your Annual Report will be reviewed by Business Services and filed within 48 hours. Please keep this report for your records.

SOS Control Number: |

|

|

Corporation |

Date Formed: |

Formation Locale: |

|

|

|

(1) Name and Mailing Address: |

|

(2) Principal Office Address: |

(3) Registered Agent (RA) and Registered Office (RO) Address Agent Changed:

:

(4) Name and business address (with zip code) of the President, Secretary and other principal officers.

Title

Name

Business Address

City, State, Zip

(5) Board of Directors names and business address (with zip code). ( ___ None )

Name

Business Address

City, State, Zip

(6)This section applies to

A.Our records reflect that your

B.If a Tennessee religious corporation, please check here if blank: ___Religious

(7) |

Signature: Electronic |

|

(8) Date: |

|

|

|

|

(9) |

Type/Print Name: |

|

(10) Title: |

|

|

|

|

RDA 1678 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Filing Number | This report has the filing number 02343160. |

| Status | The status of this Annual Report is complete. |

| Online Filing | You can file your report online at TNBear.TN.gov/AR. |

| Due Date | The report is due on or before April 1, 2010. |

| Filing Fee | A fee of $20 applies if there are no changes to the registered agent or office; otherwise, it is $40. |

| Submission Confirmation | The Annual Report has been successfully paid for and submitted. |

| Review Period | Business Services will review and file your report within 48 hours. |

| Record Keeping | It is important to keep a copy of this report for your records. |

| Governing Law | This report is governed by Tennessee state law. |

| Non-Profit Indication | The report includes a section to specify if the corporation is a public or mutual benefit non-profit. |

Guidelines on Utilizing Annual Report

Completing the Annual Report form is a straightforward process that requires attention to detail and careful review. After filling out this form, it will be submitted online, and your information will be processed by Business Services. Typically, your report will be reviewed and filed within 48 hours. Keeping a copy of your report for your records is essential for tracking any future filings or changes.

- Begin by visiting the official filing website: http://TNBear.TN.gov/AR.

- Locate the specific Annual Report form for your corporation.

- Input the Filing Number: 02343160.

- Enter the status of your report, ensuring it is marked as Complete.

- Review the due date for submission, ensuring it is on or before 04/01/2010.

- Determine the filing fee by assessing if any changes were made to the registered agent or address. If there are no changes, enter $20; if changes were made, enter $40.

- Provide information for the following sections:

- Name and Mailing Address.

- Principal Office Address.

- Registered Agent and Registered Office Address.

- If the agent has changed, indicate this accordingly.

- List the names and business addresses of the President, Secretary, and other principal officers in the provided format.

- Fill in the names and business addresses of the Board of Directors, if applicable.

- If your corporation is a non-profit, complete the relevant section, indicating if it is a Public or Mutual benefit corporation. If it is a religious corporation, check the appropriate box.

- Sign the report electronically in the designated section.

- Enter the date of submission in the indicated field.

- Type or print your name in the provided area.

- Fill in your title as required.

What You Should Know About This Form

What is the deadline for filing the Annual Report?

The Annual Report for Tennessee corporations must be filed by April 1 each year. It is crucial to meet this deadline to avoid any potential penalties or issues with your business status. You can file your report online at the specified web address.

What are the fees associated with the Annual Report filing?

The filing fee for the Annual Report is $20 if there are no changes made to block 3, which pertains to the registered agent and registered office. However, if any changes are made in that section, the fee increases to $40. Ensure that you review the required information carefully to avoid unnecessary fees.

How long does it take for the Annual Report to be processed?

Once you submit your Annual Report, it will be reviewed by Business Services. Typically, the process takes no longer than 48 hours. After that, your report will be officially filed, and it is advisable to keep a copy of it for your records.

What information do I need to provide in the Annual Report?

The Annual Report requires information such as the name and mailing address of your corporation, the principal office address, and details regarding your registered agent and registered office. Additionally, the names and business addresses of the president, secretary, other principal officers, and board of directors must be included. If your corporation is a non-profit, there are specific sections that require additional information regarding its classification.

Common mistakes

Filling out the Annual Report form can be a straightforward task, but there are common mistakes that many individuals make that can lead to confusion or delays. One prevalent error is not paying attention to the filing fee. The fee varies based on whether there are changes in block 3 regarding the registered agent or office. If changes are made, a fee of $40 is required, while no changes result in a $20 fee. Failing to include the correct payment can delay the processing of the report.

Another frequent oversight involves the completeness of the provided information. It is essential to ensure that all sections of the form are filled out accurately. Leaving parts blank, especially important details such as the name and address of the registered agent, can lead to complications. Each piece of information helps verify the identity and location of the corporation.

The registered agent section also trips up many. If there is a change in the registered agent or the office address, it is crucial to reflect this accurately in block 3. Failing to update this information can result in legal notifications not being received, which may pose significant issues in the future.

Names of corporate officers and board members should be spelled correctly, along with their business addresses. Incorrect details may lead to misunderstandings or the inability to contact these individuals when necessary. Ensuring accuracy here is vital for maintaining transparency and legality.

Another error to avoid involves the non-profit corporation section. If the corporation is a non-profit, it must be specified correctly as either a public or mutual benefit corporation. Omitting this information or providing incorrect details can result in a rejection of the report.

Additionally, many individuals overlook the signature requirement. Every report must include an electronic signature to validate the submission. A form without a signature will not be processed, requiring further attention to rectify the situation.

Providing the date on which the report is signed is also essential. Inaccurate or missing dates can lead to confusion regarding the timely filing of the Annual Report. This detail is critical to compliance with state regulations.

Lastly, ensuring the type or print name of the person signing the form is essential. This clarity not only helps in identification but also reinforces the legitimacy of the document. Without clear identification, potential issues can arise regarding accountability.

Documents used along the form

The Annual Report form is a key document for corporations in Tennessee, serving as a means to inform the state about the corporation’s status and essential details. Additional documents may be required or used alongside the Annual Report for various purposes related to corporate compliance and governance. Below is a list of other common forms and documents that are often associated with the Annual Report.

- Bylaws: This document outlines the rules and regulations governing the internal management of the corporation. It defines the roles of officers, board members, and the procedures for meetings and decision-making.

- Articles of Incorporation: This form contains fundamental information about the corporation, including its name, duration, purpose, and the number of shares authorized to issue if applicable. It must be filed with the state to legally establish the corporation.

- Board Resolutions: These documents document formal decisions made by the board of directors. They may address various matters such as the approval of significant transactions or changes in corporate policy.

- Corporate Minutes: Minutes serve as the official record of meetings held by the board of directors and shareholders. They capture discussions, decisions made, and attendance details to ensure transparency and compliance.

- Registered Agent Consent Form: This form confirms the acceptance by an individual or business to act as the registered agent for the corporation. It is essential for ensuring that the corporation has a reliable contact for legal and official documents.

- Annual Franchise Tax Return: Depending on the state, this document may be required in addition to the Annual Report. It reports the corporation’s income and is used to calculate state franchise taxes owed.

- Change of Address Form: Should there be any changes in the principal office or registered office address, this form is necessary to update the state’s records accordingly.

- Proof of Insurance: For certain types of corporations, providing proof of necessary insurance policies may be required to demonstrate compliance with legal and regulatory standards.

Each of these documents plays a critical role in maintaining corporate compliance and governance. They ensure that corporations adhere to state regulations and facilitate clear communication with state authorities.

Similar forms

The Annual Report form shares similarities with several other important documents. Each serves a specific purpose in business operations and compliance. Below is a list of similar documents:

- Certificate of Incorporation: This document officially creates a corporation by outlining essential information such as name, purpose, and registered agent.

- Bylaws: These rules govern the internal management of the corporation, detailing the roles of officers and how meetings are conducted.

- Articles of Organization: Similar to the Certificate of Incorporation, this document is used for forming limited liability companies (LLCs) and establishes foundational information.

- State Business License: A legal requirement that allows a business to operate within a particular state, ensuring compliance with local regulations.

- Financial Statements: Essential for transparency, these reports provide a snapshot of a company's financial status, including income and expenses.

- Tax Returns: Documents filed with the IRS providing details on income, deductions, and tax liabilities, necessary for compliance and financial planning.

- Meeting Minutes: Written record of the proceedings and decisions made during a company's meetings, crucial for maintaining corporate transparency.

- Business Renewal Application: Required for renewing a business license, ensuring that the corporation remains compliant with state regulations.

Dos and Don'ts

When filling out the Annual Report form for your Tennessee Corporation, consider the following important points. They will help ensure a smooth and accurate submission process.

- Do: Double-check all entries for accuracy before submitting. Mistakes can lead to delays or additional costs.

- Do: Use the correct filing fee according to whether you have made changes to the registered agent or office. Ensure you pay $20 for no changes and $40 for any changes.

- Do: Keep a copy of your submitted report for your records. This will help you track your filings and serve as proof of compliance.

- Do: Fill in all required fields completely. Incomplete forms may result in rejection or request for additional information.

- Do: Review the deadlines carefully. Submissions must be made before April 1st to avoid penalties.

- Don't: Wait until the last minute to file your report. Allow ample time for any unexpected issues that may arise.

- Don't: Assume all information from previous years is still correct. Verify the details, especially the names and addresses of officers and directors.

- Don't: Ignore the specific requirements for non-profit corporations, if applicable. Ensure you properly check the appropriate boxes.

- Don't: Forget to provide your signature. An unsigned report is considered invalid and will not be accepted.

- Don't: Submit your form via the wrong method. Make sure to file online at the designated website to avoid delays.

Misconceptions

Understanding the Annual Report form can help avoid confusion and ensure compliance. Here are seven common misconceptions about the form, along with clarifications for each one.

- Filing an Annual Report is Optional: Many people believe that submitting an Annual Report is not necessary. In reality, filing is a requirement for maintaining your corporation's good standing in Tennessee.

- Changes to the Registered Agent are Free: Some assume that you can change the registered agent or office without any costs. However, if changes are made to this information, the fee increases to $40 from the standard $20.

- You Can Ignore It Once Submitted: Another misconception is that after submission, the report can be forgotten. It's essential to keep a copy of your report for your records, as you'll need it for future reference.

- Only Corporations Need to File: Some might think that only for-profit corporations have to submit an Annual Report. In fact, non-profit organizations also need to complete this form to stay compliant.

- There Is No Deadline: Some people believe they can file the report anytime during the year. However, the report has a strict due date of April 1st each year.

- All Information Is Automatically Updated: It’s a common belief that once you file the Annual Report, all previously filed information is automatically updated. Changes to the registered agent or principal office must be manually indicated in the designated blocks.

- Payment Guarantees Approval: Finally, some individuals think that simply paying the fee guarantees that their report will be approved. While payment is necessary, the report still must be reviewed and accepted by Business Services.

Being aware of these misconceptions can help ensure your filing process is smooth and compliant with Tennessee regulations. Don’t hesitate to reach out if you have further questions or need assistance.

Key takeaways

Filling out the Annual Report form is an essential task for corporations in Tennessee. Here are some important takeaways to keep in mind:

- Timeliness is key: The Annual Report must be submitted by April 1st each year to avoid penalties.

- Filing fees vary: Ensure you pay $20 if there are no changes to the registered agent or office. A $40 fee applies if changes are made.

- Record retention: Always keep a copy of the submitted Annual Report for your records.

- Completing the form online can save time. Use the designated site: http://TNBear.TN.gov/AR.

- The report will be reviewed and filed within 48 hours after submission.

- Accurate data is crucial. Double-check the names and addresses of the registered agent and office before submitting.

- Include details for all principal officers, such as the President and Secretary, along with their business addresses.

- Non-profit corporations need to specify whether they are a public or mutual benefit corporation.

- Signature fields require an electronic signature for validation. Make sure to type or print your name and include your title.

- Filing an incorrect or incomplete form could lead to delays or additional fees. Take your time and ensure everything is filled out correctly.

Browse Other Templates

File Articles of Incorporation California - The Statement of Dissolution can be a straightforward process if all steps are followed.

Gram Molecular Weight Formula - Empower your study habits with the wealth of resources available online.

Texas Wildlife Exemption - Tax penalties occur if agricultural use is improperly reported after approval.