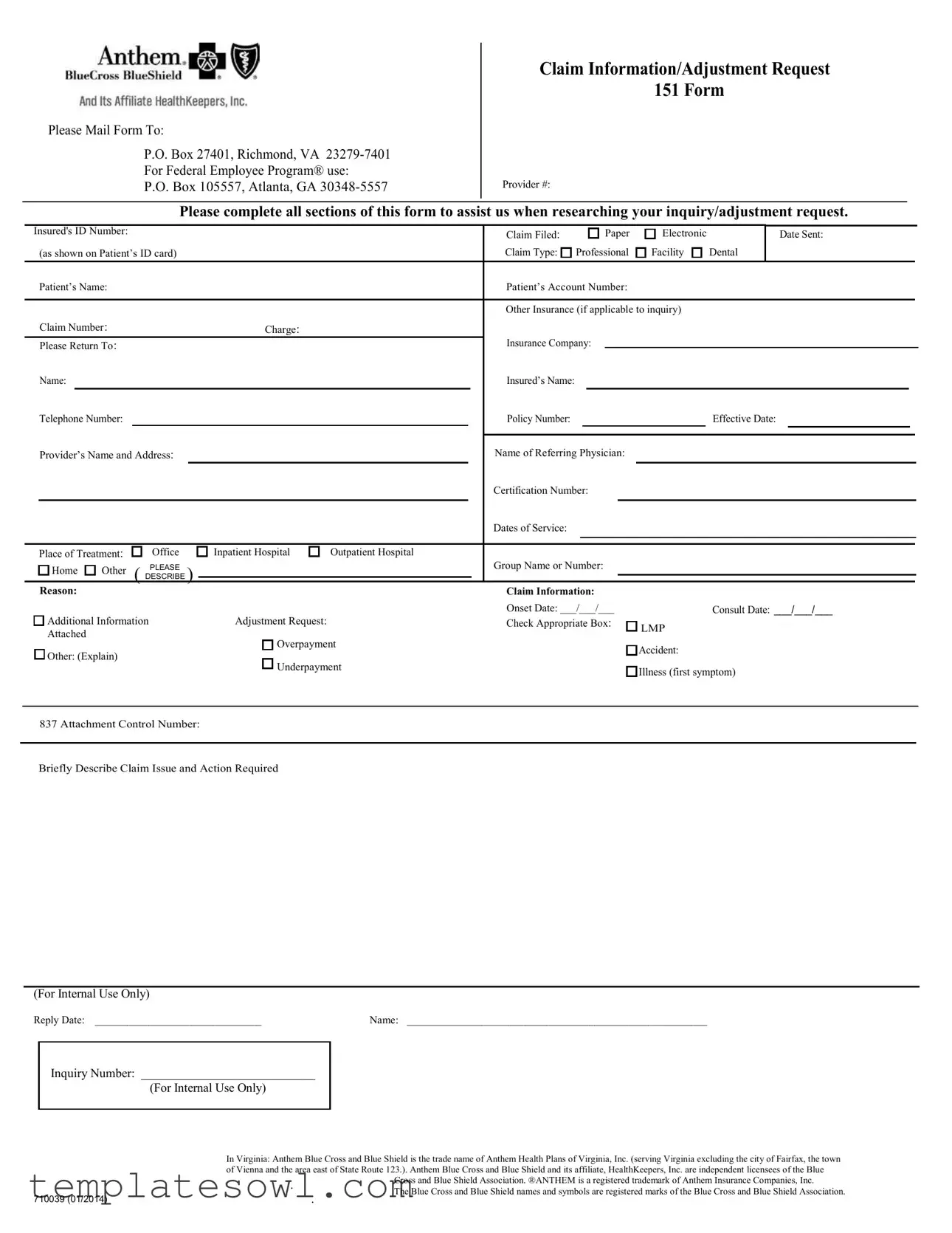

Fill Out Your Anthem 151 Form

The Anthem 151 form serves a critical role in the healthcare system, facilitating effective communication between healthcare providers and insurance companies. This form is specifically designed for submitting claim information and adjustment requests. It requires careful completion of various sections to help expedite the inquiry or adjustment process. Providers must supply crucial details such as their identification number, the insured's ID number, and various dates related to the services rendered. Importantly, the form gathers information regarding the patient, including their name and account number, while also allowing for inputs on any additional insurance coverage, which can impact the claim. Key areas such as reason for adjustment, charge amounts, and the place of treatment must be accurately filled out to ensure a smooth review by the insurance company. For separate claims linked to federal employee programs, specific mailing addresses are provided, and all relevant data, including the dates of service and referring physician, must be neatly organized. It also includes a section for the provider's contact information. Ultimately, the Anthem 151 form is essential for addressing billing discrepancies, ensuring patients receive the coverage and benefits they deserve in an efficient manner.

Anthem 151 Example

Please Mail Form To:

P.O. Box 27401, Richmond, VA

For Federal Employee Program® use:

P.O. Box 105557, Atlanta, GA

Claim Information/Adjustment Request

151 Form

Provider #:

Please complete all sections of this form to assist us when researching your inquiry/adjustment request.

Insured's ID Number: |

|

|

|

|

|

|

Claim Filed: |

|

|

|

|

|

|

Paper |

|

Electronic |

|

Date Sent: |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

(as shown on Patient’s ID card) |

|

|

|

|

Claim Type: |

|

|

Professional |

|

|

Facility |

|

|

|

Dental |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Patient’s Name: |

|

|

|

|

|

|

Patient’s Account Number: |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

Other Insurance (if applicable to inquiry) |

|

|

|

|

|

|||||||||||||||||

|

Claim Number: |

|

|

Charge: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Please Return To: |

|

|

|

|

|

|

Insurance Company: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Name: |

|

|

|

|

|

|

|

|

Insured’s Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Telephone Number: |

|

|

|

|

|

|

Policy Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effective Date: |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Provider’s Name and Address: |

|

|

|

|

|

Name of Referring Physician: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

Certification Number: |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

Dates of Service: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Place of Treatment: |

Office |

Inpatient Hospital |

Outpatient Hospital |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Home |

Other |

PLEASE |

|

|

|

|

Group Name or Number: |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

( DESCRIBE ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Reason: |

|

Additional Information |

Adjustment Request: |

Attached |

|

|

Overpayment |

Other: (Explain) |

|

|

Underpayment |

Claim Information:

Onset Date: ___/___/___

Check Appropriate Box:

Consult Date: ___/___/___

LMP

LMP

Accident:

Illness (first symptom)

837 Attachment Control Number:

Briefly Describe Claim Issue and Action Required

(For Internal Use Only)

Reply Date: _______________________________Name: ________________________________________________________

Inquiry Number: ____________________________

(For Internal Use Only)

|

In Virginia: Anthem Blue Cross and Blue Shield is the trade name of Anthem Health Plans of Virginia, Inc. (serving Virginia excluding the city of Fairfax, the town |

|

|

of Vienna and the area east of State Route 123.). Anthem Blue Cross and Blue Shield and its affiliate, HealthKeepers, Inc. are independent licensees of the Blue |

|

|

. |

Cross and Blue Shield Association. ®ANTHEM is a registered trademark of Anthem Insurance Companies, Inc. |

|

The Blue Cross and Blue Shield names and symbols are registered marks of the Blue Cross and Blue Shield Association. |

|

|

|

|

710039 (01/2014) |

|

. |

Form Characteristics

| Fact Name | Description |

|---|---|

| Mailing Address | Please send the completed form to P.O. Box 27401, Richmond, VA 23279-7401. |

| Federal Employee Program | For claims related to the Federal Employee Program, use P.O. Box 105557, Atlanta, GA 30348-5557. |

| Claim Types | The form allows for submission of different claim types including professional, facility, and dental claims. |

| Required Sections | Each section of the form must be completed to facilitate the inquiry or adjustment request. |

| Insured’s Information | Detailed information such as the insured's ID number and account number is required for processing. |

| Virginia Regulation | Anthem Blue Cross and Blue Shield operates under state regulations of Virginia, specifically Anthem Health Plans of Virginia, Inc. |

| Claim Description | A brief description of the claim issue and required action is necessary for efficient processing. |

Guidelines on Utilizing Anthem 151

Filling out the Anthem 151 form is a process that requires attention to detail. Each section of the form must be completed accurately to ensure that your request is handled efficiently. Below are the steps to guide you through the process of properly filling out the form.

- Mailing Address: Write the appropriate mailing address at the top of the form. For regular claims, use: P.O. Box 27401, Richmond, VA 23279-7401. For Federal Employee Program® claims, use: P.O. Box 105557, Atlanta, GA 30348-5557.

- Claim Information: Fill in the Provider Number, Insured's ID Number, and whether the claim was filed on paper or electronically, including the date sent.

- Claim Type: Indicate whether the claim is for Professional, Facility, or Dental services.

- Patient Details: Enter the Patient’s Name and Account Number. If applicable, include other insurance details.

- Claim Information: Input the Claim Number and charge amount for the services rendered.

- Insurance Company Information: Write the name of the Insurance Company and fill in both the Insured’s Name and the Telephone Number.

- Policy Information: Provide the Policy Number and Effective Date of the insurance policy.

- Provider Identification: Enter the Provider’s Name and Address, and the name of the Referring Physician if applicable.

- Dates of Service: Specify the Dates of Service and the Place of Treatment (choose from the options provided).

- Group Information: Fill in the Group Name or Number, if relevant, and elaborate on the reason for the claim or adjustment request.

- Adjustment Request: Check the appropriate boxes regarding the nature of your inquiry or adjustment request, including Overpayment or Underpayment.

- Onset Date and Consultation Date: Provide the Onset Date and Consult Date for the medical condition or treatment.

- 837 Attachment Control Number: Enter the control number if you have it.

- Claim Issue Description: Briefly describe the claim issue and the action required. Leave space for internal use details such as Reply Date and Inquiry Number.

What You Should Know About This Form

What is the Anthem 151 form?

The Anthem 151 form is a Claim Information/Adjustment Request form used to address inquiries or adjustment requests related to healthcare claims. It helps patients and providers submit necessary information to Anthem for processing claims, adjustments, or inquiries efficiently.

How do I submit the Anthem 151 form?

To submit the Anthem 151 form, complete all required sections and mail it to the appropriate address. For general inquiries, send the form to P.O. Box 27401, Richmond, VA 23279-7401. If you are using the Federal Employee Program®, direct the form to P.O. Box 105557, Atlanta, GA 30348-5557.

What information is required when filling out the form?

When completing the Anthem 151 form, ensure to provide the following: the insured's ID number, claim filed date, type of claim (professional, facility, dental), patient’s name and account number, claim number, charge details, and the insurance company information. Include data about additional insurance if applicable, treating provider details, and a brief description of the claim issue.

What should I do if I need to adjust a claim?

If you need to adjust a claim, clearly indicate the reason for the adjustment on the Anthem 151 form. Options include overpayment, underpayment, or other specified issues. Attach any necessary documentation to support your request and provide additional details as needed.

How long does it take to process the Anthem 151 form?

The processing time for the Anthem 151 form can vary based on the complexity of the claim and the volume of submissions being handled. Typically, expect a response within a few weeks. If you do not hear back within a reasonable timeframe, following up with Anthem is advisable.

Who can I contact for help with the Anthem 151 form?

If you have questions or need assistance with the Anthem 151 form, contact Anthem’s customer service directly at the telephone number provided on your insurance card or on their website. They are equipped to help clarify any steps related to your claim or adjustment request.

Common mistakes

Filling out the Anthem 151 form can seem straightforward, but many individuals often make critical mistakes. One common error is not providing the correct Provider Number. This number is essential for identifying the healthcare provider associated with the claim. If it’s missing or incorrect, it can lead to significant delays in processing your request, which can affect your insurance coverage.

Another frequent mistake involves the Insured’s ID Number. Neglecting to enter this number accurately can halt the claim process. Always double-check this information against your insurance card to ensure it matches perfectly. Even a single incorrect digit can cause problems that are easily avoided with a little attention to detail.

People sometimes fail to indicate the Claim Type clearly. There are different categories such as Professional, Facility, or Dental. Selecting the wrong type can lead to the claim being sent to the incorrect department, which can further delay resolution. Make sure to mark the appropriate box and ensure it aligns with the type of services received.

Dates are another area where mistakes commonly occur. Whether it’s the Onset Date, Consult Date, or Dates of Service, providing accurate and consistent dates is crucial. Inconsistencies or errors can raise red flags in processing, leading to inquiries and potential rejection of your claim.

Providing insufficient Additional Information is also a common misstep. If your claim requires special explanation, this section is your opportunity to clarify any nuances related to your situation. The more information you provide, the easier it will be for the claims team to assess your request comprehensively.

Another mistake involves omitting the Claim Number if it’s applicable. This number links your previous claims or inquiries, helping to streamline the process. Make sure not to overlook this important detail, as it can help avoid duplication and clarify issues more effectively.

Often, people do not specify the Reason for their claim adjustment. It is essential to explain precisely why you are requesting an adjustment. Whether it’s due to an overpayment or underpayment, being clear about your reason provides context that can expedite the review process.

Finally, individuals sometimes fail to review the entire form before mailing. Taking a moment to ensure all fields are filled out properly can save substantial time and frustration later on. Verifying every detail can make all the difference in ensuring a smooth claims experience.

Documents used along the form

The Anthem 151 form is an important document used when submitting claims or adjustment requests related to health insurance. However, it is often used in conjunction with various other forms and documents that can provide clarity and support for your claim. Below is a list of commonly used forms that may accompany the Anthem 151 form, each serving a specific purpose in the claims process.

- CMS-1500 Form: This is the standard claim form used by healthcare providers to bill Medicare and many health insurers. It captures essential information about the patient, the services provided, and the insurance details. If you are submitting services rendered in a professional setting, this form is typically required.

- UB-04 Form: For facility claims, the UB-04 form is essential. It is used by hospitals and other facility providers to request reimbursement for services. This form details everything from demographic information to specific charges for services and treatments provided during a patient’s stay.

- Secondary Insurance Claim Form: If the patient has additional insurance coverage, the secondary insurance claim form is used to seek reimbursement after the primary insurer has processed the claim. This form helps to outline what has been paid by the primary insurer and details the remaining balance that is now the responsibility of the secondary insurer.

- Medical Records Release Form: This form authorizes healthcare providers to release medical records to the insurance company or relevant parties for processing claims. It is crucial when the insurer needs additional information to adjudicate a claim or inquiry related to medical necessity.

- Provider Authorization Request: Sometimes, a prior authorization is needed before certain medical services or procedures. This form is used to request approval from the insurance company to confirm coverage for specific services before they are rendered.

- Patient Responsibility Statement: This document outlines the patient's share of costs for the services received, including deductibles, copayments, and any non-covered services. It can be helpful in clarifying to both the provider and patient the financial responsibilities that fall outside of what the insurance will cover.

Understanding these forms can streamline your claims process and ensure you have all necessary documentation ready for submission. Each document plays a specific role and, when used together with the Anthem 151 form, facilitates a smoother interaction with your insurance provider. Always ensure that you have the most current versions of these forms and that they are filled out accurately to avoid delays in processing your claim.

Similar forms

The Anthem 151 form is a vital document used for various purposes related to claim submissions and inquiry adjustments. Several other documents share similar functionalities and are often utilized within the health insurance system. Here are five documents that are akin to the Anthem 151 form:

- CMS-1500 Form: This is a standard form used by healthcare providers to bill Medicare and other health insurers. Just like the Anthem 151 form, it captures essential patient and claim information required for reimbursement processing.

- UB-04 Form: Mainly used by facilities like hospitals, the UB-04 captures patient information and billing details. Similar to the Anthem 151, it serves as a critical tool for claims submission but is tailored specifically for institutional claims.

- Claim Adjustment Reason Codes (CARC): This set of codes helps identify reasons for claim adjustments. Like the Anthem 151 form, these codes provide clarity on claim issues and facilitate communication between providers and insurers.

- Health Insurance Claim Form (HICF): Used not only for billing but also for tracking claims status, this form aligns closely with the Anthem 151 in gathering comprehensive information about claims and patient data.

- Request for Reconsideration Form: This document is used when providers wish to contest a claim decision. Similar to the Anthem 151 form, it requires detailed information about the original claim and the basis for reconsideration.

Dos and Don'ts

When filling out the Anthem 151 form, attention to detail is crucial. Here are seven things to keep in mind that will help ensure your form is completed correctly.

- Do read the instructions carefully before starting. Understanding what is required will save time and reduce errors.

- Do provide accurate information for each section of the form. Double-check names, dates, and numbers.

- Do include all necessary attachments. If you're requesting an adjustment, support your request with relevant documentation.

- Do ensure that the Claim Type is selected correctly. This detail can impact the processing of your claim.

- Don't leave any sections blank. Completing every part ensures a smoother review process.

- Don't forget to sign and date the form. Without your signature, the submission may be considered incomplete.

- Don't use correction fluid or erasers on the form. Errors should be crossed out neatly instead to maintain clarity.

Following these tips can help streamline your experience and improve the chances of a successful outcome with your Anthem 151 form submission.

Misconceptions

Misconceptions about the Anthem 151 form can lead to confusion and delays in processing claims. Below are four common misconceptions explained:

- All sections must be filled out for every claim. Some sections are only necessary based on the type of claim being submitted. Not all fields are mandatory for every situation.

- The form can only be submitted by healthcare providers. Patients or insured individuals can also submit the form if they are addressing issues related to their claims.

- Only paper submissions are accepted. Electronic submissions are allowed as long as all required information is accurately completed and transmitted.

- This form is only for medical claims. The Anthem 151 form can be used for various types of claims, not limited to medical services. It can also cover dental and facility claims.

Key takeaways

Here are key takeaways regarding the completion and use of the Anthem 151 form:

- Ensure to mail the completed form to the appropriate address based on your needs.

- For Federal Employee Program inquiries, use the designated P.O. Box in Atlanta.

- Complete all sections of the form to facilitate a thorough review of your request.

- Be sure to include the insured's ID number, as well as the claim number if available.

- Specify the type of claim, such as Professional, Facility, or Dental.

- Provide accurate charge information to avoid delays.

- Include additional insurance details if applicable.

- Clearly state your reason for the adjustment request, elaborating if necessary.

- Attach any relevant documents that may support your claim or request.

- Make a note of important dates, such as the date the claim was filed and dates of service.

Following these guidelines will lead to a smoother process and help you receive timely responses.

Browse Other Templates

Submit a Claim - Keep copies of submitted documents for your records.

Sba Form 2289 - Equal opportunity provisions must be posted visibly for employees and applicants in relation to the loan use.

Metro Mobility Bus - Be prepared to discuss your travel capabilities and any assistive devices you may use during the evaluation.