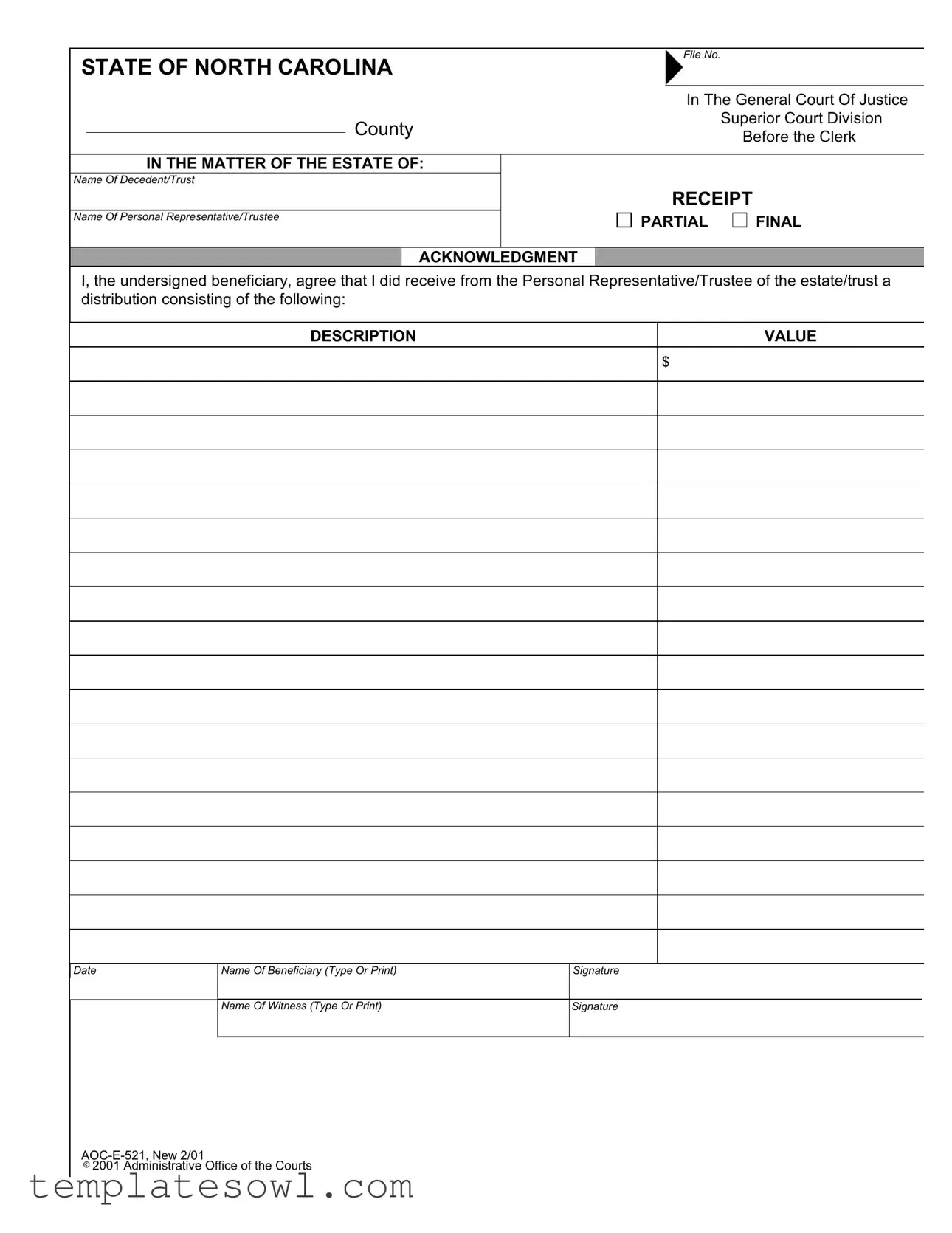

Fill Out Your Aoc E 521 Form

The AOC E 521 form is a vital document used in the estate management process in North Carolina. This form plays a key role in acknowledging the distribution received by beneficiaries from a decedent's estate or a trust. Specifically, it captures essential details such as the name of the decedent or trust, the personal representative or trustee, and the items received by the beneficiary along with their respective values. Beneficiaries must provide their names and signatures to confirm receipt of the distribution, ensuring that all parties are in agreement regarding the assets allocated. Additionally, the form requires the signature of a witness, which adds a layer of verification to the process. The use of this form helps maintain clear records of asset distribution and supports the legal formalities associated with estate and trust management.

Aoc E 521 Example

STATE OF NORTH CAROLINA

County

File No.

In The General Court Of Justice

Superior Court Division

Before the Clerk

IN THE MATTER OF THE ESTATE OF:

Name Of Decedent/Trust

Name Of Personal Representative/Trustee

RECEIPT

PARTIAL

PARTIAL  FINAL

FINAL

ACKNOWLEDGMENT

I, the undersigned beneficiary, agree that I did receive from the Personal Representative/Trustee of the estate/trust a distribution consisting of the following:

DESCRIPTION |

VALUE |

$

Date

Name Of Beneficiary (Type Or Print) |

Signature |

|

|

|

|

Name Of Witness (Type Or Print) |

Signature |

|

|

|

|

2001 Administrative Office of the Courts

2001 Administrative Office of the Courts

Form Characteristics

| Fact Name | Description |

|---|---|

| Document Title | AOC E 521 is the official form used for receipts related to distributions from an estate or trust in North Carolina. |

| Governing Law | This form is governed by the North Carolina General Statutes, specifically Chapter 28A related to probate and estate administration. |

| Purpose | The form serves to document the receipt of a distribution by a beneficiary from a personal representative or trustee. |

| Form Requirements | It must contain the decedent's name, the personal representative's name, and a detailed description of the distribution. |

| Beneficiary Details | Information on the beneficiary, including their typed or printed name and signature, is required for validation. |

| Witness Signature | The form mandates a witness signature alongside the beneficiary's to ensure its legal authenticity. |

| Date of Distribution | The date when the distribution was received must be clearly indicated on the form. |

| Form Version | The form is designated AOC-E-521, with the latest revision indicated as 2/01 in the year 2001. |

Guidelines on Utilizing Aoc E 521

To fill out the AOC E 521 form, follow these steps carefully to ensure all necessary information is provided correctly.

- Begin by entering the STATE OF NORTH CAROLINA at the top of the form.

- Fill in the County where the estate is being administered.

- Write the File No. assigned to the estate.

- Indicate the General Court of Justice Superior Court Division on the form.

- In the section labeled IN THE MATTER OF THE ESTATE OF:, type or print the Name of Decedent/Trust.

- Next, fill in the Name of Personal Representative/Trustee.

- For the RECEIPT PARTIAL FINAL ACKNOWLEDGMENT, write your name as the Name of Beneficiary in the appropriate space.

- Specify the DESCRIPTION of the distribution you received.

- Fill in the VALUE of the distribution.

- Enter the Date you received this distribution.

- Type or print your name in the Name of Beneficiary section once again, if required.

- Sign the form in the Signature space for the beneficiary.

- Type or print the name of a witness in the designated area labeled Name of Witness.

- Finally, have the witness sign the form in the Signature space for the witness.

After completing the form, make sure to double-check all entries for accuracy before submitting it to the appropriate court office.

What You Should Know About This Form

What is the AOC E 521 form?

The AOC E 521 form is a legal document used in the state of North Carolina within the Superior Court Division. It serves as a receipt and acknowledgment for beneficiaries of an estate or trust, confirming the distribution they have received from the Personal Representative or Trustee. This form is crucial for maintaining clear records and ensuring a transparent process in estate management.

Who should use the AOC E 521 form?

This form is utilized by beneficiaries who have received a distribution from the estate or trust of a decedent. If you are a beneficiary and have received assets—whether cash, property, or other items—you should complete and sign this form to acknowledge receipt formally. The Personal Representative or Trustee also has a role in providing this documentation.

What information is required on the AOC E 521 form?

The form requires specific information to properly identify both the beneficiary and the estate or trust involved. Key details include the name of the decedent or trust, the name of the Personal Representative or Trustee, a description of the distribution received, its value, and the date of distribution. Additionally, both the beneficiary and a witness must sign the document to validate it.

Why is it important to complete the AOC E 521 form?

Completing the AOC E 521 form serves several important purposes. First, it provides legal protection for both the beneficiary and the estate, showing that the beneficiary has received their entitled portion. Second, it contributes to the proper accounting of estate assets, which is essential for the administration process. Lastly, having a signed acknowledgment helps prevent future disputes regarding the distribution of assets.

Is there a deadline for submitting the AOC E 521 form?

While there is no set deadline for submitting the AOC E 521 form, it is advisable to complete it as soon as you receive your distribution. This will help ensure that records are updated promptly and any potential misunderstandings regarding distributions are minimized. Always check with your estate administrator or legal advisor for guidance tailored to your specific situation.

Can the AOC E 521 form be modified?

Generally, the AOC E 521 form should not be modified, as it is a standardized form provided by the Administrative Office of the Courts. Making changes might invalidate the document or create confusion about the nature of the acknowledgment. If you believe modifications are necessary, consult with a legal professional to explore your options.

What happens if a beneficiary refuses to sign the AOC E 521 form?

If a beneficiary refuses to sign the AOC E 521 form, it can pose challenges for the Personal Representative or Trustee in documenting distributions. Without the acknowledgment, there may be uncertainty about whether the distribution was made. It is often advisable to address any concerns the beneficiary has directly and explore the reasons behind their refusal. Seeking legal counsel may also be beneficial in such cases.

How can I obtain an AOC E 521 form?

The AOC E 521 form can be obtained from the North Carolina Administrative Office of the Courts website or directly from the Clerk of Court's office in your county. It is available as a downloadable file, making it easy to access and print. If you face any challenges in locating the form, the Clerk’s office can assist you in acquiring it.

What should I do with the AOC E 521 form after it is completed?

Once the AOC E 521 form is completed and signed by both the beneficiary and a witness, it should be retained for your records. It is also recommended that a copy be provided to the Personal Representative or Trustee. This ensures all parties have proper documentation of the distribution. In addition, keeping a copy may help in case future questions arise regarding the estate's administration.

Common mistakes

When completing the AOC E-521 form, it is common for individuals to make a variety of mistakes that can affect the processing of the document. One frequent issue involves incomplete information. Essentials like the names of the decedent, personal representative, and the beneficiary should be clear and complete. Omitting any of these critical details can lead to delays or complications in the estate distribution process.

Another mistake often seen is the use of incorrect values in the distribution section. Beneficiaries sometimes underestimate or overestimate the value of the assets received, which can cause confusion later. It is vital to ensure that the values listed are accurate and reflect the current worth of the items distributed.

Moreover, individuals frequently neglect the date of receipt. This date is an essential component of the form; it establishes when the beneficiary accepted the distribution. Without this date, the form may be considered incomplete and could potentially invalidate the acknowledgment of receipt.

Signature errors also occur. Beneficiaries might overlook the need for witness signatures. If a witness is required, not having one can complicate the verification process. Ensure both the beneficiary and a witness sign the document as necessary.

Many beneficiaries mistakenly think that typing their names is sufficient, disregarding the necessity of actual signatures. Handwritten signatures are crucial as they authenticate the acceptance of the distribution. Therefore, ensuring the signatures are completed in ink is essential for validity.

In addition, individuals often fail to review the form thoroughly before submission. This lack of diligence can lead to overlooked errors that might have been corrected with a careful review. Taking the time to read through the entire form can greatly increase the likelihood of a smooth processing experience.

Another common mishap involves alterations on the form. Striking through text or making changes can cause confusion and may not be accepted. It is advisable to fill out the form carefully and start anew if a mistake is made.

Lastly, some individuals misunderstand the significance of notarization. While a witness might suffice for some, certain cases require notarization to validate the forms further. Familiarizing oneself with the requirements beforehand can help avoid confusion and ensure compliance with legal standards.

Documents used along the form

The AOC E 521 form is commonly used in the context of estate distribution in North Carolina. To complement this form, several other documents may be required or beneficial during the estate settlement process. Here is a list of commonly associated forms and documents:

- Form AOC E-505: This is the Application for Appointment of Personal Representative. This form initiates the process for an individual to be appointed as the personal representative of a decedent's estate. It outlines necessary details about the deceased and the proposed representative.

- Form AOC E-506: The Letters of Administration. Once a personal representative is appointed, these letters provide them the legal authority to manage the estate, facilitating the distribution of assets according to the will or state law.

- Form AOC E-513: This document serves as the Inventory of the Estate. It lists all assets owned by the decedent, providing a comprehensive account of what will be distributed to the beneficiaries.

- Form AOC E-518: This is the Affidavit of Collection of Personal Property. It simplifies the process for small estates, allowing beneficiaries or heirs to collect personal property directly without formal probate proceedings.

- Form AOC E-519: The Final Account filed by the personal representative details the financial activities of the estate, including distributions made and expenses incurred during the administration of the estate.

- Form AOC E-523: This is the Certificate of Service of Notice to Interested Parties. It confirms that all interested parties have been informed about significant actions regarding the estate, ensuring transparency in the process.

- Last Will and Testament: If available, this legal document outlines the wishes of the deceased, including asset distribution and appointment of guardians for minors, playing a crucial role in guiding the personal representative.

- Trust Documents: In cases where the estate is held in a trust, the documents establishing the trust will detail the terms and beneficiaries, guiding the distribution of the trust's assets.

- Tax Documents: The decedent's final income tax returns and any estate tax filings are essential for compliance with tax obligations, potentially affecting the net value of the estate available for distribution.

Each of these forms and documents plays a significant role in the estate administration process. Together, they help ensure that the distribution of assets is conducted lawfully and fairly, respecting the wishes of the deceased and providing clarity to all parties involved.

Similar forms

-

AOC E-522: This form is a similar document used for the acknowledgment of distribution in estate matters. Like the AOC E-521, it requires beneficiary details and provides a comprehensive description of the distributed assets.

-

AOC E-523: This document serves to record the distribution of specific assets during the settlement of an estate. It mirrors the AOC E-521 in functionality, providing a means for beneficiaries to formally acknowledge receiving their portion of the estate.

-

AOC E-524: Used to confirm final distributions, the AOC E-524 addresses the fulfillment of all estate obligations. Much like the AOC E-521, it requires beneficiary signatures to validate the transfer of assets.

-

AOC E-525: This form documents the distribution of assets at an interim stage in the estate settlement process. Its role is similar to that of the AOC E-521, as both facilitate transparency and record-keeping regarding beneficiary distributions.

-

AOC G-190: This document is often used in guardianship cases to acknowledge the receipt of funds or assets by a ward. The AOC G-190 aligns with the AOC E-521 in that it captures beneficiaries' acknowledgment of their received assets, ensuring proper documentation.

Dos and Don'ts

When completing the AOC E 521 form, it is essential to be accurate and thorough. Here are seven important tips to guide you through the process:

- Do ensure all names are spelled correctly, including the decedent and the beneficiary.

- Don't leave any blank spaces. If a section does not apply, indicate that with "N/A" instead of leaving it empty.

- Do double-check the value of the distribution to ensure it is accurate.

- Don't forget to sign both the beneficiary and witness sections. Signatures are crucial for the validity of the document.

- Do include the date of the distribution to provide a clear timeline of events.

- Don't overlook the importance of having a qualified witness sign the form if required.

- Do read through the completed form carefully to catch any mistakes before submitting it.

Following these tips can help ensure that your filing is smooth and compliant with the requirements.

Misconceptions

Many people hold misconceptions about the Aoc E 521 form, leading to confusion in legal matters related to estate distribution. Here are four common misconceptions clarified:

- Misconception 1: The Aoc E 521 form is only for final distributions.

- Misconception 2: Only the estate’s personal representative can fill out this form.

- Misconception 3: The Aoc E 521 form is not legally binding.

- Misconception 4: Witness signatures are optional on the Aoc E 521 form.

This form can be used for both partial and final distributions, making it a versatile tool for beneficiaries. Whether you’re receiving an entire inheritance or just part of it, this form is relevant.

While the personal representative or trustee will typically handle the form, beneficiaries have an important role. They must acknowledge receipt of their distribution by signing the form.

In reality, this form serves as a legal acknowledgment of what has been received from the estate or trust. It solidifies the transaction and can protect both the beneficiary and the estate from future disputes.

While it may not always be strictly required, having a witness signature is advisable. It adds an extra layer of verification and can strengthen the credibility of the document in legal situations.

Key takeaways

Here are four key takeaways regarding the Aoc E 521 form:

- The form is used in North Carolina to acknowledge the receipt of distributions from a decedent's estate or trust.

- Beneficiaries must provide their name, signature, and details about the distribution they received, which includes a description and its value.

- A witness must also sign the form to validate the acknowledgment, ensuring that the process is transparent.

- The completed form should be filed in conjunction with the estate or trust proceedings, as it plays a critical role in documenting financial transactions.

Browse Other Templates

How to Stop Unemployment Garnishment - The use of the form helps facilitate the update process across different state departments.

Mass Accident Report - The form ensures that all relevant crash information is properly recorded.

Va Application 10-2850c - Applicants must answer questions regarding any disciplinary actions on licenses.