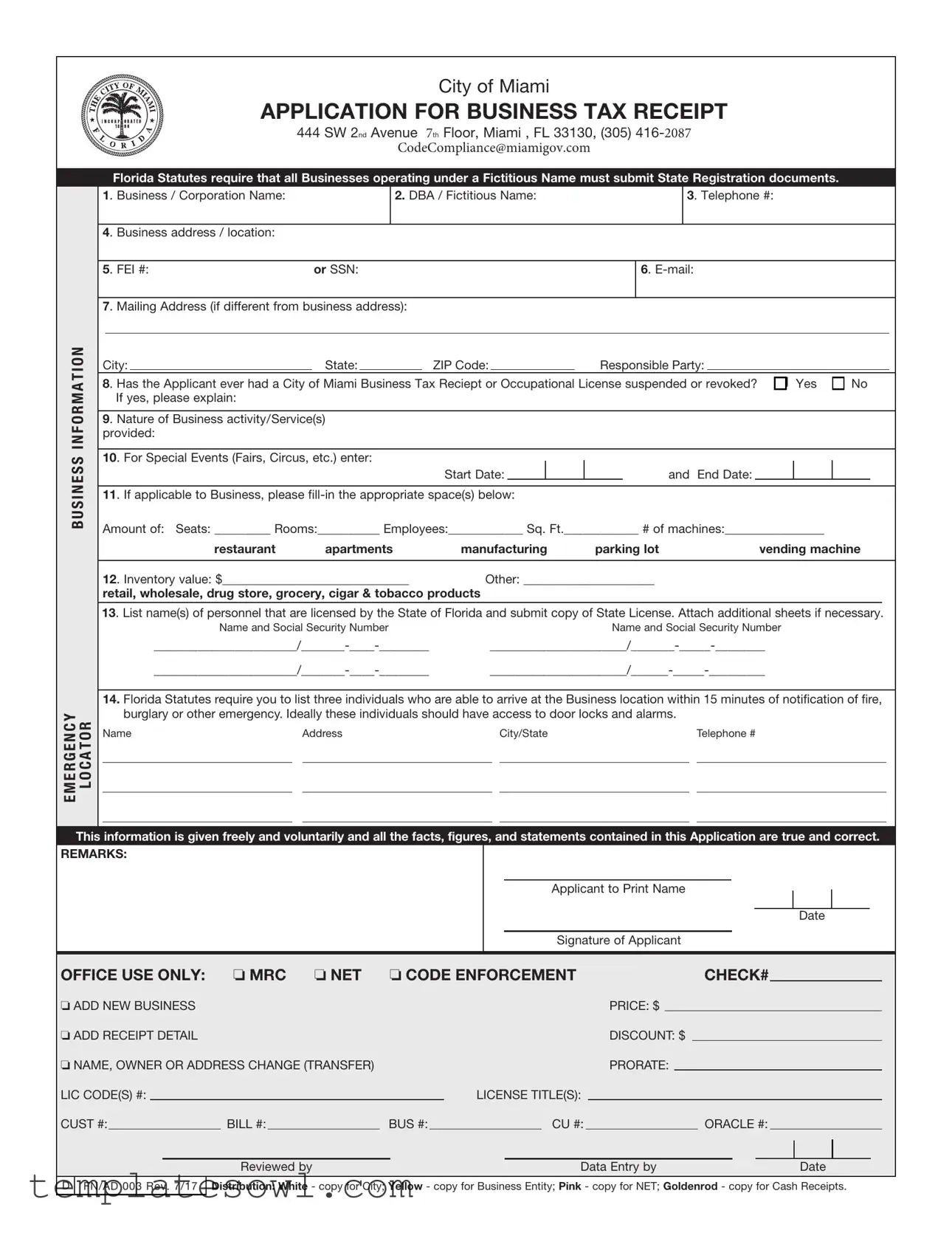

Fill Out Your Application For Business Tax Receipt Form

The Application for Business Tax Receipt form is a crucial document for operating a business in Miami. This form is required by Florida Statutes for all businesses using a fictitious name and must be completed accurately to ensure compliance with local regulations. Key sections of the form include basic business information, such as the business name, the owner’s contact numbers, and the physical business address. Applicants must also provide their federal employer identification number or social security number, along with an email address for correspondence. It's important to disclose whether the applicant has previously had a business tax receipt suspended or revoked, as this information plays a role in the approval process. Additionally, the form asks for details about the nature of the business and any special events being conducted. For certain business types, such as restaurants or retail establishments, there are specific requirements regarding capacity and inventory value. Furthermore, the application mandates that businesses list three emergency contacts who can respond promptly to alerts. Accurate and honest completion of all sections ensures a smoother application process and adherence to city regulations.

Application For Business Tax Receipt Example

City of Miami

APPLICATION FOR BUSINESS TAX RECEIPT

444 SW 2nd Avenue 7th Floor, Miami , FL 33130, (305)

CodeCompliance@miamigov.com

B U S I N E S S I N F O R M A T I O N

E M E R G E N C Y L O C A T O R

Florida Statutes require that all Businesses operating under a Fictitious Name must submit State Registration documents.

1. Business / Corporation Name: |

|

|

2. DBA / Fictitious Name: |

|

|

|

3. Telephone #: |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. Business address / location: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. FEI #: |

or SSN: |

|

|

|

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. Mailing Address (if different from business address): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

City: |

|

State: |

|

ZIP Code: |

|

|

Responsible Party: |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

|||||||||||||||||||

8. Has the Applicant ever had a City of Miami Business Tax Reciept or Occupational License suspended or revoked? |

|

r |

r |

|||||||||||||||||||||

|

If yes, please explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Nature of Business activity/Service(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

provided: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. For Special Events (Fairs, Circus, etc.) enter: |

Start Date: |

|

|

|

|

|

and End Date: |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. If applicable to Business, please |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Amount of: Seats: _________ Rooms:__________ Employees:____________ Sq. Ft.____________ # of machines:________________ |

||||||||||||||||||||||||

|

|

restaurant |

apartments |

manufacturing |

parking lot |

vending machine |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. Inventory value: $______________________________ |

Other: _____________________ |

|

|

|

|

|

|

|

|

|||||||||||||||

retail, wholesale, drug store, grocery, cigar & tobacco products |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

13. List name(s) of personnel that are licensed by the State of Florida and submit copy of State License. Attach additional sheets if necessary.

Name and Social Security Number |

Name and Social Security Number |

14.Florida Statutes require you to list three individuals who are able to arrive at the Business location within 15 minutes of notification of fire, burglary or other emergency. Ideally these individuals should have access to door locks and alarms.

Name |

Address |

|

City/State |

Telephone # |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This information is given freely and voluntarily and all the facts, figures, and statements contained in this Application are true and correct.

REMARKS:

Applicant to Print Name

Date

Signature of Applicant

OFFICE USE ONLY: o MRC o NET o CODE ENFORCEMENT |

|

|

|

CHECK# |

|

o ADD NEW BUSINESS |

PRICE: $ |

|

|

|

|

o ADD RECEIPT DETAIL |

DISCOUNT: $ |

|

|

||

o NAME, OWNER OR ADDRESS CHANGE (TRANSFER) |

PRORATE: |

|

|

||

LIC CODE(S) #: |

|

|

|

|

|

|

|

LICENSE TITLE(S): |

|

|

|

|

|

|

|

|

|

||||||

CUST #: |

|

|

BILL #: |

|

BUS #: |

|

|

|

CU #: |

|

ORACLE #: |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reviewed by |

|

|

|

|

|

Data Entry by |

|

|

|

|

Date |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

D |

FN/AD 003 Rev. 7/17 |

Distribution: White - copy for City; Yellow - copy for Business Entity; Pink - copy for NET; Goldenrod - copy for Cash Receipts. |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Location | The Application for Business Tax Receipt can be submitted at the City of Miami office located at 444 SW 2nd Avenue, 7th Floor, Miami, FL 33130. |

| Contact Information | For assistance, businesses can call (305) 416-2087 or email CodeCompliance@miamigov.com. |

| Fictitious Name Requirement | Florida Statutes mandate that businesses operating under a fictitious name submit necessary registration documents. |

| Emergency Contact | Applicants must provide names and contact information for three individuals who can respond to emergencies within 15 minutes. |

| Statement of Truth | Applicants certify that all information provided in the application is true and correct, given freely and voluntarily. |

Guidelines on Utilizing Application For Business Tax Receipt

Completing the Application for Business Tax Receipt is essential for businesses operating in Miami. To ensure the process goes smoothly, follow these precise steps for filling out the form correctly.

- Obtain the Application for Business Tax Receipt form from the City of Miami's official website or local office.

- Provide the Business / Corporation Name in the designated field.

- If applicable, include the DBA / Fictitious Name.

- Enter a valid Telephone Number where the business can be reached.

- Fill out the Business Address / Location with street address, city, state, and ZIP code.

- Write the FEI Number or Social Security Number (SSN) of the business owner.

- Input the E-mail address for communication purposes.

- If the mailing address differs from the business address, fill in the Mailing Address section.

- Indicate if you are the Responsible Party by checking “Yes” or “No”.

- Answer whether the applicant has ever had a business tax receipt or occupational license suspended or revoked. If “Yes,” provide an explanation.

- Describe the Nature of Business Activity/Service(s) Provided.

- If your business involves special events, enter the respective Start Date and End Date.

- If applicable, enter the amounts for Seats, Rooms, Employees, Square Feet, and Number of Machines.

- Provide the Inventory Value and complete the Other section if relevant.

- List the names and social security numbers of personnel licensed by the State of Florida. Attach additional sheets if necessary.

- List three individuals who can respond to emergencies at the business location with their Name, Address, City/State, and Telephone Number.

- Sign and print your Name on the form and add the Date of completion.

Once you have carefully filled out the form, you'll need to submit it along with any required documentation to the designated office. Keep a copy for your records. Ensure all information is accurate before submission, as errors can delay processing.

What You Should Know About This Form

What is the purpose of the Application For Business Tax Receipt?

The Application For Business Tax Receipt serves as a formal request to the City of Miami for permission to operate a business within its jurisdiction. This receipt acts as a license, ensuring that businesses comply with local regulations. It helps local authorities keep track of businesses and their activities, thus promoting accountability and transparency. The form collects essential information about the business, including its name, location, and nature of operations. In addition, it verifies that the business has met state requirements, especially for those operating under a fictitious name.

Who needs to submit this application?

Any person or entity wishing to engage in business activities in the City of Miami must submit the Application For Business Tax Receipt. This includes sole proprietors, partnerships, corporations, and other business structures. Specifically, businesses that utilize a fictitious name must also provide state registration documents. It is crucial for entrepreneurs to comply with this requirement before commencing operations to avoid legal issues. Failure to obtain a tax receipt could result in fines or restrictions on business operations.

What information is required on the form?

The application requests a variety of information crucial for assessing the business's legitimacy. Applicants must provide details such as the official business name, any fictitious names used, and contact information. Additionally, it asks for the business address and any state-issued licenses held by personnel. This form also collects information about business activities, the nature of services offered, and emergency contacts who can respond swiftly to situations at the business location. Properly completing all sections is essential to prevent delays in processing the application.

What happens after submitting the application?

Once submitted, the application undergoes a review process by the City of Miami. The relevant departments will assess the information provided to ensure compliance with local laws. If everything is in order, the applicant will receive a business tax receipt, allowing the business to operate legally. If there are issues or discrepancies, the applicant may be contacted for clarification or additional information. It is advisable for business owners to keep a copy of the application and any correspondence for their records.

Common mistakes

Filling out the Application For Business Tax Receipt form is essential for any business operating in Miami. However, many applicants make common mistakes that can delay the process or lead to unnecessary complications. One frequent mistake is providing inaccurate information. It’s crucial to double-check that the business name and address are correct and consistent throughout the application. Ensure the DBA, if applicable, matches exactly with the business’s registered name.

Another common error is leaving out important contact information. The application requires a phone number and email address. If these fields are incomplete or illegible, this can hinder communication. Make sure to write clearly and include current information, so that the city can reach you without difficulty.

Some applicants neglect to provide the required documentation, such as State Registration documents for businesses using a fictitious name. Florida Statutes mandate that these documents be submitted. Failing to attach the necessary paperwork can lead to delays or even denial of the application. It’s wise to gather all required documents before starting the form to streamline the process.

Many people forget to answer all questions thoroughly. Questions like past suspensions or revocations of a Business Tax Receipt are important. If your answer is 'yes,' be sure to provide an explanation. Omitting details can cause the application to be flagged for review or rejected. Transparency is essential for a smooth application process.

Another mistake is overlooking the section for emergency contacts. Florida law requires listing three individuals who can reach the business location quickly in case of an emergency. Carefully consider who is best suited for this task, and provide accurate contact information. This requirement ensures that the local authorities can reach someone promptly if needed.

In addition, applicants often fail to specify their nature of business activity or services provided. This section is critical for the city to understand what type of business is being conducted. Always be specific and detailed when describing the business activities, as this can impact the type of license issued.

Finally, procrastination can lead to errors as well. Submitting the application close to deadlines can create unnecessary stress. Take the time to review the entire form carefully, ensuring all details are filled out correctly. Making hasty decisions might result in missed information or mistakes that could be easily avoided with a little extra time and attention.

Documents used along the form

When applying for a Business Tax Receipt in the City of Miami, several additional forms and documents may be necessary. These provide crucial information and ensure compliance with local regulations. Below are four common forms that complement the Application for Business Tax Receipt.

- State Registration Documents: Florida law mandates that businesses operating under a fictitious name must file specific registration documents with the state. This verification is essential to ensure that the business name is unique and legally compliant.

- Occupational License: Some businesses may need an Occupational License to operate legally in Miami. This document demonstrates that the business meets industry standards and local regulations, safeguarding public interests.

- Proof of Insurance: Many businesses are required to carry liability insurance. Providing proof of this insurance demonstrates financial responsibility and protects both the business and consumers in case of incidents.

- Emergency Contact List: When completing the application, applicants are asked to submit a list of emergency contacts. This list typically contains individuals who can respond quickly to emergencies at the business's location, ensuring timely action and safety.

Incorporating these documents along with the Application for Business Tax Receipt streamlines the approval process. Understanding and preparing the necessary paperwork can facilitate smoother interactions with city officials, leading to successful business operations.

Similar forms

The Application For Business Tax Receipt form has several counterparts that serve similar purposes in the context of business registration and compliance. Below is a list of documents that share common features with this application:

- Business License Application: Similar to the Business Tax Receipt, this document is required by some jurisdictions for businesses to operate legally. It collects vital information about the business entity, its address, and its ownership details.

- Occupational License Application: This form is often required for specific professions. Like the Business Tax Receipt application, it requests the nature of business activities and personal information about the applicant.

- Fictitious Name Registration: When a business operates under a name that differs from its legal name, this registration is necessary. It parallels the Business Tax Receipt in that it verifies the name under which the business is conducting activities.

- Sales Tax Registration: Businesses that sell taxable goods often need to register with the state to collect sales tax. This process parallels the Business Tax Receipt, as both require detailed information about the business practices.

- Employer Identification Number (EIN) Application: This document is essential for tax purposes. It gathers information about the business entity and is similar to the Business Tax Receipt in its focus on the business structure and ownership.

- Business Entity Registration: State-stipulated documentation is needed to formally create a registered business entity. It shares features with the Business Tax Receipt, as both require foundational data about the business.

- Certificate of Good Standing: Often required for businesses engaging in contracts or loans, this certificate confirms that the business is authorized to operate in the state. It resembles the Business Tax Receipt by confirming the legal status of the business.

- Zoning Permit Application: This application ensures that the business location complies with local zoning regulations. Like the Business Tax Receipt, it requires detailed information about the business activities and operating location.

Dos and Don'ts

When filling out the Application For Business Tax Receipt form, attention to detail is essential. Here’s a helpful guide on what to do and what to avoid during this process:

- Double-check your information. Make sure the business name, address, and contact information are accurate. Errors can lead to delays in processing.

- Provide complete documentation. Attach all required state registration documents, especially if you're operating under a fictitious name. Missing documents may result in a denied application.

- List all relevant personnel. Include the names and social security numbers of personnel who possess the necessary licenses. This information is required by Florida statutes.

- Ensure emergency contacts are reachable. Select individuals who can respond quickly during emergencies. This could be crucial for the safety of your business.

- Avoid incomplete sections. Leaving sections blank can lead to automatic rejection of your application. Fill out every required part of the form.

- Do not submit false information. Providing misleading details can have serious legal consequences. All statements should be factual and truthful.

- Do not overlook deadlines. Ensure your application is submitted on time to prevent penalties or lapses in business operations.

- Refrain from altering the form. Making changes to the official application can invalidate it. Always use the original version provided by the city.

Misconceptions

When it comes to the Application For Business Tax Receipt form, misconceptions can lead to confusion and mistakes in the application process. Here are nine common misunderstandings debunked to help make your experience smoother:

- It's only for new businesses. Many believe the form is applicable solely to new businesses opening in Miami. In reality, existing businesses must also renew their Business Tax Receipt, even if no changes have been made.

- You don't need to submit additional documents. Some think that simply filling out the form is sufficient. However, businesses operating under a fictitious name must include their State Registration documents as part of the application.

- Only physical businesses need a receipt. Many assume that only storefronts require a Business Tax Receipt. In fact, businesses operated from home, online, or virtually still need to apply.

- The application can be submitted electronically. While digital submission seems convenient, it may not always be available. Check the current submission process, as it may require physical submission at the designated office.

- All business types have the same application requirements. It's a common belief that the requirements are the same for every business type. Instead, specific industries may have unique stipulations, such as additional licenses or different fees.

- No need to list emergency contacts. Some applicants overlook the necessity to provide emergency contacts. Florida law requires listing three individuals who can respond quickly to emergencies at the business location.

- The processing time is quick. Many anticipate a fast turnaround on their application. In reality, processing times can vary, so it's wise to submit the application well in advance of any planned business activities.

- You can change your business name later. Some believe they can amend their business name easily after submitting the application. Changes may require a new application, which can cause delays and additional fees.

- The fee is fixed. There's a misconception that the Business Tax Receipt fee remains constant. Fees can vary based on the type of business and other factors, so be sure to check the latest fee schedule.

By understanding these common misconceptions, you can navigate the Application for Business Tax Receipt process with greater confidence and accuracy.

Key takeaways

When filling out the Application For Business Tax Receipt form, there are several important points to keep in mind:

- Provide accurate business information. This includes your business name, address, and contact details.

- Ensure you have all necessary documents ready. Florida Statutes require registration documents for businesses operating under a fictitious name.

- List three individuals who can respond quickly in case of an emergency. Their contact information is vital.

- Be honest about any previous business licenses. If you have had a license suspended or revoked, explain the circumstances.

- Review the submission requirements. Make sure the completed form is sent to the right office to avoid any delays.

Completing this form correctly is essential for your business operations in Miami.

Browse Other Templates

Ihsaa Physical Form 2023-24 - Understanding the procedure for completing the PPE can enhance an athlete's readiness for sports.

Boeing Advantage+ Health Plan - Using the incorrect BEMS ID could lead to complications in processing your request.