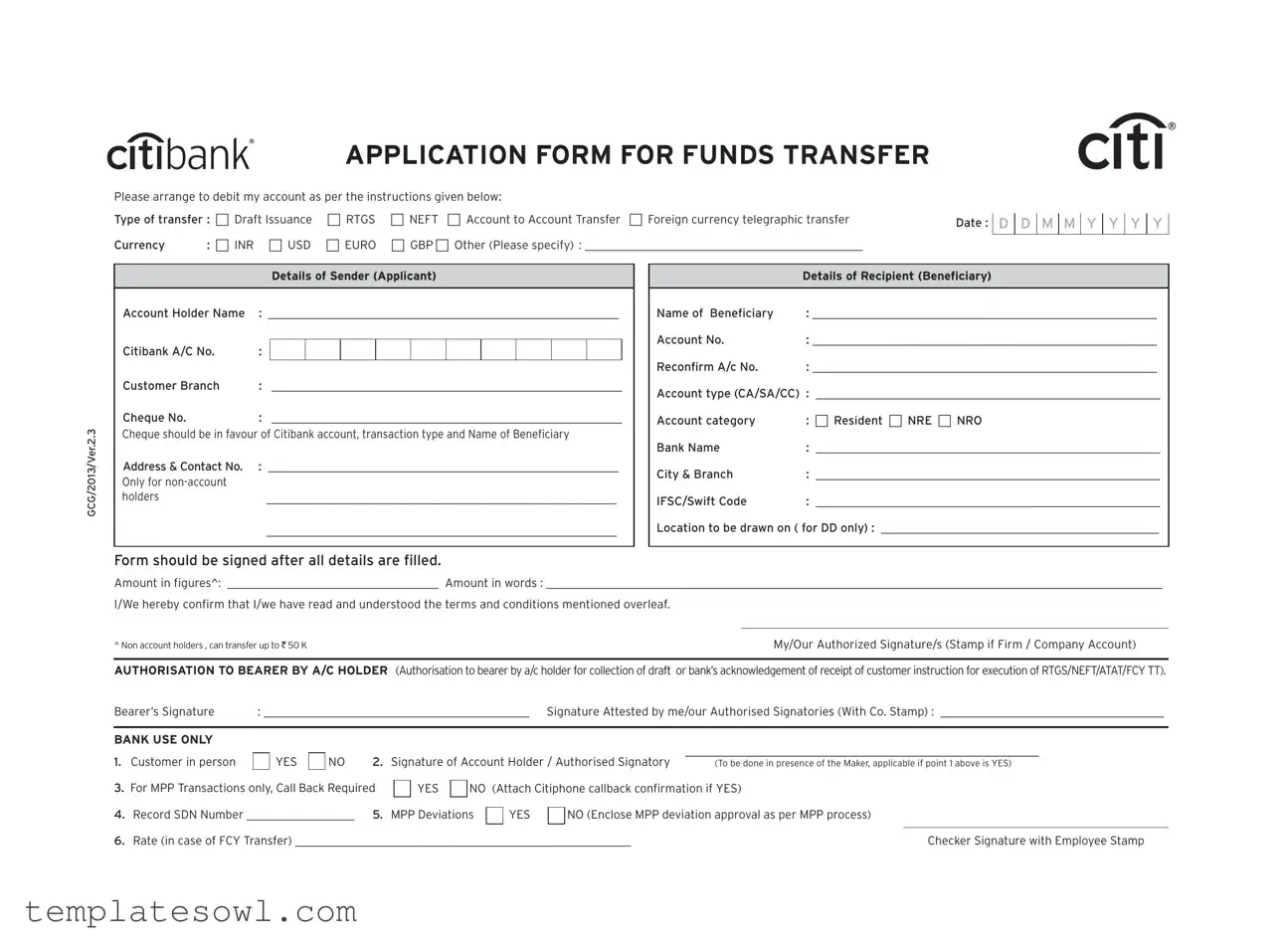

Fill Out Your Application Funds Transfer Form

The Application Funds Transfer form is an essential tool for customers seeking to initiate various types of money transfers. This form provides clear options for users, allowing them to select the appropriate transfer method, such as Draft Issuance, RTGS, NEFT, Account to Account Transfer, or Foreign Currency Telegraphic Transfer. It captures crucial details, including the account holder's information, the recipient’s account specifics, and the currency type, ensuring that all necessary information is clearly documented. For those transferring funds in different currencies, the form includes options for INR, USD, EURO, GBP, or other currencies. Additionally, it requires both the sender’s and recipient’s banking details, such as account numbers, bank names, and IFSC or Swift codes. Customers must confirm the amount in both figures and words, thereby reducing the risk of errors. Acknowledgment of terms and conditions is also requested to ensure that customers understand the transaction implications. With specific provisions for non-account holders and detailed authorization requirements for payments or collection of drafts, the form seeks to facilitate a clear and secure funds transfer process.

Application Funds Transfer Example

APPLICATION FORM FOR FUNDS TRANSFER

Please arrange to debit my account as per the instructions given below: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Type of transfer : Draft Issuance |

RTGS |

NEFT Account to Account Transfer Foreign currency telegraphic transfer |

Date : |

|

D |

|

D |

|

M |

|

M |

|

Y |

|

Y |

|

Y |

|

Y |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Currency |

: INR USD |

EURO |

GBP Other (Please specify) : ______________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

GCG/2013/Ver.2.3

|

|

|

Details of Sender (Applicant) |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Holder Name |

: __________________________________________________________ |

|

|||||||||||

Citibank A/C No. |

: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer Branch |

: |

__________________________________________________________ |

|||||||||||

Cheque No. |

: |

__________________________________________________________ |

|||||||||||

Cheque should be in favour of Citibank account, transaction type and Name of Beneficiary |

|||||||||||||

Address & Contact No. |

: __________________________________________________________ |

|

|||||||||||

Only for |

|

|

|

|

|

|

|

|

|

|

|

|

|

holders |

|

__________________________________________________________ |

|

||||||||||

__________________________________________________________

|

Details of Recipient (Beneficiary) |

|

|

Name of Beneficiary |

: _________________________________________________________ |

Account No. |

: _________________________________________________________ |

Reconfirm A/c No. |

: _________________________________________________________ |

Account type (CA/SA/CC) |

: _________________________________________________________ |

Account category |

: Resident NRE NRO |

Bank Name |

: _________________________________________________________ |

City & Branch |

: _________________________________________________________ |

IFSC/Swift Code |

: _________________________________________________________ |

Location to be drawn on ( for DD only) : ______________________________________________

Form should be signed after all details are filled.

Amount in figures^: ___________________________________ Amount in words : ______________________________________________________________________________________________________

I/We hereby confirm that I/we have read and understood the terms and conditions mentioned overleaf.

^ Non account holders , can transfer up to ` 50 KMy/Our Authorized Signature/s (Stamp if Firm / Company Account)

AUTHORISATION TO BEARER BY A/C HOLDER (Authorisationtobearerbya/cholderforcollectionofdraft orbank’sacknowledgementofreceiptofcustomerinstructionforexecutionofRTGS/NEFT/ATAT/FCYTT).

Bearer’s Signature |

: ____________________________________________ |

Signature Attested by me/our Authorised Signatories (With Co. Stamp) : _____________________________________ |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BANK USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

___________________________________________________________ |

||

1. |

Customer in person |

|

YES |

|

NO |

2. |

Signature of Account Holder / Authorised Signatory |

||||||||||

|

|

(To be done in presence of the Maker, applicable if point 1 above is YES) |

|||||||||||||||

3. |

For MPP Transactions only, Call Back Required |

|

|

YES |

|

NO (Attach Citiphone callback confirmation if YES) |

|||||||||||

|

|

|

|||||||||||||||

4. |

Record SDN Number __________________ |

5. |

MPP Deviations |

|

YES |

|

NO (Enclose MPP deviation approval as per MPP process) |

||||||||||

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. |

Rate (in case of FCY Transfer) ________________________________________________________ |

|

|

||||||||||||||

|

Checker Signature with Employee Stamp |

||||||||||||||||

GCG/2013/Ver.2.3

Terms & Conditions for Funds Transfer from Citibank Saving or Current accounts for RTGS/NEFT/Telegraphic Transfer, Draft issuances etc in Local and Foreign Currency. The Customer hereby understands, acknowledges and accepts that:

•The Customer shall be solely liable and responsible for providing the correct information.

•Citibank, N.A., (hereinafter referred as "Citibank") shall not be liable to act on incomplete information furnished by the customer in this Instruction Form (the "Instructions").

•The Instruction, once issued, shall be irrevocable and the Customer shall not be entitled to withdraw the same under any circumstances.

•The Customer shall execute all such other documents and writings, in addition to the Instruction, in a form and manner satisfactory to Citibank, as it may require for any transactions via NEFT and/or RTGS/TT/Drafts.

•Upon receipt of instructions, Citibank shall debit the customer's account mentioned on the Instructions. If standing instructions are provided for effecting periodic transfers, Citibank shall affect such transfers upon receipt of Instructions till such time the Instructions are revoked in writing by the Customer.

•The actual time taken to credit the beneficiary account for transactions of the nature of NEFT/RTGS depends on the time taken by the Payee's bank to process the payment.

•Without prejudice to any other rights of recovery that Citibank may have, Citibank is hereby authorized to debit any account of the Customer held with Citibank for any such fees and/or charges for these instructions and/or transactions. The charges for instructions are applicable as per schedule of charges.

•RBI (and/or any other agency/ company appointed by the RBI) shall be an intermediary/a service provider in the process of settlement of a transaction initiated using any of the funds transfer facilities and, subject to the availability of sufficient funds in the account of the Customer, a transaction should be deemed to be complete in all respects (a) in case RTGS fund transfer - upon settlement of the transaction upon the central system of the RBI, (b) in case of NEFT fund transfer - if the transaction message is not returned unaffected to Citibank within a reasonable time (decision of Citibank as regards reasonable time shall be final).

• The account to be credited, in accordance with the Instructions, is not an account on which there are restrictions, as per applicable law, on crediting monies.

•The transaction includes various

•Citibank may amend the terms and conditions from time to time, and the same are binding on the Customer.

•The Customer hereby agrees to unconditionally and irrevocably indemnify against any or and all consequences , losses, including but not limited to costs of legal proceedings, which Citibank may suffer or sustain or incur at anytime as consequence of or arising out of any funds transfer facility provided to the Customer by Citibank in good faith, including commission or omission of any Instruction of the Customer including due to any regulatory, judiciary, statutory, quasi judiciary order or notice or any other cause beyond Citibank's control. Without prejudice to the generality of the foregoing, the Customer shall indemnify and save, keep harmless and indemnified Citibank against any improper/fraudulent instructions.

•The provision of the transfer of funds via RTGS/NEFT/ telegraphic transfer, demand draft is subject to Indian laws and the guidelines and regulations issued from time to time by the RBI in this behalf.

•In the event of delay in effecting the transfer for any reasons whatsoever, any interest payment for the delayed period shall be subject to the compensation policy of the Bank.

•The encashment of the drafts or payment of transferred funds is subject to clearing or any rules, regulations, sanctions and restrictions of the country, if any, where the draft is to be encashed or transferred. The Customer also agrees that neither Citibank nor its correspondents or agents shall be liable for any delay or loss caused by any act or order of any government or government agency or as a result of any other cause whatsoever.

•The Customer understands that a refund or repurchase of the amount of the draft or of the transferred funds desired shall be made at Citibank's options and only to or from the applicant. In case of a draft, it shall be made upon receipt of the original draft duly endorsed by the applicant. The Customer agrees and acknowledges that refund or repurchase shall be made at the current buying rate for the currency in question less the costs, charges, expenses and interest and further the same can be provided only when Citibank is in possession of the funds for which the payment instructions were issued and they are free from any exchange or other restrictions.

•Unless otherwise expressly and specifically agreed in writing, Citibank may at its discretion, convert into foreign values, the funds received from the applicant, at Citibank's selling rate of the day such funds are received. Citibank's statement, in writing for such conversion shall be conclusive and binding upon the customer. The remittance made shall be payable in the currency of the country to which the remittance has been made and will be at the buying rate of Citibank's correspondents or agents unless the payee by separate arrangement with paying correspon- dent or agent obtains payment in some other currency.

•Citibank may take its customary steps for issue of drafts or for remittance. In doing so Citibank shall be free, on behalf of the Customer, to make use of any correspondent,

•In no case will Citibank or any of its correspondents or agents be liable for interruptions, errors or delays occurring in the wire cable or mails or on the part of any postal authority, telecom, cable or wireless company or any employee or such authority or any company, or through any other cause. Citibank may send any message related to the transfer in explicit language, code or cipher.

•The beneficiary banks will credit RTGS/NEFT proceeds solely based upon the beneficiary account number provided and the beneficiary name details may not be used.

•These Terms & Conditions shall be in addition to the Citibank Account Terms and conditions and shall bind the customer upon submission of duly executed form.

•All such funds transfer transactions shall be initiated by Citibank as per cutoff timings as on display at the respective branches or Citibank website, from time to time.

Form Characteristics

| Fact Name | Description |

|---|---|

| Type of Transfers | The form allows various types of transfers: Draft Issuance, RTGS, NEFT, Account to Account Transfer, and Foreign currency telegraphic transfer. |

| Currency Options | Available currencies include INR, USD, EURO, GBP, or any other specified currency. |

| Account Holder Details | It requires detailed information about the account holder, including name, account number, and contact information. |

| Beneficiary Information | The recipient must provide their name, account number, and bank details for successful transaction completion. |

| Signature Requirement | The form must be signed after all details are filled out to authorize the transfer process. |

| Authorization for Bearer | A section is included for the account holder to authorize another person for collection of drafts or acknowledgments. |

| Terms and Conditions | Users must acknowledge the terms and conditions regarding liabilities and responsibilities before submitting the form. |

| Applicable Laws | The transfers are subject to Indian laws and regulations issued by the Reserve Bank of India (RBI). |

Guidelines on Utilizing Application Funds Transfer

Filling out the Application Funds Transfer form is an essential step to initiate a transfer between accounts or for other designated purposes. After completing the form accurately, it will be necessary to submit it for processing. By following these steps, you can ensure that all required information is provided correctly to facilitate a smooth transaction.

- Select the type of transfer from the provided options (e.g., Draft Issuance, RTGS, NEFT, etc.).

- Enter the date for the transfer using the format D D M M Y Y Y Y.

- Choose the currency for the transfer, marking the relevant box (INR, USD, EURO, GBP, or Other).

- Fill in the details of the sender:

- Enter the account holder's name.

- Provide the Citibank account number.

- Indicate the customer branch.

- If applicable, include the cheque number.

- Write the address and contact number of the sender.

- Provide recipient (beneficiary) details:

- Enter the beneficiary's name.

- Provide the beneficiary's account number and confirm it.

- Indicate the account type (CA, SA, CC) and category (Resident, NRE, NRO).

- Add the bank name and the city & branch where the beneficiary holds the account.

- Provide the IFSC or SWIFT code.

- If applicable, specify the location to be drawn on (for DD only).

- Fill in the amount to be transferred both in figures and in words.

- Sign and date the form after ensuring that all the information is accurate.

- If applicable, authorize a bearer for collection of drafts or bank acknowledgements by providing the bearer’s signature and attestation by authorized signatories.

What You Should Know About This Form

What is the purpose of the Application Funds Transfer form?

The Application Funds Transfer form allows account holders to instruct Citibank to transfer funds from their account to another account, whether within India or internationally. This form can be used for various types of transactions, such as issuing drafts, making electronic transfers like RTGS and NEFT, or transferring funds in foreign currency. It ensures that the customer provides the necessary details for the transaction to be completed efficiently.

What information do I need to provide when filling out the form?

When completing the Application Funds Transfer form, customers must provide specific information. Key details include the type of transfer, date, currency, account holder’s name, Citibank account number, and details of the recipient, such as their name, account number, and bank information. The amount to be transferred should be written both in figures and words. It is crucial to be accurate, as incomplete or incorrect information could delay or prevent the transaction.

Are there any restrictions on the amount I can transfer?

What happens if there is an issue with my funds transfer?

If a problem occurs during the funds transfer process, Citibank follows specific protocols to address the situation. Customers are encouraged to reach out to Citibank’s customer service for assistance. Delays can happen due to multiple factors, such as system constraints or actions by other banks. While Citibank aims to resolve issues promptly, they may not always be liable for complications caused by circumstances beyond their control.

Common mistakes

Filling out the Application Funds Transfer form can seem straightforward, but mistakes are common. One frequent error is not selecting the correct type of transfer. Users may mistakenly choose multiple options or omit their choice altogether. Each transfer method has unique requirements and processing times, so clarity here is essential.

Another mistake people make is failing to provide accurate account details for both the sender and recipient. Importantly, the account number must be confirmed, as even a single digit error can lead to significant processing issues or delays. It’s crucial to double-check these details before submitting the form.

A third common oversight is neglecting to specify the currency for the transaction. Without this crucial information, the bank may not process the request as expected. Users should ensure they select the right currency option, especially when dealing with international transfers.

People often fail to write the amount in both figures and words. This dual requirement is meant to avoid misinterpretation. When only one format is provided, it can lead to confusion and errors in the transfer amount.

Additionally, skipping the signature on the form is a common mistake. Remember that all sections of the form must be completed and appropriately signed. Without proper authorization, the bank may refuse to process the transfer, leaving you to restart the entire process.

Another pitfall involves misunderstandings about the terms and conditions associated with the transfer. Many users overlook the fine print that outlines the responsibilities and potential fees. It’s essential for customers to read and understand these details, as ignoring them can lead to unexpected charges later on.

Finally, people frequently rush the process and submit the form without reviewing it thoroughly. Taking a few extra moments to double-check everything can make a significant difference. Simple errors can cause delays or outright rejections of the application, causing frustration and wasted time.

Documents used along the form

When submitting an Application Funds Transfer form, several other documents may need to accompany it. These additional forms help to ensure accurate processing and compliance with banking regulations. Below is a list of commonly required documents in conjunction with the funds transfer application.

- Identity Verification Document: This document typically includes a government-issued ID such as a driver's license or passport. It serves to verify the identity of the sender and is essential for complying with anti-money laundering laws.

- Account Statement: A recent statement from the sender's account may be needed. It proves the sender's account balance and confirms the account information provided in the funds transfer application.

- Authorization Letter: This letter is often required when a third party is initiating a transfer on behalf of the account holder. It includes the account holder's approval for the transfer and may need to be notarized for added security.

- Beneficiary's Details Document: This form collects specific information about the recipient, including their account details, bank name, and identification information. Accurate completion of this document helps avoid transfer delays.

- Foreign Exchange Declaration: For transfers involving foreign currency, this document specifies the purpose of the foreign exchange transaction. It is necessary for regulatory compliance and foreign exchange controls.

These documents are important for a smooth transfer process. Ensuring their accuracy and completeness minimizes the risk of delays and complications during fund transfers.

Similar forms

The Application Funds Transfer form shares similarities with several other important documents commonly used in banking and financial transactions. These documents serve specific functions but have comparable elements, particularly in terms of information required and procedures followed. Below are five documents that align closely with the Application Funds Transfer form:

- Wire Transfer Request Form: Much like the Application Funds Transfer form, a wire transfer request form facilitates the electronic transfer of funds between banks. It requires accurate details about both the sender and recipient, including account numbers and bank identifiers. The importance of correct information is emphasized in both documents to ensure successful transactions.

- Cheque Deposit Slip: Similar to the Application Funds Transfer form, a cheque deposit slip is used to instruct the bank on where to credit a deposited cheque. It requires the account number, the amount being deposited, and the signer’s information, underscoring the need for precision in account details.

- International Fund Transfer Form: This form is essential for sending money abroad. Like the Application Funds Transfer form, it requires details such as the currency to be used, the recipient's bank information, and compliance with various regulations. Both forms aim to facilitate seamless and secure transfers, albeit across different jurisdictions.

- Standing Order Instruction Form: This document allows customers to set up regular, automatic fund transfers from one account to another. Much like the Application Funds Transfer form, it necessitates clear instructions on frequency and amount, ensuring that customers remain fully aware of the transactions being initiated on their behalf.

- Bank Draft Application Form: The application form to request a bank draft closely resembles the Application Funds Transfer form in its purpose and structure. Both documents require detailed information about the sender and recipient, as well as the amount to be drafted, making accuracy crucial to avoid delays or issues in processing.

Dos and Don'ts

When filling out the Application Funds Transfer form, it’s important to adhere to guidelines that ensure the accuracy and efficiency of your transaction. Below are crucial points to consider:

- Provide Complete Information: Ensure that every section of the form is filled out completely. Incomplete forms could lead to delays or even rejection of the transaction.

- Double-Check the Beneficiary's Details: Before submitting, thoroughly verify the name and account number of the recipient. Incorrect information can result in funds being misdirected.

- Sign After Completing the Form: Always sign the form only after filling in all necessary details. Signing it prematurely can complicate the process.

- Understand the Terms and Conditions: Take the time to read and comprehend the terms that come with the funds transfer. This knowledge will help you avoid any misunderstandings later on.

Conversely, there are practices you should avoid to ensure a smooth transaction:

- Don’t Use Unofficial Channels: Avoid filling out the form outside of official Citibank premises or without supervision, as unofficial processes may lead to fraudulent activities.

- Don’t Skip Signatures: Failing to sign where required can halt the processing of your transaction. Ensure all necessary signatures are included.

- Never Provide Partial Information: Incomplete data can result in the inability to process the transfer. Every detail matters.

- Avoid Last-Minute Changes: Refraining from making last-minute modifications is advisable, as this could confuse processing staff and complicate your request.

Misconceptions

Misconception 1: The Application Funds Transfer form can be used by anyone to transfer funds, regardless of whether they have an account with Citibank.

This is incorrect. Only account holders or authorized individuals can complete the form to transfer funds.

Misconception 2: The form guarantees instant fund transfers to the beneficiary's account.

In reality, the time it takes to credit a beneficiary's account depends on the receiving bank's processing times, particularly for NEFT and RTGS transactions.

Misconception 3: Providing inaccurate or incomplete information on the form will not have consequences.

This is misleading. Customers are solely responsible for supplying accurate information. Citibank will not act on incomplete instructions.

Misconception 4: Once the funds transfer request is submitted, it can be easily modified or canceled.

Once submitted, the instruction is irrevocable and cannot be changed or withdrawn under any circumstances.

Misconception 5: Non-account holders can transfer any amount using the funds transfer form.

This is not true. Non-account holders have a limit, which is currently set at ₹50,000 for transfers.

Misconception 6: Citibank will cover any fees or charges associated with the funds transfer.

In fact, customers are responsible for any applicable fees and charges, which will be debited from their accounts.

Misconception 7: There are no restrictions on the type of accounts that can receive funds transferred using this form.

This statement is false. The account designated to receive funds must not have any restrictions on crediting money, as per applicable laws.

Misconception 8: Citibank is liable for any delays in completing the funds transfer due to external issues.

This is incorrect. Citibank cannot be held responsible for delays or deficiencies caused by system constraints or actions of third parties beyond their control.

Key takeaways

Filling out the Application Funds Transfer form requires careful attention to detail to ensure the process runs smoothly. Here are key takeaways for effectively completing and utilizing the form:

- The form caters to various types of transfers, including Draft Issuance and RTGS, so select the appropriate option to avoid processing issues.

- Accurately input the date and the specific currency being used, as these details affect the transaction's outcome.

- Provide complete information for both the sender and the recipient to facilitate prompt processing; incomplete forms may lead to delays.

- When indicating the amount, use both figures and words to minimize confusion and enhance clarity.

- Sign the form only after filling out all required sections to confirm understanding and acceptance of the terms.

- For non-account holders, be aware of the limit on transfers, which is capped at ₹50,000.

- Review the authorization to bearer section if applicable; this section allows for the draft to be collected by someone other than the account holder.

- Understand the implications of the transaction being irrevocable—once submitted, changes cannot be made.

- Be aware of potential fees associated with the service, as these charges are applicable as per the bank's schedule.

By adhering to these guidelines, users can facilitate a more effective funds transfer process and mitigate potential complications.

Browse Other Templates

26-1820 - The VA form enables streamlined processing of home loan requests for veterans.

California Sales Tax Exemption - Filing this certificate properly can lead to financial savings.

Vics Bol - Provide all additional shipper info to ensure accurate delivery.