Fill Out Your Application Insurance License Form

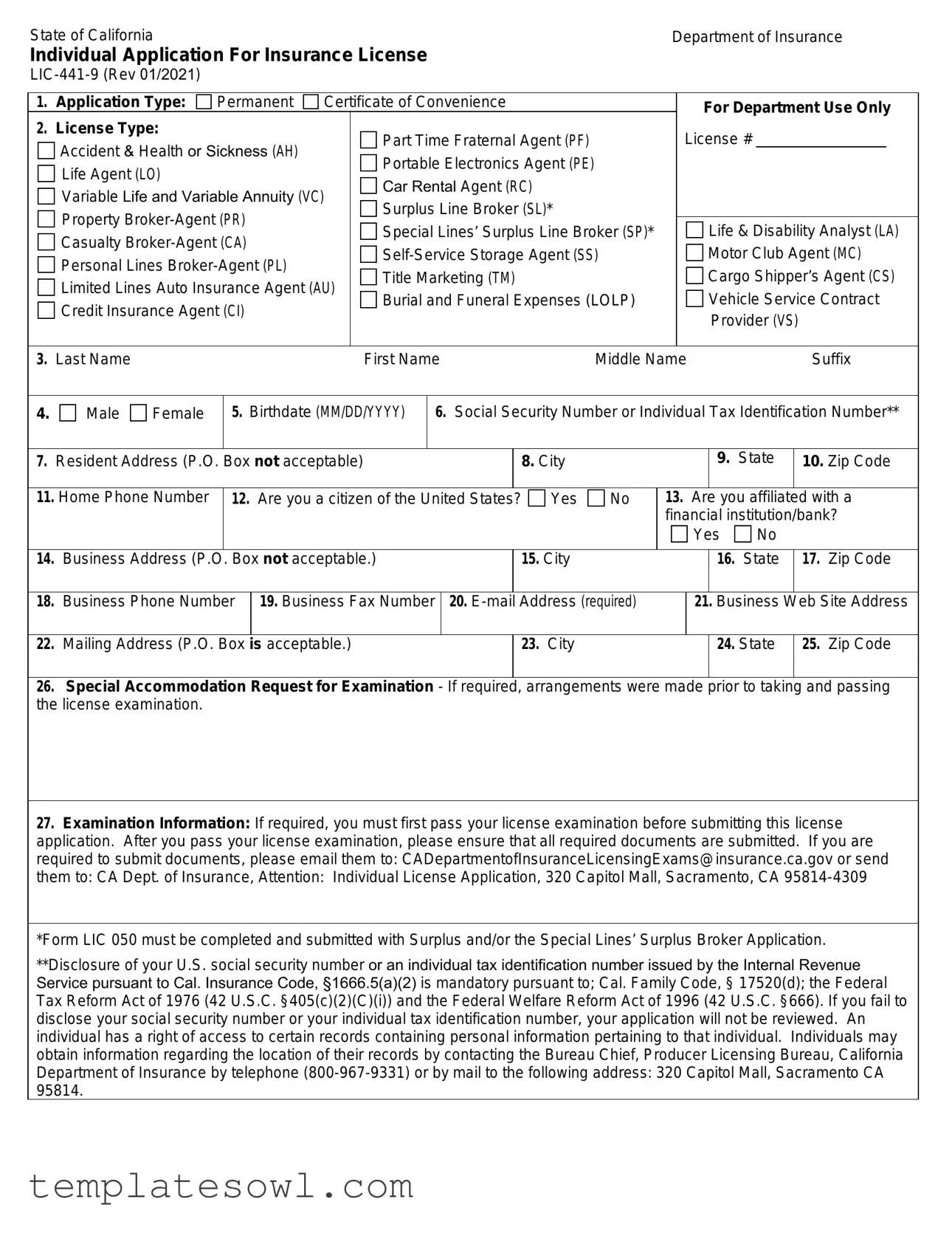

The Application Insurance License form, specifically the Individual Application For Insurance License LIC-441-9 issued by the State of California Department of Insurance, serves a critical role in the licensing process for insurance professionals. This comprehensive document requires applicants to specify the type of application they are submitting, including options for permanent or temporary licenses, as well as various categories of insurance licenses such as Life Agent, Surplus Line Broker, and more. Essential personal information, including name, address, date of birth, and social security number or tax identification number, must be provided. Applicants must also disclose their citizenship status and whether they are affiliated with a financial institution. The form includes sections for recording employment history over the past five years and checking for any prior or current insurance licenses held in California or other states. Inquiries into the applicant's criminal background, including felony and misdemeanor convictions, as well as administrative proceedings involving professional licenses, are crucial components of the form. The requirement to disclose any fictitious names intended for use, along with a section for certifying completion of necessary prelicensing education, reinforces the form's emphasis on thorough scrutiny for regulatory compliance. Properly completing and submitting the Application Insurance License form is essential, as it not only facilitates the granting of the insurance license but also ensures that applicants who pose a risk to consumers are identified and evaluated appropriately.

Application Insurance License Example

State of California |

|

|

|

|

|

|

|

|

|

Department of Insurance |

||||||||

Individual Application For Insurance License |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

1. |

Application Type: □ Permanent □ Certificate of Convenience |

|

|

For Department Use Only |

||||||||||||||

2. |

|

|||||||||||||||||

License Type: |

|

|

|

□ Part Time Fraternal Agent (PF) |

|

License # |

|

|

||||||||||

□ |

Accident & Health or Sickness (AH) |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||

Life Agent (LO) |

|

|

|

□ Portable Electronics Agent (PE) |

|

|

|

|

|

|

|

|

||||||

□ |

|

|

|

|

|

|

|

|

|

|

|

|||||||

Variable Life and Variable Annuity (VC) |

□ Car Rental Agent (RC) |

|

|

|

|

|

|

|

|

|||||||||

□ |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

Surplus Line Broker (SL)* |

|

|

|

|

|

|

|

|

||||||

□ Property |

|

|

□ Special Lines’ Surplus Line Broker (SP)* |

|

|

|

|

|

||||||||||

|

|

|

|

|

Life & Disability Analyst (LA) |

|||||||||||||

□ Casualty |

|

|

□ |

|

|

□Motor Club Agent (MC) |

||||||||||||

□ Personal Lines |

□ Title Marketing (TM) |

|

|

□Cargo Shipper’s Agent (CS) |

||||||||||||||

□ Limited Lines Auto Insurance Agent (AU) |

□ Burial and Funeral Expenses (LOLP) |

|

|

□ Vehicle Service Contract |

||||||||||||||

□ Credit Insurance Agent (CI) |

|

|

□ |

|

|

|

|

|

|

□ Provider (VS) |

||||||||

3. |

Last Name |

|

|

|

First Name |

|

Middle Name |

|

|

Suffix |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

4. |

□ Male □ Female |

5. |

Birthdate (MM/DD/YYYY) |

|

6. Social Security Number or Individual Tax Identification Number** |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. |

Resident Address (P.O. Box not acceptable) |

|

|

|

8. City |

|

|

9. |

State |

10. Zip Code |

||||||||

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

I |

|

|

I |

|

11. Home Phone Number |

12. |

|

Are you a citizen of the United States? □ Yes □ No |

13. Are you affiliated with a |

||||||||||||||

|

|

|

financial institution/bank? |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

□ Yes |

□ No |

|

|

||||

14. |

Business Address (P.O. |

Box not acceptable.) |

|

|

|

15. City |

|

|

|

16. State |

17. Zip Code |

|||||||

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

I |

|

|

I |

|

18. |

Business Phone Number |

|

19. Business Fax Number |

|

I |

20. |

Address (required) |

|

|

21. |

Business Web Site Address |

|||||||

|

|

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

22. |

Mailing Address (P.O. Box |

is acceptable.) |

|

|

|

|

|

23. City |

|

|

|

24. State |

25. Zip Code |

|||||

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

I |

|

|

I |

|

26. Special Accommodation Request for Examination - If required, arrangements were made prior to taking and passing the license examination.

27. Examination Information: If required, you must first pass your license examination before submitting this license application. After you pass your license examination, please ensure that all required documents are submitted. If you are required to submit documents, please email them to: CADepartmentofInsuranceLicensingExams@insurance.ca.gov or send them to: CA Dept. of Insurance, Attention: Individual License Application, 320 Capitol Mall, Sacramento, CA

*Form LIC 050 must be completed and submitted with Surplus and/or the Special Lines’ Surplus Broker Application.

**Disclosure of your U.S. social security number or an individual tax identification number issued by the Internal Revenue Service pursuant to Cal. Insurance Code, §1666.5(a)(2) is mandatory pursuant to; Cal. Family Code, § 17520(d); the Federal Tax Reform Act of 1976 (42 U.S.C. §405(c)(2)(C)(i)) and the Federal Welfare Reform Act of 1996 (42 U.S.C. §666). If you fail to disclose your social security number or your individual tax identification number, your application will not be reviewed. An individual has a right of access to certain records containing personal information pertaining to that individual. Individuals may obtain information regarding the location of their records by contacting the Bureau Chief, Producer Licensing Bureau, California Department of Insurance by telephone

28.Work/Personal History: Account for all time for the past five years. Give all employment experiences starting with your current employer working back five years. Include full and

|

|

From |

To |

Position Held |

||

|

|

Month Year |

Month Year |

|||

|

|

|

||||

Name |

|

|

I |

|

I |

|

|

|

|

|

|

||

City |

State |

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

I |

|

I |

|

|

|

|

|

|

||

City |

State |

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

I |

|

I |

|

|

|

|

|

|

||

City |

State |

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

I |

|

I |

|

|

|

|

|

|

||

City |

State |

|

|

|

|

|

|

|

|

|

|

|

|

29. Do you now hold, or have you ever held, an insurance license as a resident in this state or any other state?

Type of License |

|

State or Province |

|

Date License Held |

□ Yes □ No |

|

|

Is License in Force? |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30.AKA/Alias

Are you now using or have you ever used any name other than shown? □

Yes □

Yes □

No

No

If yes, list names, dates and reason(s) used:

Last |

First |

Middle |

Suffix |

Dates Used |

Reason Used |

Last |

First |

Middle |

Suffix |

Dates Used |

Reason Used |

31. Fictitious Names:

Do you intend to use a fictitious (DBA) name?

If yes, list the name: (This name must be approved by the Department prior to use) □

Yes □

Yes □

No

No

32.

Are you registered with the Securities and Exchange Commission (SEC) or Financial Industry Regulatory Authority (FINRA)?

|

□ Yes □ No |

Central Registration Depository Number (CRD) |

If CRD# is not provided, acceptable proof of registration |

must be attached before the authority may be granted. If acceptable proof is not submitted, license will be issued without variable life and variable annuity authority.

33.Prelicensing Certificates:

Do you certify that you have completed your prelicensing education? □

Yes □

Yes □

No

No

If no, your prelicensing education must be completed prior to taking your examination.

If yes, you must provide the completion date:

Page 2 of 6 |

LIC |

34. |

Background Information |

|

|

|

If you fail to fully disclose any information that is requested or |

|

|

|

if you make a false statement, your application may be denied. |

|

|

|

|

|

|

1. |

Have you ever been convicted of a felony? |

□ Yes □ No |

|

For the purpose of this application, you have been “convicted” if you were ever found guilty by verdict of a |

|

||

judge or jury; and/or ever entered a plea of guilty, nolo contendere or no contest. You must disclose all |

|

||

convictions, even if the charges were later dismissed or expunged, your guilty plea was withdrawn pursuant |

|

||

to Penal Code Section 1203.4, or you were placed on probation, received a suspended sentence or just |

|

||

ordered to pay a fine. If you fail to disclose all convictions, your application may be denied. You may exclude |

|

||

juvenile offenses tried in juvenile court. |

|

||

If you answer “Yes” to this background question, you must attach to this application: |

|

||

a) a written statement, with original signature, explaining the circumstances of each conviction or charge; |

|

||

and, |

|

||

b) certified copies of the charging documents, and of the court documents which detail the conviction, |

|

||

resolution of the charges, probation and any final judgment. |

|

||

|

|

||

2. Federal law (18 U.S.C. 1033) prohibits anyone who has been convicted of a felony involving dishonesty or |

|

||

a breach of trust or who has been convicted of any violation of 18 U.S.C. 1033 and 1034 from engaging in the |

|

||

business of insurance unless they have obtained the written consent of the Insurance Commissioner. It is a |

|

||

violation of this statute to engage in the business of insurance without the Commissioner’s written consent. If |

|

||

you have been convicted of a felony involving dishonesty or a breach of trust or a violation of 18 U.S.C. 1033 |

|

||

and 1034, then you must attach a copy of this consent. If you have not obtained this written consent, you |

|

||

must do so prior to filing your application. |

|

||

a. Have you ever been convicted of a felony involving dishonesty or a breach of trust? |

□ Yes □ No |

||

For the purpose of this application, you have been “convicted” if you were ever found guilty by verdict of a |

|||

|

|||

judge or jury; and/or ever entered a plea of guilty, nolo contendere or no contest. You must disclose all |

|

||

convictions, even if the charges were later dismissed or expunged, your guilty plea was withdrawn pursuant |

|

||

to Penal Code Section 1203.4, or you were placed on probation, received a suspended sentence or just |

|

||

ordered to pay a fine. If you fail to disclose all convictions, your application may be denied. You may exclude |

|

||

juvenile offenses tried in juvenile court. |

|

||

If you answered “Yes” to background question 2a, you must attach to this application: |

|

||

i. a written statement, with original signature, explaining the circumstances of each conviction or charge; and, |

|

||

ii. certified copies of the charging documents, and of the court documents which detail the conviction, |

|

||

resolution of the charges, probation and any final judgment. |

|

||

b. |

If you have been convicted of a felony involving dishonesty or a breach of trust, have you received written |

□ Yes □ No |

|

|

consent from the California Insurance Commissioner to engage in the business of insurance? |

|

|

3. |

Have you ever been convicted of a misdemeanor? |

□ Yes □ No |

|

For the purpose of this application, you have been “convicted” if you were ever found guilty by verdict of a |

|

||

judge or jury; and/or ever entered a plea of guilty, nolo contendere or no contest. You must disclose all |

|

||

convictions, even if the charges were later dismissed or expunged, your guilty plea was withdrawn pursuant |

|

||

to Penal Code Section 1203.4, or you were placed on probation, received a suspended sentence or just |

|

||

ordered to pay a fine. If you fail to disclose all convictions, your application may be denied. You may exclude |

|

||

juvenile offenses tried in juvenile court. |

|

||

If you answer “Yes” to this background question, you must attach to this application: |

|

||

a) |

a written statement, with original signature, explaining the circumstances of each conviction or charge; |

|

|

|

and, |

|

|

b) certified copies of the charging documents, and of the court documents which detail the conviction, |

|

||

|

resolution of the charges, probation and any final judgment. |

|

|

|

|

|

|

Page 3 of 6 |

LIC |

34. Background Information continued.

If you fail to fully disclose any information that is requested or if you make a false statement, your application may be denied.

4. Have you ever been convicted of a military offense? |

□ Yes □ No |

For the purpose of this application, you have been “convicted” if you were ever found guilty by verdict of a |

|

judge or jury; and/or ever entered a plea of guilty, nolo contendere or no contest. You must disclose all |

|

convictions, even if the charges were later dismissed or expunged, or you were placed on probation, received |

|

a suspended sentence or just ordered to pay a fine. If you fail to disclose all convictions, your application may |

|

be denied. |

|

If you answer “Yes” to this background question, you must attach to this application: |

|

a) a written statement, with original signature, explaining the circumstances of each conviction or charge; and, |

|

b) certified copies of the charging documents, and of the court documents which detail the conviction, |

|

resolution of the charges, probation and any final judgment. |

|

|

|

5. Are you currently charged with committing a crime? |

□ Yes □ No |

“Crime” includes a felony, a misdemeanor or a military offense. You may exclude traffic citations but should |

|

include driving offenses such as, but not limited to, reckless driving, driving under the influence and driving |

|

with a suspended license. |

|

If you answer “Yes” to this background question, you must attach to this application: |

|

a) a written statement, with original signature, explaining the circumstances of each charge; and, |

|

b) certified copies of the charging documents. |

|

|

|

6. Have you ever been involved in an administrative proceeding (including matters with the Department of |

□ Yes □ No |

Insurance) regarding any professional or occupational license? |

|

For the purpose of this application, “Involved” means having a license censured, suspended, revoked, |

|

cancelled, terminated; or being assessed a fine, placed on probation or surrendering a license to resolve an |

|

administrative action. “Involved” also means being named a party to an administrative or arbitration |

|

proceeding which is related to a professional or occupational license. “Involved” also means having a license |

|

application denied or the act of withdrawing an application to avoid denial. You may exclude terminations due |

|

solely to noncompliance with continuing education requirements or failure to pay a renewal fee. |

|

If you answer “Yes” to this background question, you must attach to this application: |

|

a) a written statement, with original signature, explaining the circumstances of each disciplinary incident; and, |

|

b) certified copies of the Notice of Hearing or other document that states the charges and allegations; and, of |

|

the document which demonstrates the resolution of the charges or any final judgment. |

|

|

|

7. Has any business in which you are or were an owner, partner, officer or director ever been involved in an |

|

administrative proceeding (including matters with the Department of Insurance) regarding any professional |

□ Yes □ No |

or occupational license? |

|

For the purpose of this application, “Involved” means having a license censured, suspended, revoked, |

|

cancelled, terminated; or being assessed a fine, placed on probation or surrendering a license to resolve an |

|

administrative action. “Involved” also means being named a party to an administrative or arbitration |

|

proceeding which is related to a professional or occupational license. “Involved” also means having a license |

|

application denied or the act of withdrawing an application to avoid denial. You may exclude terminations due |

|

solely to noncompliance with continuing education requirements or failure to pay a renewal fee. |

|

If you answer “Yes” to this background question, you must attach to this application: |

|

a) a written statement, with original signature, explaining the circumstances of each disciplinary incident; and, |

|

b) certified copies of the Notice of Hearing or other document that states the charges and allegations, and of |

|

the document which demonstrates the resolution of the charges or any final judgment. ‘ |

|

|

|

8. Has any demand been made or judgment rendered against you for any overdue monies by any insurer, |

|

insured or producer, or have you ever been subject to a bankruptcy proceeding? (Only include |

□ Yes □ No |

bankruptcies that involve funds held on behalf of others). |

|

If you answer “Yes,” submit a statement, with an original signature, summarizing the details of the |

|

indebtedness and arrangements for repayment, and/or type and location of bankruptcy. |

|

|

|

8 Page 4 of 6 |

LIC |

34.Background Information continued.

If you fail to fully disclose any information that is requested or if you make a false statement, your application may be denied.

9. Have you ever been notified by any jurisdiction of any delinquent tax obligation that is not the subject of |

□ Yes □ No |

|||

|

a repayment agreement? |

|||

If you answer “Yes,” identify the jurisdiction(s): |

|

|

|

|

|

|

|||

10. Are you currently a party to or have you ever been found liable in any lawsuit or arbitration proceeding |

|

|||

|

involving allegations of fraud, misappropriation or conversion of funds, misrepresentation or breach of |

□ Yes □ No |

||

|

fiduciary duty? |

|||

If you answer “Yes,” you must attach to this application: |

|

|||

a) |

a written statement, with original signature, summarizing the details of each incident; |

|

||

b) |

copy of the Petition, Complaint, or other document that commenced the lawsuit or arbitration; and |

|

||

c) |

a copy of the official document which demonstrates the resolution of the charges or any final judgment. |

|

||

|

|

|||

11. Have you or any business in which you are or were an owner, partner, officer or director ever had an |

|

|||

|

insurance agency contract or any other business relationship with an insurance company terminated |

□ Yes □ No |

||

|

for any alleged misconduct? |

|||

If you answer “Yes,” you must attach to this application: |

|

|||

a) a written statement, with original signature, summarizing the details of each incident and explaining why |

|

|||

|

you feel this incident should not prevent you from receiving an insurance license; and, |

|

||

b) copies of any relevant documents. |

|

|||

|

|

|||

35. Applicant’s Certification: |

|

|||

By submitting this electronic application I certify that I have read the foregoing application and know the contents thereof and that each statement therein made is full, true and correct. I understand that pursuant to sections 1668(h) and 1738 of the insurance code, any false statement may subject my application to denial and may subject my license(s) to suspension or revocation. Further, pursuant to insurance code sections1703 and 1733, I authorize disclosure to the insurance commissioner of all financial institution records of any fiduciary accounts for the duration of this license.

All fees are filing fees and are not refundable, whether the is acted upon or an examination taken.

Applicant’s Signature: _________________________________ City ______________ Date ___________

Page 5 of 6 |

LIC |

Notice: Information collection and Access

Section 1798.17 of the California Civil Code requires the following information to be provided when collecting information from individuals to determine compliance with the group and corporate practice provisions of the law, and to establish positive identification, to match the names of the certified list provided by the Department of Child Support Services to applicants and licensees, and of responding to requests for this information made by child support agencies.

Agency: Department of Insurance, Address: 320 Capitol Mall, Sacramento, CA

Title of official responsible for information maintenance: Chief, Producer Licensing Bureau.

Authority which authorizes the maintenance of the information: California Insurance Code, Chapters 5, 6, 7,

The consequences, if any, of not providing all of part of the requested information: It is mandatory that you provide all information requested. Omission of any item of requested information will result in the application being rejected as incomplete.

The principal purpose(s) for which the information is to be used: The information requested will be used to determine qualifications for licensure or certification, to determine compliance with the group and corporate practice provisions of the law and to establish positive identification.

Each individual has the right to review files maintained on them by the agency, unless the information is classified as confidential under section 1798.34 of the Civil code.

Instructions for completing application

RE: "Applicant name" Enter full legal name. If no middle name, enter (NMN). If any part of your legal name is an initial only, place parentheses around such initial.

RE: "Address information" Do not enter the word "same" in any address area. Enter the appropriate address. P0 Box is not acceptable for a resident or business address. Business and mailing addresses are public record and are available to the public. It is the applicant’s/licensee’s responsibility to immediately notify the department of any change in address.

RE: Additional "Exam information". If you fail to appear for a scheduled examination, an additional examination fee will be required for rescheduling.

RE: "AKA/Alias" List previously and currently used aliases and maiden names, if any. If you are currently using an "also known as" (AKA) name which you desire to be noted on record, so state. Abbreviations of true name or "nick" names are not acceptable.

RE: "Background questions" If you answer yes to any of these questions, you must submit a signed statement, with your original signature summarizing the details of each event. You must also provide the additional certified documentation described with each question.

Prelicensing Education requirements: As of January 1, 2011 all new resident applicants must:

A.take an approved minimum

B.take an approved minimum

C.take an approved minimum 40 hour class for property

D.take an approved minimum

E.take an approved minimum 20 hour class for accident and health agent license exam, and/or;

F.take an approved minimum 40 hour class for

G.take an approved minimum

H.take an approved minimum 20 hour class for the limited lines automobile insurance agent license examination, and/or;

I.take an approved minimum

An applicant will be taking 32 hours (20 and 12), 52 hours (40 and 12 or 20, 20 and 12), and 72 hours (20, 40 and 12 or 20, 20, 20 and 12) of prelicensing class hours depending on which combination of licenses are being sought.

The following documents are required to be submitted with the application for the specific license types as listed:

SL - $50,000 bond form LIC

SP - $10,000 bond form LIC

CS - $10,000 bond form LIC

CI - Action Notice of Appointment form LIC

MC - Action Notice of Appointment form LIC

Forms are available on our website at www.insurance.ca.gov. To obtain insurance licensing forms by mail, send request to: Department of Insurance, 320 Capitol Mall, Sacramento, CA

Mail application with attachments and fees to Department of Insurance, 320 Capitol Mall, Sacramento, CA

Page 6 of 6 |

LIC |

Form Characteristics

| Fact Name | Details |

|---|---|

| State | California |

| Department | California Department of Insurance |

| Form Number | LIC-441-9 (Rev 01/2021) |

| Type of Application | Permanent License or Certificate of Convenience |

| License Types Available | Includes various agent types like Life Agent, Property Broker-Agent, and Specialty license options |

| Mandatory Disclosure | Social Security Number or Individual Tax Identification Number is required as per Cal. Insurance Code, §1666.5(a)(2) |

| Submission of Documents | Required documents must be submitted post-examination; email or postal options available. |

| Legal Compliance | Application denials can occur for false statements or failure to disclose background information per sections 1668(h) and 1738 of the insurance code. |

Guidelines on Utilizing Application Insurance License

Completing the Application Insurance License form is a vital step in obtaining an insurance license. It is important to fill out the form accurately and completely to avoid delays in processing your application. Once the application is submitted, it will be reviewed by the appropriate authorities for eligibility, and further instructions or requirements may follow.

- Indicate the Application Type by checking the correct box: Permanent or Certificate of Convenience.

- Select the License Type by checking the appropriate box for the insurance category you are applying for.

- Provide your Last Name, First Name, Middle Name, and Suffix.

- Select your Gender by checking either Male or Female.

- Enter your Birthdate in the format MM/DD/YYYY.

- Provide your Social Security Number or Individual Tax Identification Number.

- Fill in your Resident Address (use a physical mailing address, no P.O. Boxes).

- Enter your City, State, and Zip Code.

- Provide your Home Phone Number.

- Indicate if you are a Citizen of the United States by checking Yes or No.

- State whether you are Affiliated with a Financial Institution/Bank by checking Yes or No.

- For your Business Address, include a physical address (no P.O. Boxes).

- Enter your Business City, State, and Zip Code.

- Provide your Business Phone Number and Business Fax Number.

- Input your E-mail Address (this is required).

- Fill out your Business Web Site Address.

- Provide a Mailing Address (P.O. Box is acceptable).

- Enter the mailing City, State, and Zip Code.

- Indicate if you require any Special Accommodation Requests for Examination.

- Complete the Examination Information section regarding your license examination.

- Specify your Work/Personal History for the past five years, detailing all employment and education.

- Answer whether you currently hold or have ever held an insurance license by checking Yes or No.

- If applicable, provide information regarding any AKA/Alias usage.

- Indicate if you plan to use a Fictitious Name, and provide the proposed name if applicable.

- For Life-Only Agent/Part Time Fraternal License applicants, indicate your registration with SEC or FINRA.

- Certify completion of your Prelicensing Education.

- Complete the Background Information section, disclosing any felony or misdemeanor convictions and related items.

- Sign the Applicant’s Certification to affirm the accuracy of your submission.

What You Should Know About This Form

What types of licenses can I apply for with the Application Insurance License form?

The Application Insurance License form facilitates applications for a variety of insurance licenses. Popular options include the Life Agent License, Property Broker-Agent License, and Casualty Broker-Agent License, among others. You'll find that the form encompasses both part-time and full-time options, catering to different professional needs. Before committing to any license type, ensure you understand the responsibilities and qualifications associated with your choice.

Do I need to pass an examination before submitting the insurance license application?

Yes, passing your relevant license examination is necessary before submitting your application. The examination must be completed successfully to validate the application process. It's crucial to ensure that all required documentation is submitted after passing the exam to avoid delays. This step not only helps demonstrate your knowledge of insurance principles but also prepares you for the challenges of the profession.

What information is required regarding my work and personal history?

The application asks for a detailed account of your work history for the past five years. You should include all types of employment—full and part-time, self-employment, military service, and even time spent in education. This thoroughness provides the Department of Insurance with a comprehensive view of your professional background, which can impact your license application.

Are there any specific requirements related to my background history?

Yes, the application delves into your background, specifically regarding any felony or misdemeanor convictions. It's important to disclose all convictions, regardless of their outcome. If you have past convictions, you will need to provide a written statement that details the circumstances and include court documents that support your case. Transparency in this section can significantly affect the review of your application.

What should I do if I've been involved in any professional or occupational license proceedings?

If you've experienced any administrative proceedings related to professional licensing, this must be disclosed on your application. You need to detail the incident and provide supporting documents. The Department of Insurance takes such matters seriously, and full disclosure can prevent complications during the application review process.

Is there an option for special accommodations when taking the examination?

Absolutely! If you require special accommodations for the examination, you can request them within the application. It's essential to make these arrangements prior to taking the exam. The goal is to ensure that every applicant has an equal chance of success, regardless of potential challenges they may face.

How do I submit my completed Application Insurance License form?

You can submit your application via email or by regular mail. For email submissions, send your documents to CADepartmentofInsuranceLicensingExams@insurance.ca.gov. Alternatively, you can mail your application to the California Department of Insurance at the provided address in the form. Ensure that every detail is filled out correctly to facilitate a smoother processing experience.

Common mistakes

When applying for an insurance license in California, people often make several common mistakes on the Application Insurance License form. One major error is failing to provide accurate personal information. Applicants are asked to fill out their name, birthdate, and social security number. If these details are incorrect, it can lead to delays or even the denial of the application.

Another frequent mistake involves choosing the wrong application type or license type. Individuals must carefully review the options available and select the appropriate categories. Choosing an incorrect type not only wastes time but can complicate the entire process. Similarly, neglecting to complete the Home and Business Address sections properly can lead to important correspondence being sent to the wrong location.

Many applicants also overlook the importance of the citizenship question. Answering “No” when you are actually a U.S. citizen can jeopardize the application. Additionally, some applicants mistakenly assume that minor instances in their background do not need to be disclosed. However, failing to disclose convictions, even if they have been dismissed, can raise red flags and result in a rejected application.

Another oversight is not providing a valid email address. This field is required for communications regarding the application status. Without a working email address, applicants may miss crucial updates. Furthermore, the business address must not be a P.O. Box. Many do not realize this, leading to complications when their application is processed.

Completing the background information section accurately is vital. Applicants frequently ignore the need to provide comprehensive details about any licenses held in other states or any previous disciplinary actions. Failure to do so might result in the application being denied due to perceived dishonesty.

Lastly, some applicants rush through the certification at the end of the application. This can result in neglecting to sign or date the application correctly. Without an original signature, online submissions can face additional scrutiny or outright rejection.

Documents used along the form

When applying for an insurance license, various additional documents may be required alongside the Application Insurance License form. These documents help ensure that the licensing body has all necessary information to process your application effectively. Below is a list of common forms and documents you might encounter during this process.

- Prelicensing Education Certificate: This document serves as proof that the applicant has completed the required prelicensing education necessary before taking the state examination.

- Background Disclosure: A statement detailing any past felony or misdemeanor convictions, which must be disclosed in accordance with state regulations. Attach any necessary documentation.

- Consent for Felony Involvement: If applicable, this is a written consent from the Insurance Commissioner allowing an applicant with a felony conviction related to dishonesty to engage in the business of insurance.

- Employment History Verification: A detailed account of the applicant’s employment history for the past five years. It includes full and part-time work as well as any gaps in employment.

- Tax Clearance Certificate: This document verifies that the applicant does not have delinquent tax obligations that might affect their eligibility for licensing.

- Financial Disclosure: Information about any financial issues like bankruptcies or judgments that may impact the applicant's ability to be licensed.

- Certified Court Documents: When necessary, certified copies of court documents related to any past criminal convictions or administrative proceedings must be provided.

- Application for DBA Name: If the applicant intends to operate under a fictitious name, this form must be submitted for approval prior to use.

- Notice of Intent to Use Fictitious Name: This document informs the licensing authority of a wish to use a DBA, ensuring it is officially documented and approved.

Completing the application process for an insurance license can be intricate. Having the right documents at hand simplifies the journey and minimizes potential delays. Always verify your state's specific requirements to ensure you've gathered all necessary paperwork accurately.

Similar forms

-

Professional License Application: Similar to the insurance license application, this document requires personal identification and professional history. Both forms ask about previous licenses and any legal issues that may affect eligibility.

-

Real Estate License Application: This application shares similarities with the insurance license application as it includes personal background information, disclosures of any criminal history, and confirmation of education credentials.

-

Contractor License Application: Like the insurance license application, this document requests proof of identification, work history, and any disciplinary actions that may have taken place in previous roles within the industry.

-

Medical License Application: This application requires detailed background checks, including criminal history and other legal disclosures, much like the insurance license application.

-

Accountancy License Application: Similar to the insurance license application, both include questions about prior licenses held, professional ethics, and any legal troubles that might impact licensure.

-

Teaching Credential Application: This form also parallels the insurance license application in terms of detailed personal information, employment history, and inquiries about any misconduct that could prevent licensure.

Dos and Don'ts

When filling out the Application Insurance License form, there are several important considerations to keep in mind. The following list outlines key actions to take, as well as common pitfalls to avoid.

- Do provide accurate personal information.

- Do ensure all sections are completed thoroughly.

- Do double-check that required documents are attached.

- Do be honest regarding your background and history.

- Don’t leave any questions unanswered; strive for full transparency.

- Don’t provide incomplete or outdated contact information.

- Don’t ignore deadlines; submit your application promptly.

Each of these actions significantly impacts the evaluation of your application. Taking the time to carefully consider each aspect of the form can ultimately enhance your chances of obtaining the desired insurance license.

Misconceptions

- Misconception 1: The application is optional for anyone seeking an insurance license.

- Misconception 2: Only residents of California need to fill out the application.

- Misconception 3: You can submit the application without passing the required examination.

- Misconception 4: You can use a P.O. Box for your business address.

- Misconception 5: Providing a social security number is optional.

- Misconception 6: Background checks are not part of the application process.

- Misconception 7: You can submit the application without detailing your work history.

The application is mandatory. You must complete it to pursue an insurance license in California.

Individuals from other states applying for a license in California must also complete this application. Resident status does not limit this requirement.

The examination must be completed and passed before the application can be submitted. This is a crucial step in the licensing process.

A physical business address is necessary. P.O. Boxes are not accepted for the business address in the application.

In fact, disclosing your social security number or Individual Tax Identification Number is required. Failure to provide this information will lead to the application not being reviewed.

Background checks are an essential part of the application. All relevant criminal history must be disclosed to ensure the integrity of the application.

A detailed employment history for the past five years is required. This includes all forms of employment, military service, and even periods of unemployment.

Key takeaways

When filling out the Application Insurance License form, consider the following key takeaways:

- Choose the Correct Application Type: Indicate whether you are applying for a Permanent license or a Certificate of Convenience.

- Specify the License Type: Select the appropriate license type that reflects your area of interest such as Life Agent, Property Broker-Agent, or others.

- Provide Accurate Personal Information: Make sure to enter your full name, birthdate, and Social Security Number or ITIN. Errors may cause delays.

- Indicate Citizenship: Clearly state whether you are a U.S. citizen. This information is essential for the processing of your application.

- Submit Contact Information: Include both your home and business phone numbers, along with an email address and website, if available.

- Complete Background Disclosure: Fully answer questions regarding felony convictions, administrative proceedings, and other relevant history. Failure to disclose may lead to denial.

- Licensing Examination: You must pass the licensing examination before submitting your application; documentation of your exam completion is necessary.

- Signature Certification: Ensure you sign the application, certifying the truthfulness of the information provided. This may have legal consequences if incorrect.

- Review Submission Guidelines: Based on your license type, follow any specific document submission guidelines outlined for your category.

Following these key points will help ensure a smooth application process for your insurance license.

Browse Other Templates

Prior Authorization Training Free - Follow-up on the authorization status after submission.

Apras - A section of the form is designated for a description of the load being transported.

Car Title Sent to Wrong Address - Each party's signature signifies agreement to the odometer's reported condition.