Fill Out Your Application Standby Letter Credit Form

The Application Standby Letter Credit form is a vital document in the world of finance and trade. Designed to facilitate secure transactions, this form requests the issuance of an irrevocable Standby Letter of Credit. Its primary purpose is to assure the beneficiary of payment should the applicant default on their financial obligation. The form outlines the essential details, such as the bank's information, the amount of credit, and the precise wording for any beneficiary's signed statement. It allows for various methods of communication, including airmail and courier services. Compliance with U.S. laws and regulations is paramount, as the applicant must certify that all related transactions adhere to the Foreign Assets Control Regulations and other relevant laws. Furthermore, the agreement also clarifies the parties’ responsibilities, including payment and reimbursement protocols, underpinned by the Uniform Customs and Practice for Documentary Credits or International Standby Practices, depending on the applicant's choice. Additional aspects of the form cover terms related to fees, acceptance of drafts, and the consequences of non-compliance. In summary, this Application Standby Letter Credit form is a comprehensive tool designed to protect the interests of all parties involved while facilitating international trade and commerce.

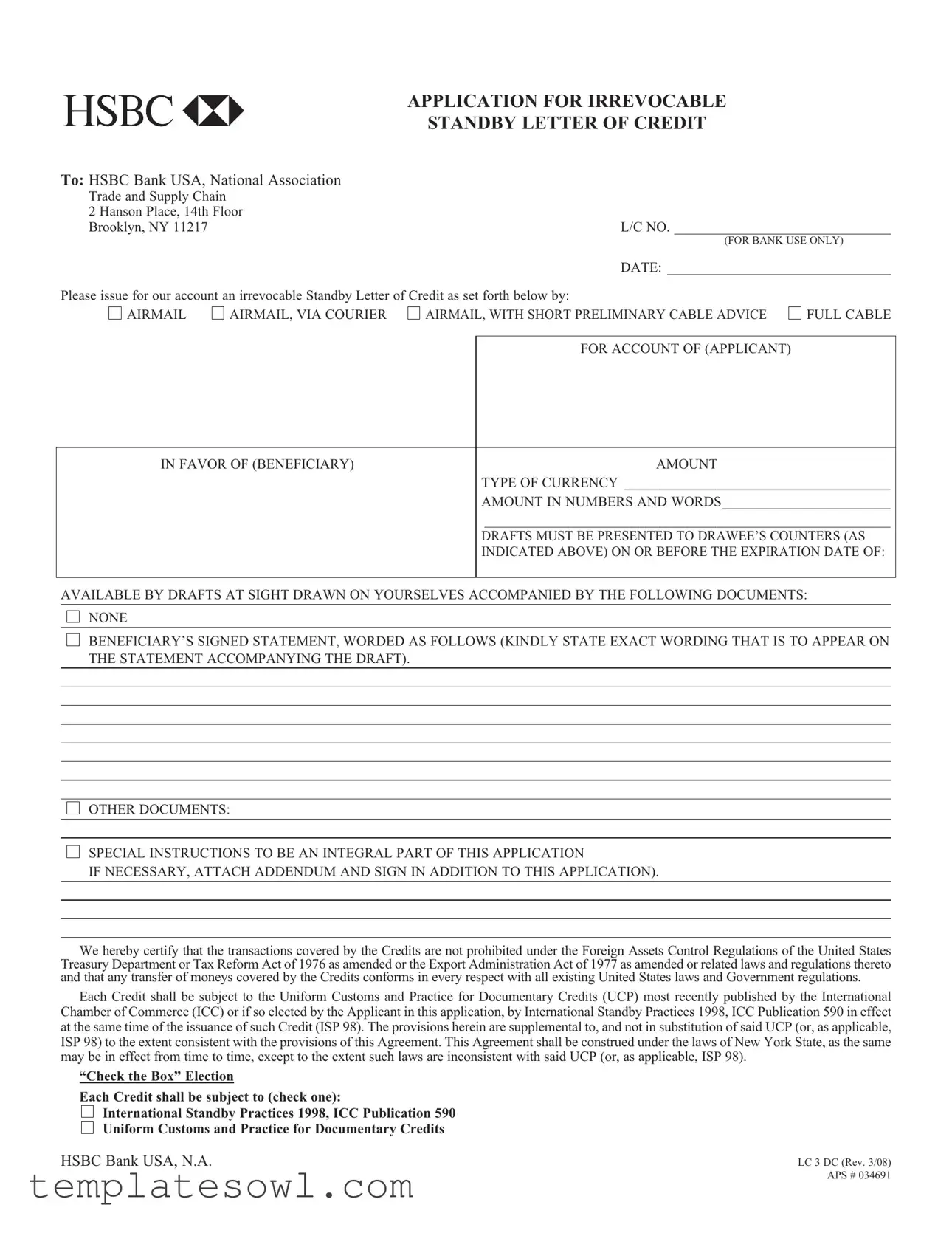

Application Standby Letter Credit Example

|

APPLICATION FOR IRREVOCABLE |

|

STANDBY LETTER OF CREDIT |

To: HSBC Bank USA, National Association |

|

Trade and Supply Chain |

|

2 Hanson Place, 14th Floor |

|

Brooklyn, NY 11217 |

L/C NO. _______________________________ |

|

(FOR BANK USE ONLY) |

|

DATE: ________________________________ |

Please issue for our account an irrevocable Standby Letter of Credit as set forth below by:

AIRMAIL |

AIRMAIL, VIA COURIER |

AIRMAIL, WITH SHORT PRELIMINARY CABLE ADVICE |

FULL CABLE |

FOR ACCOUNT OF (APPLICANT)

IN FAVOR OF (BENEFICIARY)

AMOUNT

TYPE OF CURRENCY ______________________________________

AMOUNT IN NUMBERS AND WORDS________________________

__________________________________________________________

DRAFTS MUST BE PRESENTED TO DRAWEE’S COUNTERS (AS INDICATED ABOVE) ON OR BEFORE THE EXPIRATION DATE OF:

AVAILABLE BY DRAFTS AT SIGHT DRAWN ON YOURSELVES ACCOMPANIED BY THE FOLLOWING DOCUMENTS:

NONE

NONE

BENEFICIARY’S SIGNED STATEMENT, WORDED AS FOLLOWS (KINDLY STATE EXACT WORDING THAT IS TO APPEAR ON THE STATEMENT ACCOMPANYING THE DRAFT).

BENEFICIARY’S SIGNED STATEMENT, WORDED AS FOLLOWS (KINDLY STATE EXACT WORDING THAT IS TO APPEAR ON THE STATEMENT ACCOMPANYING THE DRAFT).

OTHER DOCUMENTS:

OTHER DOCUMENTS:

SPECIAL INSTRUCTIONS TO BE AN INTEGRAL PART OF THIS APPLICATION

SPECIAL INSTRUCTIONS TO BE AN INTEGRAL PART OF THIS APPLICATION

IF NECESSARY, ATTACH ADDENDUM AND SIGN IN ADDITION TO THIS APPLICATION).

We hereby certify that the transactions covered by the Credits are not prohibited under the Foreign Assets Control Regulations of the United States Treasury Department or Tax Reform Act of 1976 as amended or the Export Administration Act of 1977 as amended or related laws and regulations thereto and that any transfer of moneys covered by the Credits conforms in every respect with all existing United States laws and Government regulations.

Each Credit shall be subject to the Uniform Customs and Practice for Documentary Credits (UCP) most recently published by the International Chamber of Commerce (ICC) or if so elected by the Applicant in this application, by International Standby Practices 1998, ICC Publication 590 in effect at the same time of the issuance of such Credit (ISP 98). The provisions herein are supplemental to, and not in substitution of said UCP (or, as applicable, ISP 98) to the extent consistent with the provisions of this Agreement. This Agreement shall be construed under the laws of New York State, as the same may be in effect from time to time, except to the extent such laws are inconsistent with said UCP (or, as applicable, ISP 98).

“Check the Box” Election

Each Credit shall be subject to (check one):

International Standby Practices 1998, ICC Publication 590

International Standby Practices 1998, ICC Publication 590

Uniform Customs and Practice for Documentary Credits

Uniform Customs and Practice for Documentary Credits

HSBC Bank USA, N.A.

LC 3 DC (Rev. 3/08) APS # 034691

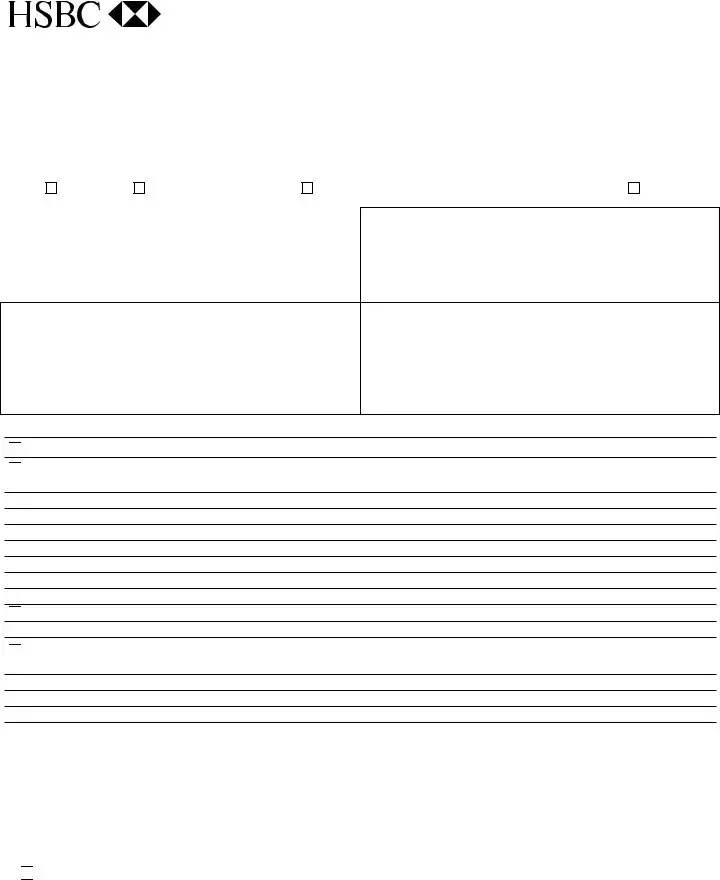

STANDBY LETTER OF CREDIT AGREEMENT

To: HSBC Bank USA, National Association Dear Sirs:

For the purpose of inducing you to issue your standby Letters of Credit (herein called the “Credits”) upon application by the Applicant who has executed the application on the reverse side and for other valuable consideration, receipt of which is hereby duly acknowledged, the Applicant hereby agrees as follows with respect to the Credits:

1.As to drafts, demands or drawings under, or purporting to be under the Credits which are payable in United States Currency, we agree in the case of each sight draft, to reimburse you at your office in immediately available funds on demand, and in the case of each time draft, at the date of maturity of such time draft, the amount due on such draft, or, if so demanded by you, to pay at your office in advance the amount to pay such draft. If no draft is to be presented under any Credit, we agree to pay you upon demand for any amounts paid by you under any Credit in conformity with the terms of such Credit. In all instances you have the right to

2.As to drafts, demands or drawings under, or purporting to be under, the Credits which are payable in currency other than United States Currency we agree: in the case of each sight draft, demand or drawing to reimburse you at your office, on demand, the equivalent of the amount paid in United States Currency as determined by your rate of exchange, on the day such draft, demand or drawing was paid, for the purchase of the currency in which such draft, demand or drawing is drawn.

3.We agree to pay you, on demand, your usual commission and all charges and expenses paid or incurred by you or your correspondents in connection therewith, including costs of reserve requirements, if any.

4.If for any reason you make payment under the Credits prior to your receipt of the aforementioned funds from the undersigned, we agree to pay you interest per annum at a rate equal to the then publicly announced HSBC Bank USA, National Association Prime Rate, as it may change from time to time, plus 3% covering the period commencing from the day of your payment and ending upon your receipt of the funds we remit to you for the actual days elapsed on the basis of a

5.We agree that in the event of any extension of the maturity or time for presentment of drafts, or documents, or any other modification of the terms of any Credits, at the request of any of us, with or without notification to the others, or in the event of any increase in the amount of any Credits at our request, this agreement shall be binding upon us with regard to such Credits so increased or otherwise modified, to drafts, documents and property covered thereby, and to any action taken by you or any of your correspondents in accordance with such extension, increase or other modification.

6.Applicant agrees that failure of the applicant to object in writing to the issuers payment and/or acceptance of any drawings under a credit by the earlier of (A) 5 days after the date the applicant receives the documents and (B) 5 days after the date the applicant receives any notice including but not limited to advices of payment that the Issuer has paid and/or accepted a conforming presentation under the documentary credit shall be conclusively deemed to be an acceptance by the applicant that the presentation is in conformity with the terms and conditions of the credit. Both the Issuer and the applicant agree that 5 days is a reasonable time.

7.The users of the Credits shall be deemed our agents and we assume all risk for their acts or omissions. Neither you nor your correspondents shall assume any liability to anyone for failure to pay or to accept if such failure is due to any restriction in force at time and place of presentment, and we agree to indemnify you and hold you harmless from any consequences that may arise therefrom. Neither you nor your correspondents shall be responsible for verifying the existence of any act, condition or statement made by any party in relation to their drawing or presentment under the Credits or in verifying or passing judgment on the reasonableness of any statement made by any party in relation to their drawing or presentment under the Credits; for the validity, sufficiency or genuineness of documents, even if such documents should in fact prove to be in any or all respects invalid, insufficient, fraudulent or forged; for failure to give any notice; for any breach of contract between the

beneficiary of the Credits, and ourselves or any of us. Furthermore, neither you nor your correspondents shall be responsible for errors, omissions, interruptions or delays in transmission or delivery of any messages, by mail, cable, telegraph, wireless or otherwise, whether or not they be in cipher, nor shall you be responsible for any error, neglect, or default of any of your correspondents; and none of the above shall affect, impair, or prevent the vesting of any of your rights or powers hereunder. In furtherance and extension and not in limitation of the specific provisions hereinbefore set forth, we agree that any action taken or not taken by you or by any correspondent of yours, under or in connection with the Credits or the relative drafts, documents or property if taken or not taken in good faith, shall be binding on us and shall not put you or your correspondents under any resulting liability to us, except if due solely to your gross negligence or willful misconduct.

8.We agree to procure promptly any licenses or certificates that may be required in the execution of the contract, agreement or understanding underlying the Credits, and to provide you, as you may anytime require or request, with copies of documents, agreements or other information and evidence. Such requests may extend to financial or other information regarding the undersigned which the undersigned agrees to provide in a prompt manner.

9.As security for the payment or performance of all our present or future obligations or liabilities of any and all kinds to you, whether incurred by us as maker, endorser, drawer, acceptor, guarantor, accommodation party or otherwise, due or to become due, secured or unsecured, absolute or contingent, joint or several, and howsoever or whensoever acquired by us (all of which are herein collectively referred to as “Obligations’), we hereby grant to you a security interest and a lien in and upon any of our property, or property in which we may have an interest, which is now or may at any time hereafter come into your possession or control, or in the possession or control of your subsidiaries or affiliates, or into the possession or control of any other party acting in your behalf, whether for the express purpose of being used by you as collateral security or for safekeeping or for any other different purpose, including such property as may be in transit by mail or carrier for any purpose or covered or affected by any documents in your possession or control or in the possession or control of your subsidiaries or affiliates, or in the possession or control of any third party acting in your behalf.

10.Upon our failure to pay any Obligations when becoming or made due, as aforesaid, you shall have, in addition to all other rights and remedies allowed by law, the rights and remedies of a secured party under the Uniform Commercial Code as in effect in the State of New York at any time and, without limiting the generality of the foregoing, you may immediately, without demand of performance and without notice of intention to sell or of time or place of sale or of redemption or other notice or demand whatsoever to us, all of which are hereby expressly waived, and without advertisement, sell at public or private sale grant options to purchase or otherwise realize upon, in New York or elsewhere, the whole or from time to time any part of the collateral upon which you shall have a security interest or lien as aforesaid, or any interest which the undersigned may have therein, and after deducting from the proceeds of sale or other disposition of said collateral all expenses (including but not limited to reasonable attorney’s fees for legal services of every kind and other expenses as set forth below) shall apply the residue of such proceeds toward the payment of any of the Obligations, in such order as you shall elect, we remaining liable for any deficiency remaining unpaid after such application. If notice of any sale or other disposition is required by law to be given, we hereby agree that a notice sent at least five days before the time of any intended public sale or of the time after which any private sale or other disposition of the said collateral is to be made, shall be reasonable notice of such sale or other disposition. At any such sale or other disposition you may yourself purchase the whole or any part of the said collateral sold, free from any right of redemption on the part of us, which right is hereby waived and released. We agree that the said collateral secures, and further agree to pay on demand, all expenses (including but not limited to reasonable

LC 3 DC (Rev. 3/08) |

APS # 034691 |

attorney’s fees for legal services of every kind and cost of any insurance and payment of taxes or other charges) of, or incidental to, the custody, care, sale or collection of, or realization upon, any of the said collateral or in any way relating to the enforcement or protection of your rights hereunder. We further agree that if at any time or from time to time you shall retain an attorney for the enforcement or protection of your rights hereunder, then such reasonable attorney’s fees shall be 20% of the amounts then owing on the Obligation or Obligations with respect to which such attorney was retained and that upon each such retention said attorney’s fees will be immediately due and owing.

11.You shall not be deemed to have any of your rights waived hereunder unless you or your authorized agent shall have signed such waiver in writing. No failure on your part to exercise and no delay in exercising any right, remedy or power hereunder shall operate as a waiver thereof nor shall any single or partial exercise by you of any right, remedy or power hereunder preclude any other or future exercise of any other right, remedy or power.

12.The word “property” as used in this agreement includes cash proceeds, deposit accounts, goods and documents relative thereto, securities, funds, and any and all other forms of property, whether real, personal or mixed and any right or interest therein.

13.If this agreement is signed by one individual, the terms “we”, “us”, shall be read throughout as “I”, “my”, “me” as the case may be. If this agreement is signed by two or more parties, it shall be the joint and several agreement of such parties.

14.The Obligations hereof shall continue in force, and apply, notwithstanding any change in the membership or ownership of any partnership or corporation undersigned, and the Obligations hereof shall bind the personal representatives successors and assigns of the undersigned, and all rights, benefits and privileges hereby conferred on you shall be and hereby are extended to and conferred upon and may be enforced by your successors and assigns.

15.We further agree that your rights, remedies, powers, security interests and liens hereunder shall continue unimpaired and that we shall be and remain obligated in accordance with the terms hereof notwithstanding the partial exercise by you of any right, remedy or power, or the release or substitution of any of the said collateral hereunder, at any time or times, or of any rights or interests therein, or any delay, extension of time, renewal, release, substitution or addition of parties, compromise or other indulgence granted by you, in reference to any of the Obligations, or any promissory note, draft, document, bill of

exchange or other instrument given in connection therewith, the undersigned hereby waiving all notice of any delay, extension, release, substitution, renewal, compromise or other indulgence, and hereby consenting to be bound as fully and effectually as if we had expressly agreed thereto in advance.

16.We agree that all Obligations of the undersigned to you, although contingent and not matured, shall become due and payable upon the occurrence of any one of the following events: admission in writing or telex of our inability to pay any debt when due; a violation of any of the terms and conditions of this Agreement, be it willful or involuntary, not expressly waived by you; a default in the payment of any interest or fee due and payable to you, your assigns or successors; a default under any borrowed money obligation; the existence of a condition which would materially and adversely affect the ability of the undersigned to operate its business as an ongoing venture; the dissolution or the complete or partial liquidation of the undersigned; or if the undersigned generally shall not pay its debts as they become due (within the meaning of the Bankruptcy Code of 1978 and any amendments thereto) or be the subject of any insolvency proceedings, or if the undersigned shall make an assignment for the benefit of its creditors or a trustee, receiver, intervenor, or custodian appointed for the purposes of reorganization or liquidation of the undersigned.

17.Each and every right, remedy and power hereby granted to you or allowed you by law or other agreement shall be cumulative and not exclusive the one of any other and may be exercised by you from time to time.

18.Notices and demands under this agreement shall be in writing and will be sufficient if delivered by hand, by first class mail postage prepaid or by registered mail addressed to the undersigned or to you at our respective principal places of business.

19.We agree that all Credits issued under this Agreement shall be irrevocable.

LC 3 DC (Rev. 3/08) |

APS # 034691 |

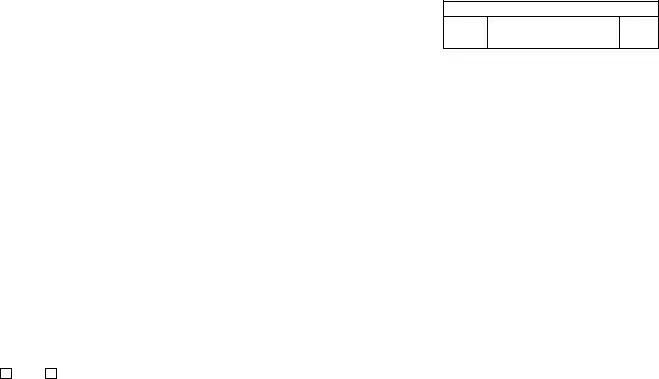

IN CONSIDERATION OF THE ESTABLISHMENT OF THE CREDIT SUBSTANTIALLY AS APPLIED FOR HEREIN, WE HAVE READ THE TERMS AND CONDITIONS SET FORTH IN THE AGREEMENT ON THE REVERSE SIDE OF THIS APPLICATION AND WE AGREE THAT THEY ARE MADE PART OF THIS APPLICATION FOR A STANDBY LETTER OF CREDIT AND ARE HEREBY ACCEPTED BY US.

|

|

|

APPROVED |

||||

|

SIGNATURE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRINT NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAP/WLI OFFICER CODE |

|

|

||||

|

|

|

|

|

|

|

|

|

DEPARTMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TELECOMM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ONLYUSE |

CIN NO. OR TIN/SSN |

|

|

||||

|

|

|

|

|

|

|

|

FACILITY NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BANK |

COST CENTER |

|

|

|

|

PURPOSE CODE |

|

|

|

|

|

|

|

|

|

PER ANNUM RATE |

CHARGE DDA |

|

SEND BILL |

||||

|

|

||||||

FOR |

|

% |

|

|

|

|

|

UP FRONT |

|

ARREARS |

|

MONTHLY |

|||

|

|

|

|

|

|

|

|

|

QUARTERLY |

|

|

ANNUAL |

|||

|

|

|

|

|

|

|

|

|

OTHER CHARGES |

|

|

|

|

|

|

|

Issuance Fee |

|

|

|

|

|

|

|

(Preparation Commission) $ |

|

|

||||

|

AMENDMENT FEE |

|

|

|

PAYMENT |

||

|

|

|

|

|

|

COMMISSION |

|

|

$ |

|

|

|

|

$ |

|

|

PARTICIPATION |

|

|

|

If Yes, Attach |

||

|

|

|

|

|

|

||

|

Yes |

No |

|

|

|

Separate Memo |

|

|

SIC CODE |

|

|

COUNTRY OF ULTIMATE RISK |

|||

|

|

|

|

|

|

|

|

_____________________________________________________________

APPLICANT

_____________________________________________________________

ADDRESS

_____________________________________________________________

AUTHORIZED SIGNATURE(S)

PLEASE SIGN OFFICIALLY

ACCOUNT NUMBER

(The following is to be executed if

the applicant is not also the account party)

AUTHORIZATION AND AGREEMENT OF ACCOUNT PARTY

To: HSBC Bank USA, National Association (Bank)

We join in the request to Bank to issue the Credit described above (Credit), naming us as Account Party. In consideration thereof, we irrevocably agree that: (i) the above Applicant has the sole right to give instructions and make agreements and amendments with respect to the foregoing application, the Credit and the disposition of documents, (ii) we shall have no right, claim, set off or defense against Bank or Bank’s correspondents respecting any matter arising in connection therewith; and (iii) we shall be jointly and severally liable with Applicant for all obligations owing to Bank in connection with the foregoing application, the agreement executed by Applicant with respect thereto, and the Credit. We agree that Applicant is authorized to assign or transfer to Bank all or any part of our obligations arising in connection with this transaction and any security therefor. Upon such assignment or transfer, Bank will be vested with all power and rights in respect of the obligations and security transferred or rights in respect of the obligations and security transferred or assigned to Bank.

Name_____________________________________________________

ACCOUNT PARTY – AS INDICATED ON FRONT

Address ___________________________________________________

By _______________________________________________________

PLEASE READ AGREEMENT CAREFULLY

HSBC Bank USA, N.A.

LC 3 DC (Rev. 3/08) APS # 034691

Form Characteristics

| Fact Name | Description |

|---|---|

| Type of Credit | This application is for an irrevocable Standby Letter of Credit, which guarantees payment as specified in the agreement. |

| Governing Law | The application is governed under the laws of New York State, unless stipulated otherwise. |

| Documentation Requirements | Drafters must present specific documents, such as the beneficiary's signed statement, for payment under the credit. |

| Currency Type | Credits can be issued in either United States currency or foreign currency as specified by the applicant. |

| Approval Process | Final issuance of the credit is contingent upon a review of the application and compliance with U.S. regulations. |

| Fees Incurred | There may be various fees associated with the issuance and amendment of the standby letter, such as issuance and amendment fees. |

| Obligation Continuity | All obligations from the agreement apply despite changes in ownership or partnership within the undersigned parties. |

Guidelines on Utilizing Application Standby Letter Credit

Successfully completing the Application for Irrevocable Standby Letter of Credit is essential for ensuring that your request is processed smoothly. Once the form is filled out, you will submit it to HSBC Bank USA for review. Your application will be assessed, and upon approval, the standby letter of credit will be issued according to the specified details. Here are the step-by-step instructions for filling out the application form:

- Enter the L/C number in the space provided (for bank use only).

- Write the date by which you are submitting the application.

- Choose your preferred delivery method by marking the corresponding option: Airmail, Airmail via Courier, or Airmail with Short Preliminary Cable Advice.

- Fill in the name of the applicant in the "For Account Of" section, as it should appear on the letter of credit.

- List the name of the beneficiary in the specified section.

- Specify the amount of the credit and select the type of currency from the provided options.

- Clearly state the amount both in numbers and in words.

- Indicate the expiration date of the letter of credit in the designated field.

- Select the availability of drafts by marking either "DRAFTS AT SIGHT" or specify other terms if necessary.

- If applicable, detail any additional required documents, including the wording for the beneficiary’s signed statement.

- Attach any special instructions or an addendum, if needed, ensuring that it is signed in addition to the application.

- Check the applicable box to indicate which custom or practice the letter of credit will be subject to: either the International Standby Practices 1998 or the Uniform Customs and Practice for Documentary Credits.

- Review the certification section to ensure all transactions comply with U.S. regulations and laws.

- Complete the signature fields, including the printed name, officer code, department, and authorized signatures as required.

- Fill in your account number and any applicable charges, such as issuance fees or amendment fees.

- Provide the applicant's address and country of ultimate risk, if applicable.

Once completed, double-check to ensure every field is filled out accurately. Proper submission will facilitate a smoother process in obtaining your standby letter of credit.

What You Should Know About This Form

What is the purpose of the Application Standby Letter Credit form?

The Application Standby Letter Credit form is used to request an irrevocable standby letter of credit from HSBC Bank USA. This document serves as a guarantee that a bank will cover a payment if the applicant fails to fulfill their contractual obligations. It is commonly used in situations involving international trade or large transactions where trust and assurance are paramount.

What information do I need to provide on the form?

When filling out the form, you will need to provide several key details. These include the amount and currency of the credit, the beneficiary (the party receiving the credit), the expiration date, and any specific documents or statements that need to accompany the drafts. Additionally, you may need to include special instructions or an addendum if required.

What types of documents must accompany drafts?

The standard requirement is to provide a signed statement from the beneficiary, indicating compliance with the terms of the standby letter of credit. If there are any additional documents required, they must be explicitly listed in the application to ensure all parties understand what is necessary for a successful transaction.

How is a standby letter of credit structured?

The standby letter of credit will include various provisions based on either the Uniform Customs and Practice for Documentary Credits (UCP) or the International Standby Practices (ISP 98). You will need to indicate your selection on the application form. This structure governs how the letter should be executed and what rules apply for fulfilling the credit obligations.

What are the applicant's responsibilities regarding payment?

The applicant is responsible for reimbursing the bank for any drafts or payments made under the standby letter of credit. This includes payment upon demand for any amounts due, plus any associated fees or costs that may arise in the execution and maintenance of the credit. It’s crucial to be prepared for these financial obligations to avoid potential issues.

What should I do if I notice errors or want to make changes after submitting the form?

If any discrepancies or necessary adjustments arise after the application is submitted, it is important to contact the bank promptly. Any modifications may need formal approval and documentation, and acting quickly can help prevent complications or misunderstandings regarding the terms of the credit.

What happens if the applicant defaults on the obligations?

In the event of default, the bank has the right to invoke its security interest in the collateral and is permitted to sell or utilize such assets to recover any unpaid obligations. The applicant remains liable for any deficiency even after the collateral is utilized, emphasizing the importance of fulfilling payment obligations.

Are there any fees associated with issuing a standby letter of credit?

Yes, there are fees for processing the standby letter of credit. These can include issuance fees, amendment fees, and payment commissions. It is advisable to review these costs on the application to understand the total financial commitment involved in securing the standby letter of credit.

Common mistakes

When individuals complete the Application for Irrevocable Standby Letter of Credit, several common mistakes can arise, potentially leading to significant delays or complications. One frequent error is not providing the required account information correctly. Applicants often forget to include accurate bank account numbers or other identifiers crucial for processing the application. This oversight can lead to the rejection of the application or erroneous transactions.

Another mistake pertains to the clarity of the beneficiary details. Applicants may fail to specify the beneficiary’s name clearly, including any relevant addresses or entities involved. Inaccuracies can lead to funds being misdirected or withheld, thus nullifying the primary purpose of issuing the letter of credit. Precision in this section is imperative to ensure proper delivery and application of the credit.

Additionally, applicants sometimes neglect to indicate the appropriate amount in both numbers and words. This dual requirement is crucial to mitigate any confusion regarding the exact sum involved. Failure to comply with this guideline may result in ambiguity and could complicate the financial transaction. Inaccurate amounts can also lead to disputes among involved parties, detracting from the efficiency of the credit process.

Timing is another vital consideration. Many applicants forget to specify a coherent expiration date for the standby letter of credit. Without a clear and reasonable time frame, the credit may not be enforceable, leaving the beneficiary unprotected. An unclear timeframe may also result in misunderstandings about obligations and rights, creating unnecessary conflict among parties involved.

Some individuals overlook the requirement to specify the necessary documents accompanying drafts, which can be a critical error. Providing incomplete documentation can lead to delays in payment or rejection of the credit altogether. It's essential that applicants include all relevant details about required documentation to facilitate smooth transactions.

Lastly, many applicants fail to review the terms and conditions before signing the application. Understanding the clauses and obligations tied to the standby letter of credit ensures that the applicants are aware of their responsibilities and risks. Neglecting this step can result in misunderstandings or unintentional breaches of agreement, leading to potential legal ramifications.

Documents used along the form

The Application Standby Letter of Credit form is often accompanied by several other important documents. These documents help establish the terms and conditions needed for a straightforward transaction. Here are some commonly used forms that may be needed along with the Application Standby Letter of Credit form:

- Letter of Credit Confirmation: This document confirms the terms of the letter of credit and might be issued by a bank to assure the beneficiary of payment under specified conditions.

- Drafts: Drafts are written orders to pay money, often requiring the beneficiary to present them to the bank for payment in accordance with the terms set forth in the letter of credit.

- Beneficiary's Statement: This is a statement provided by the beneficiary, often required to initiate a claim under the standby letter of credit.

- Commercial Invoice: This document details the sale of goods or services to the applicant and is often used to support claims for payment under the letter of credit.

- Shipping Documents: These include various transport and logistics documents that prove the goods have been shipped, which is essential for verifying compliance with the letter of credit terms.

- Insurance Certificate: This document provides proof that the goods in question are insured during transport, protecting both the applicant and the beneficiary.

- Purchase Agreement: A document outlining the terms of the sale between the applicant and the beneficiary, often required to demonstrate the underlying transaction.

- Amendment Request Form: Used to make changes to the terms of the letter of credit after its initial issuance, ensuring all parties are aware of updated terms.

- Compliance Documents: These might include certificates or regulatory documents that ensure the transaction complies with relevant laws and regulations.

- Account Authorizations: Forms authorizing specific individuals to act on behalf of the applicant, especially in regard to drawing against the standby letter of credit.

Each of these documents plays a vital role in facilitating a smooth transaction. They ensure that all parties involved have clarity on their responsibilities and rights under the standby letter of credit agreement.

Similar forms

The Application Standby Letter of Credit form shares similarities with various financial documents that serve important roles in transactions. Below are four documents that exhibit comparable features:

- Letter of Credit (LC): Similar to a standby letter of credit, a traditional letter of credit is a guarantee from a bank that a buyer's payment to a seller will be received on time and for the correct amount. Both documents ensure that the seller gets paid, allowing for smoother transactions.

- Bills of Exchange: A bill of exchange is a written order from one party to another to pay a specified amount at a designated date. Like standby letters of credit, bills of exchange facilitate payment assurances between buyers and sellers, supporting international trade.

- Performance Bond: A performance bond is a guarantee that a contractor or service provider will fulfill their contractual obligations. This document acts similarly to a standby letter of credit by providing financial security to project owners in case of non-performance.

- Documentary Collection: In a documentary collection, a bank acts as an intermediary, collecting payment from the buyer before releasing shipping documents to them. This process shares the objective of protecting both parties involved in a transaction, much like a standby letter of credit.

Dos and Don'ts

Important Guidelines for Filling Out the Application Standby Letter Credit Form

- Clearly provide the L/C number in the designated area to avoid confusion.

- Write the date on which you are submitting the application for tracking purposes.

- Ensure that the amount is specified both in numbers and words to remove any ambiguity.

- Double-check the beneficiary's information for accuracy to prevent delays in processing.

- Avoid leaving any sections of the form blank; incomplete forms can result in rejection.

- Do not forget to specify the type of currency involved; this is critical for processing.

- Refrain from using vague language in the beneficiary’s signed statement; be precise with wording.

- Never sign the application without reading all terms and conditions thoroughly; understand your obligations.

Misconceptions

- Misconception 1: All Letters of Credit are the Same.

- Misconception 2: You Do Not Need to Understand the Terms.

- Misconception 3: Letters of Credit Guarantees Payment.

- Misconception 4: Once Issued, a Letter of Credit Cannot Be Modified.

The terms and details of Letters of Credit can vary significantly. Not all Letters of Credit, including the Application Standby Letter of Credit, perform in the same manner or carry the same obligations. Each application may have specific requirements and conditions, as detailed in the provided documentation.

This misconception arises from the belief that any agreement can simply be signed without understanding its ramifications. It is essential to read and comprehend the terms of the agreement thoroughly, as they outline the responsibilities and liabilities associated with the Letter of Credit.

A common misunderstanding is that a Letter of Credit guarantees payment to beneficiaries without conditions. In reality, the fulfillment of terms and conditions is necessary before any payment can be made. Beneficiaries must present compliant documents to receive payment.

Many believe that a Letter of Credit is irrevocable and unchangeable once issued. While it is true that certain aspects are irreversible, modifications can be negotiated and agreed upon between the parties involved. Such changes need to be documented properly to be enforceable.

Key takeaways

Understanding the Application Standby Letter Credit form is crucial for its effective use. Here are key takeaways to keep in mind:

- Clearly complete the form with accurate details such as the L/C number and the date.

- Decide on the method of delivery, which can affect processing time. Options include airmail, courier, or cable advice.

- Clearly specify the amount and type of currency required.

- Drafts must be presented to the designated counters before the expiration date to avoid rejection.

- The terms must comply with U.S. laws, specifically the Foreign Assets Control Regulations and related laws.

- Select the governing rules by checking one of the provided boxes: either International Standby Practices or Uniform Customs and Practice.

- Be aware of the obligation to pay any commissions, charges, and expenses incurred by the bank.

- Consider the importance of obtaining necessary licenses or certificates related to the contract that the credit covers.

- Failure to respond to payment acceptance within the designated period (5 days) will be deemed as acceptance of the terms.

Completing this form accurately and adhering to the guidelines is essential in ensuring a smooth operation when applying for a Standby Letter of Credit. Prompt action is advised to prevent complications later in the process.

Browse Other Templates

Documents Update Rc Rushcard - It’s important to attempt resolution with the merchant before submitting.

OHR Leave Application - The form has undergone revisions to streamline the leave application process for employees.