Fill Out Your Appraisal Hvcc Form

The Appraisal HVCC Certification Form serves an essential function in the real estate transaction process by establishing guidelines around the appraisal of properties. This form is associated with the Home Valuation Code of Conduct (HVCC), which aims to promote transparency and independence in the appraisal process. It details the obligations of the lender regarding the appraisal and ensures the appraiser's qualifications meet required standards. The lender certifies the accuracy of the information regarding the property, including the borrower’s name, the loan number, and the property's address, along with the date of the appraisal. Stringent controls prevent any undue influence in the appraisal, including restrictions on communication between the appraiser and the lender's loan production staff. Information that could potentially affect the appraisal's outcome, such as the owner’s estimate of value or comparable sales data, must not be provided outside of a valid purchase agreement. The form also verifies the appraiser's licensing status and checks for any exclusions on established lists, ensuring integrity in the appraisal process. By signing this certification, the lender asserts compliance with HVCC requirements, thereby reinforcing the credibility of the appraisal. Overall, the Appraisal HVCC Certification Form plays a crucial role in fostering a fair appraisal environment in the real estate market.

Appraisal Hvcc Example

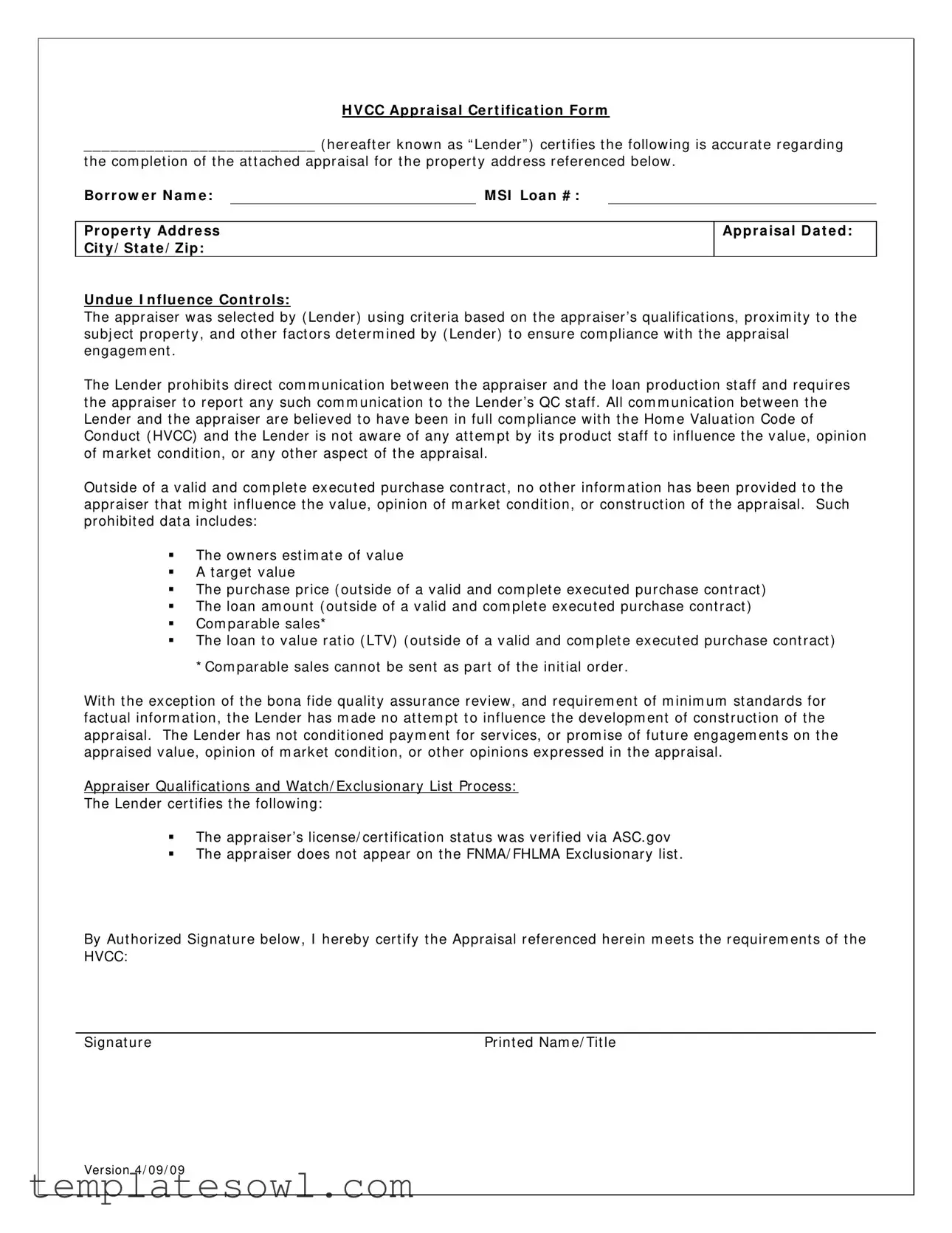

H V CC Ap p r a isa l Ce r t if ica t ion For m

__________________________ ( her eaft er k now n as “ Lender ” ) cer t ifies t he follow ing is accur at e r egar ding

t he com plet ion of t he at t ached appr aisal for t he pr oper t y addr ess r efer enced below .

Bor r ow e r N a m e : |

|

M SI Loa n # : |

Pr op e r t y Ad d r e ss Cit y / St a t e / Z ip :

Ap p r a isa l D a t e d :

U n d u e I n f lu e n ce Con t r ols:

The appr aiser w as select ed by ( Lender ) using crit er ia based on t he appr aiser ’s qualificat ions, pr ox im it y t o t he subj ect pr oper t y , and ot her fact or s det er m ined by ( Lender ) t o ensur e com pliance w it h t he appr aisal engagem ent .

The Lender pr ohibit s dir ect com m unicat ion bet w een t he appr aiser and t he loan pr oduct ion st aff and r equir es t he appr aiser t o r epor t any such com m unicat ion t o t he Lender ’s QC st aff . All com m unicat ion bet w een t he Lender and t he appr aiser ar e believ ed t o hav e been in full com pliance w it h t he Hom e Valuat ion Code of Conduct ( HVCC) and t he Lender is not aw ar e of any at t em pt by it s pr oduct st aff t o influence t he v alue, opinion of m ar k et condit ion, or any ot her aspect of t he appr aisal.

Out side of a v alid and com plet e ex ecut ed pur chase cont r act , no ot her infor m at ion has been pr ov ided t o t he appr aiser t hat m ight influence t he v alue, opinion of m ar k et condit ion, or const r uct ion of t he appr aisal. Such pr ohibit ed dat a includes:

The ow ner s est im at e of v alue

A t ar get v alue

|

The pur chase pr ice ( out side of a v alid and com plet e ex ecut ed pur chase cont r act ) |

|

The loan am ount ( out side of a v alid and com plet e ex ecut ed pur chase cont r act ) |

Com par able sales*

The loan t o v alue r at io ( LTV) ( out side of a v alid and com plet e ex ecut ed pur chase cont r act )

* Com par able sales cannot be sent as par t of t he init ial or der .

Wit h t he ex cept ion of t he bona fide qualit y assur ance r ev iew , and r equir em ent of m inim um st andar ds for fact ual infor m at ion, t he Lender has m ade no at t em pt t o influence t he dev elopm ent of const r uct ion of t he appr aisal. The Lender has not condit ioned pay m ent for ser v ices, or pr om ise of fut ur e engagem ent s on t he appr aised v alue, opinion of m ar k et condit ion, or ot her opinions ex pr essed in t he appr aisal.

Appr aiser Qualificat ions and Wat ch/ Ex clusionar y List Pr ocess:

The Lender cer t ifies t he follow ing:

The appr aiser ’s license/ cer t ificat ion st at us w as v er ified v ia ASC. gov

The appr aiser does not appear on t he FNMA/ FHLMA Ex clusionar y list .

By Aut hor ized Signat ur e below , I her eby cer t ify t he Appraisal r efer enced her ein m eet s t he r equir em ent s of t he HVCC:

Signat ur e |

Pr int ed Nam e/ Tit le |

Ver sion 4/ 09/ 0 9

Form Characteristics

| Fact Name | Description |

|---|---|

| Type of Form | This is the Appraisal Certification Form (HVCC). |

| Purpose | Ensures compliance with the Home Valuation Code of Conduct. |

| Lender's Role | The lender certifies the accuracy of appraisals for properties. |

| Appraiser Selection | The lender selects the appraiser based on qualifications and proximity to the property. |

| Communication Protocol | The lender prohibits direct communication between the appraiser and loan production staff. |

| Prohibited Influences | The appraiser must not receive estimates, target values, or purchase prices outside of a valid purchase contract. |

| Quality Assurance | A bona fide quality assurance review is allowed to ensure standards are met. |

| Verification of Licenses | The lender verifies the appraiser's license through ASC.gov. |

| Exclusion List Check | The appraiser must not appear on the FNMA/FHLMA exclusionary list. |

Guidelines on Utilizing Appraisal Hvcc

To complete the Appraisal HVCC form effectively, follow these detailed steps. This form verifies compliance with the Home Valuation Code of Conduct (HVCC) and connects selected appraisers with lenders, ensuring that everything is in order.

- Fill in the Lender Name: Write down the name of the lender at the top of the form.

- Borrower Name: Enter the name of the borrower in the designated space.

- Loan Number: Include the loan number assigned to the borrower.

- Property Address: Fill in the complete address of the property being appraised, including the city, state, and zip code.

- Appraisal Date: Record the date when the appraisal was completed.

- Select Undue Influence Controls: Indicate how the appraiser was selected by noting the criteria used by the lender.

- Communication Restrictions: State that direct communication between the appraiser and loan production staff is prohibited.

- Compliance Checkbox: Confirm that all communication between the lender and the appraiser complies with the HVCC.

- Prohibited Information: Affirm that no outside information influencing appraisal values was provided, which includes various specific data points listed in the form.

- Appraiser Qualifications: Verify the appraiser's license or certification status and ensure they are not on the exclusionary list.

- Authorized Signature: An authorized representative of the lender must sign and print their name and title at the bottom of the form.

Once the form is completed, it serves as a formal certification regarding the appraisal process, ensuring compliance with guidelines outlined by the HVCC. Make sure that everything is double-checked for accuracy before submission.

What You Should Know About This Form

What is the Appraisal HVCC form?

The Appraisal HVCC form is a certification document used by lenders to confirm that an appraisal has been completed according to the Home Valuation Code of Conduct (HVCC) standards. It outlines the processes followed in selecting the appraiser, ensures compliance with regulations, and asserts that the appraisal was not influenced by outside parties.

Who needs to fill out the Appraisal HVCC form?

The lender is responsible for filling out the Appraisal HVCC form. This includes presenting accurate information regarding the appraisal and confirming its adherence to the HVCC requirements.

What information is included in the Appraisal HVCC form?

The form contains essential details such as the borrower's name, loan number, property address, appraisal date, and a certification statement regarding the selection of the appraiser. It also lists the restrictions on communication between the appraiser and loan production staff to prevent undue influence on the appraisal's findings.

What are the restrictions on communication with the appraiser?

Direct communication between the appraiser and the loan production staff is prohibited by the lender. Instead, any necessary communication must go through the lender's quality control staff. The requirement is designed to uphold the integrity of the appraisal process and ensure compliance with the HVCC.

What prohibited information should not be provided to the appraiser?

The lender cannot provide the appraiser with details that might influence the appraisal, including the owner's estimate of value, a target value, the purchase price, the loan amount, comparable sales, or the loan-to-value ratio, unless as part of a valid and complete executed purchase contract.

How does the lender verify the appraiser's qualifications?

The lender certifies the appraiser's qualifications by verifying their licensing or certification status through the Appraisal Subcommittee (ASC) website. This ensures that the appraiser meets the necessary professional standards required for the appraisal process.

What is the significance of the exclusionary list?

The exclusionary list includes individuals who are disqualified from performing appraisals due to prior misconduct or unethical behavior. The lender certifies that the chosen appraiser does not appear on the FNMA/FHLMA exclusionary list, which is a crucial step in maintaining credibility in the appraisal process.

Is the lender allowed to influence the appraisal outcome?

No, the lender cannot condition payment for appraisal services on the appraised value or any opinions expressed in the appraisal. The lender must remain objective and ensure that the appraisal reflects an unbiased opinion of the property's market value.

What role does the authorized signature play in the Appraisal HVCC form?

The authorized signature on the Appraisal HVCC form serves as a certification by the lender that the appraisal meets HVCC requirements. It indicates that the lender takes responsibility for ensuring compliance with appraisal standards and recognizes the importance of impartiality in the appraisal process.

Common mistakes

Filling out the Appraisal HVCC form can be a simple task, but mistakes can lead to delays or complications in the appraisal process. Here are some common errors that individuals often make.

One frequent mistake is providing inaccurate or incomplete borrower information. When the form asks for the borrower’s name, it is crucial to include the full and correct name as it appears on official documents. Missing or misspelled names can lead to confusion, impacting the appraisal and potentially delaying the loan approval. Always double-check this section before submitting.

Another area where problems can arise is understanding the concept of undue influence and failing to recognize what information can and cannot be shared with the appraiser. Some people mistakenly believe that providing additional data, such as comparable sales or a target value, will help the appraiser. In reality, sharing this kind of information contravenes the guidelines of the HVCC and can undermine the integrity of the appraisal process. It’s essential to limit the information provided to only what is necessary under regulations.

Additionally, individuals often overlook the importance of the appraisal date and property address accuracy. Missing a detail such as the property address can create complications that may require a new appraisal process. Lenders need precise information to avoid issues with compliance and record-keeping. Taking a moment to verify this information saves everyone involved time and money.

Finally, a widespread mistake involves not verifying the appraiser's qualifications. The form requires the lender to confirm that the appraiser holds the appropriate license and does not appear on any exclusion lists. Failing to conduct this verification could lead to the use of an appraiser who does not meet necessary standards, which can complicate the entire loan process. Make it a point to ensure these details are checked and certified on the form.

Documents used along the form

The Appraisal HVCC form is an essential document utilized in the home loan process to ensure compliance with the Home Valuation Code of Conduct (HVCC). Several other forms and documents typically accompany this appraisal certification to provide necessary information and maintain transparency throughout the appraisal process. The following list outlines some of these documents.

- Appraisal Report: This detailed report includes the appraiser’s findings and conclusions regarding the property’s value, based on factors such as condition, location, and comparable sales.

- Loan Estimate: A standardized document provided to borrowers that outlines the terms of the loan, including estimated monthly payments, interest rates, and closing costs.

- Purchase Agreement: A legally binding document between the buyer and seller outlining the sale terms, including purchase price and any contingencies.

- Title Report: This document provides information about the property's ownership history, liens, and any encumbrances that may impact the transaction.

- Property Disclosure Statement: A form filled out by the seller detailing known issues or defects with the property, offering transparency to potential buyers.

- Credit Report Authorization: This form allows lenders to obtain the borrower’s credit report to assess their creditworthiness before approving a loan.

- Income Verification Documents: Copies of pay stubs, tax returns, or bank statements submitted by the borrower to prove their income and ability to repay the loan.

- Inspection Report: An assessment conducted by a professional inspector, detailing the condition of the home and any necessary repairs.

- Appraiser's Qualifications: Documentation that verifies the appraiser's license, experience, and any potential conflicts of interest related to the appraisal.

- Compliance Certificate: A document certifying that the appraisal adhered to all applicable regulations and guidelines, including the HVCC.

These forms and documents are crucial in facilitating a smooth transaction while ensuring compliance with regulatory standards. Each piece of documentation contributes to the overall integrity of the appraisal process and protects the interests of all parties involved.

Similar forms

-

Inspection Report: Similar to the Appraisal HVCC form, an Inspection Report outlines the condition and features of a property. It is typically completed by a qualified inspector and includes details that might influence the property’s value. Both documents aim to ensure transparency and accuracy regarding a property’s status before a transaction.

-

Purchase Agreement: The Purchase Agreement serves as a binding contract detailing the terms of a property sale. Like the HVCC form, this document requires accurate information about the property and outlines the responsibilities of buyers and sellers. Both aim to ensure that necessary conditions are met during the transaction process.

-

Loan Application: The Loan Application provides crucial information about the borrower and the property in question. Similar to the HVCC form’s requirement for transparency, the Loan Application seeks to ensure the lender is informed about all relevant aspects before approving a loan.

-

Title Report: The Title Report details the legal description of the property and any liens or encumbrances associated with it. Like the HVCC form, it aims to confirm that the property is free of any issues that could affect its ownership or value. Transparency is key in both reports.

-

Property Disclosure Statement: This document, typically provided by sellers, discloses any known issues with the property. It is akin to the HVCC form in its emphasis on honesty and transparency in property transactions, ensuring all parties are aware of potential concerns that might impact the appraisal or sale.

Dos and Don'ts

When filling out the Appraisal HVCC form, attention to detail is crucial. Here are ten essential dos and don'ts to keep in mind:

- Do accurately verify the borrower’s name and loan number.

- Do ensure the property address is correct, including city, state, and zip code.

- Do confirm the appraisal date to reflect the most recent evaluation.

- Do follow the lender’s criteria when selecting an appraiser to maintain compliance.

- Do report any direct communication attempts between the appraiser and loan production staff to the lender’s QC staff.

- Do not share information that might influence the appraisal value or opinion, such as owner estimates or the target value.

- Do not mention the purchase price outside of a valid and complete executed purchase contract.

- Do not provide the loan amount that is not part of a valid contract.

- Do not send comparable sales with the initial order for the appraisal.

- Do not allow any influence from the lender that might compromise the appraisal process.

Misconceptions

Misconceptions about the Appraisal HVCC form can lead to confusion. Here are five common misconceptions and clarifications to help you better understand this important document.

- The HVCC form guarantees a specific appraisal value. Many believe that submitting this form will automatically result in a certain appraised value. In reality, the form simply certifies compliance with the Home Valuation Code of Conduct and does not influence the value itself.

- All communication between the lender and appraiser is prohibited. While the form restricts direct communication regarding the appraisal, it does not completely eliminate all forms of communication. Proper channels exist for necessary discussions, especially those concerning compliance and quality assurance.

- The appraiser can receive information about comparable sales. Some think that sharing data on comparable sales can guide the appraiser's estimation. However, the HVCC strictly forbids this practice to maintain independence in the appraisal process.

- The lender controls the appraisal outcome. A prevailing misconception is that lenders can dictate the results of an appraisal. The HVCC is designed to protect against this by ensuring that the appraisal process remains unbiased and independent.

- Appraisers never report any communication with the lender. It’s a common belief that appraisers simply carry out their work without any oversight. On the contrary, the HVCC requires appraisers to report any direct communication with the loan production staff to the lender’s quality control team.

Understanding these misconceptions allows homeowners, buyers, and industry professionals to navigate the appraisal process with clarity and confidence.

Key takeaways

- Understand the Purpose: The Appraisal HVCC form is used to certify that the attached appraisal complies with certain standards and regulations.

- Complete Information: Fill out the form with accurate borrower information, including borrower name, loan number, and property address.

- Appraiser Selection: The lender selects the appraiser based on qualifications, proximity, and other relevant factors.

- Communication Restrictions: Direct communication between the appraiser and loan production staff is prohibited. This helps prevent undue influence on the appraisal process.

- Compliance Assurance: The lender confirms that all communications with the appraiser comply with the Home Valuation Code of Conduct (HVCC).

- Avoid Prohibited Data: Information that could influence the appraisal, such as target values or purchase prices, should not be provided outside of a valid purchase contract.

- Comparable Sales Limitations: Comparable sales information cannot be included in the initial appraisal order.

- Payment Conditions: The lender may not condition payment or future engagements based on the appraisal value or opinions expressed.

- Verification of Appraiser: The lender must verify the appraiser's license status through ASC.gov and ensure they are not on exclusion lists.

- Authorized Signature: The form must be signed by an authorized individual who certifies that the appraisal meets HVCC requirements.

Browse Other Templates

How to Register a Car in Tn - It can also be used to request a duplicate title if the original is lost or damaged.

How to Transfer Ownership in Google Drive - Transferring ownership is typically a straightforward process, but care must be taken during each step.

Temporary Vehicle Registration Application,Florida Temp Tag Request Form,Temporary License Plate Application,HSMV Temporary Plate Request,Application for Provisional License Plate,Temporary License Permit Request,Florida Temporary Tag Application,Req - The HSMV 83091 form is used to apply for a temporary license plate in Florida.