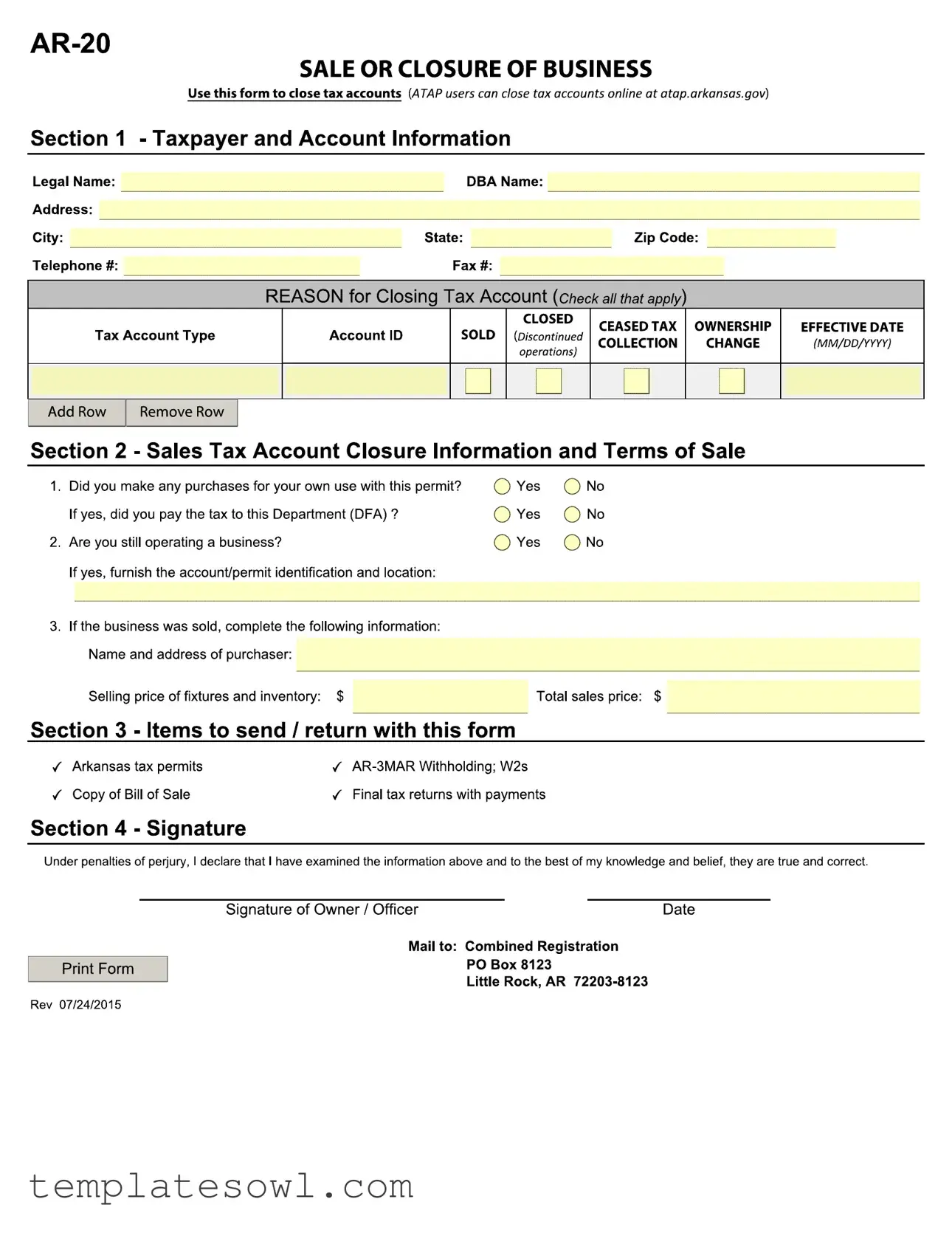

Fill Out Your Ar 20 Form

The AR-20 form is a crucial document utilized by businesses in Arkansas when they either close their tax accounts or cease operations. This form is specifically designed to facilitate the orderly closure of a business's tax obligations, ensuring that all necessary information is provided to the state tax authorities. It includes several sections that require detailed information about the taxpayer and the business account, such as the legal name, address, and reasons for closing. Various conditions are addressed, including whether the business was sold, closed permanently, or if there was a change in ownership. The form also solicits information regarding any purchases made under the sales tax permit, thereby confirming compliance with tax laws prior to closure. Alongside the form, businesses must submit certain documents, including copies of tax permits, the bill of sale, and final tax returns, to complete the process. Additionally, a declaration statement requiring the business owner's signature attests to the accuracy of the information provided. By following these procedures, businesses can effectively manage their responsibilities related to closing their tax accounts.

Ar 20 Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The AR-20 form is used to close tax accounts in Arkansas. |

| Online Closure | ATAP users can close tax accounts online at atap.arkansas.gov. |

| Sections of the Form | The form includes sections for taxpayer information, reasons for closure, and details about sales tax account closure. |

| Ownership Change | Reasons for closing include ownership changes, sales, or discontinuation of operations. |

| Sales Tax Declaration | The form requires the taxpayer to declare whether they made purchases for personal use under the tax permit. |

| Documentation Requirements | Applicants must send items such as Arkansas tax permits, a copy of the Bill of Sale, and final tax returns with the form. |

| Signature Requirement | Under penalty of perjury, the form must be signed by the owner or officer declaring the information is true. |

| Mailing Address | The completed form should be mailed to Combined Registration, PO Box 8123, Little Rock, AR 72203-8123. |

Guidelines on Utilizing Ar 20

After obtaining the AR-20 form, it is important to accurately fill it out to properly close your tax account. Below are the steps to guide you through the process of completing the form.

- Begin by filling out your Legal Name, Address, DBA Name, City, State, Zip Code, Telephone #, and Fax # in Section 1.

- Check the appropriate Reason for Closing Tax Account. Options include SOLD, CLOSED, CEASED TAX COLLECTION, or OWNERSHIP CHANGE.

- If applicable, indicate the Effective Date of the closure using the MM/DD/YYYY format.

- In Section 2, answer whether you made any personal purchases using your permit by checking Yes or No.

- If you answered Yes, specify whether you paid the tax to the Department of Finance and Administration (DFA).

- Indicate whether you are still operating a business. If Yes, provide the account or permit identification and business location.

- If the business was sold, provide the Name and Address of Purchaser and the selling price of fixtures and inventory. Provide the total sales price as well.

- In Section 3, gather the items to send or return with the form, such as Arkansas tax permits, a copy of the Bill of Sale, AR-3MAR Withholding, W-2s, and final tax returns with payments.

- Finally, sign and date the form in Section 4, ensuring that all information is true and correct. Complete the declaration under the penalties of perjury.

- Mail the completed form to: Combined Registration, PO Box 8123, Little Rock, AR 72203-8123.

Once the form is sent, you can expect to receive confirmation regarding the closure of your tax account. Make sure to keep a copy of the filled-out form and any additional documents for your records.

What You Should Know About This Form

What is the AR-20 form used for?

The AR-20 form is used to officially close tax accounts in Arkansas. It is necessary for businesses that are discontinuing operations, changing ownership, or selling their business. By completing this form, the business informs the state of its closure and ensures that tax matters are settled properly.

Who needs to fill out the AR-20 form?

Any business owner or representative who is closing their business or changing ownership must fill out the AR-20 form. This includes both sole proprietors and corporate officers. If a business is sold, the new owner may also need to be involved in the process to ensure a smooth transition.

What information is required on the AR-20 form?

On the AR-20 form, you will need to provide several details, including the legal name of the business, its address, and the reason for closing the tax account. Additionally, you must indicate whether the business was sold and provide information about the purchaser, the selling price, and any other relevant account information.

What documents must be submitted with the AR-20 form?

When submitting the AR-20 form, you must include various documents. These include your Arkansas tax permits, a copy of the Bill of Sale, any AR-3MAR forms for withholding taxes, W-2 forms, and final tax returns with payments. Submitting all required documents ensures that the closure is processed accurately.

Can I close my tax account online?

Yes, if you are an ATAP user, you can close your tax accounts online at the website atap.arkansas.gov. This online option can save time and streamline the process compared to submitting a paper form.

What happens after I submit the AR-20 form?

Once you submit the AR-20 form and all required documents, the state will review your application. After processing, your tax account will be closed, and you will receive confirmation. It's essential to keep a copy of everything submitted for your records.

Common mistakes

Completing the AR-20 form accurately is crucial for proper tax account closure in Arkansas. Many individuals make common mistakes that can lead to delays or complications. Here are five common errors to avoid when filling out this form.

One significant mistake is incomplete contact information. When filling out the form, it’s essential to provide a full legal name, address, and all relevant contact numbers including telephone and fax. Skipping any of these details can result in communication problems with tax authorities. Ensure every field is complete before submission.

Another frequent error involves the selection of closure reasons. Taxpayers often forget to check all applicable boxes in the section that requests the reason for closing the tax account. Be thorough; indicating all relevant reasons—whether the account was sold, closed, or ownership changed—helps to clarify the situation for the Department of Finance and Administration.

In Section 2, some taxpayers provide vague or insufficient information about sales transactions. When indicating whether the business was sold or closed, it’s important to list the name and address of the purchaser and to detail the selling price of fixtures and inventory. This data not only validates the closure but also ensures proper tax assessments.

Additionally, failing to attach the required documents can cause significant issues. Taxpayers must remember to send along necessary items including the Arkansas tax permits, a copy of the bill of sale, and final tax returns. Incomplete submissions can delay the processing of the account closure, so verify that all documents are included.

Lastly, not signing the form correctly is a common oversight. The form includes a section that requires the signature of the owner or officer declaring that the provided information is true under penalties of perjury. Double-check that this section is completed and the date is included; a missing signature can render the form invalid.

Documents used along the form

The AR-20 form is an important document used to officially close a business's tax accounts in Arkansas. When filing this form, there are several other related documents that may also be needed. Below is a list of other documents that are often used alongside the AR-20 form, along with a brief description of each.

- AR-3MAR Withholding: This form is used to report withholding taxes for employees at the end of a business's tax year. It provides the final report before closing the tax account.

- W-2 Forms: Issued to employees, W-2 forms summarize the annual wages paid and the taxes withheld. These must be provided to the IRS and employees when closing a business.

- Final Tax Returns: A business must file final tax returns before closing its accounts. These returns report income and tax obligations for the last reporting period.

- Bill of Sale: When a business sells its assets, a bill of sale documents the transaction. This is crucial if the business was sold to a new owner.

- Permit Closure Notices: Any licenses or permits associated with the business should also be closed or transferred. This helps prevent future tax liabilities.

- Inventory List: An inventory list details all the assets being sold with the business. This ensures an accurate accounting of what has been transferred to the new owner.

- Statement of Sale: This document outlines the terms of the sale, including prices and conditions, and is necessary for both parties to record the transaction properly.

- Ownership Change Documents: If there's been a change in ownership, documents reflecting this change will need to be filed to officially update the tax records.

Make sure to gather any necessary documentation to accompany the AR-20 form for a smooth closure process. Filing accurately and on time helps avoid future complications with tax authorities.

Similar forms

- IRS Form 1040 - This form is used by individuals to report their annual income. Similar to the AR-20, it requires identification information and an assurance of the truthfulness of the data provided, which serves to ensure clarity about the taxpayer's status.

- IRS Form 1120 - Corporations use this form to report income, deductions, and taxes owed. Like the AR-20, it includes comprehensive account details and necessitates a declaration under penalties for false statements, reinforcing accountability in business closures.

- IRS Form 941 - This quarterly form is filed by employers to report income taxes, Social Security tax, and Medicare tax withheld. The AR-20 and Form 941 both encompass sections that require thorough reporting of financial details, ensuring transparency in transitions.

- State Sales Tax Permit Cancellation Form - Similar to the AR-20, this document is filed to cancel a sales tax permit. Both forms require reason-based validation for closure and touch on remaining obligations associated with taxes and permits.

- Business License Closure Notice - This notice indicates that a business is no longer operating and facilitates the proper closing of licensing accounts. The AR-20 serves a similar role by providing the necessary closure documentation to relevant authorities.

- Application for a Business Tax Account - This form is filled out when establishing a business tax account, akin to the AR-20 in its collection of vital information about the owner and business operation status, creating a consistent process for both opening and closing accounts.

Dos and Don'ts

When filling out the AR-20 form, follow this list of important dos and don’ts to ensure a smooth process.

- Do check the legal name and address for accuracy before submitting.

- Do ensure all applicable reasons for closing the tax account are marked.

- Do fill out any required fields, including those for ownership change and effective date.

- Do include the seller and buyer’s information if the business has been sold.

- Do provide the selling price of fixtures and inventory accurately.

- Don't leave anything blank; incomplete forms may lead to delays.

- Don't forget to sign and date the form before sending it in.

- Don't submit the form without reviewing all information for correctness.

- Don't ignore the requirement to attach necessary documents such as the bill of sale.

- Don't send the form to an incorrect address; ensure it goes to the specified PO Box.

Taking these steps will help you avoid potential issues and ensure your request is processed efficiently.

Misconceptions

When it comes to the AR-20 form, there are several common misconceptions that may lead to confusion. Here are five key misunderstandings:

- Only physical businesses need to file the AR-20 form. Many believe that only brick-and-mortar establishments are required to fill out this form. In reality, any business that has a tax account, including online businesses or service providers, must submit the AR-20 form if they are closing their tax accounts.

- The AR-20 form is only for businesses that shut down entirely. Some think that the form is applicable only when a business ceases operations. However, it is also used for ownership changes or if the business has been sold. This form helps notify the state to update their records accordingly.

- You can complete the AR-20 form without having all necessary documents ready. It is a misconception that you can submit the form without needed documentation. In fact, you should include relevant documents such as copies of tax permits, a bill of sale, and final tax returns with your submission to ensure the process goes smoothly.

- Filing the AR-20 form is an optional process. There is a belief that closing a tax account may not be mandatory if you no longer operate the business. This is not true. Filing the AR-20 is essential to formally close your tax accounts and avoid any potential tax complications in the future.

- The AR-20 form can be submitted online. Some people assume that this form can only be mailed. While ATAP users have the option to close tax accounts online, others will need to submit the form by mail as indicated. Understanding the proper submission method is crucial for timely processing.

By clearing up these misconceptions, businesses can navigate the process of closing their tax accounts more effectively, ensuring compliance with state requirements.

Key takeaways

When filling out the AR-20 Form to close or sell a business in Arkansas, here are some key takeaways to ensure you complete the process smoothly:

- Legal Name and Information: Clearly provide your legal name, address, and other relevant identification details. This ensures the tax accounts are correctly associated with you.

- Reason for Closure: Be specific about why you are closing the account. You can check multiple reasons, such as selling, ceasing operations, or ownership changes.

- Sales Tax Account Information: If you had made purchases for personal use, you must disclose this. Indicate whether or not tax was paid to the Department of Finance and Administration (DFA).

- Current Business Operations: If your business is still operational, provide details regarding the account or permit identification to avoid any confusion.

- Details of Sale: If the business has been sold, include the name and address of the purchaser along with the selling price of assets like fixtures and inventory.

- Documents to Include: Remember to send necessary documentation such as the bill of sale, tax permits, and final tax returns. These ensure compliance and proper record-keeping.

- Signature Requirement: Sign the form to validate the information you provided. This act affirms that all details are correct and true to the best of your knowledge.

- Mailing Instructions: Ensure that you mail your completed form to the correct address: Combined Registration, PO Box 8123, Little Rock, AR 72203-8123.

By following these points, you can effectively close your tax accounts and ensure compliance with Arkansas regulations.

Browse Other Templates

Massachusetts Dnr - The form is effective immediately upon being signed, reflecting the patient's wishes.

Why Did I Receive a Official Form 309a - The Voluntary Petition provides a structure that helps debtors to present their case consistently.