Fill Out Your Arizona 5000 Form

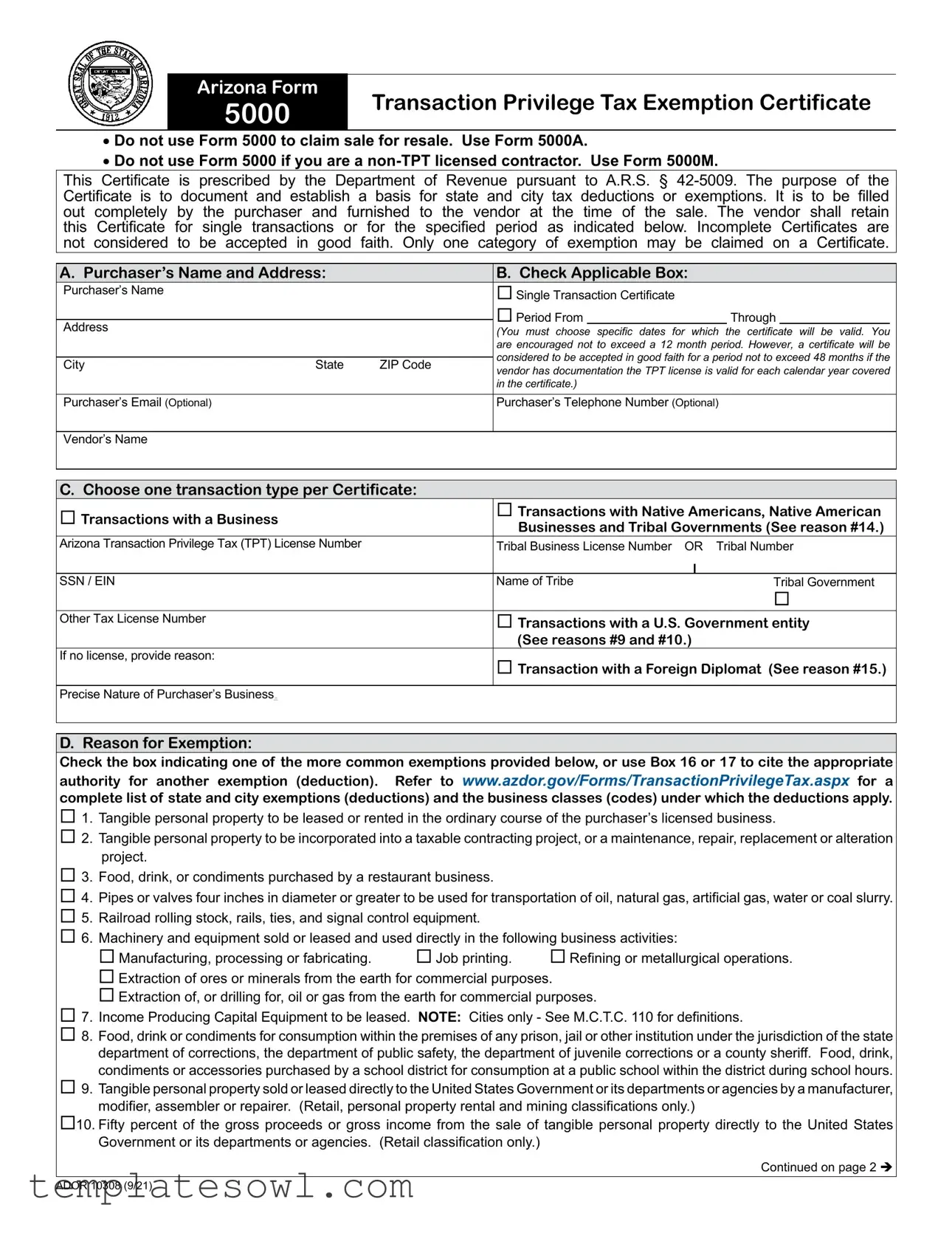

The Arizona 5000 form, officially known as the Transaction Privilege Tax Exemption Certificate, plays a crucial role in Arizona's tax framework. Designed to validate and document claims for state and local tax exemptions, it is essential for both purchasers and vendors when conducting tax-exempt transactions. The form must be completed in full by the purchaser and provided to the vendor at the time of the sale. It is important to note that this form should not be used for sales for resale, as that situation requires Form 5000A. Additionally, non-TPT licensed contractors should utilize Form 5000M. Particular care should be taken when filling out the form, as incomplete submissions are not deemed valid for tax exemption. The Arizona Department of Revenue prescribes this Certificate under A.R.S. § 42-5009. To ensure proper use, only one category of exemption can be claimed per certificate, which covers a variety of exemptions ranging from tangible personal property to specific types of transactions, such as those involving Native Americans or the U.S. government. The vendor must retain the completed certificate for single transactions or for a designated period. Buyers are advised to avoid exceeding a 12-month validity term unless they provide certain documentation to support a longer time frame. Misuse of the Arizona 5000 form can lead to significant financial liability, including taxes, penalties, and even criminal repercussions. This underscores the importance of accuracy and completeness in both its completion and submission.

Arizona 5000 Example

Arizona Form |

Transaction Privilege Tax Exemption Certificate |

|

5000 |

||

|

•Do not use Form 5000 to claim sale for resale. Use Form 5000A.

•Do not use Form 5000 if you are a

This Certificate is prescribed by the Department of Revenue pursuant to A.R.S. § |

||||||||||

Certificate is to document and establish a basis for |

state and city tax deductions or exemptions. It is to be filled |

|||||||||

out completely by the purchaser and furnished to |

the vendor at the time of |

the sale. The vendor shall retain |

||||||||

this Certificate for single transactions or |

for the specified period as indicated |

below. Incomplete Certificates are |

||||||||

not considered to be accepted in good faith. Only |

one category of exemption may be claimed on a Certificate. |

|||||||||

|

|

|

|

|

|

|

|

|

||

A. Purchaser’s Name and Address: |

|

|

B. Check Applicable Box: |

|||||||

Purchaser’s Name |

|

|

|

Single Transaction Certificate |

||||||

|

|

|

|

Period From |

|

|

|

Through |

|

|

Address |

|

|

|

|||||||

|

|

|

(You must choose specific |

dates for which the certificate will be valid. You |

||||||

|

|

|

|

are encouraged not to exceed a 12 month period. However, a certificate will be |

||||||

|

|

|

|

considered to be accepted in good faith for a period not to exceed 48 months if the |

||||||

City |

State |

ZIP Code |

|

|||||||

|

vendor has documentation the TPT license is valid for each calendar year covered |

|||||||||

|

|

|

|

|||||||

|

|

|

|

in the certificate.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Purchaser’s Email (Optional) |

|

|

|

Purchaser’s Telephone Number (Optional) |

||||||

|

|

|

|

|

|

|

|

|

|

|

Vendor’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

C. Choose one transaction type per Certificate: |

|

|

|

|

|

|

|

|

||

Transactions with a Business |

|

|

|

Transactions with Native Americans, Native American |

||||||

|

|

|

Businesses and Tribal Governments (See reason #14.) |

|||||||

|

|

|

|

|||||||

Arizona Transaction Privilege Tax (TPT) License Number |

|

|

Tribal Business License Number OR Tribal Number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN / EIN |

|

|

|

Name of Tribe |

|

|

Tribal Government |

|||

|

|

|

|

|

|

|

|

|

||

Other Tax License Number |

|

|

|

Transactions with a U.S. Government entity |

||||||

|

|

|

|

(See reasons #9 and #10.) |

||||||

If no license, provide reason: |

|

|

|

Transaction with a Foreign Diplomat (See reason #15.) |

||||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Precise Nature of Purchaser’s Business. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Reason for Exemption:

Check the box indicating one of the more common exemptions provided below, or use Box 16 or 17 to cite the appropriate authority for another exemption (deduction). Refer to www.azdor.gov/Forms/TransactionPrivilegeTax.aspx for a complete list of state and city exemptions (deductions) and the business classes (codes) under which the deductions apply.

1. Tangible personal property to be leased or rented in the ordinary course of the purchaser’s licensed business.

2. Tangible personal property to be incorporated into a taxable contracting project, or a maintenance, repair, replacement or alteration project.

3. Food, drink, or condiments purchased by a restaurant business.

4. Pipes or valves four inches in diameter or greater to be used for transportation of oil, natural gas, artificial gas, water or coal slurry.

5. Railroad rolling stock, rails, ties, and signal control equipment.

6. Machinery and equipment sold or leased and used directly in the following business activities:

Manufacturing, processing or fabricating. |

Job printing. |

Refining or metallurgical operations. |

Extraction of ores or minerals from the earth for commercial purposes.

Extraction of, or drilling for, oil or gas from the earth for commercial purposes.

7. Income Producing Capital Equipment to be leased. NOTE: Cities only - See M.C.T.C. 110 for definitions.

8. Food, drink or condiments for consumption within the premises of any prison, jail or other institution under the jurisdiction of the state department of corrections, the department of public safety, the department of juvenile corrections or a county sheriff. Food, drink, condiments or accessories purchased by a school district for consumption at a public school within the district during school hours.

9. Tangible personal property sold or leased directly to the United States Government or its departments or agencies by a manufacturer, modifier, assembler or repairer. (Retail, personal property rental and mining classifications only.)

10. Fifty percent of the gross proceeds or gross income from the sale of tangible personal property directly to the United States Government or its departments or agencies. (Retail classification only.)

Continued on page 2

ADOR 10308 (9/21)

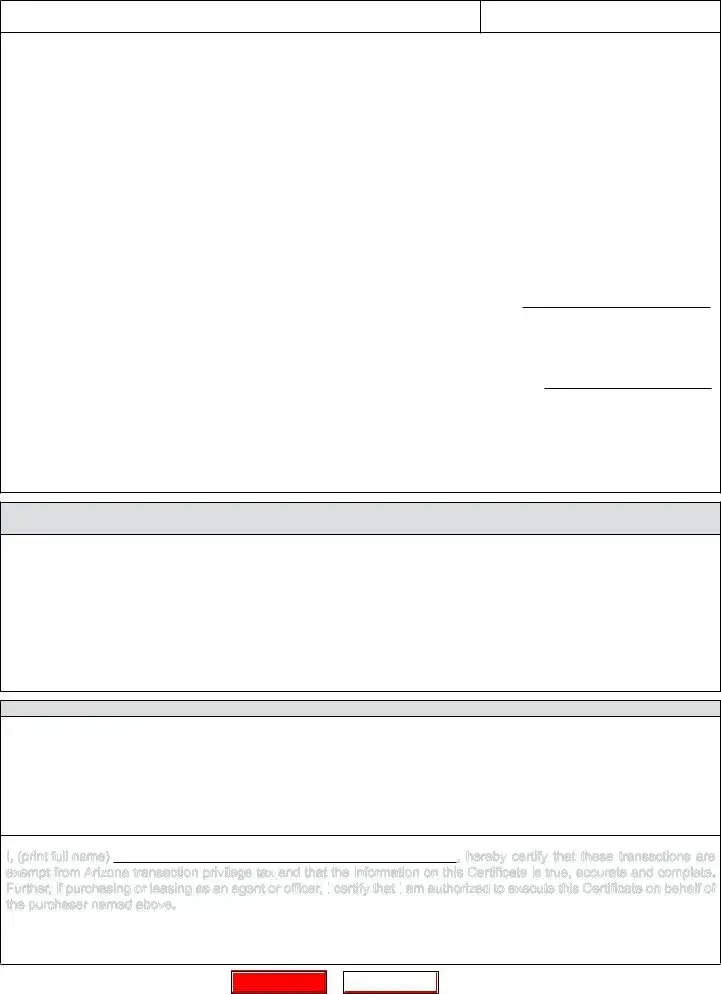

Your Name (as shown on page 1)

Arizona Transaction Privilege Tax License Number

11. Electricity, natural gas or liquefied petroleum gas sold to a qualified manufacturing or smelting business. A manufacturing or smelting business that claims this exemption authorizes the release by the vendor of the information required to be provided to the Department of Revenue pursuant to A.R.S. §

12. Electricity or natural gas to a business that operates an international operations center in this state and that is certified by the Arizona Commerce Authority. NOTE: Certification must be attached. (Utilities classification only.) (Not available for all Cities.)

13. Computer data center equipment sold to the owner, operator or qualified colocation tenant of a computer data center that is certified by the Arizona Commerce Authority pursuant to A.R.S. §

14. Sale or lease of tangible personal property to affiliated Native Americans if the order is placed from and delivered to the reservation. NOTE: The vendor shall retain adequate documentation to substantiate the transaction.

15. Foreign diplomat. NOTE: Limited to authorization on the U.S. Department of State Diplomatic Tax Exemption Card. The vendor shall retain a copy of the U.S. Department of State Diplomatic Tax Exemption Card and any other documentation issued by the U.S. Department of State. Motor vehicle purchases or leases must be

16.*Other Deduction: Cite the Arizona Revised Statutes authority for the deduction. A.R.S. §

Description:

17.*Other Cities Deduction: Cite the Model City Tax Code authority for the deduction. M.C.T.C. § Description:

*Refer to www.azdor.gov/TransactionPrivilegeTax(TPT)/RatesandDeductionCodes.aspx for a complete list of state and city exemptions (deductions) and the business classes (codes) under which the deductions apply.

E.Describe the tangible personal property or service purchased or leased and its use below. (Use additional pages if needed.)

F. Certification

A vendor that has reason to believe that this Certificate is not accurate or complete will not be relieved of the burden of proving entitlement to the exemption. A vendor that accepts a Certificate in good faith will be relieved of the burden of proof and the purchaser may be required to establish the accuracy of the claimed exemption. If the purchaser cannot establish the accuracy and completeness of the information provided in the Certificate, the purchaser is liable for an amount equal to the transaction privilege tax, penalty and interest which the vendor would have been required to pay if the vendor had not accepted the Certificate. Misuse of this Certificate will subject the purchaser to payment of the A.R.S. §

I, (print full name) |

, hereby certify that these transactions are |

exempt from Arizona transaction privilege tax and that the information on this Certificate is

on this Certificate is true, accurate and complete. Further, if

true, accurate and complete. Further, if purchasing or leasing as an agent or officer, I

purchasing or leasing as an agent or officer, I certify that I

certify that I am authorized to execute this Certificate on behalf of the purchaser named above.

am authorized to execute this Certificate on behalf of the purchaser named above.

SIGNATURE OF PURCHASER |

|

DATE |

|

TITLE |

ADOR 10308 (9/21)

Page 2 of 2

Print Form

Reset Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Arizona 5000 form is designed to document and establish a foundation for state and city tax deductions or exemptions. |

| Governing Law | This form is prescribed by the Department of Revenue in accordance with A.R.S. § 42-5009. |

| Usage | The form should not be utilized to claim a sale for resale. Instead, Form 5000A should be used for that purpose. |

| License Requirement | Non-TPT licensed contractors must not use this form but should employ Form 5000M instead. |

| Completeness Requirement | It is crucial that all sections of the form be completed; incomplete forms will not be deemed accepted in good faith. |

| Exemption Categories | Only one exemption category may be claimed on the form, ensuring clarity for tax purposes. |

| Documentation Retention | The vendor is required to retain the Certificate for single transactions or for the duration specified in an exemption claim. |

Guidelines on Utilizing Arizona 5000

Filling out the Arizona 5000 form involves providing specific information to document tax exemptions. This form must be completed by the purchaser and handed to the vendor to ensure that the transaction is processed correctly while keeping taxes in line with state regulations. Follow the steps below to ensure accurate completion.

- Purchaser's Information: Write the purchaser's name and address in the designated fields. Include the email and telephone number if desired.

- Transaction Type: Check the box that applies to the purchaser’s situation: either "Single Transaction Certificate" or "Period From Through." Make sure to choose only one.

- Vendor's Information: Provide the vendor's name along with their Arizona Transaction Privilege Tax (TPT) License Number or Tribal Business License Number.

- Transaction Category: Select one transaction type only. Options include transactions with businesses, Native American entities, or U.S. Government entities.

- Reason for Exemption: Check one box indicating the reason for the exemption. If applicable, use Boxes 16 and 17 for citing specific authorities for other exemptions.

- Description of Goods or Services: Briefly describe the tangible personal property or services being purchased or leased.

- Certification: Print the full name of the person completing the form, and confirm authorization for the purchase with a signature and date.

After completing the form, ensure it is accurate and thorough. Provide it to the vendor for retention, as they must keep it for either a single transaction or the specified period indicated on the form.

What You Should Know About This Form

What is the Arizona 5000 form?

The Arizona 5000 form is known as the Transaction Privilege Tax Exemption Certificate. It is used to document exemptions or deductions from state and city taxes when certain purchases are made. This form must be filled out by the purchaser and provided to the vendor at the time of sale.

Who needs to use the Arizona 5000 form?

Businesses or individuals that qualify for a tax exemption when purchasing specific goods or services should use this form. However, if you're making a sale for resale, you'll need to use Form 5000A. If you're a non-TPT licensed contractor, Form 5000M should be your choice.

How do I complete the Arizona 5000 form?

To fill out the form, you will need to provide detailed information, including the purchaser’s name, address, and the applicable exemption reason. It's essential to check just one box for the transaction type and exemption. Be specific and ensure all required information is complete; an incomplete form will not be considered accepted in good faith.

What if I need to claim multiple exemptions?

Unfortunately, you can only claim one category of exemption per Arizona 5000 form. If you have more than one exemption, you must complete separate forms for each exemption claimed.

How long is the Arizona 5000 form valid?

The form is typically valid for a specific transaction date that you must choose. While the general recommendation is not to exceed a 12-month period, the vendor may accept it for up to 48 months if they have valid documentation of the TPT license for each calendar year covered by the certificate.

What happens if the vendor does not believe the Arizona 5000 form is accurate?

If a vendor doubts the accuracy of the form, they are not relieved of the burden of proving entitlement to the exemption. However, if the vendor accepts the certificate in good faith, they will not have that burden, and the purchaser may need to demonstrate that the information provided is correct.

Can I use the Arizona 5000 form for purchases from the U.S. government?

Yes, the form can be used for transactions involving U.S. government entities. However, specific reasons must be checked on the form to document the type of exemption claimed during such transactions.

What are the consequences of misusing the Arizona 5000 form?

If the form is misused, purchasers may be liable for taxes, penalties, or interest that would have been required had they not accepted the exemption. Serious cases of willful misuse can lead to criminal penalties, including felony charges.

Where can I get more information about the Arizona 5000 form?

For additional details, including exemption reasons and codes, you can visit the Arizona Department of Revenue website at www.azdor.gov. It provides comprehensive guidance on the Transaction Privilege Tax and the exemptions applicable.

Common mistakes

Filling out the Arizona Form 5000 can be straightforward, but there are common mistakes that individuals often make. Understanding these can help ensure that the form is correctly completed, which in turn helps avoid potential complications with tax exemptions.

One typical mistake is failing to specify the transaction properly. The form requires the purchaser to indicate whether it is a single transaction or for a specific period. Some individuals neglect to check the appropriate box, which can result in the form being deemed incomplete. Clarity in specifying the type of transaction being claimed is essential for validation.

Another common error involves misunderstanding the eligibility for the exemption certificate. People sometimes use Form 5000 for purposes it isn’t intended for, such as claiming sales for resale. Instead, they should use Form 5000A for resale situations. Similarly, non-transaction privilege tax (TPT) licensed contractors should use Form 5000M instead of Form 5000. This misstep can lead to confusion and potential rejections.

In the section where the reason for exemption is required, individuals often fail to select just one exemption. The rules only allow for one category to be specified per certificate. Attempting to claim multiple exemptions on one form can result in rejection or delays since the rules clearly state only one may be chosen.

Providing incorrect or incomplete contact information, such as the purchaser's name or address, is another frequent issue. Ensuring that these details are accurate is crucial. An incomplete form may not be acknowledged as being submitted in good faith by the vendor.

Additionally, omitting crucial information about the nature of the purchaser’s business can lead to complications. This section requires a detailed description to establish the grounds for the exemption being claimed. If this information is vague or absent, it may render the exemption ineligible.

Some individuals overlook the necessity of attaching any required documentation. For specific exemptions—such as those relating to government entities or foreign diplomats—relevant licenses and documents must be included with the Certificate. Failing to do so could invalidate the exemption and require the vendor to pay the tax initially sought to be avoided.

It is also important to read the certificate carefully before signing. A common oversight is to not fully understand one’s responsibilities. The vendor is entitled to challenge the accuracy and completeness if any doubt arises, so the purchaser should be aware of the potential ramifications of submitting inaccurate claims.

Finally, failing to date the form or providing an unauthorized signature can also pose serious issues. The certification section confirms the authenticity of the form and the responsibility taken by the purchaser, which must be correctly filled out to maintain validity. Each of these mistakes can lead to delays, fines, or worse, so careful attention to detail is imperative when completing the Arizona Form 5000.

Documents used along the form

The Arizona Form 5000 is a critical document for businesses looking to claim tax exemptions on certain transactions. Along with this form, several other documents can be necessary or helpful in specific scenarios. Here’s a list of common forms and documents that often accompany the Arizona 5000 form:

- Arizona Form 5000A: This form is specifically used for claiming a sale for resale, unlike the 5000 which is meant for direct tax exemptions.

- Arizona Form 5000M: Non-TPT licensed contractors use this form to claim exemptions, helping them navigate their specific exemption eligibility.

- Arizona Transaction Privilege Tax (TPT) License: This license verifies the taxpayer's compliance with state tax laws and is crucial for legitimacy during transactions requiring the 5000 form.

- Vendor Documentation: Vendors should retain proof of the transaction and the validity of the TPT license throughout the exemption period to substantiate exemptions claimed.

- Certification of Exemption Letter: A detailed letter explaining the basis for the exemption can support the claims made on the Arizona 5000, particularly in more complex situations.

- Tax Exemption Certificate Verification: This form is often requested by vendors to confirm the validity of the exemption certificates against IRS or state tax records.

- Purchaser’s Affidavit: A legal statement affirming that the information provided is accurate can bolster the exemption claims if questioned by tax authorities.

- Supporting Documentation for Exemptions: Additional documents such as contracts, invoices, or purchase orders may be required to justify the specific reason for the exemption cited on the Arizona Form 5000.

- Business Class Codes Documentation: This document includes lists of business class codes and the exemptions that apply, helping purchasers ensure they are using the correct codes on their forms.

- Recordkeeping Log: A log of transactions utilizing the Arizona Form 5000 aids in maintaining organized records for any audits or inquiries from the Department of Revenue.

Utilizing these additional documents alongside the Arizona Form 5000 can help ensure compliance and simplify the exemption process. Keeping thorough and accurate records will always be beneficial).

Similar forms

- IRS Form W-9: Like the Arizona 5000, this form is used to certify taxpayer identification information. Both documents aim to ensure the vendor accurately reports income to the IRS, safeguarding both parties during financial transactions.

- IRS Form 8233: This form allows for claiming tax treaty benefits. Just as the Arizona 5000 certifies the exemption from state tax, Form 8233 establishes exemption from federal tax withholding, offering protection for qualifying individuals.

- State Sales Tax Exemption Certificate: Many states have similar exemption forms used to claim sales tax exemptions. These certificates work like the Arizona 5000 by documenting exempt purchases, ensuring both tax compliance and exemptions for eligible buyers.

- Arizona Form 5000A: This form is specifically for resale claims but shares a similar purpose with the Arizona 5000 in documenting tax exemptions. Both forms require specific details about the purchaser and the transaction to prevent misuse of tax exemptions.

- Purchasing Affidavit: Often used in various transactions, this affidavit also certifies the purpose of the purchase to qualify for tax exemptions. Like the Arizona 5000, it requires accurate information to avoid potential tax liabilities for incorrect claims.

Dos and Don'ts

When filling out the Arizona 5000 form, it is essential to follow guidelines to ensure a smooth process. Here are five key actions to take and avoid:

- Do complete the form in full before submitting it to the vendor.

- Do provide accurate and specific information regarding the transaction and exemption reason.

- Do check the applicable box for the type of transaction being claimed.

- Do retain a copy of the completed form for your records.

- Do ensure only one exemption category is claimed on each form.

- Don't use Form 5000 for sales intended for resale; this requires Form 5000A.

- Don't submit the form if you are a non-TPT licensed contractor; use Form 5000M instead.

- Don't leave any sections of the form blank, as incomplete forms may not be accepted.

- Don't claim multiple exemptions on a single Certificate.

- Don't forget to sign and date the Certificate before submitting it.

Misconceptions

Misunderstandings about the Arizona 5000 form can lead to mistakes in tax reporting and compliance. Here are five common misconceptions:

- Form 5000 is for resale purposes. Many believe they can use Form 5000 to claim tax exemptions on items meant for resale. However, this form is specifically not intended for that purpose. Instead, one should use Form 5000A for sales intended for resale.

- Any contractor can use Form 5000. It's a common belief that all contractors can use this form. In reality, non-TPT licensed contractors must use Form 5000M instead. This distinction is crucial for compliance.

- Incomplete forms are accepted. Some think that vendors can accept incomplete Arizona 5000 forms without issues. This is false. Incomplete forms are not considered to be accepted in good faith and can lead to penalties.

- Multiple exemptions can be claimed on one form. People often assume they can claim more than one category of exemption on a single certificate. This is incorrect. Only one exemption can be claimed per Arizona 5000 form.

- Once the form is submitted, no further action is needed. There is a mistaken belief that submitting the form is the end of the matter. However, vendors must retain the certificate for single transactions or for a specified period. Also, they must make sure the information remains accurate and complete throughout the validity period.

Key takeaways

- Complete the Arizona 5000 form thoroughly to ensure eligibility for tax deductions or exemptions.

- Present the completed form to the vendor at the time of the sale; vendors must retain it for their records.

- Only one category of exemption should be claimed per Certificate.

- Ensure that the Certificate is not incomplete; vendors are not required to accept it in good faith if information is missing.

- Non-TPT licensed contractors should fill out Form 5000M instead of this form.

- Be aware that this form is not for sales meant for resale—consider using Form 5000A for that purpose.

- Provide specific dates if choosing a period longer than 12 months; valid periods should not exceed 48 months with proper documentation.

- Only select one transaction type and clearly indicate the reason for the exemption in the appropriate section.

- Attach any necessary supporting documents, such as certifications required for specific exemptions, to enhance the validity of the claim.

Browse Other Templates

Vehicle Sale Agreement Word Format - Provides an organized format for recording essential transaction details.

Do I Need to Report Form 5498 on My Tax Return - It outlines steps for employers to send duplicate forms if necessary.

B13a Export Declaration Form - Accuracy in each section of the B13A helps in avoiding issues with customs.