Fill Out Your Arizona Annual Report Form

Every company operating within Arizona has the responsibility to file an Annual Report, a key document that provides essential information about its activities and status. This report is significant not only for compliance with state regulations but also for reflecting the company’s operational health. It includes vital details such as the company's current name and contact information, ownership structure, and services offered. Important questions regarding changes in ownership or compliance status are also posed, ensuring transparency and accountability. Furthermore, the form requires information about the counties served, as well as statistical data relevant to telecommunications utilities, such as the number of residential and business customers and total revenues generated from operations in Arizona. Completing the Arizona Annual Report form accurately is crucial for companies to maintain good standing with the Arizona Corporation Commission and to provide a clear picture of their operational practices to stakeholders and regulatory bodies.

Arizona Annual Report Example

ARIZONA CORPORATION COMMISSION

UTILITIES DIVISION

ANNUAL REPORT MAILING LABEL – MAKE CHANGES AS NECESSARY

Please click here if

Please click here if

Please list current Company name including dba here:

__________________________________________________________________________

ANNUAL REPORT

FOR YEAR ENDING

12

31

2020

FOR COMMISSION USE

ANN 03

20

COMPANY INFORMATION

Company Name (Business Name) _________________________________________________________

Mailing Address ____________________________________________________________________________

(Street)

_________________________________________________________________________________________

(City)(State)(Zip)

__________________________________________________________________________________________

Telephone No. (Include Area Code)Fax No. (Include Area Code)Cell No. (Include Area Code)

Email Address______________________________________________________________________________

Local Office Mailing Address _______________________________________________________________

(Street)

__________________________________________________________________________________________

(City)(State)(Zip)

Customer Service Phone No. (Include Area Code)

Website address ___________________________________________________________________________

MANAGEMENT INFORMATION

Management Contact:_________________________________________________________________________________

Management Contact:_________________________________________________________________________________

(Name)(Title)

_______________________________________________________________________________________________________________________

(Street) |

(City) |

(State) |

(Zip) |

|

|

|

|

Telephone No. (Include Area Code) |

Fax No. (Include Area Code) |

Cell No. (Include Area Code) |

|

Email Address______________________________________________________________________________

Regulatory Contact:___________________________________________________________________

Regulatory Contact:___________________________________________________________________

(Name)

(Street) |

(City) |

(State) |

(Zip) |

|

|

|

|

Telephone No. (Include Area Code) |

Fax No. (Include Area Code) |

Cell No. (Include Area Code) |

|

Email Address______________________________________________________________________________

2

Statutory Agent:__________________________________________________________________________

(Name)

________________________________________________________________________________________________________________________

(Street)(City)(State)(Zip)

____________________________________________________________________________________________________________

Telephone No. (Include Area Code)Fax No. (Include Area CodeCell No. (Include Area Code)

Attorney:________________________________________________________________________________

|

|

(Name) |

|

|

|

|

|

(Street) |

(City) |

(State) |

(Zip) |

_______________________________________________________________________________________________________________________

Telephone No. (Include Area Code)Fax No. (Include Area Code)Cell No. (Include Area Code)

Email Address:_____________________________________________________________________________

Important Changes During the Year

Yes __ No __

For those companies not subject to the affiliated interest rules, has there been a change in ownership or direct control during the year?

If yes, please provide specific details in the box below.

Yes __ No __

Has the company been notified by any other regulatory authorities during the year that they are out of compliance?

If yes, please provide specific details in the box below.

3

OWNERSHIP INFORMATION

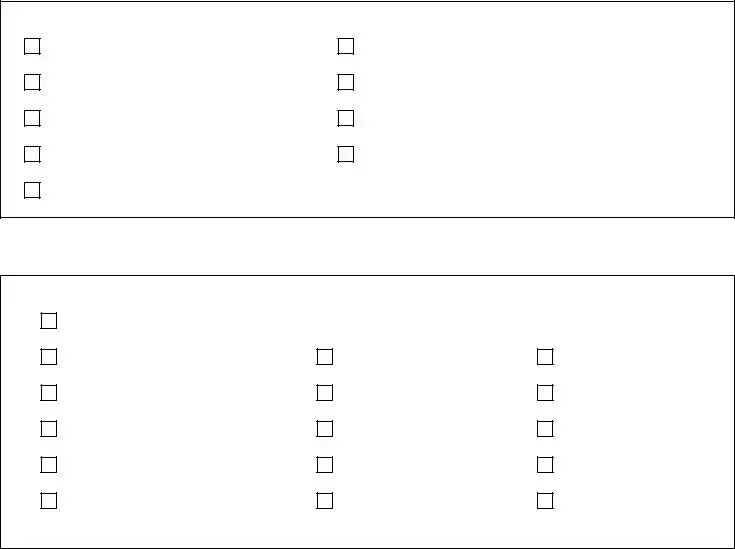

Check the following box that applies to your company:

Sole Proprietor (S)

Partnership (P)

Bankruptcy (B)

Receivership (R)

CCorporation (C) (Other than

Other (Describe)______________________________________________________________________

COUNTIES SERVED

Check the box below for the counties in which you are certificated to provide service:

STATEWIDE

APACHE

GILA

LA PAZ

NAVAJO

SANTA CRUZ

COCHISE

GRAHAM

MARICOPA

PIMA

YAVAPAI

COCONINO

GREENLEE

MOHAVE

PINAL

YUMA

4

SERVICES AUTHORIZED TO PROVIDE

Check the following box(es) for the services that you are authorized to provide:

Resold Long Distance/Interexchange Telecommunications Services (RLD) Resold Local Exchange Telecommunications Services (RLEC)

Facilities Based Private Line Telecommunications Services Alternative Operator Service Provider

Other (Specify)______________________________________________________________________

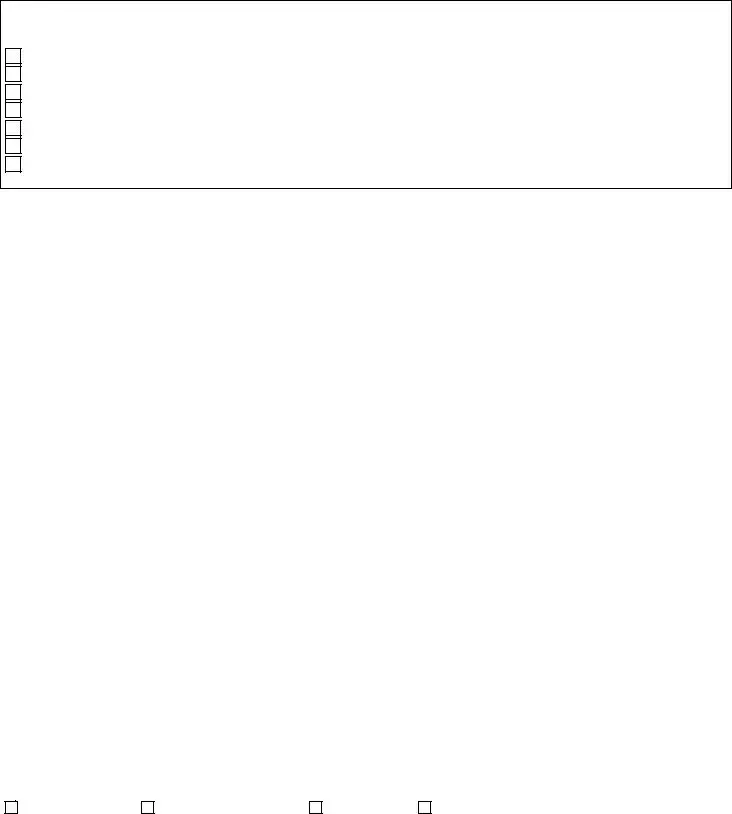

STATISTICAL INFORMATION

TELECOMMUNICATION UTILITIES ONLY

Total number of residential local exchange access lines

Total number of residential local exchange customers

Total number of business local exchange access lines

Total number of business local exchange customers

Total quantity of phone numbers assigned to Company

Total phone numbers assigned to Customers by Company

Total number of long distance residential customers

Total number of long distance business customers

Total intrastate local exchange revenue from Arizona operations

Total intrastate long distance/interexchange revenue from Arizona operations Total intrastate revenue from Arizona operations

Total intrastate income from Arizona operations

Value of Company’s total assets in Arizona Value of Company’s total assets

(Value of Company’s total assets in Arizona)/(Value of company’s total assets)

Current amount of deposits, prepayments, and advances from customers

(not including monthly service bills)

Current amount of performance bond

Current amount of Irrevocable Sight Draft Letter of Credit

Check box if Company is current on payments for:

Regulatory Assessment |

AZ Universal Service Fund |

AZ 911/E911 |

Circuit |

Voice over Internet |

Switched |

Protocol (“VoIP”) |

_______________ |

________________ |

_______________ |

________________ |

_______________ |

________________ |

_______________ |

________________ |

__________________________________

RetailOther

_______________ ________________

__________________________________

__________________________________

$_________________________________

$_________________________________

$_________________________________

$_________________________________

$_________________________________

$_________________________________

%_________________________________

$_________________________________

$_________________________________

$_________________________________

AZ Telephone Relay Service

5

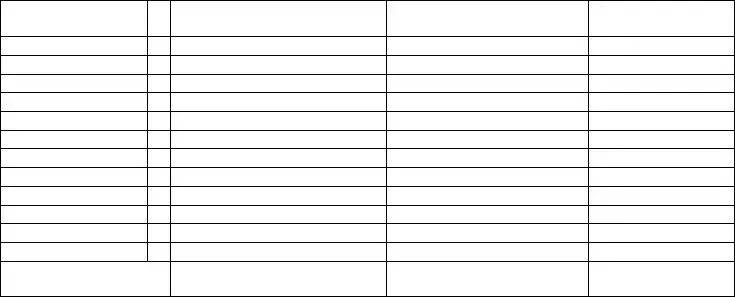

UTILITY SHUTOFFS/DISCONNECTS

MONTH

Termination without Notice

Termination with Notice

OTHER

TOTALS →

OTHER (description):

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

6

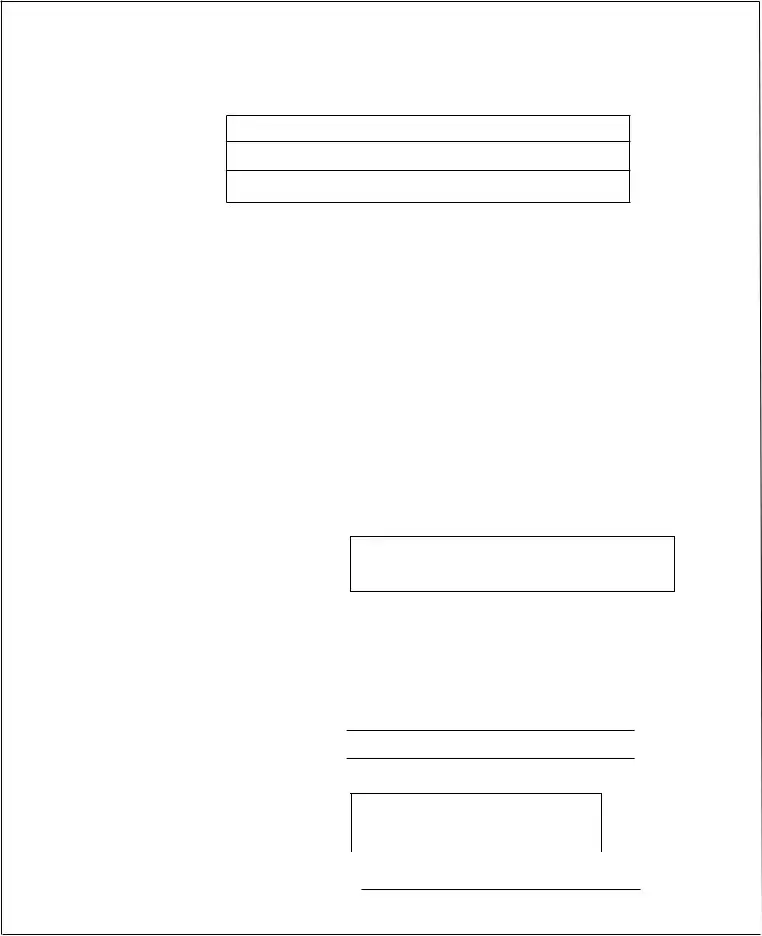

VERIFICATION

AND

SWORN STATEMENT

VERIFICATION

STATE OF ________________

I, THE UNDERSIGNED OF THE

Intrastate Revenues Only

COUNTY OF (COUNTY NAME)

NAME (OWNER OR OFFICIAL) TITLE

COMPANY NAME

DO SAY THAT THIS ANNUAL UTILITY REPORT TO THE ARIZONA CORPORATION COMMISSION

FOR THE YEAR ENDING

MONTH |

DAY |

YEAR |

12 |

31 |

2020 |

HAS BEEN PREPARED UNDER MY DIRECTION, FROM THE ORIGINAL BOOKS, PAPERS AND RECORDS OF SAID UTILITY; THAT I HAVE CAREFULLY EXAMINED THE SAME, AND DECLARE THE SAME TO BE A COMPLETE AND CORRECT STATEMENT OF BUSINESS AND AFFAIRS OF SAID UTILITY FOR THE PERIOD COVERED BY THIS REPORT IN RESPECT TO EACH AND EVERY MATTER AND THING SET FORTH, TO THE BEST OF MY KNOWLEDGE, INFORMATION AND BELIEF.

SWORN STATEMENT

IN ACCORDANCE WITH THE REQUIREMENT OF TITLE 40, ARTICLE 8, SECTION 40- 401, ARIZONA REVISED STATUTES, IT IS HEREIN REPORTED THAT THE GROSS OPERATING REVENUE OF SAID UTILITY DERIVED FROM ARIZONA INTRASTATE UTILITY OPERATIONS DURING CALENDAR YEAR 2020 WAS:

Arizona Intrastate Gross Operating Revenues Only ($)

$___________________________

(THE AMOUNT IN BOX ABOVE

INCLUDES $_________________

IN SALES TAXES BILLED, OR COLLECTED)

**REVENUE REPORTED ON THIS PAGE MUST INCLUDE SALES TAXES BILLED OR COLLECTED. IF FOR ANY OTHER REASON, THE REVENUE REPORTED ABOVE DOES NOT AGREE WITH TOTAL OPERATING REVENUES ELSEWHERE REPORTED, ATTACH THOSE STATEMENTS THAT RECONCILE THE DIFFERENCE. (EXPLAIN IN DETAIL)

SIGNATURE OF OWNER OR OFFICIAL

TELEPHONE NUMBER

SUBSCRIBED AND SWORN TO BEFORE ME

A NOTARY PUBLIC IN AND FOR THE COUNTY OF

THIS |

|

DAY OF |

(SEAL)

MY COMMISSION EXPIRES____________________________

COUNTY NAME

MONTH |

20__ |

|

|

SIGNATURE OF NOTARY PUBLIC

7

VERIFICATION

AND

SWORN STATEMENT

RESIDENTIAL REVENUE

STATE OF ARIZONA

I, THE UNDERSIGNED

OF THE

INTRASTATE REVENUES ONLY

COUNTY OF (COUNTY NAME)

NAME (OWNER OR OFFICIAL) |

TITLE |

|

|

COMPANY NAME

DO SAY THAT THIS ANNUAL UTILITY REPORT TO THE ARIZONA CORPORATION COMMISSION

FOR THE YEAR ENDING

MONTH DAY YEAR

12 31 2020

HAS BEEN PREPARED UNDER MY DIRECTION, FROM THE ORIGINAL BOOKS, PAPERS AND RECORDS OF SAID UTILITY; THAT I HAVE CAREFULLY EXAMINED THE SAME, AND DECLARE THE SAME TO BE A COMPLETE AND CORRECT STATEMENT OF BUSINESS AND AFFAIRS OF SAID UTILITY FOR THE PERIOD COVERED BY THIS REPORT IN RESPECT TO EACH AND EVERY MATTER AND THING SET FORTH, TO THE BEST OF MY KNOWLEDGE, INFORMATION AND BELIEF.

SWORN STATEMENT

IN ACCORDANCE WITH THE REQUIREMENTS OF TITLE 40, ARTICLE 8, SECTION 40- 401.01, ARIZONA REVISED STATUTES, IT IS HEREIN REPORTED THAT THE GROSS OPERATING REVENUE OF SAID UTILITY DERIVED FROM ARIZONA INTRASTATE UTILITY OPERATIONS RECEIVED FROM RESIDENTIAL CUSTOMERS DURING CALENDAR YEAR 2020 WAS:

ARIZONA INTRASTATE GROSS OPERATING REVENUES

$_________________________

(THE AMOUNT IN BOX AT LEFT INCLUDES $_____________________________

IN SALES TAXES BILLED, OR COLLECTED)

*RESIDENTIAL REVENUE REPORTED ON THIS PAGE MUST INCLUDE SALES TAXES BILLED.

SUBSCRIBED AND SWORN TO BEFORE ME

A NOTARY PUBLIC IN AND FOR THE COUNTY OF

THIS |

|

DAY OF |

|

|

|

(SEAL)

MY COMMISSION EXPIRES

SIGNATURE OF OWNER OR OFFICIAL

TELEPHONE NUMBER

NOTARY PUBLIC NAME

COUNTY NAME

MONTH |

20__ |

|

|

SIGNATURE OF NOTARY PUBLIC

8

FINANCIAL INFORMATION

Income Statements:

Attach to this annual report a copy of the company’s

Alternative templates are provided for this information. Please select one from Figure 1A, Figure 1B or Figure 1C.

(All

Arizona Administrative Code, R14.2.1115.F, states that one of the items required in this Annual Report is a statement of income for the reporting year

Balance Sheets:

Alternative templates are provided for this information. Please select one from Figure 2A or Figure 2B.

(All

Arizona Administrative Code, R14.2.1115.F, states that one of the items required in this Annual Report is a balance sheet as of the end of the reporting year

ALL INFORMATION MUST BE

RESULTS IN ARIZONA.

9

Docket No. _____________________Year Ending:

Company Name: ___________________________________________________

FIGURE 1A

Account Description |

$ Amount |

Revenues:

Expenses:

Operating Income:

Net Income:

Attachment 1

10

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Annual Report is governed by Arizona Revised Statutes § 40-207. |

| Submission Deadline | The report must be submitted by March 31 of the following year. |

| Information Required | The report includes details like company name, address, and contact information. |

| Ownership Types | Companies must indicate their business structure like LLC, Corporation, or Partnership. |

| Counties Served | Report must list all Arizona counties where the company provides services. |

| Authorized Services | Companies must specify the services they are authorized to provide, such as telecommunications. |

| Statistical Information | Telecommunication utilities are required to report various statistics, including customer counts. |

| Changes During the Year | Companies must disclose any significant changes in ownership or regulatory compliance. |

| Customer Service Contact | A designated customer service contact must be provided, including names and numbers. |

| Penalties for Non-Compliance | Filing the report late or inaccurately can result in penalties or loss of certification. |

Guidelines on Utilizing Arizona Annual Report

Completing the Arizona Annual Report form requires careful attention to detail. Be sure to provide accurate and current information in each section of the form. This report is essential for your compliance with state regulations and should be submitted on time.

- Obtain the Arizona Annual Report form from the Arizona Corporation Commission website or your business filing system.

- Verify that your company name is correct on the pre-printed label. If it is not, click the designated box on the form and write the correct name in the space provided.

- Fill in the Company Information section. Include your mailing address, telephone number, fax number, cell number, email address, and local office mailing address.

- Provide the Management Information. List the management contact’s name and title, street address, city, state, zip code, and contact information.

- Complete the section for the Regulatory Contact with the same type of information as needed for management information.

- State the name and address of your Statutory Agent and their contact information.

- If applicable, provide the attorney’s name and address along with their contact details.

- Answer the questions regarding Important Changes During the Year. Indicate whether there have been changes in ownership or if you have been notified by regulatory authorities about compliance issues.

- For Ownership Information, check the appropriate box that describes your business structure (e.g., Sole Proprietor, Partnership, Corporation, etc.).

- In the Counties Served section, select the counties in which you are authorized to provide service.

- Check the boxes for the Services Authorized to Provide that apply to your company.

- For Statistical Information, complete all applicable fields regarding your telecommunications operations, including customer numbers and revenues.

- Review all the information for accuracy and completeness.

- Sign and date the form where required.

- Submit the completed form to the Arizona Corporation Commission by the specified deadline.

What You Should Know About This Form

What is the Arizona Annual Report form?

The Arizona Annual Report form is a document that companies providing utility services in Arizona must submit to the Arizona Corporation Commission. This form collects essential information about the company's operations, management, financial details, and service statistics for the previous year. It aims to ensure that the Commission has updated information for regulatory compliance and oversight.

When is the Arizona Annual Report form due?

The Annual Report is typically due on or before March 31 each year. It covers the operations and financial performance from the preceding calendar year, specifically for the year ending on December 31. Late submissions may result in penalties or other repercussions, so timely filing is essential for all companies.

What information must be provided on the Arizona Annual Report form?

The form requires various pieces of information, including the company's current name and address, management contacts, statutory agent details, ownership structure, counties served, and services the company is authorized to provide. Additionally, telecommunication utilities must report statistical data such as customer numbers, revenue, and asset values.

What happens if there are changes in ownership during the year?

If there has been a change in ownership or direct control during the reporting year, the company must disclose this on the Annual Report form. Specific details regarding the changes should be provided in the designated section of the form, as it is crucial for regulatory purposes and ensures transparency with the Commission.

Is there a fee associated with filing the Arizona Annual Report?

Common mistakes

Filling out the Arizona Annual Report form is a vital task for any business, yet many companies encounter challenges along the way. One common mistake involves failing to update the company name or doing business as (dba) name. If the pre-printed information does not reflect your current business name, it is essential to make that correction at the top of the form. Ignoring this step can lead to confusion and potential regulatory issues down the line.

Another frequent error pertains to the mailing address. Many individuals provide outdated addresses without double-checking. It's crucial to ensure that both the mailing address and the local office address are current. Incorrect or old addresses can delay critical communications from the Arizona Corporation Commission.

Moreover, some filers overlook the importance of providing a complete contact telephone number for all relevant parties. Ensure you include area codes for your telephone, fax, and cell numbers. Omitting this information may hinder communication efforts with the necessary regulatory authorities, causing unnecessary delays or complications.

A common oversight is failing to indicate whether there have been any important changes during the reporting year. In the section regarding changes in ownership or direct control, a simple failure to respond can imply stability when, in fact, significant changes may have occurred. Transparency is critical, and detail in this section is necessary to avoid misunderstandings.

It's also important to check the box for the appropriate ownership structure of your company. Many individuals miss this step or inadvertently choose the wrong option, leading to misclassification. This classification impacts how your business is regulated and taxed, so adequate attention is necessary.

Furthermore, businesses often skip the counties served section. By checking all applicable boxes, companies ensure compliance with regional regulations. Leaving this out risks the potential for penalties; regulatory authorities need to understand where you’re authorized to operate.

An additional error that can occur involves incomplete or inaccurate service authorization checkboxes. If your company offers more than one type of service, be sure to select all that apply. Neglecting to do this could limit your reported capabilities and responsibilities.

Lastly, many filers struggle with the statistical information section, often leaving it blank or incorrectly filled. Precise data on local exchange access lines and revenue is critical for both company reporting and regulatory oversight. Always take the time to ensure that these details are accurately documented to avoid potential regulatory scrutiny.

Documents used along the form

The Arizona Annual Report form serves as a vital document for companies operating within the state. Several other forms and documents are commonly associated with this report. Each of these documents plays a specific role in ensuring compliance and providing necessary information to the Arizona Corporation Commission.

- Status Report: This document provides an update on the company's current status, including any changes in management, ownership, or operational status since the last reporting period.

- Certificate of Good Standing: Issued by the Arizona Corporation Commission, this certificate confirms that a company is compliant with state regulations, including timely annual report submissions and payment of fees.

- Change of Statutory Agent Form: If a company needs to update its statutory agent, this form must be submitted to inform the state of the new agent's contact information.

- Operating Agreement (for LLCs): This document outlines the organization's governance structure, rights, and responsibilities of members, and operational procedures for Limited Liability Companies.

- Financial Statements: Companies may be required to submit recent financial statements, providing a snapshot of financial health and supporting the data reported in the Annual Report.

These documents collectively ensure that the Arizona Corporation Commission has complete and accurate information, facilitating regulatory compliance for businesses in the state.

Similar forms

- Annual Reports: Similar to the Arizona Annual Report, many states require corporations and LLCs to submit annual reports. These documents often contain company details, financial information, and changes in management.

- Business Registration Renewal Forms: These forms are required for businesses to maintain their active status. Like the Arizona Annual Report, they often require updated contact and company information.

- Sales Tax Returns: Much like the Arizona Annual Report, these documents require specific financial data and are typically filed on an annual or quarterly basis to report business operations affected by state taxation.

- Financial Statements: Financial statements provide a snapshot of a company’s financial health. Both this document and the Arizona Annual Report include comprehensive data regarding revenues, expenses, and assets.

- Licenses and Permits Applications: Many businesses must renew licenses or permits regularly. These applications, similar to the Arizona Annual Report, necessitate current business information and compliance with state regulations.

- Tax Returns: Similar to the annual report, tax returns require businesses to disclose financial and operational data. These reports often inform state agencies about annual earnings, deductions, and tax owed.

- Partnership Agreements: Though different in structure, these documents require disclosure of management and ownership details. The Arizona Annual Report also gathers information on management structure and ownership.

- Foreign Entity Registration Forms: When businesses operate in multiple states, these forms are necessary. They require similar essential information about company structure and ownership, akin to the details requested in the Arizona Annual Report.

- Corporate Bylaws: While bylaws govern the internal management of a corporation, they also need to be kept updated and are often referenced in annual reports for compliance purposes. The emphasis on accurate and timely management details makes them somewhat similar.

Dos and Don'ts

When filling out the Arizona Annual Report form, it's essential to stay organized and accurate. Here are some do's and don'ts to keep in mind:

- Do double-check your current company name and dba. Ensure it matches your official documents.

- Do include complete and accurate mailing addresses for both your business and local office.

- Do provide all required contact information. This helps regulatory bodies reach you easily.

- Do specify any changes in ownership or control clearly, if applicable.

- Do indicate the services you're authorized to provide using the correct checkboxes.

- Don't skip questions or leave areas blank. Fill out every section as completely as possible.

- Don't underestimate the importance of deadlines. Submit the report on time to avoid penalties.

By following these guidelines, you ensure a smoother process and maintain compliance with the Arizona Corporation Commission's requirements.

Misconceptions

- Misconception 1: The Arizona Annual Report only needs to be filed if there are changes to the company.

- Misconception 2: The Annual Report can be submitted at any time during the year.

- Misconception 3: Only corporations need to file an Annual Report.

- Misconception 4: Providing incorrect information on the report is not a serious issue.

- Misconception 5: The format of the Annual Report is not important as long as all the information is provided.

- Misconception 6: I can amend my Annual Report after submitting it without consequences.

- Misconception 7: The Arizona Corporation Commission will notify me if my report is late.

- Misconception 8: Filing the Annual Report is a one-time process.

In fact, every company is required to file an Annual Report each year, regardless of whether there have been changes in ownership, management, or operations.

The report has a specific deadline, usually due at the end of the calendar year. Timely submission is essential to avoid penalties.

This report is required for various business structures, including partnerships and limited liability companies, not just corporations.

Failure to ensure accuracy can lead to penalties or complications with regulatory authorities. It is crucial to provide correct and complete information.

Adhering to the prescribed format is important. Deviating from the specified format may result in your report being rejected or delayed.

Once submitted, changes to the report typically require a formal amendment process. This can incur additional fees or delay your compliance standing.

It is the responsibility of the business owner to track deadlines. The Arizona Corporation Commission may not provide reminders for filing.

The Annual Report must be filed every year. This ongoing obligation is crucial for maintaining compliance and good standing with regulatory authorities.

Key takeaways

Filling out the Arizona Annual Report form is essential for organizations operating in the state. Here are some key takeaways to consider:

- Update Company Information: Always check and update the company name and DBA (Doing Business As) name on the form. If it is incorrect, make necessary changes right away.

- Provide Complete Contact Details: Fill out accurate and complete contact information for management, regulatory, statutory agents, and attorneys. This ensures that authorities can reach the right individuals if issues arise.

- Ownership Information: Clearly identify the business type, whether it’s a sole proprietorship, corporation, or other. This classification is vital for regulatory purposes.

- Disclose Important Changes: If there have been changes in ownership or compliance notifications, provide detailed explanations in the designated areas. Transparency can help avoid regulatory issues.

- Complete Statistical Information: For telecommunication utilities, it's crucial to report accurate statistics regarding access lines, customers, and revenue. Inaccurate figures could lead to misunderstandings or penalties.

Browse Other Templates

Fairbanks Accident Report - Driver actions leading to the crash need to be documented.

Rebounderz - All disputes must be settled in Prince William County, Virginia courts.