Fill Out Your Arizona New Hire Reporting Form

The Arizona New Hire Reporting form plays a vital role in the state's effort to maintain accurate employment records and ensure compliance with federal regulations. Employers are required to submit this form whenever they hire a new employee, providing essential details such as the employer's Federal Employer Identification Number (FEIN), their business name, and contact information. This helps keep track of all new hires for various purposes, including child support enforcement and welfare programs. The form also collects key employee data, including the Social Security Number, hire date, and whether medical insurance is offered as a benefit. By accurately completing the Arizona New Hire Reporting form, employers contribute to a system that supports public welfare initiatives while streamlining their own reporting processes. It’s important to mail the completed form to the Arizona New Hire Reporting Center or fax it to the designated toll-free number. For additional guidance or questions, employers can visit the official website or reach out through a toll-free hotline.

Arizona New Hire Reporting Example

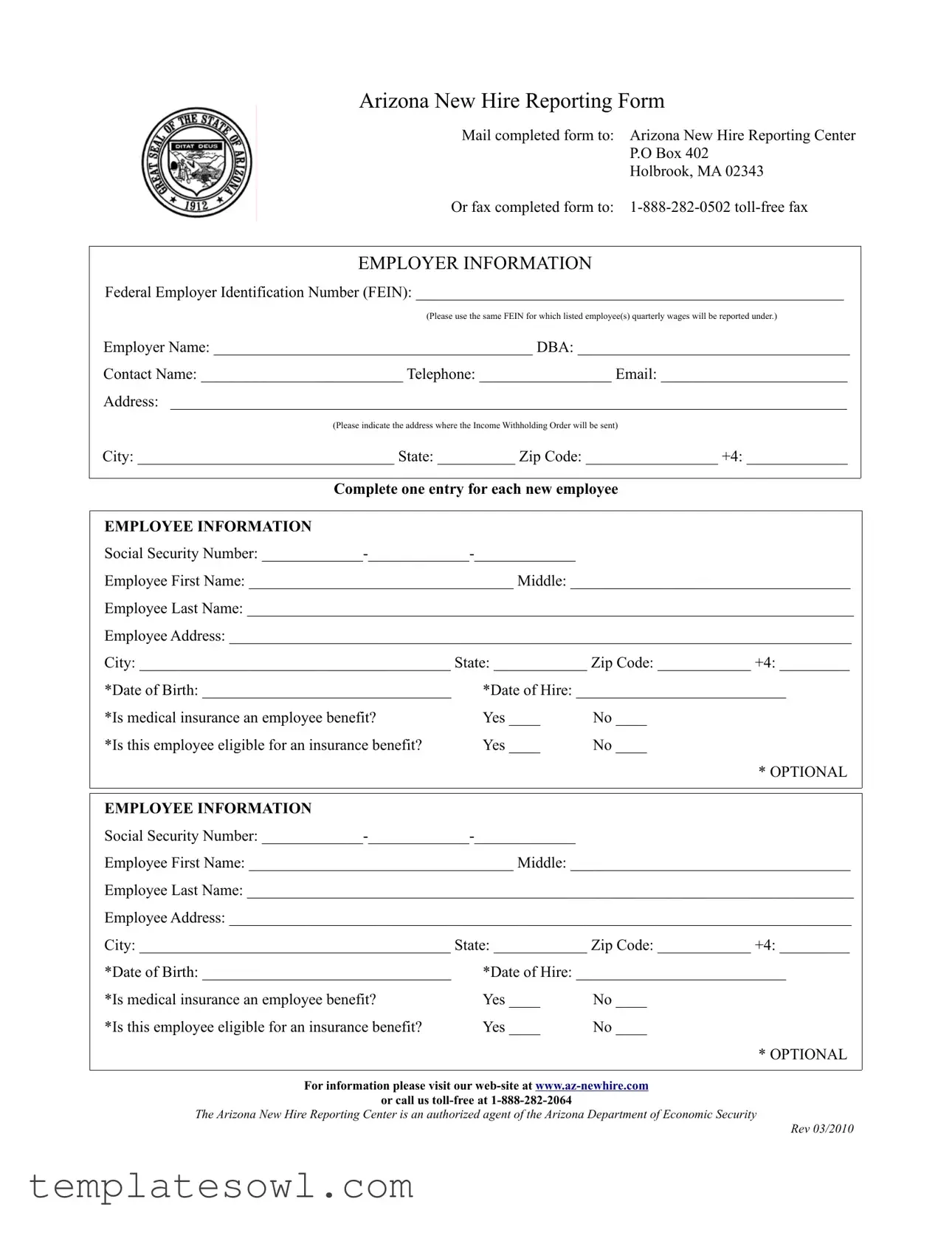

Arizona New Hire Reporting Form

Mail completed form to: Arizona New Hire Reporting Center

P.O Box 402

Holbrook, MA 02343

Or fax completed form to:

EMPLOYER INFORMATION

Federal Employer Identification Number (FEIN): _______________________________________________________

(Please use the same FEIN for which listed employee(s) quarterly wages will be reported under.)

Employer Name: _________________________________________ DBA: ___________________________________

Contact Name: __________________________ Telephone: _________________ Email: ________________________

Address: _______________________________________________________________________________________

(Please indicate the address where the Income Withholding Order will be sent)

City: _________________________________ State: __________ Zip Code: _________________ +4: _____________

Complete one entry for each new employee

EMPLOYEE INFORMATION

Social Security Number:

Employee First Name: __________________________________ Middle: ____________________________________

Employee Last Name: ______________________________________________________________________________

Employee Address: ________________________________________________________________________________

City: ________________________________________ State: ____________ Zip Code: ____________ +4: _________

*Date of Birth: ________________________________ |

*Date of Hire: ___________________________ |

|

*Is medical insurance an employee benefit? |

Yes ____ |

No ____ |

*Is this employee eligible for an insurance benefit? |

Yes ____ |

No ____ |

* OPTIONAL

EMPLOYEE INFORMATION

Social Security Number:

Employee First Name: __________________________________ Middle: ____________________________________

Employee Last Name: ______________________________________________________________________________

Employee Address: ________________________________________________________________________________

City: ________________________________________ State: ____________ Zip Code: ____________ +4: _________

*Date of Birth: ________________________________ |

*Date of Hire: ___________________________ |

|

*Is medical insurance an employee benefit? |

Yes ____ |

No ____ |

*Is this employee eligible for an insurance benefit? |

Yes ____ |

No ____ |

* OPTIONAL

For information please visit our

or call us

The Arizona New Hire Reporting Center is an authorized agent of the Arizona Department of Economic Security

Rev 03/2010

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The form is used to report new hires to help locate parents who owe child support. |

| Governing Law | Arizona Revised Statutes § 25-501 requires employers to report new hires. |

| Submission Methods | Employers can mail the completed form or fax it to the Arizona New Hire Reporting Center. |

| Mailing Address | Forms should be sent to: Arizona New Hire Reporting Center, P.O Box 402, Holbrook, MA 02343. |

| Fax Number | The toll-free fax number for submission is 1-888-282-0502. |

| Employer Information Required | Employers must provide their Federal Employer Identification Number (FEIN) and contact information. |

| Employee Information Required | Details such as the employee’s Social Security Number, name, address, date of birth, and date of hire need to be included. |

| Insurance Benefits | Optional questions about medical insurance benefits eligibility can be marked as 'Yes' or 'No.' |

| Contact Information | For assistance, employers can call toll-free at 1-888-282-2064. |

Guidelines on Utilizing Arizona New Hire Reporting

Once the Arizona New Hire Reporting form is completed, it needs to be submitted to the Arizona New Hire Reporting Center for processing. This ensures that the new employee's information is recorded and compliance requirements are met.

- Obtain the form: Access the Arizona New Hire Reporting form, which may be available online or through your HR department.

- Fill out employer information: Provide your Federal Employer Identification Number (FEIN), employer name, “Doing Business As” name, contact name, telephone number, email address, and the mailing address for income withholding orders.

- Enter employee information: For each new employee, fill in their Social Security Number, first name, middle name, last name, address, city, state, zip code, and date of birth.

- Date of Hire: Record the employee’s date of hire in the designated space.

- Medical insurance benefits: Indicate if medical insurance is an employee benefit and whether the employee is eligible for insurance benefits by checking the appropriate boxes.

- Repeat for additional employees: If you have more than one new employee to report, complete an entry for each person.

- Submit the form: Mail the completed form to the Arizona New Hire Reporting Center at P.O. Box 402, Holbrook, MA 02343, or fax it to 1-888-282-0502.

For further information, visit the Arizona New Hire website or call their toll-free number.

What You Should Know About This Form

What is the purpose of the Arizona New Hire Reporting form?

The Arizona New Hire Reporting form helps employers report new employees to the state. This process is crucial for tracking employment data and ensuring compliance with child support laws. By reporting new hires, employers help facilitate the proper enforcement of child support orders, which can aid custodial parents and guardians in receiving financial support for their children.

Who is required to complete the New Hire Reporting Form?

All employers in Arizona are obligated to complete the New Hire Reporting form for each employee they hire. This requirement applies to both full-time and part-time workers. Employers must use the same Federal Employer Identification Number (FEIN) for the reported employee as they do for their quarterly wage reporting. Timely reporting is essential to avoid potential penalties.

How do I submit the Arizona New Hire Reporting form?

You have two options for submitting the form. First, you can mail the completed form to the Arizona New Hire Reporting Center at P.O. Box 402, Holbrook, MA 02343. Alternatively, you can fax it to the toll-free number, 1-888-282-0502. Ensure that all required information is filled out correctly to prevent delays in processing.

What information is required on the form?

The form requires both employer and employee information. For employers, this includes the Federal Employer Identification Number (FEIN), name, address, and contact details. For employees, essential details such as the Social Security Number, name, address, date of birth, and date of hire are needed. Additionally, the form inquires whether the employee has medical insurance benefits and eligibility for those benefits.

What happens if I fail to report a new hire?

If an employer fails to report a new hire, they may face penalties. This non-compliance can lead to fines and other consequences. The purpose of timely reporting is not only to meet legal obligations but also to support child support enforcement efforts. Employers should ensure that they consistently complete and submit these forms to avoid such challenges.

Common mistakes

Completing the Arizona New Hire Reporting form requires careful attention to detail. One common mistake is leaving the Federal Employer Identification Number (FEIN) section blank or incorrect. This number must match the one used for reporting wages. An error here can delay the processing of the new hire information.

Another frequent error occurs when the employer's name is not filled in correctly. It is essential to ensure that both the Employer Name and "Doing Business As" (DBA) fields are accurate. Any discrepancies can lead to confusion in tracking new hires.

Employees often overlook the Date of Birth and Date of Hire sections. Providing incorrect dates can create issues with benefits eligibility and tax withholding. Therefore, double-checking these dates is crucial.

In some instances, individuals ignore the insurance benefit questions entirely. For a complete submission, mark "Yes" or "No" for both the eligibility for insurance benefits and whether medical insurance is a benefit. These responses are important for compliance purposes.

Another mistake involves incorrect or missing Social Security Numbers. This information is critical for reporting to various government agencies. Ensuring this number is accurate prevents delays in processing and verification.

Many employers fail to provide accurate contact information. It's vital to complete the fields for Contact Name, Telephone, and Email. This information is necessary for follow-up questions or issues that might arise during processing.

Providing an incomplete address for the employer can also create problems. The address must be filled out completely, including the city, state, and zip code. An incomplete address may lead to incorrect delivery of important documents, such as Income Withholding Orders.

Lastly, some people forget to mail or fax the form within the required time frame. Submitting the form promptly helps avoid penalties and ensures compliance with state regulations. Make sure to send the completed form as soon as possible after hiring a new employee.

Documents used along the form

The Arizona New Hire Reporting Form is an essential document for employers who have recently hired employees in the state. However, several other forms and documents often accompany this reporting form to ensure compliance with various regulations and to streamline the onboarding process. Here’s a look at some of these important documents.

- Employee's W-4 Form: This form is used by employees to indicate their tax withholding preferences, which ultimately affects the amount of income tax withheld from their paychecks. It ensures that employers can accurately calculate the necessary withholdings for federal income tax.

- I-9 Employment Eligibility Verification: This document is crucial for verifying the identity and legal authorization to work in the U.S. Employers must complete this form for each new hire and keep it on file to comply with federal law.

- Direct Deposit Authorization Form: If an employee opts for direct deposit, this form allows employers to deposit paychecks directly into the employee's bank account. It typically requires the employee’s banking information and a signature to authorize the setup.

- State Tax Withholding Form: Also known as the A-4 form in Arizona, it is used to determine state income tax withholding for employees. Employers are required to have this form filled out to ensure the correct amount of state taxes is withheld from an employee’s paycheck.

Collectively, these documents help employers navigate the necessary legal and logistical requirements of hiring new employees in Arizona. Organizing and completing all forms accurately ensures a smooth onboarding process and keeps the organization in compliance with federal and state regulations.

Similar forms

- W-4 Form: Similar to the Arizona New Hire Reporting form, the W-4 form is used to gather important information about an employee's tax withholding preferences. Both forms require the employee's personal information, including Social Security Number and address.

- I-9 Form: The I-9 form verifies the identity and employment authorization of individuals hired for work in the United States. Like the Arizona New Hire Reporting form, it involves collecting personal data from the employee and ensuring compliance with federal regulations.

- State New Hire Forms: Many states have their own new hire reporting requirements. These forms gather similar information, such as the employee's name, address, and date of hire, serving to report newly hired employees for state benefits and tax purposes.

- Employment Application: The employment application gathers detailed information about a prospective employee's background, including work history and personal data. The similarities lie in the personal information collected and the purpose of assessing eligibility for employment.

- Payroll Information Form: This form collects details necessary for processing payroll, including Social Security Number and relevant employment dates. It is similar as both forms require specific employee information to ensure accurate payroll processing.

- Employee Benefits Enrollment Form: This document is used to enroll employees in benefit plans. Both forms require the employee's personal information and details about coverage eligibility, helping employers manage employee benefits effectively.

- Workers' Compensation Information Form: Similar in that it collects essential data regarding employees, this form is used to report injuries and assess coverage. It includes personal details, ensuring the tracking and management of workplace injuries.

- Direct Deposit Authorization Form: This authorization form allows employees to set up direct deposit for their paychecks. Both forms require personal banking details and employee information to process payments and ensure funds are delivered correctly.

Dos and Don'ts

When filling out the Arizona New Hire Reporting Form, it's essential to get it right. Here’s a handy guide on what to do and what to avoid:

- Do provide your Federal Employer Identification Number (FEIN) accurately to ensure proper tracking of employee wages.

- Do fill in all required fields for both employer and employee information to prevent delays.

- Do include the correct dates of birth and hire, as this information is vital for record-keeping.

- Do verify the mailing address where the Income Withholding Order will be sent; this helps avoid future complications.

- Don't leave any mandatory fields blank; incomplete forms can lead to issues during processing.

- Don't submit multiple forms for the same employee within the same reporting period; this creates confusion and unnecessary paperwork.

- Don't forget to double-check your contact information, including phone number and email, for any follow-up inquiries.

By following these guidelines, you can help ensure a smooth reporting process for your new employees. Taking these steps will save time and keep everything organized.

Misconceptions

Understanding the Arizona New Hire Reporting form can seem daunting. Plenty of misconceptions often cloud the process, leading to confusion for employers. Here’s a list of nine common misunderstandings about this important form, along with clarifications to set the record straight.

- Only large companies need to report new hires. This is false. All employers, regardless of size, must report new hires. The reporting requirement applies to any business that has employees.

- The form must be submitted on paper. Many believe they must physically mail or fax the form. However, electronic submissions are often accepted and may even be encouraged to streamline the process.

- Reporting is optional if the employee is part-time. In reality, every new employee, full-time or part-time, must be reported. Consistency in reporting is essential for compliance.

- Employers can choose when to report new hires. It’s a misconception that timing is flexible. Employers are required to report each new hire within 20 days of their start date.

- The reporting form is the same for all states. While many states have similar requirements, each state may have its own form and specific instructions. The Arizona New Hire Reporting form is unique to Arizona requirements.

- Only the employee’s Social Security number is necessary. Besides the Social Security number, the form asks for additional details such as the employee’s name, address, and date of hire. Completeness is vital for successful reporting.

- The Arizona New Hire Reporting Center contacts new employees directly. This isn’t typically the case. The center primarily serves the employers and state agencies, while communication with employees is generally the employer’s responsibility.

- This report is only for tax purposes. Not quite! The purpose of new hire reporting extends beyond tax collection; it also helps enforce child support orders and prevent fraud.

- No penalties for not reporting. This belief is misleading. Failing to report can result in substantial fines for employers. It’s important to stay compliant to avoid potential consequences.

Clearing up these misconceptions can lead to a smoother hiring process. Employers should familiarize themselves with the correct procedures and stay informed about their obligations regarding the Arizona New Hire Reporting form.

Key takeaways

The Arizona New Hire Reporting form is essential for employers in Arizona. Here are key takeaways to help guide you through filling it out and using it effectively.

- Purpose of the Form: This form is designed to report newly hired employees to the Arizona Department of Economic Security and is crucial for tracking child support and unemployment benefits.

- Submission Methods: Employers can submit the completed form by mail or fax. For mailing, send it to the Arizona New Hire Reporting Center, P.O Box 402, Holbrook, MA 02343. If faxing, use the toll-free number 1-888-282-0502.

- Employer Identification: Each employer must provide their Federal Employer Identification Number (FEIN). This number links to the employee’s quarterly wage reports.

- Employee Information: Complete all required fields for each new employee. This includes their Social Security Number, name, address, and dates of birth and hire.

- Medical Insurance Benefits: Indicate whether medical insurance is an employee benefit and whether the employee is eligible for an insurance benefit. This section is crucial for compliance with family support obligations.

- Optional Information: While providing additional employee information is optional, including it can help streamline processes for both the employer and the employee.

- Deadline for Reporting: Employers are required to report all new hires within 20 days of the employee's start date. Timeliness is important to remain compliant.

- Web Resources: For further assistance, employers can visit the official website at www.az-newhire.com or call the toll-free hotline at 1-888-282-2064 for guidance.

- Updates Required: If an employer has multiple new hires, they must submit a separate form for each individual. Ensure accuracy to prevent issues down the line.

Understanding these key aspects of the Arizona New Hire Reporting form can lead to smoother administration and compliance with state requirements.

Browse Other Templates

How to Become a Roadside Assistance Provider for Progressive - Coverage extends to the United States, Canada, and limits are specified for claims payments.

If I Get Fired From My Job Can I Collect Unemployment - The form includes a declaration to ensure the information provided is truthful.