Fill Out Your Arizona Repossession Affidavit Form

The Arizona Repossession Affidavit form serves as a crucial document in the vehicle repossession process, outlining both the rights and responsibilities associated with the reclaiming of a vehicle. This form is required to document a repossession when the owner defaults on a loan or breach of a contract. In it, the legal owner and lienholder affirm their ownership and the specific details of the vehicle, including the Vehicle Identification Number (VIN), make, model, and year. The affidavit must declare that the vehicle is physically located within Arizona and confirm the repossession date. This clears any questions about the vehicle's location during the repossession process. Additionally, the form protects the State of Arizona and its affiliates from liability, emphasizing that they will not be held accountable for relying on the affidavit's contents. The form also includes a section for a bill of sale, allowing for a smooth transfer of ownership from the seller to the buyer. Notably, it requires the seller to provide an odometer reading, ensuring compliance with federal and state laws, along with an acknowledgment from the buyer regarding the odometer status. Accurate completion of this form is vital, as inaccuracies could lead to legal repercussions for the involved parties.

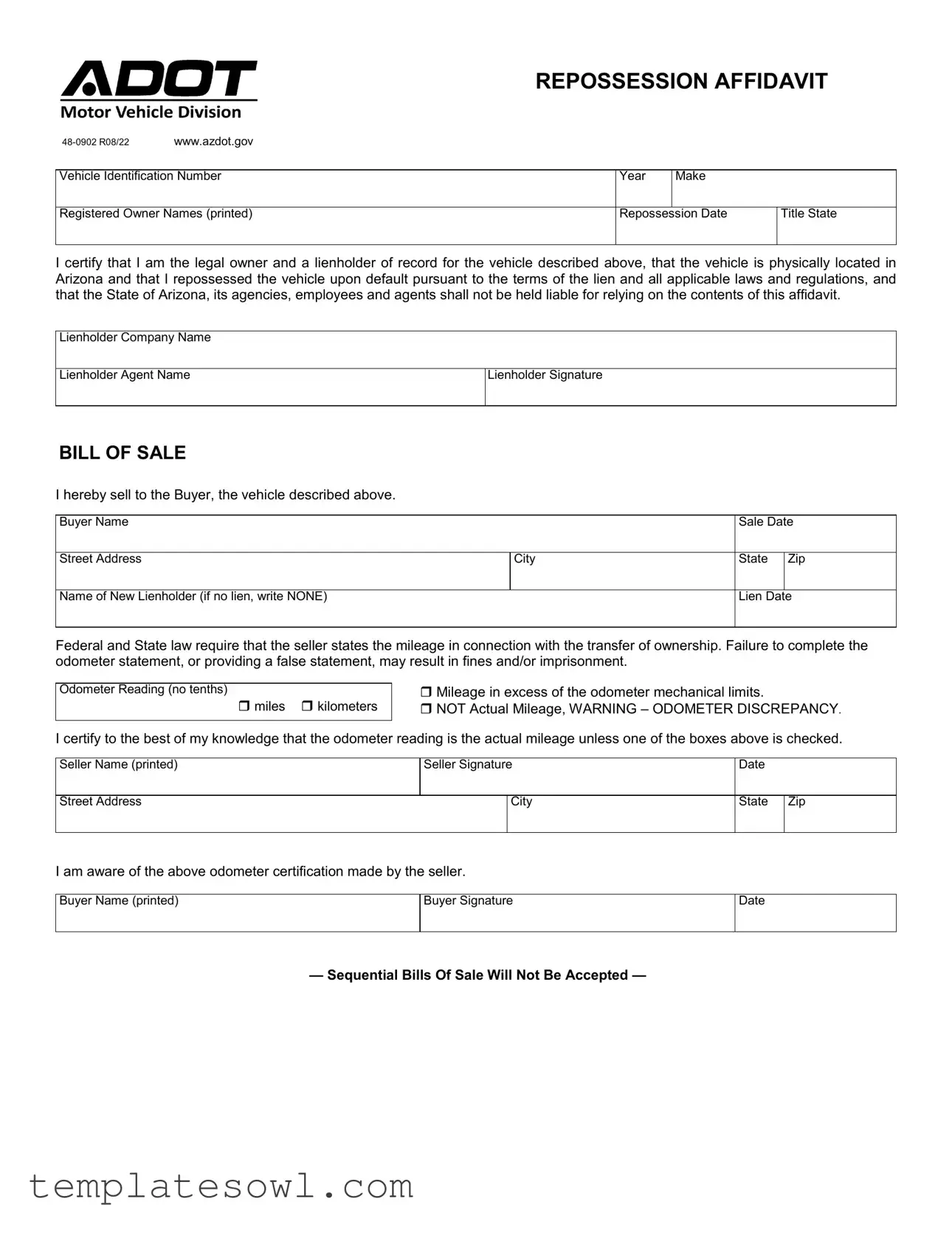

Arizona Repossession Affidavit Example

REPOSSESSION AFFIDAVIT

Vehicle Division

www.azdot.gov |

|

|

|

|

|

|

|

|

|

Vehicle Identification Number |

Year |

Make |

|

|

|

|

|

I |

|

Registered Owner Names (printed) |

Repossession Date |

Title State |

||

|

|

|

|

I |

I certify that I am the legal owner and a lienholder of record for the vehicle described above, that the vehicle is physically located in Arizona and that I repossessed the vehicle upon default pursuant to the terms of the lien and all applicable laws and regulations, and that the State of Arizona, its agencies, employees and agents shall not be held liable for relying on the contents of this affidavit.

Lienholder Company Name |

|

|

|

|

|

|

|

Lienholder Agent Name |

Lienholder Signature |

|

|

|

I |

|

|

BILL OF SALE |

|

|

|

I hereby sell to the Buyer, the vehicle described above. |

|

|

|

|

|

|

|

Buyer Name |

|

Sale Date |

|

|

|

|

|

Street Address |

City |

State |

Zip |

|

I |

|

I |

Name of New Lienholder (if no lien, write NONE) |

|

Lien Date |

|

|

|

|

|

Federal and State law require that the seller states the mileage in connection with the transfer of ownership. Failure to complete the odometer statement, or providing a false statement, may result in fines and/or imprisonment.

Odometer Reading (no tenths)

miles kilometers

Mileage in excess of the odometer mechanical limits.

NOT Actual Mileage, WARNING – ODOMETER DISCREPANCY.

I certify to the best of my knowledge that the odometer reading is the actual mileage unless one of the boxes above is checked.

Seller Name (printed)

Seller Signature

Date

Street Address

City

State Zip

I am aware of the above odometer certification made by the seller.

Buyer Name (printed)

Buyer Signature

Date

— Sequential Bills Of Sale Will Not Be Accepted —

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The document is titled “Repossession Affidavit” and is used for vehicle repossession in Arizona. |

| Governing Law | The governing law for this affidavit is Arizona Revised Statutes § 48-0902. |

| Vehicle Information | The affidavit requires essential vehicle details including Vehicle Identification Number (VIN), year, and make. |

| Legal Certification | The legal owner and lienholder must certify their ownership and the vehicle's location in Arizona. |

| Liability Disclaimer | The document states that Arizona and its agents are not liable for the affidavit’s content. |

| Odometer Statement | The form includes an odometer reading declaration that must be accurately completed to avoid penalties. |

| Transfer of Ownership | A bill of sale section allows for the sale of the vehicle to a buyer, specifying purchase details. |

| Sequential Bills of Sale | The document specifies that sequential bills of sale will not be accepted for vehicle transfer. |

Guidelines on Utilizing Arizona Repossession Affidavit

After gathering all necessary information, you can proceed to fill out the Arizona Repossession Affidavit form. This document will require specific details about the vehicle, the lienholder, and both the seller and buyer information. Following these instructions will help ensure that the form is completed accurately, which is crucial for its acceptance.

- Begin at the top of the form, entering the Vehicle Identification Number (VIN).

- Below the VIN, fill in the Year and Make of the vehicle.

- Next, provide the names of the Registered Owners in printed format.

- Indicate the Repossession Date.

- In the next field, write the Title State.

- In the certification section, confirm that you are the legal owner and lienholder by signing your name and writing the current date.

- Fill in the Lienholder Company Name and the Lienholder Agent Name.

- Next, indicate the Sale Date for the vehicle.

- Enter the Buyer Name and the complete Street Address, City, State, and Zip Code of the buyer.

- If there is a new lienholder, state their name; if not, write NONE.

- Provide the Lien Date.

- Complete the Odometer Reading section by entering the mileage and selecting the appropriate mileage box.

- Print the Seller Name and sign the document, including the current date.

- Finally, have the buyer print their name, sign, and date the acknowledgment of the odometer certification.

Once the form is filled out completely, review it for accuracy. Ensure that all signatures are present. This will help in avoiding potential delays or complications during the submission process.

What You Should Know About This Form

What is the purpose of the Arizona Repossession Affidavit form?

The Arizona Repossession Affidavit serves as a legal document that indicates the repossession of a vehicle by a lienholder. It confirms that the vehicle is physically located in Arizona and that the repossession occurred following the terms of the lien agreement and applicable laws. This document protects both the lienholder and the state, ensuring that the liabilities associated with the vehicle are clearly outlined.

Who needs to fill out the Arizona Repossession Affidavit form?

The form must be completed by the legal owner of the vehicle who also holds the lien. This typically includes finance companies or individuals who financed the vehicle purchase. Every lienholder involved in the repossession process must certify their involvement by signing the affidavit, thereby confirming their legal ownership and authority over the vehicle.

What information is required on the form?

Several critical details must be provided on the Arizona Repossession Affidavit. This includes the vehicle's identification number (VIN), make, and year. The form also requires the registered owner's name, the repossession date, and the name of the lienholder. Additionally, the form includes sections to document the sale of the vehicle if applicable, including buyer information and odometer readings.

What happens if the form is not accurately completed?

Failing to accurately complete the form can lead to serious consequences. If the odometer statement is not filled out or contains false information, it may result in fines or even criminal charges. It is crucial for both the seller and buyer to ensure the information reflects the truth to avoid any future legal complications.

Is the Arizona Repossession Affidavit form legally binding?

Yes, the Arizona Repossession Affidavit is a legally binding document once completed and signed. It certifies that the lienholder has repossessed the vehicle according to the legal stipulations and that all the information provided within the affidavit is accurate. Misrepresentation or failure to comply with the affixed declarations can lead to legal repercussions.

How can one obtain the Arizona Repossession Affidavit form?

The Arizona Repossession Affidavit form can be obtained from the Arizona Department of Transportation's website. It is often available for download in PDF format. Alternatively, you can visit the local DMV for physical copies. Ensuring you have the most current version of the form is vital, as these documents can be updated over time.

Common mistakes

Filling out the Arizona Repossession Affidavit form requires careful attention to detail. One common mistake occurs when individuals do not provide complete and accurate vehicle identification information. This may seem straightforward, but omitting the Vehicle Identification Number (VIN) can create significant problems. The VIN is essential for accurately identifying the vehicle, and any discrepancies here could lead to delays or complications.

Another prevalent error involves the certification of ownership. When completing the affidavit, individuals must ensure they are indeed the legal owner and a lienholder of record for the vehicle. Failing to confirm this status can result in legal issues down the line. Before signing, double-check that all ownership details are correct and reflect the current state of affairs.

Odometer readings also lead to confusion. Some individuals may forget to complete the odometer statement or provide incorrect information. This section requires precise details about the vehicle's mileage. Not including the correct reading or misrepresenting it can lead to fines or legal repercussions. Always record the odometer reading accurately and consider checking for any discrepancies.

Finally, the signature requirements often lead to errors. Individuals sometimes forget to sign or may use the wrong name when signing the affidavit. It is essential to ensure that all necessary signatures are provided by both the seller and the buyer. Not adhering to this rule can invalidate the entire affidavit. Take the time to confirm that all parties have signed and that names match with the provided printed information.

Documents used along the form

The Arizona Repossession Affidavit is an essential document for lienholders who need to recover vehicles due to default. However, several other forms are often required or beneficial to accompany this affidavit, ensuring a smooth transition and lawful compliance during the repossession process. Below is a list of additional documents that may be relevant.

- Bill of Sale: This document records the sale of the repossessed vehicle to a new buyer. It includes essential details such as the buyer's name, sale date, and odometer reading, ensuring a clear transfer of ownership.

- Title Transfer Document: Issued by the state, this form facilitates the change of title from the lienholder to the new owner. It serves as the official record of the new owner's claim to the vehicle.

- Odometer Disclosure Statement: Required by both federal and state law, this statement must accompany the sale of a vehicle. It certifies the odometer's mileage at the time of sale, preventing any potential fraud.

- Notice of Repossession: This document informs the borrower of the repossession, detailing the defaults and the lienholder's rights. Providing this notice is often a legal requirement before repossession occurs.

- Replevin Action Form: In some cases, this form may be needed if the borrower disputes the repossession. It allows the lienholder to legally reclaim the vehicle through the court system.

- Lien Release Document: When the vehicle is fully paid off, this form indicates that the lien has been released. It serves as proof that the borrower owns the vehicle free and clear of any debts.

- Proof of Insurance: Typically required by lenders, this document confirms that the vehicle is insured. It can be particularly important in protecting both the lienholder and the new owner against potential liabilities.

Understanding these accompanying documents can help streamline the repossession process and ensure compliance with the necessary legal requirements. Always consult with a knowledgeable individual or entity to confirm that you have the right documents to protect your interests.

Similar forms

The Arizona Repossession Affidavit form is similar to several other legal documents related to vehicle ownership and transfer. Each document serves a distinct purpose but shares common elements of ownership verification, obligations of parties, and implications for liability. The following are comparable documents:

- Bill of Sale: This document confirms the sale of a vehicle from the seller to the buyer. Like the Repossession Affidavit, it includes information about the vehicle, such as the Vehicle Identification Number (VIN), and serves as a legal record of the transaction.

- Title Transfer Application: A title transfer application is used when the ownership of a vehicle changes hands. This form also requires information about the vehicle and must be filed with the relevant state department, similar to the Affidavit’s certification of repossession details.

- Secured Party’s Proof of Claim: This document is used to assert a lien on a vehicle or other personal property. It establishes the secured party's claim and provides evidence of ownership and legal rights, paralleling the repossession evidence indicated in the Affidavit.

- Odometer Disclosure Statement: Required under federal law, this statement must accompany the sale or transfer of a vehicle and certifies the odometer reading at the time of sale. This aligns with the odometer certification included as part of the Repossession Affidavit.

- Power of Attorney for Vehicle Transactions: This document allows one person to act on behalf of another in legal matters regarding vehicle ownership. It can facilitate the sale or repossession process, similar to how the Repossession Affidavit confirms the authority to reclaim a vehicle.

Dos and Don'ts

When filling out the Arizona Repossession Affidavit form, there are important guidelines to follow to ensure accuracy and compliance. Here’s a concise list of what to do and what to avoid.

- Do read the instructions carefully before starting to fill out the form.

- Do provide accurate information, including vehicle details and identification numbers.

- Do ensure that all required signatures are obtained from the appropriate parties.

- Do double-check the odometer reading and accompanying statements for accuracy.

- Do submit the form to the correct agency after it has been fully completed.

- Do keep a copy of the completed Affidavit for your records.

- Don’t rush through the form; take your time to avoid mistakes.

- Don’t leave any fields blank unless specified; incomplete forms may be rejected.

- Don’t provide false information, as this can lead to legal consequences.

- Don’t forget to include the date next to each signature.

- Don’t assume that all information is obviously understood; clarity is essential.

- Don’t overlook any additional documentation that may be required when submitting the form.

Misconceptions

Here are some common misconceptions about the Arizona Repossession Affidavit form. Understanding these can help ensure that the process of vehicle repossession is clear and compliant with the law.

- Only banks can complete the affidavit. Many people believe that only banks have the authority to fill out this form. In reality, any legal owner or lienholder of the vehicle can complete it, as long as they follow the necessary regulations.

- The affidavit can be completed without proof of ownership. Some mistakenly think that filling out the form is all that is needed. A legal owner must provide proof of ownership, such as the vehicle title and lien details.

- It’s unnecessary to report the odometer reading. This is a common myth. Federal and state laws require that the odometer reading must be included when transferring ownership to avoid penalties.

- Once the vehicle is repossessed, the debtor is not informed. Many believe the debtor will not be notified after repossession. However, notifying the debtor is typically a necessary step in the process.

- Only a lawyer can help with repossession. While legal advice can be beneficial, using the Arizona Repossession Affidavit does not require a lawyer. Many individuals successfully manage the process themselves.

- The affidavit guarantees the buyer will receive the vehicle. Some assume that submitting this form automatically transfers ownership. The affidavit helps facilitate the process but does not guarantee a buyer's entitlement to the vehicle.

- All vehicles can be repossessed. There is a misconception that any vehicle can be repossessed at any time. Vehicles must be specified in the lien agreement and repossession must follow proper legal procedures.

- Filling out this form is optional. Some people believe they can skip this step altogether. In Arizona, completing the affidavit is a legal requirement following the repossession of a vehicle.

- You can sell the vehicle without notifying the previous owner. It’s false to think that you can sell a repossessed vehicle without informing the original owner. Notification is a key legal obligation after repossession.

Clearing these misconceptions can make the repossession process smoother for everyone involved.

Key takeaways

When filling out the Arizona Repossession Affidavit form, understanding the key components is crucial for a smooth process. Here are nine essential takeaways:

- Legal Ownership: You must certify that you are the legal owner and a lienholder of record for the vehicle in question.

- Location Confirmation: The vehicle must be physically located in Arizona at the time of repossession.

- Repossession Statement: Clearly state the repossession date and confirm it was upon default, according to the terms of the lien.

- Liability Waiver: The affidavit includes a waiver that protects the State of Arizona from liability based on the affidavit's contents.

- Bill of Sale: Complete the Bill of Sale section if you are selling the repossessed vehicle to a new buyer.

- Mileage Disclosure: Federal and State law mandates that accurate mileage must be stated during the ownership transfer.

- Odometer Reading: Provide the exact odometer reading, ensuring you are aware of any discrepancies.

- Signatures Required: Both the seller and buyer must print and sign their names to validate the sale.

- No Sequential Bills of Sale: Keep in mind that sequential bills of sale will not be accepted, so confirm that all documentation is complete and valid.

Paying attention to these details will help ensure compliance with Arizona laws regarding vehicle repossession and transfer of ownership.

Browse Other Templates

Drivers Time Record Sheet - The time record is a vital tool for fleet management and scheduling.

866-873-8279 - There are specific requirements for various diagnoses related to inflammation.

Medication List Example - An organized medication list simplifies doctor visits.