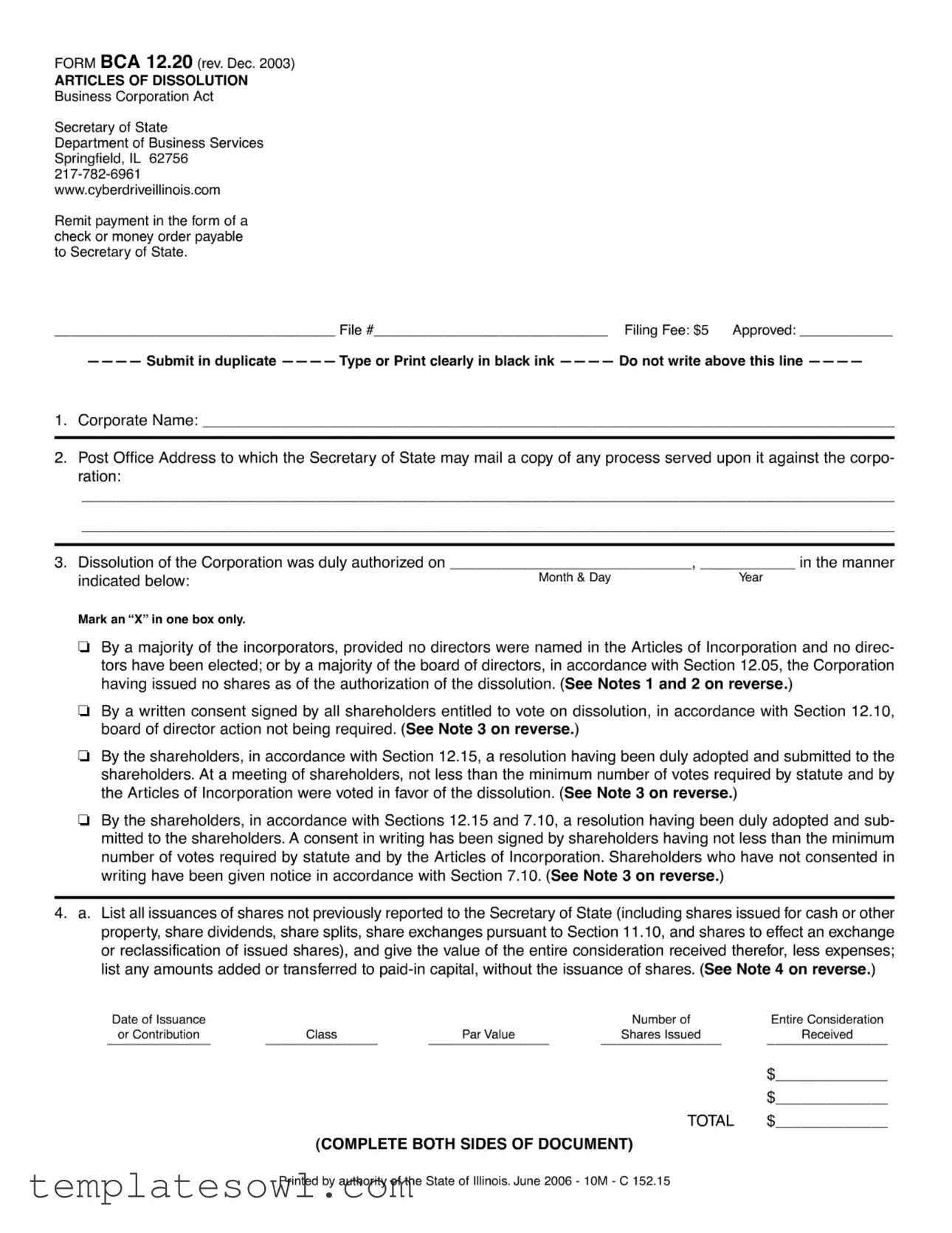

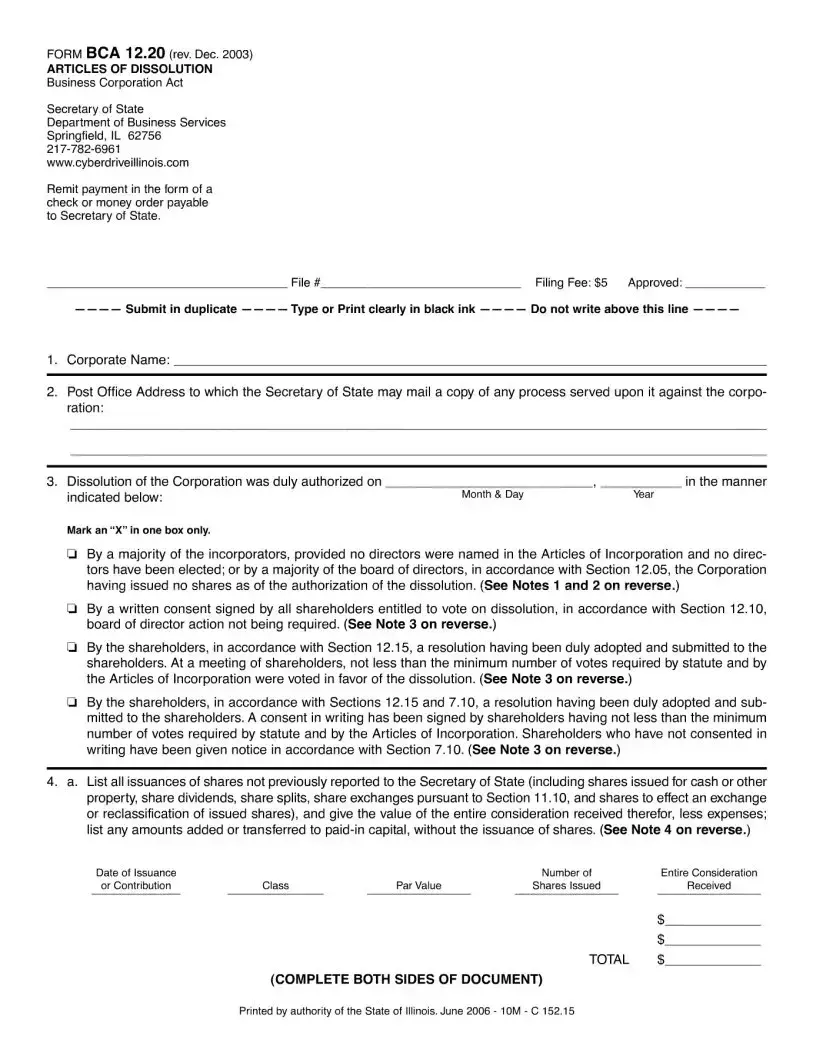

Fill Out Your Articles Of Dissolution Form

The Articles of Dissolution form is a vital document for any corporation that decides to cease its operations legally. Located under the Business Corporation Act and governed by the Secretary of State’s Department of Business Services in Illinois, this form facilitates the official dissolution process. It includes essential details such as the corporate name, address for service of process, and the specific authorization method for the dissolution, whether it be by the incorporators, the board of directors, or through shareholder consent. Identifying how the dissolution was approved is critical, as accuracy helps ensure compliance with state laws. The form also requires information on the corporation's shares, including any issuances or cancellations that occurred prior to the dissolution. Additionally, the authorized officer of the corporation must sign the document, affirming the truthfulness of the provided information. This form should be submitted in duplicate, along with a filing fee, ensuring that all procedural requirements are met for a smooth dissolution process.

Articles Of Dissolution Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Articles of Dissolution form is governed by the Business Corporation Act of Illinois. |

| Filing Fee | The filing fee for submitting the Articles of Dissolution is $5, payable by check or money order. |

| Approval Requirements | Dissolution must be authorized by a majority of the incorporators, directors, or shareholders, depending on the situation. |

| Submission Method | Submit the completed Articles of Dissolution in duplicate to the Secretary of State. |

Guidelines on Utilizing Articles Of Dissolution

Completing the Articles of Dissolution form is a crucial step in officially dissolving a corporation. After filling out the form, the next steps will include submitting it to the appropriate state office along with the necessary payment. Be sure to keep a copy for your records and await confirmation of dissolution from the state.

- Enter the Corporate Name in the designated field.

- Provide the Post Office Address where the Secretary of State should send any process served upon the corporation.

- Indicate how the dissolution was authorized by marking an “X” in one box only. Choose from the following options, depending on the circumstances pertaining to your corporation:

- By a majority of the incorporators

- By a majority of the board of directors

- By written consent signed by all shareholders

- By a resolution adopted and submitted to the shareholders

- By consent in writing signed by shareholders

- Fill out section 4.a. to list all issuances of shares not previously reported, including details like date of issuance, number of shares, and entire consideration received.

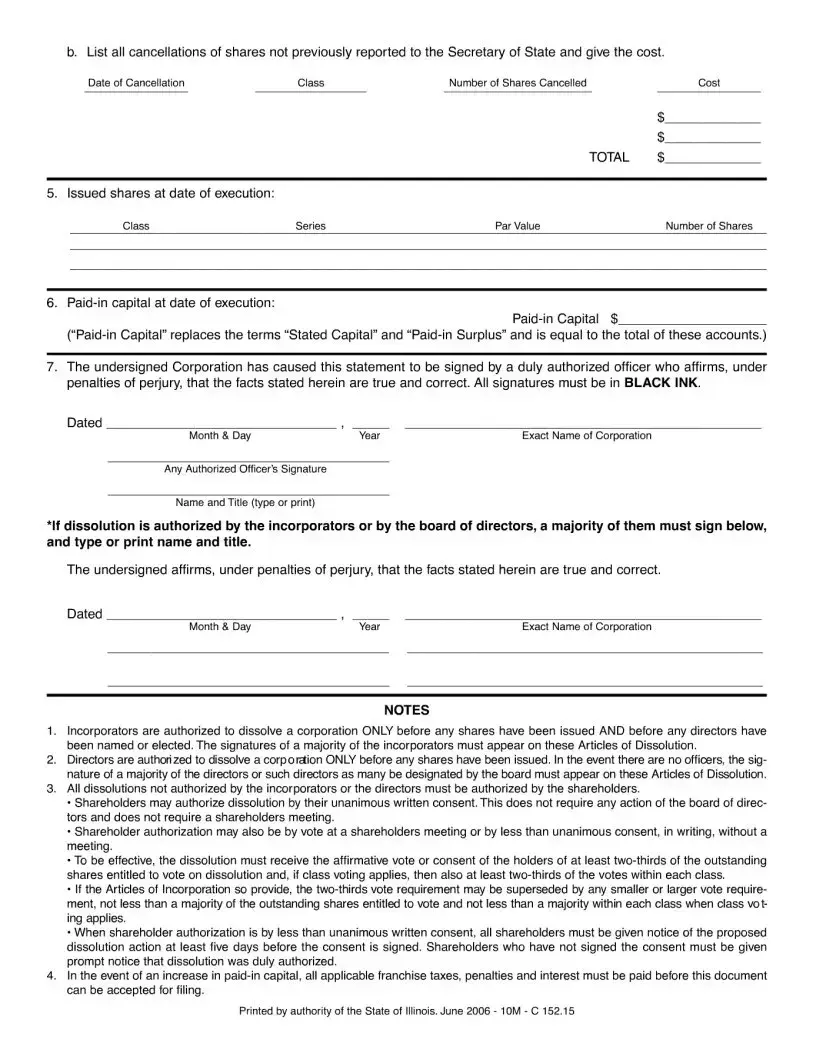

- In section 4.b., record all cancellations of shares not previously reported along with the associated costs.

- Complete section 5 by detailing the issued shares at the date of execution, indicating class, series, par value, and number of shares.

- Provide information for section 6, specifying the paid-in capital at the date of execution.

- Sign and date where indicated in section 7 in the presence of an authorized officer of the corporation.

- The authorized officer must print their name and title clearly.

- If dissolution is authorized by the incorporators or board of directors, include signatures from a majority of them as required.

- Ensure that the form is submitted in duplicate and has been filled out using black ink and clear print.

- Include the applicable filing fee and payment format, either by check or money order payable to the Secretary of State.

What You Should Know About This Form

What is the purpose of the Articles of Dissolution form?

The Articles of Dissolution form is used to officially dissolve a corporation in accordance with the Business Corporation Act. By filing this form, a corporation legally indicates that it has ceased operations and is no longer conducting business. It ensures that the dissolution is recognized by the Secretary of State and other relevant authorities.

What information is required on the Articles of Dissolution form?

The form requires several key pieces of information. This includes the corporate name, mailing address for any served processes, the method of dissolution, details about issued shares and any cancellations, and the signatures of authorized officers. Additionally, it is necessary to provide the date of issuance or cancellation of shares along with financial details related to those transactions.

What are the filing fees associated with the Articles of Dissolution?

The filing fee for the Articles of Dissolution is set at $5. Payments should be made in the form of a check or money order made payable to the Secretary of State. It is important to ensure that the payment accompanies the submission of the form, as the dissolution cannot be processed without this fee.

Who is authorized to file the Articles of Dissolution?

Only certain individuals can authorize the dissolution of a corporation. If no shares were issued, a majority of the incorporators or directors may authorize the dissolution. If shares have been issued, the shareholders must provide authorization, either through a unanimous written consent or by a properly noticed vote during a meeting.

What happens after the Articles of Dissolution are filed?

After the Articles of Dissolution are accepted for filing, the corporation is officially dissolved. The Secretary of State will mail a copy of the filed document back to the corporation at the address provided. The corporation must ensure it addresses any remaining debts, taxes, and obligations as it will no longer be considered an active business entity.

Can a corporation reverse the dissolution after filing the Articles of Dissolution?

Once the Articles of Dissolution are filed and the dissolution is effective, reversing this process is not straightforward. A corporation may need to follow a formal procedure to reinstate itself, which may involve filing for reinstatement and meeting specific legal requirements. It is advisable to consult with a legal professional for guidance if considering reinstatement after dissolution.

Common mistakes

Filling out the Articles of Dissolution form is an important step in ending a business's existence. However, many individuals make mistakes that can lead to delays or complications. One common error is failing to clearly print or type the corporate name. This can cause confusion and may result in the rejection of the application.

Another frequent mistake involves not indicating the date when the dissolution was authorized. Without this information, it is difficult for the Secretary of State to verify that all necessary procedures were followed. Ensuring that this date is correctly filled in is essential for a smooth process.

Omitting the signature of an authorized officer is also a significant oversight. Every Articles of Dissolution must be signed by the right person. Even when the correct names are printed, if the signature is missing, the form cannot be processed.

Many people forget to list all share issuances. This section requires complete transparency about any shares issued before the dissolution. Accurately reporting this information is crucial to prevent future legal issues that may arise.

Not providing a post office address is another common mistake. This address is where the Secretary of State will send necessary paperwork. Without a valid address, important documents may not reach the corporation, leading to unnecessary complications.

Some individuals mistakenly mark more than one option for how the dissolution was authorized. This should be avoided as it can raise questions about the legitimacy of the process. Only one option should be selected in accordance with the rules set forth in the form.

Failing to report share cancellations can result in problems down the line. It is essential to include all cancellations on the form. This ensures that the records are accurate and helps prevent potential disputes in the future.

Another error occurs when the total values in the share sections do not match the amounts listed. All figures must be consistent and accurate. Discrepancies can confuse officials and result in processing delays.

Individuals also sometimes neglect to include a payment with the form. The filing fee is required for the documents to be accepted. Without timely payment, the dissolution may not be finalized as expected.

Lastly, many overlook the importance of notifying all shareholders prior to the dissolution process. Even if consent is not required, keeping all parties informed fosters a positive atmosphere and reduces the chance of misunderstandings.

Documents used along the form

When a corporation decides to dissolve, it often needs to submit several key documents in addition to the Articles of Dissolution. Each document plays a critical role in ensuring proper compliance with state regulations and the orderly winding down of business activities. Below is a list of other commonly used forms and documents associated with the dissolution process.

- Certificate of Cancellation: This document is required to formally cancel a corporation's existence after the Articles of Dissolution have been filed. It typically confirms that all debts have been settled and all necessary steps for dissolution are complete.

- Final Tax Returns: Corporations must file final income tax returns with the IRS and state tax authorities. This ensures that all tax obligations are fulfilled prior to dissolution.

- Notice to Creditors: A written notice sent to all creditors informing them of the dissolution. This notification outlines the process to file claims against the corporation for outstanding debts.

- Shareholder Resolution: A formal document detailing the approval of dissolution by the shareholders. This may include voting records or a written consent to ensure that the proper majority has authorized the dissolution.

- State Franchise Tax Clearance: A document showing that the corporation has settled all outstanding franchise taxes. Some states require this clearance before allowing dissolution to proceed.

- Final Minutes of the Board Meeting: Documentation of the final decisions made by the board of directors regarding dissolution. This serves as a record of corporate governance leading up to the decision.

- Allocation of Assets Statement: A detailed account of how the corporation's remaining assets will be distributed among shareholders and creditors. This is crucial for a transparent winding-down process.

- Form for Closeout of Employer Identification Number (EIN): A request to the IRS to close the corporation’s EIN account. This helps prevent future tax liabilities associated with the dissolved entity.

- Affidavit of Discharge: A sworn statement confirming that all liabilities have been paid or accounted for. This document helps to protect former directors and shareholders from future claims related to the corporation's debts.

It is essential for corporations to carefully prepare and submit all required documents along with the Articles of Dissolution. Failure to do so can result in legal complications or financial liabilities in the future. Consulting with a legal professional can provide valuable guidance during this process.

Similar forms

The Articles of Dissolution form is similar to several other business documents, as they all relate to the management, change, or termination of business entities. Here are five documents with which it shares similarities:

- Certificate of Formation: This document establishes a corporation's existence. It is similar to Articles of Dissolution because both are filed with the Secretary of State. One initiates the creation of a business, while the other formally ends it.

- Bylaws: Bylaws govern the internal management of a corporation. Like the Articles of Dissolution, they require approval from the board of directors or shareholders. Both documents reflect the decision-making processes within the corporation.

- Annual Report: An annual report is filed regularly to keep the state informed about a corporation's activities. This is similar to the Articles of Dissolution, as both require specific information to be officially recorded, although one maintains status while the other terminates it.

- Merger Agreement: A merger agreement outlines the terms when two or more corporations combine. This document is akin to the Articles of Dissolution because it can lead to the dissolution of one or more corporations involved. Both require the approval of shareholders and directors.

- Withdrawal Form: This is used when a corporation ceases to do business in a state. It shares the purpose of formally recognizing an end to corporate status, similar to the Articles of Dissolution, which declare the conclusion of corporate existence.

Dos and Don'ts

When completing the Articles of Dissolution form, it is important to follow certain guidelines to ensure the process goes smoothly. Below is a list of actions to take and avoid during this process.

- Do: Ensure that the corporate name is filled out accurately.

- Do: Provide a clear address for the Secretary of State to send any correspondence.

- Do: Use black ink for typing or printing the form.

- Do: Submit the form in duplicate to satisfy filing requirements.

- Do: Indicate the method of dissolution selected by marking the appropriate box.

- Do: List all issuances of shares accurately, including any changes not previously reported.

- Do: Sign the form as an authorized officer of the corporation.

- Do: Review the entire form for completeness and accuracy before submission.

- Do: Include the payment required for the filing fee along with the form submission.

- Do: Provide prompt notice to shareholders who have not consented if the dissolution is authorized by less than unanimous consent.

- Don't: Leave any sections of the form blank; every applicable part must be filled out.

- Don't: Write anything above the designated line on the form.

- Don't: Forget to include the required signatures of the majority of incorporators or directors, if applicable.

- Don't: Submit any incomplete documents to the Secretary of State.

- Don't: Ignore the requirements for notifying shareholders about voting or consent procedures.

- Don't: Use colored ink or pencil when filling out the form; stick to black ink only.

- Don't: Attempt to file the form if any franchise taxes or penalties are outstanding.

- Don't: Submit the form without verifying the date of execution and ensuring it’s accurate.

- Don't: Confuse the guidelines regarding unanimous consent and majority vote for dissolution.

- Don't: Overlook including the total values for any shares, issued or canceled, as required.

Misconceptions

- Articles of Dissolution Can Be Filed Anytime: Some believe that they can file the Articles of Dissolution at any moment. In reality, this form must be submitted after proper authorization from the board of directors or shareholders, depending on the situation.

- Dissolution Ends All Business Operations Immediately: Many individuals think that filing the Articles of Dissolution ends all business activities immediately. However, the process may involve winding down operations, settling debts, and distributing remaining assets, which can take time.

- All Shareholder Consent Is Always Needed: There is a common misconception that dissolution requires unanimous shareholder consent. In fact, dissolution can be authorized by a majority vote or agreement, depending on the circumstances and company bylaws.

- The Filing Fee Is High: Some assume that filing the Articles of Dissolution comes with a significant cost. The filing fee is actually quite low, set at just $5, making it accessible for most corporations.

- Proof of Payment Is Not Required: Some think that payment for filing the Articles of Dissolution is optional. It is essential to remit the required payment in advance to process the dissolution.

- Form Can Be Submitted in Any Format: A misconception exists that the Articles of Dissolution can be filled out and submitted in various formats. However, it must be completed in black ink and submitted as specified on the form to be accepted.

- Filing Initiates the Closure Process: While filing the Articles of Dissolution is a critical step, it does not automatically initiate the complete closure of a business. Other actions, such as settling debts and notifying creditors, are necessary steps in the dissolution process.

Key takeaways

When filling out and using the Articles of Dissolution form, consider the following key takeaways:

- Correct Filing Fee: Ensure that you include the correct filing fee of $5, payable by check or money order to the Secretary of State.

- Submission Requirements: Submit the completed form in duplicate. Clear and legible printing in black ink is essential.

- Authorization: Dissolution actions must be properly authorized. This can occur through incorporators, directors, or shareholders based on the outlined structures.

- Accurate Information: List all previously unreported share issuances and cancellations, providing the necessary details about their valuations and costs.

- Shareholder Consent: When shareholder approval is required, ensure that notice is given to all shareholders and that the appropriate voting processes are followed.

Browse Other Templates

Colorado Sales Tax Refund 2024 - Schedules A and B report deductions and exemptions; completion is required for correct filing.

Affidavit Template California - It includes a section for a notary public to verify the signatures.