Fill Out Your Aspca Insurance Form

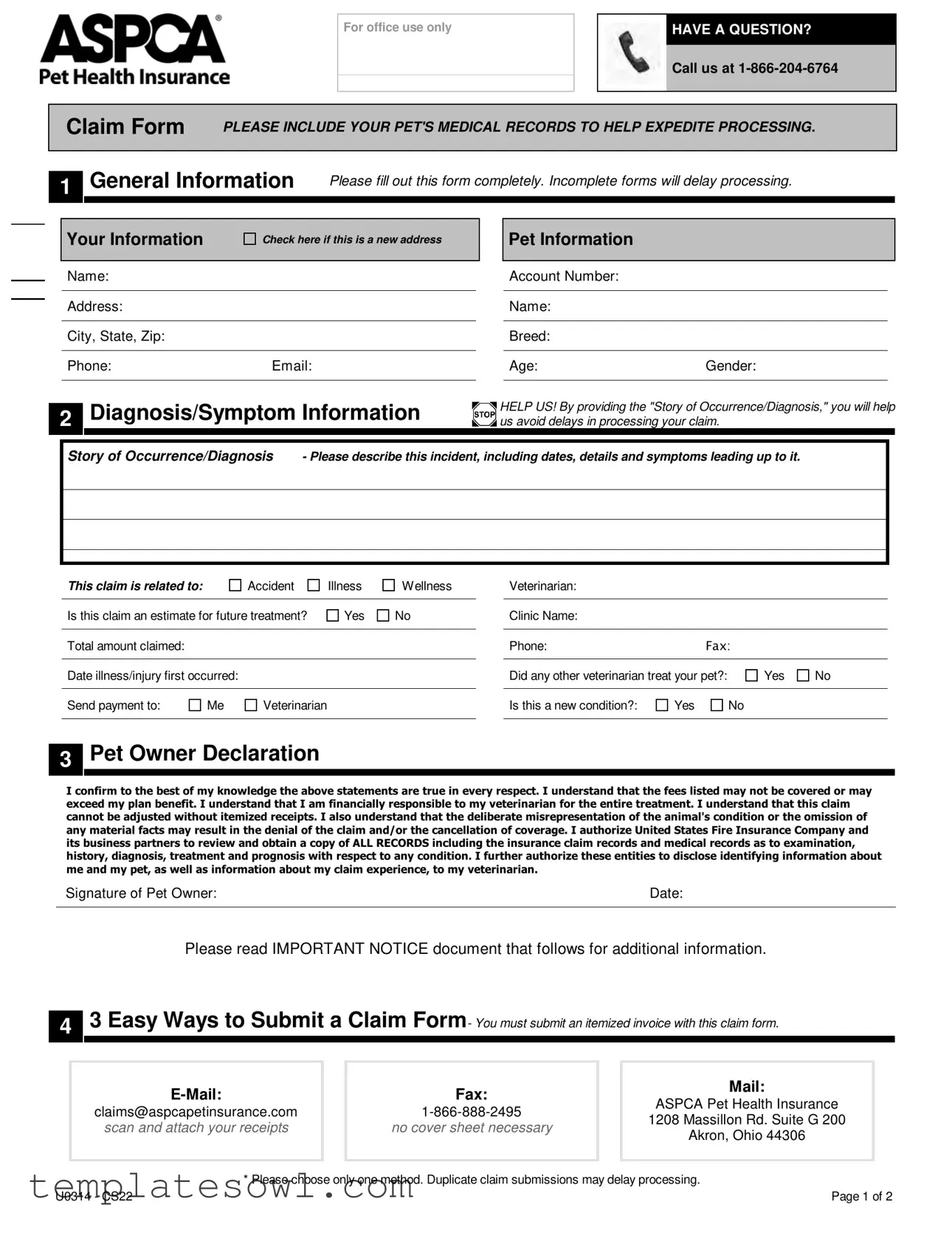

The ASPCA Insurance claim form is essential for pet owners seeking reimbursement for veterinary expenses related to their furry companions. This form demands comprehensive information to streamline the claims process and ensure a smoother experience for pet owners. Several sections require details such as the pet’s name, breed, age, and gender, as well as the pet owner's contact information. Moreover, it prompts the user to provide an account number and to explain the circumstances surrounding the claim, including any relevant medical history or symptoms leading to the diagnosis.

For optimal processing, submission of detailed medical records along with the claim form is encouraged. This helps speed up evaluations and decisions. Pet owners must indicate whether the claim pertains to an accident, illness, or wellness visit, along with the total amount being claimed. The form also addresses important considerations, including a declaration of accuracy by the pet owner and the understanding of financial responsibilities associated with veterinary care. With multiple methods available for submission—email, fax, or mail—the ASPCA ensures that pet owners can choose the most convenient option, enhancing accessibility and efficiency in the claims process.

Aspca Insurance Example

For office use only

HAVE A QUESTION?

Call us at

Claim Form |

PLEASE INCLUDE YOUR PET'S MEDICAL RECORDS TO HELP EXPEDITE PROCESSING. |

|

|

1 |

General Information |

Please fill out this form completely. Incomplete forms will delay processing. |

|

|

|

|

Your Information |

Check here if this is a new address |

|

|

Name:

Address:

City, State, Zip:

Phone:Email:

Pet Information

Account Number:

Name:

Breed:

Age:Gender:

2 |

Diagnosis/Symptom Information

HELP US! By providing the "Story of Occurrence/Diagnosis," you will help us avoid delays in processing your claim.

Story of Occurrence/Diagnosis - Please describe this incident, including dates, details and symptoms leading up to it.

This claim is related to: |

Accident |

Illness |

W ellness |

|

|

|

|

Is this claim an estimate for future treatment? |

Yes |

No |

|

|

|

|

|

Total amount claimed: |

|

|

|

|

|

|

|

Veterinarian:

Clinic Name:

Phone:Fax:

Date illness/injury first occurred: |

Did any other veterinarian treat your pet?: |

|

|

Yes

No

Send payment to:

Me

Veterinarian |

Is this a new condition?: |

Yes

No

3 |

Pet Owner Declaration

I confirm to the best of my knowledge the above statements are true in every respect. I understand that the fees listed may not be covered or may exceed my plan benefit. I understand that I am financially responsible to my veterinarian for the entire treatment. I understand that this claim cannot be adjusted without itemized receipts. I also understand that the deliberate misrepresentation of the animal's condition or the omission of any material facts may result in the denial of the claim and/or the cancellation of coverage. I authorize United States Fire Insurance Company and its business partners to review and obtain a copy of ALL RECORDS including the insurance claim records and medical records as to examination, history, diagnosis, treatment and prognosis with respect to any condition. I further authorize these entities to disclose identifying information about me and my pet, as well as information about my claim experience, to my veterinarian.

Signature of Pet Owner: |

Date: |

|

|

Please read IMPORTANT NOTICE document that follows for additional information.

4 |

3 Easy Ways to Submit a Claim Form- You must submit an itemized invoice with this claim form.

claims@aspcapetinsurance.com

scan and attach your receipts

Fax:

no cover sheet necessary

Mail:

ASPCA Pet Health Insurance

1208 Massillon Rd. Suite G 200

Akron, Ohio 44306

|

* Please choose only one method. Duplicate claim submissions may delay processing. |

U0314 - CS22 |

Page 1 of 2 |

HAVE A QUESTION?

Call us at

Claim Form - You must submit an itemized invoice with this claim form.

How do I use my plan?

1.Visit any licensed veterinarian in the U.S. or Canada, including specialists and emergency clinics.

2.Pay the veterinarian directly for services.

3.Submit a claim form with itemized invoice for reimbursement.

It's easy to submit a claim! Here's a handy checklist:

Fill out this form completely and sign it. You don't need your veterinarian's signature.

Fax, mail or email your form with invoice(s) within 270 days of treatment.

If you use email, just scan and attach the form and invoice(s).

Include a copy of your pet's medical records to help expedite processing.

Please use only one claim form per pet for each accident or illness.

List your account number on all documents you send to us.

Track your claims and sign up for direct deposit.

You can check the status of your claims easily online by signing into our free Member Center at my.aspcapetinsurance.com. In the Member Center, you can also sign up for direct deposit of claim payments. It'll save time and a trip to the bank! Just click on "My Payments."

You'll also be able to view your plan and update your payment method when it's convenient for you.

Share your pet's story!

We'd love to hear how ASPCA Pet Health Insurance helped you and your pet. Send your story and a photo of your furry friend to us at my.aspcapetinsurance.com.

NEED MORE CLAIM FORMS?

Download forms at:

my.aspcapetinsurance.com

Plans are underwritten by the United States Fire Insurance Company and administered by Fairmont Specialty Insurance

Agency (FSIA Insurance Agency in CA), members of the Crum & Forster Enterprise.

U0314 - CS22 |

Page 2 of 2 |

IMPORTANT NOTICE

NOTICE TO CLAIMANTS: Any person who, with the intent to defraud or knowingly facilitates a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement, or conceals information for the purpose of Misleading may be guilty of insurance fraud and subject to criminal and/or civil penalties.

NOTICE TO COLORADO CLAIMANTS: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policy holder or claimant for the purpose of defrauding or attempting to defraud the policy holder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies.

NOTICE TO CONNECTICUT APPLICANTS: Concealment, fraud. This entire policy shall be void if, whether before or after a loss, the insured has willfully concealed or misrepresented any material fact or circumstance concerning this insurance or the subject thereof, or the interest of the insured therein, or in case of any fraud or false swearing by the insured relating thereto.

NOTICE TO DISTRICT OF COLUMBIA CLAIMANTS: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false information material related to a claim was provided by the applicant.

NOTICE TO FLORIDA CLAIMANTS: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

NOTICE TO HAWAII CLAIMANTS: For your protection, Hawaii law requires you to be informed that presenting a fraudulent claim for payment of a loss or benefit is a crime punishable by fines or imprisonment, or both.

NOTICE TO ILLINOIS CLAIMANTS: A person who knowingly makes a false or fraudulent statement or presentation in or with reference to any application for life insurance, or for the purpose of obtaining any fee, commission, money, or benefit from or in any company transacting business under this article, commits a Class A misdemeanor.

NOTICE TO KANSAS CLAIMANTS: fraudulent insurance act means an act committed by any person who, knowingly and with intent to defraud, presents, causes to be presented or prepares with knowledge or belief that it will be presented to or by an insurer, purported insurer, broker or any agent thereof, any written statement as a part of, or in support of, an application for the issuance of, or the rating of an insurance policy for personal insurance or commercial insurance, or a claim for payment or other benefit pursuant to an insurance policy for commercial or personal insurance which such person knows to contain materially false information concerning any fact material thereto; or conceals, for the purpose of misleading, information concerning any fact material thereto.

NOTICE TO KENTUCKY APPLICANTS: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act which is a crime.

NOTICE TO LOUISIANA CLAIMANTS: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

NOTICE TO MAINE CLAIMANTS: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or denial of insurance benefits.

NOTICE TO MARYLAND APPLICANTS: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

IMPORTANT NOTICE

NOTICE TO NEW MEXICO CLAIMANTS: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to civil fines and criminal penalties.

NOTICE TO NEW JERSEY CLAIMANTS: Any person who includes any false or misleading information on an application for an insurance policy is subject to criminal and civil penalties.

NOTICE TO NEW YORK APPLICANTS: Any person who knowingly and with intent to defraud an insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime and shall be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

NOTICE TO OHIO CLAIMANTS: Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement is guilty of insurance fraud.

NOTICE TO OKLAHOMA CLAIMANTS: WARNING: Any person who knowingly, and with intent to injure, defraud or deceive any insurer makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

NOTICE TO PENNSYLVANIA CLAIMANTS: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

NOTICE TO TENNESSEE CLAIMANTS: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines or denial of insurance benefits.

NOTICE TO VIRGINIA CLAIMANTS: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or denial of insurance benefits.

NOTICE TO WASHINGTON CLAIMANTS: It is a crime to knowingly provide false, incomplete, or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines, and denial of insurance benefits.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Claim Form Requirement | A completed claim form is necessary for processing claims. Incomplete forms may result in delays. |

| Medical Records | Including your pet's medical records may help expedite the processing of your claim. |

| Submission Methods | Claims can be submitted via email, fax, or mail. Choose only one method to avoid duplicate submissions. |

| Processing Timeline | Claims must be submitted within 270 days of treatment to be eligible for reimbursement. |

| Pet Owner Declaration | The pet owner must confirm that all provided information is accurate and understands their financial responsibility. |

| Itemized Invoice Requirement | An itemized invoice is required with the claim form for reimbursement processing. |

| Account Number | It is important to list the account number on all documents submitted to ensure proper identification of the claim. |

| Governing Laws by State | Different states have specific laws regarding fraudulent claims. For example, Colorado emphasizes the criminality of providing misleading information. |

| Direct Deposit Option | Pet owners can sign up for direct deposit to receive claim payments, making the process more convenient. |

Guidelines on Utilizing Aspca Insurance

Filling out the ASPCA Insurance claim form is a straightforward process that ensures your pet’s medical expenses are reimbursed. By accurately completing the necessary information, you can facilitate a smoother review and approval of your claim. Here are the essential steps to fill out the form and submit it correctly.

- Begin with the General Information section. Enter your name, address, city, state, zip code, phone number, and email. If you have a new address, check the box indicating this.

- Provide your pet’s information, including the account number, name, breed, age, and gender.

- Move on to the Diagnosis/Symptom Information section. Describe the incident in the "Story of Occurrence/Diagnosis" area. Include dates, details, and symptoms leading up to the claim.

- Indicate whether this claim is related to an accident, illness, or wellness. Also, specify if it is an estimate for future treatment.

- Fill in the total amount claimed, as well as details about the veterinarian’s clinic, including name, phone number, and fax.

- Include the date when your pet’s illness or injury first occurred and mention if any other veterinarian treated your pet.

- Decide where to send the payment and indicate if this is a new condition.

- Lastly, complete the Pet Owner Declaration section by confirming the accuracy of your statements and signing with your name and the date.

After filling out the form, choose one submission method: email, fax, or mail. Be sure to include an itemized invoice along with any necessary medical records to streamline the claims process. This attention to detail will enhance the efficiency and effectiveness of your claim submission.

What You Should Know About This Form

What is the ASPCA Insurance form used for?

The ASPCA Insurance form is used to submit a claim for reimbursement of veterinary expenses related to your pet. This can include costs associated with accidents, illnesses, or wellness visits. It allows the insurance company to process your claim efficiently once you provide necessary information and documentation.

How do I properly fill out the ASPCA Insurance form?

To fill out the form correctly, provide complete information, including your name, contact details, and your pet's medical history. Be clear and detailed in the "Story of Occurrence/Diagnosis" section, describing the incident as well as signs and symptoms. Make sure to include your pet's medical records to expedite processing.

What documents should I include with my claim submission?

You must include an itemized invoice from your veterinarian along with your completed claim form. It is also beneficial to add your pet's medical records. This documentation helps speed up the review process and ensures your claim is processed without delays.

How can I submit my claim form?

You can submit your claim through three methods: email, fax, or mail. For email, send your scanned form and invoices to claims@aspcapetinsurance.com. If you choose fax, use the number 1-866-888-2495. Alternatively, you can mail the documents to ASPCA Pet Health Insurance at their Ohio address. Select one method only to avoid duplicate submissions that can slow processing.

How long do I have to submit a claim after my pet's treatment?

You have up to 270 days from the date of treatment to submit your claim. It is crucial to adhere to this timeline to ensure you receive reimbursement for your veterinary expenses.

What are the consequences of submitting false information?

Submitting false or misleading information on your claim can lead to severe consequences, including denial of your claim, cancellation of coverage, and legal penalties. It is essential to provide truthful details about your pet's condition and treatment to avoid any issues.

How can I track the status of my claims?

You can easily track your claims by signing into the Member Center at my.aspcapetinsurance.com. Here, you can check the status of your claims, manage your payment methods, and set up direct deposit for reimbursements, providing a convenient way to handle your pet insurance matters.

Common mistakes

When filling out the ASPCA Insurance form, many individuals accidentally make common mistakes that can hinder the swift processing of their claims. One prevalent issue is not providing complete information. Each section of the form must be filled out thoroughly. Incomplete forms often lead to delays. Make sure to enter every required piece of information, including your pet's medical records, to expedite the claims processing.

Another mistake stems from the failure to clarify the “Story of Occurrence/Diagnosis.” This section is crucial for giving context to your claim. A vague description, lacking specific details or dates, can result in unnecessary questions from the claims department. Clearly explaining what happened, along with relevant symptoms and treatment dates, will help in processing your claim more efficiently.

Many claimants also skip the important step of indicating whether the condition is new. Incorrectly marking “No” when it is a new condition can lead to claim denials. Instead, read the questions carefully and select the appropriate option based on your pet’s medical history.

Individuals often overlook the need to provide an itemized invoice with the claim form. This oversight can cause substantial delays since the claims team requires this documentation to verify expenses related to treatment. Remember to double-check that all necessary documents are attached before submission.

Some claimants fail to choose a single method of submission for the claim form. Whether you’re emailing, mailing, or faxing, be sure to select only one method. Submitting your claim multiple times can lead to confusion and processing delays.

Another frequent error is forgetting to include the account number on all submitted documents. Neglecting this detail makes it harder for the claims team to match your forms with your account. Always ensure that your account number is clearly written on every document you send.

Additionally, people sometimes forget to keep copies of the forms and invoices they submit. Having your own records can be invaluable if you need to follow up on your claim status. After you send your submission, retain copies of everything for future reference.

While filling out the form, don’t forget to sign and date it. Many individuals often overlook this step, which can lead to immediate rejections of their submissions. A signature validates your claim and acknowledges your understanding of the responsibilities outlined in the form.

Finally, rushing through the process can lead to mistakes. Taking the time to review the form after completion can help catch errors or omissions. Slower, careful filling out of the ASPCA Insurance form will lead to a smoother claim experience.

Documents used along the form

When navigating the process of submitting a claim to ASPCA Pet Health Insurance, there are a variety of other forms and documents that come into play. Understanding these documents can streamline your experience and help ensure that your claims are processed swiftly. Below is a list of common forms that you might encounter alongside the ASPCA Insurance form.

- Claim Submission Checklist: A helpful list that outlines all necessary items needed for a successful claim submission. It can guide you on what to include, such as receipts and medical records.

- Itemized Invoice: This document shows a detailed breakdown of the services provided by the veterinarian, including costs for each item. It's required to accompany the claim form for reimbursement.

- Veterinarian Referral Form: If your pet needs to see a specialist, this form provides necessary information about the referral, including details about the primary vet and the reason for the referral.

- Medical Records Release Form: This form allows you to authorize your veterinarian to release your pet’s medical records to the insurance company, aiding in the claim verification process.

- Pet Health History Form: Often completed by the veterinarian, this document summarizes your pet’s medical history, previous illnesses, and treatments, which is sometimes required for new claims.

- Continuing Treatment Form: If your pet is undergoing ongoing treatment, this form can detail the current treatment plan and expected future costs, assisting in claims related to long-term care.

- Accident/Illness Report: A detailed account of the incident or illness that led to the claim. This document may include symptoms, treatment provided, and a timeline to better clarify the circumstances.

- Claim Payment Authorization Form: This allows you to direct the insurance payment either to yourself or directly to your veterinarian, depending on your preference.

- Customer Service Feedback Form: After your claim process, completing this form can help improve the service and support provided by the insurance company.

- Important Notices Document: This outlines crucial information about your rights and responsibilities during the claims process, emphasizing the significance of accurate and complete information.

Being familiar with these forms and documents not only simplifies the claims process but can also enhance communication with your veterinarian and the insurance provider. Keeping everything organized helps ensure that your pet receives the care they need without unnecessary delays. If you have additional questions, don’t hesitate to reach out to customer support for guidance.

Similar forms

- Health Insurance Claim Form: Like the ASPCA Insurance form, a health insurance claim form requires detailed information about the patient's medical history, the diagnosis provided by healthcare professionals, and an itemized list of medical expenses. Both documents demand transparency and accuracy to avoid potential claims denial.

- Auto Insurance Claim Form: This form shares similarities with the ASPCA Insurance document in its requirement for detailed incident descriptions, witness information, and an assessment of the damages involved. Both forms seek to accumulate enough information to process claims efficiently, emphasizing the importance of accuracy in disclosures.

- Workers’ Compensation Claim Form: Workers' compensation forms and the ASPCA form both require claimants to provide information about the circumstances leading to the injury or incident. Each type of form aims to gather supporting documentation, such as medical records or incident reports, to validate the claim.

- Homeowner’s Insurance Claim Form: Much like the ASPCA document, a homeowner's insurance form requests detailed information about the loss or damage being claimed. Accuracy in representing the situation surrounding the claim is critical, as both types of claims rely heavily on the documentation provided to assess validity.

- Disability Insurance Claim Form: Similar to the ASPCA form, a disability insurance claim form asks for comprehensive medical documentation, diagnosis details, and personal information about the claimant. Both documents stress the importance of complete and truthful information to avoid delays or denials in processing the claims.

Dos and Don'ts

When filling out the ASPCA Insurance form for your pet, following some simple guidelines can help ensure that your claim is processed smoothly. Here are five things to keep in mind:

- Do fill out the form completely.

- Do include your pet's medical records to expedite processing.

- Do be honest when describing the incident and providing details.

- Don't forget to sign the form before submitting it.

- Don't submit multiple claims for the same incident using different forms.

By adhering to these dos and don’ts, you can help avoid delays and ensure a smoother claims process. Ensuring all information is accurate and complete is key to a positive experience with your pet’s insurance claim.

Misconceptions

Misconceptions about the ASPCA Insurance form can create confusion. Here are some common misunderstandings along with clarifications.

- It’s unnecessary to provide medical records. Many believe that medical records are optional. In fact, submitting them helps expedite the claims process significantly.

- Filling out the form partially is acceptable. Some people think it's okay to leave sections blank. However, incomplete forms will definitely delay processing.

- A veterinarian's signature is required. It’s a common belief that the veterinarian must sign the claim form. In reality, this is not needed—only the pet owner’s signature is required.

- There is a limit on how many claims can be submitted. Some may think they can only submit a claim once a year. Yet, you can file multiple claims as needed, as long as you adhere to the submission guidelines.

- All treatments are covered automatically. It's a misconception that all fees are covered by insurance. Pet owners should be aware that certain treatments may not be included in their plan benefits.

- Submitting the claim form by email is complicated. Many worry about electronic submissions. Actually, it’s a straightforward process—simply scan and attach the claim form with the invoices.

- If you submit a claim, you will always be reimbursed. Some individuals may think that all submitted claims guarantee reimbursement. It's important to remember that claims can be denied based on specific terms of the policy.

- The claims process is always slow. There's a belief that all claim processing takes forever. However, by including complete information and following guidelines, claims can be processed quite efficiently.

- Tracking claims is difficult. Some pet owners might assume that tracking their claims is a hassle. In fact, a member center is available online to easily check the status of submitted claims.

Addressing these misconceptions can help pet owners navigate their ASPCA Pet Health Insurance claims more effectively. Clear understanding paves the way for better care for our furry friends.

Key takeaways

Filling out and submitting the ASPCA Insurance claim form can be a straightforward process if you keep key points in mind. Here are essential takeaways to help you navigate this procedure effectively:

- Complete the Form: Ensure all sections of the claim form are filled out accurately to avoid delays.

- Include Medical Records: Attach your pet’s medical records to expedite the claims process.

- Accurate Story of Occurrence: Provide a detailed account of the incident, including dates and symptoms, to facilitate processing.

- Choose a Submission Method: You can submit the claim via email, fax, or mail. Select only one method to prevent duplicate submissions.

- Itemized Invoice Required: An itemized invoice from your veterinarian must accompany the claim form.

- Track Your Claim: Use the Member Center to check the status of your claims and consider signing up for direct deposit.

- One Claim Per Incident: Submit only one claim form per pet for each accident or illness.

- Keep Copies: Retain copies of all documents you send, including the claim form and invoice.

- Be Honest: Misrepresentation of facts can lead to denial of the claim or cancellation of coverage.

By following these key pointers, you can enhance your experience and ensure that your claim is processed smoothly. If you have any questions, do not hesitate to reach out for assistance.

Browse Other Templates

Nurse Skills Checklist Template - Documentation for adherence to nursing ethics and standards.

St 108 Form - Exemption #15 allows credit for sales taxes paid to out-of-state dealers if documented properly.

Charitable Registration Document,Nonprofit Registration Form,Illinois Charity Registration,Charitable Organization Registration,Charitable Trust Registration Statement,Solicitation for Charity Form,Fundraising Registration Statement,Illinois Charitab - Legal entity type and establishment details are also required.