Fill Out Your Assumed Name Certificate Form

The Assumed Name Certificate is a vital document for individuals or entities wishing to conduct business under a name different from their own legal name. This form is particularly significant for sole proprietorships and general partnerships, as it provides a way to establish legitimacy in the eyes of the public and the state. When filling out the form, applicants must provide specific information, including the intended business name, address, and the duration for which this name will be used (up to a maximum of ten years). There is a modest filing fee of $14, with an additional charge of 50 cents for each extra signature needed on the document. It’s also crucial to remember that if the business is structured as a limited partnership, limited liability company, or corporation, separate filings must occur with the Secretary of State. Furthermore, the Assumed Name Certificate must be filed in every county where the business operates, ensuring compliance with local regulations. Ultimately, this form serves both as a declaration of ownership and a safeguard for business entities, formalizing their intent to operate under a recognized name within their community, while also providing legal protection against potential disputes over that name.

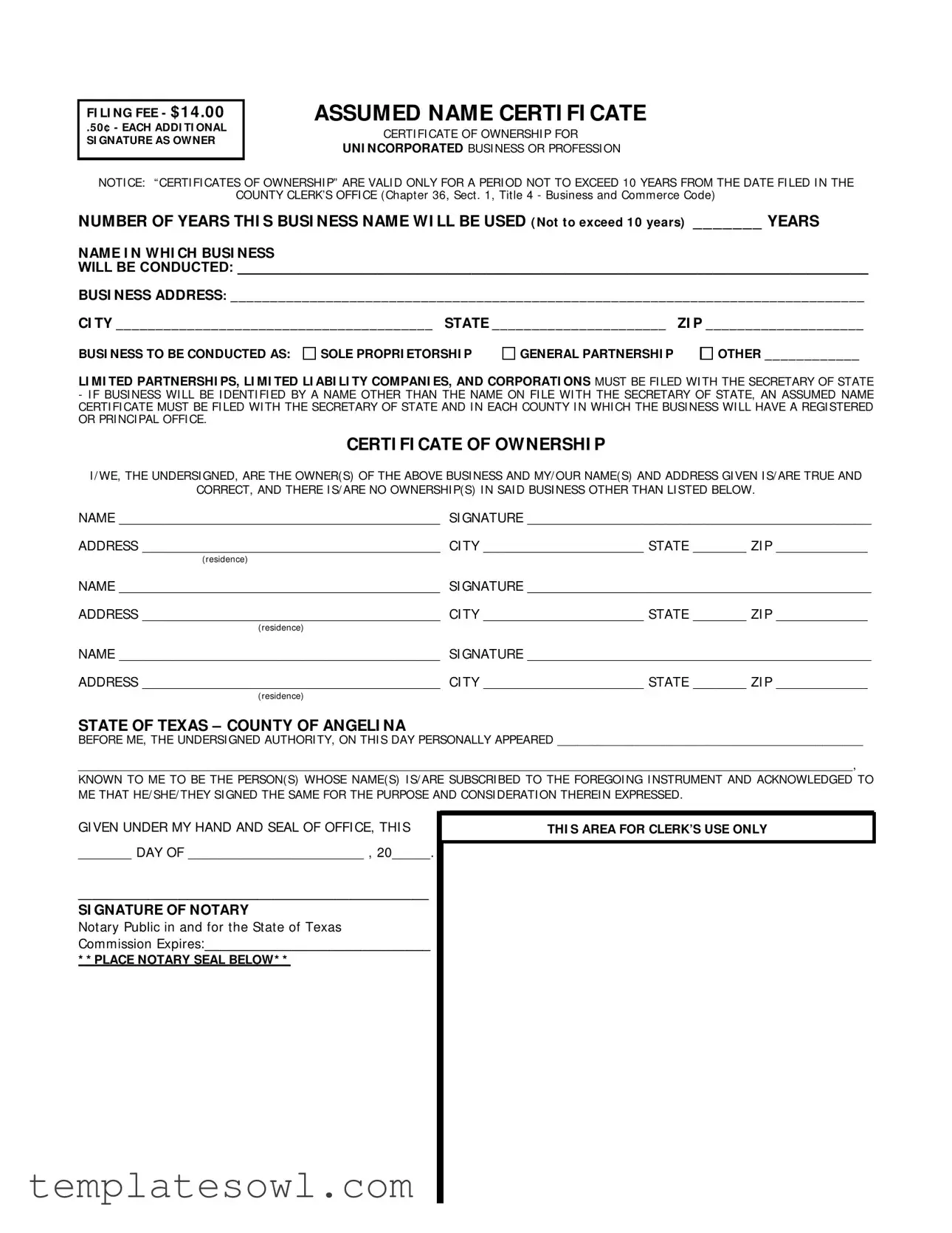

Assumed Name Certificate Example

FI LI NG FEE - $ 1 4 .0 0

.50 ¢ - EACH ADDI TI ONAL SI GNATURE AS OWNER

ASSUMED NAME CERTI FI CATE

CERTI FI CATE OF OWNERSHI P FOR

UNI NCORPORATED BUSI NESS OR PROFESSI ON

NOTI CE: “ CERTI FI CATES OF OWNERSHI P” ARE VALI D ONLY FOR A PERI OD NOT TO EXCEED 10 YEARS FROM THE DATE FI LED I N THE

COUNTY CLERK’S OFFI CE (Chapter 36, Sect . 1, Title 4 - Business and Commerce Code)

NUMBER OF YEARS THI S BUSI NESS NAME WI LL BE USED ( Not to exceed 10 years) _______ YEARS

NAME I N WHI CH BUSI NESS

WILL BE CONDUCTED: _________________________________________________________________________________

BUSI NESS ADDRESS: ________________________________________________________________________________

CI TY ________________________________________ STATE ______________________ ZI P ____________________

BUSI NESS TO BE CONDUCTED AS:

SOLE PROPRI ETORSHI P

GENERAL PARTNERSHI P

OTHER ____________

LI MI TED PARTNERSHI PS, LI MI TED LI ABI LI TY COMPANI ES, AND CORPORATI ONS MUST BE FI LED WI TH THE SECRETARY OF STATE

-I F BUSI NESS WI LL BE I DENTI FI ED BY A NAME OTHER THAN THE NAME ON FI LE WI TH THE SECRETARY OF STATE, AN ASSUMED NAME CERTI FI CATE MUST BE FI LED WI TH THE SECRETARY OF STATE AND I N EACH COUNTY I N WHI CH THE BUSI NESS WI LL HAVE A REGI STERED OR PRI NCI PAL OFFI CE.

CERTI FI CATE OF OWNERSHI P

I / WE, THE UNDERSI GNED, ARE THE OWNER(S) OF THE ABOVE BUSI NESS AND MY/ OUR NAME(S) AND ADDRESS GI VEN I S/ ARE TRUE AND

CORRECT, AND THERE I S/ ARE NO OWNERSHI P(S) I N SAI D BUSI NESS OTHER THAN LI STED BELOW.

NAME __________________________________________ SI GNATURE _____________________________________________

ADDRESS _______________________________________ CI TY _____________________ STATE _______ ZI P ____________

(residence)

NAME __________________________________________ SI GNATURE _____________________________________________

ADDRESS _______________________________________ CI TY _____________________ STATE _______ ZI P ____________

(residence)

NAME __________________________________________ SI GNATURE _____________________________________________

ADDRESS _______________________________________ CI TY _____________________ STATE _______ ZI P ____________

(residence)

STATE OF TEXAS – COUNTY OF ANGELI NA

BEFORE ME, THE UNDERSI GNED AUTHORI TY, ON THI S DAY PERSONALLY APPEARED _____________________________________________

__________________________________________________________________________________________________________________,

KNOWN TO ME TO BE THE PERSON(S) WHOSE NAME(S) I S/ ARE SUBSCRI BED TO THE FOREGOI NG I NSTRUMENT AND ACKNOWLEDGED TO ME THAT HE/ SHE/ THEY SI GNED THE SAME FOR THE PURPOSE AND CONSI DERATI ON THEREI N EXPRESSED.

GI VEN UNDER MY HAND AND SEAL OF OFFI CE, THI S

_______ DAY OF _______________________ , 20_____.

_____________________________________________

SI GNATURE OF NOTARY

Notary Public in and for the State of Texas

Commission Expires:_____________________________

* * PLACE NOTARY SEAL BELOW* *

THI S AREA FOR CLERK’S USE ONLY

Form Characteristics

| Fact Name | Description |

|---|---|

| Filing Fee | The fee for submitting an Assumed Name Certificate in Texas is $14.00, plus an additional $0.50 for each extra signature as owner. |

| Validity Period | The certificate is valid for a maximum of 10 years from the date it is filed with the county clerk’s office, as specified in Chapter 36, Section 1, Title 4 of the Business and Commerce Code. |

| Business Identification | If a business operates under a name different from the one registered with the Secretary of State, it must file an Assumed Name Certificate with both the Secretary of State and in each county where the business has a registered or principal office. |

| Ownership Verification | All owners of the business must sign the certificate, affirming that the information provided is true and that there are no other ownerships not listed within the document. |

Guidelines on Utilizing Assumed Name Certificate

Filling out the Assumed Name Certificate form is a straightforward process, but it requires careful attention to detail. Once you have completed the form, be prepared to file it with the county clerk and pay the required fee. Correctly completing the form ensures your chosen business name is registered and protects your rights to it.

- Gather necessary information: Before you start filling out the form, collect details about your business, such as the business name, address, and ownership.

- Determine the duration: Decide how many years you plan to use the business name (up to 10 years).

- Fill in the business name: Write the name under which you will conduct business in the designated space.

- Provide the business address: Enter the complete business address, including street, city, state, and zip code.

- Select the business structure: Indicate whether your business will be operated as a sole proprietorship, general partnership, or other type.

- List the owners: For each owner, fill out their name, signature, and residence address. Make sure to complete this for all owners.

- Prepare for notarization: Leave a space for a notary public to sign and date the form, acknowledging the signatures of the owners.

- Submit with payment: Take the completed form to the county clerk’s office along with the filing fee of $14.00 and any additional charges for extra signatures.

What You Should Know About This Form

What is an Assumed Name Certificate?

An Assumed Name Certificate is a document that allows a business to operate under a name that is different from its legal name. This is often necessary for sole proprietorships and partnerships that want to establish a brand identity without formally incorporating. It gives the public a way to identify the owners behind a business and offers transparency in business practices.

How long is the Assumed Name Certificate valid?

The Assumed Name Certificate is valid for a period not exceeding 10 years. After that time, business owners must file a new certificate to continue using the assumed name. This ensures that the public record remains current and reflects any changes in ownership or business operations.

What is the filing fee, and are there additional costs?

The filing fee for an Assumed Name Certificate is $14. Additionally, there is a charge of 50 cents for each extra signature if there are multiple owners listed on the certificate. Given this information, it’s important to consider these costs when preparing to file the certificate.

Where do I file the Assumed Name Certificate?

You must file the Assumed Name Certificate with the County Clerk’s Office in the county where your business operates. If your business intends to operate in multiple counties, you need to file in each of those counties as well. Proper filing in every relevant jurisdiction ensures compliance with local regulations.

Common mistakes

When filling out the Assumed Name Certificate form, many individuals inadvertently make mistakes that can lead to complications. One common error is failing to specify the duration for which the business name will be used. The form requires a number, not exceeding ten years. Leaving this blank or writing in an incorrect number can cause delays in processing the certificate.

Another frequent issue arises with the name in which the business will be conducted. Some people neglect to write the name clearly or use a name that does not match what they intend to use in practice. If the name does not accurately reflect the business's operations, it can lead to confusion or disputes.

Providing incomplete or incorrect address information is also a mistake that often occurs. Each component of the business address is crucial. Omitting details such as the city or ZIP code can delay communications and make it difficult for the clerk’s office to process the certificate promptly.

Choosing the wrong type of business entity is another mistake to watch out for. The form offers options like sole proprietorship or general partnership. Selecting the incorrect category can create legal safeguards that do not align with one's actual business structure, which might expose the owners to unnecessary liabilities.

Some applicants overlook the requirement for multiple signatures if there are multiple owners. The form specifies that each owner needs to sign and provide their respective details. Failing to include all necessary signatures can lead to the application being rejected.

For those who need notary services, forgetting to have their signatures notarized is a crucial error. The notary public verifies that the people signing the form are who they claim to be and that they are signing voluntarily. Without this step, the certificate may lack legal validity.

In addition, individuals sometimes assume that their certificate remains valid indefinitely. However, the Assumed Name Certificate is only valid for a maximum of ten years from the date it is filed. It’s important to monitor this time frame and renew the certificate as necessary to avoid potential legal issues.

Lastly, failing to understand the implications of filing in multiple counties can cause confusion. If the business operates in different locations, individuals must file the Assumed Name Certificate in each county where the business will have a registered or principal office. Neglecting to do so can result in issues with providing proof of the business's operating name in those areas.

Documents used along the form

When filing an Assumed Name Certificate form, several additional documents may be required or helpful in completing the process. Each of these documents plays a specific role in ensuring that the business name is registered correctly and that all legal obligations are met. Below is a list of documents commonly associated with filing an Assumed Name Certificate.

- Application for Business License: This document is required for obtaining a general business license, which allows your business to operate legally within your jurisdiction.

- Partnership Agreement: If the business is a partnership, this agreement outlines each partner’s responsibilities, ownership percentages, and profit-sharing arrangements.

- Certificate of Formation: Necessary for businesses set up as corporations or limited liability companies (LLCs), this document is filed with the Secretary of State and establishes the existence of the business entity.

- Tax Identification Number (TIN): Also known as an Employer Identification Number (EIN), this number is required for tax purposes and is typically needed when opening a business bank account.

- Declaration of Intent to Operate Under Assumed Name: This form, if applicable, can sometimes be required to indicate the business’s intent to operate under a fictitious name.

- Proof of Publication: Some jurisdictions require proof that the business name was published in a local newspaper, which serves as a public notice to inform the community.

These documents, when prepared and submitted correctly, can smooth the process of registering your business. They help establish your legal standing and provide clarity about your business structure. It is essential to ensure all necessary paperwork is completed accurately to avoid complications in the future.

Similar forms

The Assumed Name Certificate serves as an important legal document for business owners. Several other documents share similar functions or purposes. Here are ten such documents:

- Business License: This document authorizes individuals or companies to conduct business in a specific jurisdiction. Like the Assumed Name Certificate, it identifies the business and ensures compliance with local regulations.

- Partnership Agreement: When two or more individuals run a business together, they often create this document. It outlines each partner's role and responsibilities, similar to how an Assumed Name Certificate identifies owners of a business.

- Operating Agreement: For Limited Liability Companies (LLCs), this document sets forth the management structure and operational procedures. It serves a similar purpose of formalizing ownership and governance.

- Certificate of Incorporation: This document is necessary for forming a corporation. It legally establishes the company and identifies its structure, much like how the Assumed Name Certificate identifies a business operating under a different name.

- DBA Registration (Doing Business As): Often required for businesses operating under a name different from their legal name, the DBA registration is similar to the Assumed Name Certificate in providing a public declaration of the business name.

- Sell Agreement: When a business is sold, this document outlines the terms of transfer. It serves to document ownership changes, akin to the Assumed Name Certificate that identifies current business owners.

- Trade Name Registration: This document protects a specific business name within a particular industry. It functions in a related manner to the Assumed Name Certificate by ensuring the name's legitimacy.

- Tax Registration Form: Businesses must often register for tax purposes, and this form identifies the business entity for the IRS. Similar to the Assumed Name Certificate, it provides essential information about the business.

- Business Management Plan: This is a blueprint for managing a business effectively. It shares commonalities with the Assumed Name Certificate in that both documents provide clarity on the business's operational aspects.

- Federal Employer Identification Number (EIN): Businesses apply for an EIN to operate legally and for tax purposes. This number identifies the entity in a similar manner as the Assumed Name Certificate identifies a business's operating name.

Dos and Don'ts

When filling out the Assumed Name Certificate form, attention to detail is crucial. Here are some important dos and don’ts to keep in mind:

- Do ensure you fill out the form completely, providing all the required information.

- Do double-check that the business name is spelled correctly and matches what you intend to use.

- Do include the correct number of years you plan to use the assumed name, keeping it within the maximum of 10 years.

- Do sign the certificate in the designated areas. Each owner must provide their signature.

- Don’t leave any sections blank; missing information can delay the processing of your certificate.

- Don’t forget to include the filing fee of $14.00, plus any additional fees for extra signatures.

Following these guidelines will help streamline the filing process and ensure your business operates smoothly under the assumed name. Careful preparation can prevent unnecessary complications down the line.

Misconceptions

- Assumed Name Certificates are only for sole proprietorships. This misconception overlooks that any unincorporated business, including general partnerships, must file an assumed name certificate if they operate under a name different from the owners' legal names.

- Once filed, the certificate lasts indefinitely. In fact, the certificate is valid for up to 10 years. Business owners must refile before the expiration to continue using the assumed name.

- Only one owner can sign the certificate. If a business has multiple owners, each must sign the certificate. Each signature incurs an additional fee as noted in the filing guidelines.

- Filing with the Secretary of State and the county clerk is optional. Businesses must file with both offices if they intend to use an assumed name. Not doing so could lead to penalties.

- The assumed name must be completely unique. While it's important to choose a distinguishable name, the law allows some similarities as long as it does not cause confusion in the marketplace.

- Filing an assumed name certificate guarantees trademark protection. Filing a certificate does not provide trademark rights. To secure a trademark, separate steps must be taken with the U.S. Patent and Trademark Office.

- There are no consequences for not filing. Failing to file can result in legal issues. If someone else uses the same name, it can lead to disputes and complications in asserting rights over that name.

- Anyone can notarize the certificate. The notarization must be performed by a licensed notary public in the state where the business operates. This is a requirement for the certificate to be valid.

- All types of business must file the same version of the certificate. Different entity types may have specific forms or additional requirements. It is important to follow the guidelines appropriate for the business structure.

Key takeaways

When filling out and using the Assumed Name Certificate form, there are several important points to consider:

- Filing Fee: A fee of $14.00 is required for the initial filing. Additionally, there is a charge of $0.50 for each extra signature as an owner.

- Validity Period: The certificate will remain valid for a maximum of 10 years from the filing date in the county clerk’s office.

- Business Name Duration: Indicate how many years the assumed business name will be used, ensuring it does not exceed 10 years.

- Owner Information: Complete the owner(s) section accurately, providing names, signatures, and addresses for all owners involved.

- Business Structure: Specify the type of business structure, such as sole proprietorship or general partnership. Other structures may have additional filing requirements with the Secretary of State.

- Additional Filing Requirements: If the business name differs from the name on file with the Secretary of State, an Assumed Name Certificate needs to be filed both with the Secretary of State and in each county where the business operates.

- Notarization: The form must be notarized, confirming that the signers are the owners of the business and that the information provided is accurate.

Browse Other Templates

Authentication Form Global Affairs Canada - Ensure clarity in name spelling to prevent discrepancies during travel.

How Much Back Child Support Is a Felony in Maryland - The original protective order details must be referenced in the petition.