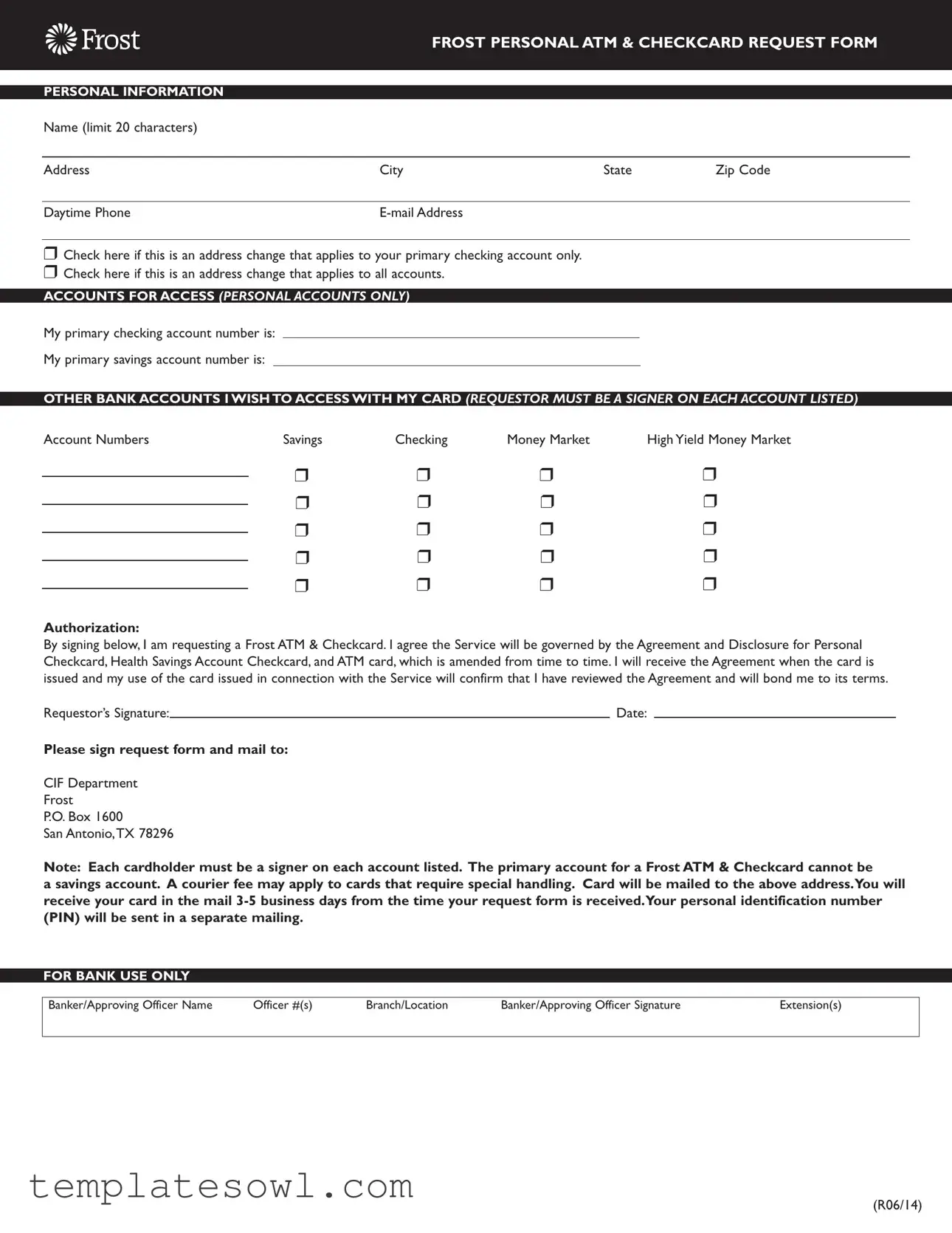

Fill Out Your Atm Request Form

The ATM Request Form serves as a crucial document for individuals seeking to obtain a Frost ATM and Checkcard. This form collects personal details, such as the applicant's name, address, contact number, and email address, ensuring accurate identification and communication. Applicants are required to indicate if they are changing their address, specifying whether the change pertains solely to the primary checking account or all accounts associated with them. Additionally, the form requires applicants to specify their primary checking and savings account numbers, facilitating access to those accounts. Further access to other bank accounts can also be requested, provided that the applicant is a signer on the accounts listed. This includes options for savings, checking, money market, and high-yield money market accounts. By signing the form, applicants formally request the card and acknowledge their agreement to the terms outlined in the governing documents, which will be provided upon issuance. The completed form must then be submitted by mail to the designated department, and applicants can expect their card to arrive within three to five business days. A separate mailing will also deliver the personal identification number (PIN) associated with the card. It is essential to note that the primary account for receiving a Frost ATM & Checkcard cannot be a savings account, and a courier fee may be applicable for cases requiring special handling.

Atm Request Example

FROST PERSONAL ATM & CHECKCARD REQUEST FORM

PERSONAL INFORMATION

Name (limit 20 characters)

Address |

City |

State |

Zip Code |

|

|

|

|

Daytime Phone |

|

|

❒Check here if this is an address change that applies to your primary checking account only.

❒Check here if this is an address change that applies to all accounts.

ACCOUNTS FOR ACCESS (PERSONAL ACCOUNTS ONLY)

My primary checking account number is:

My primary savings account number is:

OTHER BANK ACCOUNTS I WISH TO ACCESS WITH MY CARD (REQUESTOR MUST BE A SIGNER ON EACH ACCOUNT LISTED)

Account Numbers |

Savings |

Checking |

Money Market |

High Yield Money Market |

|

❒ |

❒ |

❒ |

❒ |

|

||||

|

❒ |

❒ |

❒ |

❒ |

|

||||

|

❒ |

❒ |

❒ |

❒ |

|

||||

|

❒ |

❒ |

❒ |

❒ |

|

||||

|

❒ |

❒ |

❒ |

❒ |

|

Authorization:

By signing below, I am requesting a Frost ATM & Checkcard. I agree the Service will be governed by the Agreement and Disclosure for Personal Checkcard, Health Savings Account Checkcard, and ATM card, which is amended from time to time. I will receive the Agreement when the card is issued and my use of the card issued in connection with the Service will confirm that I have reviewed the Agreement and will bond me to its terms.

Requestor’s Signature: |

|

Date: |

Please sign request form and mail to:

CIF Department

Frost

P.O. Box 1600

San Antonio, TX 78296

Note: Each cardholder must be a signer on each account listed. The primary account for a Frost ATM & Checkcard cannot be

a savings account. A courier fee may apply to cards that require special handling. Card will be mailed to the above address.You will receive your card in the mail

FOR BANK USE ONLY

Banker/Approving Officer Name |

Officer #(s) |

Branch/Location |

Banker/Approving Officer Signature |

Extension(s) |

|

|

|

|

|

(R06/14)

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | This form enables customers to request a Frost ATM & Checkcard for access to their personal accounts. |

| Personal Information Required | Applicants must provide their name, address, city, state, zip code, daytime phone number, and email address. |

| Address Change Options | Checkboxes are available to indicate if the address change applies only to the primary checking account or to all accounts. |

| Account Types | Applicants must provide details for their primary checking and savings accounts, as well as any other accounts they wish to access. |

| Signature Requirement | The form must be signed by the requestor to authorize the issuance of the ATM & Checkcard. |

| Delivery Timeline | The card is mailed to the provided address within 3-5 business days after the request form is received. |

| PIN Mailing | The personal identification number (PIN) will be sent separately for security reasons. |

| Primary Account Limitations | Only checking accounts can be designated as the primary account for the Frost ATM & Checkcard. |

Guidelines on Utilizing Atm Request

After completing the ATM Request form, the next steps involve submitting the form to the specified address for processing. The card will be mailed to the provided address within 3 to 5 business days after the request has been received. A personal identification number will be sent separately for security purposes.

- Begin by filling in your personal information. This includes your name, address, city, state, zip code, daytime phone number, and email address.

- If applicable, indicate if this is an address change for your primary checking account only or for all accounts by checking the appropriate box.

- Next, provide information about your accounts for access. Enter your primary checking account number followed by your primary savings account number.

- If you wish to access other bank accounts, fill in the account numbers for each type of account you want to include, ensuring you are a signer on all accounts listed.

- Read the authorization statement carefully. By signing below, you are requesting the Frost ATM & Checkcard and agreeing to the terms set forth in the accompanying agreement.

- Sign the request form where indicated and date it.

- Finally, mail the completed form to the address provided at the bottom of the form: CIF Department, Frost, P.O. Box 1600, San Antonio, TX 78296.

What You Should Know About This Form

What is the Frost Personal ATM & Checkcard Request Form?

The Frost Personal ATM & Checkcard Request Form is a document that customers use to request an ATM and Checkcard. This card provides access to banking services, enabling users to manage their personal accounts conveniently.

Who can complete the request form?

Any customer with a primary checking account at Frost can complete this request form. Additionally, individuals who are signers on other accounts they wish to access through the card may also list these accounts on the form.

What personal information is required on the form?

The form requires several pieces of information, including the applicant's name, address, city, state, zip code, daytime phone number, and email address. There are also options to indicate whether the request is for an address change applicable to the primary checking account or all accounts.

Can I access accounts other than my primary checking account?

Yes, you can request access to other personal accounts, including savings, money market, and high-yield money market accounts. However, the requestor must be a signer on each of the accounts listed.

What are the limitations regarding the primary account?

The primary account for obtaining a Frost ATM & Checkcard must be a checking account. Savings accounts are not eligible as primary accounts for this card request.

How long will it take to receive my card?

Once your request form is received and processed, you can expect to receive your card in the mail within 3 to 5 business days. It is important to ensure that the mailing address provided is accurate to avoid delays.

Will I receive my PIN with the card?

No, the personal identification number (PIN) will be sent in a separate mailing. This is a security measure to ensure that your PIN remains confidential until you are ready to use it.

Is there a courier fee for special handling of the request?

Yes, a courier fee may apply if your card requires special handling. This fee will be communicated as part of the processing of your request.

Where do I send the completed request form?

Once filled out, the request form should be signed and mailed to the following address: CIF Department, Frost, P.O. Box 1600, San Antonio, TX 78296. Ensure that all sections are complete to avoid processing delays.

Common mistakes

Filling out the Frost Personal ATM & Checkcard Request Form can be straightforward, but many people make common mistakes that can delay their application or lead to issues down the road. Here are eight mistakes to watch out for when completing the form.

One common mistake is not providing the correct name.

The form limits names to 20 characters. It’s essential to ensure that the name you provide matches the one on your banking documents. An error could lead to confusion and delay in issuing your card.

Another frequent issue is failing to accurately fill in contact information.

Make sure your address, phone number, and email address are correct. An incorrect email could prevent you from receiving important updates regarding your card. Also, add a check mark if you are changing your address, but only for your primary checking account or all accounts as appropriate.

Many applicants skip the account numbers section or make mistakes there. Ensure that the account numbers you provide for your primary checking and savings accounts are accurate. You must also be a signer on any other bank accounts you wish to access with your card. Leaving these blank can result in a rejection of your request.

People often sign the request form without noting the date. This seems minor, but the absence of a date can slow down processing. Be sure to sign and date the form to confirm your request.

Another oversight involves reading the terms and conditions. Some applicants do not take the time to understand the agreement related to the card. By signing the form, you confirm that you’ve reviewed the terms. Not doing so can create unwanted surprises down the line.

In addition, applicants sometimes assume that the primary account for an ATM & Checkcard can be a savings account. This is incorrect. The primary account must be a checking account. An incorrect selection here can lead to immediate rejection of your application.

Many people fail to consider that a courier fee might apply for special handling of cards. Being upfront about this can save you trouble later if you need expedited service. Always check the conditions regarding fees.

Finally, remember that each cardholder needs to be a signer on each account listed.

Don’t forget to double-check that everyone you intend for the card to be issued to has proper signing authority on each account. This is a critical part of ensuring you don’t run into issues once your card is issued.

By avoiding these common mistakes, you can help ensure a smoother process for receiving your Frost ATM & Checkcard.

Documents used along the form

When completing the ATM Request form, several additional forms and documents might be necessary to ensure a smooth application process. Here’s a list of common documents that may accompany your request.

- Identity Verification Form: This document confirms your identity and may require you to submit a copy of your government-issued ID.

- Account Ownership Statement: A declaration that verifies your ownership of the listed accounts. This may help establish your right to access funds from various accounts.

- Change of Address Form: If updating your address, this form ensures all relevant accounts reflect your new information.

- ATM Agreement and Disclosure: You will receive this document when your card is issued. It outlines the terms and conditions associated with using the ATM and Checkcard.

- Authorization for Direct Deposit: If you wish to set up direct deposits to your account, this form is needed to provide details to your employer or depositing agency.

- Credit Application: If you plan on applying for additional banking services, completing this application may be required to assess your creditworthiness.

- Debit Card Terms and Conditions: This document specifies the policies governing the use of your debit card, including fees and limits.

- Bank Account Agreement: This document outlines the rights and responsibilities associated with your bank accounts, ensuring that account holders understand their obligations.

- Privacy Policy Statement: It details how your personal information will be handled by the bank and your rights regarding your data.

Gathering the necessary documents alongside the ATM Request form will help streamline the process, ensuring that there are no delays in receiving your card and accessing your funds. Always check with your bank for specific requirements as they may vary.

Similar forms

Account Opening Form: Similar to the ATM Request form, this document collects personal and account information. It establishes a primary relationship with the bank and often includes consent for account-related services.

Change of Address Form: This form allows customers to update their contact details. Like the ATM Request form, it requires specific information to ensure that the changes apply correctly to the accounts.

Debit Card Application: This document requests a debit card linked to a bank account. It includes similar personal information and account access sections, as well as an authorization clause.

Online Banking Enrollment Form: This form is designed to set up online banking services. It asks for personal information and account details, ensuring secure access to account management.

Account Signer Authorization Form: This document is used to add or remove signers on an account. It requires signatures and account information, paralleling the authorization component found in the ATM Request form.

ATM User Agreement: This agreement outlines the terms for using an ATM card. It serves a similar purpose as the authorization in the ATM Request form, confirming understanding and acceptance of usage terms.

Health Savings Account Application: This application collects information specific to health savings accounts. Like the ATM Request form, it requires personal information and account details, ensuring proper processing.

Dos and Don'ts

The following guidelines can help ensure a smooth experience when filling out the ATM Request form:

- Do provide complete and accurate personal information. This includes your full name, address, and contact details. Double-check for correct spelling and numbers.

- Do specify your primary checking account number. Ensure this field is filled out correctly, as it is crucial for processing your request.

- Do indicate any address changes. If applicable, clearly check the appropriate boxes regarding address changes for your accounts.

- Do sign and date the form. Without a signature and date, your request may not be processed.

- Don’t list accounts you are not a signer on. Only include those accounts where you have signing authority.

- Don’t forget to send the form to the correct address. Ensure you mail it to the CIF Department at Frost, as listed.

- Don’t use a savings account as your primary account. This request form requires a primary checking account.

- Don’t expect immediate processing. Be aware that it takes 3-5 business days to receive your card after your request is submitted.

Misconceptions

Misconceptions can often lead to confusion, especially when it comes to important documents like the ATM Request form. Here are seven common misconceptions you might encounter:

- All ATM cards can be linked to any type of account. Many believe they can attach their ATM card to any account type. However, the primary account for a Frost ATM & Checkcard cannot be a savings account; it must be a checking account.

- Address changes affect all accounts automatically. A common misunderstanding is that changing the address on the ATM Request form will update every account. In reality, you must specifically indicate whether the address change applies only to your primary checking account or all accounts.

- You can request access for any bank accounts. Some people think they can simply list any bank account on the form. In fact, the requestor must be a signer on each account listed for access to be permitted.

- Your card will arrive immediately after submitting the form. Many individuals expect instant access to their ATM card. In truth, the card will be mailed within 3-5 business days after the request form is received.

- All cards shipped are handled without extra fees. Some may assume that all ATM cards are processed without charge. However, a courier fee may apply if the card requires special handling.

- The personal identification number (PIN) arrives with the card. Many think they will receive their PIN together with their ATM card. This is not the case; the PIN is sent separately in its own mailing.

- Signing the form means you agree to everything without review. Individuals often believe signing means automatic agreement. However, you'll receive an Agreement and Disclosure when the card is issued, and using the card confirms your acceptance of its terms.

Understanding these misconceptions can help ensure a smoother process when completing your ATM Request form. Always take the time to review the requirements and guidelines carefully.

Key takeaways

When filling out the Frost Personal ATM & Checkcard Request Form, it is essential to keep the following key takeaways in mind:

- Provide Accurate Information: Ensure that all personal information, including name, address, and phone number, is entered correctly. Mistakes can delay your card issuance.

- Account Requirements: Your primary checking account must be a checking account, not a savings account. Double-check that your primary account details are accurate.

- List of Accounts: If you wish to access other bank accounts, remember that you must be a signer on all the accounts you list. Specify the account numbers clearly.

- Authorization is Crucial: By signing the form, you acknowledge your agreement with the associated terms and conditions. Review the Agreement and Disclosure upon receiving your card.

- Mailing Instructions: After completing the form, mail it to the specified address. Anticipate receiving your card within 3-5 business days. The PIN will arrive separately.

Browse Other Templates

Jiffy Lube Hiring Near Me - Please provide your driver's license information if it is relevant to the position you seek.

Borrower Authorization - The property address must be clearly mentioned for accurate record-keeping and processing.