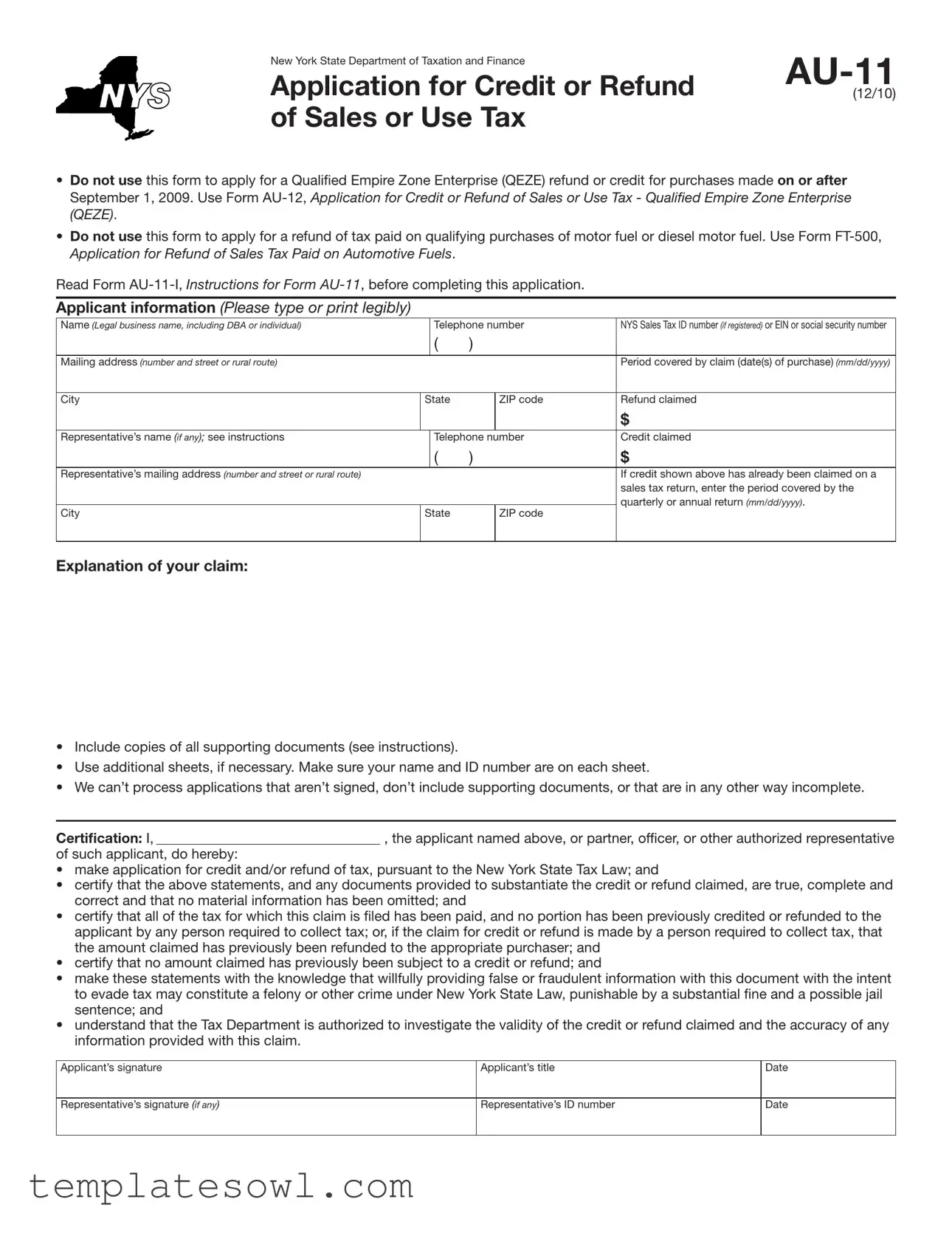

Fill Out Your Au 11 Tax Form

The AU-11 Tax form is an essential document issued by the New York State Department of Taxation and Finance, specifically designed for those seeking a credit or refund of sales or use tax. It serves a crucial purpose, allowing businesses and individuals to recoup overpaid taxes, provided they meet certain criteria. It is important to note that this form is not valid for requests related to Qualified Empire Zone Enterprise (QEZE) refunds, which requires the use of Form AU-12. Additionally, refund claims for tax paid on qualifying purchases of motor fuel or diesel must be filed using Form FT-500. The instructions for completing the AU-11 form are detailed and require thorough preparation. Applicants must include their legal business name or personal information, a valid New York State Sales Tax ID or Social Security number, and the period of the claim, ensuring the request is precisely documented. To process refunds efficiently, it is critical to include all supporting documentation and sign the application to avoid delays. As tax matters can be complex, the form emphasizes the importance of accuracy and honesty, warning applicants of potential legal repercussions for providing false information. Completing the AU-11 correctly can lead to significant financial relief, making it a vital resource for eligible parties.

Au 11 Tax Example

New York State Department of Taxation and Finance |

|

|

|

Application for Credit or Refund |

(12/10) |

of Sales or Use Tax |

|

•Do not use this form to apply for a Qualiied Empire Zone Enterprise (QEZE) refund or credit for purchases made on or after September 1, 2009. Use Form

•Do not use this form to apply for a refund of tax paid on qualifying purchases of motor fuel or diesel motor fuel. Use Form

Read Form

Applicant information (Please type or print legibly)

Name (Legal business name, including DBA or individual) |

|

Telephone number |

NYS Sales Tax ID number (if registered) or EIN or social security number |

||

|

|

( |

) |

|

|

|

|

|

|

|

|

Mailing address (number and street or rural route) |

|

|

|

|

Period covered by claim (date(s) of purchase) (mm/dd/yyyy) |

|

|

|

|

|

|

City |

State |

|

ZIP code |

Refund claimed |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Representative’s name (if any); see instructions |

|

Telephone number |

Credit claimed |

||

|

|

( |

) |

|

$ |

Representative’s mailing address (number and street or rural route) |

|

|

|

|

If credit shown above has already been claimed on a |

|

|

|

|

|

sales tax return, enter the period covered by the |

|

|

|

|

|

quarterly or annual return (mm/dd/yyyy). |

City |

State |

|

ZIP code |

|

|

|

|

|

|

|

|

Explanation of your claim:

•Include copies of all supporting documents (see instructions).

•Use additional sheets, if necessary. Make sure your name and ID number are on each sheet.

•We can’t process applications that aren’t signed, don’t include supporting documents, or that are in any other way incomplete.

Certification: I, |

|

, the applicant named above, or partner, oficer, or other authorized representative |

of such applicant, do hereby:

•make application for credit and/or refund of tax, pursuant to the New York State Tax Law; and

•certify that the above statements, and any documents provided to substantiate the credit or refund claimed, are true, complete and correct and that no material information has been omitted; and

•certify that all of the tax for which this claim is iled has been paid, and no portion has been previously credited or refunded to the applicant by any person required to collect tax; or, if the claim for credit or refund is made by a person required to collect tax, that the amount claimed has previously been refunded to the appropriate purchaser; and

•certify that no amount claimed has previously been subject to a credit or refund; and

•make these statements with the knowledge that willfully providing false or fraudulent information with this document with the intent to evade tax may constitute a felony or other crime under New York State Law, punishable by a substantial ine and a possible jail sentence; and

•understand that the Tax Department is authorized to investigate the validity of the credit or refund claimed and the accuracy of any information provided with this claim.

Applicant’s signature |

Applicant’s title |

Date |

|

|

|

Representative’s signature (if any) |

Representative’s ID number |

Date |

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The AU-11 form is used to apply for a credit or refund of sales and use tax in New York State. |

| Restrictions | This form cannot be used for a Qualified Empire Zone Enterprise (QEZE) refund, which requires the use of Form AU-12. |

| Motor Fuel Exemption | Tax refunds for motor fuel or diesel motor fuel cannot be requested using this form. Instead, Form FT-500 should be used. |

| Supporting Documents | Applicants must include copies of all supporting documents. Incomplete applications cannot be processed. |

| Signature Requirement | The application must be signed by the applicant or an authorized representative; otherwise, it is deemed incomplete. |

| Certification of Truthfulness | Applicants certify that all provided information is true and complete, acknowledging the consequences of providing false information. |

| Governing Law | The application is governed by New York State Tax Law, which outlines the criteria for claims and the authority to investigate them. |

Guidelines on Utilizing Au 11 Tax

Filling out the AU-11 Tax form requires careful attention to detail and the inclusion of accurate information. This process involves gathering necessary documentation and ensuring that all sections of the form are properly completed. Incomplete submissions may result in delays or denial of the application.

- Obtain the AU-11 Tax form from the New York State Department of Taxation and Finance website or through other official channels.

- Type or print your legal business name, including any DBA (doing business as) names, in the designated section.

- Provide your telephone number for direct contact regarding your application.

- Enter your NYS Sales Tax ID number, EIN, or social security number as appropriate.

- Fill in your mailing address, including street address, city, state, and ZIP code.

- Indicate the period covered by the claim by providing the appropriate date(s) in mm/dd/yyyy format.

- State the refund amount claimed in the designated box.

- If applicable, provide the name of any representative and their contact number.

- Enter the credit amount claimed if different from the refund amount.

- If you have already claimed the credit, include the period covered by your sales tax return.

- Write an explanation of your claim, detailing the reason for your request. Attach supporting documents, and ensure your name and ID number are on each page.

- Provide your signature, your title, and the date of completion.

- If applicable, ensure that any representative signs and enters their ID number and date.

Once the form is completed, review it for accuracy and completeness before submission. Make sure to include all required supporting documents, as incomplete applications will not be processed. After submission, keep a copy for your records and monitor for any follow-up communications from the Tax Department.

What You Should Know About This Form

What is the AU-11 Tax form used for?

The AU-11 Tax form is an application used to request a credit or refund of sales or use tax in New York State. However, it's important to note that this form cannot be used for specific situations, such as applying for a refund related to the Qualified Empire Zone Enterprise (QEZE) purchases made after September 1, 2009. In such cases, Form AU-12 should be used instead. Additionally, the AU-11 form is not applicable for refunds on motor fuel or diesel motor fuel tax payments; that requires Form FT-500.

Who is eligible to file the AU-11 form?

Any individual or business that has paid sales or use tax in New York State can file the AU-11 form if they believe they are entitled to a credit or refund. However, the application must be completed correctly. This includes providing proof of purchase and ensuring the claim meets the required criteria. It’s also critical that the tax for which a refund is being claimed has been fully paid, and that it hasn't been previously credited or refunded.

What information do I need to provide with the AU-11 form?

When filling out the AU-11 form, you must provide several key pieces of information. This includes your legal business name or individual name, telephone number, and the Utah Sales Tax ID number, or your Employer Identification Number (EIN) or Social Security number. You will also need to specify the period covered by your claim and the amount of refund or credit you are seeking. Importantly, any claim must be supported by documentation proving the legitimacy of your request, and all pages should include your identifier.

What happens if I submit an incomplete AU-11 form?

Submitting an incomplete AU-11 form can result in delays or even denial of your application. The New York State Department of Taxation and Finance requires that all applications be signed and include relevant supporting documents. If any necessary information is missing, the department may not process your application until you provide the completed documentation. Therefore, double-checking your form and ensuring everything is included before submission is crucial.

What are the consequences of providing false information on the AU-11 form?

Providing false or misleading information on the AU-11 form is a serious matter. Under New York State law, willfully giving false information to evade tax can lead to severe penalties, including substantial fines and potential jail time. It is very important to ensure that all statements made while completing the form are accurate and that no material information is omitted. The Tax Department reserves the right to investigate claims for validity, so honesty is paramount throughout the process.

Common mistakes

Filing the AU-11 Tax form can be a straightforward process, but several common mistakes can lead to delays or rejections. One of the primary errors occurs when individuals use the wrong form altogether. The AU-11 is specifically not meant for applying for a Qualified Empire Zone Enterprise (QEZE) refund. If purchases were made on or after September 1, 2009, then it’s crucial to use Form AU-12 instead. This simple mistake can cause unnecessary back-and-forth communication with the tax office.

Another frequent oversight is failing to provide required supporting documents. Each application must include relevant documentation to back up the claim. Without these documents, the application may be deemed incomplete. It’s highly advisable to carefully review the instructions and ensure that all necessary documents are included before submission.

Legibility is more important than many realize. When filling out the form, ensure that you type or print all information clearly. Illegible handwriting or unclear entries can lead to misunderstandings and mistakes in processing your request. Take the time to double-check this aspect to avoid potential issues.

The omission of critical information is also a common pitfall. When filling out the applicant information section, all details, such as the legal business name, NYS Sales Tax ID number, and mailing address, must be complete and accurate. Missing even one piece of information can halt the progress of your claim.

Attention to the period covered by the claim is vital. Applicants should specify the correct dates in the designated area. Mistakes in this section can result in miscalculations of the refund amount and could even jeopardize the entire application.

Signature errors represent another common mishap. It is crucial that the application is signed by an authorized person. Applications that lack a signature or are improperly signed cannot be processed. Ensure that all signatures are legible and in the appropriate places.

Many applicants tend to overlook the certification statements, which is a vital part of the form. It's important to understand that these statements confirm the legitimacy of the claim. Inaccurate statements can lead to serious consequences, including potential penalties for providing false information.

Finally, a lack of follow-up after submitting the application can lead to unresolved issues. After sending the AU-11 form, it's advisable to follow up with the tax department to confirm receipt and check on the application’s status. This proactive approach can help catch any problems early.

Documents used along the form

The AU-11 Tax form is a vital document for claiming a refund or credit for sales or use tax in New York. When submitting this form, you may also need to provide additional documents to support your claim. Below is a list of commonly used forms and documents that can accompany the AU-11 form.

- Form AU-12: This form is used specifically for applying for a refund or credit as a Qualified Empire Zone Enterprise (QEZE). It is essential for businesses that qualify under this program.

- Form FT-500: This document is tailored for individuals or businesses seeking a refund of sales tax paid on motor fuel or diesel motor fuel purchases.

- Form AU-11-I: The instructions for completing the AU-11 form provide detailed guidance. It outlines the necessary steps to ensure your application is complete and accurate.

- Purchase Receipts: To support your claim, include photocopies of all relevant purchase receipts indicating the sales tax paid. These should correspond to the period covered by your claim.

- Sales Tax Certificates: If applicable, submit any relevant sales tax exemption certificates. These documents demonstrate that you are eligible for exemption on specific purchases.

- Proof of Payment: Including documentation that proves the tax payment was made can strengthen your claim. Bank statements or payment confirmations can serve this purpose.

- Nullified Credit Documentation: If claiming a credit, provide documents showing that the credit was not initially claimed. This can avoid delays in processing your request.

- Additional Sheets: If more space is needed to explain your claim, submit additional sheets with all pertinent information and identification numbers included.

- Signature Authorization: If a representative is submitting on your behalf, include any necessary authorization documents that grant them the right to act for you.

Gathering these documents in advance can help streamline the application process for your tax refund or credit. Ensuring all forms are completed accurately can lead to quicker approval and peace of mind.

Similar forms

The AU-11 Tax form is specifically designed for applying for credits or refunds of sales or use tax in New York State. Several other forms serve similar purposes, addressing different aspects of tax refund claims. Below is a list of seven comparable documents:

- Form AU-12: This form is utilized for individuals or businesses applying for a credit or refund of sales or use tax specifically related to Qualified Empire Zone Enterprises (QEZE) for purchases made after September 1, 2009.

- Form FT-500: This application is for refunds specifically for sales tax paid on automotive fuels, including motor fuel and diesel. It serves a focused purpose compared to the broader AU-11.

- Form ST-140: This Refund Application form is for sales tax paid on tangible personal property or services. It assists in claiming refunds for specific purchases not covered under the AU-11.

- Form NYS-45: Used by employers, this form is necessary for claiming a refund or credit for overpaid unemployment insurance taxes. Though different in intent, it also reflects on tax adjustments.

- Form IT-201: This is an individual income tax return that may facilitate claims for refunds of state taxes. It takes a broader scope but can yield refunds akin to the AU-11.

- Form CT-3: This application is for corporations claiming a refund on overpaid franchise taxes. Similarities arise in their refund mechanisms, yet they address different tax types.

- Form IT-205: This is the partnership return where partners can claim their share of refunds on New York State taxes, emphasizing the flow of tax credits and refunds.

Review these forms closely as each serves a particular purpose in the realm of New York tax refunds, ensuring you choose the appropriate application for your situation.

Dos and Don'ts

When filing out the AU-11 Tax form, here are nine important dos and don'ts to keep in mind:

- Do read the instructions carefully before starting your application. Understanding the requirements can save time.

- Do ensure all information is legible. Clearly printed or typed entries can prevent processing delays.

- Do include your legal business name, including any "doing business as" (DBA) names.

- Do attach all necessary supporting documents. Incomplete applications may be rejected.

- Do provide a clear explanation of your claim. This helps in understanding the reason for your refund or credit request.

- Don't use this form if you are applying for a Qualified Empire Zone Enterprise (QEZE) credit. Instead, use Form AU-12.

- Don't apply for a refund for motor fuel taxes using this form. Refer to Form FT-500 for those claims.

- Don't forget to sign your application. An unsigned form will not be processed.

- Don't leave any fields blank. Ensure all applicable sections are completed to avoid rejection.

By following these guidelines, you can help ensure that your AU-11 application is complete and accurate, facilitating a smoother review process.

Misconceptions

Here are five misconceptions about the AU-11 Tax form that you should be aware of:

- It can be used for any type of tax refund. The AU-11 is specifically for claiming a refund of sales or use tax. For motor fuel tax refunds, form FT-500 should be used instead.

- It applies to all purchases made in New York State. This form is not applicable for purchases made on or after September 1, 2009, by Qualified Empire Zone Enterprises (QEZE). Those claims need form AU-12.

- Submitting the application without supporting documents is acceptable. Incomplete applications, including those without necessary documentation, cannot be processed. Always include copies of supporting documents as per the instructions.

- Only businesses can apply using this form. Individuals can also file for a refund if they have a valid claim and the required documentation to support it.

- Filing a false claim has no serious consequences. Providing false information or omitting material facts is a serious offense that can result in penalties, including fines or jail time.

Key takeaways

- Use the Correct Form: The AU-11 Tax form is not for every refund application. Ensure you're not applying for a Qualified Empire Zone Enterprise (QEZE) refund or for motor fuel taxes, as you will need different forms.

- Complete and Accurate Information: Fill out the form legibly. Include your legal business name, contact details, and Sales Tax ID number. Accuracy is crucial to avoid delays.

- Supporting Documents: Always attach copies of all relevant documents to support your claim. If necessary, use additional sheets, but remember to include your name and ID number on each one.

- Signature and Certification: The application must be signed, certifying that all information is true and complete. Unsigned forms or those without proper documentation will not be processed.

Browse Other Templates

What Does Exempt Mean on W-4 - A worksheet is provided to estimate the federal income tax you want withheld.

Mn Background Check Form - Fee structures for background studies vary based on residency history outside of Minnesota.

Trade Name Meaning - The address of the owner must be clearly stated on the application.