Fill Out Your Authorization And Direction Pay Form

The Authorization And Direction Pay form is a crucial document designed to streamline the payment process directly from an insurance company to a repair facility, ensuring quicker and more efficient service for vehicle owners experiencing claims. This form captures essential information about the vehicle owner, including their name, contact details, and vehicle specifics like year, make, and model. It also includes vital claim information, such as the insurance company handling the claim and a designated claim number. By completing the direction to pay section, the vehicle owner authorizes their insurance company to pay the repair facility directly, thereby reducing potential delays in receiving funds. Additionally, the owner accepts responsibility to promptly notify the repair shop if they accidentally receive any checks intended for them, ensuring that funds are delivered to the right place without unnecessary hold-ups. Overall, this form simplifies interactions between car owners, insurance companies, and repair shops, paving the way for a smoother claims experience.

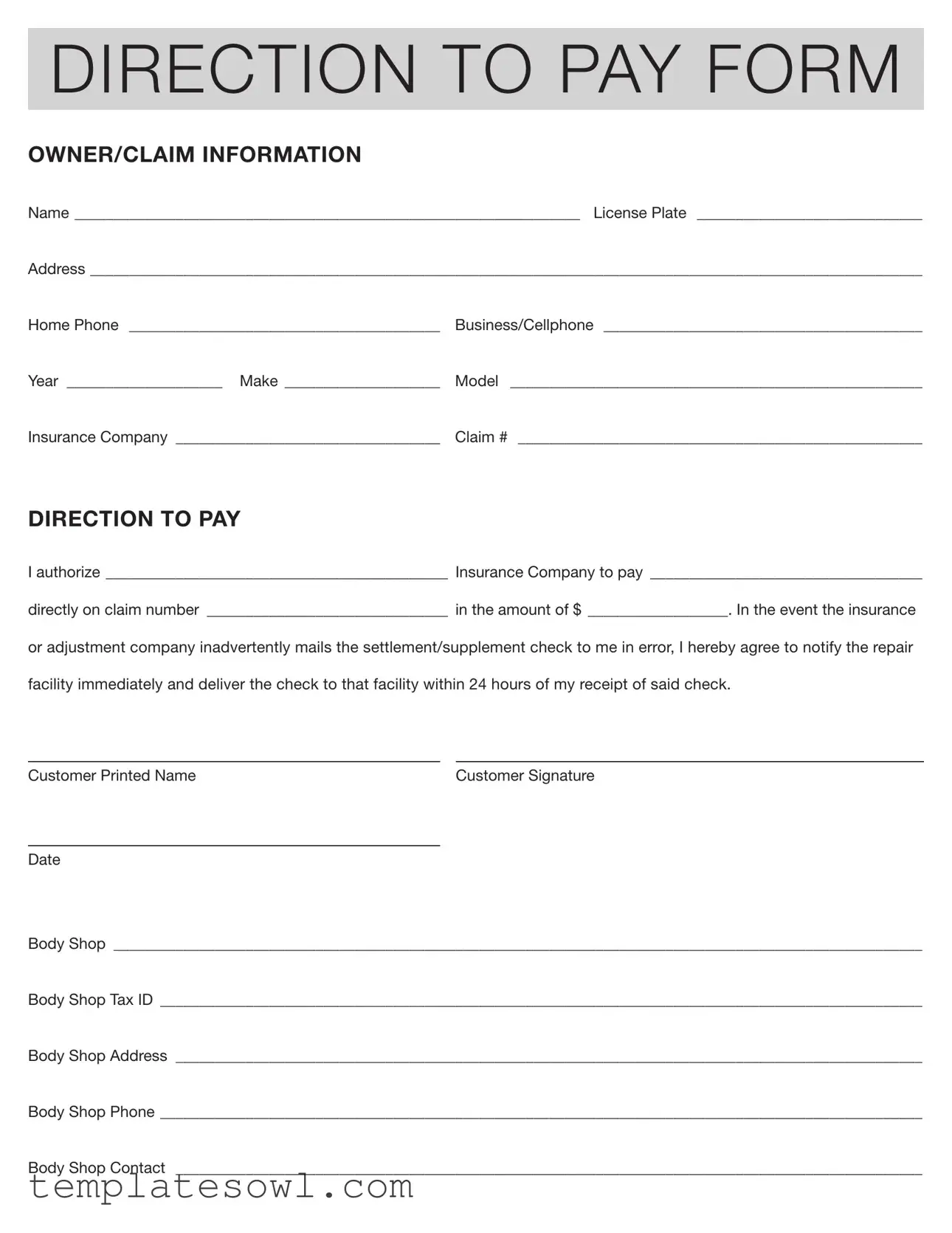

Authorization And Direction Pay Example

DIRECTION TO PAY FORM

OWNER/CLAIM INFORMATION

Name _________________________________________________________________ License Plate ______________________________

Address ___________________________________________________________________________________________________________

Home Phone _________________________________________ |

Business/Cellphone __________________________________________ |

Year _____________________ Make _____________________ |

Model _ _____________________________________________________ |

Insurance Company ___________________________________ |

Claim # _____________________________________________________ |

DIRECTION TO PAY

I authorize ____________________________________________ Insurance Company to pay ____________________________________

directly on claim number ________________________________ in the amount of $___________________. In the event the insurance

or adjustment company inadvertently mails the settlement/supplement check to me in error, I hereby agree to notify the repair facility immediately and deliver the check to that facility within 24 hours of my receipt of said check.

Customer Printed Name |

Customer Signature |

Date

Body Shop _________________________________________________________________________________________________________

Body Shop Tax ID ___________________________________________________________________________________________________

Body Shop Address _________________________________________________________________________________________________

Body Shop Phone __________________________________________________________________________________________________

Body Shop Contact _________________________________________________________________________________________________

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | The Authorization and Direction to Pay form allows an insured individual to direct their insurance company to pay a specific body shop directly for repairs. |

| Required Information | This form requires the insured's name, address, license plate number, and contact information, as well as details about the vehicle being repaired. |

| Insurance Details | The form must include the name of the insurance company, the claim number, and the amount that is to be paid to the body shop. |

| Authorization | The insured must provide explicit authorization for the insurance company to issue payment to the body shop. |

| Notification Requirement | If the insurance company mistakenly sends a payment to the insured, they are required to notify the body shop and deliver the check within 24 hours. |

| Body Shop Information | The form collects essential information about the body shop, including the name, tax ID, address, contact number, and the contact person. |

| Importance of Signature | The insured must print their name, sign the form, and date it to validate the authorization. |

| State Requirements | In some states, specific laws govern how this authorization must be handled, including compliance with state insurance regulations. |

| Record Keeping | Both the insured and the body shop should keep copies of this completed form for their records as proof of authorization. |

Guidelines on Utilizing Authorization And Direction Pay

After completing the Authorization And Direction Pay form, you will be directing your insurance company to make payments involved in your claim directly to your repair facility. Follow the steps below to ensure all necessary information is accurately provided.

- Claim Owner Information: Enter your full name in the space provided. Next, input your license plate number and complete address, including street, city, state, and ZIP code. Don’t forget to add your home phone number and your business or cellphone number.

- Vehicle Information: Fill in the year, make, and model of your vehicle. Be thorough to avoid any issues.

- Insurance Details: Provide the name of your insurance company and your claim number. This ensures the payment is processed correctly.

- Payment Direction: Write the name of the insurance company you are authorizing to pay the repair facility. Next, indicate the name of the repair facility that will receive the payment, and include the specific claim number associated with this payment.

- Payment Amount: Clearly state the amount that will be directed for payment to the repair facility.

- Agreement Statement: Be prepared to acknowledge that if your settlement check is mistakenly sent to you, you will notify the repair facility right away and provide them with the check within 24 hours.

- Customer Verification: Print your name again, sign to authorize the payment direction, and date the form.

- Body Shop Information: Fill in the body shop’s name, tax ID, and their complete address. Include their phone number and contact person for any follow-up.

What You Should Know About This Form

What is the Authorization and Direction Pay form?

This form is used to authorize an insurance company to pay a designated body shop directly for repairs related to a claim. It ensures that the payment is handled properly and expedites the repair process.

Who needs to fill out the Authorization and Direction Pay form?

The form must be completed by the owner of the vehicle who is making a claim with their insurance company. This includes providing details such as the vehicle's license plate, make, model, and claim information.

What information is required on the form?

Users must provide their personal information, such as name, address, and contact numbers. Additionally, details about the vehicle, including the year, make, and model, as well as the insurance company and claim number, are necessary. The body shop’s information is also required for the payment to be processed correctly.

How does the payment process work?

Once the form is filled out and submitted, the insurance company will issue a payment directly to the designated body shop. The form gives the body shop the authorization to receive payment on the owner’s behalf.

What happens if the insurance company sends the check to me instead of the body shop?

If the insurance company accidentally sends the payment check to the vehicle owner, they must notify the body shop immediately. The check must then be delivered to the body shop within 24 hours of its receipt to avoid any delays in repairs.

Can I revoke the Authorization and Direction Pay form after it has been submitted?

Revocation of the authorization may be possible, but it is important to contact the insurance company and client representative to discuss the circumstances. Compliance with any requirements or processes set forth by the insurance company will be necessary.

What if the body shop can't complete the repairs?

If the body shop is unable to complete the repairs for any reason, the vehicle owner should contact their insurance company. The owner may need to fill out another form or change the repair facility for payment purposes.

Is there a specific time frame for the payment to be processed?

The time frame for payment can vary based on the insurance company’s policies and procedures. Generally, payments are processed as quickly as possible once all necessary forms are submitted and approved.

Do I need to sign the Authorization and Direction Pay form?

Yes, the vehicle owner is required to sign the form to confirm their authorization for payment to the designated body shop. The signature verifies the agreement between the owner and the insurance company.

Can I use this form for any type of claim?

This form is specifically designed for auto insurance claims related to vehicle repairs. It is important to ensure that the body shop and claim meet the requirements outlined by the insurance policy before proceeding.

Common mistakes

Filling out the Authorization and Direction to Pay form correctly is essential for a smooth claims process. One common mistake is leaving out necessary personal information. Failing to provide your name, address, and license plate can lead to delays or complications. Make sure that all fields in the owner or claim information section are completely filled out to avoid any processing issues.

Another frequent error involves not specifying the correct insurance company or claim number. This can cause confusion and ultimately result in the delay of payments. It’s important to double-check that the name of the insurance company and the exact claim number are accurate. Inaccuracies here can lead to claims being denied or misdirected.

The amount you authorize for payment must also be clearly stated. Omitting this figure can create uncertainty about the payment amount. This mistake not only frustrates the body shop but may also lead to additional follow-ups and potential delays in getting your vehicle repaired. Be precise when entering the payment amount.

Lastly, many people forget to sign and date the form. A missing signature invalidates the entire document. Ensure that you sign your name and include the date before submitting the form. This simple step helps to confirm your authorization and moves the process along efficiently.

Documents used along the form

The Authorization and Direction Pay form is an essential document in the insurance claims process, allowing for direct payment to a repair facility. Several other forms and documents are frequently used in conjunction with this form to facilitate and clarify the claims process. Below is a concise overview of these related documents.

- Claim Form: This document is completed by the policyholder to provide details about the incident, including the date, time, and location. It serves as the official request for the insurance company to evaluate and process the claim.

- Estimation Form: An estimate form is provided by the repair shop detailing the anticipated costs for repairs. This document often includes itemized costs for parts and labor, which aids the insurance company in approving the claim.

- Proof of Loss Form: This form is often required by insurers to substantiate the claim. It lays out the specifics of the loss, including what was damaged or lost and the corresponding value.

- Release of Liability: This document ensures that the claimant relinquishes any further claims against the insurance company after payment is received. This protects the insurer from future claims regarding the same incident.

- Insurance Policy Document: The policy document outlines the coverage terms, conditions, and exclusions. It serves as a reference for both the claimant and the insurer regarding what is covered in the claim.

- Repair Authorization Form: This form is necessary for the repair facility to begin work on the vehicle. It is typically signed by the vehicle owner and indicates approval for repairs as well as the estimated costs.

- Subrogation Agreement: In situations where an insurer pays out a claim but seeks to recover costs from a third party, this document facilitates that process. It allows the insurance company to step into the shoes of the claimant and pursue reimbursement.

- Payment Receipt: Once the payment is made, this document confirms the transaction. It includes details of the payment amount and the parties involved, serving as proof of payment to both the claimant and the repair facility.

These documents collectively contribute to a smoother claims process, ensuring that all parties involved have the necessary information and permissions to proceed with repairs and settlements. Understanding each document's role is vital for effective communication and management of insurance claims.

Similar forms

The Authorization And Direction Pay form shares similarities with various other documents used in financial and insurance transactions. Below is a list of ten such documents and how they relate:

- Power of Attorney: This document allows one person to act on behalf of another in financial or legal matters, similar to how the Authorization and Direction Pay form allows a policyholder to direct payment to a repair facility.

- Direct Deposit Authorization Form: Like the Direction to Pay form, this one permits a financial institution or employer to deposit funds directly into a designated account, streamlining the payment process.

- Assignment of Benefits Form: Used in insurance claims, this form assigns the right to receive benefits to a third party, akin to directing the insurance payout to a service provider.

- Claim Release Form: A document that releases an insurer from any further obligations after the payment is made, just as the Direction to Pay document outlines the obligations related to payment direction.

- Letter of Authorization: This serves as a written permission for someone to act on behalf of a person, similar in function to the Directive allowing a designated payment.

- Insurance Claim Form: While this initiates a claim for loss, it also works hand in hand with the Direction to Pay form, as the outcome often dictates payment direction.

- Settlement Agreement: This document confirms the agreement between parties on the resolution of a claim, often accompanied by a Direction to Pay for the agreed amount.

- Third-Party Payment Authorization: This authorizes a third party to receive payment for services rendered, mirroring the intent of the Direction to Pay form regarding payments made to a body shop.

- Service Provider Payment Request Form: This requests payment from an insurer or another source for services rendered, closely related to instructing payment through the Direction to Pay.

- Insurance Payment Acknowledgment: When insurers acknowledge receipt of payment instructions, they function similarly to the tool that communicates your intentions as expressed in the Direction to Pay form.

Each document shares a common theme of facilitating and authorizing the transfer of funds, ensuring that payments are made directly to those providing services or managing claims efficiently.

Dos and Don'ts

When filling out the Authorization And Direction Pay form, consider the following guidelines:

- Clearly write your name and contact information at the top of the form.

- Double-check your license plate number for accuracy.

- Fill out the insurance company information completely.

- Specify the claim number in the designated space.

Now, here are some things to avoid:

- Never leave any required fields blank.

- Avoid using abbreviations that may confuse the reader.

- Do not sign the form before completing all sections.

- Refrain from submitting the form without a copy for yourself.

Misconceptions

Misconceptions about the Authorization and Direction to Pay form can lead to confusion. Here are seven common myths along with clarifications:

- It is only for auto insurance claims. Many people believe this form is exclusively for auto-related damages. In reality, it can apply to various types of claims, including property damage and personal injury settlements.

- The form guarantees payment. A common misunderstanding is that submitting this form ensures payment from the insurance company. However, the insurance company must first approve the claim before any payment occurs.

- You must submit the form in person. Some individuals think that the Authorization and Direction to Pay form must be delivered in person. This is not true; it can often be submitted electronically or via mail.

- Only the claimant can complete the form. This form can be filled out by designated representatives, such as legal guardians or power of attorney holders, with proper authorization.

- You cannot request changes after submission. Once the form is submitted, people may assume it's final. In fact, changes can often be requested, but they usually require a new form or a written amendment.

- The body shop must accept the payment arrangement. Some believe that the body shop has no choice but to accept payment directed through this form. However, acceptance is at the discretion of the body shop and depends on their policies.

- All insurance companies accept this form. While many insurance companies are familiar with the Authorization and Direction to Pay form, not all may accept it or have the same processes in place. It’s essential to verify with the specific insurer.

Key takeaways

- Ensure all personal information is accurate. This includes your name, license plate, and contact details. Errors can lead to delays in processing.

- Clearly identify the insurance company and the specific claim number. This information is critical for directing the payment correctly.

- Specify the exact amount you are authorizing for payment. Omitting this detail might lead to confusion or the payment not being processed as intended.

- If the insurance check is sent to you by mistake, you must act promptly. Notify the repair facility immediately and deliver the check to them within 24 hours.

- Double-check that you have signed and dated the form. Your signature confirms your authorization and is necessary for processing.

- Provide complete and accurate information for the body shop, including the tax ID, address, and contact details. This helps ensure a smooth transaction between your insurance company and the repair facility.

Browse Other Templates

Parental Release Form - This authorization form must be filled out accurately to avoid legal issues.

Legal Client Intake Form Template Word - Clarify the scope of representation; it’s specific to your traffic matter.

Social Communication Questionnaire Age Range - The form addresses both typical and atypical communication styles.