Fill Out Your Auto Credit Personal Form

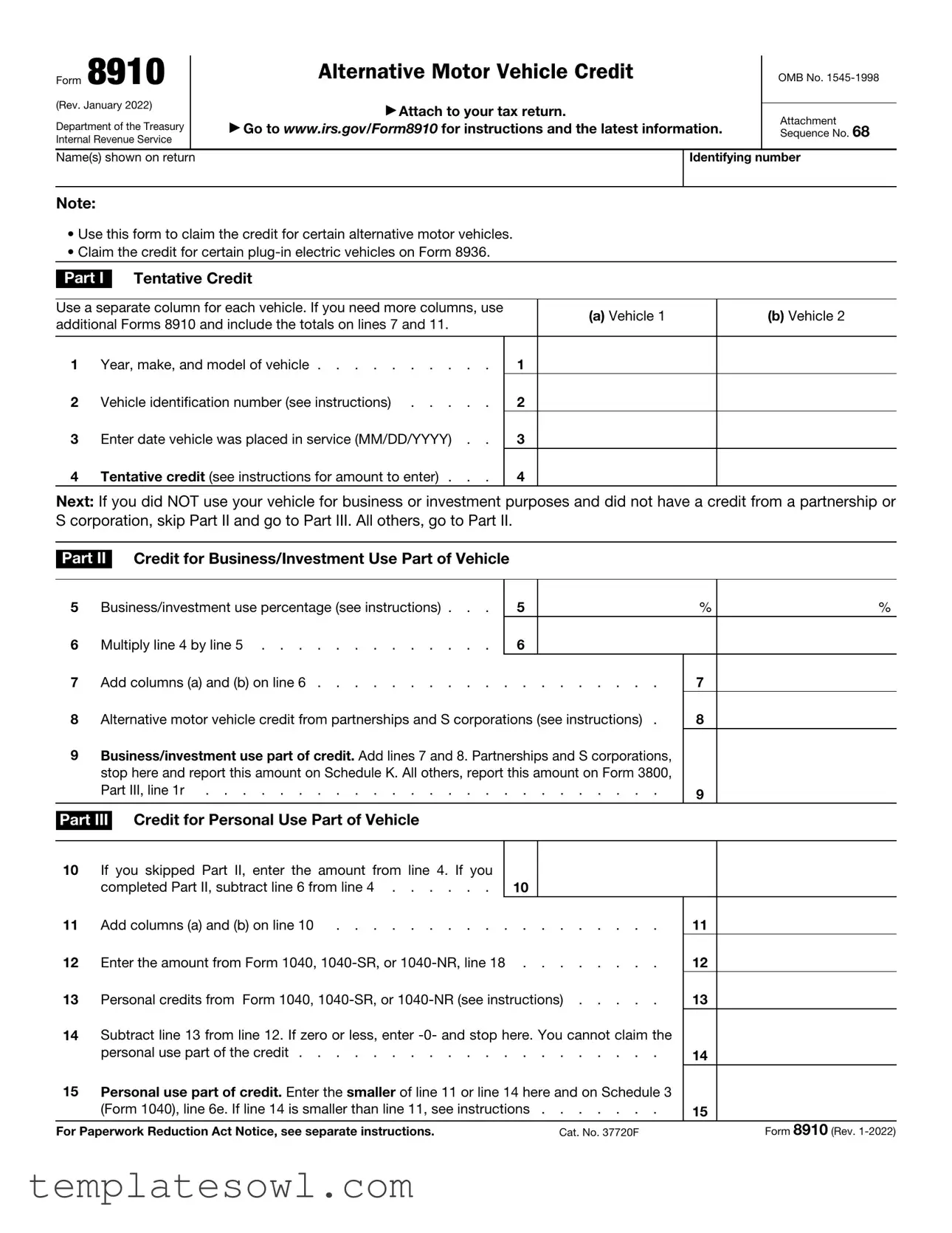

The Auto Credit Personal form, also known as Form 8910, is an important document for taxpayers wishing to claim a credit for certain alternative motor vehicles. This form should be attached to your tax return. It is geared specifically towards individuals who own qualified alternative motor vehicles and want to benefit financially from their investment. The process for completing the form is straightforward, beginning with Part I, where you’ll outline the tentative credit for each vehicle you own. If your vehicle serves a dual purpose, such as business and personal use, you'll find sections dedicated to calculating the credit for both. Information like the vehicle’s identification number and year, make, and model must be provided. For those using their vehicle solely for personal use, Part III guides you in determining the eligible credits. It’s crucial to be aware of where to report the final amounts, especially if you are involved with partnerships or S corporations. Additional resources and instructions can be found on the IRS website, ensuring you have the latest information as you complete your tax return. Understanding this form may help you maximize your tax savings and provide clarity on the credits available for alternative motor vehicles.

Auto Credit Personal Example

Form 8910 |

|

|

Alternative Motor Vehicle Credit |

|

OMB No. |

||

|

|

||||||

(Rev. January 2022) |

|

|

▶Attach to your tax return. |

|

|

|

|

|

|

|

Attachment |

|

|||

|

|

|

|

|

|||

Department of the Treasury |

|

|

▶ Go to www.irs.gov/Form8910 for instructions and the latest information. |

|

68 |

||

|

|

|

Sequence No. |

||||

Internal Revenue Service |

|

|

|

|

|

|

|

Name(s) shown on return |

|

|

|

Identifying number |

|

||

|

|

|

|

|

|

|

|

Note:

•Use this form to claim the credit for certain alternative motor vehicles.

•Claim the credit for certain

Part I Tentative Credit

Use a separate column for each vehicle. If you need more columns, use |

|

(a) Vehicle 1 |

(b) Vehicle 2 |

|

additional Forms 8910 and include the totals on lines 7 and 11. |

|

|||

|

|

|

||

|

|

|

|

|

1 |

Year, make, and model of vehicle |

1 |

|

|

2 |

Vehicle identification number (see instructions) |

2 |

|

|

3 |

Enter date vehicle was placed in service (MM/DD/YYYY) . . |

3 |

|

|

4 |

Tentative credit (see instructions for amount to enter) . . . |

4 |

|

|

Next: If you did NOT use your vehicle for business or investment purposes and did not have a credit from a partnership or S corporation, skip Part II and go to Part III. All others, go to Part II.

Part II Credit for Business/Investment Use Part of Vehicle

5 |

Business/investment use percentage (see instructions) . . . |

5 |

|

% |

6 |

Multiply line 4 by line 5 |

6 |

|

|

7 |

Add columns (a) and (b) on line 6 |

7 |

||

8 |

Alternative motor vehicle credit from partnerships and S corporations (see instructions) . |

8 |

||

9Business/investment use part of credit. Add lines 7 and 8. Partnerships and S corporations, stop here and report this amount on Schedule K. All others, report this amount on Form 3800,

Part III, line 1r |

. . . . . . . . . . . . . . . . . . . . . . . . . |

9 |

%

Part III Credit for Personal Use Part of Vehicle

10If you skipped Part II, enter the amount from line 4. If you

|

completed Part II, subtract line 6 from line 4 |

10 |

|

11 |

Add columns (a) and (b) on line 10 |

11 |

|

12 |

Enter the amount from Form 1040, |

12 |

|

13 |

Personal credits from Form 1040, |

13 |

|

14Subtract line 13 from line 12. If zero or less, enter

personal use part of the credit |

14 |

15Personal use part of credit. Enter the smaller of line 11 or line 14 here and on Schedule 3

(Form 1040), line 6e. If line 14 is smaller than line 11, see instructions |

15 |

|

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 37720F |

Form 8910 (Rev. |

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Number | Form 8910 |

| Purpose | Claim credit for certain alternative motor vehicles. |

| OMB Number | OMB No. 1545-1998 |

| Latest Revision Date | January 2022 |

| Attachment Requirement | Must be attached to your tax return. |

| Website for Instructions | Visit www.irs.gov/Form8910 for instructions. |

| Use for Plug-in Vehicles | Plug-in electric vehicles are claimed on Form 8936. |

| Part II Usage | Used if the vehicle was for business or investment purposes. |

| Schedule Reporting | Report partnership and S corporation credits on Schedule K. |

| State-Specific Governing Laws | Consult state law as requirements may vary by state. |

Guidelines on Utilizing Auto Credit Personal

Filling out the Auto Credit Personal form is straightforward. You'll provide information about your vehicle and claim any applicable credits. It is important to ensure all details are accurate for a smooth processing experience with the IRS.

- Gather Required Information: Collect details such as your vehicle’s year, make, model, and identification number.

- Complete Vehicle Information: In Part I, list the vehicle's information in the provided columns, including the date it was placed in service and the tentative credit amount.

- Evaluate Usage: Determine if you used the vehicle for business or investment purposes. If not, skip Part II and move to Part III. If yes, continue to fill out Part II.

- Fill Out Part II (if applicable): Provide the business/investment use percentage, calculate the credit based on line 4, and complete the necessary fields.

- Move to Part III: If you skipped Part II, use the tentative credit amount from line 4. If you completed Part II, subtract line 6 from line 4 for the appropriate credit calculation.

- Finalize Your Credit: Complete the final lines in Part III, including any necessary calculations and checks against your personal credits from your tax return.

- Review and Submit: Double-check all entries for accuracy before attaching the form to your tax return and submitting it.

What You Should Know About This Form

What is the purpose of the Auto Credit Personal form?

The Auto Credit Personal form, officially known as Form 8910, is used by taxpayers to claim a credit for certain alternative motor vehicles. This includes vehicles that qualify under specific criteria set by the IRS. If you wish to benefit from tax credits related to these types of vehicles, completing this form correctly is essential.

What vehicles can I claim the credit for using this form?

You can claim the credit for specific alternative motor vehicles, which typically includes certain types of electric and hybrid vehicles. However, if your vehicle is a plug-in electric vehicle, you will need to use Form 8936 instead. For a comprehensive list of eligible vehicles, it is advisable to consult the instructions on the IRS website.

How do I determine my tentative credit amount?

The tentative credit amount depends on various factors, including the year, make, and model of your vehicle. You will find applicable credit amounts in the instructions for the form. The calculations generally require you to input the correct figures for these factors on the designated lines within the form.

What should I do if my vehicle was used for both personal and business purposes?

If your vehicle was used for both personal and business purposes, you must complete Part II of the form to determine the business/investment use percentage. This involves calculating the percentage of time you used the vehicle for these purposes and then applying that percentage to your tentative credit. The resulting figure will help you understand how much credit you can claim.

How do I report the credit amount if I am involved in a partnership or S corporation?

For individuals associated with partnerships or S corporations, any alternative motor vehicle credit resulting from business use should be reported on Schedule K. The form guides you on how much to report based on your calculated figures. Individuals not associated with such entities will report the amount directly on Form 3800.

What should I do if I cannot claim the personal use part of the credit?

If your calculations indicate that you cannot claim the personal use part of the credit, you will need to enter a "-0-" on the line designated for personal use credit. It is crucial to follow the instructions precisely, as a failure to report accurately could lead to issues with your tax return.

Common mistakes

Filling out the Auto Credit Personal form, officially known as Form 8910, can often feel daunting. It's essential to take your time and pay close attention to detail, as even small mistakes can lead to delays or issues with your tax return. Here are some common pitfalls to avoid when completing the form.

One frequent mistake is failing to use the correct vehicle identification number (VIN). The VIN is unique to each vehicle and is crucial for accurately claiming the credit. Double-checking this number against your vehicle documents ensures that the credit goes to the right car.

Another common error involves the year, make, and model of the vehicle. Ensure that you enter the information accurately in Part I. If this information does not match IRS records, it may create discrepancies that could slow down processing.

Using incorrect dates is also a mistake that can be easily avoided. The date the vehicle was placed in service must be entered in the MM/DD/YYYY format. Forgetting to use this specific format can lead to confusion and potentially cost you your credit altogether.

Individuals might skip over Part II if their vehicle was not used for business or investment purposes. This may seem like a small detail, but it's essential to follow instructions closely. Not completing all required sections can lead to an incomplete filing.

Additionally, using an inaccurate business/investment use percentage can lead you astray. Make sure to assess and enter this percentage carefully. Failing to document your calculations could result in an exaggerated or understated claim.

People often forget to add their alternative motor vehicle credit from partnerships or S corporations in Part II. Skipping this step can impact the total credit available to you, so always consult the instructions to see what's necessary for your particular situation.

Moving to Part III, a frequent oversight occurs when individuals fail to correctly enter data from previous lines. For example, if you skip subtracting line 6 from line 4 without proper calculations, it can lead to overstating your personal use credit.

When it comes to the final numbers, it’s all too easy to forget to enter the smaller of line 11 or line 14 in the spot requested. This step is crucial, as it ultimately determines the credit you’ll report on your tax return.

Lastly, some might overlook the importance of attaching this form to their tax return. Ensure that you follow through and include the form so that the IRS receives it along with your submission. Neglecting this step can lead to delays in processing.

By paying careful attention to these common mistakes, you can greatly improve your chances of successfully claiming the Auto Credit. Taking a methodical approach makes the process smoother and more manageable, allowing you to focus on what matters most: enjoying your alternative motor vehicle!

Documents used along the form

The Auto Credit Personal form, specifically Form 8910, is often used in conjunction with several other documents during the tax filing process for claiming credits related to alternative vehicles. Each of these forms serves a distinct purpose, ensuring accurate reporting and claiming of eligible tax benefits. Below is a list of documents typically utilized alongside the Auto Credit Personal form.

- Form 8936: This form is used to claim the credit for plug-in electric vehicles. It allows taxpayers to provide specific details about the vehicle and calculate the credit based on eligibility criteria.

- Schedule K-1: Generally issued by partnerships and S corporations, this document reports the income, deductions, and credits allocated to each partner or shareholder, which can impact the reporting of credits on Form 8910.

- Form 3800: This form is used to claim various tax credits, including the business investment credit. It helps individuals and entities summarize their nonrefundable tax credits for the year.

- Form 1040: The individual income tax return form that all U.S. residents must file. It includes personal information, income details, and calculations for any tax credits and liabilities.

- Form 1040-SR: A version of the standard Form 1040 specifically designed for seniors age 65 and older, helping streamline the filing process for this demographic while claiming credits.

- Form 1040-NR: This form is used by non-resident aliens who must file a U.S. tax return. It enables them to report their income and claim eligible deductions and credits.

- Form 8862: If an individual has previously claimed certain credits and had them disallowed, they must complete this form to claim the credit again in future tax years.

- Form 8829: Used for claiming the expenses for business use of a home. If a vehicle is partially used for business purposes, this form may be relevant for calculating related deductions.

- Form 8880: This document is for claiming the Credit for Qualified Retirement Savings Contributions. It serves as a reminder that various credits can be claimed on tax returns and must be reported correctly.

- Form 8863: This form is utilized to claim education credits. Individuals claiming multiple credits may need to reference various forms to ensure proper reporting.

Understanding these accompanying documents is essential for effectively claiming tax credits related to alternative motor vehicles. By accurately completing each relevant form, taxpayers can optimize their tax benefits while complying with federal regulations.

Similar forms

The Auto Credit Personal form (Form 8910) is similar to several other documents used for tax reporting and credit claims. Here are eight documents that share common purposes or structures:

- Form 8936: This form is for claiming the credit for certain plug-in electric vehicles. Like Form 8910, it allows taxpayers to report specific vehicle details and calculate the credit amount based on the vehicle's characteristics.

- Form 3800: This form is used to claim various business credits. It also includes sections for reporting credits from partnerships and S corporations, similar to how Form 8910 handles business and personal uses of vehicles.

- Schedule K-1: Used by partnerships, this form reports each partner's share of income, deductions, and credits. It has processes in place for reporting business credits, akin to the methods outlined in Form 8910 for claiming credits from partnerships.

- Form 8880: This is the Credit for Qualified Retirement Savings Contributions form. Like Form 8910, it enables taxpayers to claim a credit based on specific criteria, although the focus is on retirement contributions rather than vehicle use.

- Form 8862: This form is used to claim the Earned Income Credit after disallowance. Similar to Form 8910, applicants must meet certain eligibility criteria and provide detailed information to qualify for the credit.

- Form 5695: This is used for claiming residential energy credits. Both forms require detailed information about eligibility and calculations to determine the applicable credit, focusing on energy efficiency.

- Form 1040: The main individual income tax return form. While much broader in scope, it is where the final calculation of various credits—including those from Form 8910—will ultimately be reported.

- Form 8863: This form is for education credits. It similarly outlines eligible expenses and calculates credits, allowing taxpayers to reduce their tax liabilities based on qualified expenses, just as with vehicle credits on Form 8910.

Each of these documents has its own unique focus but shares fundamental similarities in structure and purpose with the Auto Credit Personal form.

Dos and Don'ts

When filling out the Auto Credit Personal form, keep these tips in mind:

- Do double-check all the information you enter. Accuracy is crucial.

- Don't leave any fields blank. If a field doesn't apply, write "N/A."

- Do ensure you have the correct vehicle identification number. It should match the vehicle title.

- Don't guess the tentative credit amount. Refer to the instructions provided for accurate calculations.

- Do read the instructions carefully to understand each part of the form.

- Don't forget to attach the form to your tax return before submitting.

Misconceptions

- Belief that the form applies to all vehicle types. The Auto Credit Personal form is specifically designed for certain alternative motor vehicles. Not every vehicle qualifies, so it’s crucial to ensure the vehicle meets the necessary criteria.

- Assumption that only business-related vehicles qualify. While business and investment use can yield a credit, personal use of qualifying vehicles also provides an opportunity for a tax benefit. This form serves both business and personal vehicle claims.

- Thinking the form is only for electric vehicles. Though many associate it with electric vehicles, it actually covers a variety of alternative motor vehicles. Hybrid and other alternative fuel options may also qualify.

- Underestimating the importance of the vehicle identification number (VIN). The VIN is a critical part of the application process. Failing to include the correct VIN can lead to delays or denials in credit claims.

- Believing all tax credits are available instantly. The credit amount may not be immediately accessible. Individuals must follow specific calculations and steps outlined in the form, often leading to delays before funds are obtained.

- Ignoring the need for accurate documentation. Properly completed forms alone are insufficient. Supporting documentation related to eligibility and usage must be maintained and may be required if questions arise during audits.

- Assuming the form is straightforward and does not require careful reading. The form contains detailed instructions that demand careful consideration. Skipping important sections can lead to errors and missed opportunities for claiming the credit.

Key takeaways

Filling out the Auto Credit Personal form (Form 8910) can be straightforward if you keep some key points in mind.

- This form allows individuals to claim a credit for qualifying alternative motor vehicles.

- To claim a credit for plug-in electric vehicles, use Form 8936 instead.

- Each vehicle needs a separate column on the form; additional cars require you to fill out extra forms.

- Make sure to enter the year, make, model, and vehicle identification number accurately.

- The vehicle must be placed in service before you can claim a credit; enter the date accordingly.

- If your vehicle was not used for business or investment, skip Part II and go directly to Part III.

- For business or investment use, report the percentage of usage to calculate the credit correctly.

- All calculations in Part II should be summed for total credits, if applicable.

- Make sure to compare personal credit amounts properly in Part III to ensure accurate reporting.

- Any credit amounts should be reported on your tax return, ensuring you include all necessary documentation.

Remember to check the IRS website or refer to the instructions included with the form for the most current information.

Browse Other Templates

Xpo Bill of Lading Pdf - The formatting of the Bill of Lading allows for easy identification of shipment details.

Llc Charter Number - Make sure to include all required information to expedite processing.