Fill Out Your Axis Bank Dispute Form

The Axis Bank Dispute Form serves as a crucial tool for cardholders who wish to formally raise concerns regarding unauthorized or erroneous transactions. This form provides a structured way for individuals to document and communicate specific issues related to their banking activities, contributing to a more efficient dispute resolution process. Cardholders are required to fill in their personal details, including their name, contact number, email, and card information. Past transaction issues can be categorized—ranging from duplicate billing and service discrepancies to unauthorized transactions and failed ATM withdrawals. Each category prompts the cardholder to specify the nature of the dispute, along with providing supporting documentation, which may strengthen their case. Clear guidelines are provided for attaching relevant agreements, correspondence with merchants, and evidence of return for disputed goods or services. Furthermore, the form includes a declaration section, where cardholders confirm the veracity of the information provided, underscoring the importance of honesty in initializing disputes. Ultimately, the use of this form is aimed at facilitating an improved resolution experience for customers, while simultaneously protecting both the cardholders and Axis Bank from potential fraudulent claims.

Axis Bank Dispute Example

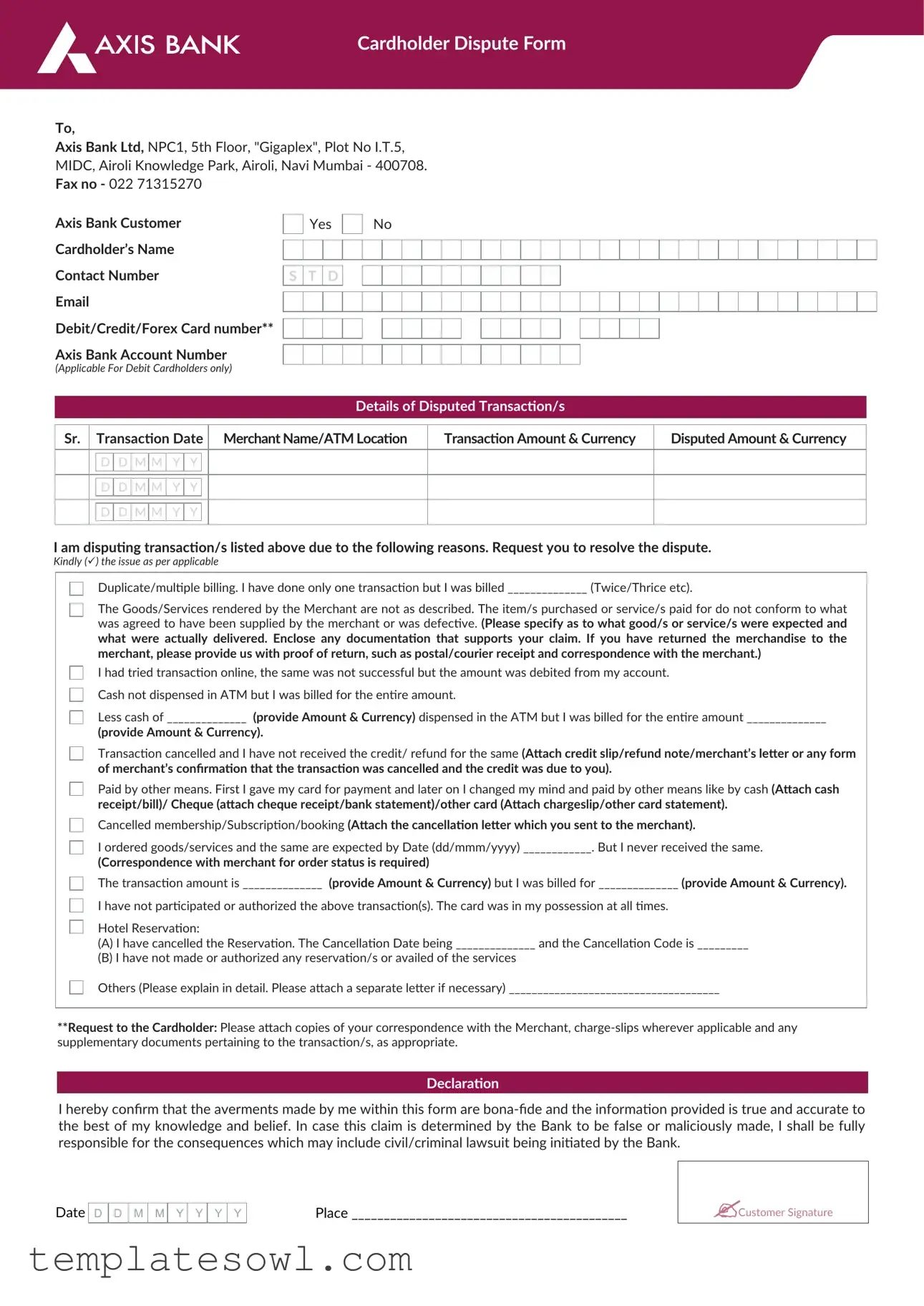

Cardholder Dispute Form

To,

Axis Bank Ltd, NPC1, 5th Floor, "Gigaplex", Plot No I.T.5,

MIDC, Airoli Knowledge Park, Airoli, Navi Mumbai - 400708.

Fax no - 022 71315270

Axis Bank Customer

Cardholder’s Name Contact Number Email

Debit/Credit/Forex Card number** Axis Bank Account Number

(Applicable For Debit Cardholders only)

Yes

Yes

No

No

S T D

Details of Disputed Transaction/s

Sr. |

|

Transaction Date |

Merchant Name/ATM Location |

Transaction Amount & Currency |

Disputed Amount & Currency |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I am disputing transaction/s listed above due to the following reasons. Request you to resolve the dispute.

Kindly () the issue as per applicable

Duplicate/multiple billing. I have done only one transaction but I was billed ______________ (Twice/Thrice etc).

The Goods/Services rendered by the Merchant are not as described. The item/s purchased or service/s paid for do not conform to what was agreed to have been supplied by the merchant or was defective. (Please specify as to what good/s or service/s were expected and what were actually delivered. Enclose any documentation that supports your claim. If you have returned the merchandise to the merchant, please provide us with proof of return, such as postal/courier receipt and correspondence with the merchant.)

I had tried transaction online, the same was not successful but the amount was debited from my account. Cash not dispensed in ATM but I was billed for the entire amount.

Less cash of ______________ (provide Amount & Currency) dispensed in the ATM but I was billed for the entire amount ______________

(provide Amount & Currency).

Transaction cancelled and I have not received the credit/ refund for the same (Attach credit slip/refund note/merchant’s letter or any form of merchant’s confirmation that the transaction was cancelled and the credit was due to you).

Paid by other means. First I gave my card for payment and later on I changed my mind and paid by other means like by cash (Attach cash receipt/bill)/ Cheque (attach cheque receipt/bank statement)/other card (Attach chargeslip/other card statement).

Cancelled membership/Subscription/booking (Attach the cancellation letter which you sent to the merchant).

I ordered goods/services and the same are expected by Date (dd/mmm/yyyy) ____________. But I never received the same.

(Correspondence with merchant for order status is required)

The transaction amount is ______________ (provide Amount & Currency) but I was billed for ______________ (provide Amount & Currency).

I have not participated or authorized the above transaction(s). The card was in my possession at all times. Hotel Reservation:

(A)I have cancelled the Reservation. The Cancellation Date being ______________ and the Cancellation Code is _________

(B)I have not made or authorized any reservation/s or availed of the services

Others (Please explain in detail. Please attach a separate letter if necessary) _____________________________________

**Request to the Cardholder: Please attach copies of your correspondence with the Merchant,

Declaration

I hereby confirm that the averments made by me within this form are

Date

D D  M M

M M  Y Y Y

Y Y Y  Y

Y

Place ___________________________________________

Customer Signature

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Purpose | This form is used for disputing transactions on Axis Bank cards, including debit, credit, and forex cards. |

| Contact Information | Disputes should be submitted to Axis Bank Ltd, NPC1, 5th Floor, "Gigaplex", Plot No I.T.5, MIDC, Airoli Knowledge Park, Airoli, Navi Mumbai - 400708. |

| Transaction Details Required | The form requires details such as transaction date, merchant name, transaction amount, and the disputed amount. |

| Reasons for Dispute | Cardholders can dispute transactions for reasons such as duplicate billing, goods not as described, or unauthorized transactions. |

| Documentation Needed | Supporting documentation, such as correspondence with the merchant or proof of return, must be attached to the form. |

| Declaration Requirement | The cardholder must confirm the truthfulness of the information provided and acknowledge potential legal consequences for false claims. |

| Applicable Governing Laws | The governing law for disputes may vary by state. It is advisable to check state-specific regulations regarding financial disputes. |

Guidelines on Utilizing Axis Bank Dispute

Once you have all the necessary information, filling out the Axis Bank Dispute form can be straightforward. Follow these steps carefully to ensure your dispute is clearly communicated and documented.

- Start by providing your personal details. Fill in your name, contact number, and email address at the top of the form.

- Next, enter the debit, credit, or forex card number in the designated field.

- If you're a debit cardholder, include your Axis Bank account number as well.

- Specify the details of the disputed transaction. List the transaction date, merchant name or ATM location, transaction amount and currency, and the disputed amount and currency.

- In the section regarding reasons for disputing the transaction, indicate the type of dispute by marking the appropriate option with a check ().

- If applicable, provide specific information on the nature of the dispute. Explain what goods or services were expected and what was actually provided. Attach supporting documentation.

- Complete any additional claims as required. Use the spaces provided to provide details about duplicate billing, online transaction failures, unreceived cash from ATMs, or other issues.

- Attach all relevant documents to support your claim. This includes receipts, correspondence with the merchant, and proof of return if applicable.

- Sign and date the form, affirming the accuracy of the information provided.

- Finally, send the completed form to the address listed at the top of the form. You can also fax it to the number provided.

What You Should Know About This Form

What is the Axis Bank Dispute Form used for?

The Axis Bank Dispute Form is specifically designed for cardholders to formally report disputes regarding transactions made on their debit, credit, or forex cards. It allows customers to provide necessary details about disputed transactions and request assistance in resolving the issue.

What information do I need to provide in the dispute form?

To complete the dispute form, you will need to provide your name, contact number, email address, and card number. Additionally, you should include details of the disputed transaction such as transaction date, merchant name or ATM location, transaction amount, and any reasons for disputing the charge. Providing documentation to support your claim is also essential.

How do I submit the completed dispute form?

You can submit the Axis Bank Dispute Form by mailing it to the address provided in the form. Alternatively, you can also fax the completed form to the number listed. Ensure that you keep a copy for your records in case follow-up is needed.

What types of disputes can I report using this form?

The form accommodates various types of disputes, including but not limited to duplicate billing, goods or services not as described, unsuccessful online transactions with a debited amount, issues with ATM cash dispensing, unauthorized transactions, canceled reservations, and others. It's essential to select the specific reason for your dispute accurately.

What documentation should I attach with the dispute form?

Supporting documentation can include any correspondence with the merchant, receipts confirming your transactions, proof of return (if applicable), a cancellation letter, or any relevant statements that validate your claim. Having these documents will strengthen your case and assist Axis Bank in resolving your dispute more effectively.

How will I know if my dispute has been resolved?

Once you submit the form, Axis Bank will review the information provided and will typically communicate their findings or any necessary follow-up actions. You should keep an eye on your email or phone for updates. If you do not receive communication within an expected timeframe, consider reaching out to customer service for clarification.

What if the merchant does not respond to my complaint?

If the merchant fails to address your concerns, it's important to document this lack of response. Submitting this documentation along with your dispute form to Axis Bank can support your case. Axis Bank plays a role in resolving disputes and may assist in mediating the situation with the merchant.

Can I dispute a transaction after a certain time period?

Generally, disputes must be reported within a specific window of time from the date of the transaction. This timeframe varies by card issuer and type of transaction. It is advisable to check Axis Bank’s policies or contact customer service as soon as you recognize an issue to confirm what your options are.

Is there any risk in submitting a false dispute claim?

Submitting false claims can have serious consequences. Axis Bank’s declaration section indicates that submitting information that is found to be false or maliciously made can lead to civil or criminal action. Hence, providing accurate and truthful information is crucial when filling out the dispute form.

What happens after I submit my dispute claim?

After submission, the bank will initiate an investigation into your claim. This process may involve reviewing records from the merchant and any supporting documents you provided. The duration of the investigation can vary, but Axis Bank will keep you informed throughout the process until a resolution is reached.

Common mistakes

Filling out the Axis Bank Dispute form can seem straightforward, but there are common mistakes that can complicate the process. Understanding these mistakes can help ensure a more efficient resolution to your dispute.

One of the most frequent errors is failing to provide complete contact information. Users might forget to fill in their name, contact number, or email address. These details are essential for the bank to reach out and address the dispute. If any part of this information is missing, it delays the response time as the bank has to seek clarification.

Another common mistake involves incomplete transaction details. Cardholders often forget to include all necessary information about the disputed transactions. This includes the transaction date, merchant name, and amounts involved. Without accurate details, the bank may struggle to identify the transaction and understand the nature of the dispute.

Some individuals mistakenly check off multiple reasons for disputing a transaction without providing clear explanations. It is crucial to be specific about the issues being faced. Simply checking multiple boxes without elaboration does not help the bank understand the situation and can lead to confusion in the review process.

Additionally, not attaching supporting documentation is a common pitfall. Many cardholders overlook the need to include relevant correspondence, receipts, or proof of return. Supporting documents substantiate the claim and provide the necessary evidence for the bank's investigation. Without this, claims may be dismissed or require additional clarification, causing further delays.

Finally, some people neglect to read the declaration section carefully. This part requires confirmation that the information provided is accurate. A lack of attention here could result in unintended consequences, especially if the form is found to be misleading or false. Every statement made should be truthful to avoid potential civil or criminal repercussions.

Documents used along the form

The Axis Bank Dispute Form is essential for resolving transaction issues, but it often works alongside other important documents. Below is a list of related forms and documents that may be needed during the dispute process, outlining their purposes.

- Transaction History Statement: This document details all transactions associated with a specific account. It helps the cardholder verify the disputed charge and provides evidence of the transaction in question.

- Merchant Correspondence: Any emails, letters, or messages exchanged with the merchant related to the disputed transaction. This proves attempts to resolve the issue directly with the merchant.

- Credit Slip or Refund Note: A document issued by the merchant confirming that a refund has been processed. This is vital when disputing a transaction that should result in a refund.

- Cancellation Letter: If the dispute involves a cancelled service or subscription, this letter can show that the cancellation was communicated to the merchant.

- Charge-Slip or Receipt: This is the proof of the original transaction. It details the date, amount, and nature of the charge, serving as crucial evidence in disputes.

- Bank Statement: A detailed account statement from the bank that showcases all transactions over a specific period. It can help verify unauthorized charges or discrepancies in amounts.

These documents support the process of disputing transactions and provide necessary information to help resolve issues efficiently. Always ensure to keep copies of all relevant correspondence and documents when filing a dispute.

Similar forms

- Credit Card Dispute Form: This document serves a similar purpose, allowing cardholders to report unauthorized or disputed transactions on their credit card accounts. Like the Axis Bank Dispute Form, it requires details about the transaction and reasons for the dispute.

- Fraud Reporting Form: Customers use this form to report suspicious activity or potential fraud on their accounts. Both forms require personal information and transaction details to investigate the claim effectively.

- Chargeback Request Form: When customers want to reverse a charge due to dissatisfaction or unauthorized transactions, they use this form. It mirrors the Axis Bank Dispute Form in collecting transaction specifics and supporting evidence.

- Refund Request Form: This document is used by customers seeking a refund for a transaction. The requirements for supporting documentation and detailed transaction information are comparable to those in the Axis Bank Dispute Form.

- Return Merchandise Authorization (RMA) Form: This form is used for returning items purchased and often needs reason codes and transaction details, aligning closely with the structure of the Axis Bank Dispute Form.

- Identity Theft Claim Form: When customers believe their personal information has been compromised, they can file this claim. Similar to the dispute form, it requires detail-oriented information to establish the claim's validity.

- Loan Dispute Form: Customers can use this form if they find discrepancies in their loan statements. Both forms focus on accurate information and provide a channel for addressing financial disputes.

- Consumer Complaint Form: This is used to lodge complaints against merchants or service providers. Like the Axis Bank Dispute Form, it requires explicit details about the issue and the involved parties to facilitate resolution.

Dos and Don'ts

Things You Should Do:

- Ensure that all personal information, such as your name and contact details, is accurate.

- Provide clear details of the disputed transaction, including the date and amount.

- Attach any supporting documents, like receipts or correspondence with the merchant.

- Check the appropriate reasons for the dispute to help expedite the process.

Things You Shouldn't Do:

- Do not leave any fields blank; incomplete forms can delay your claim.

- Avoid using vague language; be specific about the issue to ensure clarity.

- Do not forget to sign and date the form before submission.

- Do not submit false information as this can lead to serious consequences.

Misconceptions

Misconceptions can lead to confusion, especially when dealing with financial institutions like Axis Bank. Here are eight common misconceptions about the Axis Bank Dispute Form, clarified for better understanding.

- Submitting the form guarantees a refund. Many believe that simply filling out the form will ensure they receive their money back. However, completion of the form initiates a review process; approval is not guaranteed.

- All disputes are handled the same way. Each dispute varies based on the nature of the claim. Axis Bank assesses disputes individually, considering evidence and circumstances.

- The bank requires no documentation. In fact, providing supporting documents, such as receipts and correspondence, is crucial for substantiating your claim. Without proper documentation, the bank may not process your dispute favorably.

- Only recent transactions can be disputed. Customers often think they can only dispute transactions within a limited time frame. However, Axis Bank allows for disputes on transactions that may have occurred several weeks or even months ago, depending on bank policy.

- Filing a dispute is a lengthy process. While some may fear that resolving a dispute takes an eternity, Axis Bank aims to provide timely responses. The actual resolution time can vary based on the specifics of the case, but prompt communication helps speed up the process.

- All types of transactions can be disputed. Not all transactions qualify for dispute resolution. For example, transactions that are clearly authorized or that fall outside of the bank's parameters may not be eligible for dispute handling.

- Disputing a charge affects your credit score. Many worry that filing a dispute will negatively impact their credit report. Generally, disputing a charge does not affect your credit score, as it is a process to resolve discrepancies, not an indicator of credit risk.

- Your signature is optional on the form. Contrary to popular belief, a signature is essential. It serves as a declaration of authenticity and intent, making it clear that the claim is made in good faith.

Understanding these misconceptions can empower cardholders to navigate disputes with confidence and clarity. Always remember to read the terms and troubleshoot any uncertainties directly with the bank.

Key takeaways

When filling out the Axis Bank Dispute form, it is important to follow these key takeaways:

- Cardholder Information: Ensure your name, contact number, email, and card details are correctly entered to facilitate timely processing.

- Transaction Details: Accurately list each disputed transaction, including transaction date, merchant name, and amounts in both currency columns.

- Reason for Dispute: Clearly identify the reason for disputing each transaction by checking the appropriate box provided in the form.

- Supporting Documentation: Attach relevant documents, such as receipts, correspondence with merchants, or proof of return, to reinforce your claim.

- Declaration Section: Complete the declaration to affirm that all information provided is accurate and truthful.

- Signature and Date: Ensure to sign the form and include the date to validate your submission.

- Submission Method: Submit the form via the designated address or fax number, ensuring you retain copies of everything for your records.

Following these guidelines will help in processing your dispute effectively.

Browse Other Templates

De9 - Accuracy is essential to avoid penalties or delays.

Walk in Dmv Near Me - The DMV may request additional proof of ownership after submission.