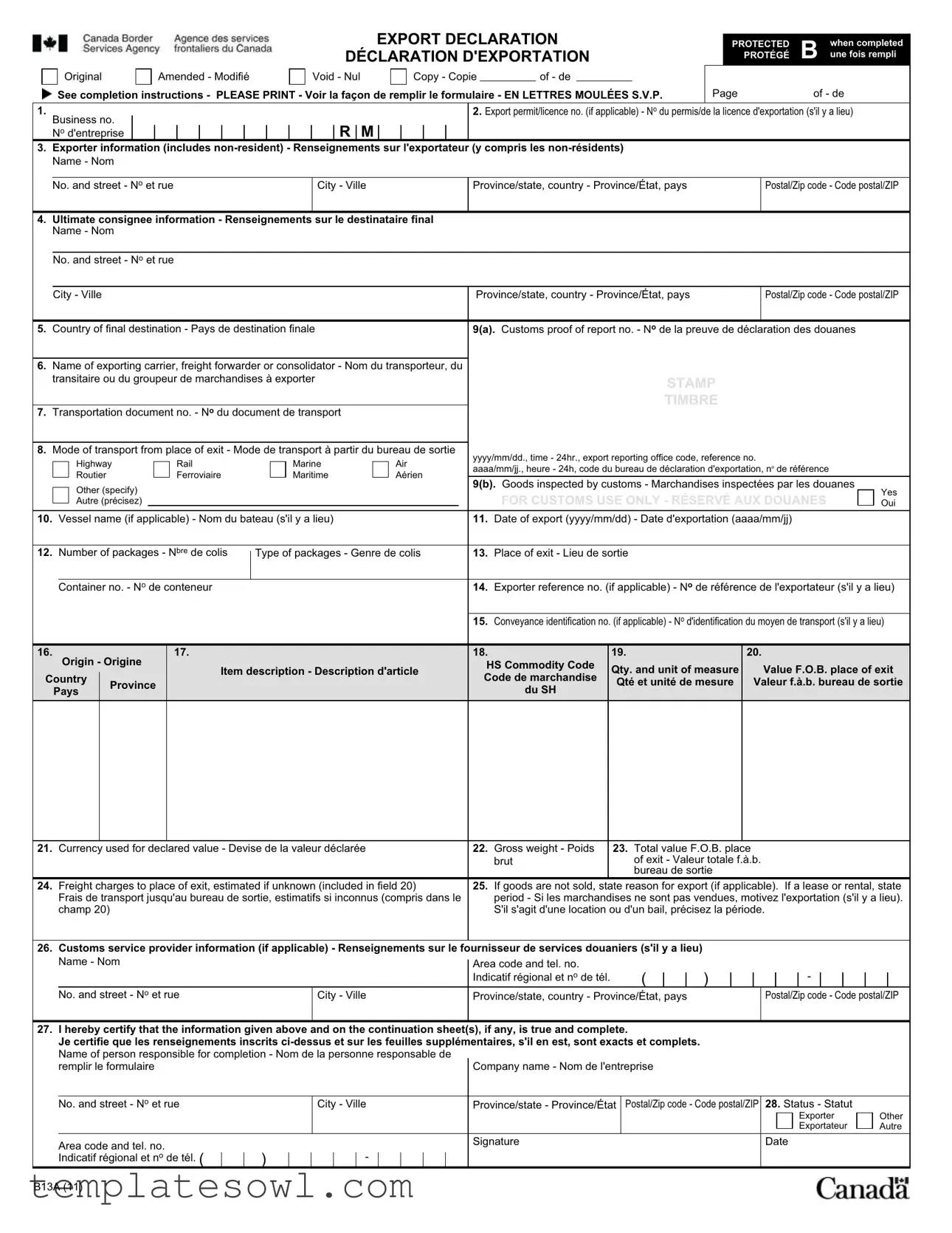

Fill Out Your B13A Form

The B13A form plays a crucial role in the exportation process, serving as a comprehensive declaration required by Canadian customs authorities. This document demands detailed information about the exporting business, including its Business Number and any relevant export permits or licenses. It requires specifics about the ultimate consignee, such as their name and address, along with the country of final destination for the goods. The mode of transport and the name of the exporting carrier must also be indicated, which is essential for tracking the shipment. Various items on the form, including details about the goods being exported—such as quantity, value, and HS Commodity Code—are mandatory. Additionally, the B13A accounts for logistical nuances like weight, number of packages, and the reason for export if goods are not sold. Compliance with the completion instructions is vital; the form must be legible, and correct checkboxes must be marked to indicate whether it is an original, amended, void, or copy submission. Ensuring the accuracy of the information provided is not just a procedural requirement but also impacts possible penalties under the Administrative Monetary Penalty System. In all, the B13A form encapsulates a significant amount of data that must be meticulously completed to facilitate a seamless export process while adhering to regulatory guidelines.

B13A Example

EXPORT DECLARATION

DÉCLARATION D'EXPORTATION

PROTECTED |

when completed |

PROTÉGÉ |

B une fois rempli |

|

|

|

Original |

|

|

|

|

|

|

Amended - Modifié |

|

|

|

|

|

|

Void - Nul |

|

|

|

|

|

|

Copy - Copie |

|

|

of - de |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page |

|

|

|

|

|

|

|

|

of - de |

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

See completion instructions - PLEASE PRINT - Voir la façon de remplir le formulaire - EN LETTRES MOULÉES S.V.P. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

1. |

Business no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Export permit/licence no. (if applicable) - No du permis/de la licence d'exportation (s'il y a lieu) |

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

|

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

No d'entreprise |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

3. Exporter information (includes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

Name - Nom |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

No. and street - No et rue |

|

|

|

|

|

|

City - Ville |

Province/state, country - Province/État, pays |

|

|

|

|

|

|

Postal/Zip code - Code postal/ZIP |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

4. Ultimate consignee information - Renseignements sur le destinataire final |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

Name - Nom |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

No. and street - No et rue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

City - Ville |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Province/state, country - Province/État, pays |

|

|

|

|

|

|

Postal/Zip code - Code postal/ZIP |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

5. |

Country of final destination - Pays de destination finale |

|

|

|

|

|

|

|

|

|

|

9(a). Customs proof of report no. - No de la preuve de déclaration des douanes |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

6. Name of exporting carrier, freight forwarder or consolidator - Nom du transporteur, du |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

transitaire ou du groupeur de marchandises à exporter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STAMP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIMBRE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

7. Transportation document no. - No du document de transport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

8. Mode of transport from place of exit - Mode de transport à partir du bureau de sortie |

yyyy/mm/dd., time - 24hr., export reporting office code, reference no. |

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

Highway |

|

|

|

|

Rail |

|

|

|

|

Marine |

|

|

|

|

Air |

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

aaaa/mm/jj., heure - 24h, code du bureau de déclaration d'exportation, no de référence |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

Routier |

|

|

|

|

|

|

|

|

|

Ferroviaire |

|

|

|

|

Maritime |

|

|

|

|

Aérien |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9(b). Goods inspected by customs - Marchandises inspectées par les douanes |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

Other (specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

Autre (précisez) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR CUSTOMS USE ONLY - RÉSERVÉ AUX DOUANES |

|

|

Oui |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

10. |

|

Vessel name (if applicable) - Nom du bateau (s'il y a lieu) |

|

|

|

|

|

|

|

|

|

|

11. |

Date of export (yyyy/mm/dd) - Date d'exportation (aaaa/mm/jj) |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

12. |

|

Number of packages - Nbre de colis |

|

Type of packages - Genre de colis |

13. |

Place of exit - Lieu de sortie |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Container no. - No de conteneur |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Exporter reference no. (if applicable) - No de référence de l'exportateur (s'il y a lieu) |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. Conveyance identification no. (if applicable) - No d'identification du moyen de transport (s'il y a lieu) |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

|

Origin - Origine |

|

17. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

|

|

|

19. |

|

|

|

|

|

|

|

|

20. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item description - Description d'article |

|

HS Commodity Code |

Qty. and unit of measure |

|

|

|

Value F.O.B. place of exit |

||||||||||||||||||||||||||||||||||||||||||||||||||

|

Country |

|

|

|

|

|

|

|

|

|

|

|

|

Code de marchandise |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Province |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Qté et unité de mesure |

|

Valeur f.à.b. bureau de sortie |

||||||||||||||||||||||||||||||||||||||

|

|

Pays |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

du SH |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

|

Currency used for declared value - Devise de la valeur déclarée |

22. |

Gross weight - Poids |

23. |

Total value F.O.B. place |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

brut |

|

|

of exit - Valeur totale f.à.b. |

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

bureau de sortie |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

24. |

|

Freight charges to place of exit, estimated if unknown (included in field 20) |

25. |

If goods are not sold, state reason for export (if applicable). If a lease or rental, state |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

Frais de transport jusqu'au bureau de sortie, estimatifs si inconnus (compris dans le |

|

|

period - Si les marchandises ne sont pas vendues, motivez l'exportation (s'il y a lieu). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

champ 20) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S'il s'agit d'une location ou d'un bail, précisez la période. |

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

26. Customs service provider information (if applicable) - Renseignements sur le fournisseur de services douaniers (s'il y a lieu) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

Name - Nom |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Area code and tel. no. |

|

|

( |

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicatif régional et no de tél. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

No. and street - No et rue |

|

|

|

|

|

|

City - Ville |

Province/state, country - Province/État, pays |

|

|

|

|

|

|

Postal/Zip code - Code postal/ZIP |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

27. I hereby certify that the information given above and on the continuation sheet(s), if any, is true and complete. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

Je certifie que les renseignements inscrits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

Name of person responsible for completion - Nom de la personne responsable de |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

remplir le formulaire |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company name - Nom de l'entreprise |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

No. and street - No et rue |

|

|

|

|

|

|

City - Ville |

Province/state - Province/État |

Postal/Zip code - Code postal/ZIP |

28. Status - Statut |

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exporter |

|

|

|

Other |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exportateur |

|

|

|

Autre |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Area code and tel. no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

Indicatif régional et no de tél. ( |

|

|

|

|

) |

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

B13A (11) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

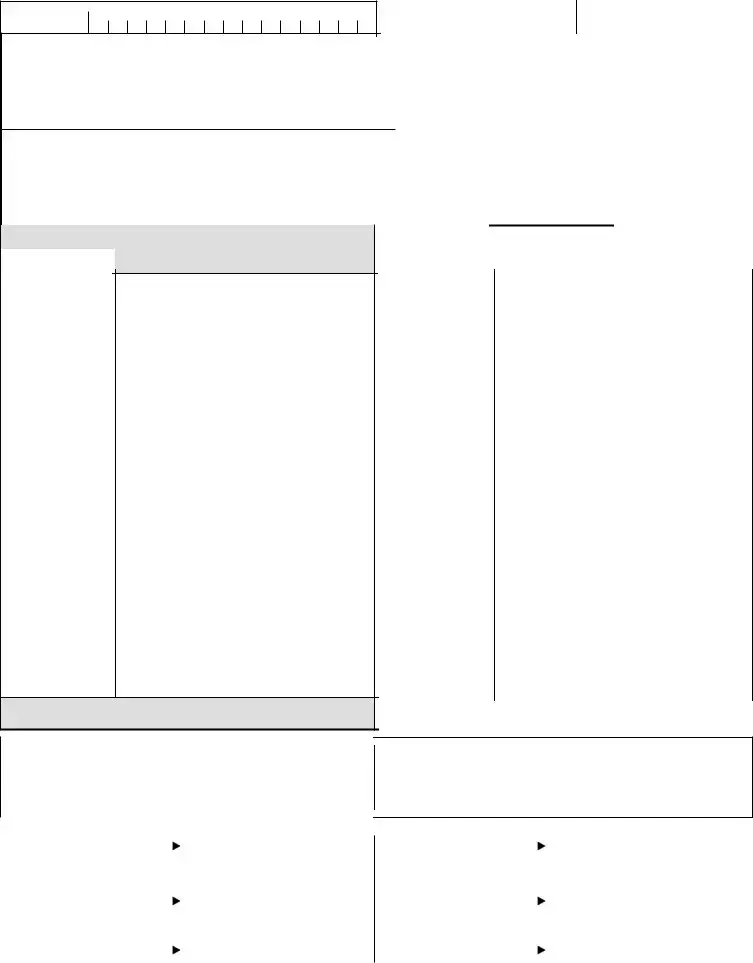

EXPORT DECLARATION - CONTINUATION SHEET |

|

|

||

PROTECTED |

when completed |

|||

DÉCLARATION D'EXPORTATION - FEUILLE SUPPLÉMENTAIRE |

|

PROTÉGÉ |

B une fois rempli |

|

1. Business no. |

R M |

|

|

No d'entreprise |

Page |

of - de |

2.Export permit, licence or certificate no. (if applicable) - No du permis, du certificat ou de 12. Container no. - No de conteneur la licence d'exportation (s'il y a lieu)

14.Exporter reference no. (if applicable) - No de référence de l'exportateur (s'il y a lieu)

15.Conveyance identification no. (if applicable) - No d'identification du moyen de transport (s'il y a lieu)

16. Origin - Origine

Country |

Province |

|

Pays |

||

|

||

|

|

17.

Item description - Description d'article

18. |

19. |

20. |

|

HS Commodity Code |

Qty. and unit of measure |

Value F.O.B. place of exit |

|

Code de marchandise |

|||

Qté et unité de mesure |

Valeur f.à.b. bureau de sortie |

||

du SH |

|||

|

|

||

|

|

|

|

|

|

|

22.Gross weight - Poids brut

23.Total value F.O.B. place of exit - Valeur totale f.à.b. bureau de sortie

Information from this declaration will be used for customs control purposes, and may be shared with other government departments to enforce Canadian laws. Details are available in the Treasury Board of Canada publication called Info Source. Info Source is available at public libraries, government public reading rooms and on the Internet at: http://infosource.gc.ca.

Les renseignements fournis dans cette déclaration serviront à des fins de contrôle douanier et pourront être partagés avec d'autres ministères afin de faire respecter les lois canadiennes. Vous trouverez des détails à ce sujet dans la publication du Conseil du Trésor du Canada, Info Source. Info Source est disponible dans les bibliothèques publiques, les salles de lecture publiques du gouvernement et sur Internet à http://infosource.gc.ca.

For information on how to report exports and how to code export commodities, contact:

For statistical information, contact:

For information on exports, refer to

Data Assembly Section

International Trade Division, Statistics Canada Tel: (613)

Marketing and Client Services Section International Trade Division, Statistics Canada Tel: (613)

Tel: 1 (800)

Tel: (204)

visit the CBSA Web site at: www.cbsa.gc.ca

Pour des renseignements sur la façon de déclarer vos exportations et sur la codification des marchandises exportées, communiquez avec :

Pour des renseignements statistiques, communiquez avec :

Pour des renseignements sur les exportations, consultez le

Unité de la collecte des Données

Division du commerce international, Statistique Canada Tél. : (613)

Section du Marketing et Services à la clientèle

Division du commerce international, Statistique Canada Tél. : (613)

Courriel : commerce@statcan.gc.ca

Tél. : 1 800

Tél. : (204)

le site Web de l'ASFC au : www.asfc.gc.ca

Courriel :

B13A - EXPORT DECLARATION |

B13A - DÉCLARATION D'EXPORTATION |

Completion Instructions |

Façon de remplir le formulaire |

PLEASE PRINT. ILLEGIBLE FORMS ARE NOT ACCEPTABLE AND MAY BE SUBJECT TO PENALTY. ALL FIELDS ARE MANDATORY IF APPLICABLE.

Original, amended, void and copy: check the appropriate box to indicate whether the B13A is the original document, has been amended, has been submitted but cancelled, or is a copy of the original document. Copies are required for multiple shipments. For copies, state which copy is represented, e.g., copy 2 of 4. If the document is a copy of an amended document, both the "Amended" and "Copy" boxes are to be checked.

Page __ of __: write "Page 1 of 1" if only the first page is submitted. If the first page plus two continuation sheets are submitted, write "Page 1 of 3" on the first page.

EN LETTRES MOULÉES S.V.P. LES FORMULAIRES ILLISIBLES NE SONT PAS ACCEPTABLES ET POURRAIENT DONNER LIEU À DES SANCTIONS. TOUS LES CHAMPS SONT OBLIGATOIRES S'IL Y A LIEU.

Document original, modifié, annulé et copie : cochez la case appropriée afin d'indiquer si le B13A est le document original, s'il a été modifié, s'il a été présenté, puis annulé, ou s'il s'agit d'une copie du document original. Des copies sont requises pour les expéditions multiples.

Pour les copies, veuillez indiquer ce qu'elles représentent, p. ex. copie 2 de 4. S'il s'agit d'une copie d'un document modifié, les cases intitulées « Modifié » et « Copie » doivent être cochées.

Page __ de __ : écrivez « Page 1 de 1 » si seulement la première page est présentée. Si, en plus de la première page, deux feuilles supplémentaires sont présentées, écrivez « Page 1 de 3 » sur la première page.

Explanation |

Explication |

Field No. |

Champ n° |

1.Enter the federal government assigned Business Number (BN), including the six- digit RM account identifier, of the person or company that exports the goods or causes them to be exported.

Exception: Enter NBNR (No BN Required) when a conveyance is permanently exported by a diplomat, as a personal effect or as a gift/donation.

1.Inscrivez le numéro d'entreprise (NE) assigné par le gouvernement, y compris l'identificateur de compte RM de six chiffres, de la personne ou de l'entreprise qui exporte les marchandises ou suscite leur exportation.

Exception : Inscrivez ANER (aucun NE requis) lorsqu'un moyen de transport est exporté en permanence par un diplomate en tant qu'effet personnel ou cadeau/don.

Note: Administrative Monetary Penalty System penalties will be assessed against |

Nota : Toute pénalité en vertu du Régime de sanctions administratives pécuniaires sera |

the company whose BN appears on the form. |

imposée à l'endroit de l'entreprise dont le NE apparaît sur le formulaire. |

To request a BN, visit the Canada Revenue Agency Web site at

Continuation sheet(s) may be included to provide the information found in fields 2, 12,

2.State the permit, licence or certificate number for goods and technologies subject to export controls. This includes goods and technologies covered under General Export Permits (GEP).

3.An exporter is defined as the person or company, including a

1. If the BN is that of a customs service provider (CSP), state the name/address of the person or company contracting the CSP.

4.Enter the full name and address of the ultimate consignee or, if not available, the name and address of the foreign importer.

5.Show the country of final destination where the goods are to be consumed, further processed or manufactured, as known at the time of export.

6.Show the name of the carrier that will transport the goods out of Canada or the name of the freight forwarder or consolidator handling the exportation.

7.Indicate the reference number that the carrier will use to track the shipment (e.g., booking number, manifest number, waybill number or file number of the CSP).

8.Check the box indicating the last mode of transport by which the goods left the country. For the box "Other" specify the mode, e.g., pipeline. Goods travelling by truck on an air waybill to a U.S. airport for shipment overseas are considered highway exports.

9.(a) Stamp the B13A, either manually or by using the stamp machine, at the customs office (an inland office or at the place of exit) where the goods are reported and available for inspection. The stamp must be identical on the three copies of the B13A. Indicate the date and time the B13A was submitted, the export reporting office code and a unique

(b) If the goods are inspected by customs, the customs officer will affix his/her stamp in this field and check the "Yes" box.

10.If the mode of transport is marine, provide the vessel name.

11.Show the date the goods are expected to be exported.

12.Show the number and type of packages (e.g., 3 drums, 7 skids). For car load, truck load, or container load shipments, show the car, trailer or container number. If the container no. is not available, write TBD. Amend declaration when no. is known. Write bulk, break bulk, RORO

Pour obtenir un NE, accédez au site Web de l'Agence du revenu du Canada (ARC) à l'adresse

1 800

Des feuilles supplémentaires peuvent être incluses pour fournir les renseignements qui correspondent aux champs 2, 12, 14 à 20, 22 et 23.

2.Indiquez le numéro du permis, du certificat ou de la licence pour les marchandises et technologies assujetties à des contrôles d'exportation. Ceci comprend les marchandises et technologies visées par une licence générale d'exportation (LGE).

3.Un exportateur s'entend d'une personne ou d'une entreprise, y compris un

4.Inscrivez le nom et l'adresse complète du destinataire final ou, si non disponible, le nom et l'adresse de l'importateur étranger.

5.Indiquez le pays de destination finale où les marchandises doivent être consommées, transformées ou ouvrées davantage, tel que connu au moment de l'exportation.

6.Indiquez le nom du transporteur qui transportera les marchandises à l'extérieur du Canada ou le nom du transitaire ou du groupeur qui s'occupera de l'exportation.

7.Indiquez le numéro de référence dont se servira le transporteur afin de retracer l'envoi (p. ex. le numéro de contrat, de manifeste, de connaissement ou de dossier du fournisseur de services douaniers).

8.Cochez la case indiquant le dernier mode de transport emprunté par les marchandises quittant le pays. Pour la case « autre », veuillez préciser le mode, p. ex. pipeline. Les marchandises transportées par camion jusqu'à un aéroport américain pour une expédition outremer sont considérées comme étant exportées par mode routier.

9.(a) Le B13A doit être estampillé manuellement ou à l'aide d'un timbre dateur au bureau de douane (à un bureau intérieur ou au bureau de sortie) où les marchandises sont déclarées et disponibles pour inspection. Les timbres apparaissant sur les trois copies du B13A doivent être identiques. Indiquez la date et l'heure de soumission du B13A, le code du bureau de déclaration d'exportation et un numéro de référence unique de six chiffres.

(b)Si les marchandises font l'objet d'une inspection, l'agent apposera le timbre des douanes dans ce champ et cochera la case « oui ».

10.Si le mode de transport est maritime, inscrivez le nom du bateau.

11.Indiquez la date prévue d'exportation.

12.Indiquez le nombre et le genre de colis (p. ex. : 3 cylindres, 7 palettes). Pour les expéditions en wagon, en camion ou en conteneur, veuillez indiquer le numéro de wagon, de camion ou de conteneur. Si le nº de conteneur n'est pas disponible, veuillez inscrire « à déterminer ». Modifiez la déclaration si le numéro est connu. Veuillez inscrire vrac, marchandises diverses, transbordeur roulier, cargo

B13A - EXPORT DECLARATION |

B13A - DÉCLARATION D'EXPORTATION |

Completion Instructions |

Façon de remplir le formulaire |

Explanation |

Explication |

Field No. |

Champ n° |

13.State the place of exit through which the goods are expected to leave Canada.

14.Enter the exporter's internal reference number that can be used to trace the shipment - usually an invoice or purchase order number.

15.If the good being exported from Canada is a conveyance, enter the vehicle identification number (VIN), the hull identification number (HIN) or the serial number of the conveyance. Conveyances for export include vehicles, motorcycles, all terrain vehicles, boats, etc. which are found in Chapters 87, 88 and 89 of the Customs Tariff. This does not include the identification number of the transport vehicle used to export the conveyance.

16.If the goods are of Canadian origin, state the province from which the goods were grown, mined or manufactured. If not, state the country. In addition, if the goods are further processed imported goods or are imported goods being exported, state the province from which the goods are exported.

17.Provide a complete description of the goods in normal trade terms with sufficient detail to verify the declared HS code. General terms such as groceries, meats, dry goods, machinery, parts, prints, etc., will not be accepted. Describe each individual item with a separate classification number on a separate line. If a conveyance is exported, state the VIN, HIN or serial number of the conveyance to be exported.

18.State either the Canadian 8 digit HS export code or the Canadian 10 digit import code from the Customs Tariff. Exporters of chemicals listed in 7003 of the Export Control List should use the 10 digit HS import code. Exporters can obtain information on the Canadian HS codes by referring to the contact information provided at the bottom of the continuation sheet or by visiting www.statcan.ca/english/tradedata/cec/index.htm.

19.For each line, state the quantity and unit of measurement for each item as specified by the Canadian export classification requirements or the import customs tariff or the permit. If no quantity or unit exists, and if the goods are not controlled by an Other Government Department, leave the field blank.

Note: When weight is required, show the net weight not including outercoverings. Use metric measurements, ex. International System of Units (SI).

13.Indiquez le bureau de sortie où les marchandises doivent quitter le Canada.

14.Inscrivez le numéro de référence interne de l'exportateur dont

15.Si la marchandise exportée du Canada est un moyen de transport, inscrivez le numéro d'identification du véhicule (NIV), le numéro d'identification de coque (NIC) ou le numéro de série du moyen de transport. Les moyens de transport pour exportation comprennent les véhicules, les motocyclettes, les véhicules tous terrains, les bateaux, etc. tel que décrit aux chapitres 87, 88 et 89 du Tarif des douanes. Ceci ne comprend pas le numéro d'identification du véhicule utilisé pour l'exportation du moyen de transport.

16.Si les marchandises sont d'origine canadienne, indiquez la province où elles ont été cultivées, minées ou fabriquées. Sinon, veuillez indiquer le pays d'origine. De plus, s'il s'agit de marchandises importées transformées davantage ou de marchandises importées qui sont exportées, indiquez la province d'où elles sont exportées.

17.Fournissez une description complète des marchandises en utilisant une terminologie commerciale normale avec suffisamment de détails pour vérifier le code SH déclaré. Des termes généraux, tels que viandes, marchandises sèches, machineries, imprimés, ne seront pas acceptés. Décrivez chaque article portant un numéro de classement distinct sur une ligne distincte. S'il s'agit de l'exportation d'un moyen de transport, indiquez le NIV, le NIC ou le numéro de série du moyen de transport à exporter.

18.Indiquez le numéro du Système harmonisé (SH) canadien à 8 chiffres ou le code d'importation à 10 chiffres du Tarif des douanes. Les exportateurs de substances chimiques énumérées sous 7003 de la Liste des marchandises d'exportation contrôlée doivent utiliser le code SH à 10 chiffres. Les exportateurs peuvent obtenir de plus amples informations sur les codes du SH canadien en se référant aux coordonnées de contact fournies au bas de la feuille supplémentaire ou en consultant le : www.statcan.ca/francais/tradedata/cec/index_f.htm.

19.Pour chaque ligne, indiquez la quantité et l'unité de mesure pour chaque article tel qu'indiqué dans les exigences de la nomenclature canadienne des exportations, dans le tarif des douanes pour les importations ou sur la licence. S'il n'y a pas de quantité ou d'unité et si les marchandises ne sont pas sous contrôle d'un autre ministère, n'inscrivez rien dans la case.

Nota : Lorsqu'un poids est requis, inscrivez le poids net, sans inclure les revêtements extérieurs. Veuillez utiliser des mesures métriques, p. ex. le Système international

d'unités (SI).

20.State the value of each item on a separate line. This value will include the freight charges, handling, insurance, or similar charges incurred to the place of exit from Canada, minus any discounts entered into prior to exportation, but will exclude the portion of these charges that apply from the Canadian place of exit to the foreign destination. If the goods are shipped "no charge", show the value the goods would have been sold for under normal conditions.

21.Identify the currency used in fields 20 and 23 (e.g., Canadian dollars, U.S. dollars, Japanese yen). If a continuation sheet is required for fields

22.State the gross shipping weight which is the actual weight of the goods and packaging, but excludes the weight of

23.Enter the total of the values found in field 20.

24.Show the freight charge in Canadian dollars from the place of lading to the place of exit from Canada (estimate the amount if unknown, this includes the use of Incoterms). For example, goods shipped from Edmonton to Vancouver by rail, to be put on a ship for Japan, show the rail costs only. Shipments leaving Toronto by air, show zero if no charges were incurred in getting the goods to the airport.

20.Indiquez la valeur de chaque article sur une ligne différente. Cette valeur devra comprendre les frais de transport, de manutention, d'assurance ou tout frais semblable occasionné jusqu'au bureau de sortie du Canada, moins tout rabais accordé avant l'exportation, mais devra exclure la partie de ces frais qui s'appliquent à partir du bureau de sortie du Canada jusqu'à la destination étrangère. Si les marchandises sont expédiées « sans frais », inscrivez la valeur à laquelle les marchandises auraient été vendues dans des conditions normales.

21.Identifiez la devise dont vous vous servez dans les champs 20 et 23 (p. ex. dollars canadiens, dollars américains, yen japonais). Si une feuille supplémentaire est requise pour les champs 16 à 20, les champs 22 et 23 ne doivent être remplis que sur cette feuille.

22.Inscrivez le poids brut de l'expédition, ce qui est le poids total des marchandises et de l'emballage, mais en excluant le poids des conteneurs réutilisables.

23.Indiquez le total des valeurs inscrites au champ 20.

24.Indiquez les frais de transport en dollars canadiens du lieu de déchargement au bureau de sortie du Canada (estimez le montant à défaut de connaître ces frais, ceci comprend l'utilisation d'Incoterms). Par exemple, pour des marchandises expédiées d'Edmonton à Vancouver par rail, afin d'être chargées sur un navire à destination du Japon, indiquez seulement le coût du transport ferroviaire. Pour des expéditions partant de Toronto par avion, indiquez zéro si aucuns frais n'ont été engagés pour transporter les marchandises jusqu'à l'aéroport.

25.If the goods are not sold, state the reason for the export, (e.g., repair and return, lease, transfer of company goods). If the goods have been leased to a person/ company in another country, identify the period of the lease or rental agreement.

26.Enter the name, address, and telephone number, including area code of the customs service provider.

27.Show the name, company, address, and telephone number of the person who completed form B13A. The person responsible for the accuracy of the data must sign in this field.

28.Indicate whether the person signing the declaration is the exporter of the goods or another person, i.e. acting on behalf of the exporter such as a customs service provider.

25.Si les marchandises ne sont pas vendues, donnez la raison de l'exportation (p. ex. réparation et retour, bail, transfert de marchandises appartenant à l'entreprise). Si les marchandises ont été louées à une personne ou à une entreprise dans un autre pays, indiquez la période visée par le bail ou par la location.

26.Inscrivez le nom, l'adresse et le numéro de téléphone, y compris le code régional du fournisseur de services douaniers.

27.Indiquez le nom, l'entreprise, l'adresse et le numéro de téléphone de la personne qui a rempli le formulaire B13A. La personne responsable de l'exactitude des données doit signer dans ce champ.

28.Indiquez si la personne qui signe la déclaration est l'exportateur des marchandises ou une autre personne représentant

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Form Purpose | The B13A form is used for export declarations in Canada, allowing authorities to track the movement of goods leaving the country. |

| Business Number | Exporters must provide their federally assigned Business Number, essential for identifying the entity responsible for the export. |

| Customs Proof | This form requires a customs proof of report number, ensuring that the exporting goods are accounted for in customs records. |

| Mode of Transport | Exporters must specify the mode of transport used when the goods leave Canada, including options like highway, rail, marine, or air. |

| Goods Description | A detailed description of the goods must be provided, ensuring accuracy in classification and compliance with customs requirements. |

| Governing Law | The B13A form is governed by Canadian customs regulations as part of the Customs Act and the Export and Import Permits Act. |

Guidelines on Utilizing B13A

After completing the B13A form, it is essential to submit it to the customs office where the goods are reported for export. Ensure that all relevant information is accurate and complete, as any errors may lead to penalties or delays in the export process.

- In field 1, enter the federal Business Number (BN) assigned to the exporter, including the six-digit RM account number.

- If applicable, provide the export permit, license, or certificate number in field 2.

- Complete information about the exporter in field 3, including name and address.

- In field 4, enter the name and address of the ultimate consignee.

- Indicate the country of final destination in field 5.

- Input the name of the exporting carrier or freight forwarder in field 6.

- Provide the transportation document number in field 7.

- Select the mode of transportation for the shipment in field 8.

- Stamp the form in field 9(a) at the customs office, and if inspected, check the appropriate box in 9(b).

- If applicable, enter the vessel name in field 10.

- Indicate the expected date of export in field 11.

- Complete the number and type of packages in field 12.

- State the place of exit for the goods in field 13.

- Enter the exporter reference number in field 14 if applicable.

- If exporting a conveyance, provide its identification number in field 15.

- Indicate the origin of the goods in field 16.

- Provide a detailed item description in field 20.

- Include the HS Commodity Code in field 18.

- Enter the quantity and unit of measure for each item in field 19.

- State the value for each item in field 20.

- Indicate the currency used for declared value in field 21.

- Provide the gross weight of the shipment in field 22.

- Enter the total value in field 23.

- Specify estimated freight charges in field 24.

- If the goods are not sold, explain the reason for export in field 25.

- Include customs service provider information in field 26, if applicable.

- Enter the name and contact information of the person completing the form in field 27.

- Finally, indicate the status of the certifying person in field 28.

What You Should Know About This Form

What is the B13A form and why is it required?

The B13A form is an export declaration used in Canada. It must be completed when exporting goods out of the country. This form ensures that the exported items comply with Canadian laws and helps customs authorities track goods. It provides essential information about the exporter, the goods being shipped, and their destination. Completing this form accurately is crucial to avoid delays or penalties during the export process.

Who needs to fill out the B13A form?

Any person or company exporting goods from Canada must fill out the B13A form. This includes residents and non-residents. If a conveyance, such as a vehicle or boat, is being exported, special information about the conveyance may also be required. If an emigrant is exporting personal effects, they do not need to provide a Business Number (BN) while filling out the form. Regardless of who is exporting, all information must be complete and accurate.

What information is required on the B13A form?

The B13A form requires various details, including the exporter's business number, the ultimate consignee's information, and specifics about the goods being exported. You will need to provide descriptions, quantities, and values of the items. Details about the mode of transportation, destination country, and any applicable export permits or licenses must also be included. All information must be clearly written and ready for customs review.

What happens if the B13A form is not completed correctly?

If the B13A form is filled out incorrectly or is illegible, it may not be accepted by customs authorities. This can lead to delays in shipping, potential penalties, or even the refusal of the shipment. It is essential to ensure that all fields are completed as required and that the form is clear. If you realize there is an error after submission, you may need to file an amended form to correct the information provided.

How can I get assistance with completing the B13A form?

Common mistakes

Filling out the B13A form, which serves as an export declaration, can be a bit complex. Errors made during its completion can lead to delays and complications in the exporting process. Here are four common mistakes people often make when filling out this important document.

One frequent error is related to the business number. Many individuals forget to include their federally assigned Business Number (BN). The BN is essential as it identifies the exporter. In cases where an exception applies, such as a diplomat exporting personal effects, it’s important to note "NBNR" for "No BN Required." Not providing this information correctly can lead to unnecessary penalties.

Another common mistake involves inaccurate information in the ultimate consignee section. Exporters sometimes provide incomplete addresses or incorrect names for the ultimate consignee. This information is critical because it tells customs where the goods are headed. If this section is filled out incorrectly, shipments might be delayed or returned, which could result in additional costs.

People also tend to misinterpret the section on the item description. General terms like "mechanical parts" or "clothing" are often used, which do not offer enough detail. Customs requires a complete description of each item being exported, including quantity and value. Without this specific information, customs officials may need to stop the shipment to gather more details, causing delays.

Lastly, many individuals overlook the currency section. Exporters should clearly indicate which currency is used for values declared on the form. If not specified, customs could assume a different currency, leading to confusion regarding the total value of the shipment. Accurate declaration is crucial for proper processing of taxes and duties.

By being mindful of these common mistakes and double-checking the information provided on the B13A form, exporters can help ensure a smoother export process. Attention to detail helps in avoiding unnecessary complications and facilitates timely deliveries.

Documents used along the form

The B13A form is a crucial document for exporting goods from Canada. Along with it, several other forms and documents may be required to ensure compliance with customs regulations. Here are five commonly used documents that often accompany the B13A form.

- Export Permit or License: This document is necessary for certain goods subject to export controls. It verifies that the exporter has the legal authority to ship specific items out of the country.

- Customs Invoice: This provides detailed information regarding the goods being exported. It typically includes descriptions, quantities, and values, helping customs assess duties and taxes.

- Packing List: The packing list outlines the contents of each package being shipped. It serves as a reference for both the exporter and customs officials to ensure accuracy and completeness of the shipment.

- Bill of Lading: This serves as a contract between the exporter and the carrier. It outlines the responsibilities for transportation and can be either a document of title or receipt for the goods being shipped.

- Certificate of Origin: This document certifies the country where the goods are produced. It is often required by customs in the destination country to determine import duties and compliance with trade agreements.

Collectively, these documents facilitate a smooth export process and help to ensure compliance with international trade laws. Providing complete and accurate information will minimize delays and ensure successful shipment of goods.

Similar forms

- Customs Invoice (Form B3): Similar to the B13A, the Customs Invoice provides detailed information about the goods being exported. It requires specific details about the items, including their value and quantity, to determine duties and taxes.

- Export License Application: This document is necessary when exporting controlled goods. Like the B13A, it requires information on the exporter, consignee, and details of the goods to confirm compliance with export regulations.

- Bill of Lading: This document serves as a receipt for the goods and a contract for transportation. It shares similarities with the B13A in identifying the shipper, consignee, and a description of the cargo being transported.

- Export Packing List: The packing list details the contents of each package. Similar to the B13A, it outlines the quantity and type of goods being exported but with a focus on the packaging aspect.

- Freight Forwarder Agreement: This document outlines the terms between the exporter and the freight forwarder. It mirrors the B13A in detailing the transportation of goods and responsibilities in the export process.

- ATA Carnet: The ATA Carnet is used for temporary exports. Like the B13A, it provides customs documentation and details about the goods being taken out of the country.

- Commercial Invoice: This document is a bill from the seller to the buyer. It also requires detailed information about the goods, similar to the B13A, to facilitate customs clearance and valuation.

- Certificate of Origin: This document certifies the origin of the goods. It is similar to the B13A in exporting goods, as it provides valuable information to customs regarding trade agreements and duties.

- Shipper's Letter of Instruction: This document is provided to the freight forwarder and details how to handle the shipment. Like the B13A, it clarifies important details regarding the export process.

- Import Declaration: Though for the receiving country, an import declaration must include details the same way the B13A does for exports, providing information on the goods and their value for customs purposes.

Dos and Don'ts

- Do: Ensure all information is filled out clearly using capital letters to avoid any confusion.

- Do: Include the correct Business Number (BN) assigned by the federal government to the exporting entity.

- Do: Provide the full address of both the exporter and the ultimate consignee to facilitate processing.

- Do: Use precise language and detailed descriptions for goods. Avoid vague terms like "machinery" or "electronics."

- Don’t: Leave any mandatory fields blank, as all fields must be completed if applicable.

- Don’t: Forget to check the appropriate box indicating whether the form is original, amended, void, or a copy.

- Don’t: Assume the customs office will rectify any errors. Double-check all details before submitting.

- Don’t: Ignore deadlines for submission. Timely submissions are crucial for compliance and may avert penalties.

Misconceptions

- Misconception 1: The B13A form is only for Canadian exporters.

- Misconception 2: The B13A form can be submitted any time before shipment.

- Misconception 3: Any information can be provided in a general manner.

- Misconception 4: You do not need a Business Number (BN) if you are a personal exporter.

- Misconception 5: The B13A form is not relevant for goods under export control.

- Misconception 6: The B13A form is a one-page document.

This form is applicable not just to Canadian exporters, but also to non-residents who are exporting goods from Canada. Non-residents can also fill out the B13A to declare their exports.

It must be stamped at the customs office when the goods are reported and available for inspection. This stamp must be identical on all copies of the B13A submitted.

Specific details are crucial. For example, a complete description of the goods must be given in normal trade terms. Vague terms like "machinery" or "groceries" are unacceptable.

Normally, the B13A requires a BN. However, individuals exporting personal or household effects may use the designation NBNR (No BN Required).

If the goods are controlled or require a permit, it is mandatory to indicate the correct permit, license, or certificate number in the appropriate field on the B13A.

The B13A form can include continuation sheets for additional information about the export. Multiple pages may be necessary based on the details of the shipment.

Key takeaways

Key Takeaways on Filling Out and Using the B13A Form:

- The B13A form is mandatory for exporting goods from Canada, and all fields must be filled out accurately.

- Information must be provided regarding the exporter, including their Business Number (BN) and contact details.

- The form requires detailed descriptions of the goods, including quantity, value, and HS commodity codes to ensure proper classification.

- In some cases, a continuation sheet can be used to provide additional information if the space on the main form is insufficient.

- Ensure the stamp from the customs office is applied to the form, confirming that customs has inspected and accepted the shipment.

- Correct submission of the form is essential to avoid penalties, so it's important to ensure legibility and accuracy throughout the document.

Browse Other Templates

Printable Body Shop Quality Control Checklist - Regular inspections of waste storage areas are crucial for compliance.

Vbs Full Form - Gather needed details to tailor the VBS experience for each child.

How Many Hours Can a Minor Work per Week in California - Employers must maintain compliance with the stated work hours.