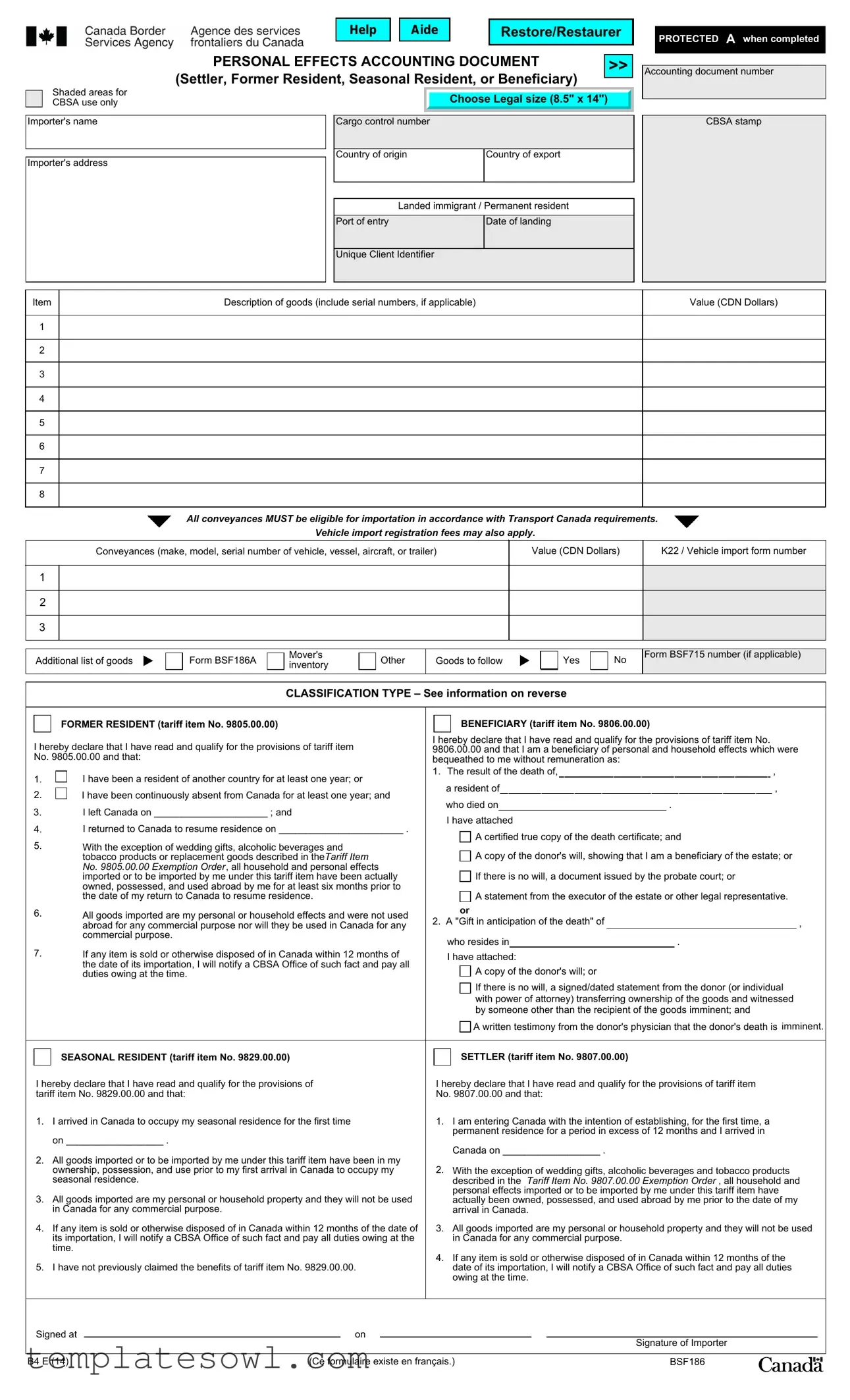

Fill Out Your B4 And B4E Form

The B4 and B4E forms serve vital functions within the framework of Canadian customs regulations, specifically addressing the importation of personal and household effects by various categories of individuals—settlers, former residents, seasonal residents, and beneficiaries. These forms are essential for individuals returning to Canada, as they facilitate the lawful declaration of goods and grant access to exemptions under specific tariff items. Each form includes critical sections requiring details such as the importer's name, cargo control numbers, and item descriptions, including serial numbers where applicable. Not only do they require a declaration of ownership and usage of the items abroad for a minimum period, but they also mandate that the goods imported are strictly for personal use and not for commercial purposes. Additionally, for beneficiaries receiving goods from deceased persons, specific documentation, such as death certificates and wills, is necessary to claim exemptions. Understanding the nuances of these forms, including the various tariff items—9805.00.00 for former residents, 9806.00.00 for beneficiaries, and 9807.00.00 for settlers—ensures compliance and can alleviate potential duties upon re-entry into Canada. Ultimately, the B4 and B4E forms play a key role in streamlining the customs process for individuals reintegrating into Canadian society, thus easing their transition and safeguarding their rights as returning residents.

B4 And B4E Example

Help |

Aide |

Restore/Restaurer |

PERSONAL EFFECTS ACCOUNTING DOCUMENT |

|

>> |

|

(Settler, Former Resident, Seasonal Resident, or Beneficiary) |

|

PROTECTED A when completed

Accounting document number

Shaded areas for CBSA use only

Importer's name

Importer's address

|

|

Choose Legal size (8.5" x 14") |

|

|

|

|

|

Cargo control number |

|

|

|

|

|

|

|

Country of origin |

|

Country of export |

|

|

|

|

|

|

|

||

Landed immigrant / Permanent resident |

|||

|

|

|

|

Port of entry |

|

Date of landing |

|

CBSA stamp

Unique Client Identifier

Item

1

2

3

4

5

6

7

8

Description of goods (include serial numbers, if applicable)

Value (CDN Dollars)

All conveyances MUST be eligible for importation in accordance with Transport Canada requirements.

Vehicle import registration fees may also apply.

|

Conveyances (make, model, serial number of vehicle, vessel, aircraft, or trailer) |

Value (CDN Dollars) |

K22 / Vehicle import form number |

|

|

|

|

1

2

3

Additional list of goods

Form BSF186A

Mover's inventory

Other

Goods to follow |

|

Yes |

|

No

Form BSF715 number (if applicable)

CLASSIFICATION TYPE – See information on reverse

|

|

FORMER RESIDENT (tariff item No. 9805.00.00) |

|

|

|

BENEFICIARY (tariff item No. 9806.00.00) |

||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||

|

I hereby declare that I have read and qualify for the provisions of tariff item |

I hereby declare that I have read and qualify for the provisions of tariff item No. |

||||||||||||||||||||||

|

9806.00.00 and that I am a beneficiary of personal and household effects which were |

|||||||||||||||||||||||

|

No. 9805.00.00 and that: |

bequeathed to me without remuneration as: |

|

|

|

|

|

|

|

|

||||||||||||||

1. |

|

I have been a resident of another country for at least one year; or |

1. |

The result of the death of, |

|

|

, |

|

|

|||||||||||||||

|

|

|

a resident of |

, |

|

|

||||||||||||||||||

2. |

|

I have been continuously absent from Canada for at least one year; and |

|

|

|

|

||||||||||||||||||

|

|

|

who died on |

|

|

. |

|

|

|

|

|

|

||||||||||||

3. |

|

I left Canada on _____________________ ; and |

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

I have attached |

|

|

|

|

|

|

|

|

|||||||||||||

4. |

|

I returned to Canada to resume residence on _______________________ . |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

A certified true copy of the death certificate; and |

||||||||||||||||||||

5. |

|

With the exception of wedding gifts, alcoholic beverages and |

|

|

|

|||||||||||||||||||

|

|

|

|

A copy of the donor's will, showing that I am a beneficiary of the estate; or |

||||||||||||||||||||

|

|

|

tobacco products or replacement goods described in theTariff Item |

|

|

|

||||||||||||||||||

|

|

|

No. 9805.00.00 Exemption Order, all household and personal effects |

|

|

|

If there is no will, a document issued by the probate court; or |

|||||||||||||||||

|

|

|

imported or to be imported by me under this tariff item have been actually |

|

|

|

||||||||||||||||||

|

|

|

owned, possessed, and used abroad by me for at least six months prior to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

the date of my return to Canada to resume residence. |

|

|

|

A statement from the executor of the estate or other legal representative. |

|||||||||||||||||

6. |

|

All goods imported are my personal or household effects and were not used |

2. |

|

or |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

abroad for any commercial purpose nor will they be used in Canada for any |

A "Gift in anticipation of the death" of |

|

|

|

|

, |

|

||||||||||||||

7. |

|

commercial purpose. |

|

|

who resides in |

|

|

. |

|

|

|

|

|

|||||||||||

|

If any item is sold or otherwise disposed of in Canada within 12 months of |

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

I have attached: |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

the date of its importation, I will notify a CBSA Office of such fact and pay all |

|

|

|

A copy of the donor's will; or |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

duties owing at the time. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

If there is no will, a signed/dated statement from the donor (or individual |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

with power of attorney) transferring ownership of the goods and witnessed |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

by someone other than the recipient of the goods imminent; and |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

A written testimony from the donor's physician that the donor's death is imminent. |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

SEASONAL RESIDENT (tariff item No. 9829.00.00) |

|

|

|

SETTLER (tariff item No. 9807.00.00) |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

I hereby declare that I have read and qualify for the provisions of |

|

I hereby declare that I have read and qualify for the provisions of tariff item |

|||||||||||||||||||||

|

tariff item No. 9829.00.00 and that: |

|

No. 9807.00.00 and that: |

|

|

|

|

|

|

|

|

|||||||||||||

1. |

I arrived in Canada to occupy my seasonal residence for the first time |

|

1. I am entering Canada with the intention of establishing, for the first time, a |

|||||||||||||||||||||

|

|

on __________________ . |

|

|

|

permanent residence for a period in excess of 12 months and I arrived in |

||||||||||||||||||

|

|

|

|

|

Canada on __________________ . |

|

|

|

|

|

|

|

|

|||||||||||

|

2. All goods imported or to be imported by me under this tariff item have been in my |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

2. With the exception of wedding gifts, alcoholic beverages and tobacco products |

||||||||||||||||||||||

|

|

ownership, possession, and use prior to my first arrival in Canada to occupy my |

|

|||||||||||||||||||||

|

|

seasonal residence. |

|

|

|

described in the Tariff Item No. 9807.00.00 Exemption Order , all household and |

||||||||||||||||||

|

3. All goods imported are my personal or household property and they will not be used |

|

|

|

personal effects imported or to be imported by me under this tariff item have |

|||||||||||||||||||

|

|

|

|

actually been owned, possessed, and used abroad by me prior to the date of my |

||||||||||||||||||||

|

|

in Canada for any commercial purpose. |

|

|

|

arrival in Canada. |

|

|

|

|

|

|

|

|

||||||||||

|

4. If any item is sold or otherwise disposed of in Canada within 12 months of the date of |

|

3. All goods imported are my personal or household property and they will not be used |

|||||||||||||||||||||

|

|

its importation, I will notify a CBSA Office of such fact and pay all duties owing at the |

|

|

|

in Canada for any commercial purpose. |

|

|

|

|

|

|

|

|

||||||||||

|

|

time. |

|

|

|

|

|

4. If any item is sold or otherwise disposed of in Canada within 12 months of the |

||||||||||||||||

5. |

I have not previously claimed the benefits of tariff item No. 9829.00.00. |

|

||||||||||||||||||||||

|

|

|

date of its importation, I will notify a CBSA Office of such fact and pay all duties |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

owing at the time. |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signed at |

|

|

on |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Importer |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

B4 E (14) |

|

(Ce formulaire existe en français.) |

|

BSF186 |

||||||||||||||||||||

<<

Privacy Statement - The information collected on this form is under the authority of the Customs Act and will be used to document goods, currency and monetary instruments that are detained by the Canada Border Services Agency (CBSA) or, abandoned to the Crown until the goods have either been returned to the traveller, transferred to another government department or disposed of by the CBSA. The personal information on this form is protected in accordance with the Privacy Act and other laws. The information may be disclosed to internal or external bodies as a consistent use. Information may also be used for the purpose of enforcement and disclosed to other government departments and internal CBSA programs as a secondary use. Under the law, failure to provide the information may result in fine or criminal proceedings.

You have the right to access and/or to correct your personal information under the Privacy Act. Further information about this collection may be found by referring to the following Personal Information Banks: Food, Plant and Animal Program (CBSA PPU 062) and Occupational Health and Safety (PSU907). For more information, visit www.infosource.gc.ca.

Tariff Item No. 9805.00.00 (Former Resident)

Goods imported by a member of the Canadian Forces, by an employee of the Canadian government, or by a former resident of Canada returning to Canada to resume residence in Canada after having been a resident of another country for a period of not less than one year, or by a resident returning after an absence from Canada of not less than one year, and acquired by that person for personal or household use and actually owned, possessed and used abroad by that person for at least six months prior to that person's return to Canada and accompanying that person at the time of their return to Canada.

"Goods" does not include goods that are sold or otherwise disposed of within twelve months after importation.

For the purpose of this tariff item:

(a)the provisions shall apply to either wine not exceeding 1.5 litres or any alcoholic beverages not exceeding 1.14 litres and tobacco products not exceeding fifty cigars, two hundred cigarettes, two hundred tobacco sticks and two hundred grams of manufactured tobacco if they are included in the baggage accompanying the importer, and no relief from payment of duty and taxes is being claimed in respect of alcoholic beverages or tobacco products under another item in this Chapter at the time of importation;

(b)if goods (other than alcoholic beverages, cigars, cigarettes, tobacco sticks and manufactured tobacco) are not accompanying the person returning from abroad, they may be classified under this item when imported at a later time if they are reported by the person at the time of return to Canada; and

(c)any article which was acquired after March 31, 1977 by a class of persons

named in this tariff item and which has a value for duty as determined under the Customs Act of more than $10,000 shall not be classified under this tariff item.

Section 84 of the Customs Tariff reads:

84.Goods that, but for the fact that their value for duty as determined under section 46 of the Customs Act exceeds the value specified under tariff item No. 9805.00.00, would be classified under that tariff item, shall be classified under Chapters 1 to 97 and their value for duty reduced by that specified value.

Short Title

1.This Order may be cited as the Tariff Item No. 9805.00.00 Exemption Order.

Interpretation

2.In this Order,

"bride's trousseau" means goods acquired for use in the household of a newly married couple, but does not include vehicles, vessels or aircraft;

"wedding presents" means goods of a

Exemption

3.The following goods are exempt from the

(a)alcoholic beverages owned by, in the possession of and imported by a person who has attained the minimum age at which a person may lawfully purchase alcoholic beverages in the province in which the CBSA Office where the alcoholic beverages are imported is situated;

(b)tobacco products owned by and in the possession of the importer;

(c)a bride's trousseau owned by, in the possession of and imported by a recently married person or a

(d)wedding presents owned by, in the possession of, and imported by the recipient thereof;

(e)any goods imported by a person who has resided abroad for at least five years immediately prior to returning to Canada and who, prior to the date of return, owned, was in possession of and used the goods; and

(f)goods acquired as replacements for goods that, but for their loss or destruction as the result of fire, theft, accident or other unforeseen contingency, would have been classified under tariff item No. 9805.00.00 of the Customs Tariff, on condition that

(i)the goods acquired as replacements are of a similar class and approximately of the same value as the goods they replaced,

(ii)the goods acquired as replacements were owned by, in the possession of, and used by a person prior to the person's return to Canada, and

(iii)evidence is produced at the time the goods are accounted for under section 32 of the Customs Act that the goods they replaced were lost or destroyed as the result of fire, theft, accident or other unforeseen contingency.

Tariff Item No. 9806.00.00 (Beneficiary)

Personal and household effects of a resident of Canada who has died, on the condition that such goods were owned, possessed and used abroad by that resident;

Personal and household effects received by a resident of Canada as a result of the death or in anticipation of death of a person who is not a resident of Canada, on condition that such goods were owned, possessed and used abroad by that

All the foregoing when bequeathed to a resident of Canada.

Tariff Item No. 9807.00.00 (Settler)

Goods imported by a settler for the settler's household or personal use, if actually owned, possessed and used abroad by the settler prior to the settler's arrival in Canada and accompanying the settler at the time of the settler's arrival in Canada.

For the purpose of this tariff item:

(a)"goods" may include:

(i)either wine not exceeding 1.5 litres or any alcoholic beverages not exceeding 1.14 litres, and

(ii)tobacco products not exceeding fifty cigars, two hundred cigarettes, two hundred tobacco sticks and two hundred grams of manufactured tobacco;

(b)"goods" does not include imported goods that are sold or otherwise disposed of within twelve months after importation; and

(c)if goods (other than alcoholic beverages, cigars, cigarettes, tobacco sticks and manufactured tobacco) are not accompanying the settler at the time of the settler's arrival in Canada, they may be classified under this tariff item when imported at a later time if they are reported by the settler at the time of the settler's arrival in Canada.

Short Title

1.This Order may be cited as the Tariff Item No. 9807.00.00 Exemption Order. Interpretation

2.The following goods are exempt from the use requirements specified in tariff item No. 9807.00.00 :

(a)alcoholic beverages imported by a settler who has attained the minimum age at which a person may lawfully purchase alcoholic beverages in the province in which the customs office where the alcoholic beverages are imported is situated;

(b)tobacco products;

(c)household goods acquired by a settler and set aside for use in the household of the settler whose marriage occurred within three months before the settler's arrival in Canada or is to occur within three months after the settler's arrival in Canada; and

(d)wedding gifts received outside Canada by a settler in consideration of the settler's marriage which occurred within three months before the settler's arrival in Canada or is to occur within three months after the settler's arrival in Canada.

Tariff Item No. 9829.00.00 (Seasonal Resident)

Household furniture and furnishings for a seasonal residence, excluding construction materials, electrical fixtures or other goods permanently attached to or incorporated into a seasonal residence;

Tools and equipment for the maintenance of a seasonal residence;

The foregoing, on condition that:

(i)the goods are imported by a person who is not a resident of Canada and who owns or leases for not less than three years a residence in Canada for seasonal use, other than a

(ii)the person is entitled to only one importation for each seasonal residence under this tariff item;

(iii)the goods are for the personal use of that person or their family and are not for any commercial, industrial or occupational purpose;

(iv)the goods are owned, possessed and used by that person or their family before their first arrival in Canada to occupy the seasonal residence;

(v)the goods are not sold or otherwise disposed of in Canada for at least one year after the date of their importation; and

(vi)the goods accompany the seasonal resident at the time of the seasonal resident's first

arrival in Canada to occupy the seasonal residence or, if not imported at the time of first arrival in Canada, are, at that time, described and listed on a customs accounting document as goods to follow.

NOTE FOR FORMER RESIDENTS AND SETTLERS TO CANADA (TARIFF ITEM NOS. 9805.00.00 AND 9807.00.00)

A minimum duty applies to cigarettes, tobacco sticks, and manufactured tobacco that you include in your personal exemption entitlement. However, this duty does not apply if the products have an excise stamp "DUTY PAID CANADA DROIT ACQUITTÉ".

Please refer to section 21 of the Customs Tariff for legislative references.

<<

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The B4 and B4E forms are used for documenting personal effects being imported into Canada. |

| Applicable Tariffs | These forms reference various tariff items, including 9805.00.00 (Former Resident), 9806.00.00 (Beneficiary), 9807.00.00 (Settler), and 9829.00.00 (Seasonal Resident). |

| Importer's Responsibility | The importer must declare that all goods are for personal use and have been owned and used abroad for at least six months. |

| Document Requirements | Importers may need to provide supporting documents such as wills, death certificates, and statements from estate executors. |

| Goods Definition | “Goods” refers to personal or household items and does not include those used for commercial purposes. |

| 12-Month Rule | If imported goods are sold or disposed of within 12 months, the importer must notify a CBSA office and pay the appropriate duties. |

| Exemption Conditions | Exemptions exist for items such as wedding gifts, and certain alcohol and tobacco products, subject to quantity limits. |

| Seasonal Resident Criteria | Seasonal residents must own or lease a residence in Canada for at least three years to import household furnishings. |

| Paper Size | The B4 and B4E forms must be printed on legal-sized paper (8.5" x 14"). |

| Legal Authority | The completion of these forms falls under the authority of the Customs Act and the overall management of the Canada Border Services Agency (CBSA). |

Guidelines on Utilizing B4 And B4E

Filling out the B4 and B4E form is an important step for individuals returning to Canada, whether as settlers, former residents, seasonal residents, or beneficiaries. The next steps will guide you through completing the form accurately to ensure proper processing and compliance with regulations.

- Begin by writing the importer's name and address at the top of the form.

- Select the appropriate cargo control number and indicate your country of origin and country of export.

- Specify your status (Settler, Former Resident, Seasonal Resident, or Beneficiary) and provide necessary identification numbers such as the Unique Client Identifier (UCI).

- List each item you are importing. For each one, provide a description, including serial numbers if applicable, and the value in Canadian dollars.

- If you’re importing a conveyance (vehicle, vessel, aircraft, or trailer), include specific details such as make, model, and serial number, along with its value.

- Indicate if there are additional goods by checking “Yes” or “No” and provide the necessary forms if applicable.

- Fill out the classification type section according to your specific status and check the corresponding tariff item box.

- Review the declaration section carefully, confirming that you meet the requirements for the selected tariff item.

- Sign and date the form at the bottom to validate your information and ensure its accuracy.

Once you have completed the form, it will be submitted as part of your entry process into Canada. Ensure all information is clear and accurate to avoid delays or complications.

What You Should Know About This Form

What is the purpose of the B4 and B4E form?

The B4 and B4E forms are used to document the importation of personal effects and household goods into Canada. They are specifically designed for use by former residents, settlers, seasonal residents, and beneficiaries. These forms help establish that the goods being imported meet specific conditions for exemption from duties and taxes under Canadian law.

Who needs to fill out a B4 or B4E form?

Individuals who are returning to Canada after living abroad, as well as those who are bringing in personal belongings as a result of inheriting goods from a deceased person, must complete a B4 or B4E form. This includes former residents, settlers who intend to establish permanent residency, seasonal residents, and beneficiaries of estates.

What information is required on the B4 and B4E forms?

The forms require detailed information about the importer's identity, the nature and value of the goods being imported, and their country of origin, among other details. Specific items such as make, model, and serial numbers of vehicles, along with proof of ownership, may also be necessary. Furthermore, declarations confirming that the importer qualifies under the appropriate tariff item must be provided.

What are the tariff items associated with the B4 and B4E forms?

There are several tariff items relevant to the B4 and B4E forms: Tariff Item No. 9805.00.00 for former residents, 9806.00.00 for beneficiaries, 9807.00.00 for settlers, and 9829.00.00 for seasonal residents. Each item has specific eligibility criteria and requirements regarding the goods being imported, including ownership duration and intended use.

How can imported goods affect the importer's duty situation?

Imported goods may be subject to duties if they do not meet exemption criteria outlined in the relevant tariff item. Moreover, if goods are sold or disposed of within twelve months of importation, the importer must notify the Canada Border Services Agency (CBSA) and may have to pay applicable duties at that time. This can prevent unintended consequences later on.

What happens if goods are disposed of shortly after importation?

If any imported items are sold or otherwise disposed of within the first year after importation, the importer is responsible for informing a CBSA office. Failure to do so may lead to penalties or the requirement to pay duties for those goods. It is crucial for importers to keep detailed records and notify authorities as needed.

Are there exemptions for certain items under the B4 and B4E forms?

Yes, certain items may be exempt from customary ownership or use requirements. Alcoholic beverages, tobacco products, bridal trousseaus, and wedding gifts fall under specific exemptions. However, these items must still comply with all applicable laws regulating their importation and use within Canada.

Common mistakes

When filling out the B4 and B4E forms, many people encounter common pitfalls that can lead to delays or complications in processing. The first mistake often made is providing incomplete personal information. It’s crucial to ensure that all required fields, such as your name and address, are fully filled. Missing details can cause significant issues, including longer processing times or, worse, rejection of your application.

Another frequent error is failing to accurately describe the goods being imported. Providing vague descriptions or neglecting to include serial numbers may raise questions during the customs review. Be specific about each item’s brand, model, and condition to avoid complications later on.

A third mistake is incorrect valuation of goods. Many individuals underestimate the total value of their personal effects or fail to convert the currency into Canadian dollars properly. Be diligent in providing accurate valuations, as customs officials rely on this information for assessment purposes.

The fourth error relates to the eligibility of goods. All items must comply with Transport Canada importation requirements. Some importers mistakenly believe that all personal items are exempt. Familiarize yourself with the regulations regarding what can be imported to ensure compliance.

Additionally, declaring items that are not personal effects can create problems. Certain categories of goods, such as commercial items, are not eligible for the exemptions under these tariff items. Check to ensure that everything on your list qualifies as personal or household effects.

The fifth mistake arises from misunderstanding documentation requirements. Each declaration requires specific supporting documents. Failing to attach necessary papers, like a will or proof of death when declaring goods received as part of an estate, places you at risk for delays or denial of duty exemptions.

People also commonly misstate their residency status. It’s essential to clearly identify if you are a former resident, beneficiary, seasonal resident, or settler. Incorrectly indicating your status can lead to incorrect tariff applications and possible penalties.

Another common issue is neglecting to sign and date the form. Without your signature, the B4 and B4E forms are not valid. Always remember the final step of signing, which confirms that all information provided is true and complete.

Finally, many individuals forget to keep a copy of the completed forms for their records. Retaining a copy can be incredibly useful should any questions or issues arise after submission. Ensure you have a record of what was declared and all accompanying documentation for future reference.

By avoiding these nine common mistakes, you can greatly increase the likelihood of a smooth and efficient process when completing your B4 and B4E forms.

Documents used along the form

When completing the B4 and B4E forms, several additional documents can often be necessary to streamline the importation process for personal and household effects. Each document serves a specific purpose and helps ensure compliance with customs regulations. Here’s a closer look at some of the most commonly used forms and documents.

- BSF186A Form: Known as the Mover's Inventory, this form provides a detailed list of items that are being imported as part of a move. It helps customs officials verify the goods against what has been declared on the B4 and B4E forms.

- Form BSF715: This form is used to report the importation of certain goods, primarily used for personal effects. It may need to be included if specified within your customs declaration.

- Death Certificate: A certified true copy may be required for beneficiaries importing goods from a deceased individual. It serves to affirm the claim that these items were bequeathed legally.

- Will or Probate Document: This can be necessary for demonstrating the legal transfer of ownership of goods from a deceased person to a beneficiary. It provides proof to customs that the beneficiary is entitled to the effects.

- Executor's Statement: If you are receiving goods as a result of someone's death, a statement from the executor of the estate can provide additional proof that you are entitled to the imported goods.

- Proof of Ownership: Documentation that proves the goods were owned, possessed, and used abroad by the individual importing them. This can include receipts, invoices, or other ownership records.

- Temporary Import Permit: If you're bringing specialized equipment into Canada for a limited time, this permit may also be required. It outlines compliance with temporary importation regulations.

- Transportation Document: Proof of how the goods were transported, such as a bill of lading or shipping manifest. This helps clarify when and where the goods were acquired before importation.

Gathering the necessary forms and documents ensures a smoother importation process when bringing personal effects into Canada. Understanding what is needed can help avoid potential delays at customs and ensure compliance with the regulations set forth by the Canada Border Services Agency.

Similar forms

-

Form BSF186A: This document serves as an inventory for movers, similar to the B4 and B4E forms, by listing the personal effects being transported. Both documents require detailed descriptions and values of items being moved into Canada.

-

Form BSF715: This form is used for declaring specific goods and conditions of importation. Like the B4 and B4E forms, it emphasizes compliance with Canadian customs regulations and requires information about the items being imported.

-

Vehicle Import Form K22: This form specifically relates to the import of vehicles into Canada. It shares similarities with the B4 and B4E forms in terms of listing vehicle details and ensuring eligibility for importation according to Canadian regulations.

-

Form E29B: Used for temporary importation of goods, this document requires the declaration of items, similar to what is required in the B4 and B4E forms, while also addressing their intended temporary use.

-

Form B3: The Canada Customs Coding Form is focused on goods being imported for commercial use. However, it shares the common requirement for information about the nature of the goods, akin to the B4 and B4E forms.

-

Form B15: This form is for household goods, paralleling the B4 and B4E forms as it also documents items being imported for personal use and requires details on the goods' ownership and usage prior to importation.

-

Import Declaration Form: This is used for various types of goods entering Canada. Similar to the B4 and B4E forms, it requires thorough disclosure of the goods' descriptions and values, ensuring compliance with customs laws.

-

Form B1: The Canada Customs Declaration form applies to general goods being imported. Like the B4 and B4E forms, it necessitates accurate information about goods, their values, and the importer's status.

-

Form BSF507: Beneficiary Personal Effects Declaration takes a similar approach to documenting personal belongings being imported, particularly focusing on those inherited or received as part of a settlement, much like the B4 and B4E forms.

-

CBSA Declaration Card: Required from travelers entering Canada, this card collects essential details about personal goods being brought into the country. It parallels the B4 and B4E forms by gathering similar information about items and their values.

Dos and Don'ts

When filling out the B4 and B4E forms, certain practices can ensure a smoother process. Below is a list of actions you should take and avoid while completing these important forms:

- Do read the instructions carefully before starting. Understanding each section can save you time and confusion.

- Do provide accurate information about your personal details and the goods you are importing. Inaccuracies can lead to delays or penalties.

- Do include serial numbers for valuable items whenever applicable. This adds clarity and helps the authorities track your goods.

- Do ensure that all items listed comply with Transport Canada’s importation requirements. This is crucial for avoiding disallowances.

- Do sign and date the form where indicated. This validates your declaration and confirms your understanding of the process.

- Don't leave any shaded sections blank. These are designated for CBSA use and must be completed by the officials.

- Don't attempt to import items for commercial use under these personal effects forms. This could result in legal issues and forfeiture.

- Don't overlook the requirement to notify the CBSA if you sell any item within 12 months post-importation. Transparency is essential.

- Don't wait until the last minute to fill out these forms. Completing them in advance can help you avoid mistakes and stress.

Paying attention to these dos and don’ts can help you navigate the requirements of the B4 and B4E forms with ease. Taking the time to be thorough will help ensure your experience is positive and compliant.

Misconceptions

Here are ten common misconceptions about the B4 and B4E forms that many individuals have when dealing with the importation of goods into Canada:

- 1. The B4 and B4E forms are only for new immigrants. Many believe these forms are exclusively for new settlers, but they are also applicable for former residents and beneficiaries receiving personal effects.

- 2. I can import anything without restriction. It’s a common misunderstanding that all personal items are eligible for duty-free importation. Certain goods, like commercial products, are explicitly excluded.

- 3. All items must be declared even if they are gifts. Not all gifts need to be declared. However, items received that are intended for commercial use must be declared.

- 4. I can import used goods without proof of use. It's assumed that if an item is used, it's quickly exempt from proof requirements. In reality, items must have been owned and used for a minimum duration before importing.

- 5. There’s no timeframe to import items after returning to Canada. Some believe they can delay the import of personal belongings indefinitely. However, certain items should be imported within a specified period (usually 12 months) of the individual’s return to Canada.

- 6. The value of my goods doesn’t matter. A common misconception is that the value of goods has no bearing on duties or taxation. This is untrue; the value must be reported, and it can affect duties owed.

- 7. I can import any number of alcoholic beverages duty-free. Many think they can import an unlimited quantity of alcohol. However, there are strict limits on the amount allowed without incurring duties.

- 8. The B4 and B4E forms are the same. While both forms serve similar purposes, they cater to different circumstances and types of importers, leading to varied requirements and declarations.

- 9. I can wait to declare my goods after six months. Some believe they can delay declaration until after six months, but the declaration needs to be made upon arrival or during the established timeframe.

- 10. The information I provide on these forms is not protected. There’s a belief that personal information on these customs forms is not confidential, but it's protected under the Privacy Act and other regulations.

Understanding these misconceptions can help streamline the import process and ensure compliance with Canadian customs laws.

Key takeaways

Understanding the B4 and B4E forms is essential for anyone looking to import personal effects into Canada. Here are some key takeaways that will help guide you through the process:

- Eligibility Requirements: Ensure you qualify under one of the tariff items: Former Resident, Beneficiary, Settler, or Seasonal Resident. Each category has specific conditions that must be met.

- Complete Documentation: Fill out all sections of the form accurately. Incomplete information could delay approval or result in additional duties.

- Value Declaration: Be honest about the value of your goods in Canadian dollars. This value impacts any duties you may owe upon importation.

- Goods Ownership: You must demonstrate that the goods have been owned and used abroad for a certain period, typically at least six months, before your return to Canada.

- Notification of Changes: If you sell or dispose of any imported items within 12 months of their importation, you must inform the Canada Border Services Agency (CBSA) and pay any applicable duties.

- Special Exemptions: Some items, like wedding gifts or items acquired due to unforeseen circumstances, may be exempt from certain requirements. Be sure to check if your goods qualify.

Filling out the B4 and B4E forms can feel overwhelming, but paying attention to these key points can simplify the process. Take your time, be thorough, and you'll navigate through customs with greater ease.

Browse Other Templates

Referral Forms - Encourage notes on client preferences to guide the search.

Gifting a Car to Family - The form must be filled out completely to comply with Texas gifting laws.

How to Fill Out W-9 Form for Individual - Understanding the roles played by multiple individuals in a business is crucial for tax determination.