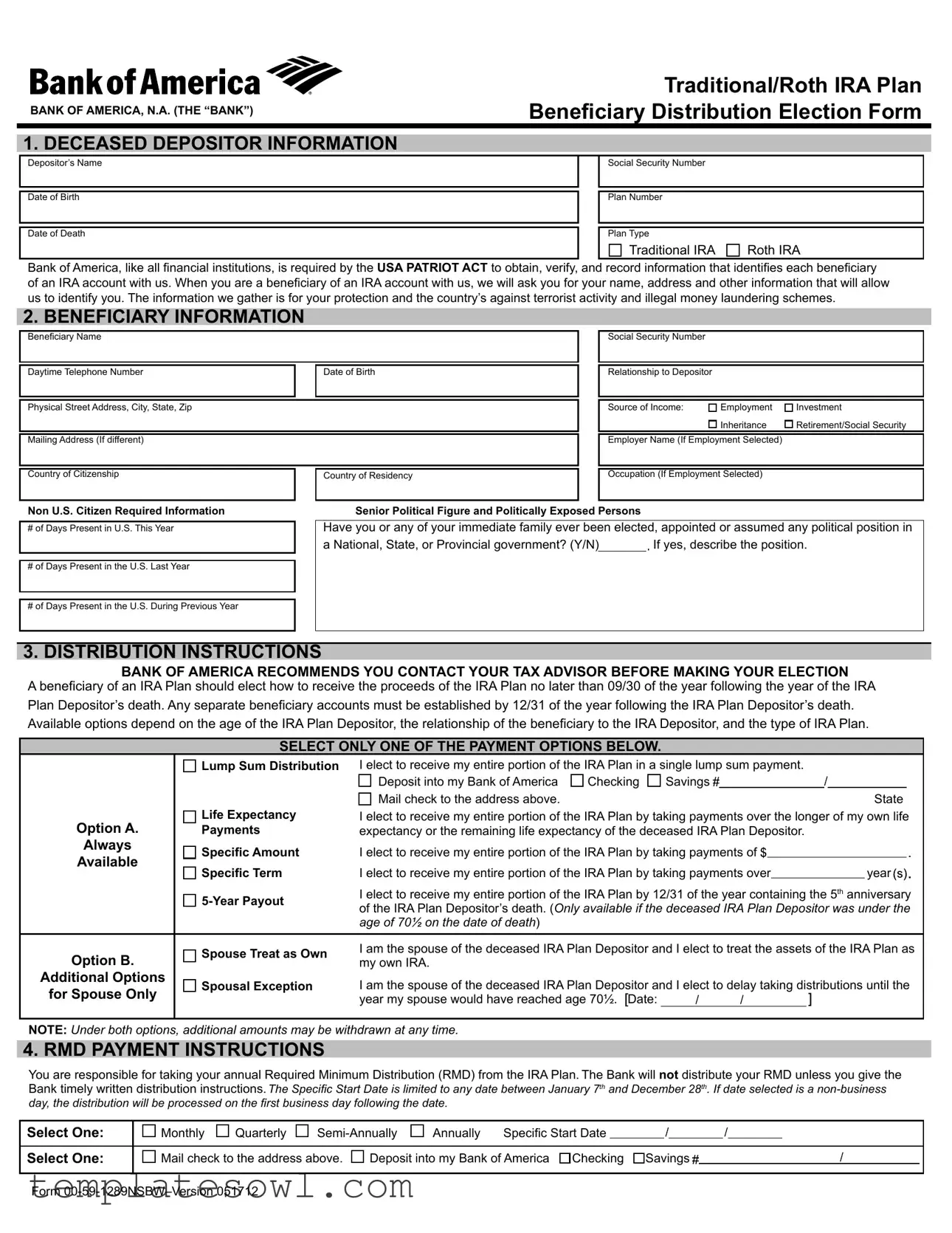

Fill Out Your Bank Of America Beneficiary Form

The Bank of America Beneficiary form is an essential document for anyone designated as a beneficiary of a Traditional or Roth IRA. When a depositor passes away, this form becomes critical for managing the distribution of their IRA assets. It includes sections that request both the deceased's and the beneficiary's information, ensuring compliance with regulations like the USA PATRIOT ACT, which mandates financial institutions to verify beneficiary identities. The form outlines various distribution options available to beneficiaries, such as lump sums or payment over specified terms, reflecting the beneficiary's relationship to the deceased and the type of IRA. Timely completion is vital; beneficiaries must make their election by September 30 of the year following the depositor's death. It also covers important considerations like Required Minimum Distributions (RMDs), tax withholding elections, and the acknowledgement of terms. By understanding the details of this form, beneficiaries can effectively access their inheritance while adhering to relevant legal and tax implications.

Bank Of America Beneficiary Example

BANK OF AMERICA, N.A. (THE “BANK”)

Traditional/Roth IRA Plan

Beneficiary Distribution Election Form

1. DECEASED DEPOSITOR INFORMATION

Depositor’s Name

Date of Birth

Date of Death

Social Security Number

Plan Number

Plan Type

Traditional IRA

Roth IRA

Roth IRA

Bank of America, like all financial institutions, is required by the USA PATRIOT ACT to obtain, verify, and record information that identifies each beneficiary of an IRA account with us. When you are a beneficiary of an IRA account with us, we will ask you for your name, address and other information that will allow us to identify you. The information we gather is for your protection and the country’s against terrorist activity and illegal money laundering schemes.

2. BENEFICIARY INFORMATION

Beneficiary Name

Daytime Telephone Number |

|

Date of Birth |

|

|

|

|

|

|

Physical Street Address, City, State, Zip |

|

|

|

|

|

|

|

|

Mailing Address (If different) |

|

|

|

|

|

|

|

|

Country of Citizenship |

|

Country of Residency |

|

|

|

Social Security Number

Relationship to Depositor

Source of Income: |

Employment |

Investment |

|

Inheritance |

Retirement/Social Security |

|

|

|

Employer Name (If Employment Selected) |

|

|

|

|

|

Occupation (If Employment Selected)

Non U.S. Citizen Required Information

#of Days Present in U.S. This Year

#of Days Present in the U.S. Last Year

#of Days Present in the U.S. During Previous Year

Senior Political Figure and Politically Exposed Persons

Have you or any of your immediate family ever been elected, appointed or assumed any political position in

a National, State, or Provincial government? (Y/N) |

|

If yes, describe the position. |

3. DISTRIBUTION INSTRUCTIONS

BANK OF AMERICA RECOMMENDS YOU CONTACT YOUR TAX ADVISOR BEFORE MAKING YOUR ELECTION

A beneficiary of an IRA Plan should elect how to receive the proceeds of the IRA Plan no later than 09/30 of the year following the year of the IRA Plan Depositor’s death. Any separate beneficiary accounts must be established by 12/31 of the year following the IRA Plan Depositor’s death. Available options depend on the age of the IRA Plan Depositor, the relationship of the beneficiary to the IRA Depositor, and the type of IRA Plan.

SELECT ONLY ONE OF THE PAYMENT OPTIONS BELOW.

Lump Sum Distribution I elect to receive my entire portion of the IRA Plan in a single lump sum payment.

Lump Sum Distribution I elect to receive my entire portion of the IRA Plan in a single lump sum payment.

|

|

Deposit into my Bank of America |

Checking |

Savings |

|

|

|

|

|

||||

|

Life Expectancy |

Mail check to the address above. |

|

|

|

|

|

|

|

|

State |

||

Option A. |

I elect to receive my entire portion of the IRA Plan by taking payments over the longer of my own life |

||||||||||||

Payments |

expectancy or the remaining life expectancy of the deceased IRA Plan Depositor. |

|

|

|

|

||||||||

Always |

Specific Amount |

I elect to receive my entire portion of the IRA Plan by taking payments of |

|

|

|

|

|

||||||

Available |

|

|

|

|

|||||||||

Specific Term |

I elect to receive my entire portion of the IRA Plan by taking payments over |

|

|

|

|

year |

|||||||

|

|

|

|

|

|||||||||

|

I elect to receive my entire portion of the IRA Plan by 12/31 of the year containing the 5th anniversary |

||||||||||||

|

of the IRA Plan Depositor’s death. (Only available if the deceased IRA Plan Depositor was under the |

||||||||||||

|

|

||||||||||||

|

|

age of 70½ on the date of death) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Option B. |

Spouse Treat as Own |

I am the spouse of the deceased IRA Plan Depositor and I elect to treat the assets of the IRA Plan as |

|||||||||||

my own IRA. |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

Additional Options |

Spousal Exception |

I am the spouse of the deceased IRA Plan Depositor and I elect to delay taking distributions until the |

|||||||||||

for Spouse Only |

|||||||||||||

|

year my spouse would have reached age 70½. Date: |

|

|

|

|

|

|

|

|

|

|||

NOTE: Under both options, additional amounts may be withdrawn at any time.

4. RMD PAYMENT INSTRUCTIONS

You are responsible for taking your annual Required Minimum Distribution (RMD) from the IRA Plan. The Bank will not distribute your RMD unless you give the Bank timely written distribution instructions. The Specific Start Date is limited to any date between January 7th and December 28th. If date selected is a

Select One: |

Monthly |

Quarterly |

Annually |

Specific Start Date |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select One: |

Mail check to the address above. |

Deposit into my Bank of America |

Checking |

Savings |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form

5. TAX WITHHOLDING ELECTION

Notice of Withholding Election: Distributions you receive from your Individual Retirement Account are subject to Federal income tax withholding and may be subject to State income tax withholding and/or Local income tax withholding based on your state and municipality of residence unless you elect not to have withholding apply.

You are liable for Federal, and applicable State and Local income taxes on the taxable portion of your distribution. If you elect not to have withholding apply to your distribution, or if you do not have enough tax withheld from your distribution, you may be responsible for payment of estimated taxes. You may also incur penalties under the estimated tax rules if your withholding and estimated tax payments are not sufficient.

Withholding Election: You MUST indicate your withholding election below.

Complete if you are providing a U.S. Address:

Federal Withholding:

Important: Please note that if you do not make a withholding election, federal income tax will be automatically withheld from your distribution at a rate of 10%.

Do not withhold federal income tax from my distribution.

Do not withhold federal income tax from my distribution.

Withhold federal income tax from my distribution (check one):

Withhold federal income tax from my distribution (check one):

At a rate of 10% |

At a rate of |

|

% (must be greater than 10%) |

State Withholding:

Important: State withholding may also be required in certain states when you elect federal income tax withholding. North Carolina residents are required to use form

The minimum required for the state of |

|

|

|

is |

|

. |

|

|

|

|

Do not withhold state income tax from my distribution. |

from my distribution at the rate of |

|

%, or amount of $ |

|

. |

|||||

Withhold state income tax for the state of |

|

|

|

|||||||

Local Withholding:

Important: Local withholding may also be required in certain states.

The minimum required for the municipality of |

|

|

|

is |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Do not withhold local income tax from my distribution. |

|

|

|

|

|

|

|

|

||

Withhold local income tax for the municipality of |

|

from my distribution at the rate of |

|

%, or amount of $ |

|

. |

||||

Complete if you are providing a Foreign Address:

Important: If you are a U.S. citizen or a Resident Alien with a foreign address, you may not waive the Federal withholding requirement and you must complete Form

I am a U.S. Citizen or Resident Alien living abroad (check one)

I am a U.S. Citizen or Resident Alien living abroad (check one)

Withhold: |

At a rate of 10% |

At a rate of |

|

% (must be greater than 10%) |

6. BENEFICIARY’S ACKNOWLEDGMENT

I acknowledge that I have read and completed this Form. I further acknowledge that neither the Bank nor its agents or employees have made any representations to me regarding tax or any other effects of my elections/instructions on this Form, and the Bank has advised me to speak to my tax advisor regarding my elections/instructions. I direct the Bank to effect the elections/instructions I have made on this Form and agree that the Bank and its agents and employees have no liability for any action or inaction taken by them in reliance upon such elections/instructions.

BENEFICIARY SIGNATURE (REQUIRED) |

|

DATE |

Form

BANK OF AMERICA, N.A. (THE “BANK”)

Traditional/Roth IRA Plan

Beneficiary Distribution Election Form

Informational Sheet

BANK OF AMERICA RECOMMENDS YOU CONTACT YOUR TAX ADVISOR BEFORE MAKING YOUR ELECTION

A beneficiary of an IRA Plan should elect how to receive the proceeds of the IRA Plan no later than 09/30 of the year following the year of the IRA Plan Depositor’s death. Any separate beneficiary accounts must be established by 12/31 of the year following the IRA Plan Depositor’s death. Available options depend on the age of the IRA Plan Depositor, the relationship of the beneficiary to the IRA Depositor, and the type of IRA Plan.

Complete, sign and send the distribution form:

To your Local Bank of America Banking Center

Or, mail to the following address:

Bank of America, N.A.

Mail code:

P.O. Box 619040

Dallas, TX

1. DECEASED DEPOSITOR INFORMATION

Depositor’s Name — Enter the deceased person’s name

Social Security Number — Enter the deceased person’s social security number

Date of Birth — Enter the deceased person’s Date of Birth

Plan Number — Enter the deceased person’s Plan Number that is being processed

Date of Death — Enter the date of death for the account owner (deceased person

Plan type — Select the plan type of the deceased account holder

2. BENEFICIARY INFORMATION

Bank of America, like all financial institutions, is required by the USA PATRIOT ACT to obtain, verify, and record information that identifies each beneficiary of an IRA account with us. When you are a beneficiary of an IRA account with us, we will ask you for your name, address and other information that will allow us to identify you. The information we gather is for your protection and the country’s against terrorist activity and illegal money laundering schemes.

Beneficiary Name — Enter the name of the beneficiary for the plan identified in the Plan Number section

Social Security Number — Enter the Social Security Number for the beneficiary listed in the Beneficiary Name section. If the beneficiary is an entity, enter the Employer Identification Number (EIN)

Daytime Telephone Number — Enter the best contact number that you can be reach at during the day

Date of Birth — Date of birth for the person listed in the Beneficiary Name section. If the beneficiary is an Entity, please list the Date of Birth for the decedent

Relationship to the Depositor — Example, Daughter, Mother, or Father. If the beneficiary is an Entity please leave this field blank

Physical Street Address, City, State, Zip — Enter the street address for the beneficiary listed in the Beneficiary Name section. Please note: This must be a physical address to comply with the USA Patriot ACT.

Source of Income — Select the appropriate option from the list provided. If the beneficiary is an Entity, please select Inheritance.

Mailing Address — Complete only if different from the Physical Address listed.

Employer Name — List the beneficiary’s current employer

Country of Citizenship — Enter the Country that the Beneficiary is a citizen

Country of Residency — Enter the Country the Beneficiary resides in

Occupation — Enter the Beneficiary’s current occupation or job ONLY if employment was selected as Source of Income

Non U. S. Citizen Required Information

of Days Present in the U.S. This Year — Enter the number of days that the beneficiary has been present in the U. S. for the current year

of Days Present in the U.S. This Year — Enter the number of days that the beneficiary has been present in the U. S. for the current year

of Days Present in the U.S. Last Year — Enter the number of days that the beneficiary was in the U.S. during the last calendar year

of Days Present in the U.S. Last Year — Enter the number of days that the beneficiary was in the U.S. during the last calendar year

of Days Present in the U.S. Prior to the Last Year — Enter the number of days that the beneficiary was in the U.S. Prior to the last full calendar year

of Days Present in the U.S. Prior to the Last Year — Enter the number of days that the beneficiary was in the U.S. Prior to the last full calendar year

Senior Political Figure and Politically Exposed Person

Indicate if you should be identified as a senior political figure or politically exposed person. Provide details on the position held or relationship.

3. DISTRIBUTION INSTRUCTIONS

Please ensure that you select only one of the payment options from the list. Selecting multiple options can delay the processing of your request.

Option A:

Lump Sum Distribution — Available to all beneficiaries. This option would be a single lump sum payment of the funds directly to the beneficiary

Life Expectancy — Payments would be made over the life expectancy of the beneficiary list in the Beneficiary Name section Specific Amount — Payment amounts would be disbursed as specified by the beneficiary (the beneficiary will be responsible to ensure that their disbursement amount meets IRS requirements)**

Specific Term — Payments will be disbursed over a specified term as elected by the beneficiary (the beneficiary will be responsible to ensure that their disbursement amount meets IRS requirements)**

Option B (Spousal Options):

Spouse Treat as Own — An IRA plan honoring the deceased depositor’s existing IRA Plan terms would be established for the spouse, and the account would be treated as their own.

Spousal Exception — The spouse elects to delay taking distributions until the deceased account holder would have reached 70½

**Under these methods denoted above, additional amounts may be withdrawn at any time.

Please note: If you selected any option except Lump Sum, please ensure Section 4 is completed (if applicable).

4. RMD PAYMENT INSTRUCTIONS

The Beneficiary is responsible for taking their annual Required Minimum Distribution (RMD) from the IRA Plan. The Specific Start Date is limited to any date between January 7th and December 28th. If date selected is a

Please review the options carefully and select the appropriate distribution for the beneficiary.

5. TAX WITHHOLDING ELECTION

Notice of Withholding Election: Distributions you receive from your Individual Retirement Account are subject to Federal income tax withholding and may be subject to State income tax withholding and/or Local income tax withholding based on your state and municipality of residence unless you elect not to have withholding apply.

You are liable for Federal, and applicable State and Local income taxes on the taxable portion of your distribution. If you elect not to have withholding apply to your distribution, or if you do not have enough tax withheld from your distribution, you may be responsible for payment of estimated taxes. You may also incur penalties under the estimated tax rules if your withholding and estimated tax payments are not sufficient.

You MUST indicate your withholding election on the form provided.

Federal Withholding:

Important: Please note that if you do not make a withholding election, federal income tax will be automatically withheld from your distribution at a rate of 10%.

State Withholding:

Important: State withholding may also be required in certain states when you elect federal income tax withholding. Note that North Carolina residents must use Form

Local Withholding:

Important: Local withholding may also be required in certain states.

Complete denoted section if you are providing a Foreign Address:

Important: If you are a U.S. citizen or a Resident Alien with a foreign address, you may not waive the Federal withholding requirement and you must complete Form

For additional questions, please contact your local Bank of America Banking Center or our customer service associates are available

Form Characteristics

| Fact Name | Description |

|---|---|

| Deceased Depositor Information | The form requires comprehensive details about the deceased IRA account holder, including their name, date of birth, and date of death. |

| USA PATRIOT ACT Compliance | Bank of America must collect identifying information from beneficiaries to comply with the USA PATRIOT ACT. |

| Beneficiary Identification | Information such as name, address, and Social Security number is required to identify beneficiaries properly. |

| Distribution Deadlines | Beneficiaries must elect how to receive funds by September 30 of the year following the depositor's death. |

| Required Minimum Distribution (RMD) | Beneficiaries are accountable for taking their annual RMD, with details established in the form. |

| Tax Withholding | Distributions may be subject to federal, state, and local tax withholdings unless otherwise elected by the beneficiary. |

| Spousal Options | Spouses may treat the inherited IRA as their own or delay distributions until a certain age, subject to specific criteria. |

| Payment Options | Beneficiaries can choose from various distribution methods, including lump sum or periodic payments based on life expectancy. |

| State-Specific Forms | For North Carolina residents, an additional form (NC-4P) must be used for state tax withholding elections. |

| Beneficiary Acknowledgment | Beneficiaries must acknowledge they have read and understood the implications of the elections and instructions in the form. |

Guidelines on Utilizing Bank Of America Beneficiary

To complete the Bank of America Beneficiary form, it is important to gather all required personal information related to both the deceased account owner and the beneficiary. Ensure accuracy in the details to avoid delays in processing. After filling out the form, it should be signed and submitted either to a local Bank of America Banking Center or mailed to the specified address.

- Fill out the Deceased Depositor Information:

- Enter the deceased person’s name.

- Input the deceased person’s social security number.

- Provide the deceased person’s date of birth.

- Include the deceased person's plan number.

- Enter the date of death for the deceased account owner.

- Select the plan type: Traditional IRA or Roth IRA.

- Complete the Beneficiary Information:

- Input the name of the beneficiary.

- Provide the beneficiary’s social security number or EIN if the beneficiary is an entity.

- Enter a daytime telephone number.

- Provide the beneficiary’s date of birth.

- State the relationship to the depositor (e.g., Daughter, Mother, Father).

- Fill in the physical street address, city, state, and zip code.

- Complete mailing address if different from the physical address.

- Select the source of income from the options given.

- For employment, provide the employer's name and the beneficiary’s occupation.

- Enter the country of citizenship and residency for the beneficiary.

- If applicable, provide information regarding the number of days present in the U.S. this year, last year, and during the prior year.

- Indicate if the beneficiary is a senior political figure or politically exposed person.

- Select Distribution Instructions:

- Choose one payment option, such as Lump Sum Distribution or treat as Own for a spouse.

- For non-spouse beneficiaries, ensure to choose just one among the other options.

- Specify RMD Payment Instructions:

- Indicate how often to take the Required Minimum Distribution (Monthly, Quarterly, Semi-Annually, Annually).

- Select a specific start date for the distribution.

- Fill out the Tax Withholding Election:

- Select whether to withhold federal and state tax from the distribution.

- Specify the withholding percentage if applicable.

- Sign and Date the Form:

- Ensure to sign the acknowledgment section.

- Include the date of signature.

Once the form is complete and signed, it is ready to be submitted. Mail it to the address provided or return it to a Bank of America location. Keep a copy for your records.

What You Should Know About This Form

What is the purpose of the Bank of America Beneficiary form?

The Bank of America Beneficiary form is designed to help identify beneficiaries of an IRA account. When a person passes away, the beneficiaries need to access the funds and make decisions on how to receive them. The form collects required personal information to comply with laws, like the USA PATRIOT ACT, and to ensure accurate and secure processing of the IRA distribution. This information helps protect both the beneficiary and the financial institution from potential illegal activities.

What are the options for receiving distributions from the IRA?

Beneficiaries have several choices for receiving distributions from the IRA. They can opt for a lump sum distribution, where they receive the entire amount in one payment. Alternatively, they can choose to receive payments over a set term or through life expectancy calculations. For spouses, special options are available, allowing them to treat the IRA as their own or delay distributions until they would have reached a specific age. Each option impacts taxes and future withdrawals, so understanding these choices is crucial.

When must beneficiaries make their distribution election?

Beneficiaries must make their distribution election no later than September 30 of the year following the year of the IRA account holder's death. It's important to act on this promptly, as failure to do so may affect the distribution options available. Additionally, if separate beneficiary accounts are needed, they must be established by December 31 of the following year. Planning ahead can prevent complications during this difficult time.

Are there any tax implications associated with IRA distributions?

Yes, distributions from an IRA are generally subject to federal income tax, and there may be state and local taxes involved as well. Beneficiaries must indicate their withholding preferences on the form. If no choice is made, federal taxes will automatically be withheld at a rate of 10%. This can result in unexpected tax obligations, so it is advisable to consult with a tax advisor to fully understand the tax implications and requirements based on individual circumstances.

Common mistakes

Filling out the Bank of America Beneficiary form is a crucial step when dealing with an IRA account. However, many people make common mistakes that can lead to delays or complications. Understanding these pitfalls can help ensure that the form is completed accurately and efficiently.

One frequent error involves entering incorrect information about the deceased depositor. People sometimes confuse the date of birth or the date of death. This mistake can create confusion, leading to delays in processing the beneficiary request. Always double-check these dates to ensure they match official documents.

Another common mistake occurs with the beneficiary's information. Leaving out important details, such as the Social Security number or the physical street address, could cause the Bank to reject the form. If you're a beneficiary, include all required information neatly and accurately to avoid unnecessary roadblocks.

Many individuals also neglect to select only one payment option. The form clearly states to choose just one from the available options, but impulsively checking multiple boxes can lead to processing delays. Read through each option carefully and select the one that best fits your situation. A single clear choice avoids confusion and expedites the entire process.

Tax withholding can also trip people up. Failing to indicate a withholding election may result in a default 10% federal withholding on distributions. It’s essential to decide in advance whether you want taxes withheld, as this can impact your overall financial situation. Complete this part of the form thoughtfully to prevent surprises come tax season.

Additionally, some beneficiaries do not complete the Required Minimum Distribution (RMD) section or omit it entirely. Forgetting to take your annual RMD can have serious tax implications. Stay informed and follow the guidelines for RMD to avoid penalties that could diminish the account’s value.

Finally, individuals sometimes forget to sign the acknowledgment section. A missing signature can render the form invalid, delaying the processing of your beneficiary benefits. After filling out the form, take a moment to review it thoroughly, ensuring that every section is completed and duly signed.

By avoiding these common mistakes, you can ensure that your interactions with the Bank of America go smoothly, allowing for a swift resolution to your beneficiary claims. Double-check your information, follow instructions carefully, and consult a trusted advisor if you have questions along the way.

Documents used along the form

When dealing with the aftermath of a loved one’s passing and the management of their IRA account, the Bank of America Beneficiary Form is essential. However, there are several other important documents you may encounter during this process that can help clarify and expedite the transition of the account and its benefits. Here are some commonly used forms and documents you should know about:

- Death Certificate: This is a legal document that officially states the date of death and is often required to settle the deceased’s affairs, including IRA account distributions.

- Will or Trust Document: If the deceased created a will or trust, this document outlines how their assets, including the IRA, should be distributed. It may also specify beneficiaries and any conditions tied to the inheritance.

- Tax Identification Number (TIN) Application (Form W-7): If a beneficiary is a non-resident alien or is not assigned a Social Security Number, they may need to apply for a TIN for tax purposes. This can be necessary to properly manage any distributions.

- Spousal Consent Form: If the beneficiary is the spouse of the deceased and wishes to treat the IRA as their own, this form is often needed to verify the spouse's intention and to protect the account’s assets.

These documents help ensure that the beneficiary and the financial institution can manage the account according to the law and the deceased's wishes. Familiarizing yourself with these forms can streamline the process and provide clarity during a challenging time.

Similar forms

Here are nine documents that are similar to the Bank of America Beneficiary Form. Each has its own purpose, but they all share common elements related to beneficiary designation and distribution processes.

- Last Will and Testament: This document details how a person’s assets will be distributed upon their death. Like the beneficiary form, it identifies beneficiaries and outlines the process for asset distribution.

- Living Trust: A living trust allows a person to manage their assets during their lifetime and specifies how those assets should be distributed after death. Beneficiaries are named, similar to the IRA beneficiary form.

- Payable on Death (POD) Account Designation: This document allows account holders to name a beneficiary for their bank account. Upon death, the named beneficiary automatically receives the account funds, akin to an IRA's beneficiary structure.

- Transfer on Death (TOD) Designation: A TOD designation applies to securities and allows the account holder to name a beneficiary who will receive those assets automatically upon death, similar to the transfer of IRA assets.

- Life Insurance Beneficiary Designation: This form allows policy owners to specify who will receive the death benefit from the policy. Like the IRA beneficiary form, it ensures a clear plan for distribution after the policyholder's death.

- 401(k) Beneficiary Designation Form: A form used by retirement plan participants to select beneficiaries for their 401(k) accounts. It operates similarly to the IRA beneficiary form, ensuring that funds transfer smoothly.

- Health Savings Account (HSA) Beneficiary Designation: This form allows individuals to name beneficiaries for their HSA. Distribution of funds upon death is managed in a way that mirrors the IRA’s beneficiary process.

- Uniform Transfer to Minors Act (UTMA) Custodial Accounts: This form allows a minor to receive gifts of money or property. It designates a custodian who manages the assets until the minor reaches adulthood, relating closely to beneficiary designation.

- Funding Authorization for Estate Expenses: This document authorizes the payment of estate debts and expenses after death. While it does not designate beneficiaries directly, it aligns with the distribution process, ensuring funds are available for settling the estate.

Dos and Don'ts

When filling out the Bank of America Beneficiary form, it is crucial to follow certain guidelines to ensure the process goes smoothly. Below is a list of do's and don'ts to consider during this important task.

- Do double-check all personal information entered, including the deceased depositor's name, Social Security number, and dates, as errors can lead to processing delays.

- Do carefully select only one payment option from the available choices to avoid confusion and potential delays in your request.

- Do consult a tax advisor before making your election to ensure that you fully understand the tax implications of your decisions.

- Do complete all relevant sections, including the RMD payment instructions if applicable, to prevent any missing information that could hold up your application.

- Don't leave fields blank unless specified. Completing all sections of the form adequately helps the bank process your request efficiently.

- Don't forget to sign and date the form. A missing signature could result in forfeiting your election options and delay your application.

Misconceptions

- Misconception 1: Beneficiaries must wait a long time to receive their funds.

- Misconception 2: All beneficiaries can access the funds in the same way.

- Misconception 3: Taxes are not a concern when accessing IRA funds.

- Misconception 4: Beneficiaries do not need to provide any information to Bank of America.

- Misconception 5: Funds can be withdrawn without any formalities after choosing a distribution option.

In fact, beneficiaries should elect how to receive the proceeds from the IRA account within a year after the account holder's death. Delays only occur if the proper forms are not completed on time.

Not all beneficiaries have the same distribution options. Choices depend on the relationship to the deceased and the type of IRA. Spousal beneficiaries often have different options compared to non-spousal beneficiaries.

Distributions from an IRA are subject to federal income tax, and potentially state and local taxes as well. Beneficiaries must be aware of tax implications and ensure proper withholding is selected.

Bank of America requires various details from beneficiaries to comply with regulations, including identification information. This is essential for safeguarding against fraud and illegal activities.

Once the selection is made, beneficiaries must follow through with the required paperwork. Additionally, if not automatically processed, beneficiaries are responsible for ensuring compliance with distributions, including Required Minimum Distributions (RMDs).

Key takeaways

Filling out and using the Bank of America Beneficiary Form involves several key steps and considerations. Below are important takeaways to ensure correct completion and submission.

- Deceased Depositor Information: Provide accurate details about the deceased, including their name, social security number, and date of birth.

- Beneficiary Identification: As required by the USA PATRIOT ACT, beneficiaries must provide personal information to verify their identity, including name, address, and social security number.

- Distribution Deadline: Beneficiaries should elect how to receive distributions by September 30 of the year following the depositor's death.

- Options for Receiving Funds: Various payment options are available, such as lump sum, life expectancy payments, or a specific term. Only select one option to avoid processing delays.

- Annual RMD Responsibility: Beneficiaries are responsible for their Required Minimum Distribution (RMD) and must provide written distribution instructions to the bank.

- Tax Withholding Election: Distributions are subject to federal and potentially state taxes. Beneficiaries must indicate their choice for tax withholding on the form.

- Special Considerations for Non-U.S. Citizens: Non-U.S. citizens need to provide additional information regarding their presence in the U.S. and related documentation, such as Form W-8BEN.

- Document Submission: Completed forms can be submitted at a local Bank of America Banking Center or mailed to the designated address provided on the form.

- Contact for Questions: For clarity or assistance, beneficiaries can contact customer service at Bank of America or visit their local banking center.

- Important Acknowledgment: By signing the form, beneficiaries acknowledge understanding their rights and responsibilities concerning tax implications and the elections made.

Browse Other Templates

South Carolina Title - Form 400 can be submitted via mail to the SCDMV’s designated address.

Pca Northeast - Ensure that all signatories are present during signing.

Lowes Rebate Status - Submit your rebate online for a smoother process at the Rebate Center.