Fill Out Your Bank Of America Transfer Form

The Bank of America Transfer form is an essential document when managing various types of retirement accounts, including Individual Retirement Accounts (IRAs) and Coverdell Education Savings Accounts (CESAs). It requires users to fill out relevant customer information, such as name, Social Security Number, and contact details. The form also gathers information about the existing financial institution from which the funds are being transferred, as well as the type of account involved, be it a traditional IRA, Roth IRA, or another qualified plan. Individuals must specify their transfer instructions, indicating whether they wish to transfer all or part of their assets, and whether the transfer should occur immediately or after a certain period. Additionally, it includes direct rollover instructions, which necessitate understanding any additional documentation needed from current plan administrators. Each applicant must indicate where the transferred funds should be deposited at Bank of America, choosing from various account types or specifying new accounts. It is vital to note the acceptance of the terms and conditions outlined in the form, ensuring awareness of potential tax implications and responsibilities associated with the transfer. Overall, completing this form correctly facilitates smooth transitions of retirement funds to Bank of America while adhering to regulatory requirements.

Bank Of America Transfer Example

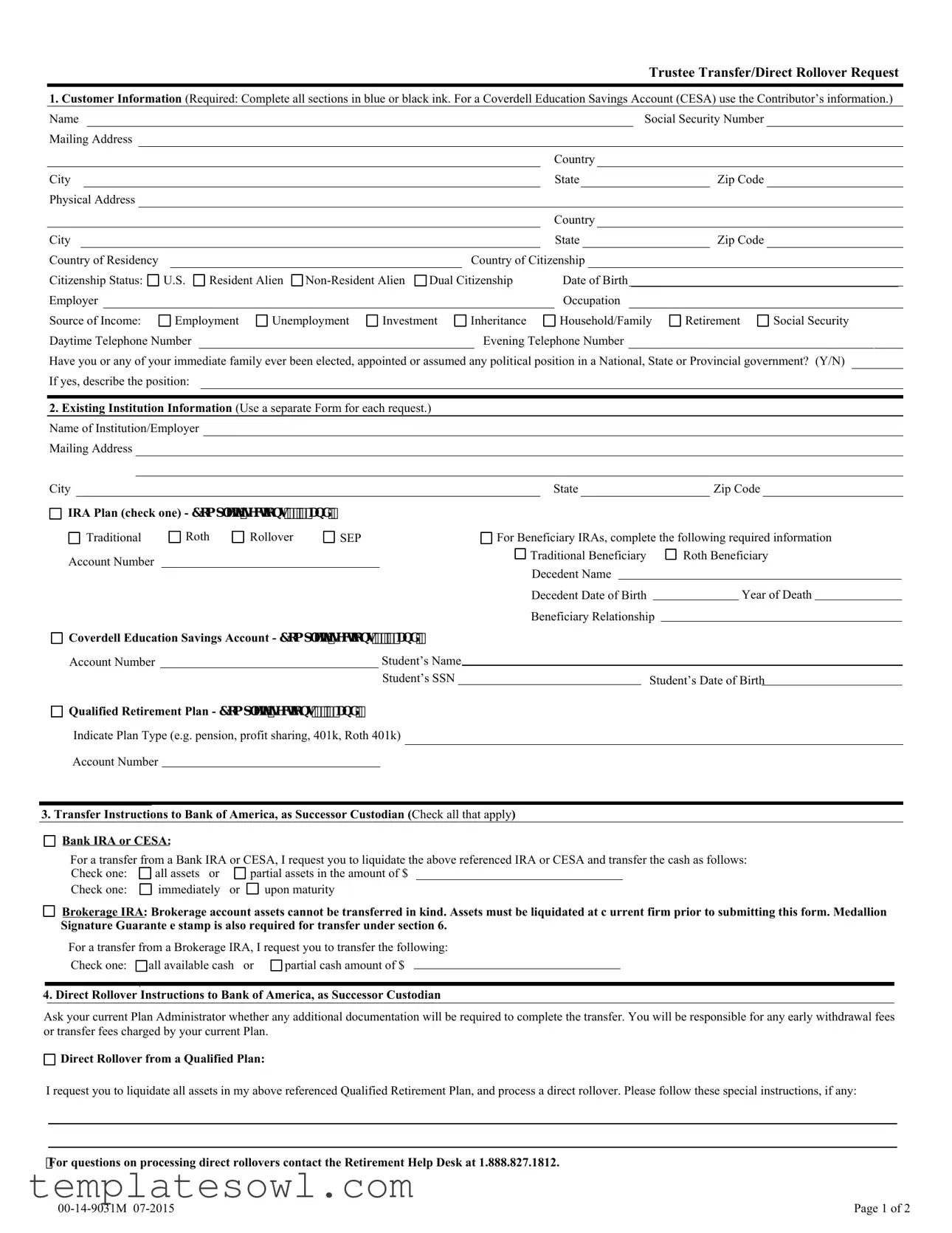

Trustee Transfer/Direct Rollover Request

1.Customer Information (Required: Complete all sections in blue or black ink. For a Coverdell Education Savings Account (CESA) use the Contributor’s information.)

Name |

|

|

|

|

|

Social Security Number |

|

|||

Mailing Address |

|

|

|

|

|

|

|

|||

|

|

|

|

|

Country |

|

|

|

|

|

City |

|

|

State |

|

|

Zip Code |

|

|||

Physical Address |

|

|

|

|

|

|

|

|||

|

|

|

|

|

Country |

|

|

|

|

|

City |

|

|

State |

|

|

Zip Code |

|

|||

Country of Residency |

|

|

|

|

|

|

|

Country of Citizenship |

|

|

|

||||

Citizenship Status: |

U.S. |

Resident Alien |

Dual Citizenship |

Date of Birth ___________________________________________ |

|||||||||||

Employer |

|

|

|

|

|

|

|

|

|

|

Occupation |

|

|

|

|

Source of Income: |

|

Employment |

Unemployment |

Investment |

Inheritance |

Household/Family |

Retirement |

Social Security |

|||||||

Daytime Telephone Number |

|

|

|

|

|

|

Evening Telephone Number |

|

|

|

|||||

Have you or any of your immediate family ever been elected, appointed or assumed any political position in a National, State or Provincial government? (Y/N) If yes, describe the position:

2.Existing Institution Information (Use a separate Form for each request.) Name of Institution/Employer

Mailing Address

City |

|

|

|

|

|

State |

|

|

Zip Code |

|

||||

IRA Plan (check one) - &RPSOHWHVHFWLRQVDQG |

|

|

|

|

|

|

|

|

|

|

|

|||

|

Traditional |

Roth |

Rollover |

SEP |

For Beneficiary IRAs, complete the following required information |

|||||||||

Account Number |

|

|

|

Traditional Beneficiary |

Roth Beneficiary |

|||||||||

|

|

|

Decedent Name |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

Decedent Date of Birth |

|

|

|

Year of Death |

|

||||

|

|

|

|

|

Beneficiary Relationship |

|

|

|

|

|

||||

Coverdell Education Savings Account - &RPSOHWHVHFWLRQVDQG |

|

|

|

||

Account Number |

|

Student’s Name |

|

|

|

|

|

|

|

||

|

|

Student’s SSN |

|

Student’s Date of Birth |

|

|

|

|

|

|

|

Qualified Retirement Plan - &RPSOHWHVHFWLRQVDQG

Qualified Retirement Plan - &RPSOHWHVHFWLRQVDQG

Indicate Plan Type (e.g. pension, profit sharing, 401k, Roth 401k)

Account Number

3. Transfer Instructions to Bank of America, as Successor Custodian (Check all that apply)

Bank IRA or CESA:

Bank IRA or CESA:

For a transfer from a Bank IRA or CESA, I request you to liquidate the above referenced IRA or CESA and transfer the cash as follows:

Check one: |

all assets or |

partial assets in the amount of $ |

Check one: |

immediately or |

upon maturity |

Brokerage IRA: Brokerage account assets cannot be transferred in kind. Assets must be liquidated at c urrent firm prior to submitting this form. Medallion Signature Guarante e stamp is also required for transfer under section 6.

Brokerage IRA: Brokerage account assets cannot be transferred in kind. Assets must be liquidated at c urrent firm prior to submitting this form. Medallion Signature Guarante e stamp is also required for transfer under section 6.

For a transfer from a Brokerage IRA, I request you to transfer the following:

Check one: |

all available cash or |

partial cash amount of $ |

4. Direct Rollover Instructions to Bank of America, as Successor Custodian

Ask your current Plan Administrator whether any additional documentation will be required to complete the transfer. You will be responsible for any early withdrawal fees or transfer fees charged by your current Plan.

Direct Rollover from a Qualified Plan:

Direct Rollover from a Qualified Plan:

I request you to liquidate all assets in my above referenced Qualified Retirement Plan, and process a direct rollover. Please follow these special instructions, if any:

For questions on processing direct rollovers contact the Retirement Help Desk at 1.888.827.1812.

Page 1 of 2 |

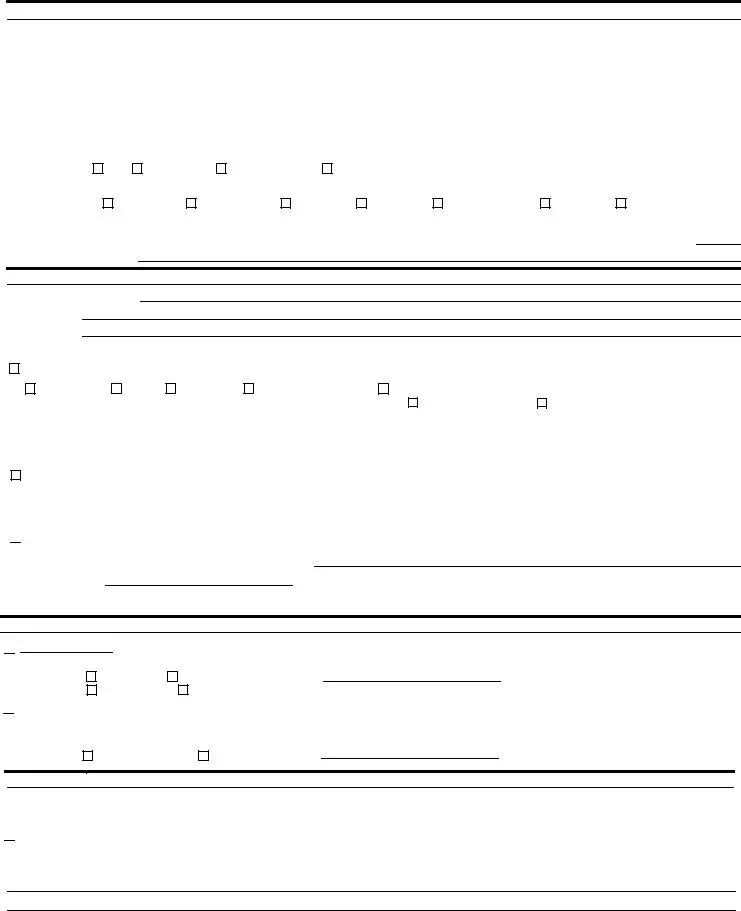

5.Bank of America Plan/Account (If you do not make a selection, funds received will be credited to the Money Market IRA/CESA.) I hereby direct Bank of America, N.A., as Successor Custodian, to deposit the funds referenced on this form to my

Type of Plan: |

Traditional |

Roth |

Rollover |

SEP |

CESA |

Traditional Beneficiary |

Roth Beneficiary |

IRA/CESA Plan Number

Deposit in Existing Account Number

Deposit in Existing Account Number

Deposit in a New Account under the following product type:

Deposit in a New Account under the following product type:

Money Market IRA/CESA (no term)

Term

|

|

|

|

Interest Rate |

|

Annual Percentage Yield |

|||

|

|

|

Term |

Risk Free |

Featured/Promotional |

|

% |

|

% |

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

|

6. Customer's Acceptance (read and complete) |

|

|

|

|

||||

|

A. |

I have received, read and agree to the terms and conditions of the disclosure contained in the deposit agreement, fee schedule and plan document. |

|||||||

|

|

I have read the instructions on this form and authorize the transaction described above. |

|

|

|

||||

I am solely responsible for making sure that any contributions, transfers, conversions or rollovers to this IRA plan are permitted under the rules of the plan and the applicable tax laws, and take full responsibility for any resulting effects, taxes or damages.

B.I understand if I transfer / rollover funds from a Qualified Plan and commingle them with other IRA funds, I might not be able to roll the funds over to another Qualified Plan later. Due to the important tax consequences of rolling over funds to an IRA or other qualified plan, I have been advised to seek the advice of a tax professional.

C.If this is a direct rollover from a Qualified Plan directly to Bank of America, I authorize the employer to handle it according to the instructions on this form. I understand I am responsible for ensuring that Bank of America has received the forms needed to complete a direct rollover to open my Bank of America IRA. Bank of America may cancel my IRA if the direct rollover isn’t received within 90 days and there are no funds in the account.

D.If this is a custodian/trustee transfer, I authorize the existing custodian/trustee to handle it according to the instructions on this form. I understand this transaction is a transfer to a new custodian and not a taxable distribution to me. I also understand that if I’m 70½ or older, I am required to take my required minimum distribution, however, I do not have to take this year’s required minimum distribution before the existing custodian/trustee can transfer the remaining funds to Bank of America.

E.The interest rate and annual percentage yield quoted are valid for 30 days from the date signed below. If the funds are received after 30 days, the rate assigned will be the current rate at that time for the product.

For Bank Use: Medallion Signature Guarantee stamp (Only applicable for securities such as stocks, bonds or mutual funds or brokerage account)

Depositor’s Signature (Required) |

Date |

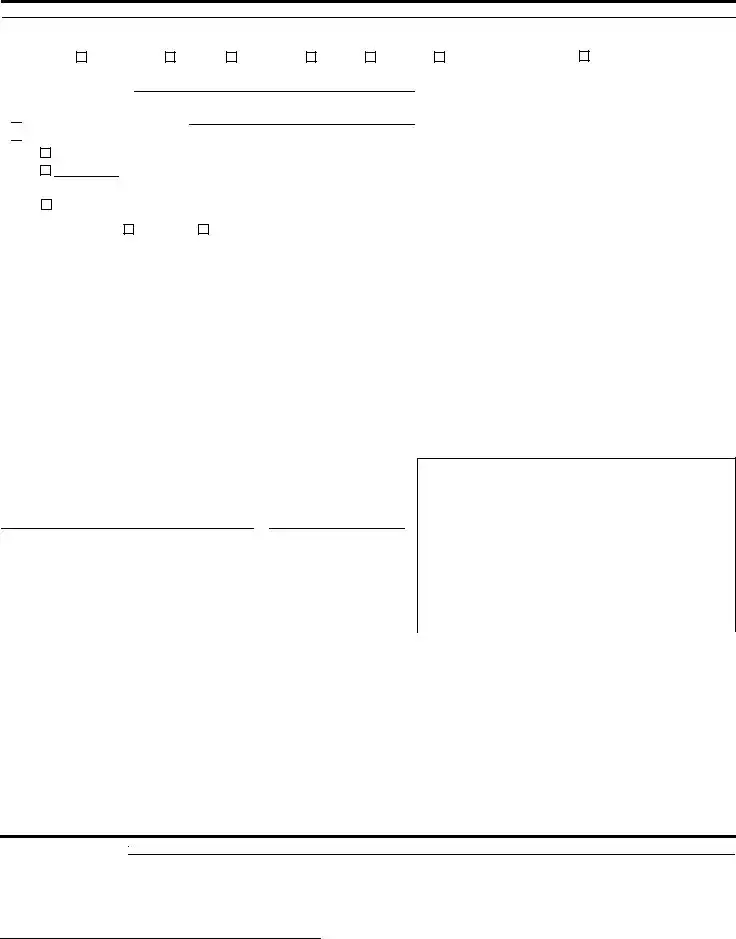

BROKERAGE: In the case of a transfer from a brokerage account, the transferring firm may require signature authorization including but not limited to, signature guarantee, medallion guarantee or some other form of necessary stamp. These guarantees help protect against fraud. Most banks and brokerage firms can provide one. Please contact the transferring firm for clarification.

For Bank Use only: |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|||||

Identification Type: |

|

|

|

Identification Number: |

|

|

|

|||

|

|

|

|

|

|

|||||

Identification Issued By: |

|

|

Identification Issue Date / Expiration Date: |

/ |

/ |

|||||

|

|

|

|

|

|

|

|

|||

Delivery Instructions to Bank of America |

|

|

|

|

|

|

||||

Make checks payable to: Bank of America, N.A. for the benefit of |

|

|

|

|

|

|

||||

|

|

|

|

|

(the name of the IRA/CESA owner) |

|

|

|||

Mail to: |

Regular Mail: |

Bank of America, N.A. |

Overnight Mail: Bank of America, N.A. |

|

|

|||||

|

|

|

||||||||

|

|

|

|

|

|

|

||||

|

|

|

|

P.O. Box 619040 |

|

4500 Amon Carter Blvd |

|

|

||

|

|

|

|

Dallas, TX |

|

Fort Worth, TX 76155 |

|

|

||

Bank Information - For Internal Use Only (must be completed - required information)

Date |

|

|

Banking Center Name |

|

|

|

|

|

|

||

Associate's Name |

|

Associate's Phone Number |

|

||

Bank of America will accept the transfer authorized on this form. |

|

|

|

||

(Required: Bank Representative Signature Here*)

*By signing the Authorized Signature, this confirms that the identity of the customer has been verified and Bank of America will accept funds as successor custodian.

Page 2 of 2 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used for Trustee Transfers and Direct Rollover Requests to Bank of America. |

| Required Information | Customers must complete all sections using blue or black ink, including personal and account details. |

| Dependence on State Laws | The form is subject to state-specific laws governing contributions and rollovers, which may vary. |

| Transfer Instructions | Instructions must specify whether the full or a partial amount of assets is to be transferred. |

| Tax Implications | Participants are advised to seek tax professional advice due to potential tax consequences from rollovers. |

| Medallion Signature Guarantee | A Medallion Signature Guarantee stamp is often needed for transfers from brokerage accounts. |

| Response Timeline | Bank of America must receive rollover forms within 90 days to avoid cancellation of the IRA. |

| Validity of Rates | The interest rate and annual percentage yield quoted on the form are valid for 30 days from the date signed. |

Guidelines on Utilizing Bank Of America Transfer

Completing the Bank of America Transfer Form is a straightforward process that helps ensure your financial assets are transferred smoothly. To facilitate this, it's important to provide accurate information in each section. Follow the steps below to fill out the form correctly.

- Customer Information: Fill in your name, Social Security Number, mailing address, and physical address. Also, indicate your country of residency and citizenship status. Don't forget to include your date of birth and occupation, as well as details about your source of income and contact numbers.

- Existing Institution Information: Specify the name of your current institution or employer and provide their mailing address. Choose your IRA plan type and, if applicable, complete the details for Beneficiary IRAs or Coverdell Education Savings Accounts. Make sure to include account numbers and relationships as needed.

- Transfer Instructions: Indicate the type of account you are transferring (e.g., Bank IRA or Brokerage IRA). Specify whether you want to transfer all assets or a partial amount, and note how you want the funds handled (immediately or upon maturity).

- Direct Rollover Instructions: If you’re initiating a direct rollover from a Qualified Plan, ensure you consult your current Plan Administrator about additional documentation. Provide any special instructions as needed.

- Bank of America Plan/Account: Choose the type of plan for the deposited funds, whether you want an existing or new account, and indicate any specific terms for the account.

- Customer's Acceptance: Carefully read and acknowledge the terms and conditions before signing. This step confirms your understanding of the transfer process and any potential implications.

After completing the form, ensure that all sections are filled out correctly and double-check your information for accuracy. Once everything is in order, submit the form according to the instructions provided by Bank of America. If you receive assistance during this process, don’t hesitate to ask questions for clarity. Your financial transition should be as seamless as possible.

What You Should Know About This Form

What is the primary purpose of the Bank of America Transfer form?

The Bank of America Transfer form serves as a request for transferring assets from existing retirement accounts, such as IRAs or 401(k) plans, into an account with Bank of America. This form is necessary for initiating the transfer or rollover process, ensuring the appropriate instructions are followed, and allowing both the existing and receiving institutions to process the request efficiently.

What information is required in the Customer Information section of the form?

The Customer Information section requires various personal details. This includes the customer's name, Social Security Number, mailing and physical addresses, date of birth, and contact numbers. It is also essential to indicate citizenship status and whether any immediate family members hold political positions. Accurate completion of this section is crucial, as it facilitates the identification and processing of the transfer request.

How should the existing institution information be filled out?

In the Existing Institution Information section, the customer must provide the name and address of the current financial institution holding the retirement account. Additionally, selecting the correct type of IRA plan—like Traditional, Roth, or SEP—and entering the relevant account number are necessary steps. This information helps Bank of America communicate with the current institution to execute the transfer or rollover appropriately.

Can assets be transferred in kind from a brokerage account?

No, assets held in a brokerage account cannot be transferred in kind, meaning the investments cannot be moved as is. Instead, these assets must be liquidated at the current firm before submitting the transfer form. After liquidation, the available cash can then be transferred to Bank of America. A Medallion Signature Guarantee stamp is also required for such transfers.

What are the responsibilities of the customer during the transfer process?

Customers have several responsibilities when submitting the transfer form. They must ensure that all provided information is accurate and that they understand any potential tax implications or fees associated with the transfer. Additionally, customers need to verify that all necessary documents are submitted to their current plan administrator, especially for direct rollovers. Seeking advice from a tax professional is recommended to navigate any complexities involved.

What happens if the direct rollover is not completed within a specific timeframe?

If a direct rollover from a Qualified Plan to Bank of America is not completed within 90 days, the bank may cancel the IRA account if no funds have been received. It is the customer's responsibility to ensure that all necessary forms are submitted timely. Any delays could complicate the transfer process and potentially affect the customer's retirement savings strategy.

Common mistakes

Filling out the Bank of America Transfer form can be a straightforward task, but several common mistakes can hinder the process. One frequent mistake is leaving sections incomplete. Customers must fill out all mandatory fields in blue or black ink. Failing to provide complete information, such as Social Security numbers or mailing addresses, will lead to delays or rejections. Missing even one detail can slow down the entire transfer process.

Another mistake involves incorrect selection of account types. There are various types of accounts for transfer, including IRA, CESA, or Qualified Retirement Plan. It is crucial to accurately identify which type of account each section pertains to. Choosing the wrong option not only complicates the transaction but may also have tax repercussions or prevent funds from being transferred to the appropriate account.

Inadequate instructions for transfers can also cause confusion. For instance, when transferring from a brokerage IRA, one must liquidate assets beforehand, but not everyone realizes this requirement. Additionally, if Medallion Signature Guarantees are required, customers should ensure they have obtained them before submitting the form. Otherwise, the transfer request may be delayed or denied.

Overlooking the importance of current employer information is yet another oversight. Individuals must notify their current Plan Administrator about the transfer and confirm any required documentation. Neglecting this step may lead to unexpected fees or complications during the rollover process. It is essential to maintain clear communication with all involved parties to facilitate a smooth transition.

Another common error is not understanding the tax implications of the transfer. Misjudging how combining funds can affect future rollovers to a qualified plan might result in substantial tax liabilities. Thus, it is advisable to seek guidance from a tax professional to avoid these pitfalls.

Lastly, failing to read the acceptance terms can be detrimental. Customers are responsible for ensuring they fully comprehend the terms and conditions associated with their transfer request. Skimming over this information could lead to misunderstandings that impact the overall management of the account. It’s crucial to take the time to understand what you are agreeing to and the responsibilities that come with the transfer.

Documents used along the form

When completing a Bank of America Transfer form, you may need several related documents to ensure a smooth transfer process. Below is a list of forms and documents that are often used alongside it, along with a brief description of each.

- Medallion Signature Guarantee: This stamp verifies the authenticity of your signature and protects against unauthorized transactions. It’s often required when transferring assets from a brokerage account.

- Transfer Authorization Form: A document that allows the current custodian to release your assets to Bank of America. It specifies the details of the transfer and the accounts involved.

- Direct Rollover Form: Used for rolling over an old retirement plan into an IRA. This form provides details about the source and destination of the funds.

- Coverdell Education Savings Account (CESA) Application: If transferring funds from a CESA, this application is necessary to set up a new account or designate existing account information.

- IRA Disclosure Statement: This document contains important information about the terms and conditions of your IRA, including fees and tax implications.

- Employer Distribution Request Form: If your transfer involves funds from an employer-sponsored retirement plan, this form might be needed to request a distribution.

- Proof of Identity: Various forms of identification, such as a driver’s license or passport, may be required to confirm your identity during the transfer process.

Having these documents ready will help facilitate a smooth and efficient transfer of your funds to Bank of America. It’s always advisable to double-check each form for completeness and accuracy before submission.

Similar forms

- Transfer Request Form: Similar to the Bank of America Transfer form, a general transfer request form is used to request the transfer of assets from one financial institution to another, requiring personal and account information.

- Rollover Request Form: This document allows individuals to initiate a rollover of funds from one retirement account to another, similar to how the transfer form instructs the movement of funds.

- IRA Establishment Form: It serves as the first step to open an Individual Retirement Account (IRA), like the Bank of America Transfer form, which also relates to IRA assets.

- Beneficiary Designation Form: This document identifies beneficiaries for accounts, akin to how the transfer form records beneficiaries for IRA funds.

- Medallion Signature Guarantee Form: Often required for transfers, it verifies the identity of the account holder, much like its necessity in the Bank of America Transfer form.

- Withdrawal Request Form: This is used to request the withdrawal of funds from an account, similar to how the transfer form facilitates the release of funds to a new custodian.

- Change of Address Form: It provides updated contact information for account holders, paralleling the personal information section in the Bank of America Transfer form.

- Investment Exchange Form: This allows account holders to exchange investments within their account, mirroring the liquidating aspect of asset transfer in the Bank of America Transfer form.

- Account Closure Form: It instructs financial institutions to close a customer’s account, in a way related to the account transfer aspect of the Bank of America form.

- Power of Attorney Form: This grants authority to another person to act on behalf of the account holder, similar to how the Bank of America Transfer form allows instructions for asset movement.

Dos and Don'ts

When filling out the Bank of America Transfer form, following certain guidelines can make the process smoother and help avoid mistakes. Here’s what you should and shouldn’t do:

- Do: Fill in all sections completely. Use blue or black ink to avoid any issues with readability.

- Do: Double-check your Social Security Number. An incorrect number can delay the transfer process.

- Do: Ensure that you are selecting the correct type of IRA or CESA for the transfer.

- Do: Confirm whether any additional documentation is needed from your current plan administrator.

- Do: Read the terms and conditions. Understanding these can help prevent unexpected fees or issues later.

- Don’t: Leave any required fields blank. Omitting information may lead to rejection of your transfer request.

- Don’t: Forget to provide valid contact numbers. This is important if the bank needs to reach you regarding your request.

- Don’t: Assume that your existing custodian understands your intentions without clearly stating them in the form.

- Don’t: Ignore the requirement for a Medallion Signature Guarantee if you are transferring from a brokerage account.

- Don’t: Wait until the last moment to send your completed form. Timely submission helps ensure prompt processing.

Misconceptions

Understanding the Bank of America Transfer Form can help reduce confusion during the transfer process. Here are five misconceptions clarified:

- All transfers are tax-free. While many transfers can occur without immediate tax implications, some types may incur taxes or penalties. Always verify the specific rules associated with your account type.

- The form can be completed in any ink color. The Bank of America Transfer Form requires completion in blue or black ink. This ensures clarity and proper processing, so be mindful of the ink you choose.

- Only one transfer can be processed at a time. You can use multiple forms for different transfer requests. However, each transfer will require a separate form, making it crucial to complete each one thoroughly.

- All assets must be liquidated for a transfer. This is not necessarily true. For certain accounts, you may choose to transfer specific assets without liquidating them first. Check the requirements based on your account type.

- You don’t need to inform your current custodian. It’s important to notify your existing custodian prior to the transfer. Some custodians might require additional documentation or processing times that could impact your transfer.

Clearing up these misconceptions can streamline your transfer experience with Bank of America. Remember to read all instructions carefully and consider seeking professional advice if you have further questions.

Key takeaways

Complete Required Sections: Fill out all sections of the Bank of America Transfer form in blue or black ink. Incomplete forms may delay the transfer process.

Coverdell Education Savings Accounts: When filling out the form for a Coverdell Education Savings Account, use the contributor's information rather than the beneficiary's details.

Transfer Instructions: Be clear about whether you are requesting a full transfer of all assets or a partial transfer. Specify whether the transfer should occur immediately or upon maturity.

Consult Your Current Plan Administrator: Before initiating a direct rollover, check with your current Plan Administrator for any additional documentation needed to complete the transfer.

Understand Tax Implications: Be aware of the tax consequences associated with rolling over funds. It is advisable to consult a tax professional to ensure compliance with applicable tax laws.

Browse Other Templates

Lynn University Transcript - The form highlights the value placed on student privacy regarding transcript requests.

T Accounts Accounting - Enables easy identification of account impacts.

Ut Forms - Only authorized individuals can retrieve the transcript for you.