Fill Out Your Bankruptcy B10 Proof Of Claim Form

The Bankruptcy B10 Proof of Claim form serves as a vital instrument in the bankruptcy process, allowing creditors to assert their rights to receive payment from a debtor's estate. When a debtor files for bankruptcy, any creditor wishing to realize their claims must complete this specific form and submit it to the bankruptcy court. This form requires essential details, including the name of the debtor and the corresponding bankruptcy case number, in order to ensure accurate and efficient processing. Furthermore, creditors must disclose the total amount owed as of the bankruptcy filing date, along with the basis for their claim—whether it stems from goods sold, services rendered, or other financial obligations. Notably, if the claim is secured by a lien on property, additional information regarding the nature of the collateral and the value of that property must be provided. Creditors are also required to specify if portions of the claim fall into priority categories, which determines the order of payment during the bankruptcy proceedings. Attachments play a crucial role as well, as creditors must include supporting documentation to substantiate their claims. Overall, the B10 form is not merely a bureaucratic necessity; it represents the creditor's opportunity to recover debts owed while navigating the complexities of the bankruptcy system.

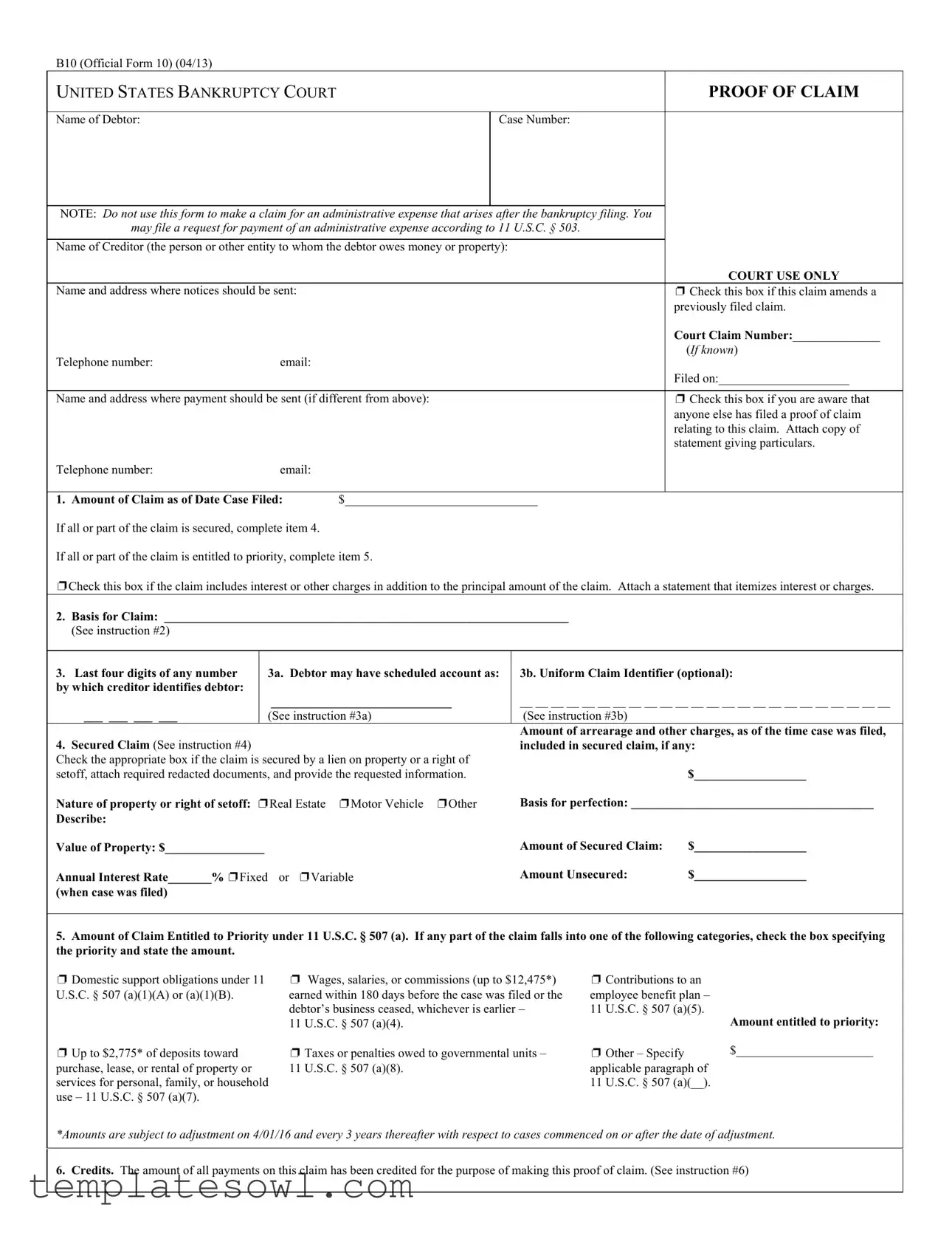

Bankruptcy B10 Proof Of Claim Example

B10 (Official Form 10) (04/13)

UNITED STATES BANKRUPTCY COURT |

__________ District of __________ |

PROOF OF CLAIM |

||

|

|

|

|

|

Name of Debtor: |

|

|

Case Number: |

|

|

|

|

||

NOTE: Do not use this form to make a claim for an administrative expense that arises after the bankruptcy filing. You |

|

|||

may file a request for payment of an administrative expense according to 11 U.S.C. § 503. |

|

|||

|

|

|||

Name of Creditor (the person or other entity to whom the debtor owes money or property): |

|

|||

|

|

|

|

COURT USE ONLY |

Name and address where notices should be sent: |

|

|

❐ Check this box if this claim amends a |

|

|

|

|

|

previously filed claim. |

|

|

|

|

Court Claim Number:______________ |

|

|

|

|

(If known) |

Telephone number: |

email: |

|

|

|

|

|

|

|

Filed on:_____________________ |

|

|

|||

Name and address where payment should be sent (if different from above): |

❐ Check this box if you are aware that |

|||

|

|

|

|

anyone else has filed a proof of claim |

|

|

|

|

relating to this claim. Attach copy of |

|

|

|

|

statement giving particulars. |

Telephone number: |

email: |

|

|

|

|

|

|

||

1. Amount of Claim as of Date Case Filed: |

$_______________________________ |

|

||

If all or part of the claim is secured, complete item 4. |

|

|

|

|

If all or part of the claim is entitled to priority, complete item 5. |

|

|||

❐Check this box if the claim includes interest or other charges in addition to the principal amount of the claim. Attach a statement that itemizes interest or charges.

2. Basis for Claim: _________________________________________________________________

(See instruction #2)

3. Last four digits of any number |

|

3a. Debtor may have scheduled account as: |

3b. Uniform Claim Identifier (optional): |

|

by which creditor identifies debtor: |

|

|

|

|

|

|

_____________________________ |

__ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ |

|

___ ___ ___ ___ |

|

(See instruction #3a) |

(See instruction #3b) |

|

|

|

|

Amount of arrearage and other charges, as of the time case was filed, |

|

4. Secured Claim (See instruction #4) |

|

included in secured claim, if any: |

||

Check the appropriate box if the claim is secured by a lien on property or a right of |

|

|

||

setoff, attach required redacted documents, and provide the requested information. |

|

$__________________ |

||

Nature of property or right of setoff: ❐Real Estate ❐Motor Vehicle ❐Other |

Basis for perfection: _______________________________________ |

|||

Describe: |

|

|

|

|

Value of Property: $________________ |

|

Amount of Secured Claim: |

$__________________ |

|

Annual Interest Rate_______% ❐Fixed |

or ❐Variable |

Amount Unsecured: |

$__________________ |

|

(when case was filed) |

|

|

|

|

5. Amount of Claim Entitled to Priority under 11 U.S.C. § 507 (a). If any part of the claim falls into one of the following categories, check the box specifying the priority and state the amount.

❐ Domestic support obligations under 11 |

❐ Wages, salaries, or commissions (up to $12,475*) |

❐ Contributions to an |

|

U.S.C. § 507 (a)(1)(A) or (a)(1)(B). |

earned within 180 days before the case was filed or the |

employee benefit plan – |

|

|

debtor’s business ceased, whichever is earlier – |

11 U.S.C. § 507 (a)(5). |

|

|

11 U.S.C. § 507 (a)(4). |

|

Amount entitled to priority: |

❐ Up to $2,775* of deposits toward |

❐ Taxes or penalties owed to governmental units – |

❐ Other – Specify |

$______________________ |

purchase, lease, or rental of property or |

11 U.S.C. § 507 (a)(8). |

applicable paragraph of |

|

services for personal, family, or household |

|

11 U.S.C. § 507 (a)(__). |

|

use – 11 U.S.C. § 507 (a)(7). |

|

|

|

*Amounts are subject to adjustment on 4/01/16 and every 3 years thereafter with respect to cases commenced on or after the date of adjustment.

6. Credits. The amount of all payments on this claim has been credited for the purpose of making this proof of claim. (See instruction #6)

B10 (Official Form 10) (04/13) |

2 |

7.Documents: Attached are redacted copies of any documents that support the claim, such as promissory notes, purchase orders, invoices, itemized statements of running accounts, contracts, judgments, mortgages, security agreements, or, in the case of a claim based on an

DO NOT SEND ORIGINAL DOCUMENTS. ATTACHED DOCUMENTS MAY BE DESTROYED AFTER SCANNING.

If the documents are not available, please explain:

8.Signature: (See instruction #8) Check the appropriate box.

❐ I am the creditor. |

❐ I am the creditor’s authorized agent. |

❐ I am the trustee, or the debtor, |

❐ I am a guarantor, surety, indorser, or other codebtor. |

|

|

or their authorized agent. |

(See Bankruptcy Rule 3005.) |

|

|

(See Bankruptcy Rule 3004.) |

|

I declare under penalty of perjury that the information provided in this claim is true and correct to the best of my knowledge, information, and reasonable belief.

Print Name: _________________________________________________

Title: _________________________________________________

Company: _________________________________________________

Address and telephone number (if different from notice address above): |

(Signature) |

(Date) |

_________________________________________________ |

|

|

_________________________________________________ |

|

|

_________________________________________________ |

|

|

Telephone number:email:

Penalty for presenting fraudulent claim: Fine of up to $500,000 or imprisonment for up to 5 years, or both. 18 U.S.C. §§ 152 and 3571.

INSTRUCTIONS FOR PROOF OF CLAIM FORM

The instructions and definitions below are general explanations of the law. In certain circumstances, such as bankruptcy cases not filed voluntarily by the debtor,

exceptions to these general rules may apply.

Items to be completed in Proof of Claim form

Court, Name of Debtor, and Case Number: |

claim is entirely unsecured. (See Definitions.) If the claim is secured, check the |

|

Fill in the federal judicial district in which the bankruptcy case was filed (for |

box for the nature and value of property that secures the claim, attach copies of lien |

|

example, Central District of California), the debtor’s full name, and the case |

documentation, and state, as of the date of the bankruptcy filing, the annual interest |

|

number. If the creditor received a notice of the case from the bankruptcy court, |

rate (and whether it is fixed or variable), and the amount past due on the claim. |

|

all of this information is at the top of the notice. |

|

|

|

5. Amount of Claim Entitled to Priority Under 11 U.S.C. § 507 (a). |

|

Creditor’s Name and Address: |

If any portion of the claim falls into any category shown, check the appropriate |

|

Fill in the name of the person or entity asserting a claim and the name and |

box(es) and state the amount entitled to priority. (See Definitions.) A claim may |

|

address of the person who should receive notices issued during the bankruptcy |

be partly priority and partly |

|

case. A separate space is provided for the payment address if it differs from the |

the law limits the amount entitled to priority. |

|

notice address. The creditor has a continuing obligation to keep the court |

|

|

informed of its current address. See Federal Rule of Bankruptcy Procedure |

6. |

Credits: |

(FRBP) 2002(g). |

An authorized signature on this proof of claim serves as an acknowledgment that |

|

|

when calculating the amount of the claim, the creditor gave the debtor credit for |

|

1. Amount of Claim as of Date Case Filed: |

any payments received toward the debt. |

|

State the total amount owed to the creditor on the date of the bankruptcy filing. |

|

|

Follow the instructions concerning whether to complete items 4 and 5. Check |

7. |

Documents: |

the box if interest or other charges are included in the claim. |

Attach redacted copies of any documents that show the debt exists and a lien |

|

|

secures the debt. You must also attach copies of documents that evidence perfection |

|

2. Basis for Claim: |

of any security interest and documents required by FRBP 3001(c) for claims based |

|

State the type of debt or how it was incurred. Examples include goods sold, |

on an |

|

money loaned, services performed, personal injury/wrongful death, car loan, |

interest in the debtor’s principal residence. You may also attach a summary in |

|

mortgage note, and credit card. If the claim is based on delivering health care |

addition to the documents themselves. FRBP 3001(c) and (d). If the claim is based |

|

goods or services, limit the disclosure of the goods or services so as to avoid |

on delivering health care goods or services, limit disclosing confidential health care |

|

embarrassment or the disclosure of confidential health care information. You |

information. Do not send original documents, as attachments may be destroyed |

|

may be required to provide additional disclosure if an interested party objects to |

after scanning. |

|

the claim. |

|

|

|

8. |

Date and Signature: |

3. Last Four Digits of Any Number by Which Creditor Identifies Debtor: |

The individual completing this proof of claim must sign and date it. FRBP 9011. |

|

State only the last four digits of the debtor’s account or other number used by the |

If the claim is filed electronically, FRBP 5005(a)(2) authorizes courts to establish |

|

creditor to identify the debtor. |

local rules specifying what constitutes a signature. If you sign this form, you |

|

|

declare under penalty of perjury that the information provided is true and correct to |

|

3a. Debtor May Have Scheduled Account As: |

the best of your knowledge, information, and reasonable belief. Your signature is |

|

Report a change in the creditor’s name, a transferred claim, or any other |

also a certification that the claim meets the requirements of FRBP 9011(b). |

|

information that clarifies a difference between this proof of claim and the claim |

Whether the claim is filed electronically or in person, if your name is on the |

|

as scheduled by the debtor. |

signature line, you are responsible for the declaration. Print the name and title, if |

|

|

any, of the creditor or other person authorized to file this claim. State the filer’s |

|

3b. Uniform Claim Identifier: |

address and telephone number if it differs from the address given on the top of the |

|

If you use a uniform claim identifier, you may report it here. A uniform claim |

form for purposes of receiving notices. If the claim is filed by an authorized agent, |

|

identifier is an optional |

provide both the name of the individual filing the claim and the name of the agent. |

|

facilitate electronic payment in chapter 13 cases. |

If the authorized agent is a servicer, identify the corporate servicer as the company. |

|

|

Criminal penalties apply for making a false statement on a proof of claim. |

|

|

|

|

B10 (Official Form 10) (04/13) |

3 |

__________DEFINITIONS__________

______INFORMATION______

Debtor

A debtor is the person, corporation, or other entity that has filed a bankruptcy case.

Creditor

A creditor is a person, corporation, or other entity to whom debtor owes a debt that was incurred before the date of the bankruptcy filing. See 11 U.S.C. §101 (10).

Claim

A claim is the creditor’s right to receive payment for a debt owed by the debtor on the date of the bankruptcy filing. See 11 U.S.C. §101 (5). A claim may be secured or unsecured.

Proof of Claim

A proof of claim is a form used by the creditor to indicate the amount of the debt owed by the debtor on the date of the bankruptcy filing. The creditor must file the form with the clerk of the same bankruptcy court in which the bankruptcy case was filed.

Secured Claim Under 11 U.S.C. § 506 (a)

A secured claim is one backed by a lien on property of the debtor. The claim is secured so long as the creditor has the right to be paid from the property prior to other creditors. The amount of the secured claim cannot exceed the value of the property. Any amount owed to the creditor in excess of the value of the property is an unsecured claim. Examples of liens on property include a mortgage on real estate or a security interest in a car. A lien may be voluntarily granted by a debtor or may be obtained through a court proceeding. In some states, a court judgment is a lien.

A claim also may be secured if the creditor owes the debtor money (has a right to setoff).

Unsecured Claim

An unsecured claim is one that does not meet the requirements of a secured claim. A claim may be partly unsecured if the amount of the claim exceeds the value of the property on which the creditor has a lien.

Claim Entitled to Priority Under 11 U.S.C. § 507

(a)

Priority claims are certain categories of unsecured claims that are paid from the available money or property in a bankruptcy case before other unsecured claims.

Redacted

A document has been redacted when the person filing it has masked, edited out, or otherwise deleted, certain information. A creditor must show only the last four digits of any

Evidence of Perfection

Evidence of perfection may include a mortgage, lien, certificate of title, financing statement, or other document showing that the lien has been filed or recorded.

Acknowledgment of Filing of Claim

To receive acknowledgment of your filing, you may either enclose a stamped

Offers to Purchase a Claim

Certain entities are in the business of purchasing claims for an amount less than the face value of the claims. One or more of these entities may contact the creditor and offer to purchase the claim. Some of the written communications from these entities may easily be confused with official court documentation or communications from the debtor. These entities do not represent the bankruptcy court or the debtor. The creditor has no obligation to sell its claim. However, if the creditor decides to sell its claim, any transfer of such claim is subject to FRBP 3001(e), any applicable provisions of the Bankruptcy Code

(11 U.S.C. § 101 et seq.), and any applicable orders of the bankruptcy court.

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | The Bankruptcy B10 Proof of Claim form is used by creditors to assert their claims against a debtor in bankruptcy proceedings. |

| Filing Location | This form must be filed with the bankruptcy court that is handling the debtor's case, identified by the district and case number. |

| Types of Claims | Creditors can submit secured claims, unsecured claims, and claims entitled to priority. Each type has specific requirements outlined in the form. |

| Documentation Requirements | Creditors must attach supporting documents, such as promissory notes or contracts. Original documents should not be sent, as they may be destroyed. |

| Adjustment of Priority Amounts | Amounts for certain priority claims are subject to adjustments every three years. This is particularly relevant for claims regarding wages and domestic support obligations. |

| Important Legal References | The relevant laws governing the Proof of Claim include 11 U.S.C. § 101 (definitions) and 11 U.S.C. § 507 (priority claims). |

Guidelines on Utilizing Bankruptcy B10 Proof Of Claim

After filling out the Bankruptcy B10 Proof Of Claim form, you will submit it to the appropriate bankruptcy court. This submission is essential to ensure that your claim is recognized in the bankruptcy proceedings. Remember to keep a copy for your records and consider sending it with a method that provides confirmation of delivery.

- Identify the federal judicial district where the bankruptcy case was filed. Write this at the top of the form, along with the debtor’s full name and the case number.

- Provide the name and address of the creditor, including where notices should be sent. If payment should go elsewhere, fill in that information as well.

- Indicate whether this claim amends an earlier filed claim, if relevant. If so, include the court claim number.

- State the total amount of the claim as of the date the bankruptcy case was filed. If any part of the claim is secured or entitled to priority, be prepared to complete those sections of the form.

- Explain the basis for the claim. Provide specific details about how the debt was incurred, referencing goods or services provided.

- Fill in the last four digits of any account number by which the creditor identifies the debtor. If applicable, you may also enter a uniform claim identifier.

- If your claim is secured, specify the nature of the property and its value. Complete the section on the amount of the secured claim and provide documentation to support this claim.

- Identify any portion of your claim entitled to priority under U.S. bankruptcy law. Check appropriate boxes and include the amounts as necessary.

- Note any credits that have been applied to the claim. Ensure that all applicable documents supporting the claim are included.

- Attach any supporting documents, such as contracts or invoices. Remember to redact sensitive information. Do not send original documents, as they may be destroyed after scanning.

- Sign and date the form. Indicate whether you are the creditor or an authorized agent, and provide your printed name and title, if applicable.

What You Should Know About This Form

What is the Bankruptcy B10 Proof Of Claim form?

The Bankruptcy B10 Proof Of Claim form is a document that creditors use to declare the amount of debt owed to them by a debtor filing for bankruptcy. It helps the court recognize the creditor's claim against the debtor’s assets. Filling out this form is necessary to participate in the bankruptcy process and potentially get paid for the debt.

Who should fill out the B10 form?

The B10 form should be completed by creditors—individuals or entities that are owed money or property by the debtor. This includes businesses, individuals with personal loans, and service providers who have not been paid for services rendered prior to the bankruptcy filing.

How do I know if my claim is secured or unsecured?

A secured claim is one that has a lien backing it, allowing the creditor the right to take specific property if the debtor doesn’t pay. Examples include mortgages and car loans. An unsecured claim, on the other hand, does not offer this protection and depends solely on the debtor's promise to pay. If the claim exceeds the value of secured property, it might have both secured and unsecured portions.

What information do I need to provide on the form?

You'll need to provide your name and contact information, details about the debtor, and specifics about the amount owed. Include if the claim is secured or entitled to priority, as well as any necessary documentation that proves your claim, such as invoices or contracts.

What documents do I need to attach with the B10 form?

You should include copies of any relevant documents that support your claim, such as contracts, invoices, or proof of a lien. Make sure these documents are redacted to protect sensitive information. Original documents should not be sent, as they may be destroyed after they are scanned.

What happens after I submit the B10 form?

Once you fill out and submit the B10 form, the court will review your claim. If your claim is approved, it will be considered in the bankruptcy proceedings. You may receive a notice acknowledging your claim, either by mail or through the court's online system, PACER.

Can I amend my claim after submitting the form?

Yes, if you need to change any information in your claim, you can amend it by submitting a new B10 form and checking the appropriate box indicating that it is an amended claim. It’s important to keep the court informed of any changes to ensure the accuracy of your claim in the bankruptcy case.

What are the consequences of submitting false information on the B10 form?

Submitting false information could lead to severe penalties, including fines of up to $500,000 or imprisonment for up to five years. It’s essential to be honest and accurate when filling out the form to avoid legal repercussions.

Common mistakes

Filling out the Bankruptcy B10 Proof Of Claim form can seem daunting, but it's crucial for ensuring that creditors receive the payments they are owed. Many people, however, make common mistakes that can lead to complications or the rejection of their claims. Here are nine prevalent errors to avoid.

One frequent mistake is not including the proper court information. Each bankruptcy case is assigned to a specific court and district. Incomplete or inaccurate information may result in delays or prevent processing altogether. It’s essential to fill out these details correctly at the top of the form.

Another common error involves failing to specify the correct amount of the claim as of the date the case was filed. The total should reflect what the debtor owes, including any interest or additional charges. Ignoring this detail could lead to underpayment if the claim is later accepted based on inaccurate figures.

Inappropriate categorization of the claim is another misstep. Many filers forget to indicate whether their claim is secured or unsecured. If there's collateral backing the debt, this must be clearly stated, along with the necessary information about the security interest. Skipping this can complicate the creditor's ability to recover what they are owed.

Another significant error arises when the filer doesn't attach necessary supporting documents. Claims often require evidence, such as promissory notes or contracts, to substantiate the amount owed. Omitting these documents can result in a claim being rejected, which can be frustrating for everyone involved.

When it comes to interest or additional charges, many fail to check the correct box regarding this. If a claim includes these factors, it is vital to indicate it and provide an itemized statement. This oversight can impact the total claim accepted by the court.

Failure to uphold proper signature requirements can also lead to mistakes. Each claim form must be signed by the creditor or an authorized representative. Not adhering to these specifications can cause the claim to be dismissed, regardless of the accuracy of the information provided.

Moreover, neglecting to provide the last four digits of the debtor's identification number can create issues. This information helps the court track claims more effectively. A lack of this detail reduces the claim's traceability and may needlessly delay the process.

It's also crucial to remember that claims must not include administrative expenses that arise after filing. Many individuals confuse these expenses with regular claims. It is important to file those separately as per the guidelines stated in the form.

Lastly, one of the most important yet overlooked aspects is keeping the contact information current. The form requires the creditor's address and contact details for future notifications, and any changes must be communicated to the court to prevent missed communications. Failure to do so could lead to delays in receiving important updates or notices.

In sum, while completing the Bankruptcy B10 Proof Of Claim form may feel challenging, being aware of these nine common mistakes can lead to a smoother filing process. Precision and attention to detail can help creditors recover what they are owed without unnecessary complications.

Documents used along the form

The Bankruptcy B10 Proof Of Claim form is pivotal in submitting a formal claim against a debtor's bankruptcy estate. However, several other documents and forms often accompany it to provide additional context or information. Below is a list of documents commonly utilized alongside the B10 form, including brief descriptions of their purposes.

- Claim Objection Form: This form allows other parties to formally contest the validity of a claim made by a creditor, outlining reasons for the objection and supporting evidence.

- Notice of Bankruptcy Case Filing: This document informs creditors and interested parties about the bankruptcy case's initiation and provides essential details like the case number and court location.

- Statement of Financial Affairs: This form, included in most bankruptcy filings, provides a comprehensive overview of the debtor's financial situation, including income, expenses, debts, and assets.

- Schedules of Assets and Liabilities: These schedules detail the debtor's assets, liabilities, income, and expenses, forming the foundation of the bankruptcy case and informing all parties involved.

- Proof of Service: A document certifying that copies of the Proof of Claim and related documents were delivered to the debtor and other parties as required by bankruptcy rules.

- Additional Supporting Documents: Creditors may need to include supporting evidence for their claims, such as contracts, invoices, or payment records, depending on the nature of the debt.

- Mortgage Proof of Claim Attachment: When a claim is secured by a debtor's principal residence, this attachment must provide additional details regarding the secured claim and supporting documents.

- Notice of Claim Transfer: Should a creditor transfer their claim to another party, this document must be filed to notify the court and other interested parties of the change.

- Request for Payment of Administrative Expense: If a creditor incurs costs during the bankruptcy process that necessitate compensation, this form is used to formally request payment.

- Reaffirmation Agreement: This form allows a debtor to legally reaffirm a debt after filing for bankruptcy, indicating they wish to continue paying the debt despite the bankruptcy proceedings.

Utilizing the appropriate documents alongside the Bankruptcy B10 Proof Of Claim can streamline the process and enhance the chances of a successful claim. Understanding the need for these additional forms is essential for all parties navigating bankruptcy proceedings.

Similar forms

Proof of Claim (Official Form 410): Similar to the B10 form, Official Form 410 is used in bankruptcy cases to assert a claim against a debtor's estate. Both forms require the creditor to declare the amount owed and provide justification for the claim. However, Form 410 is specifically tailored for bankruptcy cases under different chapters of the Bankruptcy Code, making it versatile across various filings.

Motion to Allow Claim: This document is filed when a creditor seeks court approval to have their claim recognized. Like the B10 form, it addresses the nature of the debt and the amount owed. However, a Motion to Allow Claim is typically used in situations where the claim is disputed or when additional legal proceedings are necessary to affirm the claim's validity.

Notice of Claim: A Notice of Claim serves a similar function in that it informs the bankruptcy court of a creditor’s claim. This document, like the B10 form, includes details such as the creditor's information and the amount owed. The key distinction lies in that a Notice of Claim may not require the same level of detail about supporting documentation or priority status as is required on the B10.

Creditor's Claim in Chapter 13 Plan: This document is part of a Chapter 13 bankruptcy plan where creditors list their claims to be repaid over time. While the B10 captures the claim details at the initial stage, this subsequent document outlines how the claim will be treated throughout the plan period. The creditor must still provide information about the amount owed and basis for the claim, similar to the B10.

Proof of Claim for Governmental Units (Official Form 410-G): Specifically designed for government entities, this form is also analogous to the B10. It includes particular requirements that reflect the nature of government claims, including tax claims and fines. Similar to the B10, it requires the amount owed, proper identification of the claim, and adherence to particular filing protocols.

Dos and Don'ts

When filling out the Bankruptcy B10 Proof of Claim form, attention to detail is important. Here are some dos and don’ts to keep in mind:

- Do include the full name of the debtor and the case number at the top of the form.

- Do provide accurate and complete details about your claim, including amounts owed.

- Do attach any necessary documentation that supports your claim, such as invoices or contracts.

- Do ensure that any sensitive information is properly redacted.

- Don't file the claim if it concerns an administrative expense that arose after the bankruptcy filing.

- Don't forget to sign and date the form before submission.

By following these guidelines, you can help ensure that your proof of claim is processed efficiently.

Misconceptions

Misconception 1: The B10 Proof Of Claim form is the same as a bankruptcy discharge.

It’s important to understand that the B10 form is used to assert a creditor's claim against the debtor. It doesn’t mean the debt is automatically discharged. Filing the form does not guarantee payment or forgiveness of the debt.

Misconception 2: I can use the B10 form for post-bankruptcy administrative expenses.

This is incorrect. The B10 Proof Of Claim form is not intended for claims related to expenses incurred after the bankruptcy has been filed. For those claims, a different procedure must be followed under 11 U.S.C. § 503.

Misconception 3: The amount listed on the B10 form is final and cannot be adjusted later.

The stated amount of the claim can indeed be challenged or amended. Creditors have the option to file amended claims if circumstances change or if they discover additional amounts owed. Always keep your records updated.

Misconception 4: I don’t need to submit supporting documents with my claim.

This is a false assumption. Attaching redacted copies of supporting documents, like contracts or invoices, strengthens your claim. Without this evidence, your claim may be scrutinized or rejected.

Misconception 5: Filing the B10 form guarantees that I will receive my money back.

Submitting the form does not guarantee repayment. Other creditors may have higher priority claims, and available funds may not cover all debts. Understanding the priority hierarchy is crucial for realistic expectations.

Key takeaways

- The Bankruptcy B10 Proof of Claim form is used by creditors to assert their claims against a debtor in bankruptcy.

- Make sure to fill out the name of the debtor and the case number accurately at the top of the form.

- Claims cannot be made for expenses incurred after the bankruptcy filing; these must be filed separately under 11 U.S.C. § 503.

- Provide a clear and concise statement under the "Basis for Claim" section explaining how the debt was incurred.

- Always check the appropriate boxes if your claim includes any interest or charges beyond the principal amount and provide itemization.

- Documents substantiating the claim should be attached, including promissory notes or invoices, but do not send original documents.

- It is essential to sign and date the form, declaring that the information provided is accurate to the best of your knowledge.

- Check for any previously filed claims related to your claim and attach relevant documentation if applicable.

- Keep a copy of the completed claim form for your records and consider requesting acknowledgment of filing for future reference.

Browse Other Templates

Nyc Corp Tax Rate - Clear and accurate completion of the form ensures a smoother filing process for corporations.

Key Form Template - Prior to departure from the College, employees must complete the key return portion of the agreement.

Free Gerber Engraved Baby Spoon - Available items include baby spoons, cups, and frames to cherish milestones.