Fill Out Your Bbt Form

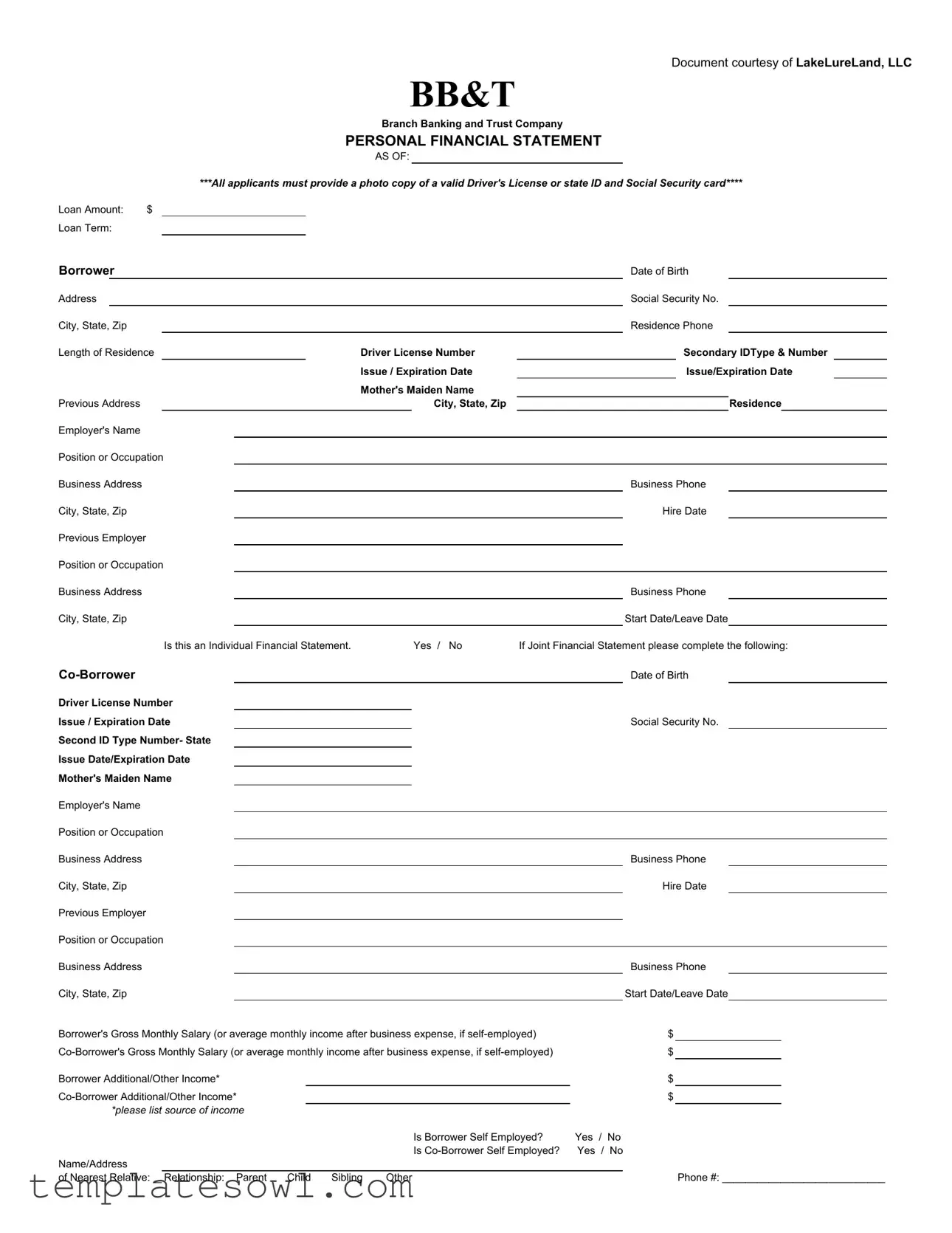

The BB&T Personal Financial Statement, often referred to simply as the BB&T form, is a comprehensive document designed to provide a clear snapshot of an individual's financial situation. Key components of the form include personal identification information, such as the borrower's name, address, and social security number, along with details about employment history and income sources. This form requires applicants to list their assets, which encompass bank accounts, life insurance policies, stocks, real estate holdings, and vehicles, among others. Each asset section is structured to capture the necessary financial details, including current market values and any associated debts. Additionally, the form addresses liabilities, such as outstanding loans and alimony obligations, and includes sections for contingent liabilities and disclosures about any legal actions. The BB&T form also emphasizes the importance of accurate information, as it serves as a critical tool for evaluating creditworthiness when applying for loans or other financial services. Moreover, applicants must acknowledge their understanding that any false information could affect their eligibility for credit. This detailed structure not only aids in determining financial health but also streamlines the process for borrowers seeking financial assistance.

Bbt Example

Document courtesy of LakeLureLand, LLC

BB&T

Branch Banking and Trust Company

PERSONAL FINANCIAL STATEMENT

AS OF:

***All applicants must provide a photo copy of a valid Driver's License or state ID and Social Security card****

Loan Amount: |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan Term: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrower |

|

|

|

|

|

|

|

|

|

Date of Birth |

||||||||

Address |

|

|

|

|

|

|

|

|

|

|

Social Security No. |

|

||||||

City, State, Zip |

|

|

|

|

|

|

|

|

|

Residence Phone |

|

|||||||

Length of Residence |

|

|

Driver License Number |

|

|

|

|

Secondary IDType & Number |

|

|||||||||

|

|

|

|

|

|

|

Issue / Expiration Date |

|

|

|

|

Issue/Expiration Date |

||||||

|

|

|

|

|

|

|

Mother's Maiden Name |

|

|

|

|

|

|

|

|

|

|

|

Previous Address |

|

|

|

|

|

|

City, State, Zip |

|

|

|

|

|

|

Residence |

||||

Employer's Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position or Occupation |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Business Address |

|

|

|

|

|

|

|

|

|

Business Phone |

|

|||||||

City, State, Zip |

|

|

|

|

|

|

|

|

|

Hire Date |

||||||||

Previous Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position or Occupation |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Business Address |

|

|

|

|

|

|

|

|

|

Business Phone |

|

|||||||

City, State, Zip |

|

|

|

|

|

|

|

|

|

Start Date/Leave Date |

|

|||||||

|

|

|

Is this an Individual Financial Statement. |

|

Yes / No |

If Joint Financial Statement please complete the following: |

||||||||||||

|

|

|

|

|

|

|

|

|

Date of Birth |

|

||||||||

Driver License Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Issue / Expiration Date |

|

|

|

|

|

Social Security No. |

|

|||||||||||

Second ID Type Number- State |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Issue Date/Expiration Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Mother's Maiden Name |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Employer's Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position or Occupation |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Business Address |

|

|

|

|

|

|

|

|

|

Business Phone |

|

|||||||

City, State, Zip |

|

|

|

|

|

|

|

|

|

Hire Date |

||||||||

Previous Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position or Occupation |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Business Address |

|

|

|

|

|

|

|

|

|

Business Phone |

|

|||||||

City, State, Zip |

|

|

|

|

|

|

|

|

|

Start Date/Leave Date |

|

|||||||

Borrower's Gross Monthly Salary (or average monthly income after business expense, if |

$ |

|

|

|

|

|

|

|

||||||||||

$ |

|

|

|

|

|

|

|

|||||||||||

Borrower Additional/Other Income* |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

$ |

|

|

|

|

|

|

|

||||||

*please list source of income |

|

|

|

|

|

|

|

|

|

|

Is Borrower Self Employed? |

Yes / No |

|

|

|

|

|

Is |

Yes / No |

|

Name/Address |

|

|

|

|

|

|

of Nearest Relative: __ Relationship: Parent |

Child |

Sibling |

Other |

|

Phone #: ____________________________ |

|

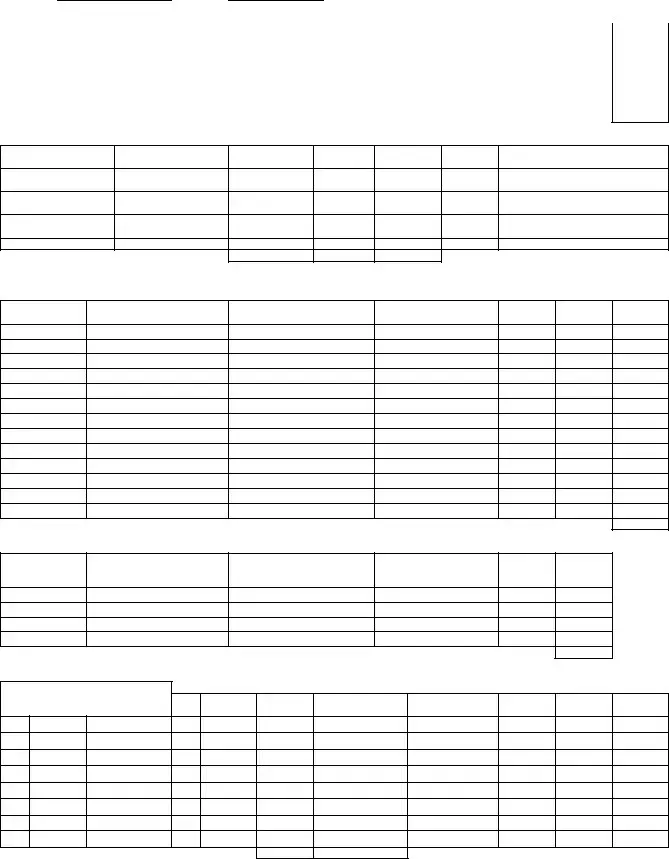

BB&T PERSONAL FINANCIAL STATEMENT |

PAGE 2 |

Name:Date:

Schedule 1 - DEPOSIT ACCOUNTS

NAME OF FINANCIAL INSTITUITON |

Account |

Account |

AND LOCATION |

Number |

Balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 2 - LIFE INSURANCE

NAME OF FINANCIAL INSTITUITON |

Account |

Account |

AND LOCATION |

Number |

Balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

Name of Person

Company

Face Amount

Cash Value Policy Loans

Policy

If Assigned, to whom?

Insured

Assigned?

Schedule 3 - MARKETABLE STOCKS/BONDS NYSE, AMEX, NASDAQ

(If stocks or bonds are held in a brokerage account, just summarize account as one entry and attach statement)

NUMBER OF SHARES/ FACE VALUE (BONDS)

DESCRIPTION

REGISTERED IN

NAME OF

IF PLEDGED TO WHOM?

DATE

ACQUIRED

COST

MARKET

VALUE

TOTAL

Schedule 4 - STOCK IN CLOSELY HELD CORPORATIONS (Please provide F/S if total value exceeds 10% of your net worth)

NUMBER OF SHARES/ OWNED & % OWNSHP

CORPORATION NAME

STOCK HELD IN THE NAME OF

STOCKHOLDER'S EQUITY

ANNUAL

STATEMENT

DATE

VALUE OF SHARES

TOTAL

Schedule 5 - VEHICLES, BOATS, MACHINERY, AND EQUIPMENT

DESCRIPTION

YR |

MAKE |

MODEL |

YR

ACQ

COST

MARKET

VALUE

LOAN

BALANCE, IF ANY

LOAN PAYABLE TO

PAYMENT AMOUNT

PAYMENT

FREQUENCY

ORIGINAL

TERM (in Mths)

TOTAL

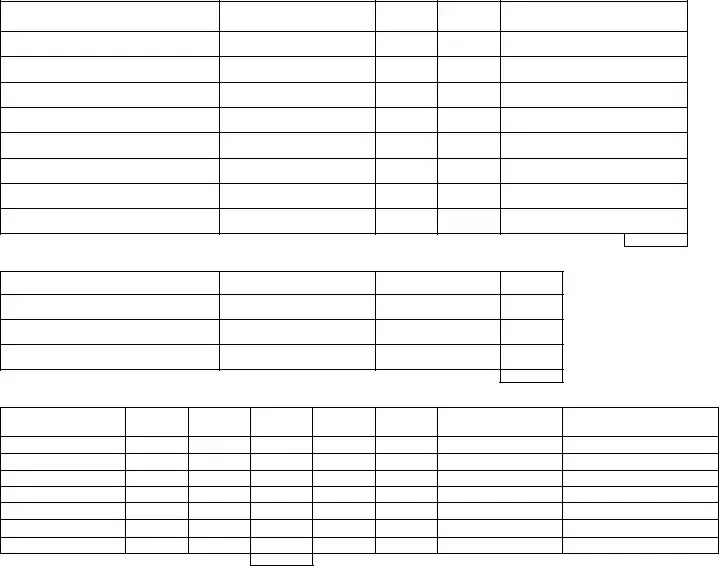

BB&T PERSONAL FINANCIAL STATEMENT |

|

|

|

|

PAGE 3 |

||||

Name: |

|

|

Date: |

|

|

|

|

|

|

Schedule 6 - REAL ESTATE |

|

|

|

|

|

|

|

|

|

LOCATION OR ADDRESS |

|

|

|

COST/ |

MARKET |

MORTGAGE |

|

MORTGAGE PAYABLE TO |

|

DESCRIPTION OF PROPERTY |

|

|

TITLE IN THE NAME OF |

YR ACQUIRED |

VALUE |

BALANCE |

HOW PAYABLE (Amt per month) |

||

|

|

|

|

|

|

|

|

$ |

per |

|

|

|

|

|

|

|

|

$ |

per |

|

|

|

|

|

|

|

|

$ |

per |

|

|

|

|

|

|

|

|

$ |

per |

|

|

|

|

|

|

|

|

$ |

per |

|

|

|

|

|

|

|

|

$ |

per |

|

|

|

|

|

|

|

|

$ |

per |

|

|

|

|

|

|

|

|

$ |

per |

|

|

|

|

|

TOTAL |

|

|

|

|

Schedule 7 - OTHER ASSETS (PERSONAL PROPERTY, FURNITURE, ETC.)

DESCRIPTION

VALUE

COST/

YR ACQUIRED

TO WHOM PLEDGED

TOTAL

Schedule 8 - VESTED INTEREST IN PENSION/RETIREMENT ACCOUNTS

ACCOUNT TYPE

IN NAME OF

INVESTED WITH

MARKET

VALUE

TOTAL

Schedule 9 - OTHER LOAN PAYABLES

NAME OF LENDER

ORIGINAL

DATE

ORIGINAL AMOUNT

LOAN

BALANCE

REPAYMENT

TERMS

PAYMENT AMOUNT

COLLATERAL PLEDGED

OTHER COMAKERS

ENDORSERS

TOTAL

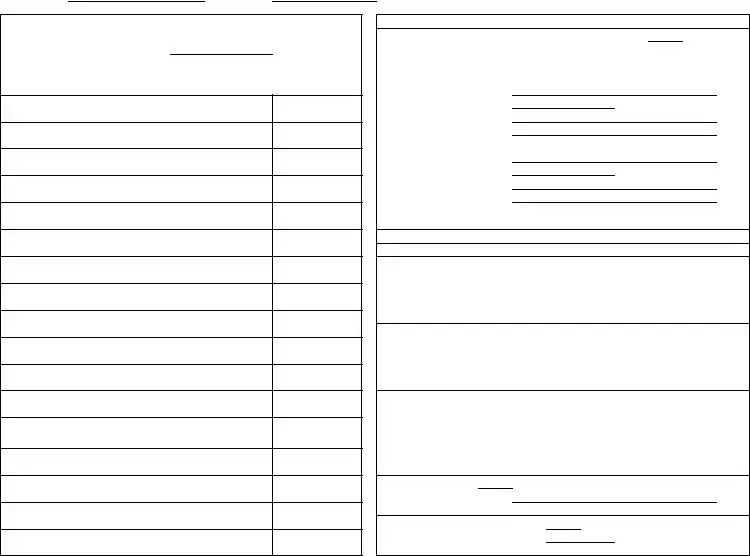

BB&T PERSONAL FINANCIAL STATEMENT

Name:Date:

SOURCE OF INCOME

FOR YEAR ENDED

(Attach a copy of your most recent Income Tax Return and

Salaries - Yours

Salaries - Your spouses, if applicable

Bonuses & Commissions

Dividends

Interest

Net Profits from:

Rental Property

Proprietorships

Partnerships

Joint Ventures

Other Income: (Alimony, child support or separte maintenance income need not be revenealed if you do not wiish to have it considered as a basis for repaying this debt)

TOTAL INCOME

PAGE 4

CONTINGENT LIABILITIES

Are you indirectly liable for obligations of others?

If yes, list and describe. If the obligation is for a business or if you need additional space, list and describe on an attachment.

Name of Borrower

Total Amount Owed

Lender:

Description

Name of Borrower

Total Amount Owed

Lender:

Description

Total Amount as endorser, comaker, or guarantor.

PERSONAL INFORMATION

Number of DepenantsAges

Are you obligated to pay alimony, child support, or separate maintenance payments? If so, provide details:

Are you a defendant in any suits or legal actions?

If so, describe:

Have you ever declared bankruptcy or had any judgements recorded against you? If so, explain circumstances. (Please include dates, location, amounts)

Do you have a will?

If so, who is the executor?

Do you have disability insurance?

If so, what is the monthly amounts?

What years are covered?

REPRESENTATIONS AND WARRANTIES

The information contained in this statement is provided to induce Branch Banking and Trust Company ("BB&T") to extend or to continue the extension of credit to the undersigned or to others upon the guaranty of the undersigned. The undersigned acknowledge and understand that BB&T is relying on the information provided herein in deciding to grant or continue credit or to accept a guaranty thereof. Each of the undersigned represents, warrants, and certifies that the information provided herein is true, correct, and complete. Each of the undersigned agrees to notify BB&T immediately and in writing of any change in name, address, or employment and of any material adverse change (1) in any of the information contained in this statement or (2) in the financial condition of any of the undersigned or (3) in the ability of any of the undersigned to perform its obligations to BB&T. In the absence of such notice or a new full written statement, this should be considered a continuing statement and substantially correct. If the undersigned fail to notify BB&T as required above, or if any information herein should prove to be inaccurate or incomplete in any material respect, BB&T may declare the indebtedness of the undersigned or the indebtedness guaranteed by the undersigned, as the case may be, immediately due and payable. BB&T is authorized to make all inquires it deems necessary to verify the accuracy of the information contained herein and to determine the creditworthiness of the undersigned. The undersigned authorize any person or consumer reporting agency to give BB&T any information they may have on the undersigned. Each of the undersigned authorizes BB&T to answer questions about BB&T's credit experience with the undersigned. As long as any obligation or guaranty of the undersigned to BB&T is outstanding, the undersigned shall supply annually an updated financial statement. This personal financial statement and any other financial or other information that the undersigned give BB&T shall be BB&T's property.

THE UNDERSIGNED HAVE READ AND FULLY UNDERSTAND THE FOREGOING REPRESENTATIONS AND WARRENTIES

________________________ |

_________________________________________ |

DATE |

YOUR SIGNATURE |

________________________ |

_________________________________________ |

DATE |

YOUR SIGNATURE |

This statement received by: ____________________________ |

|

Date ________________ Branch ________________________ |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the BB&T Form | This form serves as a personal financial statement, necessary for individuals seeking credit from BB&T. It summarizes a borrower's financial status and income. |

| Required Documents | All applicants need to provide a photocopy of their valid driver’s license or state ID, as well as their Social Security card. |

| Inclusion of Additional Borrower | The form allows for a co-borrower. If applicable, both parties must complete sections pertaining to their personal and financial information. |

| Confidentiality and Accuracy | Applicants must certify that the information provided is accurate and complete. They are also required to notify BB&T of any changes in their financial circumstances. |

Guidelines on Utilizing Bbt

The BB&T Personal Financial Statement is a critical document that aids in assessing the financial situation of an individual or joint borrowers. Completing this form accurately is essential for a variety of financial applications, ensuring that all necessary information is available for consideration. Below are the step-by-step instructions for filling out the form.

- Gather Necessary Documents: Collect a valid driver’s license or state ID, Social Security card, and recent income tax returns for accurate reporting.

- Fill Out Personal Information: Enter the borrower's name, date of birth, address, Social Security number, and contact details.

- Employment Details: Provide information on current and previous employment, including employer names, positions, and contact details.

- Income Information: Enter gross monthly salary and any additional income for both borrower and co-borrower, if applicable.

- Complete Joint Information: If applicable, fill out the co-borrower’s details, including personal and employment information.

- List Assets: Complete separate sections for deposit accounts, life insurance policies, stocks and bonds, closely held corporations, vehicles, real estate, and any other assets, carefully detailing all requested information.

- Detail Liabilities: Include any loans payable to lenders, along with the original amounts and payment terms.

- Disclose Contingent Liabilities: Provide information on any obligations for which you are indirectly liable.

- Complete Personal Information Section: Answer questions regarding dependents, legal obligations, previous bankruptcies, and other personal disclosures.

- Read and Sign: Carefully review the representations and warranties section. Provide signatures and dates for both the borrower and co-borrower as needed.

After completing the BB&T Personal Financial Statement, ensure to double-check for accuracy and completeness. Submitting this form along with the requisite documentation is your next step toward financial evaluation.

What You Should Know About This Form

What is the purpose of the BB&T Personal Financial Statement?

The BB&T Personal Financial Statement is a tool used to gather important financial information about an individual or a couple applying for credit. It helps the bank assess a borrower's financial health and ability to repay loans. This statement collects details about income, assets, liabilities, and personal information, providing a comprehensive view of the applicant's financial situation.

What information is required to complete the BB&T form?

To fill out the BB&T Personal Financial Statement, you will need to provide your personal details such as your name, address, date of birth, social security number, and employment information. Additionally, you must include financial information like monthly salary, income from other sources, and details about your assets like vehicles, bank accounts, and investments. The form also requires disclosures about any alimony or lawsuits, if applicable.

Is any documentation required when submitting the BB&T Personal Financial Statement?

Yes, applicants must include specific documentation when submitting the form. A photocopy of a valid driver's license or state ID, along with a social security card, is required to prove identity. Furthermore, attaching the most recent income tax return will also support the financial details provided in the statement, ensuring the information collected is accurate and verifiable.

What if I have joint finances with a co-borrower?

If you are applying as a co-borrower, it is essential to complete the joint sections of the BB&T Personal Financial Statement. This includes sharing relevant details about your co-borrower’s personal and financial information, such as income and debts. By doing this, both parties’ financial situations will be assessed together, which can affect the loan approval process.

What happens after submission of the financial statement?

After you submit the BB&T Personal Financial Statement, the bank reviews the information to assess your creditworthiness. They may contact you for any clarifications or further documentation if needed. It’s also important to remember that if there are any significant changes to your financial situation or personal information, you need to notify BB&T immediately. This helps keep your records current and accurate, which is vital for your credit account.

Common mistakes

Filling out the BB&T Personal Financial Statement can seem straightforward, but it’s easy to make mistakes that could delay or complicate your application. Understanding common pitfalls can save you time and enhance your chances of approval. Here are six frequent mistakes people make.

1. Missing Required Documentation is a major issue. Applicants often forget to include a valid driver’s license and social security card, which are mandatory. Without these documents, the review process cannot even begin. Make sure to check your application thoroughly to ensure all required documents are attached.

2. Incomplete Information frequently leads to delays. Every section of the BB&T form needs to be filled out completely. Leaving fields blank or providing vague answers can raise red flags. For instance, if you list income sources without specifying their amounts, it may cause confusion. Always provide precise details to avoid unnecessary follow-ups.

3. Inaccurate Financial Data can have serious consequences. Double-check every figure you provide, from your monthly salary to your account balances. If you input the wrong amounts, it can skew the bank's perception of your financial health. Review your recent bank statements and pay stubs to ensure accuracy.

4. Failing to Update Personal Information is another common mistake. If your address, employment status, or family situation has changed since your last financial statement, make sure to reflect those updates. Missing or outdated information can impact your creditworthiness and confuse the bank reviewing your application.

5. Overlooking the Co-Borrower Section if applying jointly is a crucial error. Many applicants forget to fill out the details for their co-borrower, resulting in incomplete information. If you're applying with someone else, ensure their financial details are accurately provided, including their income sources and employment history.

6. Ignoring Contingent Liabilities can lead to problems down the line. Some applicants underestimate the importance of declaring potential liabilities or obligations, such as co-signing a loan. Not mentioning these can give a misleading picture of your financial situation. Always disclose all relevant financial obligations to provide a more accurate assessment of your liabilities.

By paying attention to these common mistakes, you can submit a cleaner, more accurate application. Carefulness pays off when it comes to financial documentation!

Documents used along the form

The BB&T Personal Financial Statement Form is often used in conjunction with several other important documents to support the loan application process. Below is a list of commonly associated forms and documents, each explained briefly to clarify their purpose and significance.

- Driver's License or State ID: This document serves as a primary form of identification for individuals. It verifies the applicant's identity and helps confirm their residency, ensuring the accuracy of the provided information.

- Social Security Card: This card is crucial as it provides proof of the applicant's Social Security Number (SSN). It's used to verify income and credit history.

- Income Tax Return: A copy of the most recent income tax return shows the applicant's earnings over the previous year. This document allows the lending institution to assess financial stability and capacity to repay the loan.

- K-1 Form: This document reports income from partnerships, S corporations, estates, and trusts. For self-employed individuals or partners, K-1s provide additional details about income sources.

- Credit Report: A current credit report gives a comprehensive view of the applicant's credit history, outstanding debts, and payment behavior. This report helps lenders evaluate creditworthiness and risk.

- Loan Documentation: This encompasses any existing loan agreements or repayment schedules the applicant has with other lenders. It's essential for understanding the applicant's overall debt and repayment obligations.

In conclusion, providing these documents alongside the BB&T financial statement enhances the application’s credibility. It creates a clearer picture of financial history and stability, helping to facilitate the loan approval process.

Similar forms

The BB&T Personal Financial Statement (Bbt form) serves the purpose of detailing an individual's financial condition. It is quite similar to several other financial and legal documents in terms of structure and content. Here are five documents that share similarities:

- Personal Loan Application: Like the Bbt form, a personal loan application collects information about an individual's financial status, income sources, and liabilities. Both forms require personal identification details and financial disclosures to assist lenders in assessing creditworthiness.

- Net Worth Statement: A net worth statement is closely related to the Bbt form as it summarizes a person's assets and liabilities. Both documents provide a clear picture of an individual's financial situation and help lenders evaluate the ability to repay debts.

- Credit Application: A credit application, whether for a credit card or another form of credit, is also similar to the Bbt form. Both require personal and financial information, including income, debts, and identification. This information assists credit issuers in making informed decisions.

- Tax Return Documents: Tax returns are another document that bears resemblance to the Bbt form. Both contain financial information about income, assets, and sometimes liabilities. Loan providers often request tax returns to verify income and financial history.

- Business Financial Statement (for self-employed individuals): For those who are self-employed, a business financial statement shares key similarities with the Bbt form. It outlines the financial status of a business, including revenue, expenses, and liabilities, which helps lenders assess personal and business finances collectively.

Dos and Don'ts

Filling out the BB&T Personal Financial Statement form is a critical task that requires careful attention to detail. Here are some essential tips on what to do and what to avoid in order to ensure your application is processed smoothly.

- Do read the entire form carefully before starting. Understanding the required information will help you fill it out correctly.

- Do provide a photocopy of a valid Driver's License or state ID and Social Security card as instructed. Failing to include these could delay your application.

- Do list all sources of income. Be thorough in detailing your monthly salary and any additional earnings.

- Do verify the accuracy of your financial figures before submitting. Inaccuracies could lead to complications or denial of your application.

- Do keep your records organized. Maintain records of past employment, addresses, and financial institutions for easy reference.

- Don’t leave any sections blank unless explicitly stated. Missing information may result in rejection or delayed processing.

- Don’t provide misleading or false information. Honesty is crucial, as discrepancies can lead to serious consequences.

- Don’t rush through the process. Take your time to ensure everything reflects your current financial situation accurately.

- Don’t forget to sign and date the form where indicated. An unsigned application is considered incomplete and will not be processed.

By following these guidelines, you can increase the chances of a smooth application process for your BB&T Personal Financial Statement. Proper preparation and attention to detail are key to success.

Misconceptions

Misconceptions about the BB&T Personal Financial Statement are common, and understanding the truth can help prospective borrowers navigate the process with clarity. Here’s a list of six prevalent misconceptions:

- Only wealthy individuals need to fill out the form. Many people mistakenly believe that the BB&T Personal Financial Statement is only for wealthy individuals. In reality, the form is essential for anyone seeking a loan or credit, regardless of income level.

- Submitting the form guarantees loan approval. Some individuals think that submitting this statement automatically means their loan will be approved. However, while it is an important component, other factors such as credit history and repayment ability also play significant roles in the approval process.

- You can skip providing personal information. There is a misconception that you can leave out personal details without consequences. However, providing accurate and complete information is crucial since any omissions may lead to delays or even denials.

- It only needs to be completed once. Many believe they only need to fill out the BB&T Personal Financial Statement once. In reality, borrowers are typically required to update the statement annually or whenever their financial circumstances change.

- It is the same as a tax return. Some confuse the personal financial statement with a tax return. While both contain financial information, the personal financial statement is a concise document specifically designed to evaluate one's current financial status for lending purposes.

- Only individuals need to fill it out. There’s a common belief that this statement is only for individuals. In reality, joint borrowers, such as couples applying for a loan together, must also complete a personal financial statement to provide a complete picture of their combined financial health.

By recognizing these misconceptions, borrowers can come to the table better prepared and fully understand the expectations involved in obtaining credit through BB&T.

Key takeaways

Filling out and using the BB&T Personal Financial Statement can be a critical step in securing financial support. Here are some key takeaways to keep in mind:

- Gather Required Documentation: Before you start filling out the form, ensure that you have a valid driver’s license or state ID, Social Security card, and the most recent tax returns readily accessible.

- Accurate Information: It’s vital to provide precise and complete information. Any inaccuracies could delay the process or negatively impact your application. Be thorough with loan details, income sources, and monthly expenditures.

- Joint Applicants: If applying with a co-borrower, include their financial details as required. Both borrowers are responsible for the accuracy and truthfulness of the information submitted.

- Confidentiality Matters: Keep in mind that all information provided is confidential and meant to evaluate your creditworthiness. BB&T will use this information to determine your eligibility for credit.

Taking the time to fill out the BB&T form correctly can lead to a smoother application process. Prepare early, stay organized, and ensure the information you provide reflects your true financial situation.

Browse Other Templates

Bcbss - This form must be completed diligently to reflect the patient's true medical capabilities and limitations.

What Is a Wage Theft Prevention Notice - The employer provides their mailing address for official correspondence.