Fill Out Your Beneficiary Change Form

When it comes to planning for the future, understanding the Beneficiary Change form is crucial for anyone managing a retirement plan or life insurance policy. This form allows individuals to update important personal information, such as their name, address, and contact details. The form further requires information about the beneficiaries you wish to designate—those who will receive your benefits after your passing. It's essential to specify both primary and contingent beneficiaries. Primary beneficiaries are those who inherit first, while contingent beneficiaries are in line to receive benefits only if no primary beneficiary survives you. Accuracy is key, as the total percentage for each beneficiary must sum to 100%. Additionally, for any changes to your name, you'll need to provide proof, such as a marriage certificate or driver's license. Notably, this form also offers a paperless delivery option, allowing all statements and documents to be sent directly to your email. This modern convenience ensures you stay informed while maintaining easy access to your retirement information. Ultimately, taking the time to thoroughly complete this form can significantly impact the financial legacy you leave behind.

Beneficiary Change Example

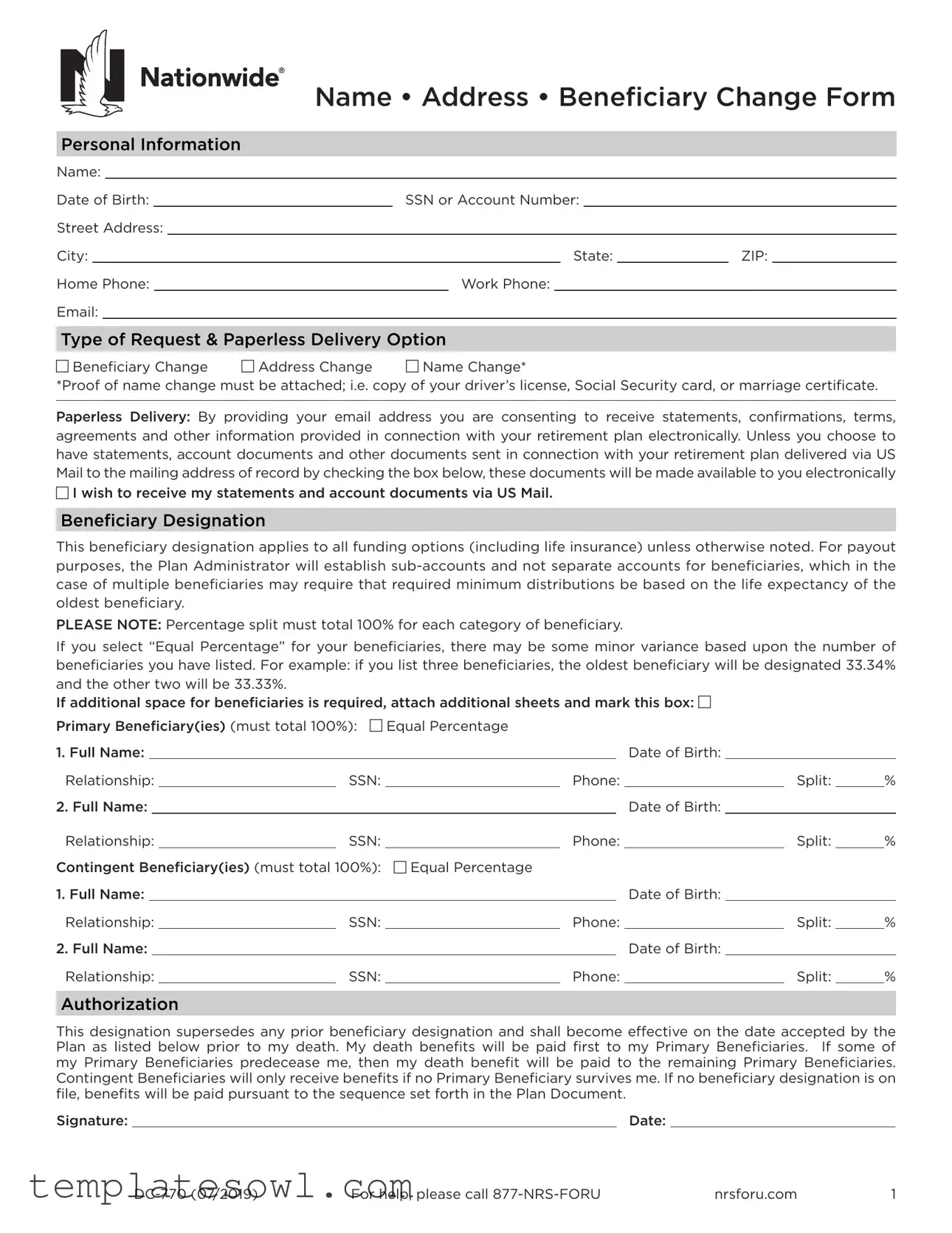

Name • Address • Beneficiary Change Form

Personal Information

Name:

Date of Birth: |

|

|

SSN or Account Number: |

|

|

|

|

|||||||

Street Address: |

|

|

|

|

|

|

|

|

|

|

||||

City: |

|

|

|

|

|

State: |

|

ZIP: |

|

|||||

Home Phone: |

|

|

|

Work Phone: |

|

|

|

|

||||||

Email: |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of Request & Paperless Delivery Option |

|

|

|

|||||||||||

c Beneficiary Change |

c Address Change |

c Name Change* |

|

|

|

|||||||||

*Proof of name change must be attached; i.e. copy of your driver’s license, Social Security card, or marriage certificate.

Paperless Delivery: By providing your email address you are consenting to receive statements, confirmations, terms, agreements and other information provided in connection with your retirement plan electronically. Unless you choose to have statements, account documents and other documents sent in connection with your retirement plan delivered via US Mail to the mailing address of record by checking the box below, these documents will be made available to you electronically

cI wish to receive my statements and account documents via US Mail.

Beneficiary Designation

This beneficiary designation applies to all funding options (including life insurance) unless otherwise noted. For payout purposes, the Plan Administrator will establish

PLEASE NOTE: Percentage split must total 100% for each category of beneficiary.

If you select “Equal Percentage” for your beneficiaries, there may be some minor variance based upon the number of beneficiaries you have listed. For example: if you list three beneficiaries, the oldest beneficiary will be designated 33.34% and the other two will be 33.33%.

If additional space for beneficiaries is required, attach additional sheets and mark this box: c

Primary Beneficiary(ies) (must total 100%): c Equal Percentage

1. Full Name: |

|

|

|

|

|

|

Date of Birth: |

|

|

|

||

Relationship: |

|

SSN: |

|

Phone: |

|

|

Split: |

% |

||||

2. Full Name: |

|

|

|

|

|

|

Date of Birth: |

|

|

|

|

|

Relationship: |

|

SSN: |

|

Phone: |

|

|

Split: |

% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent Beneficiary(ies) (must total 100%): c Equal Percentage

1. Full Name: |

|

|

|

|

|

|

Date of Birth: |

|

|

|

||

Relationship: |

|

SSN: |

|

Phone: |

|

|

Split: |

% |

||||

2. Full Name: |

|

|

|

|

|

|

Date of Birth: |

|

|

|

|

|

Relationship: |

|

SSN: |

|

Phone: |

|

|

Split: |

% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorization

This designation supersedes any prior beneficiary designation and shall become effective on the date accepted by the Plan as listed below prior to my death. My death benefits will be paid first to my Primary Beneficiaries. If some of my Primary Beneficiaries predecease me, then my death benefit will be paid to the remaining Primary Beneficiaries.

Contingent Beneficiaries will only receive benefits if no Primary Beneficiary survives me. If no beneficiary designation is on file, benefits will be paid pursuant to the sequence set forth in the Plan Document.

Signature: |

|

Date: |

|

||

|

For help, please call |

|

nrsforu.com |

1 |

|

Model Beneficiary Designations

Indicate the full names of the beneficiaries, their Social Security numbers, date of birth, relationship to you, address, phone number, and split you’d like each one of them to receive. Please use the following designations as a guide when completing this form.

|

Name |

Split% |

Relationship |

SSN |

Date Of Birth |

1. |

Primary: Joan Nation |

100% |

spouse |

01/02/1962 |

|

2. |

Primary: Joan Nation |

100% |

spouse |

01/02/1962 |

|

|

Contingent: Henry Nation |

100% |

son |

06/26/1984 |

|

3. |

Primary: Joan Nation |

100% |

spouse |

01/02/1962 |

|

|

Contingent: Henry Nation |

50% |

son |

06/26/1984 |

|

|

Contingent: Betty Nation |

50% |

daughter |

02/12/1980 |

|

4. |

Primary: Henry Nation |

50% |

son |

06/26/1984 |

|

|

Primary: Betty Nation |

50% |

daughter |

02/12/1980 |

|

5. |

Primary: Henry Nation |

34% |

son |

06/26/1984 |

|

|

Primary: Betty Nation |

33% |

daughter |

02/12/1980 |

|

|

Primary: John Nation |

33% |

son |

09/31/1986 |

|

6. |

Primary: Sara Nation |

60% |

mother |

10/14/1950 |

|

|

Primary: George Nation |

40% |

father |

12/30/1945 |

|

|

Contingent: Jean Nation |

100% |

sister |

03/29/1971 |

7.Primary: My Estate

8.First National Bank of Canton, Ohio, as Trustee under Trust Agreement with Robert E. Nation dated January 1, 2002. (Attach a copy of the title and signature page of the Trust).

Generic beneficiary designations will not be accepted. Examples of generic designations include:

1.My spouse, parent(s), sister(s), brother(s), son(s), daughter(s).

2.My children.

3.Children of this marriage or any past marriage.

4.As designated in my will.

Form Return

By mail: |

Nationwide Retirement Solutions |

Email: |

rpublic@nationwide.com |

|

PO Box 182797 |

By fax: |

|

|

Columbus, OH |

|

|

2 |

For help, please call |

nrsforu.com |

Form Characteristics

| Fact | Description |

|---|---|

| Personal Information Required | The form requires the applicant's full name, address, date of birth, Social Security Number or account number, and contact information. |

| Request Types | Applicants can change a beneficiary, address, or name. If changing a name, proof must be submitted with the form. |

| Paperless Delivery Consent | By providing an email address, the applicant agrees to receive communications electronically, unless opting for US Mail delivery. |

| Beneficiary Designation | Beneficiaries must total 100% in designated shares. If using equal percentages, the splits may vary slightly based on the total number of beneficiaries. |

| Governing Law | The specific laws governing the form may vary by state; for instance, in California, the Probate Code governs beneficiary designations. |

| Authorization Effectiveness | This designation supersedes any prior beneficiary designations and becomes effective upon acceptance by the Plan Administrator. |

Guidelines on Utilizing Beneficiary Change

After completing the Beneficiary Change form, submit it according to the provided instructions. Ensure all information is accurate to avoid delays in processing your request. Double-check your entries, and don’t forget any necessary attachments.

- Begin by entering your personal information. Fill in your name, date of birth, Social Security number (or account number), street address, city, state, ZIP code, home phone, work phone, and email address.

- Select the type of request you are making. Check the box for either Beneficiary Change, Address Change, or Name Change. If you choose name change, remember to attach proof such as a copy of your driver’s license, Social Security card, or marriage certificate.

- Decide if you prefer paperless delivery for your documents. If so, provide your email address. If you want to receive documents via US Mail, check the appropriate box.

- Fill out the Beneficiary Designation section. List your primary beneficiaries and ensure their percentage totals 100%. Indicate if you wish to use an equal percentage split.

- For each primary beneficiary, provide their full name, date of birth, relationship to you, Social Security number, phone number, and desired split percentage.

- If you have contingent beneficiaries, repeat the previous step for them, ensuring their total also adds up to 100% if applicable.

- Sign and date the form. By signing, you confirm this change will supersede any previous beneficiary designations.

- Review the entire form for accuracy and completeness.

- Submit your form by mail, email, or fax according to the instructions provided at the end of the form.

What You Should Know About This Form

What is a Beneficiary Change form?

This form allows you to update who will receive your benefits in the event of your passing. You can designate primary beneficiaries, who will receive benefits first, and contingent beneficiaries, who will receive benefits if no primary beneficiaries are alive.

Who should I list as my beneficiaries?

You can list anyone you choose as your beneficiaries—family members, friends, or even organizations. Just ensure that you have their full names, dates of birth, and Social Security numbers. Make sure the percentages you assign total 100% for each category.

Can I change my beneficiaries at any time?

Yes, you can change your beneficiaries whenever necessary. Just complete a new Beneficiary Change form and submit it following the provided instructions.

What happens if I don’t update my form?

If your Beneficiary Change form is not updated, benefits will be distributed according to the last valid designation on file. If no designation exists, it will follow the plan's default sequence outlined in the Plan Document.

What details do I need to provide for each beneficiary?

You’ll need to provide the full name, date of birth, Social Security number, relationship to you, phone number, and the percentage of the benefit they will receive. Each category’s total must equal 100%.

What if my beneficiaries die before I do?

If a primary beneficiary passes away before you, their share will be divided among the remaining primary beneficiaries. Contingent beneficiaries only receive benefits if there are no surviving primary beneficiaries.

Do I need to provide proof of a name change?

Yes, if you wish to change your name on the form, you must attach proof of the name change, such as a driver’s license, Social Security card, or marriage certificate.

Will I receive documents electronically?

If you provide your email address and choose the paperless delivery option, you consent to receive statements and confirmations electronically. Otherwise, you can opt to receive documents via U.S. Mail.

What if I need additional space for beneficiaries?

If you run out of space on the form for listing beneficiaries, attach additional sheets as necessary. Just make sure to mark the box indicating that you have done so.

How do I submit the completed form?

Once you’ve completed your Beneficiary Change form, you can send it by mail to Nationwide Retirement Solutions, fax it to 877-677-4329, or email it to rpublic@nationwide.com. Ensure that you keep a copy for your records.

Common mistakes

When filling out the Beneficiary Change form, individuals often overlook critical details that can affect the distribution of their assets. A common mistake is failing to ensure that the total percentage for each beneficiary adds up to 100%. This oversight can lead to complications or delays in the processing of beneficiaries after the policyholder's passing. It’s vital to check that the designated splits are clear and total 100% for both primary and contingent beneficiaries.

Another frequent error involves using vague beneficiary designations. Designating beneficiaries in generic terms, such as “my spouse” or “my children,” may seem straightforward. However, these descriptions can create confusion or disputes. Always use full names and specific relationships to avoid any future complications during the claims process.

Many people also neglect to update their beneficiary information following significant life changes. After events such as marriage, divorce, or the birth of a child, it is essential to promptly review and update the designated beneficiaries. Failing to do so may result in unintended beneficiaries receiving the assets.

In addition, not providing complete information for each beneficiary can lead to potential issues. Beneficiaries must include their full names, Social Security numbers, dates of birth, and contact information. Incomplete forms can delay the execution of the plan.

Another critical mistake is not following the instructions for contingent beneficiaries. Many individuals forget to specify contingent beneficiaries. If all primary beneficiaries are deceased, having named contingent beneficiaries ensures that the benefits will still be distributed as intended.

Finally, individuals sometimes make errors in their signatures or fail to date their form. Each beneficiary designation is effective only with the appropriate signature and date. It is a matter of formality that should not be overlooked, as this can render the form invalid.

Taking the time to accurately complete the Beneficiary Change form is crucial. Double-checking all entries can prevent misunderstandings and ensure that your wishes are honored.

Documents used along the form

The Beneficiary Change form is a vital document used to update the beneficiaries of your retirement plan. Several other forms and documents often accompany this form to ensure a smooth process and provide required information. Below is a list of these commonly used forms and their descriptions.

- Address Change Form: This form updates the address on file for a participant. It's essential for ensuring that all future correspondence reaches you accurately.

- Name Change Form: If you've legally changed your name, this form allows you to update your records. Remember to attach proof of the name change, like a marriage certificate or a new driver's license.

- Financial Institution Form: Some plans require a separate form from your financial institution to verify your account details. This helps ensure that contributions and distributions are accurately managed.

- Spousal Consent Form: This form is necessary in cases where a spouse must approve the beneficiary designation, particularly if the primary beneficiary is someone other than the spouse.

- Trust Information Form: If you designate a trust as a beneficiary, this document is used to provide details about the trust, ensuring it meets necessary legal requirements.

- Power of Attorney (POA) Document: This legal document grants someone else the authority to manage your affairs if you're unable. It may be needed to facilitate changes in your beneficiary designations.

- Tax Identification Form: This form provides the Tax Identification Number (TIN) for all beneficiaries. It's required to ensure proper tax reporting for distributions.

- Withdrawal Request Form: If you're withdrawing funds from your retirement plan, this form details how you want your funds distributed to your beneficiaries.

- Affidavit of Surviving Spouse: This document may be required to confirm the status of a spouse in cases where there is a question about the marital relationship at the time of death.

- Document Submission Cover Sheet: This sheet is often used to accompany the forms you submit, listing all enclosed documents to streamline the processing of your request.

Making sure you have all necessary forms and documents can greatly assist in the beneficiary change process. Completing these accurately ensures that your intentions for your beneficiaries are fulfilled without unnecessary delays.

Similar forms

- Will: A will allows you to specify how your assets will be distributed after your death. Like a Beneficiary Change form, it enables you to name individuals to receive specific assets and can outline alternate beneficiaries.

- Power of Attorney: This document grants someone the authority to make decisions on your behalf if you are unable to do so. Similar to changing beneficiaries, it involves the designation of a trusted individual to act in your best interest.

- Trust Agreement: A trust allows you to place your assets under the management of a trustee for the benefit of your named beneficiaries. Both documents require detailing specific individuals who will receive benefits upon certain conditions being met.

- Health Care Proxy: A health care proxy designates someone to make medical decisions for you if you cannot. Just like the Beneficiary Change form, it emphasizes the importance of specifying who will act on your behalf for your best interests.

- Living Will: This document outlines your wishes regarding medical treatment if you become incapacitated. Both it and the Beneficiary Change form reflect personal preferences about your care or asset distribution.

- Retirement Account Beneficiary Designation: Individual retirement accounts (IRAs) often require a specific form to designate beneficiaries. Like the Beneficiary Change form, it ensures that assets are passed on according to your wishes.

- Life Insurance Policy: A life insurance policy designates beneficiaries to receive a payout upon your death. Similar to a Beneficiary Change form, it involves naming individuals who should benefit from the policy's proceeds.

- Real Estate Title Transfer: When you transfer ownership of real property, you usually name a new owner. This action parallels the process of changing beneficiaries by identifying who will receive value from the asset.

- Family Settlement Agreement: This document is used to settle an estate and allocate assets among beneficiaries. Like the Beneficiary Change form, it ensures clear communication and agreement among all parties involved.

- Asset Distribution Plan: An asset distribution plan outlines how your personal property will be shared among beneficiaries. Similar to the Beneficiary Change form, it emphasizes thoughtful planning for your loved ones' futures.

Dos and Don'ts

When it comes to filling out the Beneficiary Change form, attention to detail is key. Here’s a straightforward list of things you should and shouldn’t do:

- Double-check your personal information. Make sure your name, address, and other details are correctly filled out to avoid any delays.

- List full names and relationships. Clearly state each beneficiary’s full name and their relationship to you. This helps ensure clarity.

- Specify percentages accurately. Ensure the total percentages for primary and contingent beneficiaries equal 100% to avoid complications.

- Include required attachments. If there’s a name change, include proof like a marriage certificate or updated ID.

- Review your contact preferences. Decide whether you want to receive documents via email or mail, and mark the appropriate box.

- Avoid generic beneficiary designations. Avoid using terms like "my children" or "spouse" without their full names; this can lead to confusion.

- Don’t forget to sign the form. Leaving this blank invalidates your changes.

- Don’t leave any sections blank without a reason. If a section doesn’t apply, mark it as such to prevent any oversight.

By following these do's and don’ts, you’ll be better prepared to submit your Beneficiary Change form accurately and efficiently. This proactive approach can save time and ensure that your wishes are clearly understood.

Misconceptions

Many people are often misinformed about the Beneficiary Change form. Understanding the facts can make a significant difference when it comes to ensuring that your assets are distributed according to your wishes. Here are seven common misconceptions:

- Any beneficiary designations can be used. Some believe they can name any individual or entity generically, but this is not true. Using vague terms like "my children" may lead to confusion and disputes.

- Only a will controls beneficiary designations. While a will is important, it does not override the designations made on the Beneficiary Change form. This form holds priority in most cases.

- All beneficiaries must be of equal age or relationship. There is no requirement that beneficiaries share the same age or even relationship to the policyholder. The choice is fully personal.

- Beneficiaries receive equal shares by default. Unless explicitly stated, the assets will not be divided equally. The form requires you to specify the percentage share for each beneficiary.

- A contingent beneficiary doesn't matter. Some think that naming a contingent beneficiary is unnecessary, but this can be crucial. If your primary beneficiaries pass away before you, the contingent beneficiaries will inherit.

- Changing beneficiaries is a lengthy process. The process can be straightforward and may not take much time at all, provided that the form is filled out correctly.

- You can disregard the submission instructions. Ignoring the specified submission process can lead to delays or the rejection of the form. Always ensure that you follow the outlined procedures to avoid issues.

Clearing up these misconceptions can help ensure that the rightful beneficiaries receive their intended benefits, preserving your wishes. Staying informed is not just beneficial; it is essential.

Key takeaways

Filling out and using the Beneficiary Change form is a crucial task that ensures your intentions regarding benefits are accurately represented. Attention to detail will help avoid complications later. Here are key takeaways to keep in mind:

- Complete Personal Information: Provide accurate details such as your name, date of birth, and Social Security number. This information is essential for proper identification and processing.

- Verify Delivery Preferences: Consider selecting the electronic delivery option for statements and documents. This method is often faster and more convenient.

- Designate Beneficiaries Clearly: Be specific when naming Primary and Contingent Beneficiaries. Ensure their total percentage adds up to 100% for each category.

- Name Change Requirements: If changing your name, attach documentation like a marriage certificate or updated driver’s license. Incomplete forms may hinder processing.

- Understand the Payout Structure: The Plan Administrator will establish sub-accounts for beneficiaries. This means the minimum distributions will depend on the oldest beneficiary’s life expectancy.

- Reevaluate Regularly: Life events like marriage, divorce, or the birth of children may necessitate updates to your beneficiary designations.

- Submit the Form Promptly: Timeliness in submitting the form ensures that your wishes are reflected accurately and prevents any delays in benefit distribution.

These considerations can significantly ease the process and ensure that your wishes are honored when it matters most.

Browse Other Templates

Documents Needed to Apply for Social Security Retirement Benefits Online - Your application can be submitted in person or via mail.

Arizona Health Care - Keep track of your application status and respond to inquiries promptly.

Florida Notice of Commencement Form - A surety bond is mentioned if applicable, along with relevant details.