Fill Out Your Beneficiary Planner Form

The Beneficiary Planner form, provided by Colonial Penn Life Insurance Company, serves as an essential resource for individuals seeking to organize important information pertaining to their estate and final wishes. Designed specifically for policyholders, this instrument allows individuals to communicate crucial details to designated family members or friends, ensuring that their intentions are clear and accessible after passing. The form offers structured sections to document a variety of key information, including the location of important papers, the tasks that need to be addressed, and the specific bills that require payment or accounts that should be closed. Through its user-friendly format, the Beneficiary Planner not only aids in decluttering one’s affairs, but also emphasizes the importance of discussing this information with a trusted individual, thus providing peace of mind about future access. Individuals are encouraged to personalize the guide further, adjusting as necessary by adding supplementary sheets and revisiting the contents periodically to ensure that all details remain current. By utilizing this invaluable planning tool, one can not only facilitate a smoother transition for loved ones but also contribute to a more organized and thoughtful legacy.

Beneficiary Planner Example

How to Use Your

Beneficiary Planner

This unique Beneficiary Planner has been prepared for

you by Colonial Penn Life Insurance Company, as a special service to our policyholders. It has been designed to make it

very easy for you to tell a family member or friend where things are...

and what your wishes may be after you pass away. This helpful planning guide provides room for you to fill in such vital information as...

♦Where your important papers are;

♦What needs to be taken care of;

♦What bills need to be paid or accounts cancelled;

♦And much more.

Please take some time to complete the information in this valuable resource guide. (If you need additional room in specific areas, you can add a sheet of paper.) Then, be sure to go over the information with a trusted family member or friend, put this guide in a safe place, and tell that person where the safe place is for their future reference. We also recommend that you review the information periodically and keep it

Preparing this information is a helpful way for you to get organized. Plus, it will be a great help to your family, your friends, and even your pets.

More About You and Your Family

Single Married Widow/Widower Divorced

Name of Spouse

Maiden Name

Number of Children

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Beneficiary Planner is designed to help policyholders organize and communicate their wishes and important information for their loved ones after their passing. |

| Provider | This form is provided by Colonial Penn Life Insurance Company as a service to its policyholders. |

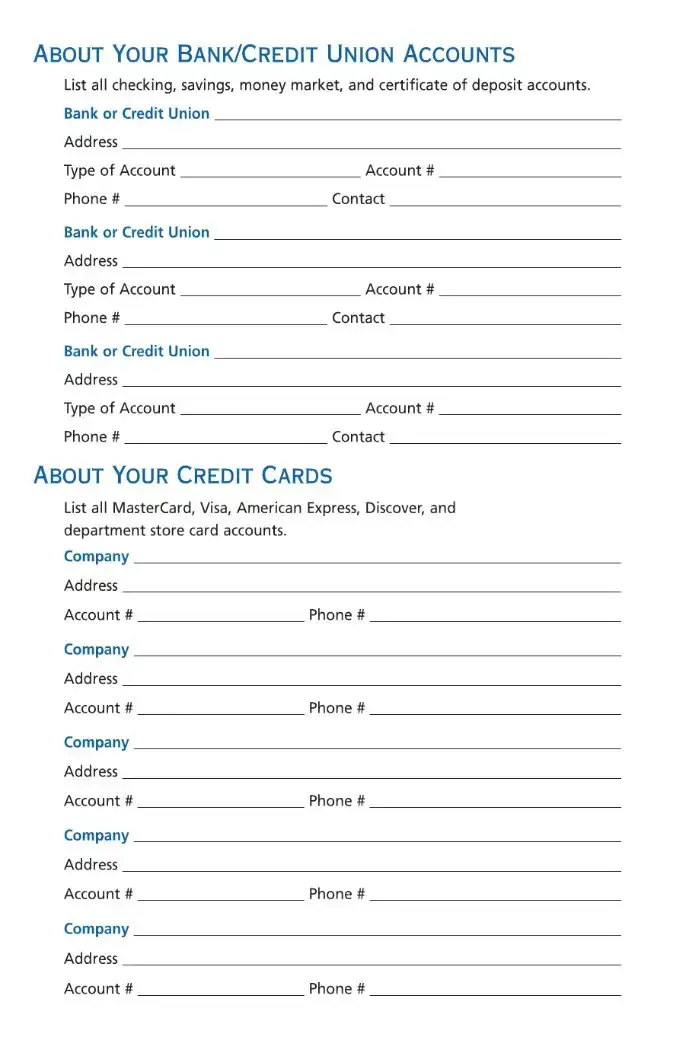

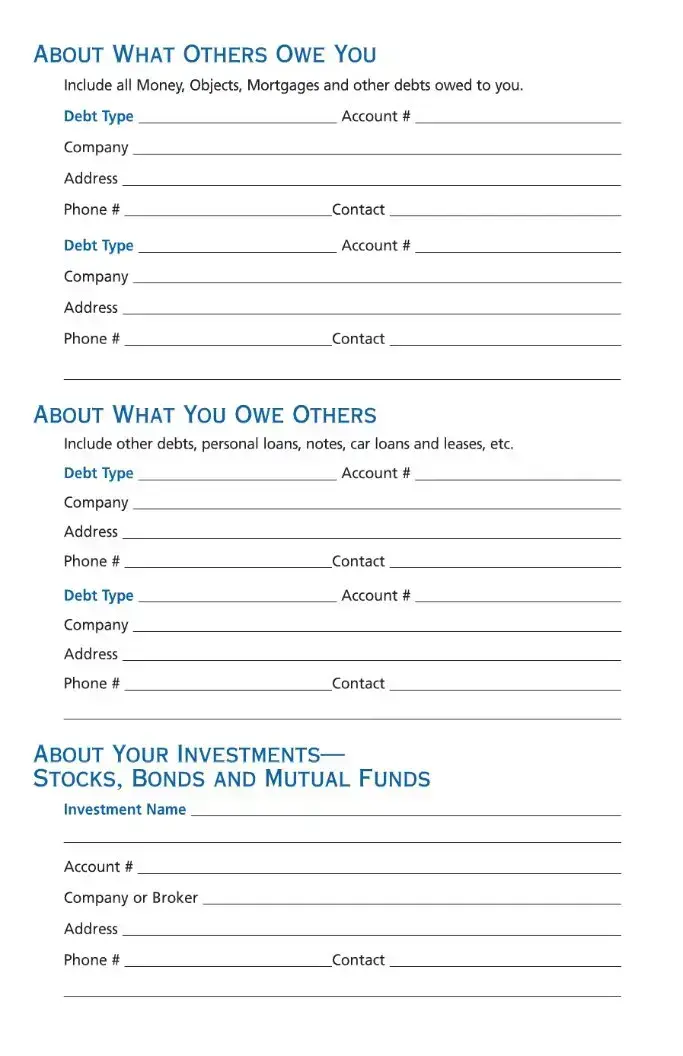

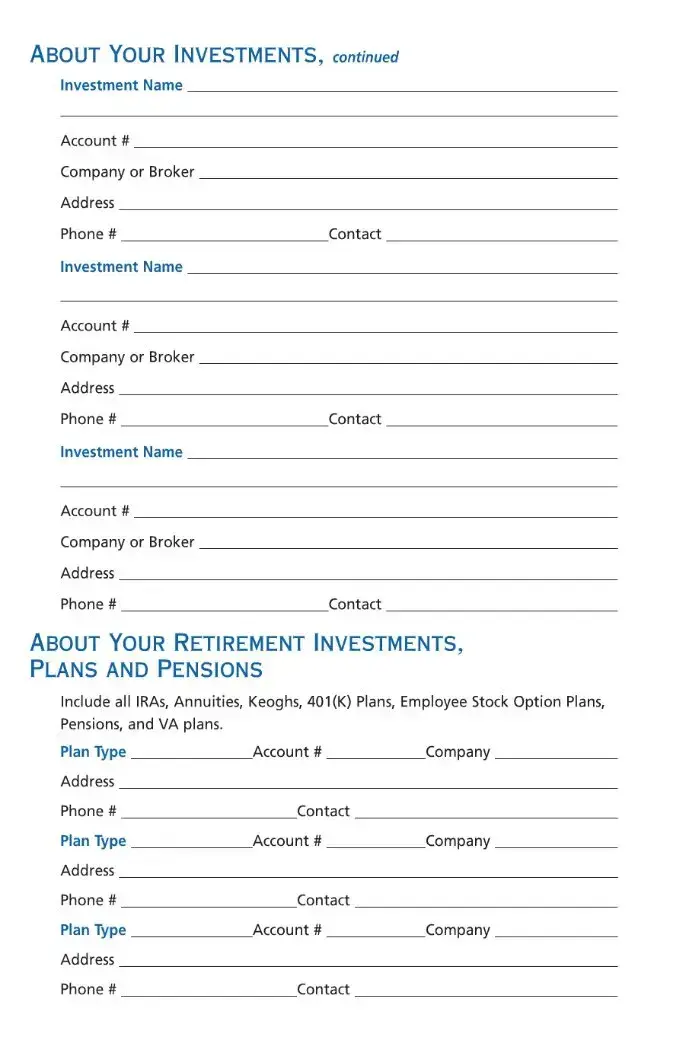

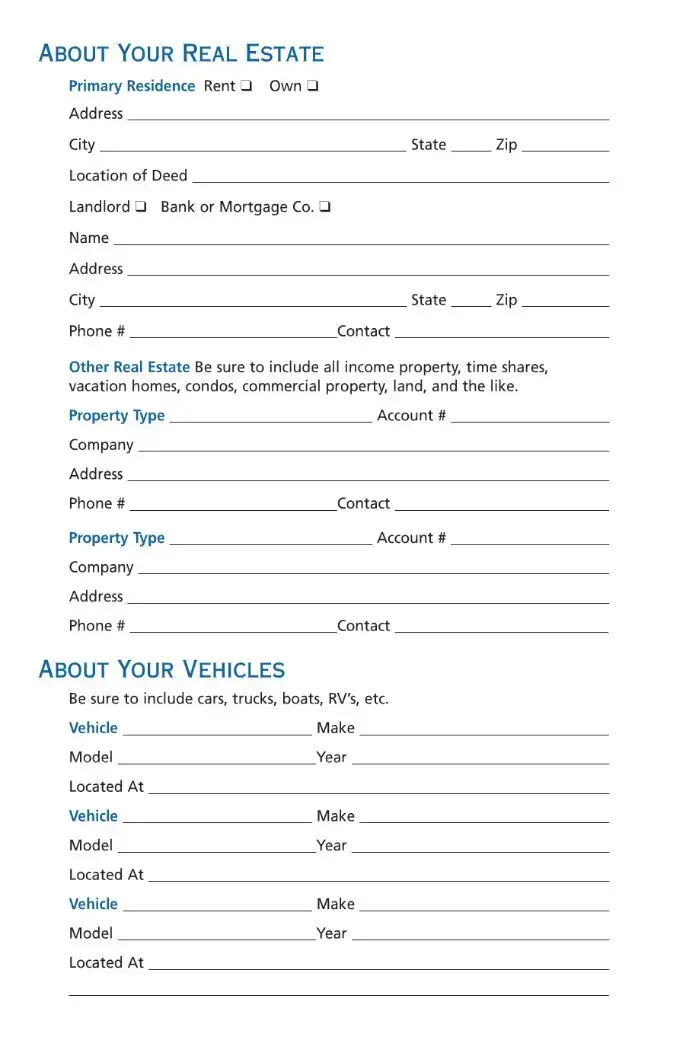

| Information Included | The planner allows users to document where important papers are located, what bills need to be paid, and what accounts should be canceled. |

| Communication | It is essential for users to discuss the completed form with a trusted family member or friend to ensure that their wishes are known. |

| Updates | Policyholders should review and update the information periodically to reflect any changes in their circumstances or wishes. |

| Storage | The completed form should be stored in a safe place, with clear instructions given to a trusted person regarding its location. |

| Additional Space | If users need more space for specific information, they are encouraged to add sheets of paper as necessary. |

| Life Circumstances | The form accommodates various life situations, allowing users to indicate their marital status and information about their family, including children. |

Guidelines on Utilizing Beneficiary Planner

Completing the Beneficiary Planner form is an important step in organizing your affairs and sharing your wishes with loved ones. This process will help ensure that your important information is easily accessible when needed. Follow these steps to fill out the form accurately.

- Gather necessary information: Collect details about your important documents, accounts, and wishes before starting to fill out the form.

- Fill in your personal details: Provide your name, marital status, maiden name (if applicable), and the number of children you have.

- List important papers: Indicate where your important documents are stored, such as wills, insurance policies, and financial records.

- Outline your wishes: Write down what should be taken care of after you pass away, including any specific requests or arrangements.

- Detail financial responsibilities: List any bills that need to be paid, accounts that should be canceled, or any other financial matters that require attention.

- Include additional information: If necessary, attach extra sheets of paper to provide more room for information.

- Review the completed form: Go over the details with a trusted family member or friend to ensure clarity and accuracy.

- Store securely: Keep the planner in a safe location and inform your chosen person where to find it.

- Regularly update: Make it a habit to review and update the planner periodically to maintain its relevance.

What You Should Know About This Form

What is the Beneficiary Planner form?

The Beneficiary Planner form is a specially designed guide provided by Colonial Penn Life Insurance Company to assist policyholders in outlining their wishes and important information regarding their affairs. It serves as a tool to help individuals communicate their preferences and the location of important documents to their loved ones.

How does the Beneficiary Planner assist me?

This planner helps you organize vital information that your family or friends will need after you pass away. You can document where important papers are kept, what responsibilities need to be taken care of, what bills should be paid, and how to handle various accounts. By providing this information, you relieve your loved ones of the burden of searching for details during a difficult time.

Who should fill out the Beneficiary Planner?

Any policyholder who wishes to leave clear instructions for their family and friends should fill out the Beneficiary Planner. Whether you are single, married, a widow, a widower, or divorced, completing this guide ensures the people you care about have all necessary information when the time comes.

What kind of information can I include in the planner?

You can include a wide range of information in the Beneficiary Planner. This might cover where your important documents are stored, what specific needs must be addressed after your passing, and a list of bills that need payment or accounts that should be canceled. Additionally, there may be space to include personal messages or wishes you would like your loved ones to know.

Can I add extra information beyond what is provided in the form?

Yes, if you find that the space provided is insufficient for all of your information, you can attach additional sheets of paper. This ensures that you can provide as much detail as needed for your family to have a comprehensive understanding of your wishes.

What should I do after completing the Beneficiary Planner?

Once you have filled out the Beneficiary Planner, it is advisable to review the information with a trusted family member or friend. They should know where you keep the completed form and should be aware of your wishes. Storing the planner in a safe place is crucial, so don’t forget to share that location with your chosen person.

How often should I review the Beneficiary Planner?

It’s important to review the Beneficiary Planner periodically. Life circumstances change, and keeping the information current will ensure that it remains a helpful resource for your loved ones. Updates might be needed after significant life events such as marriage, divorce, or the birth of children.

Why is it important to prepare this information?

Preparing this information serves multiple purposes. It helps you become organized, eases the stress on your loved ones, and provides clear directions regarding your affairs. This thoughtful planning can also extend to ensuring that your pets are cared for, should that be a concern.

What is the best way to keep the Beneficiary Planner secure?

Storing the Beneficiary Planner in a safe place is essential. This could be a locked drawer or safe where important documents are kept. Just ensure that the individual you trust knows how to access that location. Providing clear instructions makes it easier for them to find the planner when they need it.

Common mistakes

Filling out the Beneficiary Planner form is an important task, but many people make simple mistakes that can create complications later on. One common error occurs when individuals fail to specify the names of their beneficiaries clearly. Providing only a relationship, such as "my daughter" without including her full name can lead to confusion. If there are multiple family members with similar names, a lack of clarity might cause disputes or unintended consequences when the time comes to distribute assets.

Another frequent mistake is neglecting to update the form when significant life changes occur. Changes such as marriage, divorce, or the birth of a child necessitate an immediate review of the Beneficiary Planner. Failing to make these updates can result in outdated information being followed, which may not reflect a person’s current wishes. It's essential to treat this document as a living document that evolves with one’s life circumstances.

Additionally, some individuals overlook the importance of sharing this information with their loved ones. Many people complete the form but do not communicate its existence or location to their beneficiaries. Without this communication, even the most thorough planning can go to waste. Beneficiaries must know where to find the planner to ensure that their designated roles are fulfilled after a loved one passes.

Moreover, underestimating the necessity of documenting all relevant information is a common pitfall. The Beneficiary Planner is an opportunity to provide detailed instructions on important matters, such as where essential papers are located and what needs to be done after one's passing. Skimming over these details could leave loved ones overwhelmed and unsure of how to proceed at a difficult time.

Finally, some people fail to periodically review and revise the planner. Life is full of changes, and as time passes, circumstances may alter a person’s wishes regarding the distribution of their estate. Committing to a regular review of the information ensures that it remains relevant and truly reflects the individual’s intentions. This diligence provides peace of mind and clarity for both the planner and their beneficiaries.

Documents used along the form

The process of organizing important information for loved ones is essential for ensuring that one's wishes are respected after passing. Alongside the Beneficiary Planner form, several other documents often work in conjunction to provide a comprehensive guide. These documents offer additional details about financial matters, healthcare preferences, and directives to be followed. Below is a list of related forms and their descriptions.

- Last Will and Testament: This legal document outlines how a person's assets will be distributed after their death. It designates a personal representative to carry out the wishes of the deceased regarding property and dependents.

- Living Will: A living will specifies a person's healthcare preferences in case they become unable to communicate their wishes due to illness or injury. It typically covers end-of-life decisions, resuscitation orders, and preferences for life-sustaining treatments.

- Power of Attorney: This form grants an individual the authority to make financial decisions on behalf of another person in cases of incapacity. It can be customized to be effective immediately or only upon the principal's incapacity.

- Healthcare Proxy: Similar to a power of attorney, a healthcare proxy designates someone to make medical decisions for a person if they are unable to do so themselves. It ensures that the individual's healthcare preferences are honored.

- Trust Document: A trust is a legal arrangement that allows a person to transfer assets to be managed by a trustee for the benefit of chosen beneficiaries. It can help avoid probate and provide clearer instructions on asset management and distribution.

- Funeral Planning Document: This form allows individuals to specify their preferences regarding funeral arrangements, including burial or cremation, type of service, and other details. Providing these instructions can ease the burden on family members at a difficult time.

Collectively, these documents help ensure that an individual’s wishes are fully articulated and respected. Preparing and discussing these forms with family members can significantly ease the process of handling affairs after someone has passed away.

Similar forms

The Beneficiary Planner form shares similarities with several other important documents that assist in estate planning and organization. Here are six documents that provide comparable functions:

- Last Will and Testament: Like the Beneficiary Planner, a Last Will and Testament outlines your wishes regarding the distribution of your assets after passing. It specifies who will handle your affairs and ensures your intentions are clear.

- Power of Attorney: This document allows you to appoint someone to manage your financial and legal decisions if you become incapacitated. It is similar to the Beneficiary Planner in that it helps ensure your needs are addressed when you are unable to do so.

- Living Will: A Living Will states your preferences for medical treatment in situations where you cannot communicate them. The Beneficiary Planner also conveys important wishes, albeit focused more on financial and logistical matters.

- Trusts: Trusts facilitate the management and distribution of your assets, often avoiding probate. The Beneficiary Planner aligns with this purpose by detailing where and how to access those assets swiftly after your death.

- Advance Healthcare Directive: This document outlines your healthcare preferences should you be unable to communicate your wishes. Similar to the Beneficiary Planner, it guides decision-makers in sensitive situations regarding your care.

- Financial Inventory: This document provides a comprehensive list of your financial accounts and assets. Like the Beneficiary Planner, it is designed to help loved ones manage your affairs efficiently after you pass away.

Dos and Don'ts

When filling out the Beneficiary Planner form, it’s important to approach the task thoughtfully. Here are some key do's and don'ts to keep in mind:

- Do provide accurate and complete information about your important papers.

- Do discuss your wishes with a trusted family member or friend.

- Do keep the Planner in a safe place, and inform someone about its location.

- Do review and update the information regularly as your circumstances change.

- Do consider including additional notes on separate paper if you need more space.

- Don't leave out essential details about bills and accounts that need attention.

- Don't rush through the form. Take your time to ensure accuracy.

- Don't ignore the importance of keeping this information current.

- Don't keep the Planner in a location where it could be easily overlooked.

- Don't forget to communicate your wishes clearly to avoid confusion later.

Misconceptions

Misconceptions about the Beneficiary Planner form can lead to confusion about its purpose and use. Here are some common myths, along with clarifications to help you understand the true value of this planning guide:

- The Beneficiary Planner is complicated to fill out. Many people think it requires extensive legal knowledge, but it is designed to be straightforward. Simply provide information about your important documents and wishes.

- I only need to complete it once. This form is not a one-time task. Regular reviews and updates are encouraged to reflect any changes in your life or preferences.

- It's only important for older adults. Anyone, regardless of age, can benefit from having their wishes documented. Life is unpredictable, and preparation can ease burdens on loved ones.

- Once I fill it out, it will be automatically shared with my beneficiaries. This form does not automatically inform anyone. You'll need to discuss it with your trusted family member or friend and ensure they know where to find it.

- It only covers financial arrangements. While it does address financial matters, it can also include personal wishes and other important information about your life. It’s a comprehensive resource!

- The Beneficiary Planner is only for insurance policyholders. Although it is prepared for Colonial Penn Life Insurance Company's policyholders, anyone can benefit from completing this form to organize their affairs and wishes.

Understanding these misconceptions can help you see the true value of the Beneficiary Planner. By taking the time to prepare this resource, you provide clarity and support for your loved ones during a difficult time.

Key takeaways

When using the Beneficiary Planner form, keep the following key takeaways in mind:

- This form serves as a vital tool to communicate your wishes to family and friends after your passing.

- Fill in important details, such as the location of crucial papers and accounts that need attention.

- Take time to complete all sections thoroughly, as this ensures that nothing is overlooked.

- If you require extra space, feel free to attach a separate piece of paper.

- Review the completed form with a trusted individual to ensure they understand your wishes.

- Store the planner in a safe location and inform your chosen confidant where to find it.

- Regularly review and update the information to keep it current and relevant.

- Completing this planner not only organizes your affairs but also eases the burden on your family and friends.

Browse Other Templates

Social Security Disability Forms - You should notify the Social Security Administration of any significant changes in circumstances.

Minnesota Repossession Laws - This document certifies the repossession of a vehicle and applies for a new certificate of title.