Fill Out Your Bhsf 1 Mpp Form

The BHSF Form 1-MPP is an essential application for individuals with disabilities who are seeking healthcare coverage while maintaining employment. Intended specifically for those aged 16 to 64, this form aids in acquiring Medicaid through the Medicaid Purchase Plan. The application process requires precise personal information such as the applicant's name, address, and contact details. It also inquires about the individual’s language proficiency for effective communication during the process. Furthermore, applicants must detail their employment history, including income sources and any additional benefits they may receive, such as Social Security or pensions. Understanding the scope of one’s assets is vital as well; thus, the form requests disclosures related to checking and savings accounts, retirement savings, and other financial resources. Individuals are prompted to disclose their medical conditions and provide information about health care providers for comprehensive assessment. Additionally, the applicant must agree to several rights and responsibilities, including reporting any changes in circumstances promptly. This form not only serves as a means to secure medical benefits but also emphasizes the importance of accuracy and truthfulness in the information provided. Mediation and assistance options, such as interpreter services and contact information for local Medicaid offices, further support applicants throughout this potentially complex process.

Bhsf 1 Mpp Example

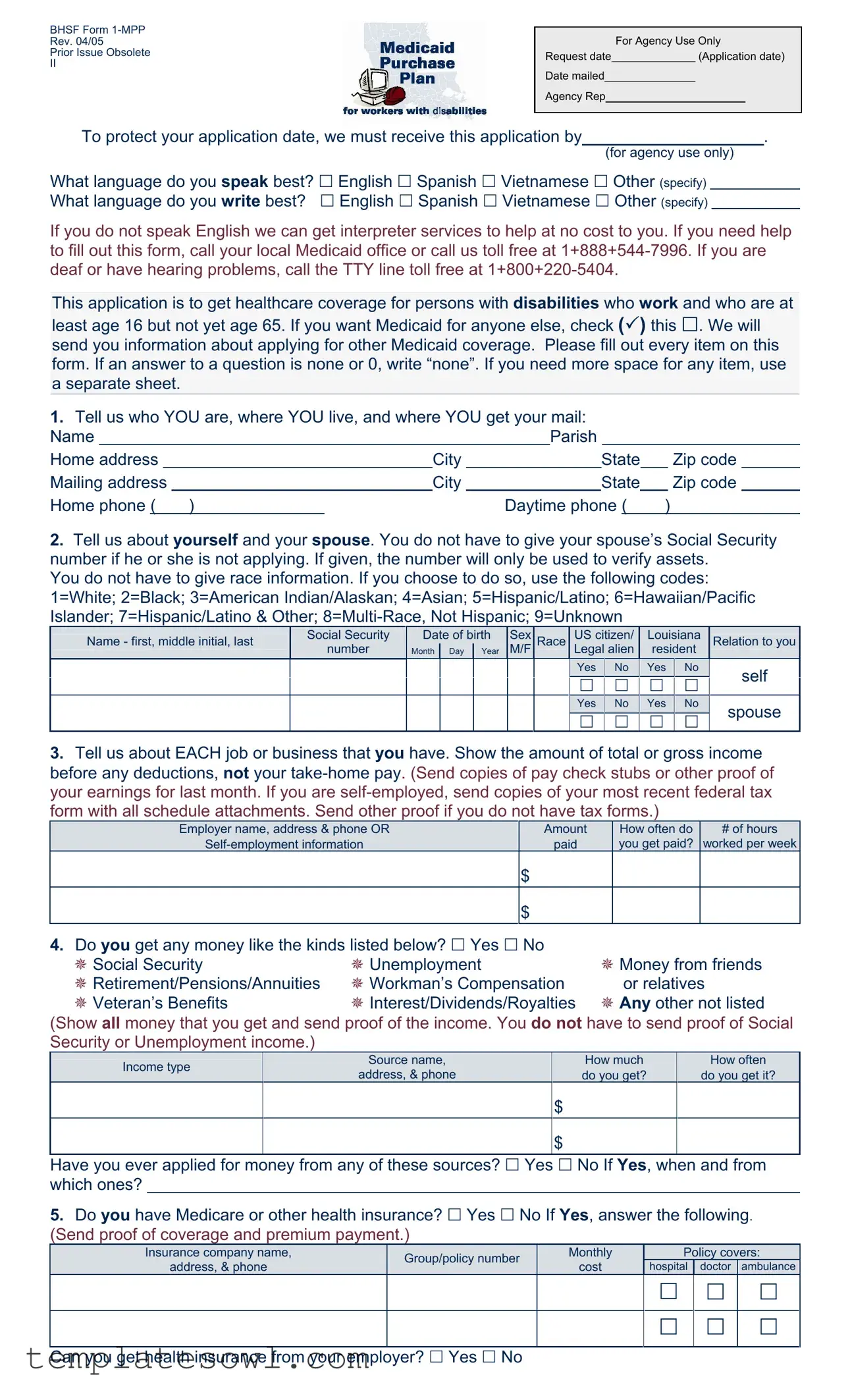

BHSF Form

Rev. 04/05

Prior Issue Obsolete

II

For Agency Use Only

Request date |

|

(Application date) |

Date mailed

Agency Rep

To protect your application date, we must receive this application by |

|

. |

(for agency use only)

What language do you speak best? English Spanish Vietnamese Other (specify) What language do you write best? English Spanish Vietnamese Other (specify)

If you do not speak English we can get interpreter services to help at no cost to you. If you need help to fill out this form, call your local Medicaid office or call us toll free at

This application is to get healthcare coverage for persons with disabilities who work and who are at

least age 16 but not yet age 65. If you want Medicaid for anyone else, check ( ) this . We will send you information about applying for other Medicaid coverage. Please fill out every item on this form. If an answer to a question is none or 0, write “none”. If you need more space for any item, use a separate sheet.

1.Tell us who YOU are, where YOU live, and where YOU get your mail:

Name |

|

|

|

Parish |

|

|

|

|

||||||

Home address |

|

City |

|

|

State |

|

Zip code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

City |

|

|

State |

|

Zip code |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Home phone ( ) |

|

Daytime phone ( |

) |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.Tell us about yourself and your spouse. You do not have to give your spouse’s Social Security number if he or she is not applying. If given, the number will only be used to verify assets.

You do not have to give race information. If you choose to do so, use the following codes: 1=White; 2=Black; 3=American Indian/Alaskan; 4=Asian; 5=Hispanic/Latino; 6=Hawaiian/Pacific Islander; 7=Hispanic/Latino & Other;

Name - first, middle initial, last |

Social Security |

Date of birth |

Sex |

Race |

US citizen/ |

Louisiana |

Relation to you |

||

|

number |

Month |

Day |

Year |

M/F |

|

Legal alien |

resident |

|

|

Yes |

|

No |

|

Yes |

|

No |

|

self |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|||||||

|

Yes |

|

No |

|

Yes |

|

No |

|

spouse |

|

|

|

|

|

|

||||

3.Tell us about EACH job or business that you have. Show the amount of total or gross income before any deductions, not your

Employer name, address & phone OR |

Amount |

How often do |

# of hours |

paid |

you get paid? |

worked per week |

$

$

4.Do you get any money like the kinds listed below? Yes No

Social Security |

Unemployment |

Money from friends |

Retirement/Pensions/Annuities |

Workman’s Compensation |

or relatives |

Veteran’s Benefits |

Interest/Dividends/Royalties |

Any other not listed |

(Show all money that you get and send proof of the income. You do not have to send proof of Social Security or Unemployment income.)

|

Income type |

|

Source name, |

|

|

How much |

|

How often |

|

|

|

address, & phone |

|

|

do you get? |

|

do you get it? |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

$ |

|

|

|

|

$

Have you ever applied for money from any of these sources? Yes No If Yes, when and from which ones?

5.Do you have Medicare or other health insurance? Yes No If Yes, answer the following. (Send proof of coverage and premium payment.)

Insurance company name, |

Group/policy number |

Monthly |

|

Policy covers: |

|||

address, & phone |

cost |

hospital |

doctor |

ambulance |

|||

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Can you get health insurance from your employer? Yes No

6.Do you, or you jointly with your spouse, have any assets or resources like those listed below? Yes No If Yes, give us the following information. (Send proof of ownership and value.)

|

Asset/Resource |

Company name, address, & phone; |

Value |

Amount owed |

|

||||

|

Account number and/or description |

|||

|

|

|

|

|

|

Checking/Savings accounts (type) |

|

$ |

|

|

|

|

|

|

|

Certificates of Deposit |

|

$ |

|

|

Retirement accounts |

|

$ |

|

|

Annuities/Trusts |

|

$ |

|

|

Stocks/Bonds |

|

$ |

|

|

Vehicles (if more than one) |

|

$ |

$ |

|

Property, other than your home |

|

$ |

$ |

|

Other (please be specific) |

|

$ |

$ |

7.Did you ever apply for or get Social Security Disability or Supplemental Security Income (SSI)

benefits? Yes No If Yes, when? |

|

Was a decision made? Yes No |

|

If Yes, what was the decision? |

|

|

|

|

|

|

|

8.What is your disability?

Tell us about the doctors or other medical providers who care for you:

Provider’s name(s)

Address & phone of this medical provider

9.Where did you find out about the Medicaid Purchase Plan?

Rights and Responsibilities

I declare that I am a U.S. citizen or in this country legally.

The information I gave on this form is true and correct to the best of my knowledge. I realize if I knowingly give information that is not true OR if I knowingly hold back information, I may get health benefits for which I am not eligible. If that happens, I can be lawfully punished for fraud. I may also have to pay Medicaid back for any medical bills which are paid incorrectly.

I understand that the information I give about my situation will be checked. I agree to help do that, and to let Medicaid get information it needs from government agencies, employers, medical providers, and other sources. If I refuse to help with this process or in later reviews caused by reported changes, or as part of a Recipient Eligibility review, it will mean that I can’t get Medicaid until I do help.

I know that Social Security numbers will only be used to get information from other government agencies to prove my eligibility.

I agree to tell Medicaid within 10 days if 1) I move out of state; 2) there are changes in where I live or get my mail; 3) there are any changes in other health insurance coverage; 4) there is any change in my work status.

By accepting Medicaid, I agree that any medical payments received from other sources will be sent to the Department of Health and Hospitals for any services that were covered by Medicaid.

I can ask for a Fair Hearing if I think the decision made on my case is unfair, incorrect or being made too late.

Medicaid can’t treat me differently because of my race, color, sex, age, disability, religion, nationality or political belief. If I think they have, I can call the U.S. DHHS Regional Office for Civil Rights in Dallas, TX at

Signature of Applicant or Authorized Representative |

|

Date |

|

|

|

Signature of Agency Representative, if applicable |

|

Date |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form is for individuals with disabilities who are working and between ages 16 and 65 to apply for healthcare coverage. |

| Language Accessibility | Interpreters are available at no cost for individuals who do not speak English. |

| Contact Information | Applicants can reach their local Medicaid office or call a toll-free number for assistance. |

| Eligibility Requirements | Applicants must be U.S. citizens or legal residents and meet specific income and asset criteria. |

| Proof of Income | Applicants must submit proof of income for the previous month, including pay stubs or tax forms for self-employed individuals. |

| Asset Disclosure | Details of assets must be provided, and proof of ownership and value should be submitted. |

| Rights and Responsibilities | Applicants must declare the accuracy of their information and understand the consequences of providing false information. |

| Governing Law | This form operates under Louisiana Medicaid laws. |

Guidelines on Utilizing Bhsf 1 Mpp

After completing the BHSF 1 MPP form, you will submit it to the appropriate agency. You will receive confirmation of receipt, and any necessary follow-up actions will be communicated to you. It is important to ensure that each section is accurately filled out to avoid delays in processing your application.

- Fill in your Name, Parish, Home address, City, State, and Zip code in the designated spaces.

- Provide your Mailing address (if different), as well as your Home phone and Daytime phone numbers.

- In the next section, indicate the language you speak and write best.

- If applicable, give information about your spouse, including their Name, Social Security number, Date of birth, Sex, Race, and Residency status.

- List your employment details, including Employer name, address, phone, and your gross income from all jobs.

- Indicate any other sources of income by checking Yes or No, and provide specifics if you receive any financial support.

- State whether you have Medicare or other health insurance and provide the necessary details.

- If you have any assets or resources, check Yes and list them along with pertinent details.

- Answer whether you have ever applied for Social Security Disability or Supplemental Security Income (SSI), and if so, provide the necessary details.

- Describe your disability and list the names and contact information for your medical providers.

- Indicate where you learned about the Medicaid Purchase Plan.

- Finally, read and affirm your understanding of the rights and responsibilities before signing and dating the form.

What You Should Know About This Form

What is the purpose of the BHSF Form 1-MPP?

The BHSF Form 1-MPP is used to apply for healthcare coverage under Medicaid for people with disabilities who are aged between 16 and 64. It serves as a means to gather essential information for determining eligibility for Medicaid services.

What information do I need to complete the form?

You will need to provide personal details, including your name, address, and social security number. Additionally, information regarding your income, employment, and any existing health insurance must be included. This ensures the completion of your application and helps in assessing your financial situation.

Do I need to submit proof of my income?

Yes, you must provide proof of your income as part of the application. This can include copies of pay stubs if you are employed or recent tax forms if you are self-employed. This documentation is crucial for confirming your eligibility for Medicaid benefits.

What should I do if I need help filling out the form?

If you require assistance, you can contact your local Medicaid office or call the toll-free number at 1-888-544-7996 for guidance. Interpreter services are also available at no cost if you do not speak English.

What happens after I submit the form?

After submitting the application, Medicaid will review the information provided. If additional information or documentation is needed, they will reach out to you. You will also receive updates about the status of your application and any decisions made regarding your eligibility for benefits.

Common mistakes

Filling out the BHSF Form 1-MPP can be a straightforward task, but many individuals make common mistakes that can delay or complicate their applications. One frequent error is failing to fill out every item on the form. It's essential to provide information for each question. If something does not apply or there is nothing to report, simply write "none" or "0." Omitting this information can lead to unnecessary delays in processing.

Another mistake occurs when applicants rush through the form without double-checking their work. Small errors, such as typos in names or incorrect dates of birth, can create significant problems. It is crucial to review the information carefully before submitting. Accurate details help ensure a smoother application process.

Many people also overlook the importance of providing proof of income and assets. The form requests documentation, including paycheck stubs, tax forms, or other relevant evidence. Failing to include these items can result in a denial of benefits. Always make sure to attach the necessary documentation to support the claims made in the application.

Additionally, some applicants do not pay attention to the specified deadlines for submission. The form warns that the application must be received by a certain date to protect the application date. Ignoring this timeline can jeopardize the review process. It is vital to submit the form as early as possible to avoid complications.

Language barriers can also pose challenges. While the form provides options for speaking and writing languages, individuals might not realize that interpreter services are available at no cost. Utilizing these services can help applicants complete the form accurately and confidently.

Another frequent error is misunderstanding the requirements for spousal information. While it is not mandatory to provide a spouse’s Social Security number, many mistakenly assume they should include it anyway. Providing unnecessary information can complicate the review process. Applicants should focus only on what is required.

Applicants sometimes fail to mention all sources of income. The form specifically asks for income from various sources, including social security and pensions. Omitting this information, either intentionally or by mistake, can lead to serious consequences. Being transparent about all income is crucial.

In some cases, applicants overlook the asset disclosure section. This section requires information about checking accounts, retirement funds, and other resources. Not disclosing assets or providing inaccurate values can hinder eligibility. Ensure that all relevant financial details are provided.

Lastly, many individuals underestimate the importance of the rights and responsibilities section of the form. This part outlines significant conditions and possible penalties for inconsistencies in the provided information. Being clear about these responsibilities is essential for a fair review process. Understand these commitments before signing and submitting the application.

Documents used along the form

The BHSF Form 1-MPP is crucial for individuals applying for healthcare coverage under the Medicaid Purchase Plan. Alongside this form, several other documents and forms may be necessary to support the application and verify eligibility. Here’s a brief overview of some commonly used forms and documents.

- Medicaid Application Form: This form initiates the process for seeking Medicaid benefits, detailing personal information, income, and other eligibility factors.

- Proof of Income Documentation: Applicants must provide evidence of income, such as pay stubs or tax returns, to verify eligibility for benefits.

- Social Security Administration Benefit Verification Letter: This letter confirms if the applicant receives Social Security Disability or Supplemental Security Income, which may impact Medicaid eligibility.

- Medicare Coverage Information: Proof of existing Medicare coverage is needed, including policy numbers and details, enabling better assessment of health insurance status.

- Assets Disclosure Form: This form outlines any assets owned by the applicant, such as savings accounts or real property, which can affect Medicaid eligibility limits.

- Authorization for Release of Information: This document allows Medicaid to obtain necessary information about the applicant’s financial or medical history from other agencies.

- Medical Provider Information Form: This form lists healthcare providers who treat the applicant, ensuring Medicaid can verify medical needs relevant to the disability claim.

- Fair Hearing Request Form: Should there be any disputes regarding eligibility or coverage decisions, this form allows applicants to request a hearing to appeal Medicaid's decisions.

Collecting and preparing these forms and documents in advance can streamline the application process. Ensuring accurate and complete submissions aids in a smoother review by Medicaid, ultimately supporting the goal of securing essential health coverage.

Similar forms

The BHSF Form 1-MPP is an essential document for individuals seeking healthcare coverage under the Medicaid Purchase Plan, particularly for those with disabilities. Several other forms share similar purposes, structures, or information requirements. Below is a concise comparison highlighting four documents that are akin to the BHSF Form 1-MPP:

- Medicaid Application Form: This form collects detailed personal and financial information to determine eligibility for Medicaid benefits. Like the BHSF Form 1-MPP, it requires information about income, assets, and any health insurance coverage.

- Social Security Disability Insurance (SSDI) Application: Individuals applying for SSDI must provide information about their work history, income, and disability status. Both forms necessitate proof of income and typically require documentation of any medical conditions affecting the applicant’s ability to work.

- Supplemental Security Income (SSI) Application: SSI applicants must disclose similar personal and financial details as in the BHSF Form 1-MPP. Information on income, resources, and living arrangements is critical for both applications, aiming to establish financial need and eligibility.

- Medically Needy Program Application: This application is designed for individuals whose income exceeds Medicaid limits but have high medical expenses. Both forms ask about financial resources and healthcare needs, highlighting applicants' financial burdens due to medical expenses.

Dos and Don'ts

When filling out the BHSF 1 MPP form, it is vital to ensure accuracy and completeness. Here are some guidelines to help you navigate the process smoothly.

- Do make sure to complete every item on the form. If an answer is none or 0, write “none” instead of leaving it blank.

- Do seek assistance if needed. Utilize interpreter services if you are not comfortable communicating in English, or call your local Medicaid office for help.

- Do provide proof of income and assets where applicable. For example, send copies of paycheck stubs or tax forms if you are self-employed.

- Do keep a copy of the completed form for your records. This will help you track what information you’ve submitted.

- Don't rush through the form. Take your time to read each question carefully to avoid errors.

- Don't omit any information. Even if some sections do not apply to you, it’s important to indicate that.

- Don't forget to sign and date the form. An unsigned application may delay processing.

- Don't use abbreviations or slang. Use clear and complete language to ensure your application is understood.

Misconceptions

The BHSF Form 1-MPP plays a crucial role in obtaining healthcare coverage for individuals with disabilities who work. However, several misconceptions often surround this form. Here’s a closer look at these misunderstandings:

- Misconception 1: The form is only for individuals who can speak English.

- Misconception 2: Anyone can apply for the program, regardless of their age or disability status.

- Misconception 3: You must provide your spouse’s Social Security number, even if they are not applying.

- Misconception 4: The form is too complicated and time-consuming to complete.

- Misconception 5: You do not need to provide proof of income or other financial documentation.

- Misconception 6: The Medicaid Purchase Plan is automatically granted if you fill out the form.

- Misconception 7: Once you get Medicaid, you will never need to provide updated information again.

This is not true. While the form includes English as a language option, assistance in other languages is available at no cost. An interpreter can help applicants navigate the process.

Actually, the application is specifically intended for people who are at least 16 years old but not yet 65 and have a disability. This age limit must be respected to qualify.

There is no requirement to give your spouse’s Social Security number unless they are applying. If provided, it only serves the purpose of asset verification.

While the form has numerous sections, clear instructions are provided. Help is available through local Medicaid offices, and many find that they can complete it with relative ease.

Proof of income is required. Applicants must submit pay stubs or other evidence of earnings, ensuring that all financial information is accurately represented.

Submitting the application does not guarantee approval. An evaluation of eligibility based on the provided information will take place before any benefits are awarded.

It is important to report any changes in your situation. You must inform Medicaid within 10 days if your address, income, or insurance status changes, as this can affect your eligibility.

Understanding these misconceptions can help applicants navigate the BHSF Form 1-MPP with greater confidence and clarity. Access to correct information ensures that everyone has the chance to receive the healthcare coverage they need.

Key takeaways

Filling out the BHSF 1 MPP form can seem overwhelming, but it’s crucial for securing healthcare coverage for those with disabilities. Here are some key takeaways to keep in mind:

- Submit Promptly: Ensure your application is mailed by the due date to protect your application date.

- Language Assistance: If English isn’t your first language, interpreter services are available at no cost.

- Complete Every Item: Fill out every item on the form. If something doesn’t apply, simply write “none.”

- Use Extra Sheets if Necessary: If you need more space, don’t hesitate to attach additional sheets.

- Provide Accurate Income Details: Report your gross income from all jobs, not just what you take home.

- Include All Income Types: Don’t leave out any income sources; this includes Social Security, unemployment, and money from friends or relatives.

- Report Insurance Coverage: If you have Medicare or other health insurance, provide the necessary proof and details.

- Disclose Assets: Make sure to report any assets or resources you or your spouse own, along with their current value.

- Be Honest About Your Disability: Clearly describe your disability and provide information about your medical providers.

- Know Your Rights: Understand your rights regarding eligibility, and don’t hesitate to ask for a Fair Hearing if you believe you’ve been treated unfairly.

Taking these steps will help ensure a smoother application process and increase your chances of receiving the coverage you need.

Browse Other Templates

Deposit Receipt - This form ensures that all security deposit transactions are recorded formally.

10-5345a Va Form - Gathering necessary information beforehand makes filling out the form easier.

Michigan Elk Drawing - Updating your account ensures you continue to receive the latest filing benefits.