Fill Out Your Bill Payment Checklist Form

Managing monthly bills can feel overwhelming, but having a solid strategy simplifies the process significantly. A Bill Payment Checklist form is an essential tool that helps individuals keep track of their financial obligations. This form allows users to fill in the month and year, listing each bill, the amount due, and the payment date. Your checklist will enable you to mark bills as paid, ensuring nothing slips through the cracks. By organizing bills in this format, you can visually confirm your due dates and payment amounts, helping you manage your cash flow more effectively. Plus, it offers peace of mind by reducing the chances of late payments, thereby avoiding potential fees. The act of checking off each paid bill not only keeps you accountable but also provides a sense of accomplishment as you see your progress unfold throughout the month.

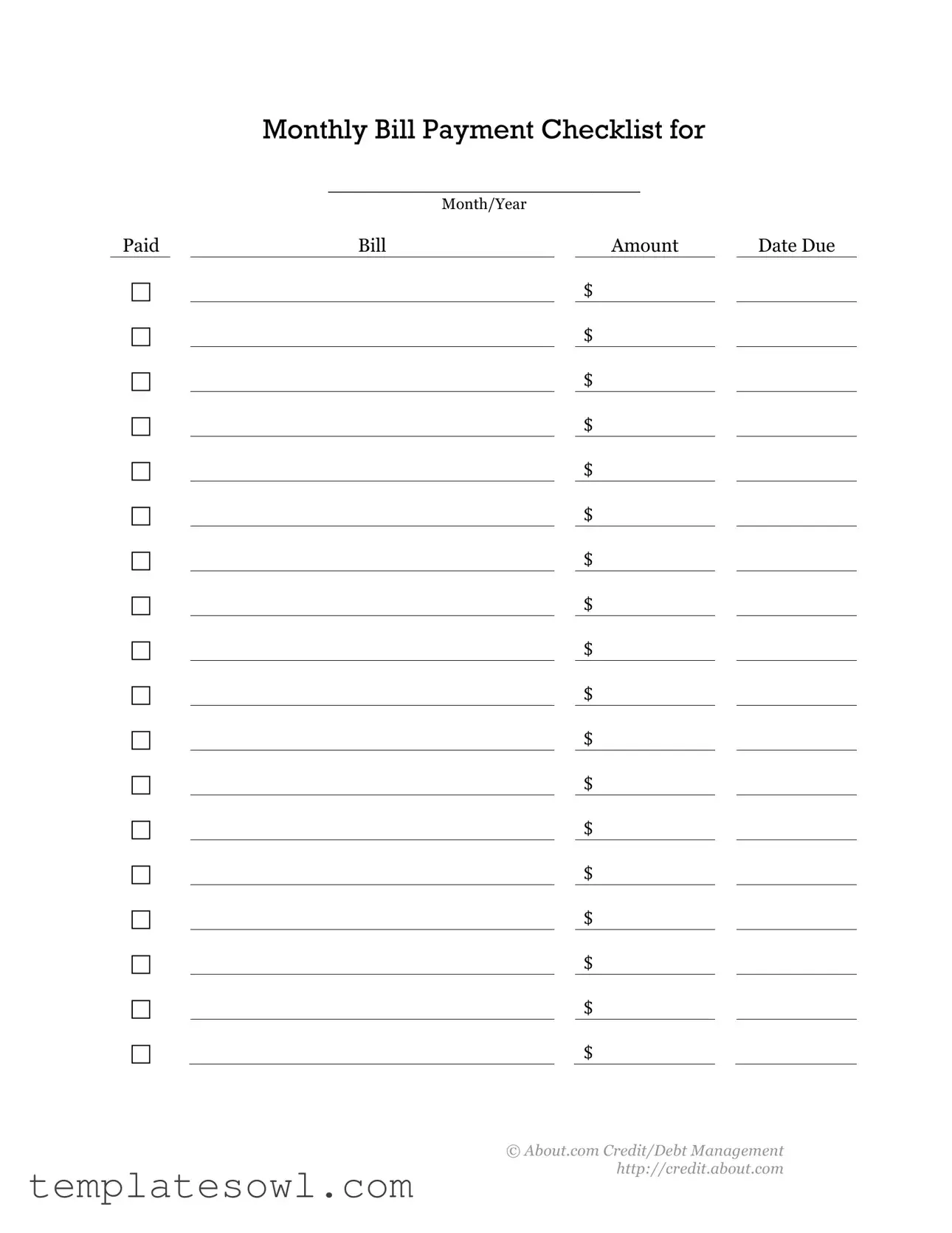

Bill Payment Checklist Example

PAID

Monthly Bill Payment Checklist for

__________________________

MONTH/YEAR

|

BILL |

|

AMOUNT |

|

DATE DUE |

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

©About.com Credit/Debt Management http://credit.about.com

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Bill Payment Checklist form is designed to help individuals track and manage their monthly bills efficiently. |

| Structure | The form includes spaces to record the bill amount, due date, and status of payment (paid or unpaid). |

| Monthly Use | This checklist is meant to be used each month and can accommodate multiple bills. |

| Financial Awareness | Using this form promotes financial awareness by encouraging regular bill tracking. |

| Holds Money Accountability | The checklist helps users stay accountable for their financial obligations, reducing the risk of late fees. |

| Customization | Users can customize the form by writing in the month and year, tailoring it to their specific needs. |

| Visual Indication | The checkbox feature allows users to visually indicate which bills have been paid. |

| Accessibility | This checklist format is easy to understand, making it accessible for users with varying levels of financial literacy. |

| State-Specific Compliance | Compliance with state regulations may be necessary, depending on individual financial or legal requirements. |

Guidelines on Utilizing Bill Payment Checklist

Successfully filling out the Bill Payment Checklist form is an important task that helps individuals plan and track their monthly expenses. After completing the form, you will have a clear overview of your bills, their amounts, and due dates. This can prevent late payments and improve your financial management.

- Begin by locating the section that asks for the MONTH/YEAR. Write in the appropriate month and year for your bill payments.

- In the first blank line, write down the name of the bill or service you are paying for.

- Next, in the BILL AMOUNT section, enter the total amount due for that bill.

- Fill in the DATE DUE with the exact date when the payment must be made.

- Continue this process for each bill, using a new line for every separate bill payment. Ensure all bills are listed.

- Once all the bills have been documented, review your entries to confirm that everything is accurate.

- If a payment has already been made, check the corresponding box labeled PAID next to that bill.

By following these steps, you will have created a comprehensive checklist that keeps your bill payments organized. This method provides clarity and can help you stay on top of your financial obligations.

What You Should Know About This Form

What is the purpose of the Bill Payment Checklist form?

The Bill Payment Checklist form serves as a helpful tool to track your monthly expenses. By listing all your bills, their amounts, and due dates, it helps ensure you do not miss payments. This organization can help avoid late fees and negative impacts on your credit score. Moreover, it provides a clear visual representation of your financial obligations for the month, allowing for better budgeting and planning.

How should I fill out the Bill Payment Checklist form?

To complete the Bill Payment Checklist, start by writing your name, the month, and the year at the top of the form. Next, list each bill, its corresponding amount, and the due date in the designated rows. Be sure to check the box next to each bill once you have made the payment. This simple practice can enhance your ability to stay organized and manage your bills effectively.

How can this form help me manage my finances better?

This checklist can improve your financial management in several ways. First, it consolidates all your bills into one easy-to-read format, reducing the chances of overlooking any payments. Second, it allows for advanced planning; you can see upcoming due dates and ensure funds are available. Over time, this form can assist in identifying patterns in your spending habits, enabling you to make informed decisions and adjustments to your budget as needed.

What should I do if I have multiple bills or unique payment dates?

If you have several bills or varying due dates, utilize the available lines on the checklist to accommodate your needs. Write down each bill under the appropriate month, ensuring you include all necessary details. Additionally, consider making a note next to any bills that require special attention, such as bills paid on a different schedule or those subject to change. This level of detail can help maintain clarity around your financial responsibilities.

Common mistakes

Completing the Bill Payment Checklist form accurately is crucial for maintaining financial organization. One common mistake occurs when individuals forget to include the month and year at the top of the form. This detail is essential for tracking payments and identifying any recurring bills over different periods.

Another frequent error involves overlooking the bill amounts. Individuals may leave this section blank or input incorrect figures. Without proper amounts, it becomes difficult to gauge total expenses or ensure that enough funds are available for payment.

In addition to the bill amounts, the due dates need careful attention. Some people mistakenly enter incorrect dates or neglect to fill them out completely. Missing due dates can lead to late fees, increased interest, or a negative impact on credit scores.

A third mistake arises in the payment confirmation section. Individuals may not check the payment box after making a payment. This can create confusion later, as it becomes challenging to remember which bills have been paid and which remain outstanding.

Moreover, some users fail to keep track of multiple payments due for the same month. Neglecting to list all bills can lead to oversights and missed payments. Every outstanding bill should be accounted for to maintain a clear picture of financial obligations.

Mismanagement of the overall layout can also contribute to errors. Individuals sometimes fill out the form hastily, leading to illegible handwriting or a disorganized presentation of information. This lack of clarity may cause misunderstandings about which bills correspond to which amounts.

The use of abbreviations can complicate matters as well. While short forms may save space, they often result in confusion. A clear description for each bill is always preferable to ensure quick recognition and response.

Additionally, failing to review the completed checklist before submission may lead to missed mistakes. Taking a moment to double-check all entries can prevent easily avoidable errors, such as incorrect amounts or due dates.

Finally, not keeping a copy of the filled-out checklist can pose challenges in the future. Individuals should maintain a personal record, as having a reference is beneficial for tracking payment histories and supporting budgeting efforts.

Documents used along the form

The Bill Payment Checklist form is a useful tool to organize and keep track of your monthly expenses. However, there are other essential documents that often accompany this checklist, assisting in maintaining a comprehensive view of your financial obligations. Each of these documents plays a unique role in ensuring smooth bill management and providing clarity on payments.

- Invoice: This document details the goods or services provided, along with the total amount due. It serves as a formal request for payment from the service provider.

- Payment Receipt: After a payment is made, a receipt is issued as proof of the transaction. It includes the amount paid, date, and method of payment, providing a record for your financial tracking.

- Billing Statement: A summary of all transactions during a billing period. It highlights outstanding charges, previous payments made, and the current balance due.

- Account Summary: This document gives an overview of your accounts, including total balances, upcoming payments, and any overdue amounts, helping you visualize your overall financial status.

- Payment Plan Agreement: If you’re on a payment plan, this document outlines the terms and conditions, specifying payment amounts and due dates, ensuring clarity on your obligations.

- Authorization Form: For automatic payments, this form grants permission to deduct funds from your account on a specified schedule, ensuring timely bill payments without manual intervention.

- Expense Report: A record of all your expenses during a specified period, useful for tracking spending and comparing it against your budget, helping you to identify areas for savings.

- Late Payment Notice: If a payment has not been received by its due date, this notice alerts you of the missed deadline and outlines any penalties incurred, prompting you to address the matter promptly.

By utilizing the Bill Payment Checklist alongside these associated documents, individuals can navigate their financial responsibilities with greater ease and confidence. Organizing these forms not only aids in tracking payments but also contributes to overall financial wellness.

Similar forms

The Bill Payment Checklist form serves as an invaluable tool for managing monthly expenses. Here are ten documents that share similarities with this checklist, highlighting their utility in financial organization.

- Expense Tracker: This document allows individuals to keep a detailed log of all their monthly expenditures. Like the Bill Payment Checklist, it helps in tracking payment due dates, ensuring that financial obligations are met on time.

- Budget Planner: A budget planner outlines income and expenses, providing a comprehensive view of financial health. The Bill Payment Checklist complements this by focusing specifically on payment deadlines, assisting individuals in sticking to their budget.

- Payment Reminder Calendar: A calendar that marks payment due dates can be immensely helpful. Similar to the checklist, it serves as a visual reminder for upcoming bills and helps prevent late fees.

- Payment Confirmation Receipt: This document confirms that a payment has been made. While the Bill Payment Checklist tracks upcoming payments, receipts serve as proof of completed transactions, reinforcing financial accountability.

- Credit Card Statement: Monthly statements provide a detailed account of transactions. The Bill Payment Checklist aligns with this by helping users keep track of when to pay the balance to avoid interest charges.

- Utility Bill Summary: A summary that aggregates utility costs can help assess monthly expenses. Similar to the checklist, it emphasizes the importance of timely payments to avoid service interruptions.

- Financial Goals Worksheet: This document helps in setting and tracking long-term financial objectives. The Bill Payment Checklist can support these goals by ensuring immediate payments are handled, thus contributing to overall financial stability.

- Debt Repayment Plan: A repayment plan outlines how debts will be managed. Similarity lies in the focus on due dates; both documents help prioritize payments to avoid defaulting.

- Monthly Financial Review: This review assesses all financial activities for the month. It mirrors the checklist by ensuring that due payments are not overlooked during evaluations.

- Automatic Payment Setup Form: This form is used to authorize automatic bill payments. The Bill Payment Checklist remains relevant by marking dates for those payments that may need attention or adjustment.

Each of these documents plays a crucial role in maintaining financial health, ensuring that individuals can manage their obligations effectively and mitigate the risks of missed payments.

Dos and Don'ts

When filling out the Bill Payment Checklist form, certain practices can help ensure everything is done correctly. Here are some dos and don'ts to guide you.

- Do make sure to enter the correct month and year at the top of the form.

- Do double-check the bill amounts before entering them.

- Do note the due dates clearly for each bill.

- Do mark each bill as PAID once completed.

- Don't leave any blank spaces for bill amounts or due dates.

- Don't hesitate to ask for clarification if you’re unsure about any bills.

- Don't forget to keep a copy of the checklist for your records.

- Don't ignore any comments or notes that might help you track payments.

Misconceptions

Many people have misconceptions about the Bill Payment Checklist form. Let's clarify these misunderstandings.

- It's only for utility bills. The checklist can be used for all types of monthly bills, including rent, mortgage, and subscriptions, not just utility bills.

- It's unnecessary if I use online banking. Even with online banking, a checklist helps keep track of due dates and amounts, ensuring nothing gets overlooked.

- It’s a complicated tool. The Bill Payment Checklist is straightforward and easy to use. It’s designed for anyone to understand, regardless of their financial background.

- Once I fill it out, I don’t need to check it again. Regularly reviewing the checklist can help identify discrepancies or late payments, so it’s important to keep it updated.

- It only shows due dates. The form allows tracking of bill amounts, payment confirmation, and due dates, giving a complete overview of monthly expenses.

- It’s not needed if I have a reminder on my phone. While reminders are useful, having a physical checklist provides a clear visual of all your bills in one place.

- You need to have multiple forms for different bills. This checklist can accommodate various bills on a single form. There’s no need to create separate ones.

- Using it makes me seem unorganized. On the contrary, using a checklist reflects good organizational skills. It shows a proactive approach to managing finances.

- It’s outdated. The checklist remains a relevant tool for managing finances. Digital alternatives exist, but many still find the checklist practical and effective.

Key takeaways

Below are key takeaways for effectively filling out and using the Bill Payment Checklist form. This tool helps maintain financial organization and ensures timely bill payments.

- The checklist is designed to track monthly bills, making it easier to manage finances.

- Clearly write your name and the month/year at the top of the form to personalize it.

- List each bill, including the bill amount and due date, to avoid missing payments.

- Check off each bill as it is paid to visually track progress and stay organized.

- Keep a record of the payment amounts; this can help with budgeting for future months.

- Review the form regularly to catch any overdue payments or missed bills.

- Print multiple copies of the checklist for different months or household members.

- Use the form to compare the payment schedules; adjust payments if necessary to manage cash flow.

- Modify the form to add extra bills as they arise, ensuring nothing is overlooked.

- Stay committed to this process—consistent use can lead to better financial health.

The Bill Payment Checklist is not just a form; it is a practical tool for fostering financial responsibility. By utilizing it

Browse Other Templates

Arkansas W2 Form - The form helps the state reconcile the amount of income tax collected.

1300/22 - This form plays a significant role in documenting service members’ requests and changes.

Metlife Bill Pay - A mobile number and email ID are requested for communication purposes.