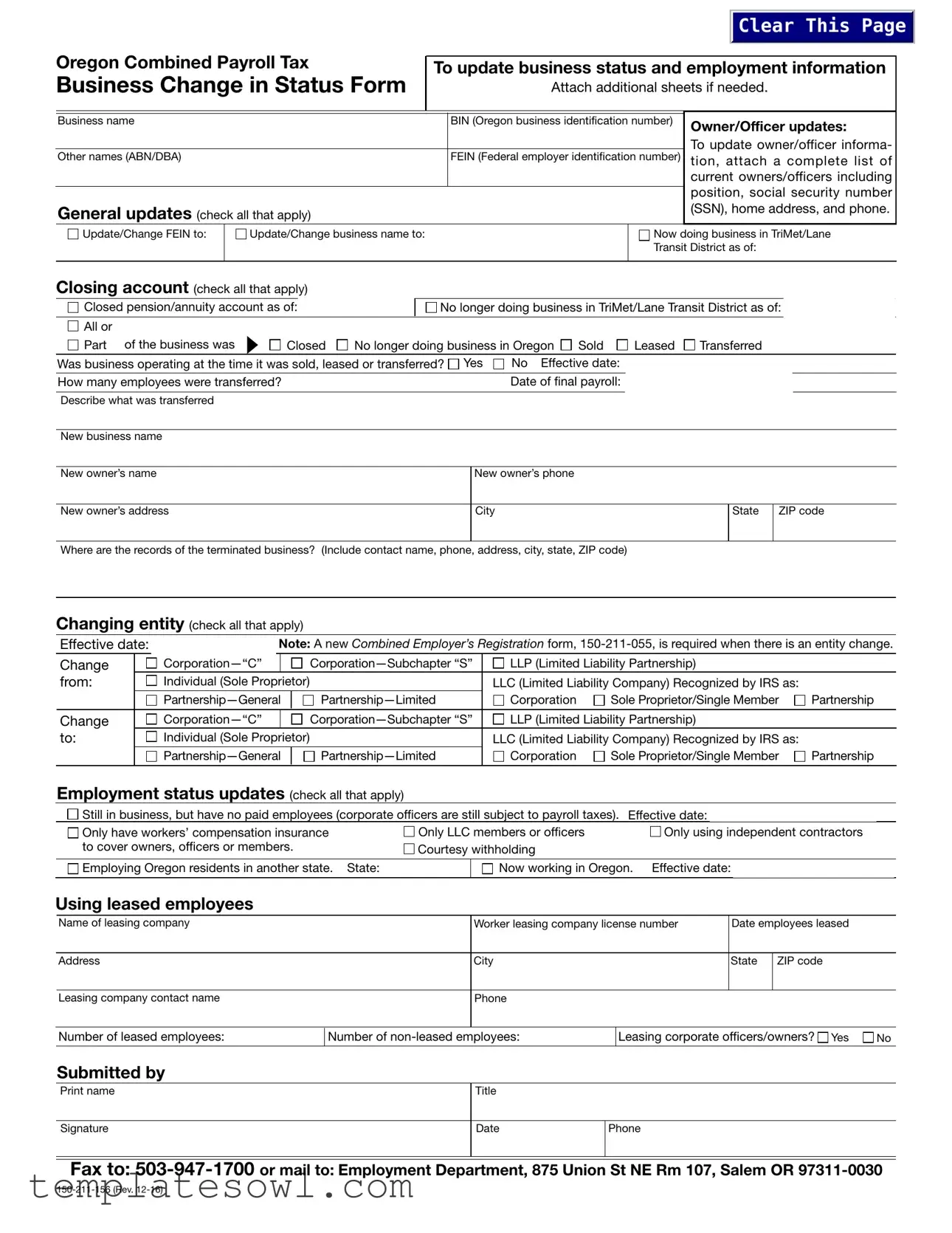

Fill Out Your Bin Oregon Form

The Bin Oregon form, officially known as the Oregon Combined Payroll Tax Business Change in Status Form, plays a crucial role in managing updates related to a business’s operational status and employee information. This form is designed for businesses in Oregon to communicate various changes to the Employment Department, the Department of Revenue, and the Department of Consumer and Business Services. Key sections of the form provide space for businesses to update their Oregon Business Identification Number (BIN), Federal Employer Identification Number (FEIN), and business name. In addition, it allows for the reporting of changes regarding owners, officers, and employment status. Businesses must specify if they are closing accounts or discontinuing operations in specific districts or in Oregon altogether. Important details such as the effective dates of changes and information related to leased employees are also covered. Overall, the form facilitates clear communication that is essential for compliance with Oregon’s payroll tax regulations.

Bin Oregon Example

Oregon Combined Payroll Tax

Business Change in Status Form

Clear This Page

To update business status and employment information

Attach additional sheets if needed.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business name |

|

|

|

|

|

BIN (Oregon business identification number) |

Owner/Officer updates: |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

To update owner/officer informa- |

||||

Other names (ABN/DBA) |

|

|

|

|

|

FEIN (Federal employer identification number) |

||||||||||

|

|

|

|

|

tion, attach a complete list of |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

current owners/officers including |

||||

|

|

|

|

|

|

|

|

|

|

|

|

position, social security number |

||||

General updates (check all that apply) |

|

|

|

|

|

|

|

|

(SSN), home address, and phone. |

|||||||

Update/Change FEIN to: |

|

Update/Change business name to: |

|

|

|

|

|

Now doing business in TriMet/Lane |

||||||||

|

|

|

|

|

|

|

|

|

|

|

Transit District as of: |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Closing account (check all that apply) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Closed pension/annuity account as of: |

|

|

|

No longer doing business in TriMet/Lane Transit District as of: |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Part of the business was |

Closed |

No longer doing business in Oregon |

Sold |

Leased |

Transferred |

|||||||||||

Was business operating at the time it was sold, leased or transferred? Yes |

No Effective date: |

|

|

|

|

|

|

|||||||||

How many employees were transferred? |

|

|

|

|

Date of final payroll: |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Describe what was transferred

New business name

New owner’s name

New owner’s phone

New owner’s address

City

State

ZIP code

Where are the records of the terminated business? (Include contact name, phone, address, city, state, ZIP code)

Changing entity (check all that apply)

Effective date:  Note: A new Combined Employer’s Registration form,

Note: A new Combined Employer’s Registration form,

Change |

LLP (Limited Liability Partnership) |

|

|||||

from: |

Individual (Sole Proprietor) |

|

LLC (Limited Liability Company) Recognized by IRS as: |

|

|||

|

|

Corporation |

Sole Proprietor/Single Member |

Partnership |

|||

Change |

|

LLP (Limited Liability Partnership) |

|

||||

to: |

Individual (Sole Proprietor) |

|

LLC (Limited Liability Company) Recognized by IRS as: |

|

|||

|

|

Corporation |

Sole Proprietor/Single Member |

Partnership |

|||

Employment status updates (check all that apply)

Still in business, but have no paid employees (corporate officers are still subject to payroll taxes). Effective date:

Still in business, but have no paid employees (corporate officers are still subject to payroll taxes). Effective date:

Only have workers’ compensation insurance |

Only LLC members or officers |

Only using independent contractors |

|||

to cover owners, officers or members. |

Courtesy withholding |

|

|

|

|

|

|

|

|

|

|

Employing Oregon residents in another state. State: |

|

Now working in Oregon. |

Effective date: |

|

|

Using leased employees

Name of leasing company

Worker leasing company license number

Date employees leased

Address

City

State |

ZIP code |

|

|

Leasing company contact name

Phone

Number of leased employees:

Number of

Leasing corporate officers/owners? Yes |

No |

Submitted by

Print name

Signature

Title

Date |

Phone |

|

|

|

|

|

|

|

Fax to:

Business Change in Status Form Instructions

Use this form to notify the Employment Department (OED), Department of Revenue (DOR), and Department of Consumer and Business Services (DCBS) of changes to your business or employment status. Attach additional sheets if needed.

General updates

NOTE: Some federal employer identification number (FEIN) and name changes may require a new Combined Employer’s Registration,

•Provide the correct FEIN for your business.

•Correct the business name and spelling errors as needed.

•Check the “Now doing business in TriMet/Lane Transit District” box and include the effective date if you’re an employer paying wages earned in the TriMet or Lane Transit District. You must register and file with the Oregon Department of Revenue. Wages include salaries, commis- sions, bonuses, fees, payments to a deferred compensation plan, or other items of value.

•For boundary questions, see the Oregon Combined Payroll Tax booklet,

——The TriMet district includes parts of Multnomah, Wash- ington, and Clackamas counties. For TriMet boundary questions call

——Lane Transit District serves the

To

•Less than one year, file a:

•One year or more, file a:

For more questions contact DOR at

Employment status updates

•Check each box that applies to your business and include the effective date of change.

•If Oregon residents are working out of Oregon, indicate which state.

•Check box and indicate effective date of employees now working in Oregon that previously worked in another state.

Using leased employees

If you lease your employees from a Professional Employer Organization (PEO)/Worker Leasing Company, fill in the information requested.

Changing entity

Include the effective date of change, check the box of the entity you’re changing from and the box of the entity chang- ing to.

NOTE: Entity changes require the completion of a new Com- bined Employer’s Registration form.

Examples include, but aren’t limited to:

•Changing from a sole proprietorship to a partnership or corporation.

•Changing from a partnership to a sole proprietorship or corporation.

•Changing from a corporation to a sole proprietorship or partnership.

•Changing of members in a partnership of five or fewer partners.

•Adding or removing a spouse as a liable owner.

•Changing from a sole proprietorship, corporation, or part- nership to a limited liability company.

Owner/officer updates

Attach a separate sheet to update or change corporate officer or owner information.

Compensation for services performed by corporate officers and shareholders is subject to payroll taxes (withholding, transit, and unemployment). If owners and officers are covered by Workers’ Compensation insurance, the hours worked are also subject to Workers’ Benefit Fund (WBF) assessment.

Fax to:

Mail to: Employment Department 875 Union St NE Rm 107 Salem OR

For additional copies of this form, download at: www.oregon.gov/dor/bus or call:

Closing account

•Check the box if you closed a pension and annuity account. Include the effective date of change.

•Check the “No longer doing business in TriMet/Lane Tran- sit District” box and include the effective date if you moved your business from the TriMet or Lane transit district and are no longer subject to this tax.

•Check the box if you closed the business or dissolved a sole proprietorship, partnership, corporation, or limited liability company, and no longer have payroll to report. Fill in the date of final payroll.

•If you sold your business, leased your employees, or trans- ferred your business assets, indicate whether the transac- tion applied to all or part of the business.

•If you leased all or part of the business, fill out the section “Using Leased Employees.”

NOTE: New or reorganized businesses must complete a Combined Employer’s Registration,

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | This form informs Oregon agencies about changes in business or employment status. |

| Governing Law | The form is governed by Oregon state tax and employment laws, including regulations from OED, DOR, and DCBS. |

| Required Information | Businesses must provide their BIN, FEIN, and updated owner/officer details if applicable. |

| Effective Date | An effective date for any changes must be provided. This helps establish the timeline for the updates. |

| Leased Employees | If leased employees are involved, specific details about the leasing company must be included. |

| Closing Accounts | The form allows businesses to indicate accounts that were closed, including pension and annuity accounts. |

| New Entity Requirement | A new Combined Employer’s Registration form is needed for entity changes, like switching from a sole proprietorship to an LLC. |

| Owner/Officer Updates | To update ownership details, businesses must attach a complete list of current owners and officers. |

| Filing Submission | This form can be submitted via fax or mailed to the Employment Department in Salem, Oregon. |

Guidelines on Utilizing Bin Oregon

Completing the Oregon Combined Payroll Tax Business Change in Status Form requires careful attention to detail. Gathering the necessary information beforehand will help ensure an accurate submission. Below are the steps to guide you through the process.

- Begin by entering your business name and Oregon business identification number (BIN) at the top of the form.

- Provide updates for the owner/officer section, attaching a complete list if necessary. Include names, positions, Social Security numbers, home addresses, and phone numbers.

- If applicable, check the boxes for any general updates that apply to your business like changes in FEIN or business name.

- Indicate if your business is now operating in the TriMet or Lane Transit District. Provide the effective date of this change.

- If you are closing the account, check all relevant boxes and provide necessary details about final payroll and the effective date of closure.

- If your business was sold, leased, or transferred, answer the question about whether operations were ongoing at the time of transfer. Enter the effective date and details of what was transferred.

- List any changes to ownership structure, checking applicable entities you are changing from and to, along with effective dates.

- For employment status updates, check all boxes that apply and provide effective dates for each change. Mention if Oregon residents are working in another state.

- Complete the section on leased employees if applicable, including the name of the leasing company and the number of leased and non-leased employees.

- Sign and date the form in the submitted by section, including your title and contact information.

- Submit the completed form by faxing to 503-947-1700 or mailing it to the Employment Department at 875 Union St NE Rm 107, Salem, OR 97311-0030.

What You Should Know About This Form

What is the purpose of the Bin Oregon form?

The Bin Oregon form, officially known as the Oregon Combined Payroll Tax Business Change in Status Form, allows businesses to notify the Employment Department, Department of Revenue, and Department of Consumer and Business Services about any changes in their status or employment information. This includes updates on business name, ownership, and employment status.

Who needs to complete the Bin Oregon form?

Any business operating in Oregon must complete the Bin Oregon form when there are significant changes. This includes changes in ownership, a business name, Federal Employer Identification Number (FEIN), or employment status. It is essential for both active businesses and those closing or changing their structure.

How should changes to ownership or officers be reported?

When updating ownership or officer information, attach a complete list of the current owners and officers. This list should include their positions, Social Security Numbers (SSN), home addresses, and phone numbers. It is important to provide accurate information to ensure compliance and avoid delays.

What should I do if my business is no longer operating?

If your business is no longer operating, you need to indicate this on the form. Check the applicable boxes related to closing your account and provide the date of the final payroll. It may also be necessary to provide details about the sale or transfer of the business, including whether it was operating at that time.

Are there any specific instructions for leased employees?

If you have leased employees through a Professional Employer Organization (PEO), you must include specific information about the leasing company, such as their license number, contact name, and number of leased employees. This ensures that all payroll obligations are correctly assigned and reported.

How can I re-open my business after closing it?

To re-open a business closed for less than one year, you must submit the Bin Oregon form. If the business has been closed for one year or more, a new Combined Employer’s Registration form is required. Ensure all information is accurate to facilitate the re-opening process.

What happens if I change my business entity type?

When changing the type of business entity, such as from a sole proprietorship to a corporation, you must complete the Bin Oregon form and indicate the effective date of the change. Also, a new Combined Employer’s Registration form is needed. This helps maintain accurate state records and compliance.

Common mistakes

Submitting the Bin Oregon form can be a straightforward process, but mistakes are common. One major error occurs when individuals fail to provide the correct Federal Employer Identification Number (FEIN). This number is vital for uniquely identifying your business for tax purposes, and errors here can delay processing. Always double-check this number before submission to avoid complications.

Another frequent mistake involves outdated business names or improperly spelled names. It's essential to ensure that the business name listed on the form matches exactly with the name on official documents. Discrepancies can create confusion and potentially lead to regulatory issues down the line. Take a moment to verify that everything is accurate before you send it in.

People also sometimes forget to indicate their effective dates of business changes. Including these dates is crucial, as it informs the tax authorities when these changes took place. Without an effective date, it becomes challenging for the authorities to understand the timeline of your business activities, which may lead to further inquiries.

A common oversight occurs when individuals neglect to check all applicable boxes related to their business status updates. Various options need to be selected depending on individual circumstances, and failure to do so can lead to incomplete applications. Make sure to review each section to see that all relevant aspects of your business's status have been indicated.

People often misplace their focus on the closing account section. Some individuals mistakenly check boxes that do not apply to their situation. This can result in the wrong information being submitted, potentially impacting tax obligations. Be thorough when reviewing which boxes you need to check to ensure accurate reporting.

Lastly, leaving out vital information regarding owners or officers can pose significant problems. When updating details about corporate officers or owners, including complete lists with positions and contact information is necessary. Incomplete submissions may delay updates and create issues with compliance. Always attach a separate sheet with full details as required.

Documents used along the form

The Bin Oregon form is crucial for businesses operating in Oregon, especially when there are changes in business status or employment information. Several other forms and documents are often used in conjunction with this form to address various business and employment needs. Below is a brief overview of these related documents.

- Combined Employer’s Registration Form (150-211-055): This form is required when a business undergoes an entity change, such as changing from a sole proprietorship to a corporation. It registers the business with the Employment Department, Department of Revenue, and Department of Consumer and Business Services.

- Business Closure Form: When a business ceases operations, this form notifies state authorities of the closure. It includes necessary details such as the date of final payroll and the reason for closure.

- Worker’s Compensation Insurance Verification: Businesses must submit proof of workers' compensation insurance to ensure compliance with Oregon law. This document is crucial for protecting employees from work-related injuries.

- Owner/Officer Update Sheet: This attached sheet includes detailed information about changes to business owners or corporate officers. It typically lists their names, positions, social security numbers, and any relevant contact information.

- Employment Status Update Form: This form is used to report updates regarding employment such as changes in the number of employees or the status of employed individuals, including independent contractors or leased employees.

- Leased Employee Information Form: If a business utilizes leased employees, this form provides essential details about the leasing company, including its license number, contact information, and the number of leased employees.

- Final Payroll Report: This report outlines the final payroll details, including the total wages paid and the reason for the final payroll, ensuring compliance with withholding and tax responsibilities.

- Tax Identification Number (TIN) Application: If a business changes its ownership structure or type, it may need to apply for a new TIN to comply with federal tax regulations.

Each of these documents serves a specific purpose and helps ensure that businesses remain compliant with Oregon's laws and regulations. Businesses should carefully complete and submit these forms as necessary for their operational needs.

Similar forms

- Combined Employer's Registration Form: Similar to the Bin Oregon form, this document is used to register or update information related to an employer’s business status, particularly regarding changes in business ownership or structure, such as transitioning to a different entity type.

- Employer Identification Number (EIN) Application: Both forms require information on business identification. The EIN form establishes a business's federal tax identification, while the Bin Oregon form includes the Federal Employer Identification Number as part of business updates.

- Notice of Change of Ownership: This document notifies relevant departments of any ownership changes in a business. Like the Bin Oregon form, it requires information about new owners and updates to the business structure or management team.

- Business Name Registration: Similar to updating business information on the Bin Oregon form, this document is used to officially register a new business name or make corrections to an existing name with the state.

- Employment Status Report: Both forms collect data regarding employment status, including how many employees are currently employed and whether the business has changed its employment practices.

- Workers' Compensation Policy Updates: This document informs the state about changes in workers' compensation insurance. It parallels the Bin Oregon form by requiring accurate reporting of current business employment practices and insurance status.

- Tax Registration Update: Much like the Bin Oregon form, this document is used to communicate changes in tax registration status to authorities, ensuring compliance with tax obligations when business operations change.

- Business Closure Notification: Similar to the closure sections in the Bin Oregon form, this notification formally informs the state that a business has ceased operations, providing necessary details about closure dates and final payroll.

Dos and Don'ts

When filling out the Bin Oregon form, it’s crucial to follow the guidelines to ensure that your submission is processed smoothly. Here are some dos and don’ts to keep in mind:

- Do provide the correct Federal Employer Identification Number (FEIN) for your business.

- Do include any name spellings and address errors to avoid delays.

- Do indicate the effective date for any status changes, especially regarding business operations in TriMet or Lane Transit District.

- Do attach additional sheets as needed for comprehensive updates about ownership or business status.

- Don’t forget to check the applicable boxes indicating your business status.

- Don’t submit incomplete or unclear information, which can lead to complications.

- Don’t neglect to include dates of closures or significant changes as they are essential for proper processing.

- Don’t skip the step of verifying that all information aligns with previous filings or registrations.

Act swiftly and accurately to ensure your business remains compliant and operations continue without interruption.

Misconceptions

- Misconception: The Bin Oregon form is only necessary during business closures. Many believe that this form is only relevant when a business is shutting down. In reality, it is essential for various changes in business status, such as updating ownership information or changing the structure of the business.

- Misconception: You can submit the form without additional documentation. Some individuals think that the form can be submitted alone. However, it often requires supporting documents, particularly when updating information about owners or corporate officers.

- Misconception: All businesses need the same updates on the form. People may assume all businesses require the same types of updates. In truth, the required sections to be filled out depend on the specific changes each business is experiencing, be it ownership changes or employment status updates.

- Misconception: The form is only for tax-related issues. While tax implications are a significant aspect of the form, it also serves to notify various state departments about broader business changes, including structural adjustments and employment status updates.

- Misconception: You only need to update your business name if it changes. Business owners often think that they need to update their name alone. However, any changes in ownership or the nature of the business also necessitate completing the form to ensure that all records are consistent.

- Misconception: The form can be submitted anytime without a deadline. Some business owners believe they can submit the form at their convenience. It's essential to do this promptly after a change occurs to avoid potential penalties and keep all filings current.

- Misconception: The form is only relevant for large businesses. There is a perception that only larger businesses deal with the form. However, it impacts sole proprietors and small businesses just as much, as they are also subject to changes in regulation and need to keep their records up to date.

- Misconception: Once submitted, no further updates are needed. Many assume that after submitting the form, they will not have to revisit it. Changes in business operations or additional ownership modifications may occur, necessitating further submissions to keep information accurate.

Key takeaways

Filling out the Bin Oregon form involves several important steps to ensure that your business updates are processed correctly. Below are key takeaways to keep in mind when navigating this form:

- Purpose of the Form: The Bin Oregon form is used to notify various agencies, including the Employment Department, Department of Revenue, and Department of Consumer and Business Services, about changes to your business or employment status.

- Business Identification: Accurately provide your Oregon business identification number (BIN) and any relevant federal employer identification number (FEIN). This information is crucial for establishing your business profile.

- Owner/Officer Updates: If there are changes in ownership or officer roles within your business, a complete list of updates must be attached. This includes personal information such as position, social security number, home address, and contact details.

- General Updates: Check all relevant boxes to indicate changes such as business name, tax registration in the TriMet or Lane Transit District, or if you are closing your account altogether.

- Entity Changes: If you are changing the legal structure of your business (for example, from a sole proprietorship to a corporation), be sure to indicate this on the form and note that a new Combined Employer’s Registration form must also be submitted.

- Informing About Employees: Clearly indicate how many employees, if any, were transferred or leased and provide details for any leased employees, including the name of the leasing company.

- Submission Process: Once completed, the form can be faxed or mailed to the appropriate Employment Department address. Ensure that you keep a copy for your records.

Browse Other Templates

Tr11 Michigan - There may be a registration transfer fee included in the application documentation.

Blank Georgia Id Template - Emergency contact information can be provided on the form for your safety.