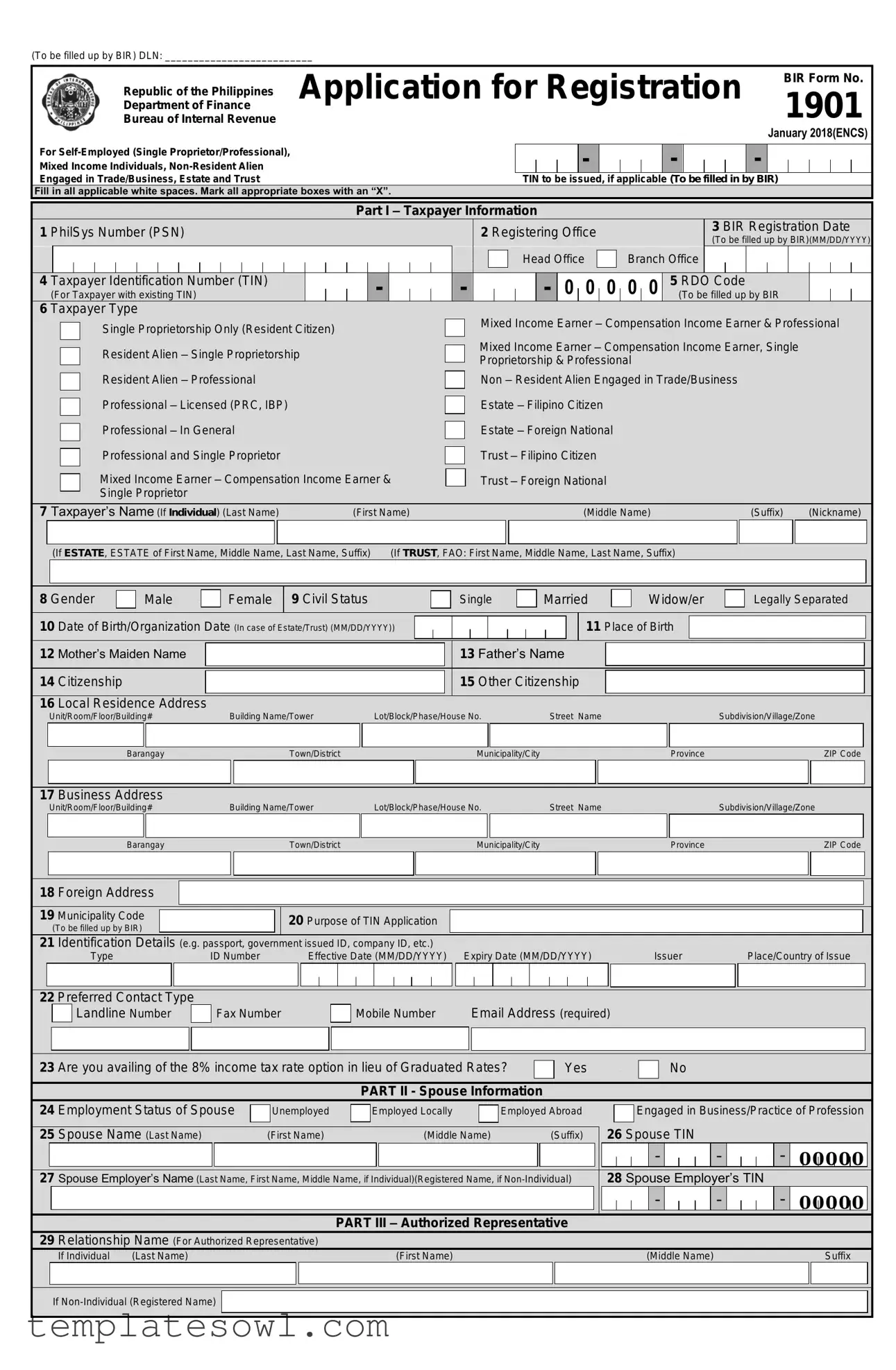

Fill Out Your Bir Form

The BIR Form 1901 serves a crucial role in the registration process for various taxpayers in the Philippines, particularly for self-employed individuals, mixed-income earners, and non-resident aliens engaging in trade or business activities. This form, required by the Bureau of Internal Revenue (BIR), must be filled out completely and accurately to ensure timely issuance of a Tax Identification Number (TIN). Each section demands specific information, starting with taxpayer details, including name, gender, civil status, and citizenship. It also asks for the applicant's local and business addresses. The form contains sections for spouse information, authorized representatives, business descriptions, and tax types applicable to the taxpayer. Individuals seeking incentives or special tax treatments may also need to complete additional sections specific to their circumstances. Proper completion of Form 1901 is essential, as the data provided can significantly affect tax obligations and compliance requirements.

Bir Example

(To be filled up by BIR) DLN: __________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Application for Registration |

BIR Form No. |

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

Republic of the Philippines |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1901 |

|

||||||||||||

|

|

|

|

|

|

Department of Finance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

Bureau of Internal Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 2018(ENCS) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|||||||||||||

|

|

Mixed Income Individuals, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

Engaged in Trade/Business, Estate and Trust |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIN to be issued, if applicable (To be filled in by BIR) |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

Fill in all applicable white spaces. Mark all appropriate boxes with an “X”. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part I – Taxpayer Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

1 PhilSys Number (PSN) |

|

|

|

|

|

|

|

|

|

|

|

|

2 Registering Office |

|

|

|

|

|

|

|

|

|

|

3 BIR Registration Date |

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(To be filled up by BIR)(MM/DD/YYYY) |

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Head Office |

|

|

|

|

Branch Office |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 Taxpayer Identification Number (TIN) |

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

- |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

5 RDO Code |

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

(For Taxpayer with existing TIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(To be filled up by BIR |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

6 Taxpayer Type

Single Proprietorship Only (Resident Citizen) |

Resident Alien – Single Proprietorship |

Resident Alien – Professional |

Professional – Licensed (PRC, IBP) |

Professional – In General

Professional and Single Proprietor |

Mixed Income Earner – Compensation Income Earner & |

Single Proprietor |

Mixed Income Earner – Compensation Income Earner & Professional

Mixed Income Earner – Compensation Income Earner, Single Proprietorship & Professional

Non – Resident Alien Engaged in Trade/Business

Estate – Filipino Citizen

Estate – Foreign National

Trust – Filipino Citizen

Trust – Foreign National

7 Taxpayer’s Name (If Individual) (Last Name) |

(First Name) |

(Middle Name) |

(Suffix) |

(Nickname) |

|||

|

|

|

|

|

|

|

|

|

(If ESTATE, ESTATE of First Name, Middle Name, Last Name, Suffix) |

(If TRUST, FAO: First Name, Middle Name, Last Name, Suffix) |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 Gender |

Male |

Female |

9 Civil Status |

Single |

Married |

Widow/er |

Legally Separated |

|

10 |

Date of Birth/Organization Date (In case of Estate/Trust) (MM/DD/YYYY)) |

|

11 Place of Birth |

|

||||

12 |

Mother’s Maiden Name |

|

|

13 Father’s Name |

|

|

||

|

|

14 |

Citizenship |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 Other Citizenship |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

Local Residence Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Unit/Room/Floor/Building# |

|

Building Name/Tower |

|

|

Lot/Block/Phase/House No. |

Street Name |

|

|

|

|

|

|

Subdivision/Village/Zone |

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barangay |

|

|

|

|

|

Town/District |

|

|

|

|

|

|

|

|

|

Municipality/City |

|

|

|

|

|

|

|

|

|

|

|

|

Province |

|

|

ZIP Code |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

Business Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Unit/Room/Floor/Building# |

|

Building Name/Tower |

|

|

Lot/Block/Phase/House No. |

Street Name |

|

|

|

|

|

|

Subdivision/Village/Zone |

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barangay |

|

|

|

|

|

Town/District |

|

|

|

|

|

|

|

|

|

Municipality/City |

|

|

|

|

|

|

|

|

|

|

|

|

Province |

|

|

ZIP Code |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 Municipality Code |

|

|

|

|

|

|

|

|

|

|

20 Purpose of TIN Application |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

(To be filled up by BIR) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

21 |

Identification Details (e.g. passport, government issued ID, company ID, etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

Type |

ID Number |

|

|

Effective Date (MM/DD/YYYY) |

Expiry Date (MM/DD/YYYY) |

|

Issuer |

|

Place/Country of Issue |

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 Preferred Contact Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Landline Number |

|

|

Fax Number |

|

|

|

|

|

|

Mobile Number |

|

Email Address (required) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

23 |

Are you availing of the 8% income tax rate option in lieu of Graduated Rates? |

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

No |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART II - Spouse Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

24 Employment Status of Spouse |

|

Unemployed |

|

Employed Locally |

|

Employed Abroad |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 Spouse Name (Last Name) |

(First Name) |

|

(Middle Name) |

(Suffix) |

||

Engaged in Business/Practice of Profession

Engaged in Business/Practice of Profession

26 Spouse TIN

-

-  -

-

-

-

0 0 0 0 0

|

27 Spouse Employer’s Name (Last Name, First Name, Middle Name, if Individual)(Registered Name, if |

28 Spouse Employer’s TIN |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

|

|

|

|

- |

|

0 0 |

0 |

|

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

PART III – Authorized Representative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

29 Relationship Name (For Authorized Representative) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

If Individual |

|

(Last Name) |

|

|

(First Name) |

|

|

|

(Middle Name) |

|

|

|

|

|

|

|

|

|

Suffix |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If

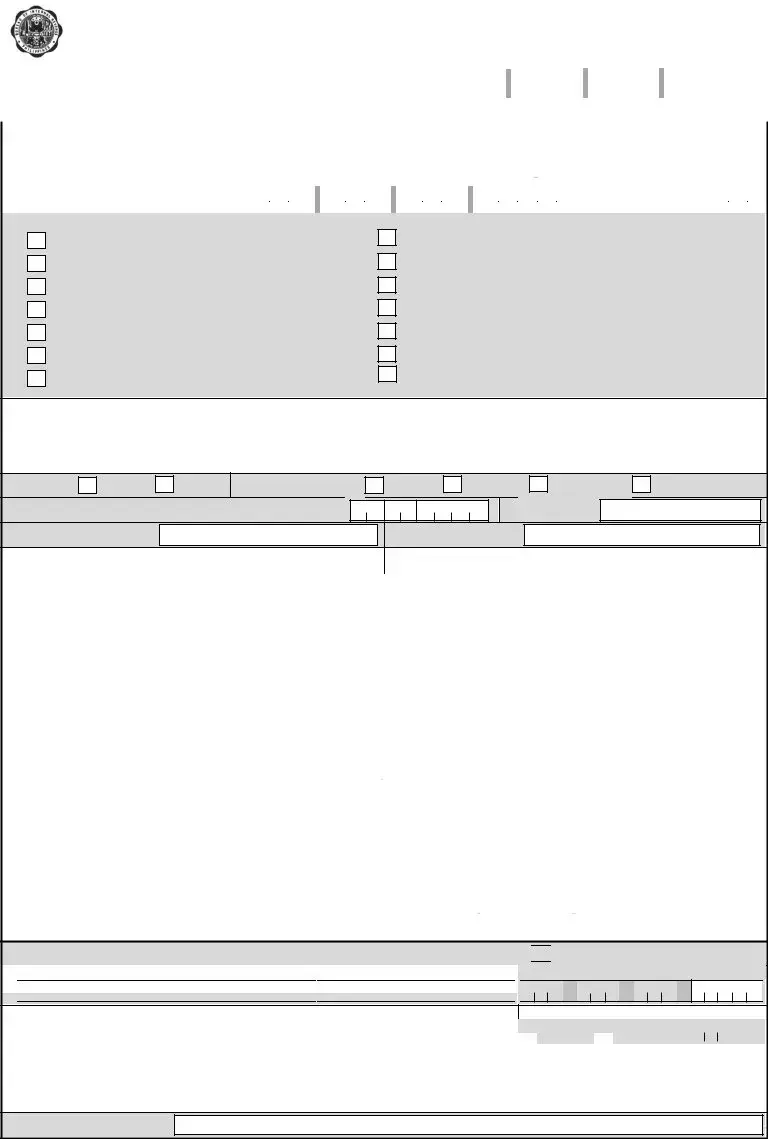

Page 2 – BIR Form No. 1901

30 Relationship Start Date (MM/DD/YYYY)

31 Address Types

Residence

Place of Business

Place of Business

Employer Address

Employer Address

32 Local Residence Address

|

|

Unit/Room/Floor/Building# |

|

Building Name/Tower |

|

Lot/Block/Phase/House No. |

Street Name |

|

Subdivision/Village/Zone |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barangay |

|

|

Town/District |

|

|

|

Municipality/City |

|

|

Province |

|

|

ZIP Code |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 Preferred Contact Type |

|

|

|

Landline Number |

Fax Number |

Mobile Number |

Email Address (required) |

Part IV – Business Information

34 Single Business Number

35 Primary/Secondary Industries (Attach additional sheet/s, if necessary) |

|

|

|||

Industry |

Trade/Business Name |

|

Regulatory Body |

||

Primary |

|

|

|

|

|

Secondary |

|

|

|

|

|

Industry |

Business Registration Number |

Business Registration Date |

PSIC Code |

Line of Business |

|

(MM/DD/YYYY) |

(To be filled up by BIR) |

||||

|

|

|

|||

Primary |

|

|

|

|

|

Secondary |

|

|

|

|

|

36 Incentives Details

36A Investment Promotion

(e.g. PEZA, BOI)

36B Legal Basis

(e.g. RA, EO)

36C Incentive Granted

(e.g. Exempt from IT,VAT,etc.)

36D No. of Years

36E Incentive Start Date

(MM/DD/YYYY)

36F Incentive End Date

(MM/DD/YYYY)

|

|

37 Details of Registration / Accreditation |

|

|

|

|

FROM |

|

|

|

|

TO |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

37A Registration / Accreditation Number |

|

|

37B Effectivity Date (MM/DD/YYYY) |

|

|

|

|

(MM/DD/YYYY) |

|

37C Date Issued (MM/DD/YYYY) |

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37D Registered Activity |

|

|

37E Tax Regime (Regular, Special, |

|

37F Activity Start Date |

|

37G Activity End Date |

|

|

|||||||||||||||||||||||||

|

|

|

|

|

Exempt) |

|

|

|

(MM/DD/YYYY) |

|

|

|

(MM/DD/YYYY) |

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38Facility Details

38A Facility Code |

F |

38B Facility Type |

PP |

SP |

WH |

SR |

GG |

BT |

|

RP |

Other (specify) |

|

(To be filled up by BIR) |

|

|

|

|

|

|

|

|

|

|

|

|

38C Facility Address |

|

|

|

|

|

|

|

|

|

|

|

|

Unit/Room/Floor/Building# |

Building Name/Tower |

|

Lot/Block/Phase/House No. |

|

Street |

Name |

|

|

Subdivision/Village/Zone |

|||

|

Barangay |

Town/District |

|

|

Municipality/City |

|

|

|

Province |

ZIP Code |

||

Part V – Tax Type

39Tax Types (this portion determines your tax liability/ies) (To be filled up by BIR)

|

|

|

|

|

|

Form Type |

|

ATC |

|

|

|

|

|

|

Form Type |

ATC |

|

|

|

|

|

|

Withholding Tax |

|

|

|

|

|

Registration Fee |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation |

|

|

|

|

|

|

|

Percentage Tax |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expanded |

|

|

|

|

|

|

|

Stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Final |

|

|

|

|

|

|

|

Overseas Dispatch And |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amusement Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fringe Benefits |

|

|

|

|

|

|

|

Under Special Laws |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VAT & Other Percentage |

|

|

|

|

|

|

|

Other Percentage Tax under NIRC (specify) |

|

|

||||

|

|

|

|

Percentage Tax |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ONETT not subject to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CGT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage Tax on |

|

|

|

|

|

|

|

Documentary Stamp Tax |

|

|

||||

|

|

|

|

Winnings & Prizes |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

On Interest Paid On Deposits And |

|

|

|

|

|

|

|

Regular |

|

|

|

|

|

|

|

|

|

|

Yield on Deposits/Substitutes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(ONETT) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Excise Tax |

|

|

|

|

|

Capital Gains – Real |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

Property |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alcohol Products |

|

|

|

|

|

|

|

Capital Gains – Stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Automobile & Non- |

|

|

|

|

|

|

|

Donor’s Tax |

|

|

|

|

|

|

|

|

|

|

Essential Goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cosmetics Procedures |

|

|

|

|

|

|

|

Estate Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mineral Products |

|

|

|

|

|

|

|

Miscellaneous Tax (specify) |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum Products |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sweetened Beverages |

|

|

|

|

|

|

|

Others (specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tobacco Products |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tobacco Inspection Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 3 – BIR Form No. 1901

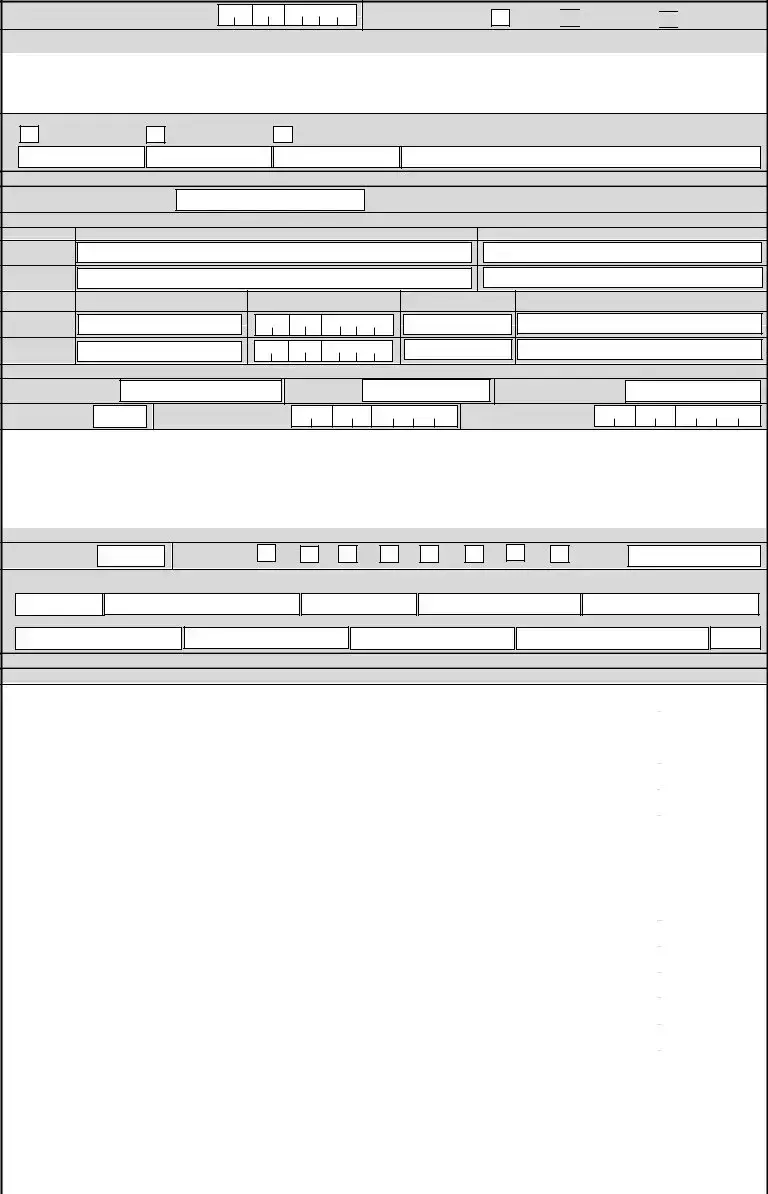

Part VI – Authority to Print

40 Authority to Print Receipts and Invoices

40A Printer’s Name |

40B Printer’s TIN |

- |

- |

- |

40C Printers Accreditation Number

40D Date of Accreditation (MM/DD/YYYY)

40D Date of Accreditation (MM/DD/YYYY)

40E Registered Address

|

|

Unit/Room/Floor/Building# |

Building Name/Tower |

Lot/Block/Phase/House No. |

Street Name |

|

Subdivision/Village/Zone |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barangay |

|

Town/District |

|

Municipality/City |

|

|

Province |

|

ZIP Code |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40F Contact Number |

40G |

|

|

40H Manner of Receipt/Invoices |

|

|

|

Bound |

|

|

|

Loose Leaf |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40I Descriptions of Receipts and Invoices |

|

(Additional Sheet/s if Necessary) |

|

|

|

|

|

|

|||||||

Others

TYPE |

NO. OF |

|||

BOXES/BOOKLETS |

||||

Description |

|

|||

|

|

|

||

VAT |

LOOSE |

BOUND |

||

NO. OF

SETS PER

BOX /

BOOKLET

NO. OF COPIES PER SET

SERIAL NO.

|

|

START |

|

END |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part VII - For Employee with Two or More Employees (Multiple Employments) Within the Calendar Year

41 Type of Multiple Employments

Successive employments (With previous

employer/s within the calendar year)

Concurrent employments (With two or more employers at the same time

with the calendar year)

(If successive, enter previous employer/s; if concurrent, enter secondary employer/s)

Previous and Concurrent Employments During the Calendar Year

41A Name of Employer

41C Name of Employer

42Declaration

41B TIN of Employer

- |

- |

- |

41D TIN of Employer

- |

- |

- |

I declare, under the penalties of perjury, that this application has been made in good faith, verified by me and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under the authority thereof. Further, I give my consent to the processing of my information as contemplated under the *Data Privacy Act of 2012 (R.A.

No. 10173) for legitimate and lawful purposes.

___________________________

Taxpayer/Authorized Representative

(Signature over Printed Name)

Part VIII – Primary/Current Employer Information

43 Type of Registered Office |

Head Office |

Branch |

44 TIN |

- |

- |

- |

45 RDO Code |

Office |

|

|

46 |

Employer Name If Individual |

|

(Last Name) |

|

|

|

|

|

|

|

|

|

(First Name) |

|

|

|

|

|

|

(Middle Name) |

|

|

|

|

|

(Suffix) |

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If |

|

(Registered Name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47 |

Employer Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Unit/Room/Floor/Building# |

|

|

|

|

|

|

Building Name/Tower |

|

|

|

Lot/Block/Phase/House No. |

Street Name |

Subdivision/Village/Zone |

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barangay |

|

|

|

|

|

|

|

|

|

|

Town/District |

|

|

|

|

|

|

|

|

|

|

|

Municipality/City |

|

|

|

|

|

|

|

Province |

|

|

|

|

|

|

|

ZIP Code |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

48 |

Contact Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Landline Number |

|

|

Fax Number |

Mobile Number |

|

|

|

|

|

|

Email Address (required) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

49 Relationship Start Date (MM/DD/YYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50 Municipality Code (To be filled up by BIR) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

51 Declaration |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stamp of BIR Receiving Office |

|

|||||||||||||||||

|

|

|

|

|

I declare, under the penalties of perjury, that this application has been made in good faith, verified by me and to the best of my knowledge and belief, is true and |

|

|

and Date of Receipt |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I give my consent |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

to the processing of my information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and l awful purposes. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

_____________________________________________ |

|

|

|

|

|

|

|

________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

EMPLOYER/AUTHORIZED REPRESENTATIVE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title/Position of Signatory |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

(Signature over Printed Name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

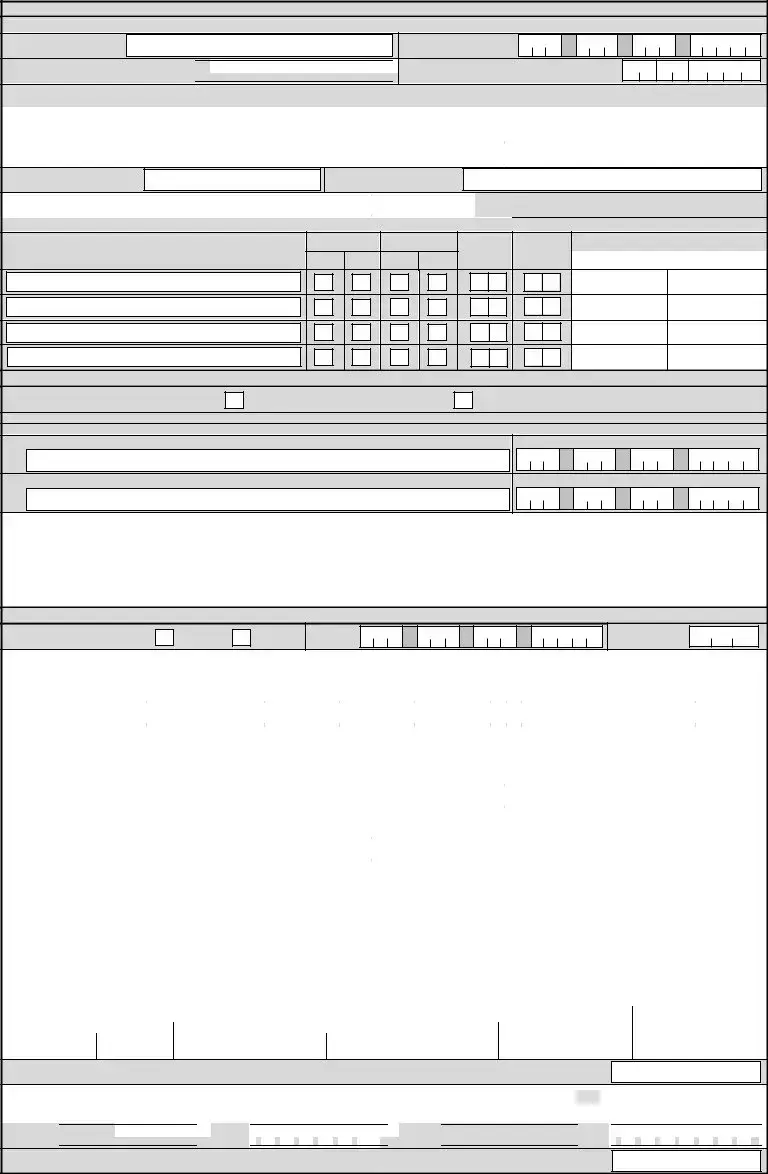

Part IX – Payment Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

52 |

For the Year |

|

|

|

|

|

|

|

|

|

|

|

53 Date of Payment (MM/DD/YYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

54 ATC |

|

|

|

MC180 |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

55 |

Tax Type |

|

|

|

|

|

RF |

|

56 Manner of Payment |

|

|

|

|

REGISTRATION FEE |

57 Type of Payment |

|

FULL PAYMENT |

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

58 Registration Fee |

58A |

|

|

59 BIR Printed Receipts / Invoices |

|

|

|

59A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60 Add: Penalties Surcharge |

Interest |

Compromise |

|

|

|

|

|

|

||

60A

60B

60B

60C

60C

60D

60D

61 Total Amount Payable (Sum of Items 58A, 59A and 60D)

*NOTE: The BIR Data Privacy Policy is in the BIR website (www.bir.gov.ph)

Documentary Requirements:

1.Any identification issued by an authorized government body (e.g. Birth Certificate, passport, driver’s license, Community Tax Certificate) that shows the name, address and birthdate of the applicant;

2.Photocopy of Mayor’s Business Permit; or Duly received Application for Mayor’s Business Permit, if the former is still in process with the LGU; and/or Professional Tax Receipt/Occupational Tax Receipt issued by the LGU;

3.Proof of Payment of Registration Fee (RF) (if with existing TIN or applicable after TIN issuance);

4.BIR Form No. 1906; (Select an Accredited Printer)

5.Final & clear sample of Principal Receipts/ Invoices;

Additional documents, if applicable:

a.Special Power of Attorney (SPA) and ID of authorized person, in case of authorized representative who will transact with the Bureau;

b.Franchise Documents (e.g. Certificate of Public Convenience) (for Common Carrier);

c. Photocopy of the Trust Agreement (for Trusts);

d.Photocopy of the Death Certificate of the deceased (for Estate under judicial settlement);

e.Certificate of Authority, if Barangay Micro Business Enterprises (BMBE) registered entity; f. Proof of Registration/Permit to Operate BOI/BOIARMM, PEZA, BCDA and SBMA

6.In case of registration of branches/facility types:

a.Photocopy of Mayor’s Business Permit; or Duly received Application for Mayor’s Business Permit, if the former is still in process with the LGU; and/or Professional Tax Receipt/Occupational Tax Receipt issued by the LGU;

or DTI Certificate;

b.Special Power of Attorney (SPA) and ID of authorized person, in case of authorized representative who will transact with the Bureau; if applicable

c. Proof of Payment of Registration Fee (RF)

d.BIR Form No. 1906; (Select an Accredited Printer) e.Final & clear sample of Principal Receipts/ Invoices;

POSSESSION OF MORE THAN ONE TAXPAYER INDENTIFICATION NUMBER (TIN) IS CRIMINALLY PUNISHABLE PURSUANT TO THE

PROVISIONS OF THE NATIONAL INTERNAL REVENUE CODE OF 1997, AS AMENDED

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | The BIR Form No. 1901 is primarily used for the registration of self-employed individuals, mixed income earners, and various types of trusts and estates in the Philippines. |

| Applicable Taxpayer Types | This form accommodates various taxpayer categories, including resident citizens, resident aliens, non-resident aliens engaged in trade or business, and estates and trusts. |

| Mandatory Information | Applicants must provide personal details, including name, address, taxpayer identification number (TIN), and PhilSys number, if applicable. |

| Registration Requirements | Supporting documents such as identification issued by government bodies, business permits, and proof of payment of registration fees are necessary for a complete application. |

| Date of Effectivity | This form was revised in January 2018, highlighting updates and compliance with legal requirements at that time. |

| Data Privacy Compliance | All information submitted will be processed in accordance with the Data Privacy Act of 2012, ensuring confidentiality and protection of the applicant's personal data. |

| Governing Law | The registration process and form usage follow the provisions of the National Internal Revenue Code (NIRC) of 1997, as amended, including regulations established by the Bureau of Internal Revenue (BIR). |

Guidelines on Utilizing Bir

Completing the BIR Form 1901 requires careful attention to detail. This process involves providing personal and business information necessary for registration. Ensure that all required fields are filled out accurately to avoid any delays in processing your application.

- Obtain a copy of BIR Form 1901.

- Fill in the DLN (Documentary Letter Number) at the top of the form.

- For personal details, enter your PhilSys Number (PSN), if available.

- Indicate the Registering Office and select the appropriate BIR Registration Date.

- Provide your Taxpayer Identification Number (TIN). Leave blank if you do not have one.

- Enter the RDO Code, if applicable.

- Choose your Taxpayer Type by marking the appropriate box.

- Fill out your Name (Last Name, First Name, Middle Name, Suffix, Nickname) as applicable.

- Mark your Gender and Civil Status.

- Provide your Date of Birth and Place of Birth.

- Complete your Mother's Maiden Name and Father's Name.

- Indicate your Citizenship and any Other Citizenship you may have.

- Input your Local Residence Address, ensuring to include all necessary details such as unit number, street name, and postal code.

- Fill out your Business Address, if applicable, and include any foreign address if relevant.

- Provide the Municipality Code.

- State your Purpose of TIN Application.

- List your identification details, including type, number, and issuer.

- Enter your preferred Contact Type and number(s).

- Indicate if you are availing of the 8% income tax rate option.

- Complete the spouse’s information, if applicable, starting with their Employment Status.

- Finish filling out the form by providing necessary business and tax information as prompted in the subsequent sections.

- Sign and date the application to certify accuracy and consent for data processing.

What You Should Know About This Form

What is the purpose of BIR Form No. 1901?

BIR Form No. 1901 is used to apply for a Taxpayer Identification Number (TIN) in the Philippines. This form is specifically for self-employed individuals, mixed income earners, non-resident aliens engaged in trade or business, and estates and trusts. Its main purpose is to collect essential taxpayer information that will help the Bureau of Internal Revenue (BIR) in ensuring proper tax registration and compliance.

Who needs to fill out this form?

Individuals who fall under the categories of self-employed persons, mixed income earners, and non-resident aliens engaged in business, as well as estates and trusts, are required to fill out this form. If someone intends to operate a business or practice a profession, they will need to submit this application to obtain their TIN, which is vital for tax obligations.

What information is required on the BIR Form No. 1901?

The form requires a variety of information, such as the taxpayer's personal details including name, date of birth, gender, civil status, and address. Additionally, it asks for the type of taxpayer, identification details, contact information, and, if applicable, information about the taxpayer’s spouse. This information is critical in determining the taxpayer's obligations and eligibility for specific tax rates.

What happens after submitting BIR Form No. 1901?

Once the form is submitted, the BIR reviews the application for accuracy and completeness. If all requirements are met, a Tax Identification Number (TIN) will be issued to the applicant. This TIN will then be used for all future tax-related transactions and will be essential for compliance with local tax laws.

Are there any supporting documents required with this form?

Yes, several supporting documents must be submitted along with BIR Form No. 1901. These include a valid identification that shows the name, address, and birthdate of the applicant, proof of payment of the registration fee, and additional documents depending on the applicant's circumstances, such as a Mayor’s Business Permit or a Trust Agreement. Ensuring these documents are complete and accurate is crucial for a smooth application process.

What are the consequences of having multiple TINs?

Possessing more than one Taxpayer Identification Number (TIN) is considered a criminal offense under the National Internal Revenue Code of 1997, as amended. This can lead to serious legal consequences, including penalties and potential criminal charges. Therefore, it is essential for applicants to apply for and use only one TIN throughout their business or professional engagements.

Common mistakes

Filling out the BIR Form 1901 can be a straightforward process, but individuals often encounter pitfalls that can lead to unnecessary delays or complications. Here are seven common mistakes to avoid when completing the form.

The first mistake is leaving sections blank. Each applicable white space must be filled out, even if the information appears redundant. For example, all personal information such as your full name, date of birth, and taxpayer identification number should be clearly entered. Omitting any of these details can cause significant processing delays.

Another common error lies in inaccurate information. It's essential to double-check that your taxpayer identification number (TIN), PhilSys number, and dates (format MM/DD/YYYY) are entered correctly. Small typographical errors can lead to major issues down the road, potentially causing miscommunication with the Bureau of Internal Revenue.

The failure to mark appropriate boxes is a frequent oversight as well. When the form requests individuals to mark boxes with an “X”, ensure that all relevant sections are correctly marked. This action is crucial; otherwise, it may suggest a lack of clarity about your status, which complicates the registration process.

Not providing valid identification details is yet another mistake. You must include specific identification information, such as the type of ID being presented, the ID number, and its issuance dates. Missing this information might result in bureaucratic setbacks, rendering your application incomplete.

More often than not, people forget to provide a preferred contact type. This form requires details such as landline numbers, mobile numbers, and email addresses. Without these, the BIR may lack a reliable way to reach you for clarifications or additional information necessary for your application.

Additionally, failing to read and understand the purpose of the form can lead to incorrect submissions. Each section serves a specific purpose, and comprehensive knowledge of what is required helps ensure accurate completion. Participants should take the time to familiarize themselves with the form’s sections before filling it out.

Lastly, neglecting to review or obtain the necessary documentary requirements is a significant misstep. Be aware of what documents are needed alongside your application, such as identification or proof of payment. Proper documentation increases the likelihood of a smooth application process, minimizing the chance of requests for additional information later.

Avoiding these pitfalls increases the chances of a successful application and can save valuable time and resources. Taking a methodical approach can make the experience as seamless as possible.

Documents used along the form

The BIR Form 1901 is an essential document for individuals applying for a Tax Identification Number (TIN) in the Philippines. However, other supporting forms are often needed to complete the registration process. Here’s a brief overview of some commonly used forms alongside the BIR 1901.