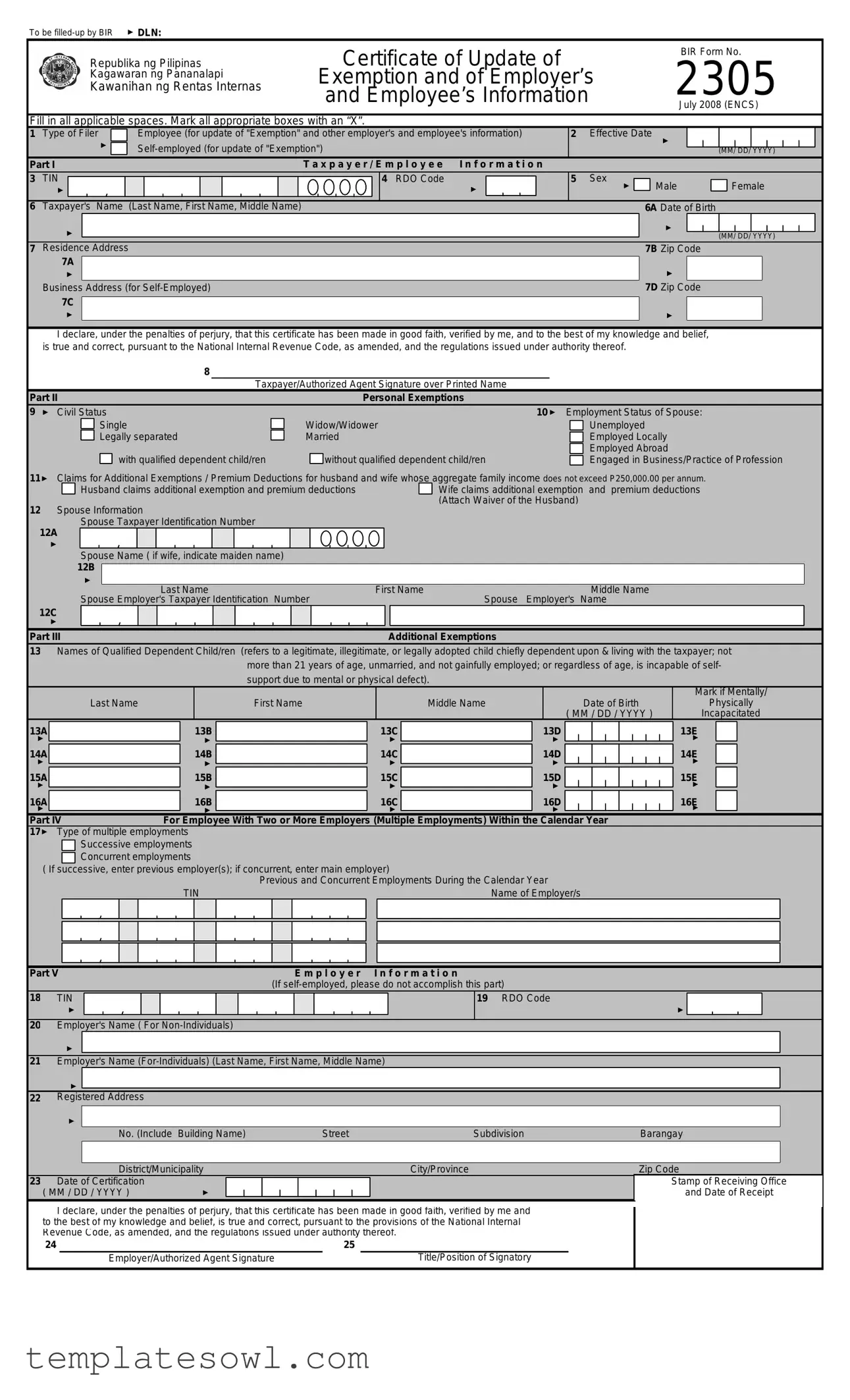

Fill Out Your Bir 2305 Form

The BIR 2305 form is an important document issued by the Bureau of Internal Revenue (BIR) in the Philippines, primarily for employees and self-employed individuals. This form serves as a Certificate of Update, focusing on exemptions and the relevant information of both employers and employees. When filling it out, one must ensure that all applicable spaces are completed, and appropriate boxes are marked with an "X." Key sections include taxpayer information, such as the Tax Identification Number (TIN), personal exemptions, and details about qualified dependent children. Additionally, the form accommodates individuals with multiple employers, enabling them to report their employment status accurately. Employers also have specific areas to fill out if they are not self-employed. Lastly, by signing the form, both the taxpayer and employer affirm that the information is accurate and truthful, which is crucial for compliance with the National Internal Revenue Code. Understanding the nuances of the BIR 2305 form ensures that you meet your tax obligations correctly and efficiently.

Bir 2305 Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Bir 2305 form serves to update the exemption and other related information of employees and self-employed individuals for tax purposes. |

| Governing Law | This form is governed by the National Internal Revenue Code of the Philippines and related regulations. |

| Filing Requirements | Individuals must fill in all applicable fields and mark appropriate boxes with an "X" to ensure accuracy in their tax exemption status. |

| Date of Issue | The form is dated July 2008, and users should ensure to check for any updates or amendments since that time. |

Guidelines on Utilizing Bir 2305

Filling out the BIR 2305 form can seem daunting at first glance, but taking it step-by-step makes it manageable. Once you've completed the form, you'll have all the necessary information ready to submit it to the Bureau of Internal Revenue. Let’s break down the process.

- Type of Filer: Choose whether you are an Employee or Self-employed. Mark the appropriate box.

- Effective Date: Fill in the date (MM/DD/YYYY) that this update becomes effective.

- Taxpayer/Employee Information: Enter your Tax Identification Number (TIN).

- RDO Code: Write down your Revenue District Office (RDO) code.

- Sex: Mark your gender by selecting Male or Female.

- Taxpayer's Name: Provide your Last Name, First Name, and Middle Name.

- Date of Birth: Complete your birth date (MM/DD/YYYY).

- Residence Address: Fill in your home address and Zip Code.

- Business Address (if self-employed): Include your business address and its Zip Code.

- Signature: Sign over your printed name, certifying the truth of your entries.

- Civil Status: Indicate whether you are Single, Married, Widow/Widower, or Legally Separated.

- Employment Status of Spouse: Check one of the options regarding your spouse's employment status.

- Claims for Additional Exemptions: Choose if either spouse claims additional exemptions and premium deductions.

- Spouse Information: Provide your spouse's TIN, Name, and Employer's TIN and Name.

- Names of Qualified Dependent Child/ren: List children who qualify for dependency exemptions, providing their details such as name and date of birth.

- Type of Multiple Employments: Indicate if you have successive or concurrent employments and list previous or concurrent employers.

- Employer Information: If you have employers, provide their TIN, RDO Code, Names, and Registered Address.

- Date of Certification: Enter the date (MM/DD/YYYY) when you are signing the certification.

- Employer/Authorized Agent Signature: The employer or authorized agent must sign, including their Title/Position.

After filling out all these sections, you'll be well on your way to having a completed BIR 2305 form ready for submission. Double-check your entries for any mistakes, ensure all required fields are filled, and then it’s time to hand it in!

What You Should Know About This Form

What is the purpose of the BIR 2305 form?

The BIR 2305 form, known as the Certificate of Update of BIR Form No. 2305, serves to update certain exemptions and information regarding both employers and employees. This form is particularly important for those claiming personal exemptions or changes in employment status. It helps ensure that the tax records are accurate and that the appropriate exemptions are applied to a taxpayer's account.

Who should fill out the BIR 2305 form?

This form is to be completed by employees who need to update their exemption claims or any relevant information to the Bureau of Internal Revenue. Self-employed individuals also use it to update their exemption status. In situations involving spouses, both parties might need to provide information on the form, especially if claiming additional exemptions together.

What information is required on the BIR 2305 form?

When filling out the BIR 2305 form, it is essential to provide various personal details. This includes the taxpayer's name, tax identification number (TIN), residency address, civil status, employment status, and information regarding dependent children. Depending on the situation, details about the spouse and joint claims for exemptions may also be required. Accurate completion of all applicable sections is critical to avoid issues with tax processing.

What happens if the BIR 2305 form is not submitted?

Failing to submit the BIR 2305 form can lead to complications regarding your tax status. It may result in missed exemptions that could reduce your taxable income. Additionally, the Bureau of Internal Revenue may have incomplete records, which can cause further issues during tax assessments or audits. It is advisable to submit the form promptly whenever updates are necessary to maintain the accuracy of your tax-related information.

Common mistakes

Filling out the BIR Form 2305 can be a straightforward process, but several common mistakes can lead to complications. One frequent error is not filling in all applicable spaces. Every section requires specific information, and leaving even one area blank can result in delays or required corrections. Review the form to ensure every relevant field is completed before submission.

Another mistake is failing to mark appropriate boxes with an "X." Each box is critical for clarifying your status, such as type of filer or civil status. If a box is not marked, it could cause confusion or misinterpretation by the processing staff.

People often miswrite their Taxpayer Identification Number (TIN) or Residential Registration District Office (RDO) code. Double-check these entries to avoid miscommunication. Incorrect numbers can significantly hinder your filing process.

Providing inaccurate personal information, such as names or dates of birth, is another common error. It’s essential to ensure that names match exactly with official documents and that dates follow the correct format. Mistakes in this section can lead to complications with verification and processing.

Individuals frequently underestimate the importance of attached documentation. If you claim additional exemptions or premium deductions, ensure that you attach the necessary forms, such as the Waiver of the Husband. Failure to include required documentation can result in delays in processing your claims.

Not indicating your spouse's employment status correctly can also create confusion. Misrepresentation of whether your spouse is employed abroad, locally, or not at all can impact claims for exemption and deductions.

Another pitfall is neglecting to list all qualified dependent children. The form requires details about each child, including their full names and dates of birth. People sometimes forget to include a dependent or fail to list them properly, which may affect eligibility for additional exemptions.

For those with multiple employers, accurately reporting previous and concurrent employment is vital. Omitting necessary information about previous employers can result in discrepancies in tax calculation or potential penalties.

Lastly, signing the form is crucial. Individuals may forget to provide their signature, which is a mandatory requirement for validation. A missing signature can halt the entire processing of your form and lead to further delays.

Documents used along the form

The BIR Form 2305 is an important document related to the updating of taxpayer information, exemptions, and other employment-related details. In addition to this form, there are several other documents that are commonly associated with its use. Below is a list detailing some of these documents.

- Form W-4: This document is used by employees to indicate their tax situation to the employer. It helps employers withhold the correct amount of federal income tax from their employees' paychecks.

- Form W-2: Employers provide this form to employees at the end of the year. It summarizes an employee's total earnings and withholdings for the year, making it necessary for filing income taxes.

- Form 1040: This is the standard individual income tax return form used by taxpayers to report their income and file taxes with the IRS.

- Form 1099: This form is used to report various types of income received throughout the year, other than wages, salaries, and tips. Independent contractors often receive this form.

- Form 2553: This document is used by corporations to elect S corporation status for federal tax purposes. It is important for qualifying corporations to reduce the double taxation of income.

- Form SS-4: Individuals use this form to apply for an Employer Identification Number (EIN), which is necessary for paying employees and filing tax returns.

- Form 4868: This form is a request for an extension of time to file a federal income tax return. It can help taxpayers avoid penalties for late filing.

- Schedule C: Self-employed individuals use this form to report income and expenses related to their business on their income tax return.

- Form 944: Small employers file this form to report and pay their payroll taxes annually instead of quarterly.

- Form 1098: This form is used to report mortgage interest received by lenders. Taxpayers often use it when claiming mortgage interest deductions.

Being aware of these documents and their purposes can assist in the accurate completion of tax filings and maintenance of proper records. Understanding the relationship between these documents and BIR Form 2305 helps ensure compliance with tax regulations and efficient management of personal or business finances.

Similar forms

-

W-4 Form: Similar to the BIR 2305, the W-4 form is used by employees in the United States to provide their employer with information about their tax situation. It allows the employer to withhold the correct federal income tax from an employee's pay. Both forms facilitate accurate tax deductions based on personal exemptions and other relevant information.

-

1099 Form: The 1099 form serves as a record of income received by non-employees, including independent contractors and freelancers. Like the BIR 2305, it helps the IRS understand an individual’s total income for tax purposes, assisting in accurate tax liabilities.

-

W-2 Form: Employees receive a W-2 form at the end of each year, detailing their yearly earnings and tax withheld. Similar to the BIR 2305, this document summarizes the income earned and associated tax deductions throughout the year.

-

Form 1040: This is the standard individual income tax return form used in the U.S. It requires individuals to report their income, claim deductions, and calculate their tax obligation. Both the 1040 and BIR 2305 contribute essential information about an individual's financial situation for tax reporting.

-

Schedule C: This document allows self-employed individuals to report income and expenses. Similar in purpose to the BIR 2305 for self-employed individuals, the Schedule C helps determine the net profit or loss from a business, providing a clear overview of an individual's earnings.

-

Form 8862: This form is necessary for taxpayers who have claimed the Earned Income Tax Credit (EITC) in the past but were disqualified in an earlier year. It is similar to BIR 2305 in that it ensures the proper claiming of credits based on personal circumstances, often revising tax information as needed.

-

Form 8832: This form is used by entities to elect how they are classified for federal income tax purposes. Just like the BIR 2305 updates employee and employer information, the Form 8832 allows businesses to accurately reflect their tax status, impacting deductions and liabilities.

Dos and Don'ts

When filling out the BIR 2305 form, keeping certain practices in mind can make the process smoother. Here’s a list of things to do and not to do:

- Do fill in all applicable spaces thoroughly.

- Do mark all appropriate boxes with an “X” clearly.

- Do double-check your Taxpayer Identification Number (TIN) for accuracy.

- Do ensure that the dates are in the correct format (MM/DD/YYYY).

- Don't leave any mandatory fields blank unless stated otherwise.

- Don't forget to sign the form before submitting it.

These steps can help make your experience with the BIR 2305 form clear and effective.

Misconceptions

Understanding the Bir 2305 form can be tricky, and there are several common misconceptions that can lead to confusion. Here are six of the most prevalent misunderstandings about this important document:

- Only Employees Need to Fill It Out: Many believe this form is exclusively for employees. However, self-employed individuals also need to fill out the Bir 2305 to update their exemptions.

- The Form is Only for Tax Returns: Some think the Bir 2305 is only relevant during tax filing season. In reality, it should be updated whenever there is a change in taxpayer information, including marital status or dependents.

- It Can Be Submitted at Any Time: There’s a misconception that timing doesn't matter. Submissions should coincide with effective dates to ensure that tax data is current and accurate.

- The Form is Too Complex to Complete: Many people feel overwhelmed by the form's structure. With a bit of guidance, most individuals can complete it without needing professional help.

- Only One Exemption is Allowed: Some individuals assume they can claim only one exemption. This isn’t true. Taxpayers may be eligible for multiple exemptions based on their family situation.

- Signatures Are Not Required: Lastly, some believe that a signature is optional. This is not the case; a signature is crucial as it validates the information provided and asserts that it has been made in good faith.

Recognizing these misconceptions can help ensure that taxpayers complete the Bir 2305 accurately and on time, preventing potential issues with their tax obligations.

Key takeaways

Understanding the BIR Form 2305 can simplify your tax filing process. Here are some important points to keep in mind:

- Complete all relevant sections: Ensure that you fill in every applicable space. Missing information can lead to processing delays.

- Mark choices clearly: When selecting options, use an “X” to mark all appropriate boxes. This helps avoid confusion.

- Double-check personal details: Verify your Taxpayer Identification Number (TIN), name, and address for accuracy. Errors can cause issues with your tax records.

- Include spouse information: If applicable, provide your spouse's details, especially if you are claiming additional exemptions.

- Maintain a signed copy: Always keep a signed copy of the form for your records. This serves as proof of submission and can be helpful in case of future inquiries.

Filling out and using the BIR Form 2305 correctly can help ensure that your tax-related matters are handled smoothly.

Browse Other Templates

How to Transfer Title After Death - All necessary parties need to understand their rights regarding the vehicle.

Case Information Statement - Existing relationships between parties may suggest conflict resolution strategies.

Va Fiduciary Form - The form has an estimated completion time of 27 minutes.