Fill Out Your Budget Form

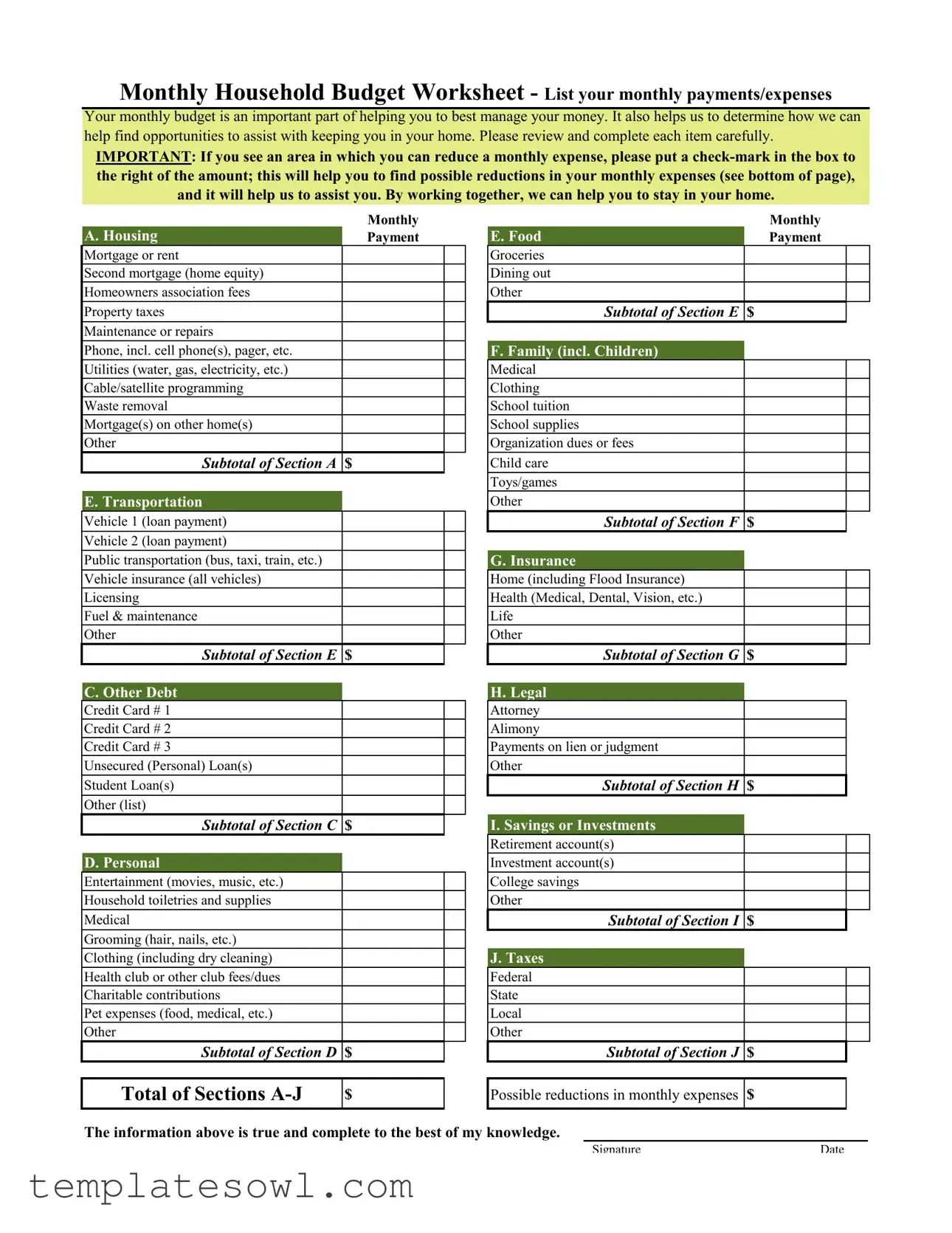

Creating a comprehensive monthly household budget is a crucial step towards effective financial management, and the Budget form serves as an essential tool in this process. This worksheet guides individuals in itemizing their monthly payments and expenses across various categories, making it easier to track where their money goes each month. Sections include housing payments, which encompass mortgage or rent, property taxes, and utilities. Additionally, there’s a segment dedicated to transportation costs, including vehicle loans, insurance, and maintenance. Other areas cover personal debts such as credit card payments and student loans, as well as expenditures for personal entertainment, family needs, insurance, taxes, and even savings or investment contributions. This form not only facilitates a thorough analysis of monthly inputs and outputs but also identifies possible reductions in spending. Users are encouraged to mark areas where they can cut back, which can reveal opportunities for savings and improve overall financial health. By diligently completing this form, individuals can clarify their financial landscape better, paving the way towards staying in their homes and enhancing their financial well-being.

Budget Example

Monthly Household Budget Worksheet - List your monthly payments/expenses

Your monthly budget is an important part of helping you to best manage your money. It also helps us to determine how we can help find opportunities to assist with keeping you in your home. Please review and complete each item carefully.

IMPORTANT: If you see an area in which you can reduce a monthly expense, please put a

|

|

Monthly |

|

|

A. Housing |

Payment |

|

|

Mortgage or rent |

|

|

|

Second mortgage (home equity) |

|

|

|

Homeowners association fees |

|

|

|

Property taxes |

|

|

|

|

|

|

|

Maintenance or repairs |

|

|

|

Phone, incl. cell phone(s), pager, etc. |

|

|

|

Utilities (water, gas, electricity, etc.) |

|

|

|

Cable/satellite programming |

|

|

|

Waste removal |

|

|

|

Mortgage(s) on other home(s) |

|

|

|

Other |

|

|

SUBTOTAL OF SECTION A $

E.Transportation

Vehicle 1 (loan payment) Vehicle 2 (loan payment)

Public transportation (bus, taxi, train, etc.) Vehicle insurance (all vehicles) Licensing

Fuel & maintenance Other

SUBTOTAL OF SECTION E $

C. Other Debt

Credit Card # 1

Credit Card # 2

Credit Card # 3

Unsecured (Personal) Loan(s)

Student Loan(s)

Other (list)

SUBTOTAL OF SECTION C $

D. Personal

Entertainment (movies, music, etc.)

Household toiletries and supplies

Medical

Grooming (hair, nails, etc.)

Clothing (including dry cleaning)

Health club or other club fees/dues

Charitable contributions

Pet expenses (food, medical, etc.)

Other

SUBTOTAL OF SECTION D $

|

Monthly |

|

E. Food |

Payment |

|

Groceries |

|

|

Dining out |

|

|

Other |

|

|

SUBTOTAL OF SECTION E |

$ |

|

|

|

|

F. Family (incl. Children) |

|

|

Medical |

|

|

Clothing |

|

|

School tuition |

|

|

School supplies |

|

|

Organization dues or fees |

|

|

Child care |

|

|

Toys/games |

|

|

Other |

|

|

SUBTOTAL OF SECTION F |

$ |

|

|

|

|

G. Insurance |

|

|

Home (including Flood Insurance) |

|

|

Health (Medical, Dental, Vision, etc.) |

|

|

Life |

|

|

Other |

|

|

SUBTOTAL OF SECTION G |

$ |

|

|

|

|

H. Legal |

|

|

Attorney |

|

|

Alimony |

|

|

Payments on lien or judgment |

|

|

Other |

|

|

SUBTOTAL OF SECTION H |

$ |

|

|

|

|

I. Savings or Investments |

|

|

Retirement account(s) |

|

|

Investment account(s) |

|

|

College savings |

|

|

Other |

|

|

SUBTOTAL OF SECTION I |

$ |

|

|

|

|

J. Taxes |

|

|

Federal |

|

|

State |

|

|

Local |

|

|

Other |

|

|

SUBTOTAL OF SECTION J |

$ |

|

Total of Sections

$

Possible reductions in monthly expenses

$

The information above is true and complete to the best of my knowledge.

SignatureDate

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Monthly Household Budget Worksheet is designed to help individuals manage their finances effectively. |

| Categories | Expenses are divided into sections, such as Housing, Transportation, and Food, allowing for detailed tracking of monthly payments. |

| Reductions | Participants are encouraged to identify areas where they can reduce expenses, assisting in potential savings. |

| Assistance | Completing this worksheet may help determine eligibility for financial assistance programs aimed at preventing housing loss. |

| Legal Reference | This form may be governed by state-specific laws regarding personal finance and housing assistance, such as the Fair Debt Collection Practices Act. |

Guidelines on Utilizing Budget

Once you have gathered all your monthly financial information, you are ready to begin filling out the Budget form. Completing this form accurately will help identify areas where you may be able to save money and better manage your household expenses. Follow these detailed steps to ensure your form is filled out correctly.

- Start by entering your monthly housing payments. This includes your mortgage or rent, second mortgage, homeowners association fees, property taxes, and any maintenance or repair costs.

- Add your phone and utility expenses. List costs for all phones, including cell phones, as well as utilities like water, gas, and electricity. Don’t forget cable or satellite programming and waste removal.

- Move on to transportation costs. Document loan payments for vehicles, public transportation, and associated expenses such as vehicle insurance, licensing, fuel, and maintenance.

- In the next section, provide details about other debts you have, such as credit card debts and personal or student loans.

- Afterwards, fill in personal entertainment and miscellaneous expenses, including those for grooming, clothing, and charitable contributions.

- Then record your food expenses. This includes groceries, dining out, and any other food-related costs.

- Next, gather expenses related to your family. This can include medical costs for family members, clothing, school tuition, and childcare.

- List your various insurance premiums, such as home, health (medical, dental, vision), and life insurance.

- Document any legal expenses you might have, including attorney fees or alimony payments.

- Fill in your savings or investments. Capture contributions to retirement accounts, investment accounts, and college savings plans.

- Lastly, record your taxes for federal, state, local, and any other relevant taxes.

- After completing sections A through J, sum your totals to record the overall total of sections A-J.

- Identify and note any areas where you think possible reductions in monthly expenses can be made. Put a check-mark in the box provided next to amounts where reductions seem feasible.

- Finally, ensure that you provide your signature and the date at the end of the form to verify the information is accurate and complete.

What You Should Know About This Form

What is the purpose of the Monthly Household Budget Worksheet?

The Monthly Household Budget Worksheet helps you track your monthly payments and expenses. This document is essential for managing your finances effectively. It can also assist organizations in determining how best to help you maintain your housing situation.

How do I fill out the budget form?

Begin by listing all your monthly payments in the designated sections. Each category covers various aspects of your expenses, such as housing, transportation, and other debts. Remember to check off any areas where you can reduce expenses, as this may help identify opportunities to save money.

Why is it important to check for possible reductions in expenses?

Checking for possible reductions in expenses can reveal areas where you may cut back. This process can lead to significant savings over time, which may provide you with more financial stability and help you to stay in your home.

What should I do if I have additional expenses not listed in the form?

If you have expenses that don’t fit into the provided categories, simply list them in the “Other” section corresponding to the relevant category. This allows you to accurately capture your full range of expenses.

How do I calculate the total of Sections A-J?

To calculate the total of Sections A-J, simply add the subtotal amounts from each section. This will give you a clear picture of your total monthly expenses, which is vital for determining your overall financial health.

What if I don’t have all the information ready to complete the form?

If you don’t have all the required information immediately, it’s best to fill in what you can. You can always return to the form and complete it once you gather the necessary data. Accurate reporting is key, so it's helpful to have as much detail as possible.

Is my information kept confidential?

Yes, typically any information provided in budget worksheets is treated with confidentiality. However, it's essential to check the privacy policy of the specific organization or service requesting the form to understand how your data will be handled.

Can I use this budget form for other financial planning needs?

Absolutely! While designed for tracking monthly expenses, this budget form can also be utilized for various financial planning purposes. Whether planning for a big purchase or assessing your overall financial situation, it offers a structured approach to understanding your finances.

What should I do after completing the form?

Once you've filled out the form, review all entries to ensure accuracy. If you’re seeking assistance, submit the form as directed by the organization. Use the findings from the worksheet as a basis for any financial discussions or planning sessions you may have.

How often should I update my budget?

It’s advisable to update your budget regularly. Monthly updates can provide a clear picture of any changes in expenses or income. This practice promotes better financial management and helps you stay on track with your financial goals.

Common mistakes

Filling out a budget form is a crucial step in managing your finances effectively. However, many people make common mistakes that can lead to inaccuracies and missed opportunities. Recognizing these errors can make a significant difference in your financial planning.

One frequent mistake is underestimating expenses. Individuals often forget to include small but recurring costs, such as subscription services or minor repairs. These seemingly insignificant amounts can add up quickly, creating a misleading picture of your financial situation.

Another common error involves failing to accurately track variable expenses. Monthly spending on groceries, entertainment, and utilities can fluctuate. Without diligent tracking, it’s easy to overlook these variations, leading to an unrealistic budget that does not reflect your actual spending habits.

Many people also neglect to separate fixed and variable expenses properly. Fixed expenses, like rent or mortgage payments, remain constant, while variable expenses change. Mixing these can complicate the budgeting process and make it harder to identify areas where savings can occur.

Omitting potential reductions in expenses is another mistake that can have serious consequences. If you see an area where you can cut costs, it should be marked on the form as stated in the instructions. This step is vital for pinpointing areas that require attention and adjusting your budget accordingly.

Additionally, some individuals fail to update their budget regularly. Financial situations can change due to new job opportunities, unexpected bills, or lifestyle changes. Keeping your budget current is essential in reflecting these shifts and ensuring it remains a useful tool.

Another critical error is not involving all household members. Family members play a significant role in household spending. They should be part of the budgeting process to provide input and foster a sense of collective responsibility.

Finally, overlooking the importance of savings can be detrimental. Budgeting isn't just about tracking expenses; it's also about planning for the future. Many individuals forget to allocate any funds towards savings or investments, which can leave them unprepared for emergencies.

Being aware of these common mistakes can help you fill out the budget form more accurately. Take the time to review your expenses, include everyone involved, and plan for savings. Each step taken today leads to a more secure financial future.

Documents used along the form

When managing your finances, several documents work alongside your monthly household budget worksheet. These additional forms and documents play a vital role in providing a comprehensive overview of your financial situation, helping you make informed decisions. Below is a list of common forms you may encounter.

- Income Statement: This document details all income sources, including salaries, bonuses, and other earnings, giving insight into your financial inflow.

- Expense Tracking Sheet: Used to monitor daily spending, this sheet allows you to record and analyze expenditures over time, facilitating budget adjustments.

- Debt List: A summary of all outstanding debts, including loan amounts, interest rates, and payment terms. This helps in prioritizing repayment strategies.

- Savings Goals Worksheet: A detailed plan outlining your saving objectives, such as buying a house or funding education, along with target amounts and timelines for achievement.

- Investment Portfolio Statement: This document provides a snapshot of your investment accounts, including stocks, bonds, and mutual funds, showing how your investments are performing.

- Asset Inventory: A comprehensive list of valuable items you own, such as property, vehicles, and collectibles, which can be useful for insurance or estate planning.

- Tax Preparation Documents: Forms related to your income tax filings, including W-2s and 1099s, essential for annual tax preparation and financial planning.

- Loan Application Form: If you need to borrow money, this form outlines your financial details and creditworthiness, facilitating the loan approval process.

- Financial Affidavit: Often used in legal matters, this document provides a snapshot of your financial situation and is typically required in divorce or custody cases.

- Retirement Planning Document: A plan that outlines your savings strategy for retirement, including projected expenses and income sources during retirement years.

Each of these documents can aid in effectively managing your finances, allowing you to identify areas for improvement and make educated financial decisions. Understanding and utilizing these forms will contribute to better financial health and security.

Similar forms

- Personal Financial Statement: Similar to the budget form, a personal financial statement details monthly income and expenses, providing a comprehensive view of an individual's financial situation to identify opportunities for improvement.

- Expense Report: An expense report tracks specific expenditures, typically for business purposes. Like the budget form, it helps users identify areas where they can control or reduce spending.

- Income Statement: An income statement summarizes revenue and expenses over a specific period. Both documents are essential for understanding cash flow and overall financial health.

- Debt Repayment Plan: This plan outlines how an individual plans to pay off debts. Similar to the budget form, it helps to allocate funds specifically toward reducing debt.

- Cash Flow Statement: A cash flow statement monitors the flow of cash in and out of an individual's accounts. It serves as a guide for managing finances effectively, much like the budget form.

- Financial Goals Worksheet: This worksheet specifies short-term and long-term financial goals. It is similar in that it requires users to evaluate their expenses and savings strategies to achieve these goals.

- Net Worth Statement: A net worth statement lists all assets and liabilities to calculate total net worth. Both documents assist in assessing one's overall financial standing.

- Savings Plan: A savings plan outlines how much money an individual intends to save over time. It parallels the budget form by necessitating the review of income and discretionary spending.

- Retirement Planning Worksheet: This worksheet helps individuals plan for retirement by evaluating current savings and projected expenses, similar to the budget form's emphasis on long-term financial health.

Dos and Don'ts

When filling out the Budget form, attention to detail is crucial. Managing your finances effectively can pave the way for better opportunities and assistance in maintaining your home. Here’s a helpful guide to keep in mind:

- Do review each section thoroughly before filling it out to ensure accuracy.

- Don't rush through the form; taking your time can prevent errors that might lead to complications later.

- Do include all forms of income to get a complete picture of your finances.

- Don't omit any expenses, no matter how small they may seem; every little bit adds up.

- Do mark areas where you can potentially reduce expenses to help identify savings.

- Don't forget to categorize your expenses properly; this will make it easier to understand your spending habits.

- Do use estimates if necessary, but try to provide the most accurate figures possible.

- Don't make assumptions about costs; gather actual bills and statements if available.

- Do keep a copy of your completed budget for your records.

- Don't neglect the importance of updating the form regularly to reflect any changes in your financial situation.

Completing the Budget form thoughtfully not only aids in financial management but also helps facilitate any assistance you may require in the future.

Misconceptions

Here is a list of misconceptions about the Budget form:

- Misconception 1: The Budget form only tracks income.

- Misconception 2: It's only for those in financial trouble.

- Misconception 3: Reductions in expenses are optional.

- Misconception 4: Completing the form is a one-time task.

Many people believe the Budget form focuses solely on income. In reality, it emphasizes both income and expenses. This comprehensive view helps individuals see where their money goes each month.

Some think the Budget form is only necessary for people facing financial difficulties. However, anyone can benefit from understanding their finances. Creating a budget is a proactive step for better money management, whether you're struggling or thriving.

Some individuals view the suggestions for reducing expenses as optional. In fact, marking potential reductions is crucial. It allows for a focused discussion on financial strategies and assists in identifying areas for improvement.

Many believe they only need to complete the form once. The reality is that budgeting is an ongoing process. Regular updates reflect changes in income or expenses, ensuring the budget remains effective and relevant.

Key takeaways

Filling out the Budget form can help you manage your finances more effectively. Here are some key takeaways:

- List All Expenses: Start by listing all your monthly payments and expenses. Be thorough to get a clear picture of your financial situation.

- Identify Reduction Opportunities: If you see a place to cut costs, mark it with a check. This can highlight areas where you might save money.

- Calculate Subtotals: For each section of the budget, calculate the subtotal. This will help you understand the overall impact of each expense category.

- Review Your Budget Regularly: Make it a habit to review and update your budget regularly. Life changes, and your budget should reflect your current situation.

Browse Other Templates

Workers Compensation Intake Form - Social Security Numbers may be needed for identification purposes.

Va Unemployability - The submittal of this application may lead to financial support critical for your wellbeing.