Fill Out Your For Goodwill Donated Goods Form

The For Goodwill Donated Goods form serves a vital purpose for both the donor and the organization, encapsulating the spirit of giving while ensuring the donation process is seamless. When you contribute to Goodwill, you not only support a worthy cause but also enable meaningful change in the lives of individuals facing challenges in the job market. The form prompts you to list the items you’ve donated—ranging from clothing and housewares to furniture and electronics—while allowing the flexibility to attach your own detailed inventory if you prefer. By keeping this receipt, you secure your record of a tax-deductible donation, helping you during tax season. Goodwill assures donors that no goods or services were exchanged for their contributions, reinforcing the philanthropic nature of the act. Furthermore, the form highlights Goodwill's mission, revealing that an impressive 90 cents of every dollar received directly funds programs and services aimed at empowering local job seekers. By donating, you’re actively participating in a cycle of benefit that extends beyond just decluttering your home. It transforms lives and strengthens communities, making it clear that when jobs thrive, so do the individuals and families within those communities.

For Goodwill Donated Goods Example

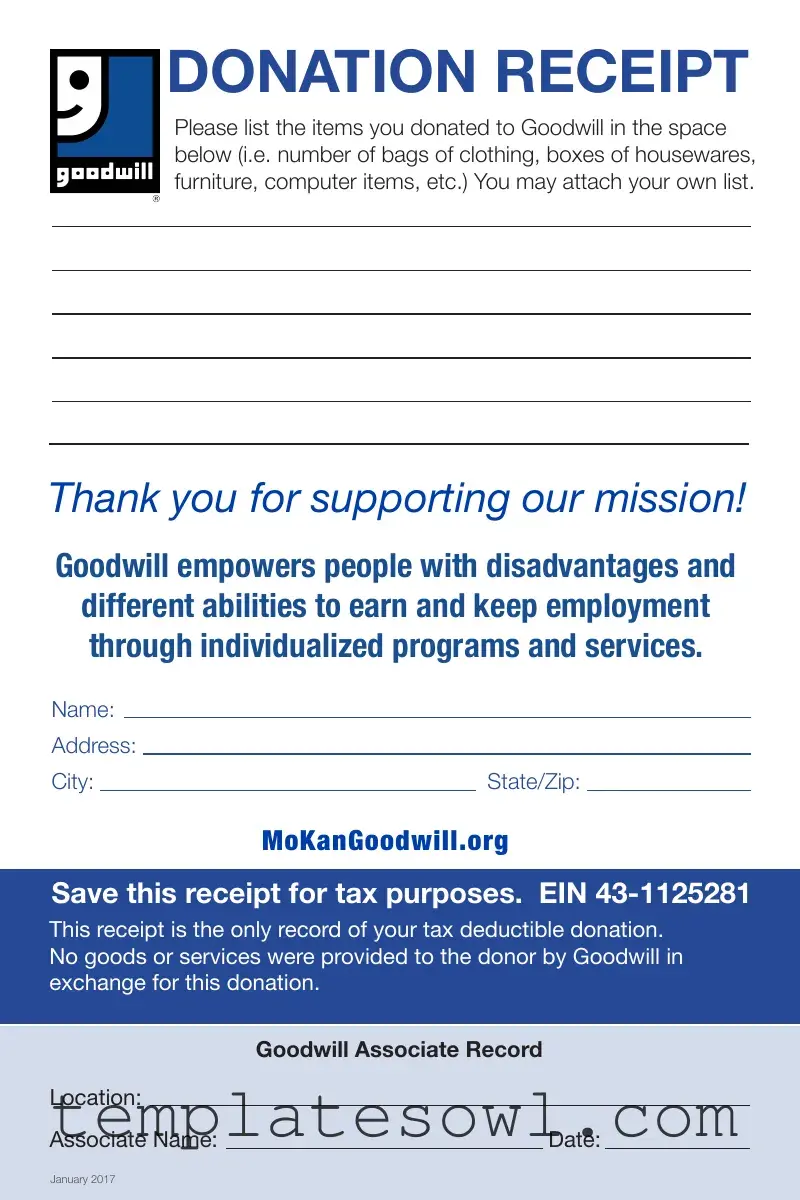

DONATION RECEIPT

Please list the items you donated to Goodwill in the space below (i.e. number of bags of clothing, boxes of housewares, furniture, computer items, etc.) You may attach your own list.

Thank you for supporting our mission!

Goodwill empowers people with disadvantages and different abilities to earn and keep employment through individualized programs and services.

Name:

Address:

City:State/Zip:

MoKanGoodwill.org

Save this receipt for tax purposes. EIN

This receipt is the only record of your tax deductible donation. No goods or services were provided to the donor by Goodwill in exchange for this donation.

|

Goodwill Associate Record |

Location: |

|

Associate Name: |

Date: |

January 2017

Goodwill spends 90¢ of every dollar on programs & services for local job seekers.

When you donate to Goodwill, your stuff gets a second chance in another person’s life instead of laying in a landfill.

High quality & unique items sell in our thrift stores & online at mokangoodwill.org/shoponline.

Unsold items get one last chance at the Goodwill Outlet in Kansas City. Here, amazing deals are purchased by the pound.

What remains is recycled or salvaged. This gets the most value out of every donation – and keeps items out of landfills.

Your donation funds programs and services for local job seekers to get the skills and confidence they need to find competitive employment.

Employment is more than a paycheck. It’s a resounding victory for the individual, for their family and for the community. When jobs thrive,

communities thrive.

MoKanGoodwill.org

Form Characteristics

| Fact Name | Details |

|---|---|

| Tax Deductibility | This form serves as the official receipt for tax-deductible donations to Goodwill. |

| Employer Identification Number (EIN) | The Goodwill organization has the EIN 43-1125281, which may be needed for tax purposes. |

| Usage of Donations | Goodwill allocates 90 cents of every dollar received to support programs and services for local job seekers. |

| Donation List | Donors can provide a detailed list of donated items or attach their own inventory list to the form. |

| Non-Exchange Clause | No goods or services were exchanged for your donation, making it a pure charitable contribution. |

| Environmental Impact | Donating helps reduce landfill waste, giving items a second chance and promoting recycling efforts. |

| Community Empowerment | Your contributions support individuals with disadvantages, helping them gain skills and confidence for employment. |

| Location of Records | The form includes a section for Goodwill associates to record their name and the location of the donation. |

| Outlet for Unsold Goods | Any unsold items are moved to the Goodwill Outlet, where they can be purchased by weight. |

| Additional Resources | More information about Goodwill and their mission can be found at MoKanGoodwill.org. |

Guidelines on Utilizing For Goodwill Donated Goods

Filling out the Goodwill Donated Goods form is a straightforward task that helps document your generous contributions. This form records the items you've donated, serving as a valuable receipt for your tax records. By providing specific information about your donation, you’re not just acknowledging your actions, but also supporting Goodwill’s mission of empowering individuals through employment opportunities. Follow these steps carefully to ensure your form is completed accurately.

- Begin by entering your name in the designated space.

- Next, input your address. Make sure to include your street address, as well as your apartment or unit number if applicable.

- Fill in your city.

- Provide your state and upload the last three digits of your zip code.

- List each item you donated in the space provided. You can describe the items in general terms, such as "three bags of clothing" or "one sofa." Ensure that you include all different types of items.

- If you have a separate list, feel free to attach it to the form.

- Keep a copy of this form for your tax purposes. This receipt is essential for documenting your tax-deductible donations.

- Finally, complete the sections for Goodwill Associate Record, including the associate's name and the date.

What You Should Know About This Form

What is the For Goodwill Donated Goods form?

The For Goodwill Donated Goods form is a receipt that acknowledges your contribution of gently used items to Goodwill. This form serves as a record for tax purposes, helping you claim a deduction on your tax return. It details the items you’ve donated, such as clothing, furniture, and other household goods.

How should I fill out the donation receipt?

When filling out the receipt, clearly list all the items you are donating. You can specify the number of bags or boxes, as well as individual items. For example, you might write “3 bags of clothing, 2 boxes of housewares, and 1 piece of furniture.” If you prefer, you can attach an additional detailed list of your donated items.

Why should I save this receipt?

It’s important to keep this receipt because it is your only official record of the tax-deductible donation. The IRS requires documentation for charitable contributions to claim deductions, and the For Goodwill Donated Goods form provides the necessary proof.

Can I donate anything I want?

While many items can be donated, Goodwill asks for donations of gently used items in good condition. This typically includes clothing, household goods, furniture, and more. However, items that are broken, damaged, or hazardous cannot be accepted, as they do not meet their donation guidelines.

What does Goodwill do with my donations?

Your donations go a long way. Goodwill will sell high-quality items in their thrift stores or online. They also have an Outlet location where unsold items are sold by the pound. Any items that remain unsold are recycled or salvaged, ensuring minimal waste. Ultimately, your contributions support job training and placement programs for local job seekers.

How does my donation help the community?

By donating to Goodwill, you’re directly impacting individuals in your community. Every dollar spent by Goodwill is reinvested into programs that help people with disadvantages or varying abilities gain employment. When these individuals thrive, it benefits families and strengthens the entire community.

Who do I contact if I have more questions about my donation?

If you have additional questions or need assistance, you can visit MoKanGoodwill.org or reach out to your local Goodwill location. They can provide more information about the donation process, answer inquiries about specific items, and help you with any other concerns regarding your contribution.

Common mistakes

When individuals fill out the For Goodwill Donated Goods form, they often make mistakes that could affect their donation records and tax benefits. One common error is failing to list all donated items. Donors sometimes forget to include every bag and box they donated, which can lead to inaccuracies when claiming tax deductions later on. It's crucial to record everything to ensure you have a proper and complete receipt for your records.

Another mistake people frequently make is not using the provided space effectively. The form allows donors to list items, yet some individuals write vague descriptions. Instead of simply stating “clothes,” it is far more beneficial to specify the contents, such as “three bags of men’s winter clothing.” This level of detail not only aids in tax reporting but also helps Goodwill in tracking donated goods.

Many forget to keep the donation receipt in a safe place. This receipt serves as the sole proof of donation for tax purposes, so it should be stored carefully with other important documents. Losing this receipt can complicate future tax filings, and organizations like Goodwill cannot always reissue receipts.

Some donors also neglect to include their name and address clearly on the form. Failing to provide complete contact information can lead to confusion, particularly if there are questions about the donation later on. Goodwill relies on this information for record-keeping and to provide assurances regarding tax-deductible statuses.

Donors often make the mistake of not asking for assistance when unsure about how to fill out the form. Goodwill associates are trained to help you with any inquiries. Asking questions can clarify any uncertainties and lead to a more accurate and efficient donation process.

Moreover, some individuals do not check the date on the form. Accurate dating helps track when donations were made, which can be significant for tax records. An outdated date might complicate matters, especially if a recipient needs to validate their charitable contributions for a specific year.

Another common oversight is not noting the number of items. Each bag or box should be counted and clarified. Simply stating “donated household items” without specifics can create complications. Goodwill appreciates knowing how many items were received because this helps them manage their services better.

Many individuals also forget to take advantage of writing their own list if they need more space than the form provides. Attaching a detailed list of donations can serve as a more comprehensive record, ensuring that all items are accounted for and accurately recorded.

Failure to understand the EIN number is another mistake. The form mentions the EIN for tax purposes, but not every donor understands its significance. Familiarizing oneself with this number allows donors to better understand how their contributions are tracked and reported for tax deductions.

Lastly, some donors assume the donation has no value if the items are used or old. This misconception can deter people from donating altogether. Goodwill’s commitment to repurposing these items means that they still hold value, both for the organization and the community. Understanding this can motivate more people to donate and contribute to the mission of Goodwill.

Documents used along the form

When you donate goods to Goodwill, it's essential to maintain accurate records and understand the various forms that may accompany your donation. Below is a list of important documents often used along with the For Goodwill Donated Goods form. Familiarizing yourself with these can enhance your donation experience and help with tax purposes.

- IRS Form 8283: This form is required for non-cash charitable contributions exceeding $500. It provides details about the items donated and must be attached to your tax return.

- Charitable Donation Log: This is a simple record to log donations throughout the year, documenting what was given and when. It helps organize your contributions for tax filing.

- Letter of Acknowledgment: A written correspondence from Goodwill verifying your donation. It may serve as proof for tax deductions if official receipts are misplaced.

- Schedule A (Form 1040): This tax form is used to itemize deductions, including charitable contributions, and can maximize your potential tax refunds.

- Goodwill Donation Tracking Form: A personal record sheet that helps in tracking items given to Goodwill, ensuring nothing is overlooked when making deductions.

- Appraisal Document: If donated items are of significant value, an appraisal might be necessary. This document supports your claim on the value of the items for tax deductions.

- State-Specific Donation Receipt: Some states have specific requirements for donation receipts. Check your state's requirements to ensure compliance and proper documentation.

- Tax Preparation Worksheet: A worksheet to aid in organizing information when completing your tax return. It can include all your donations and potential deductions.

- Goodwill Promotional Materials: Flyers or brochures that explain Goodwill's mission and programs. While not mandatory, they can help donors understand the impact of their donations.

- Itemized Value Guide: A guide that estimates the value of commonly donated items. This helps donors assess and accurately report the worth of their contributions.

By utilizing these documents and forms, you can ensure that your charitable giving is organized and maximized for tax benefits. Every contribution makes a difference, and having the right paperwork can make the process smoother.

Similar forms

The For Goodwill Donated Goods form serves as a receipt for donations, providing details about items given to the organization. Below are four documents that are similar to this form:

- Charitable Donation Receipt: This document commonly details the items donated, along with the donor's information. It serves the same purpose for tax deductions and acknowledges the contribution made to a charitable organization.

- IRS Form 8283: Used for reporting non-cash charitable contributions, this form requires a detailed description of donated items. It is necessary for donations exceeding certain values and often requires an appraisal for higher-value items.

- Donation Acknowledgment Letter: This letter is issued by charities to acknowledge a donor’s contributions. Like the Goodwill receipt, it confirms the donation for tax purposes and may include a brief description of the items contributed.

- Tax-Deductible Donation Worksheet: Typically utilized by donors to itemize their charitable contributions throughout the year. This worksheet can help organize and support claims for deductions similar to the information recorded on the Goodwill form.

Dos and Don'ts

When filling out the For Goodwill Donated Goods form, there are certain best practices to follow. Here’s a concise list of what you should and shouldn’t do:

- Do list items clearly, specifying the quantity and type (e.g., number of bags of clothing, boxes of housewares).

- Do save the receipt for tax purposes, as it serves as the official record of your donation.

- Do ensure your contact information is accurate, including your name and address.

- Do consider attaching your own detailed list of donated items for clarity.

- Do research Goodwill’s mission and services to understand the impact of your donation.

- Don't underestimate the value of smaller items; every donation makes a difference.

- Don't leave the form incomplete or unsigned, as this can lead to complications later.

- Don't include items that are damaged or not suitable for resale, as those cannot be accepted.

- Don't ignore the instructions; they help facilitate the donation process.

- Don't expect immediate feedback or follow-up; the donation process may take time.

By following these recommendations, you can ensure a smooth and effective donation experience, maximizing the impact of your contribution.

Misconceptions

Misconception 1: You don't need to keep the donation receipt.

Many people think that the receipt isn't important, but it actually serves as your record for tax purposes. This receipt is the only proof of your donation, which means you should save it carefully.

Misconception 2: You must itemize every single item you donate.

While it may be helpful to list out detailed item descriptions, it isn't required. You can simply indicate the number of bags or boxes you donated. Attaching your own list is also an option if you prefer.

Misconception 3: All donations go directly to people in need.

Donations do make a difference, but it's important to know that Goodwill also invests in programs that help individuals secure employment. Understanding this connection can help you appreciate the broader impact of your donations.

Misconception 4: Your donation won't be utilized effectively.

Some might think that their donated goods end up in landfills. In reality, Goodwill works to maximize the value of donations by selling items in thrift stores, online, or recycling them when necessary. This ensures that items can be reused or repurposed, benefiting both individuals and the environment.

Key takeaways

When filling out and using the For Goodwill Donated Goods form, consider the following key takeaways:

- Clearly list each item donated, specifying quantities, such as bags of clothing or boxes of housewares.

- The form serves as your only record for tax-deductible donations; retain it for your records.

- No goods or services were provided in exchange for your donation, ensuring the transaction is purely charitable.

- Your donation contributes to Goodwill's mission of empowering individuals facing disadvantages to gain meaningful employment.

- Goodwill allocates 90 cents of every dollar to programs and services that assist local job seekers.

- Items can have a second life through resale in Goodwill stores or online, benefiting others and reducing landfill waste.

- Unsold goods are given another opportunity at the Goodwill Outlet, where they can be purchased by weight.

- Recycling and salvaging unsold items maximizes value for each donation while minimizing environmental impact.

- Donations directly support programs that equip individuals with the skills and confidence needed for successful employment.

In summary, the form is an essential tool for tracking contributions while also fostering community support and environmental responsibility.

Browse Other Templates

Hcc Transcript - The form ensures that students maintain control over the release of their educational records.

Baseball Evaluation Sheets - Emphasize the role of physical fitness in player evaluations.

Usps Forms Online - It captures details necessary for revenue deficiency assessments linked to mailings.